Insider warrant exercise and new credit

facility improve balance sheet

Loop Media, Inc. ("Loop®") (NYSE American: LPTV), a leading

multichannel streaming platform that provides curated music video,

sports, news, entertainment channels and digital signage for

businesses, announced today a series of transactions resulting in

the Company obtaining additional cash availability of approximately

$4.0 million consisting of proceeds to the Company of approximately

$1.5 million from the repricing and exercise of certain holders of

warrants to purchase 1.8 million shares of Loop common stock, par

value $0.0001 ("Shares") at $.80 per share (at the market under

NYSE rules) and an additional $2.5 million of funds available to

the Company under a new revolving debt facility. Loop also

converted approximately $2.3 million in existing long-term debt

into 2,910,771 Shares at $0.80 per share (at the market under NYSE

rules). These transactions are with related parties and are

described in more detail below and in our Annual Report on Form

10-K for the year ended September 30, 2023, which we intend to file

with the Securities and Exchange Commission on December 18,

2023.

"Our team is focused on implementing our FY24 business plan,

including our desire to continuously strengthen our balance sheet

to support the business and allow us to focus on growing our

distribution footprint and revenues," said Jon Niermann, CEO and

Co-founder. "The additional funds provided by our Chairman is

welcomed and evidences his support of the management team and the

market opportunity for the company."

Excel Revolving Line of Credit

Effective as of December 14, 2023, Loop® entered into a

Revolving Line of Credit Loan Agreement with Excel Family Partners,

LLLP ("Excel"), an entity managed by Bruce Cassidy, Sr., Chairman

of our Board of Directors (the "Line of Credit Agreement") for up

to a principal sum of $2,500,000, under which Loop® may pay down

and re-borrow up to the maximum amount of $2,500,000 (the "Line of

Credit"). Our drawdown on the Line of Credit is limited to no more

than twenty-five percent (25%) of the last three full months'

revenue, not to exceed $1,250,000 in any quarter, and not to exceed

in aggregate the outstanding debt amount of $2,500,000. The Line of

Credit Agreement has a maturity date twelve (12) months from the

date of formal notice of termination by Excel, and accrues

interest, payable semi-annually in arrears, at a fixed rate of

interest equal to ten percent (10%) per year. Under the Line of

Credit Agreement, we granted Excel a pari passu senior security

interest.

Under the terms of the Line of Credit Agreement, on December 14,

2023, we issued to Excel a warrant to purchase up to an aggregate

of 3,125,000 Shares. Each warrant has an exercise price of $0.80

per share (at the market under NYSE rules) that expires on December

14, 2026, and is exercisable at any time prior to such date, to the

extent that after giving effect to such exercise, Excel and its

affiliates would beneficially own no more than 29.99% of the

outstanding Shares.

Excel May 2023 Secured Line of Credit Note Conversion

Agreement

On December 14, 2023, Loop® entered into a Note Conversion

Agreement with Excel to convert $2,328,617 in aggregate principal

and accrued interest under an existing secured credit agreement

(the "Note Conversion Agreement") into 2,910,771 Shares, at a

conversion price per share of $0.80 (at the market under NYSE

rules). The Note Conversion Agreement contains customary

representations, warranties, agreements and obligations of the

parties.

Repricing and Exercise of Certain Existing Warrants

On December 14, 2023, Loop® agreed to offer to amend certain

existing warrants exercisable for an aggregate of up to 4,055,240

Shares (each such warrant an "Existing Warrant") to reduce the

respective exercise prices thereof to $0.80 per share (at the

market under NYSE rules) (such new price being referred to as the

"Amended Exercise Price"), on the condition that the holder of an

Existing Warrant commit to exercise such Existing Warrant. Existing

Warrants exercisable for an aggregate of up to 786,482 shares of

our common stock are held by Excel, and Eagle Investment Group,

LLC, entities managed by Mr. Cassidy. Existing Warrants exercisable

for an aggregate of up to 443,332 Shares are held by Denise Penz, a

member of our Board of Directors. As of December 14, 2023, each of

Mr. Cassidy and Ms. Penz have entered into an agreement to exercise

their Existing Warrants, which will result in aggregate net

proceeds to the Company of $983,851. Loop® has total commitments,

including Mr. Cassidy and Ms. Penz, and from Holders of Existing

Warrants to reprice and exercise Existing Warrants for an aggregate

of 1,828,147 Shares at $.80 (at the market under NYSE rules) for an

aggregate exercise price of $1.5 million. There is no assurance

that other Existing Warrant holders (who are not officers or

directors of the Company) will agree to the repricing and exercise

of their Existing Warrants.

The offer and sale of the securities described above are being

offered in a private placement under Section 4(a)(2) of the

Securities Act of 1933, as amended (the "Securities Act"), and

Regulation D promulgated thereunder and, along with the shares of

common stock underlying the warrants, have not been registered

under the Securities Act, or applicable state securities laws.

Accordingly, the securities issued in the private placement and the

shares of common stock underlying the warrants may not be offered

or sold in the United States except pursuant to an effective

registration statement or an applicable exemption from the

registration requirements of the Securities Act and such applicable

state securities laws.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any of the securities described

herein, nor shall there be any sale of these securities in any

state or other jurisdiction in which such an offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such state or other jurisdiction.

About Loop Media, Inc.

Loop Media, Inc. ("Loop Media") (NYSE American: LPTV) is a

leading digital out-of-home ("DOOH") TV and digital signage

platform optimized for businesses, providing free music video,

news, sports and entertainment channels through its Loop TV

service. Loop Media is a leading company in the U.S. licensed to

stream music videos to businesses through its proprietary Loop

Player.

Loop Media's digital video content reaches millions of viewers

in DOOH locations including bars/restaurants, office buildings,

retail businesses, college campuses, and airports in the United

States.

Loop is fueled by one of the largest and most important

short-form entertainment libraries, including music videos, movie

trailers and live performances. Loop Media's non-music channels

cover a multitude of genres and moods and include sports

highlights, news, lifestyle and travel videos, viral videos and

more. Loop Media's streaming services generate revenue from

advertising, sponsorships and subscriptions.

To learn more about Loop Media products and applications, please

visit us online at www.loop.tv

Follow us on social:

Instagram: @loopforbusiness X (Twitter): @loopforbusiness

LinkedIn: https://www.linkedin.com/company/loopforbusiness/

Safe Harbor Statement and Disclaimer

This news release includes "forward-looking statements" within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, including, but not limited to, Loop Media's expected 2023

results, ability to compete in the highly competitive markets in

which it operates, statements regarding Loop Media's ability to

develop talent and attract future talent, the success of strategic

actions Loop Media is taking, and the impact of strategic

transactions. Forward-looking statements give our current

expectations, opinion, belief or forecasts of future events and

performance. A statement identified by the use of forward-looking

words including "will," "may," "expects," "projects,"

"anticipates," "plans," "believes," "estimate," "should," and

certain of the other foregoing statements may be deemed

forward-looking statements. Although Loop Media believes that the

expectations reflected in such forward-looking statements are

reasonable, these statements involve risks and uncertainties that

may cause actual future activities and results to be materially

different from those suggested or described in this news release.

Investors are cautioned that any forward-looking statements are not

guarantees of future performance and actual results or developments

may differ materially from those projected. The forward-looking

statements in this press release are made as of the date hereof.

Loop Media takes no obligation to update or correct its own

forward-looking statements, except as required by law, or those

prepared by third parties that are not paid for by Loop Media. Loop

Media's SEC filings are available at www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231218889876/en/

Loop Media Investor Contact Andrew J. Barwicki

andrew@barwicki.com ir@loop.tv

Loop Media Press Contact – PhillComm Global PR Agency Jon

Lindsay Phillips jon@phillcomm.global

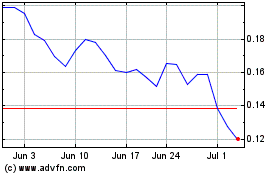

Loop Media (AMEX:LPTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Loop Media (AMEX:LPTV)

Historical Stock Chart

From Apr 2023 to Apr 2024