0001540159false--09-30FY20230false002380280238028000001011720000400000005609845365195323.940000000002300000000015401592022-10-012023-09-300001540159us-gaap:SubsequentEventMemberus-gaap:RevolvingCreditFacilityMember2023-10-310001540159us-gaap:CurrencySwapMember2022-10-012023-09-300001540159edsa:OntarioSubsidaryMember2022-10-012023-09-300001540159edsa:OntarioSubsidaryMember2023-09-300001540159edsa:UniitedStatesMember2023-09-300001540159edsa:UniitedStatesMemberedsa:TwentyFortyTwoMember2023-09-300001540159edsa:UniitedStatesMemberedsa:TwentyFortyOneMember2023-09-300001540159edsa:UniitedStatesMemberedsa:TwentyFortyMember2023-09-300001540159edsa:UniitedStatesMemberedsa:TwentyThirtyNineMember2023-09-300001540159edsa:CanadasMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyFortyTwoMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyFourtyThreeMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyFourtyOneMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyFortyMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyThirtyNineMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyThirtyEightMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyThirtySevenMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyThirtySixMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyThirtyFiveMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyThirtyFourMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyThirtyThreeMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyThirtyTwoMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyThirtyOneMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyThirtyMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyTwentyNineMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyTwentyEightMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyTwentyFiveMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyTwentySixMember2023-09-300001540159edsa:CanadasMemberedsa:TwentyTwentySevenMember2023-09-300001540159edsa:SIFAgreementMemberedsa:FebruaryTwoThousandTwentyOneMember2021-02-012021-02-280001540159edsa:SIFAgreementMemberedsa:FebruaryTwoThousandTwentyOneMember2022-10-012023-09-300001540159edsa:SIFAgreementMemberedsa:OctoberTwoThousandTwentyThreeMember2023-10-012023-10-310001540159edsa:AffiliatedDesigneesMember2022-03-012022-03-240001540159edsa:NovemberTwoTwoThousandTwentyTwoMember2022-11-012022-11-020001540159edsa:ClassBWarrantsMember2022-11-012022-11-020001540159edsa:EmployeesMember2023-09-300001540159edsa:AffiliatedDesigneesMember2022-03-240001540159edsa:PreFundedWarrantsMember2023-09-300001540159edsa:PreFundedWarrantsMember2022-03-240001540159edsa:MarchTwoFourTwoThousandTwentyTwoMember2022-03-240001540159edsa:ClassAWarrantsMember2022-11-020001540159edsa:ClassBWarrantsMember2022-11-020001540159edsa:MarchTwoFourTwoThousandTwentyTwoMember2022-03-012022-03-240001540159edsa:BlackScholesOptionMember2022-10-012023-09-300001540159edsa:WarrantsAdditionalPaidInCapitalMember2022-03-012022-03-240001540159edsa:ClassAWarrantsMember2022-11-012022-11-020001540159edsa:PreFundedWarrantsMember2022-03-012022-03-240001540159edsa:NovemberTwoTwoThousandTwentyTwoMember2022-11-012022-11-2200015401592023-03-012023-03-270001540159edsa:EmployeesMember2022-10-012023-09-300001540159edsa:TwoThousandNineteenPlanMember2022-10-012023-09-300001540159edsa:RestrictedShareUnitsOneMember2022-10-012023-09-300001540159edsa:RestrictedShareUnitsMember2023-09-300001540159edsa:RestrictedShareUnitsMember2021-10-012022-09-300001540159edsa:RestrictedShareUnitsMember2022-10-012023-09-300001540159edsa:RestrictedShareUnitsMember2021-09-300001540159edsa:RestrictedShareUnitsMember2022-09-300001540159srt:MaximumMemberedsa:StockOptionSevenMember2022-10-012023-09-300001540159srt:MinimumMemberedsa:StockOptionSevenMember2022-10-012023-09-300001540159srt:MaximumMemberedsa:StockOptionSixMember2022-10-012023-09-300001540159srt:MinimumMemberedsa:StockOptionSixMember2022-10-012023-09-300001540159srt:MaximumMemberedsa:StockOptionFiveMember2022-10-012023-09-300001540159srt:MinimumMemberedsa:StockOptionFiveMember2022-10-012023-09-300001540159srt:MaximumMemberedsa:StockOptionFourMember2022-10-012023-09-300001540159srt:MinimumMemberedsa:StockOptionFourMember2022-10-012023-09-300001540159edsa:StockOptionTwoMember2022-10-012023-09-300001540159edsa:StockOptionThreeMember2022-10-012023-09-300001540159srt:MaximumMemberedsa:StockOptionTwoMember2022-10-012023-09-300001540159srt:MinimumMemberedsa:StockOptionThreeMember2022-10-012023-09-300001540159srt:MaximumMemberedsa:StockOptionOneMember2022-10-012023-09-300001540159srt:MinimumMemberedsa:StockOptionOneMember2022-10-012023-09-300001540159srt:MaximumMemberedsa:StockOptionSevenMember2023-09-300001540159srt:MinimumMemberedsa:StockOptionSevenMember2023-09-300001540159srt:MaximumMemberedsa:StockOptionSixMember2023-09-300001540159srt:MinimumMemberedsa:StockOptionSixMember2023-09-300001540159srt:MaximumMemberedsa:StockOptionFiveMember2023-09-300001540159srt:MinimumMemberedsa:StockOptionFiveMember2023-09-300001540159srt:MaximumMemberedsa:StockOptionFourMember2023-09-300001540159srt:MinimumMemberedsa:StockOptionFourMember2023-09-300001540159srt:MaximumMemberedsa:StockOptionOneMember2023-09-300001540159srt:MinimumMemberedsa:StockOptionOneMember2023-09-300001540159edsa:StockOptionSevenMember2023-09-300001540159edsa:StockOptionSixMember2023-09-300001540159edsa:StockOptionFiveMember2023-09-300001540159edsa:StockOptionFourMember2023-09-300001540159edsa:StockOptionThreeMember2023-09-300001540159edsa:StockOptionTwoMember2023-09-300001540159edsa:StockOptionOneMember2023-09-300001540159edsa:PurchaseCommonShareOptionsMember2023-09-300001540159edsa:PurchaseCommonShareOptionsMember2021-10-012022-09-300001540159edsa:PurchaseCommonShareOptionsMember2022-10-012023-09-300001540159edsa:PurchaseCommonShareOptionsMember2021-09-300001540159edsa:PurchaseCommonShareOptionsMember2022-09-300001540159edsa:Pre-fundedWarrantSharesMember2022-10-012023-09-300001540159edsa:ClassBWarrantsMember2021-10-012022-09-300001540159edsa:ClassAWarrantsMember2021-10-012022-09-300001540159edsa:ClassBWarrantsMember2022-10-012023-09-300001540159edsa:ClassAWarrantsMember2022-10-012023-09-300001540159edsa:WarrantSevenMember2022-10-012023-09-300001540159edsa:WarrantSixMember2022-10-012023-09-300001540159edsa:WarrantFourMember2022-10-012023-09-300001540159edsa:WarrantFiveMember2022-10-012023-09-300001540159edsa:WarranttThreeMember2022-10-012023-09-300001540159edsa:WarrantTwoMember2022-10-012023-09-300001540159edsa:WarrantOneMember2022-10-012023-09-300001540159edsa:WarrantSevenMember2023-09-300001540159edsa:WarrantSixMember2023-09-300001540159edsa:WarrantFiveMember2023-09-300001540159edsa:WarrantFourMember2023-09-300001540159edsa:WarranttThreeMember2023-09-300001540159edsa:WarrantTwoMember2023-09-300001540159edsa:WarrantOneMember2023-09-3000015401592022-06-300001540159edsa:TwoThousandTwentyOneMemberedsa:LicenseCommitmentsMember2021-10-012022-09-300001540159edsa:TwoThousandSixteenMemberedsa:LicenseCommitmentsMember2022-10-012023-09-300001540159edsa:TwoThousandTwentyOneMemberedsa:LicenseCommitmentsAgreementMember2022-10-012023-09-300001540159edsa:TwoThousandTwentyOneMemberedsa:LicenseCommitmentsMember2022-10-012023-09-3000015401592023-06-300001540159us-gaap:GeneralAndAdministrativeExpenseMember2021-10-012022-09-300001540159us-gaap:GeneralAndAdministrativeExpenseMember2022-10-012023-09-300001540159us-gaap:ComputerEquipmentMember2023-09-300001540159us-gaap:ComputerEquipmentMember2022-09-300001540159us-gaap:FurnitureAndFixturesMember2022-09-300001540159us-gaap:FurnitureAndFixturesMember2023-09-300001540159edsa:IntangibleAssetsMember2022-10-012023-09-300001540159edsa:FurnitureAndEquipmentMember2022-10-012023-09-300001540159us-gaap:ComputerEquipmentMember2022-10-012023-09-300001540159edsa:EquityDistributionAgreementWithCanaccordMember2022-10-012023-09-300001540159edsa:EquityDistributionAgreementWithCanaccordMember2023-03-012023-03-310001540159us-gaap:PrivatePlacementMember2022-11-012022-11-300001540159us-gaap:PrivatePlacementMember2022-03-012022-03-310001540159us-gaap:RetainedEarningsMember2023-09-300001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001540159us-gaap:AdditionalPaidInCapitalMember2023-09-300001540159edsa:CommonStocksMember2023-09-300001540159us-gaap:RetainedEarningsMember2022-10-012023-09-300001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-012023-09-300001540159us-gaap:AdditionalPaidInCapitalMember2022-10-012023-09-300001540159edsa:CommonStocksMember2022-10-012023-09-300001540159us-gaap:RetainedEarningsMember2022-09-300001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001540159us-gaap:AdditionalPaidInCapitalMember2022-09-300001540159edsa:CommonStocksMember2022-09-300001540159us-gaap:RetainedEarningsMember2021-10-012022-09-300001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-012022-09-300001540159us-gaap:AdditionalPaidInCapitalMember2021-10-012022-09-300001540159edsa:CommonStocksMember2021-10-012022-09-300001540159us-gaap:RetainedEarningsMember2021-09-300001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-300001540159us-gaap:AdditionalPaidInCapitalMember2021-09-300001540159edsa:CommonStocksMember2021-09-3000015401592021-09-3000015401592021-10-012022-09-3000015401592022-09-3000015401592023-09-3000015401592023-12-1300015401592023-11-24iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureiso4217:CAD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-37619

EDESA BIOTECH, INC. |

(Exact name of registrant as specified in its charter) |

British Columbia, Canada | | N/A |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

100 Spy Court, Markham, ON, Canada L3R 5H6 | | (289) 800-9600 |

(Address of principal executive offices and zip code) | | (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

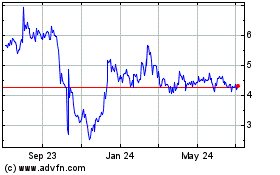

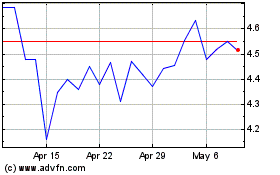

Common Shares, without par value | | EDSA | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to Section 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of March 31, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s outstanding common shares held by nonaffiliates was approximately $14,782,585 which was calculated based on 2,865,524 common shares outstanding as of that date, of which 2,315,314 common shares were held by nonaffiliates at the closing price of the registrant’s common shares on The Nasdaq Capital Market on such date. These amounts reflect the one-for-seven reverse split of the registrant’s outstanding common shares effected October 11, 2023.

As of December 13, 2023, the registrant had 3,164,722 common shares issued and outstanding.

/s/ MNP LLP

Toronto, Canada

DOCUMENTS INCORPORATED BY REFERENCE: NONE

EDESA BIOTECH, INC.

ANNUAL REPORT ON FORM 10-K

Year Ended September 30, 2023

Table of Contents

FORWARD-LOOKING STATEMENTS AND OTHER MATTERS

This Annual Report on Form 10-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the Securities Act) and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act) and, as such, may involve known and unknown risks, uncertainties and assumptions. Forward-looking statements are based upon our current expectations, speak only as of the date hereof, are subject to change and include statements about, among other things: the status, progress and results of our clinical programs; our ability to obtain regulatory approvals for or successfully commercialize any of our product candidates; our business plans, strategies and objectives, including plans to pursue collaboration, licensing or other similar arrangements or transactions; our expectations regarding our liquidity and performance, including our expense levels, sources of capital and ability to maintain our operations; the competitive landscape of our industry; and general market, economic and political conditions.

Forward-looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. You can generally identify forward-looking statements as those statements containing the words “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend,” “may,” “will,” “would,” “could,” “should,” “might,” “potential,” “continue” or other similar expressions. You should not rely on our forward-looking statements as they are not a guarantee of future performance. There can be no assurance that forward-looking statements will prove to be accurate because the matters they describe are subject to assumptions, known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond our control.

Our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors, some of which are discussed in this report in the Part I, Item 1A. Risk Factors and elsewhere in this report. Risks and uncertainties include, among others:

| · | our ability to obtain funding for our operations; |

| · | our estimates regarding our expenses, revenues, anticipated capital requirements and our needs for additional financing; |

| · | the timing of the commencement, progress and receipt of data from any of our preclinical and clinical trials; |

| · | the expected results of any preclinical or clinical trial and the impact on the likelihood or timing of any regulatory approval; |

| · | the therapeutic benefits, effectiveness and safety of our product candidates; |

| · | the timing or likelihood of regulatory filings and approvals; |

| · | changes in our strategy or development plans; |

| · | the volatility of our common share price; |

| · | the rate and degree of market acceptance and clinical utility of any future products; |

| · | the effect of competition; |

| · | our ability to protect our intellectual property as well as comply with the terms of license agreements with third parties; |

| · | our ability to identify, develop and commercialize additional products or product candidates; |

| · | reliance on key personnel; and |

| · | general changes in economic or business conditions. |

Except as required by law, we undertake no obligation to update forward-looking statements. You should review the factors and risks and other information we describe in the reports we will file from time to time with the SEC.

As used in this Annual Report on Form 10-K, “Edesa,” “the Company,” “we,” “us,” and “our” refer to Edesa Biotech, Inc. and our consolidated subsidiaries, except where the context otherwise requires.

Our logo and other trademarks or service marks of Edesa Biotech, Inc. appearing in this Annual Report on Form 10-K are the property of Edesa Biotech, Inc. This Annual Report on Form 10-K contains additional trade names, trademarks and service marks of other companies. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply relationships with, or endorsement or sponsorship of us by, these other companies.

PART 1

Item 1. BUSINESS.

Overview

We are a biopharmaceutical company developing innovative ways to treat inflammatory and immune-related diseases.

Our approach is to acquire, develop and commercialize drug candidates based on mechanisms of action that have demonstrated proof-of-concept in human subjects. We prioritize our efforts on disease indications where there is compelling scientific rationale, no approved therapies or where there are unmet medical needs, and where there are large addressable market opportunities, among other factors. We have multiple late-stage product candidates in our development pipeline.

Our most advanced drug candidate is EB05 (paridiprubart). Paridiprubart represents a new class of emerging therapies called Host-Directed Therapeutics (HDTs) that are designed to modulate the body’s own immune response when confronted with infectious diseases or even chemical agents. Importantly, these therapies are designed to work across multiple infectious diseases and threats, and could be stockpiled preemptively ahead of outbreaks. Because they are threat agnostic, HDTs like paridiprubart have the potential to become standard of care in Intensive Care Units (ICUs) and critical countermeasures for both pandemic preparedness and biodefense. We are currently evaluating EB05 as a potential treatment for Acute Respiratory Distress Syndrome (ARDS), a life-threatening form of respiratory failure. Recruitment in a Phase 3 study is ongoing.

In addition to EB05, we are developing product candidates for a number of chronic dermatological and inflammatory conditions. In November 2023, we reported final results from a Phase 2b clinical study evaluating multiple concentrations of our drug candidate, EB01 (daniluromer), as a monotherapy for moderate-to-severe chronic Allergic Contact Dermatitis (ACD), a common occupational skin condition. Among the findings, 1.0% EB01 cream demonstrated statistically significant improvement over placebo for the primary endpoint and a key secondary endpoint. For our EB06 monoclonal candidate, we have received regulatory approval by Health Canada to conduct a future Phase 2 study in patients with moderate to severe nonsegmental vitiligo, a common autoimmune disorder that causes skin to lose its color in patches. We are also preparing an investigational new drug application (IND) in the United States (U.S.) for our EB07 product candidate to conduct a future Phase 2 study in patients with fibrotic diseases such as systemic sclerosis.

Competitive Strengths

We believe that we possess a number of competitive strengths that position us to become a leading biopharmaceutical company focused on inflammatory and immune-related diseases, including:

| · | Validated technology and drug development capabilities. We believe that the strength of our technologies has been validated by our favorable clinical data and progress to date, more than C$37 million in competitive government grant and funding awards, and our multiple arrangements with third parties to develop and commercialize their clinical-stage drug candidates. |

| | |

| · | Innovative pipeline addressing large underserved markets. Our product candidates include novel clinical-stage compounds and antibodies that have significant scientific rationale for effectiveness. By initially targeting large markets that have significant unmet medical needs, we believe that we can drive adoption of new products and improve our competitive position. For example, ARDS is associated with approximately 10% of ICU admissions globally, impacts millions of people, and costs billions of dollars annually. |

| | |

| · | Intellectual property protection and market exclusivity. We have opportunities to develop our competitive position through patents, trade secrets, technical know-how and continuing technological innovation. We have exclusive license rights in our target indications to multiple patents and pending patent applications in the U.S. and in various foreign jurisdictions. In addition to patent protection, we intend to utilize trade secrets and market exclusivity afforded to new chemical entities and biologics, where applicable, to enhance or maintain our competitive position. |

| | |

| · | Experienced leadership. Our leadership team possesses core capabilities in dermatology, infectious diseases, gastrointestinal medicine, drug development and commercialization, chemistry, manufacturing and controls, and finance. Our founder and Chief Executive Officer, Pardeep Nijhawan, MD, FRCPC, AGAF, is a board-certified gastroenterologist and hepatologist with a successful track record of building life science businesses, including Exzell Pharma Inc., which was sold to BioLab Pharma in 2022, and Medical Futures, Inc., which was sold to Tribute Pharmaceuticals in 2015. In addition to our internal capabilities, we have also established a network of key opinion leaders, contract research organizations, contract manufacturing organizations and consultants. As a result, we believe we are well positioned to efficiently develop novel treatments for inflammatory and immune-related diseases. |

Our Business Strategy

Our business strategy is to develop and commercialize innovative drug products that address unmet medical needs for large, underserved markets with limited competition. Key elements of our strategy include:

| · | Prioritize the development and commercialization of later-stage product candidates. Our goal is to obtain regulatory approval and commercialize multiple clinical assets in our pipeline. We seek to expedite development, in part, through the use of innovative trial designs, including adaptive design protocols, as well as by focusing on disease indications that we believe have clear regulatory pathways and interest from potential licensing or development partners. We also plan to evaluate opportunities to apply, as applicable, for expedited regulatory review and orphan drug programs, which could potentially lead to accelerated clinical development and commercialization timelines for our product candidates. |

| | |

| · | Maximize our current portfolio opportunity by expanding use across multiple indications. We aim to identify clinical-stage assets that have the potential to treat multiple diseases. Our assets are designed to modulate pathways that are implicated across a number of immune and inflammatory/allergic conditions. For example, we believe that our monoclonal antibody candidates have potential utility in additional indications, including chronic conditions like systemic sclerosis and vitiligo. |

| | |

| · | Maximize the commercial potential of our product candidates via direct marketing or strategic arrangements. If our product candidates are successfully developed and approved, we plan to either build commercial infrastructure capable of directly marketing the products, or alternatively, outsource the sales and marketing of our products. We also plan to evaluate strategic licensing or partnering arrangements with pharmaceutical companies for the further development or commercialization of our drugs, where applicable, such as in areas or regions outside North America where a partner may contribute additional resources, infrastructure and expertise. |

| | |

| · | In-license promising product candidates. We are applying our cost-effective development approach to advance and expand our pipeline. Our current product candidates are in-licensed from academic institutions or other biopharmaceutical companies, and, from time to time, we plan to identify, evaluate and potentially obtain rights to and develop additional assets. Our objective is to maintain a well-balanced portfolio with product candidates across various stages of development. We do not currently intend to invest significant capital in basic research, which can be expensive and time-consuming. |

Acute Respiratory Distress Syndrome

ARDS is a life-threatening form of respiratory failure characterized by an exaggerated and dysfunctional immune response, rapid onset of widespread inflammation in the lungs, and hypoxia (an absence of enough oxygen in the tissues to sustain bodily functions). ARDS can be precipitated by a number of conditions including viral and bacterial pneumonia, sepsis, chest injury and even mechanical ventilation, among other causes. ARDS has historically accounted for 10% of ICU admissions, representing more than 3 million patients globally each year. Based on the prevalence data of ARDS, we estimate that there are as many as 600,000 ARDS-related admissions to ICUs each year in the seven major markets (U.S, UK, Germany, France, Spain, Italy, Japan) and Canada. According to medical literature, ICU stays for ARDS patients in the U.S. range from 7 to 21 days on average, at an average cost of more than $100,000 per patient.

For moderate to severe cases of ARDS, treatments remain limited and patients suffer high mortality rates. Countering the exaggerated innate immune response in ARDS patients has been a key area of interest among researchers. One of the most studied targets has been Toll-like receptor 4 (TLR4) - a key component of the innate immune system and an important mediator of inflammation. Since TLR4 detects molecules found in pathogens and also binds to endogenous molecules produced as a result of injury, it is a key receptor on which both infectious and noninfectious stimuli converge to induce a proinflammatory response. Specifically, TLR4 signaling activates leukocytes to secrete proinflammatory cytokines (i.e., CXCL10, IL-6, IFN-b, IL-1b, TNF-α), which under certain circumstances can result in a “cytokine storm” - a severe immune reaction in which the body releases too many cytokines into the blood too quickly.

Such upregulation of TLR4 and its associated cytokines has been observed in respiratory infections such as influenza and SARS-CoV-2. In multiple third-party studies, high serum levels of alarmins, such as calprotectin (S100A8/A9) and HMGB1(high mobility group protein B1), that bind to and activate TLR4 are associated with poor outcomes and disease progression in ARDS patients. In addition, TLR4 inhibition (antagonism) prevents cytokine production at a very early stage and has been shown to have a protective effect. For example, in preclinical studies in mice, it was demonstrated that administration of a TLR4 antagonist blocked influenza-induced lethality and ameliorated virus-induced acute lung injury. Antagonism of TLR4 has also been shown to modulate the secretion of proinflammatory cytokines (IL-6, CRP, IFNb, TNF-a, CXCL-10, IL8 and MIP-1b). Based on these data as well as previous clinical results, we believe that the modulation of TLR4 provides a compelling opportunity to treat ARDS.

EB05 (paridiprubart)

Overview

EB05 is an intravenous formulation of paridiprubart, a first-in-class monoclonal antibody (mAb) that has been engineered to alter inflammatory signaling by binding to and blocking the activation of TLR4. Specifically, paridiprubart dampens TLR4 signaling by blocking receptor dimerization (and subsequent intracellular signaling cascades). The drug has demonstrated the ability to block signaling irrespective of the presence or concentration of the various molecules that frequently bind with TLR4, known as ligands. Based on this broad mechanism of action, we believe that paridiprubart could ameliorate TLR4-mediated inflammation cascades in ARDS patients, thereby reducing lung injury, ventilation rates and mortality.

Phase 2 Results of Phase 2/Phase 3 Study

In September 2022, we reported final results for the Phase 2 part of an international Phase 2/3 clinical study evaluating the safety and efficacy of EB05 as a therapy for adult hospitalized Covid-19 patients.

The Phase 2 part of the Phase 2/3 study was primarily exploratory and designed to refine patient stratification and statistical powering for the Phase 3 study. The study included hospitalized Covid-19 patients, ranging from Level 3 (hospitalized, not requiring supplemental oxygen) on the nine-point WHO Covid-19 Severity Scale (WCSS) to WCSS Level 7 (hospitalized, requiring intubation plus additional organ support such as ECMO). Enrollment in the study as well as the analysis was stratified according to baseline WCSS level into patients with mild Covid-19, defined as WCSS level ≤4, or severe Covid-19, defined as WCSS level ≥5, or critically ill, defined as WCSS level 7. Following a single intravenous infusion of EB05 or placebo, patients were evaluated for disease progression, mortality, side effects and other critical care measurements. Standard-of-care Covid-19 treatment was given to all patients.

In the Phase 2 study, EB05 demonstrated a statistically significant and clinically meaningful trend for 28-day mortality for all randomized subjects in the critically ill cohort (the intent to treat, or ITT, population). The 28-day death rate in the EB05 plus standard of care (SOC) arm was 7.7% versus 40% in the placebo + SOC arm in critically severe patients on ECMO therapy (extracorporeal membrane oxygenation) or Invasive Mechanical Ventilation (IMV) plus organ support with ARDS at baseline (p=0.04). The Survival Analysis using Cox’s Proportional Hazard Model also demonstrated that patients treated with EB05 + SOC had an 84% reduction in the risk of dying when compared to placebo + SOC at 28 days. To our knowledge, no other study has demonstrated a result of this magnitude in this population. The 60-day mortality rate was 23.1% (3/13) in the EB05 + SOC arm versus 45% (9/20) in the placebo + SOC arm for this same population (p=0.20). The Survival Analysis using Cox’s Proportional Hazard Model showed that the patients treated with EB05 + SOC had a 61% reduction in the risk of dying when compared to placebo + SOC at 60 days.

In addition to the critically ill population, the analysis of the full Phase 2 dataset revealed other efficacy signals. For severe Covid-19 patients at WCSS Level 5 and 6 (99% of patients had ARDS at baseline), there were clinically meaningful differences with respect to the proportion of patients who were alive without any need for oxygen support at Day 28 (the Phase 2 study’s primary endpoint). From the ITT analysis of this population, 45.8% in the EB05 + SOC arm versus 36.1% in the placebo + SOC arm achieved the primary endpoint (p=0.16). Similarly positive efficacy signals were also demonstrated in this same population for the proportion of patients who achieved at least a 2-point improvement on the WCSS. From the ITT analysis of this population, 46.7% in the EB05 + SOC arm versus 36.1% in the placebo + SOC arm achieved at least a 2-point improvement in on the WCSS (p=0.12). For mild Covid-19 patients at WCSS Level ≤4, the study did not detect meaningful clinical differences between the arms for these endpoints, which is likely the result of the baseline severity score being too close to the endpoint (WCSS of 3 or less) on these scoring scales. The Phase 2 study demonstrated that EB05 appears to be well-tolerated and consistent with the observed safety profile to date.

Phase 3 of a Phase 2/Phase 3 Study

In December 2022, the U.S. Food and Drug Administration (FDA) granted Fast Track designation to EB05 as a treatment for ARDS in critically ill Covid-19 patients. The Fast Track program provides us with the opportunity for more frequent communication with the agency to discuss the development path for EB05 as a treatment for ARDS in critically ill Covid-19 patients. Investigational drugs that receive Fast Track designation are also eligible for rolling review of their marketing application as well as potential pathways for accelerated regulatory approval. To receive this designation, drug candidates must both treat a serious disease and have non-clinical or clinical data that demonstrate the potential to address an unmet medical need.

The Phase 3 part of our Phase 2/3 study is designed to assess the efficacy and safety of EB05 among hospitalized patients with severe and critical disease, for whom there continues to be limited treatment options and high mortality rates. In March 2023, we announced that the Company and the FDA agreed on the primary endpoint and population for a Phase 3 study evaluating EB05 as a therapy for hospitalized Covid-19 patients with ARDS. Under the amended protocol design, we will evaluate a single cohort of severely ill patients on invasive mechanical ventilation, both with and without additional organ support such as ECMO. The protocol calls for approximately 600 evaluable hospitalized subjects to be enrolled. The primary endpoint will be the mortality rate at 28 days. In October 2023, Canadian regulators approved an amendment that harmonized the previously approved Canadian protocol with the U.S. protocol.

Based on current hospitalization trends and our recruitment experience, we believe that Covid-19-related hospitalization patterns have become more predictable and seasonal in nature, similar to those of influenza, with increased hospitalizations and deaths anticipated in the fall/winter and among populations and geographies with low booster/vaccination rates. As a result, we believe that the pace of future enrollment will be more closely linked to the number and location of investigational sites we activate rather than the unpredictable waves of the pandemic. We plan to increase the number of investigational centers from 23 to up to 60 hospitals in the U.S. and Canada. We have the flexibility to adjust the timing of these and other clinical trial expenditures to manage our working capital.

In addition to Covid-19 induced ARDS, we are also exploring various approaches to evaluate our EB05 drug candidate in a general, all-cause ARDS population. Given the broader pool of patients, we believe a general, all-cause ARDS study could increase efficiency and expedite development timelines as well as validate the broader potential utility of EB05. Any changes we make to our clinical study protocol may impact how previously enrolled subjects are categorized and/or included in the study’s results. As of the date of this filing, recruitment is ongoing in the U.S. and Canada.

Previous Phase 1 and Phase 2 Clinical Studies

Paridiprubart has demonstrated the potential ability to regulate inflammation and resolve fever and stabilize heart and breathing rates in human subjects that were injected with lipopolysaccharide (LPS) - a potent inducer of acute systemic inflammation. In previous Phase 1 and Phase 2 clinical studies, paridiprubart has demonstrated favorable safety and tolerability profiles.

In a previous Phase 1 study, paridiprubart was administered in healthy volunteers (HV) as a single intravenous infusion using a single ascending pharmacokinetic/pharmacodynamic dose design. Paridiprubart was administered at different dose levels and was followed by in vivo LPS challenges. The study demonstrated that paridiprubart inhibited the release of various pro-inflammatory cytokines (IL-6, TNF-α and CXCL10) and stabilized certain other vital signs for up to 22 days after the infusion of paridiprubart. The study further demonstrated that cytokine response and baseline vital signs were restored at 40 days after paridiprubart infusion.

Paridiprubart demonstrated a favorable safety profile in the Phase 1 study in healthy volunteers as well as in a multiple-infusion Phase 2 study in subjects with rheumatoid arthritis (RA). In the Phase 1 study, doses ranged from 0.001 mg/kg up to 15mg/kg. The Phase 2 RA study was a multiple dose study where patients received one dose of paridiprubart 5 mg/kg every two weeks for 12 weeks. In the Phase 1 study, a total of 60 subjects received paridiprubart, and in the Phase 2 RA study, 61 patients were randomized to the paridiprubart group. There were no meaningful differences observed between the placebo and paridiprubart treatment groups with respect to the incidence of treatment emergent serious and non-serious adverse events in either of these studies.

Federal Funding from the Government of Canada

In October 2023, our wholly owned subsidiary Edesa Biotech Research, Inc. (Edesa Biotech Research) entered into a multi-year contribution agreement (the 2023 SIF Agreement) with the Canadian government’s Strategic Innovation Fund, or SIF. Under the 2023 SIF Agreement, the Government of Canada committed up to C$23 million in partially repayable funding toward (i) conducting and completing a Phase 3 clinical study of our investigational therapy EB05 in critical-care patients with ARDS caused by Covid-19 or other infectious agents, and (ii) submitting EB05 for governmental approvals and manufacturing scale-up, following, and subject to, completing the Phase 3 study and (iii) conducting two non-clinical safety studies to assess the potential long-term impact of EB05 exposure. Of the C$23 million committed by SIF, up to C$5.75 million is not repayable. The remaining C$17.25 million is conditionally repayable starting in 2029 only if and when we earn gross revenue. Edesa Biotech Research has agreed to complete the project by December 31, 2025. In the event that we or Edesa Biotech Research breach our obligations under the 2023 SIF Agreement, subject to applicable cure, the SIF may exercise a number of remedies, including suspending or terminating funding under the 2023 SIF Agreement, demanding repayment of funding previously received and/or terminating the 2023 SIF Agreement. The performance obligations of Edesa Biotech Research under the 2023 SIF Agreement are guaranteed by us.

Our previously completed Phase 2 study of EB05 was also funded, in part, by SIF. Under a February 2021 agreement (the 2021 SIF Agreement), the Government of Canada committed C$14.1 million in nonrepayable funding for an international Phase 2 study and certain pre-clinical experiments. In the event that we or Edesa Biotech Research breach our obligations under the 2021 SIF Agreement, subject to applicable cure, the SIF may exercise a number of remedies, including demanding repayment of funding previously received and/or terminating the agreement. The performance obligations of Edesa Biotech Research under the contribution agreement are guaranteed by us. All potential funding available under the 2021 SIF Agreement has been received. As of the date of this filing, we have met all of our performance and reporting requirements under the 2021 SIF Agreement.

Vitiligo

Vitiligo is a chronic autoimmune disease that causes the loss of skin pigmentation in patches. It occurs when melanocytes, the pigment-producing skin cells, die or stop producing melanin. The extent of color loss from vitiligo is unpredictable and can affect the skin on any part of the body. It is estimated that vitiligo prevalence is between 0.5 to 2% of the global population. Vitiligo patients are not born with lesioned skin. Rather, unpigmented spots appear over time, with about 50% of patients having symptom onset before 20 years of age. There are two main forms of vitiligo: segmental, where depigmentation is limited to one area and side of the body, and nonsegmental (generalized), where patches of pale skin occur on both sides of the body, often symmetrically. Nonsegmental vitiligo is the most common type of vitiligo.

At present, there is only one FDA-approved therapeutic indicated for repigmentation in vitiligo, a Janus Kinase (JAK) inhibitor cream (ruxolitinib); however, there is an increased risk of serious infections and malignancies associated with ruxolitinib. Similarly, off-label non-surgical therapies tend to be time-consuming, expensive, or prone to causing side effects. Common treatments include topical drugs, phototherapies and surgical interventions. Based on the availability and limitations of current treatments, we believe there is a significant need for well targeted and systemic immunotherapies.

EB06

Overview and Status

EB06 is a monoclonal antibody candidate that binds specifically and selectively to chemokine ligand 10 (CXCL10) and inhibits the interaction of CXCL10 with its receptor(s). We believe that there is significant scientific rationale for the potential utility of this mechanism of action to reduce disease symptoms and progression in vitiligo patients. CXCL10 is highly expressed in vitiligo patients, and has been shown to play both a key role in the trafficking of anti-melanocytic T-cells to the epidermis as well as in inducing apoptosis (death) of melanocytes. Furthermore, neutralization of CXCL10 has been demonstrated to both prevent and reverse depigmentation in animal models. EB06 is currently formulated for intravenous administration, with future plans for a potential subcutaneous formulation.

We have approval from Health Canada to conduct a Phase 2 study of EB06 in moderate to severe nonsegmental vitiligo patients, and we are currently evaluating potential funding options to initiate this project, which may include both drug manufacturing and clinical activities.

Previous Clinical Experience

EB06 has demonstrated a favorable safety and tolerability profile in three previous clinical studies of 65 subjects in total. The first Phase 1 study was a double-blind, placebo-controlled, ascending, single-dose study in 20 healthy subjects. Participants received single intravenous doses of EB06, ranging from 0.1 to 20 mg/kg. No deaths or serious adverse events (AEs) were reported. EB06 was generally safe and well tolerated at doses up to 20 mg/kg. A second Phase 1 study evaluated the effect of single doses of EB06 to generate proof-of-principle data on the neutralization of CXCL10 in an inflammatory setting in humans using an experimentally nickel-induced allergic contact dermatitis model. For this double-blind, placebo-controlled study, 16 subjects were exposed to single intravenous doses of 180 and 720 mg of EB06. No deaths or serious AEs were reported, and EB06 was generally safe and well tolerated.

A third, open-label, single-arm Phase 2 study investigating multiple administrations of EB06 in patients with primary biliary cirrhosis with an incomplete response to ursodeoxycholic acid (UDCA) was also completed. A total of 29 patients were treated with 10 mg/kg intravenous doses of EB06 every two weeks, for a total of 6 doses. No serious treatment-related AEs were reported.

In addition, in a variety of pre-clinical in vitro and in vivo experiments, EB06 demonstrated the ability to neutralize the biological activity of CXCL10. In animal toxicology studies, EB06 was well-tolerated.

Allergic Contact Dermatitis

Contact dermatitis is a common occupational and work-related skin condition. The disease can be either irritant contact dermatitis or ACD. Based on market research, we believe that together these conditions cost up to $2 billion annually in the U.S. as a result of lost work, reduced productivity, medical care and disability payments. Based on the prevalence data of contact allergy in the general population, which we sourced from scientific literature and market reports, we estimate that there are as many as 30 million people in the seven major markets (US, UK, Germany, France, Spain, Italy, Japan) and Canada with ACD, and of these, we estimate that 40% have chronic exposure or frequent recurring exposure to a causative allergen. Based on the mechanism of action and topical delivery, we believe that the total addressable patient population for EB01 is as high as five million people in the seven major markets and Canada.

ACD is caused by an allergen interacting with skin and usually occurs on areas of the body that are open to the environment, with a high prevalence on the hands and face. Common allergens associated with ACD include plants, metals, plastics and resins, rubber additives, dyes, biocides, and various cosmetics. The disease is characterized by inflammation, erythema (redness), pruritus (itchiness), and blistering of the skin. Inflammation can vary from mild irritation and redness to open sores, depending on the type of irritant, the body part affected and the degree of sensitivity. ACD can become chronic if not treated or if the causative allergen is not removed. In many chronic cases, the causative allergen is unknown or difficult to avoid (as an example, the allergen is present in the workplace).

The immune mechanisms involved in ACD are well documented. During the initial contact with the offending allergen, the immune system is sensitized. Upon subsequent contact, a delayed-type hypersensitivity reaction (Type IV) occurs at the point of contact between the skin and the allergen. As a cell-mediated response, the immune reaction primarily involves the interaction of T cells with antigens rather than an antibody response. More specifically, ACD involves an exogenous substance binding a cell surface protein to form a hapten that is recognized as a foreign antigen by the immune system. Haptens are known to signal through toll-like receptors, a family of receptors involved in the innate immune system, which leads to the induction of pro-inflammatory cytokines such as interleukin (IL)-1b. EB01 has been shown in preclinical studies to inhibit the production of pro-inflammatory cytokines induced via toll-like receptor signaling (IL-1b, IL-6, IL-8, MIP-1a, and TNF-α), suggesting that EB01 may address the underlying disease mechanism of ACD.

Generally, dermatologists view chronic ACD from both a duration and recurrence perspective, considering how often and how long symptoms persist. Chronic disease affects patients over a prolonged period, typically greater than six months or even years. These chronic patients have either frequent intermittent exposure or continuous exposure. Since inflammation in ACD is driven by external exposure to an allergen, the severity of ACD does not necessarily correlate with body surface area, as is often the case with other dermatological diseases.

Current treatment plans begin by attempting to identify and remove exposure to the causative allergen. However, the causative allergen(s) is frequently not identified, and even when it is, avoiding exposure is often not possible (e.g., it is present in the workplace), according to our market research. To our knowledge, there are no drug treatment options specifically indicated for ACD. As such, physicians must utilize agents approved for other dermatological conditions. Topical corticosteroids are the most commonly used therapeutic intervention for ACD but cannot be used continuously since they have well-known side-effects including skin thinning, stretch marks, acne, stinging, burning and dryness. Other topical treatments for ACD include topical immunomodulators such as topical calcineurin inhibitors. However, these are less efficacious than topical corticosteroids and have an FDA “black box warning” for risk of malignancies. Systemic corticosteroids can be used for acute control of severe cases of ACD but have safety concerns including hypothalamic-pituitary-adrenal axis suppression, growth suppression and loss of bone-density, thereby limiting the utility of steroids for treating chronic disease. Finally, patients may be treated with systemic immunomodulators, which have “black box warnings” and associated safety issues. Systemic therapies also need to be tapered off each time the physician wants to patch test allergens to identify the source of a patient’s ACD.

EB01 (daniluromer)

Overview and Status

EB01 is a potential first-in-class, topical vanishing cream containing a novel, non-steroidal anti-inflammatory compound. Daniluromer exerts its anti-inflammatory activity through the inhibition of certain pro-inflammatory enzymes known as secretory phospholipase 2, or sPLA2. These enzymes are secreted by immune cells upon their activation and produce arachidonic acid via phospholipid hydrolysis, which, in turn, initiates a broad inflammatory cascade. The sPLA2 enzyme family plays a key role in initiating inflammation associated with many diseases, and we believe that targeting the sPLA2 enzyme family with enzyme inhibitors will have a superior anti-inflammatory therapeutic effect because the inflammatory process will be inhibited at its inception rather than after inflammation has occurred.

Phase 2b Clinical Results of EB01

In November 2023, we reported final results from a Phase 2b clinical study evaluating multiple concentrations of our drug candidate, EB01, as a monotherapy for chronic moderate-to-severe ACD. The double-blind, placebo-controlled trial evaluated the safety and efficacy of EB01 in approximately 200 subjects, who were treated for 28 days with either EB01 cream (2.0%, 1.0% or 0.2%) or a placebo/vehicle cream. The primary efficacy outcome measurement was the mean percent improvement in symptoms from baseline at day 29 on the Contact Dermatitis Severity Index (CDSI). A key secondary efficacy measurement was the success rate of subjects achieving a score of "clear" or "almost clear" with at least a 2-point improvement from baseline after treatment at day 29 on the Investigator's Static Global Assessment (ISGA) scale.

The 1.0% EB01 cream demonstrated statistically significant improvement over placebo. For the primary endpoint, patients with 1.0% EB01-treated lesions demonstrated a 60% average improvement in symptoms from baseline at day 29 on the CDSI versus 40% for placebo/vehicle (p=0.027). For the ISGA secondary efficacy endpoint, 53% of patients with 1.0% EB01-treated lesions achieved a score of "clear" or "almost clear" with at least a 2-point improvement from baseline after treatment at day 29 (p=0.048). Only 29% of patients in the placebo group reached the same endpoint. No serious treatment-related adverse events were reported across all concentrations. The 2.0% and 0.2% formulations did not show significant differences compared to placebo. We are currently evaluating potential partnerships and funding opportunities for the continued development of this drug candidate.

Previous Clinical Results of EB01

EB01 has demonstrated efficacy for the treatment of ACD in two separate clinical trials. Both studies were double-blind, placebo/vehicle-controlled bilateral comparison studies to assess the safety, tolerability and efficacy of EB01 cream applied twice daily for the treatment of ACD of the hand and forearm as determined by the CDSI, a physician’s visual assessment. The CDSI is a composite endpoint, which grades each symptom of the disease (dryness, scaling, redness, pruritus, and fissures) scored from 0 (none) to 3 (severe), with a maximum total severity score of 15. A diagnosis of ACD was confirmed by a positive patch test deemed to be clinically relevant by the investigator.

The first Phase 2 study (n=11) was a double-blind, placebo/vehicle-controlled clinical study to assess the safety and efficacy of topical 1% EB01 cream for the treatment of ACD. Subjects selected for inclusion had bilateral ACD. Prior to randomization, subjects were patch tested. The study was bilateral in design with one lesion treated with 1% EB01 cream twice daily, while a comparable lesion was treated with placebo cream. Disease severity was assessed before treatment (Day 0) and at Day 30 by the investigator using the CDSI. For each individual patient, the change in disease score in the drug-treated hand was compared to that in the placebo-treated hand, thus making the latter an internal control for each patient. The mean change from baseline for 1% EB01 cream treated lesions was 69.9%, compared to 36.5% in the placebo cream lesions (p=0.0024).

A second Phase 2 study was a larger (n=30) bilateral study was conducted to assess 2% EB01 cream applied twice daily for 21 consecutive days in connection with the treatment of ACD. To be included in the study, patients had to have bilateral ACD with a CDSI score of at least 10 on each side, with no more than a 1-point difference between lesions. At Day 21, EB01-treated lesions had a mean improvement from baseline of 56%, compared to 24% for those treated with placebo cream (p<0.001). Efficacy of the 2% EB01 cream was maintained through Day 42 (21-days after ending treatment) with a 49% decrease in total CDSI score for 2% EB01 cream-treated hands, compared to 15% in the placebo/vehicle-treated hands (p<0.001). Within the total CDSI score, EB01 demonstrated statistically significant reductions for each of the individual CDSI components (dryness, scaling, redness, pruritus, and fissures).

Total clinical experience with daniluromer, including the current Phase 2b study, has involved approximately 270 subjects. No serious adverse events have been encountered to date.

Pre-Clinical Results

Daniluromer has demonstrated anti-inflammatory activity in a variety of in vitro and in vivo preclinical pharmacology models. Using a model for hapten signaling indicative of ACD, lipopolysaccharide-stimulated peripheral blood mononuclear cells were treated with daniluromer and shown to inhibit pro-inflammatory cytokines including IL-1b, IL-6, IL-8, MIP-1a, and TNF-α at the protein and mRNA expression levels. Additionally, in several Good Laboratory Practice animal toxicology studies, daniluromer was well-tolerated and systemic exposure was negligible (below the limit of detection). No genotoxicity was demonstrated in bacterial reverse mutation and micronucleus testing.

Other Future Product Candidates

We are seeking to advance additional product candidates as well as add new disease indications for current product candidates, and from time to time we may request approval from regulators in various jurisdictions to initiate new clinical studies or amend the scope of current clinical studies. In addition, we plan to continue to identify, evaluate and potentially obtain rights to and develop additional clinical assets across various stages of development, focusing primarily on inflammatory and immune-related diseases.

Among our activities, we are preparing IND in the U.S. for our EB07 (paridiprubart) product candidate to conduct a future study in patients with fibrotic diseases such as systemic sclerosis. This project represents a potential additional use for our anti-TLR4 monoclonal antibody candidate in chronic diseases with limited treatment options and high mortality and morbidity. In addition, our EB02 (daniluromer) drug candidate represents a potential extension of our sPLA2 anti-inflammatory technology. Based on our analysis of clinical data in dermatitis, we believe that EB02, which is currently formulated as a cream, may be effective in treating the erythema, swelling and exudation associated with hemorrhoids disease (HD). We have received approval from Health Canada for an exploratory Phase 2a clinical study of EB02 as a potential treatment for patients with grade I-III internal hemorrhoids. In light of our focus on the development of other product candidates, we are currently evaluating the timing for the initiation of this planned study of EB02. Initiating recruitment in the EB07 and EB02 studies is subject to, among other limitations, funding, regulatory approvals, drug manufacturing and activation of clinical investigational sites.

Intellectual Property and Key Licenses

We have an exclusive license from Yissum Research Development Company, the technology transfer company of Hebrew University of Jerusalem Ltd. (Yissum), for patents and patent applications that cover our product candidates EB01 and EB02 in the U.S., Canada, Australia and various countries in Europe. Method of use patents, for which we hold an inbound license from Yissum and an affiliate of Yissum, have been issued for use in dermatologic and gastrointestinal conditions and infections that will expire in 2024. We expect to seek patent term extension in the U.S. related to time under IND, which could add up to three to five years of additional protection. Additional patents subject to the license agreement have been filed by Yissum which we believe, if issued, could potentially prevent generic substitution until after 2033.

We also hold an exclusive license from NovImmune SA, for patents and patent applications that cover our product candidates that utilize our anti-TLR4 and anti-CXCL10 monoclonal antibody technology in the U.S., Canada and various other countries. Composition of matter patents, for which we hold an inbound license from NovImmune, have been issued that will expire as late as 2033 and 2028, respectively. We expect to seek patent term extension in the U.S. related to time under IND, which could extend protection. We have also filed additional method of use patent applications which we believe, if issued, could potentially prevent biosimilar substitution until as late as 2041. We have also filed provisional patent applications for use of these monoclonal antibody technologies in vitiligo (EB06) and systemic sclerosis (EB07).

In the event we are successful in commercializing a new drug candidate, we believe we would be eligible for data/market exclusivity, in addition to exclusivity rights granted through patent protection. We would be eligible for up to five years of exclusivity for EB01 and EB02 and up to 12 years of exclusivity for EB05 and EB06 after approval in the U.S., and, for any of these drug products, eight years of exclusivity after approval in Canada and ten years of exclusivity after approval in the European Union (EU).

We expect patents and other proprietary intellectual property rights to be an essential element of our business. We intend to protect our proprietary positions by, among other methods, filing U.S. and foreign patent applications related to our proprietary technology, inventions, and improvements. We also rely on trade secrets, know-how, continuing technological innovation and other in-licensing opportunities to develop and maintain our proprietary position. Our success will depend, in part, on our ability to obtain and maintain proprietary protection for our product candidates, technology, and know-how, to operate without infringing on the proprietary rights of others, and to prevent others from infringing our proprietary rights.

License Agreement with NovImmune SA

In April 2020, through Edesa Biotech Research, we entered into an exclusive license agreement (the NovImmune License Agreement) with NovImmune SA (NovImmune), which operates under the brand Light Chain Bioscience, whereby we obtained exclusive rights throughout the world to certain know-how, patents and data relating to the monoclonal antibodies targeting TLR4 and CXCL10 (the Constructs). We will use the exclusive rights to develop products containing these Constructs (the Licensed Products) for therapeutic, prophylactic and diagnostic applications in humans and animals. Unless earlier terminated, the term of the NovImmune License Agreement will remain in effect for 25 years from the date of first commercial sale of Licensed Products. Subsequently, the NovImmune License Agreement will automatically renew for 5-year periods unless either party terminates the agreement in accordance with its terms.

Under the NovImmune License Agreement, we are exclusively responsible, at our expense, for the research, development manufacture, marketing, distribution and commercialization of the Constructs and Licensed Products and to obtain all necessary licenses and rights. We are required to use commercially reasonable efforts to develop and commercialize the Constructs in accordance with the terms of a development plan established by the parties. In exchange for the exclusive rights to develop and commercialize the Constructs, we issued to NovImmune $2.5 million of newly designated Series A-1 Convertible Preferred Shares (all of which were subsequently converted into common shares) pursuant to the terms of a securities purchase agreement entered into between the parties concurrently with the NovImmune License Agreement. In addition, we are committed to payments of various amounts to NovImmune upon meeting certain development, approval and commercialization milestones as outlined in the NovImmune License Agreement up to an aggregate amount of $356 million. We also have a commitment to pay NovImmune a royalty based on net sales of Licensed Products in countries where we directly commercialize Licensed Products and a percentage of sublicensing revenue received by us in the countries where we do not directly commercialize Licensed Products.

The NovImmune License Agreement provides that NovImmune will remain the exclusive owner of existing intellectual property in the Constructs and that we will be the exclusive owner of all intellectual property resulting from the exploitation of the Constructs pursuant to the license. Subject to certain limitations, we are responsible for prosecuting, maintaining and enforcing all intellectual property relating to the Constructs. During the term of the agreement, we also have the option to purchase the licensed patents and know-how at a price to be negotiated by the parties. If we default or fail to perform any of the terms, covenants, provisions or its obligations under the NovImmune License Agreement, NovImmune has the option to terminate the NovImmune License Agreement, subject to providing us with an opportunity to cure such default. The NovImmune License Agreement is also terminable by NovImmune upon the occurrence of certain bankruptcy related events pertaining to us.

In connection with the NovImmune License Agreement and pursuant to a purchase agreement entered into by the parties in April 2020, we acquired from NovImmune its inventory of the TLR4 antibody for an aggregate purchase price of $5.0 million.

License and Development Agreement with Pendopharm

In August 2017, Edesa Biotech Research entered into an exclusive license and development agreement with Pendopharm, a division of Pharmascience Inc. (the Pendopharm License Agreement). Pursuant to the Pendopharm License Agreement, we granted to Pendopharm an exclusive license throughout Canada to certain know-how, patents and data for the sole purpose of obtaining regulatory approval for certain pharmaceutical products to allow Pendopharm to distribute, market and sell the licensed products for human therapeutic use in certain gastrointestinal conditions. If Pendopharm elects not to seek regulatory approval of the applicable product, the applicable product will be removed from the license rights granted to Pendopharm and will revert to us. If Pendopharm elects to seek regulatory approval in Canada for the sale and marketing of the applicable product, Pendopharm will be responsible for obtaining regulatory approval for the applicable licensed product in Canada. In exchange for the exclusive rights to market, import, distribute, and sell the pharmaceutical products, Pendopharm is required to pay us a royalty in respect of aggregate annual net sales for each pharmaceutical product sold in Canada. Unless earlier terminated, the term of the Pendopharm License Agreement will expire, on a licensed product by licensed product basis, on the later to occur of (i) the date that is 13 years after the first commercial sale of the licensed product in Canada; (ii) the date of expiry of the last valid licensed patent in Canada relating to the licensed product; or (iii) the date of expiry of any period of exclusivity granted to the licensed product by a regulatory authority in Canada. The Pendopharm License Agreement shall also terminate upon the termination of certain other license agreements that we have with third parties. Pendopharm also has the right to terminate the Pendopharm License Agreement for convenience upon 120 days’ notice to us.

License Agreements with Yissum and Inventor

In June 2016, Edesa Biotech Research, entered into an exclusive license agreement with Yissum, which was subsequently amended in April 2017, May 2017 and October 2022 (collectively, the Yissum License Agreement). Pursuant to the Yissum License Agreement, as amended, we obtained exclusive rights throughout the world to certain know-how, patents and data relating to a pharmaceutical product for the following fields of use: therapeutic, prophylactic and diagnostic uses in topical dermal applications and anorectal applications. Unless earlier terminated, the term of the Yissum License Agreement will expire on a country by country basis on the later of (i) the date of expiry of the last valid licensed patent in such country; (ii) the date of expiry of any period of exclusivity granted to a product by a regulatory authority in such country or (iii) the date that is 15 years after the first commercial sale of a product in such country.

Under the Yissum License Agreement, we are exclusively responsible, at our expense, for the development of the product, including conducting clinical trials and seeking regulatory approval for the product, and once regulatory approval has been obtained, for the commercialization of the product. We are required to use our commercially reasonable efforts to develop and commercialize the product in accordance with the terms of a development plan established by the parties. Subject to certain conditions, we are permitted to engage third parties to perform our activities or obligations under the agreement. In exchange for the exclusive rights to develop and commercialize the product for topical dermal applications and anorectal applications, we are committed to payments of various amounts to Yissum upon meeting certain milestones outlined in the Yissum License Agreement up to an aggregate amount of $18.4 million. In addition, in the event of a divestiture of substantially all of our assets, we are obligated to pay Yissum a percentage of the valuation of the licensed technology sold as determined by an external objective expert. We also have a commitment to pay Yissum a royalty based on net sales of the product in countries where we, or an affiliate of ours, directly commercializes the product and a percentage of sublicensing revenue received by us and our affiliates in the countries where we do not directly commercialize the product.

The Yissum License Agreement provides that Yissum shall remain the exclusive owner of the licensed technology and that we are responsible for preparing, filing, prosecuting and maintaining the patents on the licensed technology in Yissum’s name. Notwithstanding the foregoing, we will be the exclusive owner of all patents and other intellectual property that is made by, or on our behalf, after the date of the agreement, including all improvements to the licensed technology. If we default or fail to perform any of the terms, covenants, provisions or our obligations under the Yissum License Agreement, Yissum has the option to terminate the Yissum License Agreement, subject to providing us with an opportunity to cure such default. We have the right to terminate the Yissum License Agreement if we determine that the development and commercialization of the product is no longer commercially viable. Subject to certain exceptions, we have undertaken to indemnify Yissum against any liability, including product liability, damage, loss or expense derived from the use, development, manufacture, marketing, sale or sublicensing of the licensed product and technology.

In March 2021, through Edesa Biotech Research, we entered into a license agreement with the inventor of the same pharmaceutical product, which was subsequently amended in September 2023 (together, the Inventor License Agreement), to acquire global rights for all fields of use beyond those named under the Yissum License Agreement. As a result of the Inventor License Agreement, we now hold exclusive global rights to the pharmaceutical product that forms the basis of our EB01 and EB02 drug candidates for all fields of use in humans and animals. We are required to use commercially reasonable efforts to develop and commercialize the product in accordance with the terms of a development plan established by the parties. We are exclusively responsible, at our expense, for the development of the product. We are committed to remaining payments of up to an aggregate amount of $69.1 million, primarily relating to future potential commercial approval and sales milestones. In addition, if we fail to file an IND application or foreign equivalent for the product within a certain period of time following the date of the agreement, we are required to remit to the inventor a fixed license fee on a quarterly basis as long as the requirement to file an IND remains unfulfilled. We also have a commitment to pay the inventor a royalty based on net sales of the product in countries where we, or an affiliate, directly commercialize the product and a percentage of sublicensing revenue received by us and our affiliates in the countries where we do not directly commercialize the product. Unless earlier terminated, the term of the Inventor License Agreement will expire on a country by country basis on the later of (i) the date of expiry of the last valid licensed patent in such country or (ii) the date that is 15 years after the first commercial sale of a product in such country. If we default or fail to perform any of the terms, covenants, provisions or our obligations under the Inventor License Agreement, the inventor has the option to terminate the Inventor License Agreement, subject to providing us with an opportunity to cure such default. We have the right to terminate the Inventor License Agreement if we determine that the development and commercialization of the product is no longer commercially viable. Subject to certain exceptions, we have undertaken to indemnify the inventor against any liability, including product liability, damage, loss or expense derived from the use, development, manufacture, marketing, sale or sublicensing of the licensed product and technology.

Manufacturing and Marketing

We rely, and expect to continue to rely for the foreseeable future, on third-party contract manufacturing organizations, or CMOs, to produce both our synthetic chemical and biological product candidates for clinical testing, as well as for commercial manufacture if our product candidates receive marketing approval. Additional contract manufacturers are used to fill, label, package and distribute investigational drug products. We believe that this strategy will enable us to direct operational and financial resources to the development of our product candidates rather than diverting resources to establishing manufacturing infrastructure. Our current arrangements with our manufacturers are subject to customary industry terms and conditions, and manufacturing is performed on an as-requested basis. While we have not experienced significant shortages of raw materials to date, as a result of increased industry demand, CMOs have generally reported that supplies of raw materials and critical components necessary for manufacturing processes have been more challenging and expensive to obtain, and longer lead times may be required for scheduling future production runs. We believe that we have sufficient supplies on hand to complete the Phase 3 clinical study for EB05.

To supply future clinical studies and potential commercialization of our product candidates, we are engaged in discussions with various CMOs regarding long-term supply agreements. These supply agreements typically require significant financial commitments, including upfront amounts prior to commencement of manufacturing, progress payments through the course of the manufacturing process as well as payments for technology transfer and other start-up costs. Based on our discussions with CMOs and industry announcements regarding future expansion plans, we believe there will be sufficient supplies of raw materials and manufacturing capacity to service our near-term and future product needs.

Because we are focused on the discovery and development of drugs, we do not have any marketing or distribution capabilities, nor are we at a stage where we would have any customers for our investigational medicines. If we receive marketing approval or emergency use authorization in the U.S., Canada or Europe for a product candidate, we plan to either build the capabilities to commercialize the product candidate in the applicable region with our own focused, specialized sales force, or alternatively, outsource the sales and marketing infrastructure necessary to market and sell our products. We also plan to utilize strategic licensing, collaboration, distribution or other marketing arrangements with third parties for the further development or commercialization of our products and product candidates, where applicable, such as in areas or regions outside North America where a partner may contribute additional resources, infrastructure and expertise.

Competition

The pharmaceutical and biotechnology industry is highly competitive, and the development and commercialization of new drugs is influenced by rapid technological developments and innovation. We face competition from companies developing and commercializing products that will be competitive with our drug candidates, including large pharmaceutical and smaller biotechnology companies, many of which have greater financial and commercial resources than we do. For our EB01 and EB02 product candidates, our potential competitors include, among others, Aclaris Therapeutics, Inc., Citius Pharmaceuticals Inc., Dermavant Sciences, Inc., Fresh Tracks Therapeutics, Inc. (formerly Brickell), Incyte Corporation, Leo Pharma A/S, Pfizer Inc., Sanofi S.A., and Sun Pharmaceutical Industries Ltd. For our EB05 product candidate, there are numerous competing therapies, including prophylactic vaccines for the SARS-Cov2 virus, experimental stem cell therapies, novel therapeutics and repurposed commercial drugs. Our potential competitors include, among others: Aqualung Therapeutics Corporation, Eli Lilly and Company, Enzychem Lifesciences Corp., Merck & Co, Inc., Mesoblast Limited, Pfizer Inc., Regeneron Pharmaceuticals, Inc., Roche Holding AG and Veru Inc. For any future product for vitiligo or fibrotic diseases, potential competitors, include, among others: Bausch Health, Eli Lilly and Company, Galderma Laboratories, LP, Incyte Corporation, Boehringer Ingelheim AG, Chemomab Therapeutics Ltd., F. Hoffmann-La Roche AG, GlaxoSmithKline plc., Leo Pharma A/S, Merck & Co., Inc., Mitsubishi Tanabe Pharma Corporation, and Sanofi S.A. Some of the competing product development programs may be based on scientific approaches that are similar to our approach, and others may be based on entirely different approaches. Potential competitors also include new entrants to the market, academic institutions, government agencies and other public and private research organizations that conduct research, seek patent protection and establish collaborative arrangements for research, development, manufacturing and commercialization of products similar to ours or that otherwise target indications that we are pursuing. Key factors affecting the success of any approved product will be its efficacy, safety profile, drug interactions, method of administration, pricing, reimbursement and level of promotional activity relative to those of competing drugs. We believe that our product candidates will compete favorably with respect to such factors. However, we may not be able to maintain our competitive position against current and potential competitors.

Government Regulation

We plan to conduct clinical studies and seek approvals for our product candidates in the U.S., Canada, EU and other jurisdictions. Therefore, we currently are, and may in the future be, subject to a variety of national and regional regulations governing clinical trials as well as commercial sales and distribution of our products, if approved.

To conduct clinical trials for our product candidates, we rely on third parties, such as contract research organizations, medical institutions and clinical investigators. Although we have entered into agreements with these third parties, we continue to be responsible for confirming that each of our clinical trials is conducted in accordance with our investigational plan or research protocol, as well as International Conference on Harmonization Good Clinical Practices, or GCP, which include guidelines for conducting, recording and reporting the results of clinical trials.