FY

2023

--09-30

false

0001045942

20

3

2

0

0

540

10

0

0

3

1

7

3

2

2

20

3

00010459422022-10-012023-09-30

thunderdome:item

iso4217:USD

00010459422021-09-30

00010459422023-09-30

00010459422020-10-012021-09-30

00010459422020-09-30

00010459422022-09-30

0001045942trck:STOPRoyaltyMember2023-09-30

0001045942trck:AmortizationMember2023-09-30

00010459422021-10-012022-09-30

0001045942us-gaap:OperatingExpenseMember2021-10-012022-09-30

0001045942us-gaap:OperatingExpenseMember2022-10-012023-09-30

0001045942us-gaap:CostOfSalesMember2021-10-012022-09-30

0001045942us-gaap:CostOfSalesMember2022-10-012023-09-30

utr:Y

0001045942srt:MaximumMember2023-09-30

0001045942srt:MinimumMember2023-09-30

0001045942us-gaap:TradeNamesMember2022-09-30

0001045942us-gaap:TradeNamesMember2023-09-30

0001045942us-gaap:DevelopedTechnologyRightsMember2022-09-30

0001045942us-gaap:DevelopedTechnologyRightsMember2023-09-30

0001045942us-gaap:PatentsMember2022-09-30

0001045942us-gaap:PatentsMember2023-09-30

xbrli:pure

0001045942trck:LeaseLiabilitiesMember2023-09-30

0001045942trck:LongTermLiabilitiesMember2023-09-30

0001045942us-gaap:AccountsPayableAndAccruedLiabilitiesMember2023-09-30

0001045942trck:UnderAsc840Member2023-09-30

0001045942us-gaap:OtherNoncurrentLiabilitiesMember2022-09-30

0001045942us-gaap:OtherNoncurrentLiabilitiesMember2023-09-30

0001045942us-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-09-30

0001045942us-gaap:OtherAssetsMember2022-09-30

0001045942us-gaap:OtherAssetsMember2023-09-30

0001045942trck:JesusValleGonzalezEtalVTrackGroupPuertoRicoMemberus-gaap:PendingLitigationMembersrt:MinimumMember2022-05-092022-05-09

0001045942trck:SecureAlertIncVFederalGovernmentOfMexicoMember2017-03-242017-03-24

iso4217:USDxbrli:shares

0001045942trck:StockOptionsAndWarrantsMember2022-09-30

xbrli:shares

0001045942trck:StockOptionsAndWarrantsMembersrt:DirectorMember2022-09-30

0001045942trck:The2012PlanMember2022-10-012023-09-30

0001045942us-gaap:RestrictedStockMembertrck:The2022PlanMember2020-10-012021-09-30

0001045942us-gaap:RestrictedStockMembertrck:The2022PlanMember2022-10-012023-09-30

0001045942us-gaap:RestrictedStockUnitsRSUMember2022-04-132022-04-13

0001045942us-gaap:RestrictedStockMember2022-04-132022-04-13

0001045942trck:The2022PlanMember2022-09-30

0001045942us-gaap:RestrictedStockMembertrck:ManagementTwoMember2022-04-132022-04-13

0001045942us-gaap:RestrictedStockMembersrt:ManagementMember2022-04-132022-04-13

0001045942trck:WarrantsTwoMembersrt:DirectorMember2022-04-142022-04-14

0001045942trck:WarrantsOneMembersrt:DirectorMember2022-04-142022-04-14

0001045942srt:DirectorMember2022-04-142022-04-14

0001045942srt:DirectorMember2021-12-302021-12-30

0001045942srt:DirectorMember2021-12-282021-12-28

0001045942srt:DirectorMember2021-12-282022-12-28

utr:D

0001045942trck:SeriesAConvertiblePreferredStockMember2022-10-012023-09-30

0001045942trck:SeriesAConvertiblePreferredStockMember2022-09-30

0001045942trck:SeriesAConvertiblePreferredStockMember2017-10-12

0001045942trck:SeriesAConvertiblePreferredStockMember2021-09-30

00010459422021-02-15

iso4217:CLP

0001045942trck:ChileanPesosMember2021-02-15

0001045942trck:NotePayableWithBancoDeChileMaturingOnFeb172025Member2021-02-15

00010459422021-02-152021-02-15

0001045942trck:ChileanPesosMember2021-02-152021-02-15

0001045942trck:NotePayableWithBancoDeChileMaturingOnMarch42024Member2021-02-05

00010459422021-02-052021-02-05

0001045942trck:ChileanPesosMember2021-02-052021-02-05

0001045942trck:NotePayableWithHpFinancialServicesMaturingOnMarch42024Member2021-02-04

00010459422021-02-042021-02-04

0001045942trck:ChileanPesosMember2021-02-042021-02-04

00010459422021-02-02

0001045942trck:ChileanPesosMember2021-02-02

0001045942trck:NotePayableWithBancoEstadoMember2021-02-02

00010459422021-02-022021-02-02

0001045942trck:ChileanPesosMember2021-02-022021-02-02

00010459422021-01-12

0001045942trck:ChileanPesosMember2021-01-12

0001045942trck:NotePayableWithBancoSantanderMember2021-01-12

00010459422021-01-122021-01-12

0001045942trck:ChileanPesosMember2021-01-122021-01-12

0001045942trck:NotePayableWithHpFinancialServicesMaturingOnFeb62024Member2021-01-06

00010459422021-01-062021-01-06

0001045942trck:ChileanPesosMember2021-01-062021-01-06

0001045942trck:AgreementWithConrentMember2022-10-012023-09-30

0001045942trck:AgreementWithConrentMember2020-12-21

0001045942trck:AgreementWithConrentMember2020-12-20

0001045942trck:NotePayableWithBancoDeChileMaturingOnFeb172025Member2022-09-30

0001045942trck:NotePayableWithBancoDeChileMaturingOnFeb172025Member2023-09-30

0001045942trck:NotePayableWithBancoDeChileMaturingOnMarch42024Member2022-09-30

0001045942trck:NotePayableWithBancoDeChileMaturingOnMarch42024Member2023-09-30

0001045942trck:NotePayableWithHpFinancialServicesMaturingOnMarch42024Member2022-09-30

0001045942trck:NotePayableWithHpFinancialServicesMaturingOnMarch42024Member2023-09-30

0001045942trck:NotePayableWithBancoEstadoMember2022-09-30

0001045942trck:NotePayableWithBancoEstadoMember2023-09-30

0001045942trck:NotePayableWithBancoSantanderMember2022-09-30

0001045942trck:NotePayableWithBancoSantanderMember2023-09-30

0001045942trck:NotePayableWithHpFinancialServicesMaturingOnFeb62024Member2022-09-30

0001045942trck:NotePayableWithHpFinancialServicesMaturingOnFeb62024Member2023-09-30

0001045942trck:AgreementWithConrentMember2022-09-30

0001045942trck:AgreementWithConrentMember2023-09-30

0001045942trck:AmendedAgreementWithConrentMember2022-10-012023-09-30

0001045942trck:AmendedAgreementWithConrentMember2023-09-30

00010459422017-09-282017-09-28

0001045942trck:RightofuseLiabilityMember2022-09-30

0001045942trck:RightofuseLiabilityMember2023-09-30

0001045942trck:CapitalizedContractCostSantiagoMonitoringCenterMember2021-10-012022-09-30

0001045942trck:CapitalizedContractCostSantiagoMonitoringCenterMember2022-10-012023-09-30

0001045942trck:MonitoringCenterEquipmentMember2022-09-30

0001045942trck:MonitoringCenterEquipmentMember2023-09-30

0001045942trck:MonitoringAndOtherRelatedServicesMember2020-10-012021-09-30

0001045942trck:MonitoringAndOtherRelatedServicesMember2022-10-012023-09-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2021-10-012022-09-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2022-10-012023-09-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembertrck:OtherThanUnitedStatesAndLatinAmericaMember2021-10-012022-09-30

0001045942trck:OtherThanUnitedStatesAndLatinAmericaMember2021-10-012022-09-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembertrck:OtherThanUnitedStatesAndLatinAmericaMember2022-10-012023-09-30

0001045942trck:OtherThanUnitedStatesAndLatinAmericaMember2022-10-012023-09-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembersrt:LatinAmericaMember2021-10-012022-09-30

0001045942srt:LatinAmericaMember2021-10-012022-09-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembersrt:LatinAmericaMember2022-10-012023-09-30

0001045942srt:LatinAmericaMember2022-10-012023-09-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembercountry:US2021-10-012022-09-30

0001045942country:US2021-10-012022-09-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembercountry:US2022-10-012023-09-30

0001045942country:US2022-10-012023-09-30

0001045942trck:StockOptionsAndWarrantsMember2023-09-30

0001045942us-gaap:RestrictedStockMember2021-10-012022-09-30

0001045942us-gaap:RestrictedStockMember2022-10-012023-09-30

0001045942srt:MaximumMember2022-10-012023-09-30

0001045942srt:MinimumMember2022-10-012023-09-30

0001045942trck:PropertyPlantAndEquipmentExcludingMonitoringEquipmentMember2022-09-30

0001045942trck:PropertyPlantAndEquipmentExcludingMonitoringEquipmentMember2023-09-30

0001045942srt:MaximumMember2022-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerDMember2021-10-012022-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerDMember2022-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerDMember2022-10-012023-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerDMember2023-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerCMember2021-10-012022-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerCMember2022-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerCMember2022-10-012023-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerCMember2023-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerBMember2021-10-012022-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerBMember2022-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerBMember2022-10-012023-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerBMember2023-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerAMember2021-10-012022-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerAMember2022-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerAMember2022-10-012023-09-30

0001045942us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerAMember2023-09-30

0001045942us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerBMember2021-10-012022-09-30

0001045942us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerBMember2022-10-012023-09-30

0001045942us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerAMember2021-10-012022-09-30

0001045942us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMembertrck:CustomerAMember2022-10-012023-09-30

0001045942us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2022-10-012023-09-30

0001045942us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2020-10-012021-09-30

0001045942trck:NotesPayableRelatedToConstructionOfMonitoringCentersMember2023-09-30

0001045942trck:DebtMaturingInJuly2024Member2023-04-27

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-30

0001045942us-gaap:RetainedEarningsMember2022-09-30

0001045942us-gaap:AdditionalPaidInCapitalMember2022-09-30

0001045942us-gaap:CommonStockMember2022-09-30

0001045942us-gaap:CommonStockMember2021-10-012022-09-30

0001045942us-gaap:RetainedEarningsMember2021-10-012022-09-30

0001045942us-gaap:AdditionalPaidInCapitalMember2021-10-012022-09-30

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-30

0001045942us-gaap:RetainedEarningsMember2021-09-30

0001045942us-gaap:AdditionalPaidInCapitalMember2021-09-30

0001045942us-gaap:CommonStockMember2021-09-30

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-30

0001045942us-gaap:RetainedEarningsMember2023-09-30

0001045942us-gaap:AdditionalPaidInCapitalMember2023-09-30

0001045942us-gaap:CommonStockMember2023-09-30

0001045942us-gaap:RetainedEarningsMember2022-10-012023-09-30

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-012023-09-30

0001045942us-gaap:AdditionalPaidInCapitalMember2022-10-012023-09-30

0001045942trck:ProductSalesAndOtherMember2021-10-012022-09-30

0001045942trck:ProductSalesAndOtherMember2022-10-012023-09-30

0001045942trck:MonitoringAndOtherRelatedServicesMember2021-10-012022-09-30

0001045942trck:SeriesAConvertiblePreferredStockMember2023-09-30

0001045942trck:MonitoringEquipmentMember2022-09-30

0001045942trck:MonitoringEquipmentMember2023-09-30

00010459422023-12-01

00010459422023-03-31

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended September 30, 2023

|

|

or

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from ____________ to ___________

|

Commission file number: 000-23153

TRACK GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

87-0543981

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

200 E. 5th Avenue Suite 100 Naperville, Illinois 60563

(Address of principal executive offices, Zip Code)

(877) 260-2010

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, Par Value $0.0001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

|

Smaller reporting company ☒

|

| |

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

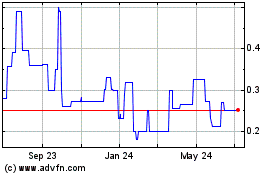

The aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant computed by reference to the closing price on March 31, 2023 was approximately $1.8 million. As of December 1, 2023, there were 11,863,758 shares of Common Stock issued and outstanding.

Documents Incorporated by Reference

None.

Track Group, Inc.

FORM 10-K

For the Fiscal Year Ended September 30, 2023

INDEX

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), relating to our operations, results of operations, and other matters that are based on our current expectations, estimates, assumptions, and projections. Words such as “may” “will”, “should”, “likely”, “anticipates”, “expects”, “intends”, “plans”, “projects”, “believes”, “estimates”, and similar expressions are used to identify these forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties, and assumptions that are difficult to predict. Forward-looking statements are based upon assumptions as to future events that might not prove to be accurate. Actual outcomes and results could differ materially from what is expressed or forecast in these forward-looking statements. Risks, uncertainties, and other factors that might cause such differences, some of which could be material, include, but are not limited to the factors discussed under the section of this Annual Report entitled “Risk Factors”.

PART I

Item 1. Business

Track Group, Inc., (the “Company”, “we”, “us”, and “our”), a Delaware corporation since 2016 and previously incorporated in 1995 as a Utah corporation, has its principal place of business at 200 E. 5th Avenue Suite 100, Naperville, Illinois 60563. Our telephone number is (877) 260-2010. We maintain a corporate website at www.trackgrp.com. Our common stock, par value $0.0001 per share (“Common Stock”), is currently listed for quotation on the OTCQB Venture Markets (“OTCQB”) under the symbol “TRCK”. Unless specified otherwise, as used in this Annual Report, references to Track Group, Inc. include the Company and its subsidiaries: Track Group Americas, Inc., a Utah corporation; Track Group – Puerto Rico, Inc., a Puerto Rico corporation; Emerge Monitoring, Inc., a Florida corporation; Emerge Monitoring II LLC, a Florida limited liability company; Integrated Monitoring Systems, LLC, a Colorado limited liability company; Track Group Chile S.p.A, a corporation formed under the laws of the Republic of Chile; Track Group Analytics Limited, a corporation formed under the laws of Canada; and Track Group International Ltd., a company formed under the laws of Israel (collectively, the “Subsidiaries”).

Company Background

The Company designs, manufactures, and markets location tracking devices and develops and sells a variety of related software, services, accessories, networking solutions, and monitoring applications. Our products and services include a full-range of one-piece GPS tracking devices, a device-agnostic operating system, a portfolio of software applications including smartphone, alcohol and predictive analytics, and a variety of accessory, service and support offerings. Our products and services are currently available worldwide and are sold through our direct sales force, as well as through value-added resellers. The Company sells to government customers on federal, state and local levels in the U.S. and to members of the Ministry of Justice (“MOJ”) internationally. Track Group’s device-agnostic platform and expanded portfolio of integrated and complimentary monitoring-related services help reduce risk and make the administration of justice better, faster, and less expensive for taxpayers.

Business Strategy

We are committed to helping our customers improve offender rehabilitation and re-socialization outcomes through our innovative hardware, software and services. We treat our business as a service business. Although we still manufacture patented tracking technology, we see the physical goods as only a small part of the integrated offender monitoring solutions we provide. Accordingly, rather than receiving a payment just for a piece of manufactured equipment, the Company receives a recurring stream of revenue for ongoing device agnostic subscription contracts. As part of our strategy, we continue to expand our device-agnostic platform to not only collect, but also store, analyze, assess and correlate location data for both accountability and auditing reasons, as well as to use for predictive analytics and assessment of effective and emerging techniques in criminal behavior and rehabilitation. We believe a high-quality customer experience along with knowledgeable salespeople who can convey the value of our products and services greatly enhances our ability to attract and retain customers. Therefore, our strategy also includes building and expanding our own direct sales force and our third-party distribution network to effectively reach more customers and provide them with a world-class sales and post-sales support experience. In addition, we are developing related-service offerings to address adjacent market opportunities in both the public and private sectors. We believe continual investment in research and development (“R&D”), including smartphone applications and other monitoring services is critical to the development and sale of innovative technologies and integrated solutions today and in the future.

Recent Developments

On April 26, 2023, the Company and Conrent entered into an amendment to the facility agreement (the “Amendment”) originally executed by and between the parties on December 30, 2013 and amended multiple times (the “Amended Facility Agreement”). The latest Amendment: (i) extended the maturity date from July 1, 2024, to July 1, 2027; (ii) amended the applicable interest rate resulting in an escalating interest rate as follows: 4% through June 30, 2024, 5% through June 30, 2025, 5.5% through June 30, 2026, and 6% through the maturity date and (iii) removed section 7.3 “Change of Control” of the Amended Facility Agreement. In return, the Company agreed to pay certain fees to Conrent.

Products and Services

Devices

ReliAlert®XC4

ReliAlert®XC4 is our flagship GPS device, which is among the safest and most reliable monitoring devices ever made. It is the only one-piece GPS device with patented 3-way voice communication to assist intervention efforts, now on the LTE network with increased battery life. This device includes on-board processing, secondary location technology, a 95db siren, embedded RF technology, anti-tampering capabilities, increased battery life and sleep mode.

ReliAlert®XC3

Advanced features enable agencies to effectively track offender movements and communicate directly with offenders in real-time, through a patented, on-board two/three-way voice communication technology. This device includes an enhanced GPS antenna and GPS module for higher sensitivity GPS, enhanced voice audio quality, increased battery performance of 50+ hours, 3G cellular capabilities, improved tamper sensory and durability enhancements.

Operating System Software

IntelliTrack

IntelliTrack is a secure state of the art device-agnostic platform that provides the foundation for seamlessly and securely connecting devices, delivering trusted data to the cloud, with views of current or historical tracking provided by Google Maps® for use with predictive analytics.

TrackerPAL®

TrackerPAL® is a secure, cloud-based monitoring system that gives customers the ability to not only collect, but also store, analyze, assess and correlate offender data for both accountability and auditing reasons, as well as to use with predictive analytics applications and assess criminal behavior and rehabilitation opportunities.

Application Software

IntelliTrack Mobile

A mobile application of the IntelliTrack software is available for Android and iOS devices.

TrackerPAL® Mobile

A mobile application of the TrackerPAL® software is available for Android and iOS devices.

Data Analytics

Our data analytics services help facilitate the discovery and communication of meaningful patterns in diverse location and behavioral data that helps agencies reduce risks and improve decision making. Our analytics applications use various combinations of statistical analysis procedures, data and text mining, and predictive modeling to proactively analyze information on community-released offenders to discover hidden relationships and patterns in their behaviors and to predict future outcomes.

Real-Time Alcohol Monitoring

BACtrack is the world’s first smartphone-based remote alcohol monitoring system. The award-winning BACtrack Mobile integrates a smartphone app and police-grade breathalyzer branded for the Company to bring blood-alcohol content (“BAC”) wirelessly to a mobile device. We can quickly and easily estimate an enrollee’s BAC and track the results over time. The smartphone monitoring application allows supervisors to send scheduled or random notifications to enrollees to take BAC tests, providing photo/location-verified and time stamped results. It also includes an onboard calendar, reminding an enrollee of court dates, testing dates, medications to take, mandatory events to attend, and other matters.

Empower

Our Empower Smartphone Application provides victim and survivor support by creating a mobile geo-zone around a survivor of domestic abuse and communicates with the offender’s tracking device – providing an early-warning notification to the survivor if he or she is in proximity of the offender or group of offenders.

Socrates

Socrates 360 is a multipurpose platform offering a wide range of content and services to people as they return to the community. The user-centric customizable capabilities include educational courses, health and wellbeing advice, secure video conferencing, access to local services, event scheduling, appointment reminders, and check-ins based on the individual’s needs.

Accessories

SecureCuff®

The SecureCuff® is a patented, optional accessory available exclusively for ReliAlert® and is the only uncuttable strap in the industry specifically made for high-risk offenders. SecureCuff® has encased, hardened steel bands that provide extreme cut-resistance and includes the same fiber-optic technology as the standard strap for tampering notification.

RF Beacon™

The RF Beacon™ is a completely self-contained, short-range transmitting station that provides a Radio Frequency (“RF”) signal communicating with assigned offender GPS devices to increase the ability to maintain critical offender location information and provide agencies with an effective way to more accurately “tether” an offender to a specific location.

Product Support and Services

Monitoring Centers

Our monitoring centers provide live 24/7/365 monitoring of all alarms generated from our devices, as well as customer and technical support. Our monitoring center operators play a vital role, and as such, are staffed with highly trained, bilingual individuals. These operators act as an extension of agency resources receiving alarms, communicating and intervening with offenders regarding violations and interacting with supervision staff, all pursuant to agency-established protocols. The facilities have redundant power sources, battery backup and triple redundancy in voice, data and IP. We have assisted in the establishment of monitoring centers for customers and local partners in the United States, Chile and other global locations.

Customer Care

We offer a range of support options for our customers. These include assistance that is built into software products, printed and electronic product manuals, in-person training, online support including comprehensive product information, as well as technical assistance.

Research and Development Program

During the fiscal year ended September 30, 2023 (“Fiscal 2023”), we incurred research and development expenses of $2,735,060, as compared to $2,432,448 recognized during the fiscal year ended September 30, 2022 (“Fiscal 2022”). The $302,612 increase in research and development was largely due to higher wages and payroll taxes of $298,846. The Company has now significantly enhanced its technology platform to improve the efficiency of its software, firmware, user interface, and automation and invested considerable time in developing a new device expected to be completed in calendar 2024. As a result of these improvements, $1,020,604 and $865,263 was capitalized as developed technology, in accordance with the accounting guidance for internal-use software, during Fiscal 2023 and Fiscal 2022, respectively.

Competition

The markets for our products and services are highly competitive and we are confronted by aggressive competition in all areas of our business. These markets are characterized by frequent product introductions and technological advances. Our competitors selling tracking devices have aggressively cut prices and lowered their product margins to gain or maintain market share. Our financial condition and operating results could be adversely affected by these and other industry-wide downward pressures on gross margins. Principal competitive factors important to us include price, product features, relative price/performance, product quality and reliability, design innovation, a strong software ecosystem, service and support, and corporate reputation.

Our specific competitors vary from market to market and we compete against other international, national and regional companies, some of whom use local partners that may have more knowledge of the local markets and the government decision-making process. Some of our competitors are owned by large public companies with broader resources, while others are backed by private equity firms with large funds, or in some cases, work as part of a consortium with extensive international experience. We expect competition in these markets to intensify as competitors attempt to imitate some of the features of our products and applications within their own products or, alternatively, collaborate with third-party providers to offer solutions that are more competitive than those they currently offer.

Competitive Strengths

Relationships with High-Quality Government Customers. We have developed strong relationships with federal, state and county customers within the United States and with Ministries of Justice internationally and managed to bring in new, sizable customers in the past year.

Industry Leading Analytics Software. Our software remains a leader with fully functioning, revenue-generating analytics on the market today, specifically designed for the offender monitoring market. State departments of corrections, county probation agencies and sheriff’s offices have utilized this solution for multiple years.

Device Agnostic Software Platform. Our software platform is device agnostic and currently accommodates offender monitoring with new products that we introduce, integrates with case management software utilized by sheriff, probation and pre-trial departments, and supports devices manufactured by competitors.

Smartphone Monitoring Pioneers in Criminal Justice. Today’s prison system incarcerates too many individuals who pose little threat to public safety, at far too great a cost. They serve their sentences in overcrowded, outdated institutions that expose them to hardened criminals. Upon release, their opportunities and lives have changed forever. Now, low-risk offender populations can serve their sentences virtually, holding jobs and taking care of family members, yet still feeling the weight of their punishment while seeing a clear path to avoiding trouble in the future. Further, taxpayers gain a clear cost advantage. To date, we have developed apps targeting alcohol monitoring, domestic violence and our core monitoring platform.

Experienced Senior Management Team. Our top executives have extensive experience in both the offender monitoring marketplace and their specific fields of expertise, whether that be sales, customer care and/or technology. We also benefit from a diverse and experienced Board of Directors.

Recurring Revenue. Our revenue is generated in large part by long-term customer contracts based on the size of the offender monitoring program throughout each month, which creates a predictable, recurring revenue stream.

Extensive Product Suite. We have a large variety of products that appeal to a broad range of government customers and greatly enhance our ability to attract and retain clients. These products include different GPS devices, alcohol monitoring devices and applications, and new smartphone applications including those that address adjacent market opportunities in both the public and private sectors and analytics software.

National Footprint with International Presence. We operate in approximately 40 states (including Washington DC and Puerto Rico) as well as select international locations, including Chile, and Saudi Arabia and Bahamas. Our presence both within the United States and abroad better positions us to compete for new and expiring government contracts.

Sources and Availability of Raw Materials

We use various suppliers and contract manufacturers to supply parts and components for the manufacture and support of our product lines. Although our intention is to establish at least two sources of supply for materials whenever possible, for certain components we have sole or limited source supply arrangements. We may not be able to procure these components from alternative sources at acceptable prices and quality within a reasonable time, or at all; therefore, the risk of loss or interruption of such arrangements could impact our ability to deliver certain products on a timely basis.

The industry in which the Company operates continues to be impacted by the global semiconductor shortage initially caused by the slowdown of many chip makers and logistics companies due to COVID-19. However, the issues have lessened significantly and the Company has been able to purchase most components within reasonable lead times. See Item 1A Risk Factors.

Dependence on Major Customers

We had sales to two entities that each represent 10% or more of our gross revenue, as follows, for the years ended September 30, 2023 and 2022, respectively:

| |

|

2023

|

|

|

%

|

|

|

2022

|

|

|

%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer A

|

|

$ |

6,730,687 |

|

|

|

20 |

%

|

|

$ |

6,095,403 |

|

|

|

16 |

%

|

|

Customer B

|

|

|

3,804,951 |

|

|

|

11 |

%

|

|

|

4,871,073 |

|

|

|

13 |

%

|

No other customer represented more than 10% of our total revenue for the fiscal years ended September 30, 2023 or 2022.

Concentration of credit risk associated with our total and outstanding accounts receivable as of September 30, 2023 and 2022, respectively, are shown in the table below:

| |

|

2023

|

|

|

%

|

|

|

2022

|

|

|

%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer A

|

|

$ |

490,848 |

|

|

|

11 |

%

|

|

$ |

1,346,854 |

|

|

|

22 |

%

|

|

Customer B

|

|

|

303,777 |

|

|

|

7 |

%

|

|

|

714,399 |

|

|

|

11 |

%

|

|

Customer C

|

|

|

630,494 |

|

|

|

14 |

%

|

|

|

675,725 |

|

|

|

11 |

%

|

|

Customer D

|

|

|

465,320 |

|

|

|

10 |

%

|

|

|

310,723 |

|

|

|

5 |

%

|

Dependence on Major Suppliers

We purchase cellular services from several major suppliers. The cost to us for these services during Fiscal 2023 and Fiscal 2022 was $1,569,639 and $2,063,075, respectively. The 24% decrease in cellular service expense in Fiscal 2023 compared to Fiscal 2022 was largely the result of lower sales volume and lower negotiated pricing.

During Fiscal 2023 and Fiscal 2022, we also purchased a significant portion of our monitoring equipment from certain suppliers. The cost of these purchases during Fiscal 2023 and Fiscal 2022 was $3,503,515 and $2,187,774, respectively. The increase in monitoring equipment was largely due to the replacement of all 3G devices with 4G LTE devices in the U.S.

Intellectual Property

We currently hold rights to patents and copyrights relating to certain aspects of our hardware devices, accessories, software and services. We have registered or applied for trademarks and service marks in the U.S. and a number of foreign countries. Although we believe the ownership of such patents, copyrights, trademarks and service marks is an important factor in our business and that our success does depend in part on the ownership thereof, we rely primarily on the innovative skills, technical competence and marketing abilities of our personnel.

We file patent applications as needed to protect innovations arising from our research, development and design, and are currently pursuing numerous patent applications around the world. Over time, we have accumulated a large portfolio of issued patents around the world. We hold copyrights relating to certain aspects of our products and services. No single patent or copyright is solely responsible for protecting our products. We believe that the duration of our patents is adequate relative to the expected lives of our products.

Many of our products are designed to include intellectual property obtained from third parties. It may be necessary in the future to seek or renew licenses relating to various aspects of our products, processes and services. Although we have generally been able to obtain such licenses on commercially reasonable terms in the past, there is no guarantee that such licenses can be obtained in the future on reasonable terms, or at all. Because of technological changes in the industries in which we compete, current extensive patent coverage and the rapid rate of issuance of new patents, it is possible that certain components of our products, processes and services may unknowingly infringe existing patents or intellectual property rights of others. From time to time, we have been notified that we may be infringing certain patents or other intellectual property rights of third parties; however, no such notices have been received in the last two fiscal years.

Trademarks. We have developed and use trademarks in our business, particularly relating to our corporate and product names. We own seven trademarks that are registered with the United States Patent and Trademark Office, plus one trademark registered in Mexico and one in Canada. In addition, we have the Track Group trademark and design registered in various countries around the world.

We will file additional applications for the registration of our trademarks in foreign jurisdictions as our business expands under current and planned distribution arrangements. Protection of registered trademarks in some jurisdictions may not be as extensive as the protection provided by registration in the United States.

The following table summarizes our trademark registrations:

|

|

|

Application

|

|

|

Registration

|

|

Status/

|

|

Trademark

|

|

Number

|

|

|

Number

|

|

Next Action

|

|

|

|

|

|

|

|

|

|

|

|

TrackerPAL®

|

|

78/843035

|

|

|

|

3345878

|

|

Registered

|

|

Mobile911®

|

|

78/851384

|

|

|

|

3212937

|

|

Registered

|

|

TrackerPAL®

|

|

CA 1315487

|

|

|

|

TMA 749417

|

|

Registered

|

|

TrackerPAL®

|

|

MX 805365

|

|

|

|

960954

|

|

Registered

|

|

ReliAlert®

|

|

85/238049

|

|

|

|

4200738

|

|

Registered

|

|

SecureCuff®

|

|

85/626037

|

|

|

|

4271621

|

|

Registered

|

|

Track Group®

|

|

86/301716

|

|

|

|

4701636

|

|

Registered

|

|

Track Group® and Design*

|

|

MP 1257077

|

|

|

|

1257077

|

|

Registered

|

|

Track Group®

|

|

88/852471

|

|

|

|

6198974

|

|

Registered

|

| |

|

|

|

|

|

|

|

|

|

Track Group®

|

|

90/245541

|

|

|

|

6408353

|

|

Registered

|

* Track Group® and Design is also a registered trademark in the following jurisdictions/countries: European Union, Switzerland, Mexico, Canada and Chile.

Patents. We have 12 patents issued in the United States. At foreign patent offices, we have 9 patents issued.

The following tables summarize information regarding our patents and patent applications. There are no assurances given that the pending applications will be granted or that they will, if granted, contain all of the claims currently included in the applications.

|

|

|

Application

|

|

|

|

|

|

|

|

US Patents

|

|

Serial No.

|

|

Date Filed

|

|

Patent No.

|

|

Issue Date

|

|

Remote Tracking and Communication Device

|

|

11/202427

|

|

10-Aug-05

|

|

7330122

|

|

12-Feb-08

|

|

Remote Tracking and Communications Device

|

|

12/028088

|

|

8-Feb-08

|

|

7804412

|

|

28-Sep-10

|

|

Remote Tracking and Communications Device

|

|

12/875988

|

|

3-Sep-10

|

|

8031077

|

|

4-Oct-11

|

|

Alarm and Alarm Management System for Remote Tracking Devices

|

|

11/486992

|

|

14-Jul-06

|

|

7737841

|

|

15-Jun-10

|

|

Alarm and Alarm Management System for Remote Tracking Devices

|

|

12/792572

|

|

2-Jun-10

|

|

8013736

|

|

6-Sep-11

|

|

A Remote Tracking Device and a System and Method for Two-Way Voice Communication Between the Device and a Monitoring Center

|

|

11/486989

|

|

14-Jul-06

|

|

8797210

|

|

5-Aug-14

|

|

A Remote Tracking Device and a System and Method for Two-Way Voice Communication Between the Device and a Monitoring Center

|

|

14/323831

|

|

3-Jul-14

|

|

9491289

|

|

8-Nov-16

|

|

A Remote Tracking System with a Dedicated Monitoring Center

|

|

11/486976

|

|

14-Jul-06

|

|

7936262

|

|

3-May-11

|

|

Remote Tracking System and Device with Variable Sampling and Sending Capabilities Based on Environmental Factors

|

|

11/486991

|

|

14-Jul-06

|

|

7545318

|

|

9-Jun-09

|

|

Tracking Device Incorporating Enhanced Security Mounting Strap

|

|

12/818453

|

|

18-Jun-10

|

|

8514070

|

|

20-Aug-13

|

|

Tracking Device Incorporating Cuff with Cut Resistant Materials

|

|

14/307260

|

|

17-Jun-14

|

|

9129504

|

|

8-Sep-15

|

|

A System and Method for Monitoring Individuals Using a Beacon and Intelligent Remote Tracking Device

|

|

12/399151

|

|

6-Mar-09

|

|

8232876

|

|

31-Jul-12

|

|

|

|

Application

|

|

|

|

|

|

|

|

International Patents

|

|

Serial No.

|

|

Date Filed

|

|

Patent No.

|

|

Issue Date

|

|

Remote Tracking and Communication Device - Canada

|

|

|

2617923

|

|

4-Feb-08

|

|

2617923

|

|

7-Jun-16

|

|

Remote Tracking and Communication Device - Mexico

|

|

MX/a/2008/001932

|

|

8-Feb-08

|

|

278405

|

|

24-Aug-10

|

|

Secure Strap Mounting System for an Offender Tracking Device - EPO

|

|

|

10009091.9

|

|

1-Sep-10

|

|

2466563

|

|

2-Nov-22

|

|

Secure Strap Mounting System for an Offender Tracking Device - Mexico

|

|

MX/a/2011/002283

|

|

28-Feb-11

|

|

319057

|

|

4-Apr-14

|

|

Secure Strap Mounting System for an Offender Tracking Device - Canada

|

|

|

2732654

|

|

23-Feb-11

|

|

2732654

|

|

1-May-18

|

|

A System and Method for Monitoring Individuals Using a Beacon and Intelligent Remote Tracking Device - Canada

|

|

|

2717866

|

|

3-Sep-10

|

|

2717866

|

|

17-May-16

|

|

A System and Method for Monitoring Individuals Using a Beacon and Intelligent Remote Tracking Device - EPO

|

|

|

09 716 860.3

|

|

6-Oct-10

|

|

2260482

|

|

9-Jan-13

|

|

A System and Method for Monitoring Individuals Using a Beacon and Intelligent Remote Tracking Device - United Kingdom

|

|

Refer to EP Patent # 2260482

|

|

A System and Method for Monitoring Individuals Using a Beacon and Intelligent Remote Tracking Device - Mexico

|

|

MX/a/2010/009680

|

|

2-Sep-10

|

|

306920

|

|

22-Jan-13

|

Trade Secrets. We own certain intellectual property, including trade secrets, which we seek to protect, in part, through confidentiality agreements with employees and other parties. Even where these agreements exist, there can be no assurance that these agreements will not be breached, that we would have adequate remedies for any breach, or that our trade secrets will not otherwise become known to or independently developed by competitors.

We intend to protect our legal rights concerning intellectual property by all appropriate legal action. Consequently, we may become involved from time to time in litigation to determine the enforceability, scope, and validity of any of the foregoing proprietary rights. Any patent litigation could result in substantial cost and divert the efforts of management and technical personnel.

Government Regulation

Our operations are subject to various federal, state, local and international laws and regulations.

Currently, we are not involved in any pending or, to our knowledge, threatened governmental proceedings, which would require curtailment of our operations because of such laws and regulations.

Seasonality

Given the consistency in recurring domestic monitoring revenue by customers throughout Fiscal 2023, we detected no material seasonality in our business. However, as in previous years, incremental domestic device deployment opportunities typically slow down in the months of July and August. We believe this is due to the unavailability of judicial and corrections officials who observe a traditional vacation season during this period. In addition, the operation in Chile generally slows around Christmas time due to the courts willingness to permit offenders being monitored to visit family.

Employees

As of December 1, 2023, we had 162 full-time employees and 5 part-time employees. None of the employees are represented by a labor union or subject to a collective bargaining agreement. We have never experienced a work stoppage and management believes that relations with employees are good.

Additional Available Information

We make available, free of charge, at our corporate website (www.trackgrp.com) copies of our annual reports filed with the Securities and Exchange Commission (“SEC”) on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, and all amendments to these reports, as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act. We also provide copies of our Forms 8-K, 10-K, 10-Q, and proxy statements at no charge to investors upon request.

All reports filed by us with the SEC are available free of charge via EDGAR through the SEC website at www.sec.gov.

Item 1A. Risk Factors

Our business is subject to significant risks. You should carefully consider the risks described below and the other information in this Annual Report, including our financial statements and related notes, before you decide to invest in our Common Stock. If any of the following risks or uncertainties actually occur, our business, results of operations or financial condition could be materially harmed, the trading price of our Common Stock could decline and you could lose all or part of your investment. The risks and uncertainties described below are those that we currently believe may materially affect us; however, they may not be the only ones that we face. Additional risks and uncertainties of which we are unaware or currently deem immaterial may also become important factors that may harm our business. Except as required by law, we undertake no obligations to update any risk factors.

Risks Related to Our Business, Operations and Industry

We face risks related to our substantial indebtedness, including risk related to the repayment of our indebtedness.

As of September 30, 2023, excluding deferred financing costs, we had $43,247,660 of indebtedness outstanding, of which $322,915 becomes due and payable within the next 12 months, $60,745 matures in 2025, $0 matures in 2026 and $42,864,000 matures in 2027. We have $438,165 of interest accrued at September 30, 2023 related to our outstanding indebtedness. Our significant indebtedness could adversely affect our ability to raise additional capital to fund our operations, make interest payments as they come due, limit our ability to react to changes in the economy or our industry, and prevent us from meeting our obligations under our outstanding debt instruments. See “Recent Developments” and Note 7 to the Consolidated Financial Statements.

Our high degree of leverage could have adverse consequences to us, including:

| |

●

|

making it more difficult for us to make payments on our debt;

|

| |

●

|

increasing our vulnerability to general economic and industry conditions;

|

| |

●

|

requiring a substantial portion of cash flow from operations to be dedicated to the payment of principal and interest on our debt, thereby reducing our ability to use our cash flow to fund our operations, capital expenditures, and future business opportunities;

|

| |

●

|

restricting us from making strategic acquisitions or causing us to make non-strategic divestitures;

|

| |

●

|

limiting our ability to obtain additional financing for working capital, capital expenditures, product development, debt service requirements, acquisitions, and general corporate or other purposes; and

|

| |

●

|

limiting our ability to adjust to changing market conditions and placing us at a competitive disadvantage compared to our competitors who may be less highly leveraged.

|

We may not be able to generate sufficient cash to service all of our indebtedness and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments or to refinance our debt obligations depends on our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. While we are currently reviewing all options regarding our indebtedness, no assurances can be given that we will be successful in refinancing, extending or restructuring the debt, and we cannot assure you that we will maintain a level of cash flows sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay investments and capital expenditures, sell assets, seek additional capital, or restructure or refinance our indebtedness.

These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. In the absence of such operating results and resources, we could face substantial liquidity difficulties and might be required to dispose of material assets or operations to meet our debt service and other obligations. We may not be able to consummate those dispositions or the proceeds that we realize from them may not be adequate to meet the debt service obligations then due.

There is no certainty that the market will continue to accept or expand the use of our products and services.

Our targeted markets may be slow to, or may never, expand the use of our products or services. Governmental organizations may not use our products unless they determine, based on experience, advertising or other factors, that our products are a preferable alternative to other available methods of tracking or incarceration. In addition, decisions to adopt new tracking devices can be influenced by government administrators, regulatory factors, and other factors largely outside of our control. No assurance can be given that key decision-makers will continue to accept or expand the use of our products, and if they do not, it could have a material adverse effect on our business, financial condition and results of operations.

Budgetary issues faced by government agencies could adversely impact our future revenue.

Our revenue is primarily derived from contracts with state, local and county government agencies in the United States and governments of Caribbean and Latin American nations. Many of these government agencies are experiencing budget deficits and may continue to do so. As a result, we may experience delays in payment on customer invoices, the amount spent by our current clients on equipment and services that we supply may be reduced or grow at rates slower than anticipated, and it may be more difficult to attract additional government clients. In light of the recent hurricanes, and the destruction sustained by many Caribbean countries, this is of increasing risk. Furthermore, the industry has experienced a general decline in average daily lease rates for GPS tracking devices. As a result of these factors, our ability to maintain or increase our revenue may be negatively affected.

We rely on significant suppliers for key products and cellular access. If we do not renew these agreements when they expire, we may not continue to have access to these suppliers’ products or services at favorable prices or in volumes as we have in the past, which could adversely affect our results of operations or financial condition.

We have entered into agreements with several national providers for cellular services. We also currently rely on a single source for the large majority of the manufacturing of our devices. If any of these significant suppliers were to cease providing products or services to us, we would be required to seek alternative sources. No assurances can be given that alternate sources could be located or that the delay or additional expense associated with locating alternative sources for these products or services would not materially and adversely affect our business and financial condition.

Our research, development, marketing and export activities are subject to government regulations. The cost of compliance or the failure to comply with these regulations could adversely affect our business, results of operations and financial condition.

There can be no assurance that changes in the legal or regulatory framework or other subsequent developments will not result in limitation, suspension or revocation of regulatory approvals granted to us. Any such events, were they to occur, could have a material adverse effect on our business, financial condition and results of operations. We are required to comply with regulations for manufacturing and export practices, which mandate procedures for extensive control and documentation of product design, control and validation of the manufacturing process and overall product quality. If we, our management, or our third-party manufacturers fail to comply with applicable regulations regarding these manufacturing practices, we could be subject to a number of sanctions, including fines, injunctions, civil penalties, delays, suspensions or withdrawals of market approval, seizures or recalls of product, operating restrictions and in some cases, criminal prosecutions.

We face intense competition, including competition from entities that are more established and may have greater financial resources than we do, which may make it difficult for us to establish and maintain a viable market presence.

Our current and expected markets are rapidly changing. Although we believe our technology has advantages over competing systems, there can be no assurance that those advantages are significant. Many of our competitors have products or techniques approved or in development and operate large, well-funded research and development programs in the field. Moreover, competitors may be in the process of developing technology that could be developed more quickly or ultimately be more effective than our products. There can be no assurance that our competitors will not develop more effective or more affordable products or achieve earlier patent protection or product commercialization.

We are dependent upon certain customers, the loss of which may adversely affect our results of operations and business condition.

During Fiscal 2023, our two top customers accounted for an aggregate of 31% of total sales. See Note 2 to the Consolidated Financial Statements. In the event any of our top customers were to terminate their agreements with the Company, our results of operations and financial condition may be adversely affected.

Our business plan is subject to the risks of technological uncertainty, which may result in our products failing to be competitive or readily accepted by our target markets.

There can be no assurance that our research and development efforts will be successful. In addition, the technology that we integrate or that we may expect to integrate with our product and service offerings is rapidly changing and developing. We face risks associated with the possibility that our technology may not function as intended and the possible obsolescence of our technology and the risks of delay in the further development of our own technologies. Cellular coverage is not uniform throughout our current and targeted markets. GPS technology depends upon “line-of-sight” access to satellite signals used to locate the user, which, under some circumstances, may limit the effectiveness of GPS tracking. In addition, the telecommunications industry continually updates its networks and technology which then requires the Company to update its devices to ensure compatibility with the new networks as is happening with the phase out of 3G cellular networks in the US.

We face risks of litigation and regulatory investigation and actions in connection with our operations.

Lawsuits, including regulatory actions, may seek recovery of large, indeterminate amounts or otherwise limit our operations, and their existence and magnitude may remain unknown for substantial periods of time. Relevant authorities in the markets in which we operate may investigate us in the future. These investigations may result in significant penalties in multiple jurisdictions, and we may become involved in disputes with private parties seeking compensation for damages resulting from the relevant violations. Such legal liability or regulatory action could have a material adverse effect on our business, results of operations, financial condition, cash flows, reputation and credibility. In addition, our business activities are subject to various governmental regulations in countries where we operate, which include investment approvals, export regulations, tariffs, antitrust, anti-bribery, intellectual property, consumer and business taxation, foreign trade, exchange controls, and environmental and recycling requirements. These regulations limit, and other new or amended regulations may further limit, our business activities or increase operating costs. In addition, the enforcement of such regulations, including the imposition of fines or surcharges for violation of such regulations, may adversely affect our results of operations, financial condition, cash flows, reputation and credibility.

Our products are subject to the risks and uncertainties associated with the protection of intellectual property and related proprietary rights.

We believe that our success depends in part on our ability to obtain and enforce patents, maintain trade secrets and operate without infringing on the proprietary rights of others, both in the United States and in other countries. Our inability to obtain or to maintain patents on our key products could adversely affect our business. We currently own 21 patents issued and have filed and may file additional patent applications in the United States and in key foreign jurisdictions relating to our technologies, improvements to those technologies, and for specific products we may develop. There can be no assurance that patents will issue on any of these applications or that, if issued, any patents will not be challenged, invalidated or circumvented. The enforcement of patent rights can be uncertain and involves complex legal and factual questions. The scope and enforceability of patent claims are not systematically predictable with absolute accuracy. The strength of our own patent rights depends, in part, upon the breadth and scope of protection provided by the patent and the validity of our patents, if any.

Our success will also depend, in part, on our ability to avoid infringing the patent rights of others. We must also avoid any material breach of technology licenses we may enter into with respect to our new products and services. Existing patent and license rights may require us to alter the designs of our products or processes, obtain licenses or cease certain activities. If patents have been issued to others that contain competitive or conflicting claims and such claims are ultimately determined to be valid and superior to our own, we may be required to obtain licenses to those patents or to develop or obtain alternative technology. If any licenses are required, there can be no assurance given that we will be able to obtain any necessary licenses on commercially favorable terms, if at all. Any breach of an existing license or failure to obtain a license to any technology that may be necessary in order to commercialize our products may have a material adverse impact on our business, results of operations and financial condition.

We also rely on trade secrets laws to protect portions of our technology for which patent protection has not yet been pursued or is not believed to be appropriate or obtainable. These laws may protect us against the unlawful or unpermitted disclosure of any information of a confidential and proprietary nature, including but not limited to our know-how, trade secrets, methods of operation, names and information relating to vendors or suppliers, and customer names and addresses. We seek to protect this un-patentable and unpatented proprietary technology and processes, in addition to other confidential and proprietary information in part, by entering into confidentiality agreements with employees, collaborative partners, consultants, and certain contractors. There can be no assurance that these agreements will not be breached, that we will have adequate remedies for any breach, or that our trade secrets and other confidential and proprietary information will not otherwise become known or be independently discovered or reverse-engineered by competitors.

We conduct business internationally with a variety of sovereign governments.

Our business is subject to a variety of regulations and political interests that could affect the timing of payment for services and the duration of our contracts. We face the risk of systems interruptions and capacity constraints, possibly resulting in adverse publicity, revenue loss and erosion of customer trust. The satisfactory performance, reliability and availability of our network infrastructure are critical to our reputation and our ability to attract and retain customers and to maintain adequate customer service levels. In addition, because our customers in these foreign jurisdictions are sovereign governments or governmental departments or agencies, it may be difficult for us to enforce our agreements with them in the event of a breach of those agreements, including, but not limited to, the failure to pay for services rendered or to complete projects that we have commenced.

Weakened global economic conditions may adversely affect our industry, business and results of operations.

The rate at which our customers purchase new or enhanced services depends on several factors, including general economic conditions in the US and abroad. These factors include overall business and consumer demand for a variety of goods and services, credit availability, interest rates, inflation rates, corporate profitability, equity and foreign exchange markets, the number of bankruptcies, and overall uncertainty with respect to the economy. The trends and volatility of these economic factors will determine the stability and predictability of economic and market conditions. These conditions will affect the rate of information technology and government spending and could adversely affect our customers’ ability or willingness to purchase our services, delay prospective customers’ purchasing decisions, reduce the value or duration of their contracts or affect renewal rates, all of which could adversely affect our operating results.

Our business is subject to risks arising from epidemic diseases, such as the recent global outbreak of the COVID-19 coronavirus.

The COVID-19 pandemic has impacted worldwide economic activity. A pandemic, including COVID-19 or another public health epidemic, poses the risk that we or our employees, contractors, suppliers, and other partners may be prevented from conducting business activities for an indefinite period of time, including shutdowns that may be requested or mandated by governmental authorities. While it is not possible at this time to estimate the impact that COVID-19 had, or could have, on our business, the COVID-19 pandemic and mitigation measures have had and may continue to have an adverse impact on global economic conditions which could have an adverse effect on our business and financial condition, including impairing our ability to raise capital when needed. In addition, for a period of time we were under a shelter-in-place mandate which may be reinstated at the discretion of state or local authorities and many of our clients worldwide may be similarly impacted.

Climate change, and related legislative and regulatory responses to climate change, may adversely impact our business.

There is increasing concern that a gradual rise in global average temperatures due to increased concentration of carbon dioxide and other greenhouse gases in the atmosphere will cause significant changes in weather patterns around the globe, an increase in the frequency, severity, and duration of extreme weather conditions and natural disasters, and water scarcity and poor water quality. These events could adversely impact the delivery of raw materials required for our products, disrupt the operation of our supply chain and the productivity of our contract manufacturers, increase our production costs, impose capacity restraints and impact the purchases of our products and services. These events could also compound adverse economic conditions and impact consumer confidence and governmental budgets. As a result, the effects of climate change could have a long-term adverse impact on our business and results of operations. In many countries, governmental bodies are enacting new or additional legislation and regulations to reduce or mitigate the potential impacts of climate change. If we, our suppliers, or our contract manufacturers are required to comply with these laws and regulations, or if we choose to take voluntary steps to reduce or mitigate our impact on climate change, we may experience increased costs for energy, production, transportation, and raw materials, increased capital expenditures, or increased insurance premiums and deductibles, which could adversely impact our operations. Inconsistency of legislation and regulations among jurisdictions may also affect the costs of compliance with such laws and regulations. Any assessment of the potential impact of future climate change legislation, regulations or industry standards, as well as any international treaties and accords, is uncertain given the wide scope of potential regulatory change in the countries in which we operate.

Our results of operations can be adversely affected by labor shortages, turnover and labor cost increases.

Labor is a component of operating our business. A number of factors may adversely affect the labor force available to us or increase labor costs from time to time, including high employment levels, federal unemployment subsidies, and other government regulations. Although we have not experienced any material disruptions due to labor shortages to date, we have observed an overall tightening and increasingly competitive labor market. A sustained labor shortage or increased turnover rates within our employee base, could lead to increased costs, such as increased overtime to meet demand and increased wage rates to attract and retain employees, and could negatively affect our ability to complete our construction projects according to the required schedule or otherwise efficiently operate our business. If we are unable to hire and retain employees capable of performing at a high level, or if mitigation measures we may take to respond to a decrease in labor availability, such as overtime and third-party outsourcing, have unintended negative effects, our business could be adversely affected.

Additionally, our operations are subject to a variety of federal, state and local employment-related laws and regulations, including, but not limited to, the U.S. Fair Labor Standards Act, which governs such matters as minimum wages, the Family Medical Leave Act, overtime pay, compensable time, recordkeeping and other working conditions, Title VII of the Civil Rights Act, the Employee Retirement Income Security Act, the Americans with Disabilities Act, the National Labor Relations Act, regulations of the Equal Employment Opportunity Commission, regulations of the Office of Civil Rights, regulations of the Department of Labor, regulations of state attorneys general, federal and state wage and hour laws, and a variety of similar laws enacted by the federal and state governments that govern these and other employment-related matters. As our employees are located in a number of states, compliance with these evolving federal, state and local laws and regulations, including increases in federal or state minimum wage laws, could substantially increase our cost of doing business while failure to do so could subject us to fines and lawsuits.

An overall labor shortage, lack of skilled labor, increased turnover or labor inflation, increase in federal or state minimum wages, or increase in general labor costs, caused by prolonged COVID-19 or as a result of general macroeconomic factors, could have a material adverse impact on our operations, results of operations, liquidity or cash flows.

The global semiconductor shortage could impact the Company’s future results.

The industry in which the Company operates, as well as many other industries (automotive, consumer products and medical devices), have been impacted by the global semiconductor shortage initially caused by the slowdown of many chip makers and logistics companies due to COVID-19. However, the issues have lessened significantly and the Company has been able to purchase most components within reasonable lead times.

We may experience temporary service interruptions for a variety of reasons, including telecommunications or power failures, fire, water damage, vandalism, civil unrest, computer bugs or viruses, malicious cyber-attacks or hardware failures.

Any service interruption that results in the unavailability of our system or reduces its capacity could result in real or perceived public safety issues that may affect customer confidence in our services. Historically, we have experienced temporary interruptions of telecommunications or power outages, which were eventually mitigated, although our customer in Puerto Rico was again disrupted by another strong storm (Hurricane Fiona) which hit the island in September 2022. Such instances may result in the slowdown or loss of customer accounts or similar problems if they occur again in the future. Given rapidly changing technologies, we are not certain that we will be able to adapt the use of our services to permit, upgrade, and expand our systems or to integrate smoothly with new technologies. Network and information systems and other technologies are critical to our business activities. Network and information systems-related events, including those caused by us, our service providers or by third parties, such as computer hacking, cyber-attacks, computer viruses, or other destructive or disruptive software, process breakdowns, denial of service attacks, malicious social engineering or other malicious activities, or any combination of the foregoing could result in a degradation or disruption of our services. These types of events could result in a loss of customers and large expenditures to repair or replace the damaged properties, networks or information systems or to protect them from similar events.

We currently have one independent director sitting on our Board of Directors.