As filed with the Securities and Exchange Commission

on December 18, 2023

Registration No. 333-__________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

ADC THERAPEUTICS SA

(Exact name of registrant as specified in its charter)

| Switzerland |

|

Not Applicable |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

|

Biopôle, Route de la Corniche 3B,

1066 Epalinges, Switzerland

(Address of Principal Executive Offices) |

| |

ADC Therapeutics SA 2022 Employee Stock Purchase

Plan

(Full title of the plans)

ADC Therapeutics America, Inc.

430 Mountain Avenue, Suite 404

New Providence, NJ 07974

(Name and Address of Agent For Service)

(908) 731-5556

(Telephone number, Including Area Code, of Agent

For Service)

Copies of all communications, including all

communications sent to the agent for service, should be sent to:

Deanna L. Kirkpatrick

Yasin Keshvargar

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

(212) 450-4000

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

|

Accelerated filer ☒ |

| Non-accelerated filer ☐ |

|

Smaller reporting company ☐ |

| (Do not check if a smaller reporting company) |

|

Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the information specified

in Item 1 and Item 2 of Part I of Form S-8 will be sent or given to participants as specified by Rule 428(b)(1) under the Securities Act.

In accordance with the rules and regulations of the U.S. Securities and Exchange Commission (the “Commission”) and

the instructions to Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement or

as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents are incorporated herein by reference:

(a) The Registrant’s Annual Report on Form 20-F filed with the

Commission on March 15, 2023 (Registration No. 001-39071), which contains the Registrant’s audited financial statements for the

latest fiscal year for which such statements have been filed;

(b) The Registrant’s Reports on Form 6-K filed with the SEC on

March 15, 2023 (only with respect to “Compensation Report of ADC Therapeutics SA for the Year Ended December 31, 2022—2. Compensation

of the Board of Directors” and “Compensation Report of ADC Therapeutics SA for the Year Ended December 31, 2022—3. Compensation

of the Members of Executive Management” in Exhibit 99.1 thereto), May 9, 2023 (only with respect to Exhibits 99.1 and 99.2), August

8, 2023 (only with respect to Exhibits 99.1 and 99.2) and November 7, 2023 (only with respect to Exhibits 99.1 and 99.2); and

(c) The description of the Registrant’s share capital which is

contained in the Registrant’s Registration Statement Form 8-A (Registration No. 001-39071), dated May 11, 2020, including any amendments

or supplements thereto.

In addition, all documents subsequently filed by the Registrant with

the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), prior to the filing of a post-effective amendment to this Registration Statement which indicates that all securities

offered have been sold or which deregisters all securities then remaining unsold, including any Reports of Foreign Private Issuers on

Form 6-K submitted during such period (or portion thereof) that is identified in such form as being incorporated by reference into this

Registration Statement, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the

date of the filing of such documents. The Registrant is not incorporating by reference any documents or portions thereof, whether specifically

listed above or filed in the future, that are not deemed “filed” with the Commission.

Any statement contained in a document incorporated or deemed to be

incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent

that a statement contained herein, (or in any other subsequently filed document which also is incorporated or deemed to be incorporated

by reference herein), modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except

as so modified or superseded, to constitute a part of this Registration Statement.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 8. Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing this Registration

Statement and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in

the city of Epalinges, Switzerland on December 18, 2023.

| |

ADC THERAPEUTICS SA |

|

| |

|

|

| |

|

|

| |

By: |

/s/ Ameet Mallik |

|

| |

Name: |

Ameet Mallik |

|

| |

Title: |

Chief Executive Officer |

|

| |

|

|

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature

appears below hereby constitutes and appoints Ameet Mallik, Jose Carmona and Peter Graham and each of them, individually, as his or her

true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or her name,

place and stead, in any and all capacities, in connection with this registration statement, including to sign in the name and on behalf

of the undersigned, this registration statement and any and all amendments thereto, including post-effective amendments and registrations

filed pursuant to Rule 462 under the Securities Act, as amended, and to file the same, with all exhibits thereto, and other documents

in connection therewith, with the U.S. Securities and Exchange Commission, granting unto each such attorney-in-fact and agent full power

and authority to do and perform each and every act in person, hereby ratifying and confirming all that each said attorney-in-fact and

agent, or his or her substitutes, may lawfully do or cause to be done by virtue hereof. Pursuant to the requirements of the Securities

Act, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

Date |

| |

|

|

|

| /s/ Ameet Mallik |

|

Chief Executive Officer and Director |

12/18/23 |

| Ameet Mallik |

|

(Principal Executive Officer) |

|

| |

|

|

|

| /s/ Jose Carmona |

|

Chief Financial Officer |

12/18/23 |

| Jose Carmona |

|

(Principal Financial Officer) |

|

| |

|

|

|

| /s/ Lisa Källebo |

|

Vice President, Corporate Controller and Chief

Accounting Officer

(Principal Accounting Officer) |

12/18/23 |

| Lisa Källebo |

|

|

|

| |

|

|

|

| /s/ Ron Squarer |

|

|

12/18/23 |

| Ron Squarer |

|

Chairman of the Board of Directors |

|

| |

|

|

|

| /s/ Peter Hug |

|

|

12/18/23 |

| Peter Hug |

|

Vice Chairman of the Board of Directors |

|

| |

|

|

|

| /s/ Viviane Monges |

|

|

12/18/23 |

| Viviane Monges |

|

Director |

|

| |

|

|

|

| /s/ Robert Azelby |

|

|

12/18/23 |

| Robert Azelby |

|

Director |

|

| |

|

|

|

| /s/ Jean-Pierre Bizzari |

|

|

12/18/23 |

| Jean-Pierre Bizzari |

|

Director |

|

| |

|

|

|

| /s/ Thomas Pfisterer |

|

|

12/18/23 |

| Thomas Pfisterer |

|

Director |

|

| |

|

|

|

| /s/ Tyrell J. Rivers |

|

|

12/18/23 |

| Tyrell J. Rivers |

|

Director |

|

| |

|

|

|

| /s/ Victor Sandor |

|

|

12/18/23 |

| Victor Sandor |

|

Director |

|

| |

|

|

|

| /s/ Peter Graham |

|

|

12/18/23 |

| Peter Graham |

|

Chief Legal Officer, Authorized Representative in the United States |

|

| ADC Therapeutics America, Inc. |

|

|

|

Exhibit 5

|

ADC Therapeutics SA

Biopôle

Route de la Corniche 3 B

1066 Epalinges

Switzerland

|

Homburger AG

Prime Tower

Hardstrasse 201

CH-8005 Zurich

homburger.ch

T +41 43 222 10 00

|

| December 18, 2023 |

| |

| ADC Therapeutics SA – Registration Statement on Form S-8 |

| |

Ladies and Gentlemen

We have acted as special Swiss counsel to ADC Therapeutics

SA, a stock corporation incorporated under the laws of Switzerland (the Company), in connection with the filing of a registration

statement on Form S-8 (the Registration Statement), to be filed with the United States Securities and Exchange Commission (the

SEC) on the date hereof for the purpose of registering under the United States Securities Act of 1933, as amended (the Securities

Act), an aggregate of 784,000 common shares of the Company, each with a nominal value of CHF 0.08 (the Common Shares).

As such counsel, we have been requested to give our opinion as to certain legal matters of Swiss law.

Capitalized terms used but not defined herein shall

have the meaning ascribed to them in the Documents (as defined below).

This opinion is confined to and given on the basis

of the laws of Switzerland in force at the date hereof. Such laws and the interpretation thereof are subject to change.

This opinion is also confined to:

| a) | the matters stated herein and is not to be read as extending, by implication or otherwise, to any other

matter, agreement or document referred to in any of the Documents (as defined below); and |

| b) | the documents listed below (collectively, the Documents). |

For the purpose of giving this opinion, we have

only examined originals or copies of the following documents:

| (i) | an electronic copy of the Registration Statement; |

| (ii) | an electronic copy of the Company's amended 2022 employee stock purchase plan, effective as of December

1, 2023 (the Plan); |

| (iii) | an electronic copy of a written resolution of the board of directors of the Company, dated May 13, 2022,

approving, inter alia, the Plan (the Board Resolution 1); |

| (iv) | an electronic copy of a written resolution of the board of directors of the Company, dated December 1,

2023, approving, inter alia, the amendments to the Plan and the filing of the Registration Statement (the Board Resolution 2,

together with the Board Resolution 1, the Board Resolutions); |

| (v) | an electronic copy of the minutes of the Company's ordinary general meeting held on June 30, 2022 (the

Shareholders' Resolution), resolving on, inter alia, the approval of the Plan; |

| (vi) | a certified copy of the notarized articles of association (statuts) of the Company dated June 14,

2023 (the Articles of Association), containing, inter alia, a capital range in the amount of CHF 7,123,355.68 (lower

limit) and CHF 10,685,033.52 (upper limit) (the Capital Range); and |

| (vii) | a certified excerpt from the Commercial Register of the Canton of Vaud, Switzerland, dated November 22,

2023, relating to the Company (the Excerpt). |

No documents have been reviewed by us in connection

with this opinion other than those listed above. Accordingly, our opinion is limited to the Documents and their impact on the parties

under Swiss law.

In this opinion, Swiss legal concepts are expressed

in English terms and not in their original language. These concepts may not be identical to the concepts described by the same English

terms as they exist under the laws of other jurisdictions. With respect to Documents governed by laws other than the laws of Switzerland,

for purposes of this opinion we have relied on the plain meaning of the words and expressions contained therein without regard to any

import they may have under the relevant governing law.

In rendering the opinion below, we have assumed

the following:

| (a) | all documents produced to us as originals are authentic and complete, and all documents produced to us

as copies (including, without limitation, electronic copies) conform to the original; |

| (b) | all documents produced to us as originals and the originals of all documents produced to us as copies

were duly executed and certified, as applicable, by the individuals purported to have executed or certified, as the case may be, such

documents; |

| (c) | all documents produced to us in draft form will be executed in the form of the draft submitted to us; |

| (d) | all signatures appearing on all original documents or copies thereof which we have examined are genuine; |

| (e) | each party to the Documents is a corporation or other legal entity duly organized and validly existing

and in good standing (if applicable) under the laws of the jurisdiction of its incorporation and/or establishment and none of the parties

to the Documents (other than the Company) has passed or, until the issuance of all Common Shares, will have passed a voluntary winding-up

resolution; no petition has been, or, until the issuance of all Common Shares, will be presented or order made by a court for the winding-up,

dissolution, bankruptcy or administration of any party (other than the Company); and no receiver, trustee in bankruptcy, administrator

or similar officer has been or, until the issuance of all Common Shares, will have been appointed in relation to any of the parties (other

than the Company) or any of their assets or revenues; |

| (f) | to the extent relevant for purposes of this opinion, any and all information contained in the Documents

is and will be true, complete and accurate at all relevant times; |

| (g) | no laws (other than those of Switzerland) affect any of the conclusions stated in this opinion; |

| (h) | the Registration Statement has been filed by the Company; |

| (i) | the filing of the Registration Statement with the SEC has been authorized by all necessary actions under

all applicable laws other than Swiss law; |

| (j) | the Registration Statement, the Excerpt and the Articles of Association are unchanged, correct, complete

and up-to-date and in full force and effect as of the date hereof and no changes have been made which should have been or should be reflected

in the Registration Statement, the Excerpt or the Articles of Association, as the case may be, as of the date hereof; |

| (k) | the Board Resolutions and the Shareholders' Resolution (i) have been duly resolved in a meeting duly

convened and otherwise in the manner set forth therein, (ii) have not been amended, and (iii) are in full force and effect; |

| (l) | the Plan has not been amended and is in full force and effect; |

| (m) | prior to the issuance of any Common Shares, the board of directors of the Company will have duly authorized

the issuance of any Common Shares or rights to receive Common Shares and will have validly excluded the pre-emptive rights of the existing

shareholders for purposes of the offering of Common Shares under the Plan as contemplated in the Registration Statement, and such authorization

and exclusion will not have been amended and will be in full force and effect until the issuance of all Common Shares; |

| (n) | any Common Shares issued out of the Capital Range will be listed on the New York Stock Exchange in accordance

with applicable laws and regulations; |

| (o) | all notices by which a right to receive Common Shares issued out of the Capital Range is exercised will

be duly delivered in accordance with Swiss law, the Plan and any applicable contractual arrangements; |

| (p) | to the extent the Company issues Common Shares out of the Capital Range against cash, the performance

of the contribution in money shall be made at a banking institution subject to the Swiss Federal Act on Banks and Savings Banks of November 8,

1934, as amended; |

| (q) | the Company has not entered and will not enter into any transaction which could be construed as repayment

of share capital (restitution des versements) and has not undertaken and will not undertake an acquisition in kind (reprise

de biens) or intended acquisition in kind (reprise de biens envisagée) without complying with the formal procedure set

forth in article 628 of the Swiss Code of Obligations; and |

| (r) | all authorizations, approvals, consents, licenses, exemptions, other than as required by mandatory Swiss

law applicable to the Company or the Articles of Association, and other requirements for the filing of the Registration Statement or for

any other activities carried on in view of, or in connection with, the performance of the obligations expressed to be undertaken by the

Company in the Registration Statement have been duly obtained or fulfilled in due time and are and will remain in full force and effect,

and any related conditions to which the parties thereto are subject have been satisfied. |

Based on the foregoing assumptions and subject

to the qualifications set out below, we express the following opinion:

| 1. | The Company is a corporation (société anonyme) duly incorporated and validly existing

under the laws of Switzerland with all requisite corporate power and authority to enter into, to perform and to conduct its business as

described in the Articles of Association. |

| 2. | The Common Shares that may be issued from the Capital Range, if and when such Common Shares are issued

pursuant to the Articles of Association, the Plan, any applicable contractual arrangements and Swiss law, and after the subscription amount

for such Common Shares has been paid-in in cash or by way of set-off, and when such Common Shares have been entered into the Company's

book of uncertificated securities, will be validly issued, fully paid as to their nominal value and non-assessable. |

The above

opinions are subject to the following qualifications:

| (a) | The lawyers of our firm are admitted to the Zurich bar and do not hold themselves to be experts in any

laws other than the laws of Switzerland. Accordingly, our opinion is confined to Swiss law only, based on our independent professional

judgment. We have abstained from examining any issues of any other laws. |

| (b) | The exercise of voting rights and rights related thereto with respect to any Common Shares is only permissible

if and when such Common Shares have been validly issued and in any case after registration in the Company's share register as a shareholder

with voting rights in accordance with the provisions of, and subject to the limitations provided in, the Articles of Association. |

| (c) | We have not investigated or verified the truth or accuracy of the information contained in the Registration

Statement, nor have we been responsible for ensuring that no material information has been omitted from it. |

| (d) | We express no opinion as to regulatory matters or as to any commercial, accounting, calculating, auditing

or other non-legal matter. |

We have issued this opinion as of the date hereof

and we assume no obligation to advise you of any changes that are made or brought to our attention hereafter.

We hereby consent to the filing of this opinion

as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit that we are in the category of persons whose

consent is required under Section 7 of the Securities Act.

This opinion shall be governed by and construed

in accordance with the laws of Switzerland. We confirm our understanding that all disputes arising out of or in connection with this opinion

shall be subject to the exclusive jurisdiction of the courts of the Canton of Zurich, Switzerland, venue being Zurich 1.

[Signature page follows]

Sincerely yours

Homburger AG

/s/ Daniel

Häusermann

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent to the incorporation by reference in this Registration

Statement on Form S-8 of ADC Therapeutics SA of our report dated March 15, 2023 relating to the consolidated financial statements and

the effectiveness of internal control over financial reporting, which

appears in ADC Therapeutics SA’s Annual Report on Form 20-F for the year ended December 31, 2022.

/s/ PricewaterhouseCoopers SA

Lausanne, Switzerland

December 18, 2023

Exhibit 107.1

Calculation of Filing Fee

Tables

FORM S-8

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

ADC THERAPEUTICS SA

(Exact Name of Registrant as

Specified in Its Charter)

Table 1: Newly Registered Securities

| Security Type |

Security Class Title (1) |

Fee Calculation Rule |

Amount Registered (2) |

Proposed Maximum Offering Price Per Unit (2) |

Maximum Aggregate Offering Price |

Fee Rate |

Amount of Registration Fee (3) |

|

Equity

|

Common Shares, par value CHF 0.08 each, to be issued pursuant to the ADC Therapeutics SA Employee Stock Purchase Plan |

Rule 457(c) and Rule 457(h) |

784,000 |

$1.70 |

$1,332,800 |

$147.60 per $1,000,000 |

$196.72 |

| Total Offering Amounts |

|

$1,332,800 |

|

$196.72 |

| Total Fee Offsets (4) |

|

|

|

- |

| Net Fee Due |

|

|

|

$196.72 |

| (1) | This Registration Statement on Form S-8 (this “Registration Statement”) covers common

shares, par value CHF 0.08 each (“Common Shares”), of ADC Therapeutics SA (the “Registrant”) issuable

pursuant to the ADC Therapeutics SA Employee Stock Purchase Plan, as amended and restated (the “ESPP”). Pursuant to

Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall

also cover any additional Common Shares that become issuable under the ESPP by reason of any share dividend, share split or other similar

transaction. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(h) and Rule

457(c) under the Securities Act on the basis of the average high and low sale prices of Common Shares on the New York Stock Exchange on

December 15, 2023. |

| (3) | Rounded up to the nearest penny. |

| (4) | The Registrant does not have any fee offsets. |

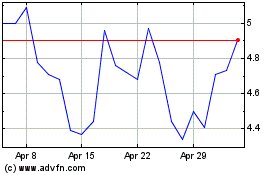

ADC Therapeutics (NYSE:ADCT)

Historical Stock Chart

From Apr 2024 to May 2024

ADC Therapeutics (NYSE:ADCT)

Historical Stock Chart

From May 2023 to May 2024