U.S. index futures are showing an increase in the pre-market on

Thursday, following the Dow Jones closing at a historic high the

day before due to indications from the Federal Reserve of several

rate cuts in 2024.

At 05:30 AM, the Dow Jones futures (DOWI:DJI) rose 85 points, or

0.23%. S&P 500 futures were up 0.29%, and Nasdaq-100 futures

were up 0.41%. The yield on 10-year Treasury bonds was at

3.947%.

In the commodities market, West Texas Intermediate crude oil for

January rose 2.02% to $70.86 per barrel. Brent crude for February

increased by 2.10%, close to $75.82 per barrel. Iron ore with a

concentration of 62%, traded on the Dalian exchange, fell 1.05% to

$133.18 per ton.

On Thursday’s economic agenda, investors are awaiting, at 08:30

AM, the unemployment insurance claims for the week ended last

Saturday and the import and export prices for November.

European markets are up, motivated by the expectation that the

Federal Reserve will reduce interest rates next year. Attention is

now turning to the imminent decisions of the European Central Bank

(ECB) and the Bank of England (BoE) on their respective interest

rates, currently expected to remain at 4.50% and 5.25%. ECB

President Christine Lagarde will hold an interview after the ECB’s

decision announcement.

Asian stock markets showed a mixed response to the recent global

excitement driven by the Fed. While the Shanghai (-0.33%) and Tokyo

stock exchanges recorded losses, due to persistent pessimism about

the Chinese economy post-economic conference, Seoul stood out with

an increase of over 1%. While Japan’s Nikkei index fell 0.73%, Hong

Kong’s Hang Seng rose 1.07%, South Korea’s Kospi increased by

1.34%, and Australia’s ASX 200 grew by 1.65%.

At the close on Wednesday, U.S. stocks were performing weakly

before jumping with the Fed announcement. The Dow reached a record

high, above 37,000 points, while the S&P 500 and Nasdaq also

rose. The Fed maintained interest rates, planning to cut them next

year to support employment and inflation. Gold and biotechnology

stood out, with Acadia Pharmaceuticals (NASDAQ:ACAD) leading the

sector after a patent lawsuit victory. Other sectors, such as

banking, commercial real estate, and utilities, also performed

well. Most major sectors showed strength, including airlines,

housing, and network technology.

In the upcoming corporate earnings on Wednesday, investors will

be paying attention to the reports from Jabil

(NYSE:JBL), Knot (NYSE:KNOT), Live

Ventures Incorporated (NASDAQ:LIVE),

Moolec (NASDAQ:MLEC), before market open. After

the close, the reports from Costco Wholesale

(NASDAQ:COST), Lennar (NYSE:LEN),

Scholastic (NASDAQ:SCHL), Mesa Air

Group (NASDAQ:MESA), among others, will be observed.

Wall Street corporate highlights for today

Apple (NASDAQ:AAPL) – Apple’s shares closed at

a record $197.96 per share on Wednesday, up 1.7% in response to the

prospect of lower Federal Reserve interest rates in 2024. Apple now

has a market capitalization of $3.08 trillion.

Spotify (NYSE:SPOT) – Apple (NASDAQ:AAPL) faces

a potential ban and fine from the European Union due to App Store

rules that affect music streaming services, with the EU considering

preventing Apple from blocking music services from directing users

to subscription options outside the App Store and fining it up to

10% of annual sales. The investigation began after a complaint from

Spotify about higher prices due to App Store rules, with the

European Commission claiming that Apple imposed unnecessary

conditions that could result in additional costs for customers.

Alphabet (NASDAQ:GOOGL) – Alphabet, owner of

Google, launched its advanced artificial intelligence model,

Gemini, for developers, significantly reducing costs. The cost of

Gemini has been reduced to between half and a quarter of the June

costs, the company said on Wednesday. Gemini offers greater

information processing capacity and tools for customization.

Meta Platforms (NASDAQ:META) – Major U.S.

companies like Walt Disney (NYSE:DIS) and Comcast (NASDAQ:CMCSA)

have increased advertising spending on Instagram after suspending

ads on Elon Musk’s platform due to antisemitic content. Disney and

Comcast raised their spending on Meta by 40% and about 6%,

respectively, in the last two weeks of November.

Amazon (NASDAQ:AMZN) – Amazon.com Inc. won a

$272 million lawsuit over alleged illegal tax exemptions in the

European Union. The EU Court of Justice rejected the European

Commission’s appeal, stating that the tax deal between Amazon and

Luxembourg did not constitute incompatible state aid with the

internal market.

Adobe (NASDAQ:ADBE) – Adobe, facing regulatory

investigation related to subscription models, forecast revenues

below estimates, resulting in a more than 5% drop in shares in

Thursday’s pre-market. Furthermore, the FTC is examining

subscription disclosure and cancellation practices, while the

acquisition of Figma is being investigated by competition

regulators. In the fourth quarter, the company reported adjusted

earnings of $4.27 per share, compared to estimates of $4.14.

Revenue was slightly above estimates.

Etsy (NASDAQ:ETSY) – Etsy saw its shares

plummet on Wednesday due to the announcement of layoffs of 225

employees (11% of the workforce) to reduce costs due to weakened

demand for handmade products. The company will face charges of

$25-30 million and expects a decline in gross sales in the fourth

quarter.

Mattel (NASDAQ:MAT), Paramount

Pictures (NASDAQ:PARA) – Mattel, Paramount Pictures, and

Temple Hill Entertainment plan to develop a live-action film based

on American Girl, following the success of “Barbie.” American

Girl’s revenue decreased by 13% in the third quarter. The film does

not yet have a release date. Writer Lindsey Anderson Beer is in

charge of the script and production.

Starbucks (NASDAQ:SBUX) – Starbucks did not

engage in anti-union practices during contractual negotiations with

the U.S. employees’ union, according to a third-party

investigation. While the inquiry recommended improvements in the

approach to unionization, it found no interference in employees’

freedom to unionize. The Starbucks Workers United union

acknowledged issues and is willing to dialogue. Starbucks plans to

resume discussions with representative stores in January.

Cal-Maine Foods (NASDAQ:CALM) – A Stephens

analyst increased Cal-Maine’s price target to $50 due to the

outlook for stronger egg prices, despite an outbreak of avian flu.

The company is expected to benefit from reduced supply and lower

grain prices.

Tesla (NASDAQ:TSLA) – Tesla is conducting a

recall of over 2 million vehicles in the U.S. due to safety

concerns with the Autopilot system. The NHTSA investigated driver

inattention and Tesla will deploy software updates. Furthermore,

Tesla has shortened the estimated waiting period for the delivery

of its Model 3 and Model Y in China from six to nine weeks to just

two to six weeks, as announced on its Chinese website on Thursday.

Elsewhere, the Indian government is not planning to reduce taxes on

imported electric vehicles, which could be a blow to Tesla’s plans

to enter the market. Negotiations between Tesla and India face

obstacles related to local production and tax incentives.

Lucid (NASDAQ:LCID) – Lucid Group has already

assembled nearly 800 cars at its factory in Saudi Arabia, focusing

on training over 200 local employees. The Saudi government has

committed to buying up to 100,000 Lucid vehicles over 10 years. The

Public Investment Fund of Saudi Arabia, which holds more than 60%

of Lucid, invested billions in the company as part of the

government’s plans to establish a hub for the electric vehicle

industry. Lucid plans to open a full construction unit in 2026.

General Motors (NYSE:GM) – General Motors’

Cruise Robotaxi unit has fired nine executives, including Chief

Operations Officer Gil West, amid a safety investigation following

an accident in San Francisco. The dismissals aim to restore

confidence and accountability in the company. In other news, Mary

Barra, CEO of General Motors, reaffirmed the company’s commitment

to becoming exclusively an electric vehicle (EV) manufacturer by

2035. Despite recent production delays, Barra emphasized the

importance of regulation aligned with customer needs.

Nordson (NASDAQ:NDSN) – The industrial

automation company reported adjusted earnings above expectations

for the fourth fiscal quarter and projected a revenue increase in

the first quarter. The company expects sales between $615 million

and $640 million for the first quarter, surpassing last year’s

$610.5 million, though below analysts’ expectations of $651.9

million.

BP (NYSE:BP) – BP has reduced former CEO

Bernard Looney’s compensation by over $40 million due to misconduct

for not disclosing personal relationships with colleagues. This

included the forfeiture of unvested stock awards and a

reimbursement of part of his 2022 cash bonus. Additionally,

JPMorgan downgraded BP to Underweight from Neutral and lowered its

target price by 11% to 550 pence. Analysts cited BP’s growing

dependence on wider standard deviation variables and concerns about

future cash returns. They suggested greater clarity in renewable

energies under a new CEO.

Occidental Petroleum (NYSE:OXY) – Occidental

Petroleum plans to pay off debts from the acquisition of CrownRock

to reduce financial burdens a year after closing. Credit rating

agencies consider the risks more manageable compared to the

Anadarko acquisition in 2019.

Berkshire Hathaway (NYSE:BRK.B) – Berkshire

Hathaway acquired about 10.5 million shares of Occidental Petroleum

(NYSE:OXY) for approximately $588.7 million this week, raising its

stake in Occidental to about 27%. The company also holds warrants

to acquire an additional 83.8 million Occidental shares. If

exercised, Berkshire’s total stake would be 33%.

Nasdaq (NASDAQ:NDAQ) – Nasdaq resolved a system

issue that affected stock orders and more than 50 clients. The

incident began due to a duplicated internal order ID in the

“FIX/RASH” management system. Nasdaq temporarily shut down the

system, blocked new orders, and cancelled open orders. The exchange

operator stated that the issue was resolved and that it was ready

for future trading.

Coinbase (NASDAQ:COIN) – Coinbase will expand

spot cryptocurrency trading services on its international exchange,

starting with Bitcoin (COIN:BTCUSD) and Ether (COIN:ETHUSD) on

December 14 for institutional clients. This expansion aims to

assess demand and may benefit the company in the long term.

Merrill Lynch (NYSE:PYT) – Merrill Lynch faces

a breach of contract lawsuit filed by an investor alleging that the

firm offered very low interest rates on client retirement money

sweep accounts. The lawsuit seeks class action certification and an

injunction against the firm, as well as damages and interest.

Goldman Sachs (NYSE:GS) – Goldman Sachs’ global

head of digital assets, Mathew McDermott, anticipates a significant

increase in blockchain-based asset trading volumes in the next one

or two years, with growing interest in cryptographic derivatives.

The bank is exploring issuing blockchain-based tokens for

traditional assets like bonds, aiming for operational efficiency

and risk reduction in financial markets.

Citigroup (NYSE:C) – Citigroup plans to pay

partial bonuses to laid-off employees based on the duration of

their service in 2023, as part of its ongoing restructuring, to be

completed in March. Citigroup will not offer bonuses for voluntary

resignations.

UBS (NYSE:UBS) – UBS Group AG is intensifying

recovery of restricted cash bonuses, paid by Credit Suisse to

retain traders before its collapse. UBS is offering multi-year

plans to hundreds of bankers aiming to recover part of the 1.2

billion Swiss francs ($1.38 billion), with the desired amount being

less than 651 million Swiss francs.

Pfizer (NYSE:PFE) – Pfizer revised down its

sales forecast for 2024, anticipating vaccine and Covid-19

treatment revenue of $8 billion, below the expected $13 billion.

This resulted in a stock drop on Wednesday and concerns about its

R&D strategy. JPMorgan analysts lowered the stock’s target

price from $34 to $30 and maintained a Neutral rating. BofA

analysts reduced their target price from $38 to $35 and also

remained neutral on the stock.

Vir Biotechnology (NASDAQ:VIR) – Vir

Biotechnology announced it will cut 12% of its staff, about 75

jobs, and close two research facilities next year. These actions

aim to save at least $40 million annually and align the company

with sustainable growth goals. CEO Marianne De Backer emphasized

the importance of these changes for the company’s future.

Johnson & Johnson (NYSE:JNJ) – Concerns

about the U.S. exclusivity loss of the drug Stelara in 2025 led a

Wells Fargo analyst to downgrade the stock and lower J&J’s

target price, suggesting that the company’s profit growth could be

affected. Stelara is a high-revenue medication for J&J used to

treat conditions like psoriasis and psoriatic arthritis.

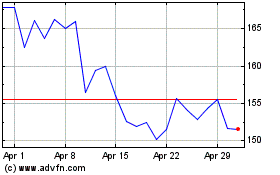

Lennar (NYSE:LEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lennar (NYSE:LEN)

Historical Stock Chart

From Apr 2023 to Apr 2024