true

to correct Exhibit 10.2

0001210618

0001210618

2023-09-26

2023-09-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K/A

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 18, 2023 (September 26, 2023)

SPI Energy

Co., Ltd.

(Exact Name of Registrant as Specified in its Charter)

| Cayman Islands |

|

001-37678 |

|

20-4956638 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

4803

Urbani Ave.

McClellan

Park, CA |

|

95652 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (408) 919-8000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Ordinary Shares |

|

SPI |

|

The NASDAQ Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This amended Current Report on Form 8-K/A is being

filed solely to correct several discrepancies that appeared in the Secured Promissory Note filed as Exhibit 10.2 and the Stock Pledge

Agreement filed as Exhibit 10.3 to the Current Report on Form 8-K filed on September 29, 2023 (the “Original 8-K), compared to the

final Secured Promissory Note and Stock Pledge Agreement that were executed by SPI Energy Co., Ltd. (the “Company”). Except

for the changes described below relating primarily to the timing of interest payments under the Secured Promissory Note (as defined below)

and the release of Shares (as defined below) pursuant to the Stock Pledge Agreement (as defined below) upon the repayment of the Secured

Promissory Note, no other material changes were made to the Original 8-K.

Item 1.01. Entry into a Material Definitive Agreement.

On September 26, 2023,

EdisonFuture, Inc. (“EdisonFuture”), a wholly-owned subsidiary of the Company, entered into a stock purchase agreement (the

“Purchase Agreement”) with Palo Alto Clean Tech Holding Limited, a British Virgin Islands exempted company which is owned

and controlled by Xiaofeng Peng, the Chairman and Chief Executive Officer of the Company, and his spouse (the “Purchaser”).

Pursuant to the terms of the Purchase Agreement, EdisonFuture agreed to sell to the Purchaser an aggregate of 12,000,000 shares of common

stock, $0.004 par value (the “Shares”), of Phoenix Motor Inc., a Delaware corporation (“Phoenix”), at a per share

price of $1.02, representing an aggregate purchase price of $12,240,000 (the “Purchase Price”). Phoenix is a subsidiary of

the Company and Xiaofeng Peng also serves as its Chairman and Chief Executive Officer.

The Purchaser agreed to

pay the Purchase Price to EdisonFuture by delivering to EdisonFuture on September 26, 2023, which was the date of closing (the “Closing”):

(a) a cash payment of

$40,000 in immediately available funds by wire transfer to EdisonFuture, and

(b) a secured promissory

note in the aggregate principal amount of $12,200,000 (the “Secured Promissory Note”), secured by all of the Purchaser’s

interest in the Shares pursuant to a stock pledge agreement (the “Stock Pledge Agreement”).

The Secured Promissory

Note bears interest at 3% per annum, payable in arrears on December 31 of each year, with the full principal balance of $12,200,000, and

all accrued but unpaid interest, due on the maturity date, which is three years from the Closing, or September 30, 2026.

The Secured Promissory Note bears interest at 3%

per annum, payable in arrears on or before December 31 of each year, commencing December 31, 2023, with the total unpaid principal balance,

and all accrued but unpaid interest, due on the maturity date of September 30, 2026.

Upon payment of principal

under the Secured Promissory Note, Shares will be released to the Purchaser pursuant to the Stock Pledge Agreement in proportion to the

principal amount paid (excluding interest payments by the Purchaser) based upon the original principal amount of $12,200,000. For example,

when the Purchaser makes a payment of principal equal to one-twelfth (1/12) of the original principal amount of the Secured Promissory

Note ($1,020,000), one-twelfth (1/12) of the Shares (1,000,000 Shares) shall be released to the Purchaser. As of December 14, 2023, no

principal amount has been paid by the Purchaser to Edison Future and no Shares have been released by Edison Future to the Purchaser under

the Stock Pledge Agreement.

The foregoing is a brief

summary only and does not purport to be a complete description, and is subject to and qualified in its entirety by reference to the Secured

Promissory Note and the Stock Pledge Agreement, which are attached hereto as Exhibit 10.2 and Exhibit 10.3, respectively, and are incorporated

by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SPI ENERGY CO., LTD. |

|

| |

|

|

|

| December 18, 2023 |

By: |

/s/ Xiaofeng Peng |

|

| |

|

Xiaofeng Peng |

|

| |

|

Chief Executive Officer |

|

Exhibit 10.2

SECURED

PROMISSORY NOTE

| $12,200,000 |

September 26, 2023 |

FOR VALUE RECEIVED,

PALO ALTO CLEAN TECH HOLDING LIMITED, a British Virgin Islands exempted company (the “Maker”), hereby promises to pay

to the order of EDISON FUTURE, INC.. or its successors and assigns (together with its successors and assigns, the “Holder”),

the principal sum of Twelve Million Two Hundred Thousand Dollars ($12,200,000), with interest on the unpaid principal amount of this Secured

Promissory Note (as amended, modified, extended, restated, replaced, or supplemented from time to time, this “Note”)

from time to time as provided herein. Capitalized terms used but not defined in this Note shall have the meanings given to them in Exhibit

A to this Note.

1.

Interest. Interest shall accrue on the unpaid principal sum of this Note at an annual rate equal to three

percent (3.00%) commencing on the date hereof through and including the date on which this Note is paid in full. Interest shall be calculated

on the basis of a year of 365 days and charged for the actual number of days elapsed. The Maker promises to pay accrued but unpaid interest

on the principal amount of this Note on December 31, each year, commencing December 31, 2023.

2.

Default Interest. From and after the Maturity Date or such earlier date as all principal owing hereunder becomes

due and payable by acceleration or otherwise, or at the Holder’s option upon the occurrence and during the continuance of an Event

of Default, the outstanding principal balance of this Note shall bear interest at an increased rate per annum (computed on the basis of

a 365-day year, actual days elapsed) equal to five percent (5.00%) per annum above the rate of interest from time to time applicable to

this Note.

3.

Interest Payments and Principal Repayment Schedule

(a)

The Maker covenants and agrees that the interest will be due and payable on or before December 31, each year, commencing

December 31, 2023.

(b)

In addition, the Maker covenants and agrees to repay to the Holder the total unpaid principal amount and all accrued but

unpaid interest of this Note on or before September 30, 2026 (the “Maturity Date”).

4.

Payments. All payments of this Note shall be made by the Maker by wire transfer of immediately available funds

to an account designated in writing by the Holder. All payments shall be made in United States dollars. If any payment to be made by the

Maker under this Note shall come due on a day other than a Business Day, payment shall be made on the next following Business Day, and

such extension of time shall be reflected in computing interest.

5.

Prepayment. The Maker may prepay the outstanding principal amount of this Note in whole or in part at any

time, provided that such prepayment is accompanied by the payment of all accrued but unpaid interest under this Note as of the date of

such prepayment. Any such prepayment shall be applied (a) first, to any accrued but unpaid interest under this Note as of the date of

such prepayment, and (b) second, to reduce the principal repayment installments under this Note in the order designated by the Maker (or,

if the Maker makes no such designation, principal prepayments made pursuant to this Section 5 shall be applied to the principal

installments under this Note in the inverse order of maturity).

6.

Records. The Maker hereby authorizes the Holder to record on a schedule attached hereto (as such schedule

may be amended, restated, supplemented, extended or otherwise modified from time to time) or in the books and records of the Holder the

amount of all payments of principal and interest in respect of this Note, which records shall, in the absence of manifest error, be conclusive;

provided, however, that the failure to make such notation shall not limit or otherwise affect the obligations of the Maker

under this Note.

7.

Security. This Note is secured in the manner and to the extent set forth in the Security Agreement.

8.

Representations and Warranties. The Maker represents and warrants to the Holder that:

(a)

Legal Status. The Maker is a British Virgin Islands exempted company duly organized, validly existing and in good

standing under the laws of the British Virgin Islands. The Maker is duly qualified to transact business and is in good standing in each

jurisdiction in which, based upon its current operations, the failure to so qualify would have a material adverse effect on the Maker’s

business, financial condition, results of operations or prospects.

(b) Authorization

and Validity. Each Loan Document has been duly authorized by the Maker and, upon the execution and delivery thereof, will

constitute a legal, valid and binding agreement and obligation of the Maker enforceable in accordance with its terms.

(c)

No Violation. The execution, delivery and performance by the Maker of each Loan Document does not (i) violate any

provision of any law or regulation, (ii) contravene any provision of the certificate of formation or limited liability company agreement

of the Maker, or (iii) result in any breach of or default under any contract, obligation, indenture or other instrument to which the Maker

is a party or by which the Maker may be bound.

(d)

Permits, Franchises. The Maker possesses, and will hereafter possess, all permits, consents, approvals, franchises

and licenses required to enable it to conduct the business in which it is now engaged in compliance in all material respects with applicable

law.

9.

Covenants. The Maker covenants that so long as any liabilities (whether direct or contingent, liquidated or

unliquidated) or obligations of the Maker to the Holder under the Loan Documents remain outstanding, and until payment in full of all

obligations of the Maker under the Loan Documents, the Maker shall:

(a)

Financial Statements. Provide to the Holder, in form and detail reasonably satisfactory to the Holder, not later

than forty five (45) days after the end of each fiscal quarter of the Maker, financial statements of the Maker for such fiscal quarter

(or if such financial statements are being delivered with respect to the end of any fiscal year of the Maker, for such full fiscal year

of the Maker), prepared by the Maker, to include a balance sheet, income statement and statement of cash flows all in reasonable detail,

certified by the chief executive officer, chief financial officer, treasurer or controller of the Maker as fairly presenting the financial

condition, results of operations, members’ equity and cash flows of the Maker.

(b)

Notices of Default. Promptly notify the Holder of the occurrence of any Event of Default.

(c)

Compliance. Preserve and maintain all licenses, permits, governmental approvals, rights, privileges and franchises

necessary for the conduct of its business; and comply with the provisions of all documents pursuant to which the Maker is organized and/or

which govern the Maker’s continued existence and with the requirements of all laws, rules, regulations and orders of any governmental

authority applicable to the Maker and/or its business excepting, in each case, any failure to comply which would not reasonably be expected

to result in a material adverse effect on the Maker’s business, financial condition, results of operations or prospects.

(d)

Payment of Obligations; Taxes. (i) Pay and discharge as the same shall become due and payable, all its material obligations

and liabilities, including all material tax liabilities, assessments and governmental charges or levies upon it or its properties or assets,

unless the same are being contested in good faith by appropriate proceedings diligently conducted and adequate reserves are being maintained

by the Maker; and (ii) timely file all material tax returns required to be filed.

(e)

Distributions. Not make any dividend or other distribution (whether in cash, securities or other property) with respect

to any membership interest or other equity interest of the Maker.

(f)

Dispositions. Not sell or otherwise dispose of its assets, other than (i) dispositions of obsolete or worn out property

or property no longer useful to the business of the Maker, whether now owned or hereafter acquired, in the ordinary course of business;

or (ii) dispositions of equipment or real property to the extent that such property is exchanged for credit against the purchase price

of similar replacement property or the proceeds of such disposition are reasonably promptly applied to the purchase price of such replacement

property or other equipment or capital assets useful to the Maker’s business.

(g)

Fundamental Changes. Not (i) merge, dissolve, liquidate or consolidate with or into another person or entity, unless

the Maker is the surviving company, or (ii) dispose of (whether in one transaction or in a series of transactions) all or substantially

all of its assets (whether now owned or hereafter acquired) to or in favor of any person or entity.

10.

Amendment. Amendments, modifications and waivers of this Note may be made only in a writing signed in ink

by the Maker and the Holder.

11.

Defaults and Remedies.

(a)

Events of Default. An “Event of Default” shall mean the occurrence or existence of any one or

more of the following:

(i)

the Maker shall default in any payment of the principal or interest of this Note, when and as the same shall become due

and payable;

(ii)

any representation or warranty made by the Maker under this Note or any other Loan Document shall prove to be incorrect,

false or misleading in any material respect when furnished or made;

(iii)

(1) a court enters a decree or order for relief with respect to the Maker in an involuntary case under Title 11, United

States Code, as amended from time to time, and any successor statute thereto (the “Bankruptcy Code”), which decree

or order is not stayed or other similar relief is not granted under any applicable federal or state law; or (2) the continuance of any

of the following events for ninety (90) days unless dismissed, bonded or discharged: (A) an involuntary case is commenced against the

Maker under any applicable bankruptcy, insolvency or other similar debtor relief law now or hereafter in effect; or (B) a decree or order

of a court for the appointment of a receiver, liquidator, sequestrator, trustee, custodian or other officer having similar powers over

the Maker or over all or a substantial part of its property, is entered; or (C) an interim receiver, trustee or other custodian is appointed

without the consent of the Maker for all or a substantial part of the property of the Maker;

(iv)

(1) the Maker commences a voluntary case under the Bankruptcy Code, or consents to the entry of an order for relief in an

involuntary case or to the conversion of an involuntary case to a voluntary case under any such law or consents to the appointment of

or taking possession by a receiver, trustee or other custodian for all or a substantial part of its property; or (2) the Maker makes any

assignment for the benefit of creditors; or

(v)

the Maker defaults in the performance of or compliance with any obligation, agreement or other provision contained herein

or in any other Loan Document (other than those specifically described as an “Event of Default” in this Section 11(a)),

and such default shall continue for a period of twenty (20) days from its occurrence.

(b)

Remedies. If an Event of Default occurs, then (a) the outstanding principal amount of, and all accrued interest on

and all other amounts payable under, this Note shall at the Holder’s option and without notice become immediately due and payable

without presentment, demand, protest or notice of dishonor, all of which are hereby expressly waived by the Maker; provided, however,

that upon the occurrence of an actual or deemed entry of an order for relief with respect to the Maker under the Bankruptcy Code, the

unpaid principal amount of this Note and all interest and other amounts payable under this Note shall automatically become due and payable;

and (b) the Holder shall have all rights, powers and remedies available under the Loan Documents, in equity or accorded by law. All rights,

powers and remedies of the Holder may be exercised at any time by the Holder and from time to time after the occurrence of an Event of

Default, are cumulative and not exclusive, and shall be in addition to any other rights, powers or remedies provided by law or equity.

12.

Remedies Cumulative. No remedy herein conferred upon the Holder is intended to be exclusive of any other remedy

and each and every such remedy shall be cumulative and shall be in addition to every other remedy given hereunder, under the other Loan

Documents or now or hereafter existing at law or in equity or by statute or otherwise.

13.

Remedies Not Waived. No course of dealing between the Maker and the Holder or any delay on the part of the

Holder in exercising any rights hereunder or any of the Loan Documents shall operate as a waiver of any right.

14.

Costs, Expenses and Attorneys’ Fees. The Maker shall pay to the Holder immediately upon demand the full

amount of all payments, advances, charges, costs and expenses, including reasonable attorneys’ fees, expended or incurred by the

Holder in connection with the enforcement of the Holder’s rights and/or the collection of any amounts which become due to the Holder

under this Note, and the prosecution or defense of any action in any way related to this Note, including without limitation, any

action for declaratory relief, whether incurred at the trial or appellate level, in an arbitration proceeding or otherwise, and including

any of the foregoing incurred in connection with any bankruptcy proceeding (including without limitation, any adversary proceeding, contested

matter or motion brought by the Holder or any other person) relating to the Maker or any other person or entity.

15.

Covenants Bind Successors and Assigns. All the covenants, stipulations, promises and agreements in this Note

shall inure to the benefit of and be binding upon the successors and permitted assigns of the Maker and the Holder. The Maker may not

assign its obligations hereunder without the prior written consent of the Holder.

16.

GOVERNING LAW. THIS NOTE SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF

DELAWARE, WITHOUT GIVING EFFECT TO ANY CHOICE OF LAW OR CONFLICT OF LAW RULES OR PROVISIONS (WHETHER OF THE STATE OF DELAWARE OR ANY OTHER

JURISDICTION) THAT WOULD CAUSE THE APPLICATION OF THE LAWS OF ANY JURISDICTION OTHER THAN THE STATE OF DELAWARE.

17.

Venue and Jurisdiction. The Maker agrees that any action or suit against the Holder arising out of or relating

to this Note shall be filed in federal court or state court located in California. The Maker agrees that Holder shall not be deemed to

have waived its rights to enforce this section by filing an action or suit against the Maker in a venue outside of California. If the

Holder does commence an action or suit arising out of or relating to this Note, the Maker agrees that the case may be filed in federal

court or state court in California. The Holder reserves the right to commence an action or suit in any other jurisdiction where the Maker

or any collateral has any presence or is located. The Maker consents to personal jurisdiction and venue in such forum selected by the

Holder and waives any right to contest jurisdiction and venue and the convenience of any such forum. The provisions of this section are

material inducements to the Holder’s acceptance of this Note.

18.

Interest Rate. If interest payable under this Note is in excess of the maximum permitted by law, the mont

chargeable hereunder shall be reduced to the maximum amount permitted by law.

19.

Headings. The headings in this Note are for convenience of reference only and shall not limit or otherwise

affect the meaning hereof.

20.

Severability. If any one or more of the provisions contained herein, or the application thereof in any circumstance,

is held invalid, illegal or unenforceable in any respect for any reason, the validity, legality and enforceability of any such provision

in every other respect and of the remaining provisions hereof shall not be in any way impaired, unless the provisions held invalid, illegal

or unenforceable shall substantially impair the benefits of the remaining provisions hereof.

21.

Notices. All notices, demands and other communications provided for or permitted hereunder shall be made in

writing and shall be by registered or certified first-class mail, return receipt requested, telecopier (with receipt confirmed), courier

service or personal delivery as follows (or to such other address or facsimile number as may be indicated by the Maker or the Holder to

the other party in writing in accordance with this Section 21):

| If to the Maker: |

Palo Alto Clean Tech Holding Limited |

| |

740 Mayview Avenue, Palo Alto, CA 94303 |

| |

Tel: 888-575-1940 |

| |

Attention: Xiaofeng Peng |

| |

|

| If to the Holder: |

EdisonFuture, Inc. |

| |

4803 Urbani Avenue, McClellan Park, California 95652 |

| |

Tel: 888-575-1940 |

| |

Attention: Hoong Khoeng Cheong |

All such notices and communications

shall be deemed to have been duly given: when delivered by hand, if personally delivered; when delivered by courier, if delivered by

commercial overnight courier service; if mailed, upon receipt of the same; or if telecopied, when receipt is acknowledged.

IN WITNESS WHEREOF,

the Maker has caused this instrument to be duly executed as of the day and year first above written.

PALO ALTO CLEAN TECH HOLDING LIMITED,

a British Virgin Islands exempted company

By: /s/ Xiaofeng Peng

Name: Xiaofeng Peng

Title: Director

EXHIBIT A

Defined Terms

“Business Day” means any day

other than a Saturday, Sunday or other day on which commercial banks are authorized to close under the laws of, or are in fact closed

in, the State of California.

“Loan Documents” means, collectively,

the Note and the Security Agreement.

“Security Agreement” means

that certain Security Agreement entered into by the Maker in favor of the Holder dated as of even date herewith, as amended, modified,

extended, restated, replaced, or supplemented from time to time.

Exhibit 10.3

STOCK PLEDGE AGREEMENT

THIS STOCK PLEDGE AGREEMENT (this “Agreement”)

is effective as of September 26, 2023, by and between PALO ALTO CLEAN TECH HOLDING LIMITED, a British Virgin Islands exempted company (“Debtor”),

and EDISONFUTURE, INC., a Delaware corporation (“Secured Party”), with reference to the following facts:

A. Debtor

has executed and delivered to Secured Party a Secured Promissory Note of even date herewith in the original principal amount of Twelve

Million Two Hundred Thousand Dollars ($12,200,000) (“Note”).

B. Debtor

desires to enter into this Agreement to secure payment and performance of its obligations under the Note.

NOW, THEREFORE, for valuable consideration, Debtor

and Secured Party agree as follows:

1.

Definitions. For purposes of this Agreement, the following terms shall have the following definitions:

1.1

“Collateral” means 12,000,000 shares of common stock of Phoenix Motor Inc., a New York corporation, purchased

by Debtor from Secured Party pursuant to that certain Stock Purchase Agreement dated as of September 27, 2023.

1.2

“Company” means Phoenix Motor Inc., a Delaware corporation.

1.3

“Event of Default” means any event of default specified in Section 4 herein.

1.4

“Obligations” means payment and performance of all obligations of Debtor under the Note.

2.

Grant of Security Interest. To secure the Obligations, Debtor hereby grants and assigns to Secured Party a security

interest in the Collateral.

3.

Debtor’s Covenants.

3.1

Negative Covenants. Without Secured Party’s prior written consent, Debtor shall not sell, transfer, assign,

pledge, mortgage, encumber, hypothecate, or otherwise dispose of or abandon any or all of the Collateral.

3.2

Voting Rights and Dividends. So long as there shall exist no Event of Default, Debtor shall be entitled to (a) exercise

his rights to voting power with respect to the Collateral pledged under this Agreement, and (b) receive dividends, if any, paid by the

Company. Upon an Event of Default, (a) Secured Party acting alone may exercise voting rights with respect to the Collateral, (b) Secured

Party alone shall be entitled to receive dividends, if any, paid by the Company (and Debtor hereby agrees promptly to remit to Secured

Party any dividends received from the Company upon after the occurrence of an Event of Default unless and until such Event of Default

has been waived in writing by Secured Party), and (c) Secured Party may cause the Collateral to be reissued in Secured Party’s name

to facilitate the exercise of such voting rights and receipt of such dividends.

3.3

Delivery of Collateral. All certificates or instruments representing or evidencing the Collateral shall be promptly

delivered by Debtor to Secured Party or Secured Party’s designee pursuant hereto at a location designated by Secured Party and shall

be held by or on behalf of Secured Party pursuant hereto, and shall be in suitable form for transfer by delivery, or shall be accompanied

by duly executed instruments of transfer or assignment in blank, all in form and substance satisfactory to Secured Party.

4.

Event of Default.

The occurrence of any of the following events or conditions shall constitute

and is hereby defined to be an “Event of Default”:

(i)

The occurrence of any default or breach under the Note; and

(ii)

The sale, lease, transfer, assignment, pledge, mortgage, encumbrance, hypothecation or other disposal of or abandonment of any

or all of the Collateral without the prior written consent of Secured Party.

5.

Release of Collateral. The parties hereby mutually agree that segments of the Collateral will be released in correlation

to the corresponding portions of the Principal Amount (as such term is defined under the Note) paid by the Debtor, with any previously

paid interest excluded. For example, when the Debtor makes a payment equal to one-twelfth (1/12) of the Principal amount ($1,020,000)

to reduce the Principal Amount, one-twelfth (1/12) of the Collateral (1,000,000 shares of the Company’s Common Stock) shall be released

to the Debtor, and this process shall continue accordingly.

6.

Remedies Upon Default. Upon the occurrence of any Event of Default, Secured Party shall, in addition to all other

rights and remedies provided hereunder or any document or agreement referred to herein, have the following rights and remedies:

6.1

Uniform Commercial Code. Secured Party shall have all of the rights and remedies of a secured party under the New

York Uniform Commercial Code and under all other applicable laws.

6.2

Sale of Collateral. Secured Party may sell or dispose of the unreleased portion of the Collateral at public or private

sale, in one or more sales, as a unit or in parcels, at wholesale or retail, and at such time and place and on such terms as Secured Party

may determine. Secured Party may be the purchaser of any or all of the Collateral at any public or private sale. If, at any time when

Secured Party shall determine to exercise Secured Party’s right to sell all or any part of the Collateral and such Collateral, or

the part thereof to be sold, Secured Party has been advised by legal counsel or has determined that the unreleased portion of the Collateral

is subject to the Securities Act of 1933, as amended, or any state securities laws, Secured Party in Secured Party’s sole and absolute

discretion, is hereby expressly authorized to sell such unreleased portion Collateral, or any part thereof, subject to obtaining all required

regulatory approvals, by private sale in such manner and under such circumstances as Secured Party may deem necessary or advisable in

order that such sale may be effected legally without registration or qualification under applicable securities laws (including without

limitation without any obligation to advertise). Without limiting the generality of the foregoing, Secured Party, in Secured Party’s

sole and absolute discretion, may approach and negotiate with a restricted number of potential purchasers to effect such sale or restrict

such sale to a purchaser or purchaser who will represent and agree that such purchaser or purchasers are purchasing for his or their own

account, for investment only, and not with a view to the distribution or sale of such unreleased portion of the Collateral or any part

thereof. Any such sale shall be deemed to be a sale made in a commercially reasonable manner within the meaning of the Uniform Commercial

Code of the State of New York and Debtor hereby consents and agrees that Secured Party shall incur no responsibility or liability for

selling all or any part of the unreleased portion of the Collateral at a price which is not unreasonably low, notwithstanding the possibility

that a higher price might be realized if the sale were public. Any public sale of any or all of the unreleased portion of the Collateral

may be postponed from time to time by public announcement at the time and place last scheduled for the sale.

6.3

Protection of Collateral. Secured Party may discharge claims, demands, liens, security interests, encumbrances and

taxes affecting any or all of the Collateral and take such other actions as Secured Party determines to be necessary or appropriate to

protect the Collateral and Secured Party’s security interest therein.

7.

Liability for Deficiency. Debtor shall at all times remain liable for any deficiency remaining on the Obligations

after any disposition of any or all of the Collateral.

8.

Waivers. Debtor waives all rights which Debtor may have (a) to require marshaling of assets or liens in the event

of a sale of the Collateral under this Agreement; (b) to require Secured Party to exhaust Debtor’s rights or remedies against any

party, or any other collateral securing any or all of the Obligations before pursuing Debtor’s rights or remedies under this Agreement;

(c) to require Secured Party to exercise any other right or power or to pursue any other remedy which Secured Party may have under any

agreement or applicable law before pursuing Secured Party’s rights or remedies under this Agreement; and (d) to assert any defense

to Secured Party’s enforcement of this Agreement based on an election of remedies by Secured Party or the manner in which Secured

Party exercises any remedy which destroys, diminishes, or interferes with any or all subrogation, reimbursement, or other rights of Debtor,

whether by operation of any statute or otherwise.

9.

Cumulative Remedies. Secured Party’s rights and remedies under this Agreement are cumulative with and in addition

to all other rights and remedies which Secured Party may have in connection with the obligations. Secured Party may exercise any one or

more of its rights and remedies under this Agreement at Secured Party’s option and in such order as Secured Party may determine

in Secured Party’s sole and absolute discretion.

10.

Attorneys’ Fees. Upon Secured Party’s demand, Debtor shall reimburse Secured Party for all costs and

expenses, including without limitation, reasonable attorney’s fees and costs, which are incurred by Secured Party, whether before

or after Debtor’s default under this Agreement, in connection with any or all of the following: (a) the exercise of any or all of

Secured Party’s rights and remedies under this Agreement or the enforcement of any obligation of any other party liable to Secured

Party in connection with the Obligations, whether or not any legal proceedings are instituted by Secured Party; (b) the protection, preservation,

management, operation, or maintenance of any or all of the Collateral; or (c) the sale or disposition of any or all of the Collateral.

11.

Notices. All notices, requests and other communications hereunder shall be in writing and shall be delivered by courier

or other means of personal service, or sent by facsimile or by deposit in the United Stated first class mail, sent certified or registered,

return receipt requested, postage prepaid and addressed to:

If to Secured Party to:

EDISONFUTURE, INC.

4803 Urbani Avenue, McClellan Park, California

95652

Telephone: 888-575-1940

Email: hk.cheong@spigroups.com

If to Debtor:

PALO ALTO CLEAN TECH HOLDING LIMITED

740 Mayview Avenue, Palo Alto, CA 94303

Telephone: 888-575-1940

Email: denton.peng@spigroups.com

All notices, requests and other communications shall be deemed given

on the date of delivery, if given by personal service, or, if sent by mail, five (5) days after deposit in the United Stated first

class mail, sent certified or registered, return receipt requested, postage prepaid to the address set forth above. Any party may change

their address for notices, requests and other communications by giving notice in the manner specified above.

12.

Interpretation. This Agreement shall be construed in accordance with and governed by the laws of the State of New

York. The headings to sections of this Agreement are for convenience only, and they do not in any way limit or amplify any of the terms

of this Agreement and shall not be used in interpreting this Agreement.

13.

Entire Agreement. This Agreement, together with the other documents being delivered pursuant to or in connection

with this Agreement, constitutes the entire agreement of the parties hereto with respect to the subject matter hereof, and supersedes

all prior agreements and understandings of the parties, oral and written, with respect to the subject matter hereof.

14.

Applicable Law; Venue. This Agreement is to be governed by and construed in accordance with the laws of the State

of New York without regard to the conflicts of laws principles thereof. Any suit brought hereon, shall be brought in the state or federal

courts sitting in New York, New York, the parties hereby waiving any claim or defense that such forum is not convenient or proper.

15.

Severability. If any provision of this Agreement shall be unlawful, void or unenforceable in whole or in part for

any reason, such provision or such part thereof shall be deemed separable from and shall in no way affect the validity or enforceability

of the remaining provisions of this Agreement.

16.

Amendment. This Agreement may be modified only by a written agreement signed by Debtor and Secured Party.

17.

Counterparts; Electronic Copies. This Agreement may be executed in more than one counterpart, each of which shall

be deemed an original, but all of which together shall constitute one and the same document. Executed copies of the signature pages of

this Agreement sent by facsimile or transmitted electronically in Portable Document Format (PDF) shall be treated as originals, fully

binding and with full legal force and effect, and each party hereto waives any rights it may have to object to such treatment.

IN WITNESS WHEREOF, the

undersigned do hereby execute this Agreement as of the date and year first set forth above.

DEBTOR:

PALO ALTO CLEAN TECH HOLDING LIMITED

By: /s/ Xiaofeng Peng

Name: Xiaofeng Peng

Title: Director

SECURED PARTY:

EDISONFUTURE, INC.

By: /s/ Hoong Khoeng Cheong

Name: Hoong Khoeng Cheong

Title: Secretary and Treasurer

v3.23.4

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

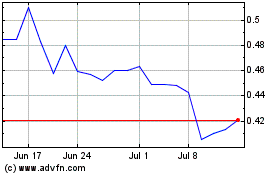

SPI Energy (NASDAQ:SPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

SPI Energy (NASDAQ:SPI)

Historical Stock Chart

From Apr 2023 to Apr 2024