false

0001643988

0001643988

2023-12-11

2023-12-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 11, 2023

Loop Media, Inc.

(Exact Name of Registrant as Specified in Charter)

| Nevada |

|

001-41508 |

|

47-3975872 |

| (State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

2600 West Olive Avenue, Suite 5470

Burbank, CA |

|

91505 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(213) 436-2100

N/A

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered or to be registered pursuant to

Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common stock, $0.0001 par value per share |

|

LPTV |

|

The NYSE American, LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Chief Operating Officer

On December 11, 2023,

the Board of Directors (the “Board”) of Loop Media, Inc. (the “Company”) appointed Randy Greenberg as Chief Operating

Officer and Chief Marketing Officer of the Company, effective on the date that the Company files its annual report on Form 10-K for the

year ended September 30, 2023, with the Securities and Exchange Commission, which is expected to be on or about December 18, 2023. Mr. Greenberg

joined the Company in July of 2023 to serve as the Head of Marketing and Operations.

Prior to joining the Company,

in 2022, Mr. Greenberg founded Hyype Space, LLC, a marketing technology app, for which he also served as its Chief Executive Officer.

He continues to serve as chairman of the board of directors of Hyype Space, LLC. Prior to 2023, Mr. Greenberg was the founder, executive

producer, advisor, and entertainment consultant at The Greenberg Group, a global entertainment content and investment advisory company,

where, from 2013 to 2023, he provided commercial and operational advice and services to various entertainment companies and

investors. While at The Greenberg Group, Mr. Greenberg was an executive producer on several films, including “The Meg”

and “Meg 2: The Trench,” in addition to being a co-executive producer on the Netflix TV series, “A Tale Dark & Grimm.”

Prior to founding The Greenberg Group, Mr. Greenberg was involved in the business strategy, marketing and executive

operations of various companies, including the Resolution Talent Agency, where he was co-founder and Co-Head of Operations from

August 2011 to October 2013. From 2006 to 2011, Mr. Greenberg served as Executive Vice President of Worldwide Marketing and Business

Affairs at Platinum Studios, a publicly traded comic book entertainment company. Prior to that, from 2001 to 2004, Mr. Greenberg

was SVP and Head of International Theatrical Marketing and Distribution at Universal Pictures, where he was responsible for the profit

and loss at the billion-dollar division, served on its motion picture greenlight committee and was a member of the

board of directors of its international theatrical joint venture. Mr. Greenberg has taught the course “The Business

of Entertainment” at UCLA Extension since 2014 and started his media career as an intern in accounting at Warner Brothers.

Mr. Greenberg holds a Bachelor of Science and Arts in Marketing from the University of Denver.

The Company entered into

an employment letter agreement with Mr. Greenberg for his initial position at the Company as the Head of Marketing and Operations (the

“HMO Employment Letter Agreement”), which was effective as of July 1, 2023. Pursuant to the terms of the HMO Employment Letter

Agreement, the Company may change Mr. Greenberg’s position, duties, work location and compensation from time to time in its discretion.

Upon his appointment as Chief Operating Officer and Chief Marketing Officer of the Company, all the other terms of Mr. Greenberg’s

employment as set forth in the HMO Employment Letter Agreement remain the same.

Pursuant to the HMO Employment

Letter Agreement, Mr. Greenberg’s employment does not have a fixed term and he is employed on an “at will” basis. Mr.

Greenberg is entitled to receive an annual base salary of $365,000 as well as discretionary bonuses as may be awarded from time to time

by the Compensation Committee of the Board, or by the Board. As part of the Company’s efforts to reduce its overall SG&A costs,

effective September 1, 2023, Mr. Greenberg’s base salary was reduced to $292,000, along with reductions in salaries of other members

of senior management, for an indefinite period of time. This reduction was still in place as of the date of this Report. Mr. Greenberg

is eligible to participate in all benefit plans that the Company offers to its executive officers, including any incentive compensation

plans. On July 1, 2023, in connection with entering into the HMO Employment Letter Agreement, Mr. Greenberg was granted options under

the Company's Amended and Restated 2020 Equity Incentive Compensation Plan to purchase 305,343 shares of common stock, with an exercise price of $2.39 per share,

vesting over a four-year period, with one quarter (1/4) of the shares subject to the option vesting on the one-year anniversary of the

date of grant, and the remaining shares vesting equally over the following thirty-six (36) months of continuous service.

The

HMO Employment Letter Agreement terminates upon death or disability and may be terminated by the Company with or without Cause, and

by Mr. Greenberg with or without Good Reason (all as defined in the HMO Employment Letter Agreement) and with or without advance

notice. If Mr. Greenberg’s employment is terminated without Cause or as a result of the death or disability of Mr. Greenberg,

he will receive unpaid and accrued base salary through date of termination as well as six (6) months’ severance, payable in

six equal installments on the Company’s regular payroll schedule, and will be subject to applicable tax withholdings. If we

terminate Mr. Greenberg for Cause or Mr. Greenberg resigns without Good Reason, unpaid and accrued base salary through the date of

termination.

In

addition, if Mr. Greenberg’s employment is terminated during a “Change in Control Period” (as defined in the HMO

Employment Letter Agreement), compensation is similar to that in a termination without Cause or resignation for Good Reason, except

Mr. Greenberg will be entitled to receive a lump sum payment equal to twelve (12) months of his then-current base salary, payable

within 60 days following Separation of Service (as defined in the HMO Employment Letter Agreement). In addition, the Company will

fully accelerate the vesting of all of Mr. Greenberg’s outstanding equity awards. Mr. Greenberg’s right to receive any

severance benefit under the HMO Employment Letter Agreement is subject to the execution and delivery to the Company of a general

release of claims. Mr. Greenberg was also required to execute the Company’s standard non-solicitation and other restrictive

covenants agreement to which he is subject for the duration of his employment and for a 24-month period following termination for

any reason.

The foregoing description

of the HMO Employment Letter Agreement does not purport to be complete and is qualified in its entirety by reference to the full text

of the HMO Employment Letter Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein

by reference.

Mr. Greenberg has no other

direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K promulgated

under the Securities Exchange Act of 1934, as amended, nor are there any such transactions currently proposed. There are no arrangements

or understandings between Mr. Greenberg and any other persons pursuant to which Mr. Greenberg was appointed as Chief Operating Officer

and Chief Marketing Officer, and there are no family relationships between Mr. Greenberg and any of our directors or executive officers.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

|

|

| Date: December 15, 2023 |

LOOP MEDIA, INC. |

| |

|

|

| |

By: |

/s/ Jon Niermann |

| |

|

Jon Niermann, CEO |

| |

|

Exhibit 10.1

September 30, 2023

Randy Greenberg

VIA EMAIL

Dear Randy:

Loop Media, Inc. (the “Company”) is pleased

to offer you employment on the terms set forth in this letter agreement (the “Agreement”). These terms are retroactive to

July 1, 2023 (the “Effective Date”).

1. Position;

Duties. You will serve as Head of Marketing and Operations, reporting to the Chief Executive Officer, working from your home in Los

Angeles. You agree to devote your best efforts and full business time, skill and attention to the performance of your duties. You are

also required to adhere to the general employment policies and practices of the Company that may be in effect from time to time, except

that when the terms of this Agreement conflict with the Company’s general employment policies or practices, this Agreement will

control. The Company may change your position, duties, work location and compensation from time to time in its discretion, subject to

the terms and conditions set forth herein.

2. Salary.

Your annual base salary will be $365,000, less applicable deductions and withholdings, payable in accordance with the Company’s

payroll practices, as may be in effect from time to time. In the event the Company implements across-the-board salary reductions affecting

all or substantially all senior executives of the Company, your annual salary will be proportionally reduced.

3. Benefits.

You will be eligible for the Company’s standard benefit programs, subject to the terms and conditions of such plans. The Company

may, from time to time, change these benefits in its discretion.

4. Equity

Award. Subject to approval by the Company’s Board of Directors (the “Board”), the Company will grant you an option

to purchase shares of the Company’s common stock at a price per share equal to the fair market value on the Effective Date, as determined

by the Board (the “Option”). The number of share options will be equal to the amount of option shares valued at $400,000,

as determined in good faith by the Company’s Chief Financial Officer using a Black Scholes valuation model and subject to approval

of the Company’s Board of Directors, eligibility requirements, enrollment criteria, and other terms and conditions of the plan in

line with and subject to Company policies. The Option shall vest over a four-year period, with one quarter (1/4) of the shares subject

to the Option vesting on the one-year anniversary of the date of grant, and the remaining shares vesting equally over the following thirty-six

(36) months of continuous service. The Option shall be issued pursuant to the terms and conditions of the Company’s Equity Incentive

Plan (the “Plan”), consistent with the requirements for an exemption from the application of Section 409A of the Internal

Revenue Code (the “Code”), and shall be governed in all respects by the terms of the Plan, the grant notice and the option

agreement.

5. Performance

Bonuses. Each year, you will be eligible to earn an annual incentive bonus pursuant to, and subject to the terms and conditions of,

the Company’s Annual Bonus Plan.

| 6. | At Will Employment; Severance. |

(a) At-Will

Employment. Your employment with the Company will be “at- will.” This means that either you or Company may terminate your

employment at any time, with or without Cause (as defined below), and with or without advance notice.

(b) Termination

without Cause Unrelated to Change in Control. If, outside of a Change in Control Period (as defined below), the Company terminates

your employment without Cause, and other than as a result of your death or disability, and provided such termination constitutes a “separation

from service” (as defined under Treasury Regulation Section 1.409A- 1(h), without regard to any alternative definition thereunder,

a “Separation from Service”), then subject to the preconditions set forth in Section 7 below, you will be entitled to

receive the following severance benefits:

(i) The

Company will pay you an amount equal to six (6) months of your then-current base salary, less all applicable withholdings and deductions,

paid over such six- month period, on the schedule described in Section 7 below.

(ii) If

you timely elect continued coverage under COBRA for yourself and your covered dependents under the Company’s group health plans

following such termination or resignation of employment, then the Company will pay the entire COBRA premiums necessary to continue your

health insurance coverage in effect for yourself and your eligible dependents on the termination date until the earliest of (A) the

close of the six (6) month period following the termination of your employment, (B) the expiration of your eligibility for the

continuation coverage under COBRA, and (C) the date when you become eligible for substantially equivalent health insurance coverage

in connection with new employment. If you become eligible for such coverage under another employer's group health plan or otherwise cease

to be eligible for COBRA during the period provided in this clause, you must immediately notify the Company of such event, and all payments

and obligations under this clause will cease.

(c) Termination

without Cause or Resignation for Good Reason Related to Change in Control. If, during a Change in Control Period (as defined below),

the Company terminates your employment without Cause, or you resign for Good Reason (as defined below), and other than as a result of

your death or disability, and provided such termination constitutes a Separation from Service, then subject to the preconditions set forth

in Section 7 below, you will be entitled to receive the following severance benefits:

(i) The

Company will pay you an amount equal to twelve (12) months of your then-current base salary (excluding any salary reduction that served

as the basis for any Good Reason resignation), less all applicable withholdings and deductions, paid in a lump-sum within 60 days following

your Separation from Service.

(ii) If

you timely elect continued coverage under COBRA for yourself and your covered dependents under the Company’s group health plans

following such termination or resignation of employment, then the Company will pay the entire COBRA premiums necessary to continue

your health insurance coverage in effect for yourself and your eligible dependents on the termination date until the earliest of (A) the

close of the twelve (12) month period following the termination of your employment, (B) the expiration of your eligibility for the

continuation coverage under COBRA, and (C) the date when you become eligible for substantially equivalent health insurance coverage

in connection with new employment. If you become eligible for such coverage under another employer’s group health plan or otherwise

cease to be eligible for COBRA during the period provided in this clause, you must immediately notify the Company of such event, and all

payments and obligations under this clause will cease.

(iii) The

Company will fully accelerate the vesting of your equity awards such that you will be deemed fully vested in all such awards.

7. Severance

Conditions. Your receipt of the severance benefits set forth in Section 6 is conditional upon (a) your continuing to comply

with all of your legal and contractual obligations to the Company; and (b) your delivering to the Company an effective and irrevocable

general release of claims in favor of the Company within 60 days following your termination date. The salary continuation set forth in

Section 6(b) will be paid in equal installments on the Company’s regular payroll schedule and will be subject to applicable

tax withholdings over the period outlined above following the date of your termination date; provided, however, that no payments will

be made prior to the release becoming effective. Within 60 days following your Separation from Service, and subject to the release being

effective by the payment date, the Company will pay you in a lump sum the salary continuation that you would have received on or prior

to such date under the original schedule but for the delay while waiting for the effectiveness of the release, with the balance of the

salary continuation being paid on the Company’s regular payroll schedule.

(a) Cause.

For purposes of this Agreement, “Cause” means any of the following: (i) unauthorized use or disclosure of the Company’s

confidential information or trade secrets, which use or disclosure causes material harm to the Company; (ii) material breach of any

agreement with the Company, which causes (or is likely to cause) material harm to the Company;

(iii) material failure to comply with the

Company’s written policies or rules, which causes (or is likely to cause) material harm to the Company; (iv) conviction of,

or plea of “guilty” or “no contest” to, a felony under the laws of the United States or any State thereof; (v) gross

negligence or willful misconduct, which causes (or is likely to cause) material harm to the Company; (vi) continuing failure to perform

assigned duties after receiving written notification of such failure from the Company; or (vii) failure to cooperate in good faith

with a governmental or internal investigation of the Company or its directors, officers or employees, if the Company has requested your

cooperation. For purposes of this Agreement, “Cause” will not exist under condition (ii), (iii), (v), (vi) or (vii) unless

the Company gives you written notice of such condition within 90 days after such condition comes into existence and you fail to remedy

such condition within 30 days after receiving such written notice.

(b) Good

Reason. For purposes of this Agreement, “Good Reason” will mean that you have resigned based on the occurrence of any

of the following events: (i) a material diminution in your salary except for across-the-board salary reductions similarly affecting

all or substantially all senior executives of the Company; (ii) a change in the geographic location of your primary place

of work that results in an increase in your one-way commute by more than 25 miles; or (iii) a material reduction in your authority,

job duties or responsibilities; provided, however, that you will not be deemed to have Good Reason if the Company survives as a separate

legal entity following a Change in Control and you hold materially the same position in such legal entity as before the Change in Control.

A resignation will only be for Good Reason if you deliver written notice of such condition to the Company within 30 days after the initial

occurrence of such condition, the Company has failed to cure such condition within 30 days after the delivery of such notice, and you

resign within 30 days after the end of such cure period.

(c) Change

in Control. For purposes of this Agreement, a “Change in Control” shall have the meaning set forth in the Plan.

(d) Change

in Control Period. For purposes of this Agreement, a Change in Control Period is defined as the period ending on the twelve (12) month

anniversary of the effective date of a Change in Control.

9. Section 409A.

The payments and benefits under this Agreement are intended to qualify for exemptions from the application of Section 409A, and

this Agreement will be construed to the greatest extent possible as consistent with those provisions, and to the extent not so exempt,

this Agreement (and any definitions hereunder) will be construed in a manner that complies with Section 409A to the extent necessary

to avoid adverse taxation under Section 409A. To the extent any payment under this Agreement may be classified as a “short-term

deferral” within the meaning of Section 409A, such payment will be deemed a short-term deferral, even if it may also qualify

for an exemption from Section 409A under another provision of Section 409A. Notwithstanding anything to the contrary herein,

to the extent required to comply with Section 409A, a termination of employment will not be deemed to have occurred for purposes

of any provision of this Agreement providing for the payment of amounts or benefits upon or following a termination of employment unless

such termination is also a Separation from Service. Your right to receive any installment payments will be treated as a right to receive

a series of separate payments and, accordingly, each installment payment will at all times be considered a separate and distinct payment.

Notwithstanding any provision to the contrary in this Agreement, if you are deemed by the Company at the time of your Separation from

Service to be a “specified employee” for purposes of Section 409A, and if any of the payments upon Separation from Service

set forth herein and/or under any other agreement with the Company are deemed to be “deferred compensation,” then, to the

extent delayed commencement of any portion of such payments is required in order to avoid a prohibited distribution under Section 409A

and the related adverse taxation under Section 409A, such payments will not be provided to you prior to the earliest of (a) the

expiration of the six- month period measured from the date of Separation from Service, (b) the date of your death or (c) such

earlier date as permitted under Section 409A without the imposition of adverse taxation. With respect to payments to be made upon

execution of an effective release, if the release revocation period spans two calendar years, payments will be made in the second of the

two calendar years to the extent necessary to avoid adverse taxation under Section 409A. With respect to reimbursements or in-kind

benefits provided hereunder (or otherwise) that are not exempt from Section 409A, the following rules will apply: (x) the

amount of expenses eligible for reimbursement, or in-kind benefits provided, during any one taxable year will not affect the expenses

eligible for reimbursement, or in-kind benefit to be provided in any other taxable year, (y) in the case of any reimbursements

of eligible expenses, reimbursement will be made on or before the last day of the taxable year following the taxable year in which the

expense was incurred and (z) the right to reimbursement or in-kind benefits will not be subject to liquidation or exchange for another

benefit. Notwithstanding anything to the contrary in this Agreement, the Company reserves the right to amend this Agreement as it deems

necessary or advisable, in its sole discretion and without your consent, to comply with Section 409A or to avoid income recognition

under Section 409A prior to the actual payment of severance benefits hereunder or imposition of any additional tax. In no event will

the Company reimburse you for any taxes or other costs that may be imposed on you as result of Section 409A.

10. Confidentiality

Obligations. As condition of your employment, you must sign and abide by the Company’s standard form of employee confidentiality

and inventions assignment agreement.

11. Arbitration.

To ensure the timely and economical resolution of disputes that may arise between you and the Company, both you and the Company mutually

agree that pursuant to the Federal Arbitration Act, 9 U.S.C. §1-16, and to the fullest extent permitted by applicable law, you will

submit solely to final, binding and confidential arbitration any and all disputes, claims, or causes of action arising from or relating

to: the negotiation, execution, interpretation, performance, breach or enforcement of this Agreement; or your employment with the Company

(including but not limited to all statutory claims); or the termination of your employment with the Company (including but not limited

to all statutory claims). BY AGREEING TO THIS ARBITRATION PROCEDURE, BOTH YOU AND THE COMPANY WAIVE THE RIGHT TO RESOLVE ANY SUCH DISPUTES

THROUGH A TRIAL BY JURY OR JUDGE OR THROUGH AN ADMINISTRATIVE PROCEEDING. The Arbitrator will have the sole and exclusive authority

to determine whether a dispute, claim or cause of action is subject to arbitration under this section and to determine any procedural

questions which grow out of such disputes, claims or causes of action and bear on their final disposition. All claims, disputes, or causes

of action under this section, whether by you or the Company, must be brought solely in an individual capacity, and will not be brought

as a plaintiff (or claimant) or class member in any purported class or representative proceeding, nor joined or consolidated with the

claims of any other person or entity. The Arbitrator may not consolidate the claims of more than one person or entity, and may not preside

over any form of representative or class proceeding. To the extent that the preceding sentences in this paragraph are found to violate

applicable law or are otherwise found unenforceable, any claim(s) alleged or brought on behalf of a class will proceed in a court

of law rather than by arbitration. Any arbitration proceeding under this Arbitration section will be presided over by a single arbitrator

and conducted by JAMS, Inc. (“JAMS”) in the JAMS location closest to your working location, under the then applicable

JAMS rules for the resolution of employment disputes (available upon request and also currently available at http://www.jamsadr.com/rules-employment-arbitration/).

You and the Company both have the right to be represented by legal counsel at any arbitration proceeding, at each party’s own expense.

The Arbitrator will: (a) have the authority to compel adequate discovery for the resolution of the dispute; (b) issue a written

arbitration decision, to include the arbitrator’s essential findings and conclusions and a statement of the award; and (c) be

authorized to award any or all remedies that you or the Company would be entitled to seek in a court of law. The Company will pay all

JAMS arbitration fees in excess of the amount of court fees that would be required of you if the dispute were decided in a court of law.

This section will not apply to any action or claim that cannot be subject to mandatory arbitration as a matter of law, to the extent such

claims are not permitted by applicable law to be submitted to mandatory arbitration and such applicable law is not preempted by the Federal

Arbitration Act or otherwise invalid (collectively, the “Excluded Claims”). In the event you intend to bring multiple claims,

including one of the Excluded Claims listed above, the Excluded Claims may be filed with a court, while any other claims will remain subject

to mandatory arbitration. Nothing in this section is intended to prevent either you or the Company from obtaining injunctive relief in

court to prevent irreparable harm pending the conclusion of any such arbitration. Any final award in any arbitration proceeding hereunder

may be entered as a judgment in the federal and state courts of any competent jurisdiction and enforced accordingly.

12. Miscellaneous.

This Agreement (including the agreements referenced herein) is the complete and exclusive statement of your agreement with the Company

on the subject matters herein, and supersedes and replaces any and all prior agreements or representations with regard to the subject

matter hereof, whether written or oral. It is entered into without reliance on any promise or representation other than those expressly

contained herein, and it cannot be modified, amended or extended except in a writing signed by you and the Chief Executive Officer. This

Agreement is intended to bind and inure to the benefit of and be enforceable by you and the Company, and our respective successors, assigns,

heirs, executors and administrators, except that you may not assign any of your duties or rights hereunder without the express written

consent of the Company. Whenever possible, each provision of this Agreement will be interpreted in such manner as to be effective and

valid under applicable law, but if any provision of this Agreement is held to be invalid, illegal or unenforceable in any respect under

any applicable law or rule in any jurisdiction, such invalidity, illegality or unenforceability will not affect any other provision

or any other jurisdiction, but this Agreement will be reformed, construed and enforced as if such invalid, illegal or unenforceable provisions

had never been contained herein. This Agreement and the terms of your employment with the Company will be governed in all aspects by the

laws of the State of California.

This offer is subject to satisfactory proof of

your right to work in the United States and satisfactory completion of a Company-required background check. If you agree to the terms

and conditions set forth herein, please sign below.

We look forward to having you join us. If you

have any questions about this Agreement, please do not hesitate to call me.

Best regards,

| /s/

Jon Niermann |

|

| Jon Niermann, Chief Executive Officer |

|

| |

|

| Accepted and agreed: |

|

| |

|

| /s/ Randy Greenberg |

|

| Randy Greenberg |

|

| |

|

v3.23.3

Cover

|

Dec. 11, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 11, 2023

|

| Entity File Number |

001-41508

|

| Entity Registrant Name |

Loop Media, Inc.

|

| Entity Central Index Key |

0001643988

|

| Entity Tax Identification Number |

47-3975872

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2600 West Olive Avenue

|

| Entity Address, Address Line Two |

Suite 5470

|

| Entity Address, City or Town |

Burbank

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91505

|

| City Area Code |

213

|

| Local Phone Number |

436-2100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.0001 par value per share

|

| Trading Symbol |

LPTV

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

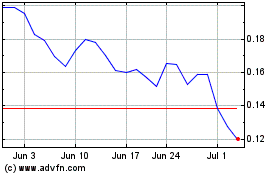

Loop Media (AMEX:LPTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Loop Media (AMEX:LPTV)

Historical Stock Chart

From Apr 2023 to Apr 2024