UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 8, 2023

MITESCO, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware | | 000-53601 | | 87-0496850 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| 18202 Minnetonka Blvd., Suite 100 Deephaven, MN 55391 |

| (Address of principal executive offices) (Zip Code) |

(844) 383-8689

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Debt Exchange Agreement

On December 8, 2023, the Company sold the remaining assets of The Good Clinic, LLC to Leading Primary Care LLC, a company organized by Michael C. Howe, the former CEO of The Good Clinic, LLC for total consideration of approximately $2.5 million. Consideration consisted of cancelling existing notes payable and accrued interest owed to Mr. Howe in the amount of approximately $2.5 million. The Company expects to recognize a gain on this transaction in the amount of approximately $2.5 million. Significant liabilities remain in The Good Clinic LLC.

On December 8, 2023, Mr. Howe also exchanged (i) 500,000 shares of Series D Preferred Stock with a stated value of approximately $0.5 million and accrued dividends of approximately $67,000, and (ii) accrued salary owed to Mr. Howe in the amount of approximately $38,000 plus a conversion incentive of 65% or approximately $25,000 for 655 shares of the Company’s Series F Preferred Stock with a liquidation value of approximately $0.6 million. Other than the conversion of incentive of the approximately $25,000 , there was no gain or loss recorded on this transaction.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Resignation of Director

On December 12, 2023, Mr. Allen Plunk resigned from his position as a director. The decision by Mr. Plunk to resign was not the result of any disagreement with the Company on any matter relating to the operations, internal controls, policies, or practices of the Company but related to personal matters.

|

Item 9.01

|

Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: December 13, 2023

|

MITESCO, INC.

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Lawrence Diamond

|

|

| |

|

Lawrence Diamond

|

|

| |

|

Chief Executive Officer

|

|

NONE

false

0000802257

0000802257

2023-12-08

2023-12-08

Exhibit 10.1

The Good Clinic LLC Asset Sale,

Settlement-Of-Debt- For-Asset Exchange Agreement

RECITALS

WHEREAS, Mitesco, Inc., a Nevada corporation, (“MITI”) and its wholly owned subsidiary The Good Clinic, LLC, a Minnesota limited liability company, (“TGC”) (MITI and TGC are collectively referred to as the “Company”) owes certain amounts, including accrued salary and Series D Preferred shares, to Michael Howe and the Michael C. Howe Living Trust (each a “Creditor” and jointly the “Creditors”);

WHEREAS, the Michael C. Howe Living Trust is the holder of certain Promissory Notes issued by the Company (the “Promissory Notes”), as listed in Exhibit A, which the parties agree are valid debts of Company;

WHEREAS, effective on November 30, 2023 the Creditors assigned all of their rights under the Promissory Notes, including fees, interest, and penalties to Leading Primary Care, LLC, a Minnesota limited liability company (“LPC”), with the Michael C. Howe Living Trust as its sole member;

WHEREAS, the Parties desire to settle all Promissory Notes, including fees, interest, and penalties, owed by the Company to LPC in exchange for all assets, including intellectual, tangible, and intangible property, owned by the Company related to TGC;

WHEREAS, the Company desires to assign all assets related to TGC, to include intellectual, tangible, and intangible property, as specified in Exhibit B (“Exchange Property”), to LPC in exchange for the Converting Debt Obligation;

WHEREAS, Creditors desire to settle with the Company by Converting Debt Obligation held by Company in exchange for Exchange Property;

WHEREAS, at closing of this Agreement, accrued salary and the Series D preferred shares will be converted to the Series F Preferred Shares on terms equal to other holders of similar notes and equity, and transferred to the Michael C. Howe Living Trust; and

WHEREAS, as of the Effective Date, the Creditors and LPC hold the following amount of debt obligations of Company (including accrued interest, penalties, and fees, as applicable):

|

Instrument

|

Notes:

|

Face Value

|

Interest through 11/30/2023

|

Total Amount

|

Value exchanging to Series F Preferred

(65% Conversion

Incentive + the Total Amount)

|

|

Note 1

|

TGC Assets

|

$1,000,000

|

$275,556 + Payoff bonus $100,000

=$375,556

|

$1,375,556

|

N/A

|

|

Note 2

|

|

$300,000

|

Note 2 Interest: $69,250 + Payoff

Bonus $30,000

=$99,250

|

$399,250

|

N/A

|

|

Note 3

|

|

$300,000

|

Note 3 Interest:

$65,750 + Payoff Bonus $30,000

= $95,750

|

$395,750

|

N/A

|

|

Note 4

|

|

$200,000

|

Note 4 Interest:

$42,833 + Payoff Bonus $20,000

= $62,833

|

$262,833

|

N/A

|

|

Note 5

|

|

$18,750

|

Note 5 Interest:

=$2,682

|

$21,432

|

N/A

|

|

Accrued Wages –

Michael

Howe

|

|

$38,300

|

N/A

|

$38,300

|

+$24,895

= $63,195

|

|

Series D – Michael C.

Howe Living Trust

|

500,000

|

$525,000

|

$66,711

|

$591,711

|

$591,711

(no 65% incentive)

|

|

Total Debt to Convert to Assets under this Agreement (“Converting Debt Obligation”)

|

Total Debt to Convert to Series F per separate agreement with simultaneous closing

|

Total Preferred Equity to Convert to Series F Preferred per separate agreement with simultaneous closing

|

|

$2,457,821

|

$63,195

|

$591,711

|

|

Total Value Converting to Series F

Preferred

|

Value of Series F Preferred Share

|

Number of Series F Preferred Shares (rounded-up to next whole share)

|

|

$654,906

|

$1,000.00 / Share

|

655 Shares

|

NOW THEREFORE, for good and valuable consideration, Company and Creditors agree as follows:

AGREEMENT

| |

1.

|

The above recitals are hereby incorporated as a material part of this Agreement with the same force and effect as if restated in this Paragraph.

|

| |

2.

|

Agreement to Sell Assets. Subject to and upon the terms of and conditions of this Agreement, Company will sell, transfer, convey, assign, and deliver to LPC, and LPC will purchase and acquire from Company as of the Effective Date, all right, title, and interest of the Company in and to the properties, assets, and rights of every nature, kind, and description, tangible and intangible (including goodwill and intellectual property), except for the Excluded Assets, primarily related to or used or held for use by TGC, LLC, as they exist on the Effective Date (collectively, the “Exchange Property”), in accordance with the assets listed at Exhibit B, which shall be incorporated herein.

|

| |

3.

|

Exchange for Debt Cancelation. In consideration for the sale and transfer of the Exchange Assets from Company to LPC, LPC shall make payment required under this agreement by canceling the promissory notes listed at Exhibit A, which shall be incorporated herein, by surrendering the Promissory Notes to the Company.

|

| |

4.

|

No Assumption of Liabilities of Company. Except for the Promissory Notes listed at Exhibit A, LPC and the Creditors shall not assume, and shall not be liable for, any liabilities, obligations, or commitments of the Company of any nature whatsoever.

|

| |

5.

|

Conversion of Accrued Salary and Series D Shares. In addition to the exchange of assets for cancellation of debt, the parties agree that any and all accrued wages by Michael C. Howe and all Series D preferred shares owed by Michael C. Howe or by the Michael C. Howe Living Trust, shall be converted to Series F Preferred shares, on terms equal to other holders of similar notes and equity.

|

| |

6.

|

Effective Date. The closing of the sale and purchase of the Exchange Assets, the cancellation of the Promissory Notes, and the conversion of accrued salary and Series D Shares to Series F Preferred Shares shall be effective on November 30, 2023.

|

| |

7.

|

Representations and Warranties of the Company. The Company hereby represents and warrants to the Creditors and LPC that:

|

| |

a.

|

MITI is a corporation duly incorporated, validly existing, and in good standing under the laws of Nevada, and has all corporate power and authority required to carry on its business as now conducted in each jurisdiction in which its ownership or lease of property or the conduct of its business requires such qualification, and has all power and authority necessary to own or hold its properties and to conduct the business in which it is engaged, except where the failure to be so qualified or in good standing (to the extent such concept exists) or have such power or authority would not, individually or in the aggregate, have a material adverse effect on MITI or on the performance by MITI of its obligations under this Agreement.

|

| |

b.

|

TGC is a limited liability company duly organized, validly existing, and in good standing under the laws of Minnesota and has all power and authority, corporate and otherwise, to enter into this Agreement and carry out the transactions contemplated hereby, to own its properties and conduct the business in which it is presently engaged.

|

| |

c.

|

The execution, delivery and performance by Company of this Agreement and the consummation by Company of the transactions contemplated herein will not (A) conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, or result in the creation or imposition of any lien, charge or encumbrance upon any property or assets of Company pursuant to, any indenture, mortgage, deed of trust, loan agreement or other agreement or instrument to which Company is a party or by which Company is bound or to which any of the property or assets of Company is subject, (B) result in any violation of the provisions of the charter or by-laws of Company or (C) result in the violation of any law or statute or

|

any judgment, order, rule or regulation of any court or arbitrator or governmental or regulatory authority having jurisdiction over Company, except, in the case of clauses (A) and (C) above, for any such conflict, breach, violation or default that would not, individually or in the aggregate, have a material adverse effect on Company or Company’s ability to perform its obligations hereunder.

| |

d.

|

All consents, approvals, authorizations and orders necessary for the execution and delivery by Company of this Agreement and for the transactions contemplated hereunder, have been obtained; and Company has the full right, power and authority to enter into this Agreement and to perform the transactions hereunder, except for such consents, approvals, authorizations, orders, licenses, registrations or qualifications the failure of which to obtain would not, individually or in the aggregate, have a material adverse effect on Company or Company’s ability to perform its obligations hereunder.

|

| |

e.

|

This Agreement has been duly authorized, and when executed and delivered by Company and, assuming due authorization, execution, and delivery by the other party hereto, constitutes a valid and legally binding agreement of Company enforceable against Company in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency or similar laws affecting creditors’ rights generally or by equitable principles relating to enforceability.

|

| |

f.

|

The Company has disposed of some physical assets since closing operations on 12/8/2022. The remaining physical assets, not donated, bartered, thrown-away (due to expiration), or sold, and/or still on the books of The Good Clinic LLC as of the date of this agreement are contained in the two (2) storage units being assumed. None of The Good Clinic LLC physical assets have been withheld for future sale.

|

| |

g.

|

The Company shall afford to the Creditors and to LPC reasonable access, upon reasonable advance notice during normal business hours to all TGC properties, books, contracts, and other business records including, but not limited to forecasts, models, and other financial records. The Company shall promptly furnish to the Creditors and to LPC all administrative files, including data contained on any and all shared drives of TGC. The Creditors and LPC acknowledge that, pursuant to the foregoing, they may become privy to financial data and other information concerning TGC and the Company normally considered confidential and that unauthorized communication of such confidential information to third parties. Accordingly, the Creditors and LPC agree to take reasonable steps to ensure such confidential information obtained by them shall remain confidential and shall not be disclosed or revealed to third parties or used to solicit any customers of the company identified therein.

|

| |

h.

|

The Company will delete records related to the Exchange Assets except for those required to be maintained, exclusively in the Company’s opinion, for support of historic audits, tax filings, as required by US securities laws, and for legal defense in ongoing lawsuits including related to construction, labor, operations, leases, and accounts payable. The related records will be kept Company confidential. Record requests related to supporting audits, tax filings, and Sec Regulations will be notified to LPC if and when disclosure is required.

|

| |

i.

|

The Company has used all of the Exchange Assets in compliance with all applicable statutes, orders, rules, and regulations relating to the conduct of the business of TGC, the violation of which could have an adverse effect on the business of TGC, assets, or financial condition. The Company has not received notice of alleged violations of any such statute, order, rule, or regulation associated with TGC.

|

| |

j.

|

Unless explicitly stated in this Agreement, the Company is exchanging (selling) this property in “As Is” condition. Creditors and LPC acknowledge and agree that LPC is accepting the Property “As Is,” without any warranties, representations or guarantees, either expressed or implied, of any kind, nature, or type whatsoever from or on behalf of Company or any of Company’s officers or directors.

|

| |

k.

|

The Company accepts full responsibility for any and all past due payments, interest, and penalties, as of the Effective Date, as outlined in the Recitals of this Agreement and included as part of the Converted Debt Obligation.

|

| |

l.

|

Other than this Agreement, the Company has not entered into any agreements or other arrangements with respect to the Converted Debt Obligation or the Exchange Assets.

|

| |

m.

|

No representation or warranty of the Company and no schedule, certificate, document, or written statement furnished to the Creditors and/or LPC by or on behalf of the Company in connection with this Agreement, or the Effective Date thereof, contains any untrue statement of a material fact or omits to state a material fact necessary to make such statements or statements not misleading.

|

| |

8.

|

Representations and Warranties of the Creditors and LPC. The Creditors and LPC hereby represent and warrant to the Company that:

|

| |

a.

|

LPC is a limited liability company duly organized, validly existing, and in good standing under the laws of Minnesota and has all power and authority, corporate and otherwise, to enter into this Agreement and carry out the transactions contemplated hereby, to own its properties and conduct the business in which it is presently engaged.

|

| |

b.

|

Creditors and LPC have full right, power, and authority to enter into this Agreement and to perform the transactions contemplated hereunder.

|

| |

c.

|

This Agreement has been duly authorized by Creditors and LPC. This Agreement constitutes a valid and legally binding agreement of Creditors and of LPC, enforceable against Creditors and/or LPC in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency or similar laws affecting the Creditors’ rights or LPC’s rights generally, or by equitable principles relating to enforceability.

|

| |

d.

|

The execution, delivery and performance by the Creditors and LPC of this Agreement and the consummation by Creditors and LPC of the transactions contemplated herein will not (A) conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, or result in the creation or imposition of any lien, charge, or encumbrance upon any property or assets of the Creditors or of LPC, pursuant to any indenture, mortgage, deed of trust, loan agreement, or other agreement or instrument to which the Creditors or LPC is a party or by which Creditors or LPC is bound or to which any of the property or assets of the Creditors or LPC is subject that, individually or in the aggregate, would have a material adverse effect on the Creditors’ or LPC’s ability to perform their obligations under this Agreement, or (B) result in the violation of any law or statute or any judgment, order, rule, or regulation of any court, arbitrator, or governmental or regulatory agency that, individually or in the aggregate, would have a material adverse effect on the

|

Creditors’ or LPC’s ability to perform their obligations under this Agreement.

| |

e.

|

As of the Effective Date hereof, LPC is the holder of the Promissory Notes listed at Exhibit A, free and clear of any liens or encumbrances, and LPC has not transferred or assigned the Promissory Notes to any person or entity.

|

| |

f.

|

As of the Effective Date hereof, Creditors will have good, valid, unencumbered, and marketable title to the Converting Debt Obligation owned by it, free and clear of any liens or encumbrances.

|

| |

g.

|

Other than this Agreement, Creditors have not entered into any agreements or other arrangements with respect to the Converted Debt Obligation.

|

| |

h.

|

As of the Effective Date, it is anticipated that the Creditors and LPC will have had sufficient opportunity to review the Administrative files on the Share Drive of the Good Clinic, the status of registration of any and all applicable trademarks related to the Good Clinic, the status of TGC payer contracts, and the status of all tangible and intangible assets included as part of the Exchange Assets.

|

| |

9.

|

Storage Facility. The parties acknowledge that some of the tangible Exchange Assets are stored in one or more storage facilities. The Company agrees to continue to pay for any and all rental fees through December 31, 2023, but that any leases for units storing Exchange Assets shall be transferred to LPC on the Effective Date. The Company shall have no responsibility for the contents of any such storage units starting on the Effective Date and all risk of loss transfers to LPC on the Effective Date, when LPC will install its own locks on the units.

|

| |

10.

|

PLLC Contract Rights. The parties also agree that the Exchange Assets include all contract rights and responsibilities associated with TGC. With respect to these specific assets, the parties agree to:

|

| |

a.

|

On the Effective Date, the Company will assign the management services agreement with the professional limited liability company that provides medical care and treatment (PLLC) to LPC.

|

| |

b.

|

The current financial manager and vice president of the PLLC will be removed upon the transfer of the management services organization (MSO) contract.

|

| |

c.

|

Access to and signing authority for the PLLC’s bank account at Bank of America shall be transferred to a financial manager to be selected by LPC. As of the Effective Date, the bank account shall have a balance not to exceed $100.00.

|

| |

d.

|

Prior to the Effective Date, the parties agree to review all Payer Contracts, with the understanding that no providers are currently credentialed with any payor and no notices of cancelation have been received.

|

| |

e.

|

It is understood by all parties that both Blue Cross Blue Shield of Minnesota and Health Partners inquired about the possible cancelation of contracts, but there are no currently no commitments regarding the contract status with any payor or Centers for Medicare & Medicaid Services (CMS).

|

| |

f.

|

It is also understood by the parties that the Company did not maintain copies of all executed payer contracts, and there is only the credit processing contract currently in force that will transfer as part of this Agreement.

|

| |

11.

|

Conditions for Closing.

|

a. The obligations for the Creditors and LPC shall be subject to the satisfaction or waiver of the following conditions:

| |

i.

|

The representations and warranties of Company in this Agreement shall be true and correct in all respects on and as of the Effective Date.

|

| |

ii.

|

The Company shall have complied with all the agreements and satisfied all the conditions on its part to be performed or satisfied at or prior to the applicable Effective Date.

|

b. The obligations of the Company to perform under this Agreement shall be subject to the satisfaction (or waiver) of the following conditions:

| |

i.

|

The representations and warranties of Creditors and LPC in this Agreement shall be true and correct in all respects on and as of the applicable Closing Date.

|

| |

ii.

|

The Creditors and LPC shall have complied with all the agreements and satisfied all the conditions on their part to be performed or satisfied at or prior to the applicable Effective Date.

|

| |

12.

|

Survival; Indemnification; Mutual Release.

|

| |

a.

|

Each of the covenants, agreements, representations, and warranties of the parties hereto contained in this Agreement shall survive the Effective Date. Notwithstanding any investigation or audit conducted before or after the Effective Date or the decision of any party to complete the transaction, each party shall be entitled to rely on the representations and warranties set forth herein. However, no representation or warranty shall survive the Effective Date if the party to which such representation or warranty is made has actual knowledge on the Effective Date that such representation or warranty is not true.

|

| |

b.

|

The Company, jointly and severally, shall indemnify and hold the Creditors and LPC harmless against any and all claims, damage, loss, liability and expenses (including without limitation reasonable expenses of investigation and reasonable actual attorney fees and expenses incurred in connection with any action, suit, or proceeding) incurred or suffered by the Creditors or LPC arising out of any misrepresentation or breach of warranty, covenant, or agreement made or to be performed by the Company pursuant to this Agreement.

|

| |

c.

|

The Creditors and LPC, jointly and severally, shall indemnify and hold the Company harmless against any and all claims, damage, loss, liability and expenses (including without limitation reasonable expenses of investigation and reasonable actual attorney fees and expenses incurred in connection with any action, suit, or proceeding) incurred or suffered by the Company made or to be performed by the Creditors or LPC pursuant to this Agreement.

|

| |

d.

|

Except for the agreements and obligations contained herein, each party hereby releases each other party and their current and former respective employees, officers, directors, agents, attorneys, heirs, representatives, assigns, predecessors, parent, affiliates, and subsidiaries, from any and all manner of causes of action, suits, debts, obligations, accounts, notes, contracts, agreements, promises, claims, cross claims, or damages whatsoever, in law or in equity, which any party herein now has or may at any time hereafter claim to have against any other party herein by reason of any matter, cause or thing whatsoever, known or unknown, liquidated or unliquidated.

|

| |

a.

|

No provision of this Agreement shall confer upon any person other than the parties hereto any rights or remedies hereunder, but this Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns.

|

| |

b.

|

The Parties agree to cooperate to modify or amend this Agreement, if such modification or amendment is needed in order to satisfy any regulatory, legal, or accounting requirements, including any adjustments needed as a result of an audit or accounting adjustment.

|

| |

c.

|

Each party hereto shall bear all expenses incurred by it in connection with the negotiation and execution of the Agreement and the consummation of the transactions provided for herein.

|

| |

d.

|

This Agreement represents the entire understanding and agreement between the parties with respect to the subject matter hereof, and it supersedes any prior understandings and agreements between such parties with respect to such subject matter. If there are any inconsistencies between the provisions of this Agreement and the provisions of any other agreement between the Parties, the provisions of this Agreement shall apply.

|

| |

e.

|

This Agreement may be executed in one or more counterparts and shall become effective when one or more counterparts have been signed by all parties. Each counterpart shall be deemed an original but all counterparts shall constitute a single instrument.

|

| |

f.

|

Any facsimile copy, other copy, or reproduction of a single counterpart original of this Agreement shall be as fully effective and binding as the original signed counterpart of this Agreement.

|

| |

g.

|

This Agreement shall be deemed to be a contract under the laws of the State of Minnesota, and for all purposes shall be construed in accordance with the laws of said state.

|

(The remainder of this page is blank and followed by the signature page.)

IN WITNESS WHEREOF, the parties have executed this Amendment effective as of the date and year above written.

PURCHASER

Leading Primary Care, LLC

By:

Printed Name: Michael Howe

Its: Chief Manager

|

CREDITOR

|

|

|

COMPANY

|

|

MICHAEL HOWE

|

|

|

MITESCO, INC.

|

|

By:

|

|

|

By:

|

|

Printed Name: Michael Howe

|

|

|

Printed Name: Sheila Schweitzer

|

|

|

|

|

Its: Chief Operating Officer

|

|

Date:

|

|

|

Date:

|

|

CREDITOR

|

|

|

COMPANY

|

|

MICHAEL C. HOWE LIVING TRUST

|

|

|

THE GOOD CLINIC, LLC.

|

|

By:

|

|

|

By:

|

|

Printed Name: Michael Howe

|

|

|

Printed Name: Lawrence Diamond

|

|

Its: Trustee

|

|

|

Its: Financial Manager

|

|

Date:

|

|

|

Date:

|

Exhibit A Promissory Notes

|

Number

|

Date

|

Borrower

|

Initial Principal Balance

|

|

1

|

December 29, 2021

|

Michael C. Howe Living Trust

|

$1,000,000.00

|

|

2

|

June 9, 2022

|

Michael C. Howe Living Trust

|

$300,000.00

|

|

3

|

July 21, 2022

|

Michael C. Howe Living Trust

|

$300,000.00

|

|

4

|

August 18, 2022

|

Michael C. Howe Living Trust

|

$200,000.00

|

|

5

|

November 29, 2022

|

Michael C. Howe Living Trust

|

$18,750.00

|

EXHIBIT B Exchange Assets

| |

•

|

Trade name and Trademark

|

| |

•

|

Other Intellectual Property o Training materials o Policies & Procedures

|

o Branding items including, but not limited to o Logo o Digital elements and physical materials. o Office Supplies o Collateral materials

| |

☐ |

PowerPoint format

|

| |

☐ |

Fonts

|

| |

☐ |

Color schemes

|

| |

☐ |

Signage

|

| |

☐ |

Other marketing materials

|

| |

☐ |

Coffee mugs

|

| |

•

|

Furniture, fixtures, and Equipment (Final inventory to be included in definitive agreement.) o Durable medical equipment o Medical supplies

|

| |

•

|

Technology assets including computers, monitors, peripherals, printers, network equipment o Digital and email records as they exist on the TGC Office365 when transfer of ownership to Leading Primary Care happens.

|

o TGC Web site, managed by Implex

o Access to PLLC medical records history as available. No Hello Health records are available except as had been downloaded by the PLLC. o Plans/ blueprints saved to TGC LLC shared drive; the Company will issue authorization to access plans from the vendor, RSP Architecture. o Administrative files, including those stored on the Office 365 Share drive of The Good Clinic, LLC, as well as forecasts, models, and other financial records contained in the Share Drive

| |

•

|

The POS credit card processing system (a contract via a GPO until early 2024. Contract to be supplied prior to closing).

|

| |

•

|

PLLC contract rights

|

Exhibit 10.2

PREFERRED EXCHANGE AGREEMENT

|

THIS PREFERRED EXCHANGE AGREEMENT, is dated as of December 7, 2023 (this “Agreement”), by and among Mitesco, Inc., a Delaware corporation (the “Company”), and Michael C. Howe Living Trust (the “Holder”).

|

WHEREAS, the Holder owns an aggregate of 500,000 shares with a stated value of $525,000 of Series D preferred shares1 (the “Exchange Securities”;

[INSERT IF APPLICABLE: WHEREAS, the Company and Holder entered into a previous Exchange Agreement, dated _______ (“Prior Exchange Agreement”), providing for the exchange of Holder’s Exchange Securities into shares of Series E Preferred Stock of the Company upon its “uplist: to a national securities exchange; and the Company and Holder now wish to cancel the Prior Exchange Agreement and instead enter into and consummate the transactions contemplated by this Agreement;]

WHEREAS, pursuant to the terms of a Securities Purchase Agreement, dated on or about the date hereof (the “Series F SPA”), the Company is conducting an offering of shares of its Series F 12% PIK Convertible Perpetual Preferred Stock, par value $0.01 per share (the “Series F Shares”), having the terms and provisions set forth in the form of Certificate of Designations, Preferences and Rights of the Series F Convertible Perpetual Preferred Stock of the Company, attached hereto as Exhibit A;

WHEREAS¸ the Holder wishes to exchange its Exchange Securities for Series F Shares, and the Company wishes to issue to the Holder Series F Shares in such exchange, all in accordance with the terms and conditions of this Agreement;

WHEREAS¸ substantially simultaneously with its execution and delivery of this Agreement, the Holder has executed and delivered (as an “Investor” thereunder) a Series F SPA (the “Series F SPA”); and

WHEREAS, the exchange provided for hereby is being made in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”);

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound hereby, agree as follows:

1. Exchange. Effective on the Closing Date under (and as defined in) the Series F SPA, the Holder shall exchange all its Exchange Securities and the amounts owing thereunder for a number of Series F Shares equal to the applicable Series F Preferred Exchange Value. The Holder shall exchange the Exchange Securities owned by it by surrendering to the Company such Exchange Securities (and the corresponding certificates, if any, evidencing the same) (the “Holder Deliveries”). Upon the later to occur of such surrender and the Closing Date under the Holder’s Series F SPA, the Company shall issue to the Holder a number of Series F Shares equal to the Series F Preferred Exchange Value. In connection with such exchange, the Company and the Holder agree that the Holder shall execute the Series F SPA, as an “Investor” thereunder, and that the Holder’s surrender of the Holder Deliveries shall constitute the Holder’s payment of its Subscription Amount (as defined in the Series F SPA, clause (ii)) under the Series F SPA. On the Closing Date upon the issuance of the Series F Shares to the Holder, the Exchange Securities shall be canceled on the books of the Company and all of the Holder’s rights with respect thereto shall automatically cease and terminate, and the Holder, by executing and becoming a party to this Agreement, shall be deemed to have consented to the cancellation of the Holder’s Exchange Securities. For purposes of this Agreement, the “Series F Preferred Exchange Value” shall be a number of Series F Shares (based on their liquidation preference of $1,000) equal to 100% of the “Stated Value” and/or liquidation preference of the Exchange Securities (including any payoff bonus or accrued dividends), rounded up, as detailed on Schedule I.

1List all relevant securities (Series C, D, E) to be exchanged.

2. Representations and Warranties of the Company. The Company hereby represents and warrants to the Holder that:

(a) the Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware;

(b) all corporate action on the part of the Company necessary for the authorization, execution and delivery of this Agreement, and the performance of all obligations hereunder, have been taken on or prior to the date hereof. This Agreement has been validly authorized, executed and delivered by the Company, and constitutes the legal, valid and binding obligations of the Company, enforceable against them in accordance with their terms, except as such enforceability may be limited by general principles of equity or by applicable bankruptcy, insolvency, reorganization, moratorium, liquidation and other similar laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies; and

(c) the Series F Shares issued in accordance herewith and under the Series F SPA have been duly authorized and validly issued and are fully paid and non-assessable.

3. Representations and Warranties of the Holder. The Holder hereby represents and warrants to the Company that:

(a) the Holder is a Trust duly organized, validly existing and in good standing under the laws of its jurisdiction of organization;

(b) all actions on the part of the Holder necessary for the authorization, execution and delivery of this Agreement, and the performance of all obligations hereunder, have been taken on or prior to the date hereof; this Agreement is validly authorized, executed and delivered by the Holder and constitutes the legal, valid and binding obligations of the Holder, enforceable against the Holder in accordance with its terms, except as such enforcement may be limited by general principles of equity or by applicable bankruptcy, insolvency, reorganization, moratorium, liquidation and other similar laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies;

(c) the Holder is acquiring the Series F Shares for its own account only and not with view towards, or for sale in connection with, the public sale or distribution thereof;

(d) the Holder is an “accredited investor” as that term is defined in Rule 501 of Regulation D, as promulgated under the Securities Act;

(e) the Holder understands that the Series F Shares are being issued to it in reliance on specific exemptions from the registration requirements of United States federal and state securities laws and that the Company is relying in part upon the truth and accuracy of, and the Holder’s compliance with, the representations, warranties, acknowledgements, and understandings of the Holder set forth herein in order to determine the availability of such exemptions and the eligibility of the Holder to acquire the Series F Shares;

(f) the Holder and its advisors, if any, have been furnished with all materials relating to the business, finances and operations of the Company and materials relating to the offer and issuance of the Series F Shares; the Holder has had the opportunity to review the Company’s filings with the Securities and Exchange Commission; the Holder and its advisors, if any, have been afforded the opportunity to ask

questions of the Company; neither such inquiries nor any other due diligence investigations conducted by the Holder or its advisors, if any, or its representatives shall modify, amend or affect the Holder’s right to rely on the Company’s representations and warranties contained herein; the Holder has sought such accounting, legal and tax advice as it has considered necessary to make an informed investment decision with respect to its acquisition of the Series F Shares; the Holder is relying solely on its own accounting, legal and tax advisors, and not on any statements of the Company or any of its agents or representatives, for such accounting, legal and tax advice with respect to its acquisition of the Series F Shares and the transactions contemplated by this Agreement;

(g) the Holder understands that no United States federal or state agency or any other government or governmental agency has passed on or made any recommendation or endorsement of the Series F Shares or the fairness or suitability of the investment nor have such authorities passed upon or endorsed the merits of the offering of the Series F Shares;

(h) the Holder: understands, acknowledges and agrees that upon its consummation of the transactions contemplated by this Agreement on the Closing Date, (i) any and all Exchange Securities owned by it will be automatically cancelled, in each instance without further action on the part of the Company or the Holder except as otherwise set forth herein, and (ii) the Holder y surrenders and waives all rights that it has in respect of all of its Exchange Securities (and, for the avoidance of doubt, until such time Holder is not surrendering or waiving any such rights;

(i) notwithstanding anything else contained in this Agreement or the Series F SPA, the Holder shall have any all rights in, to and under the Exchange Securities owned by it, until the exchange is consummated on the Closing; and

(j) on the date hereof and at all times through the Closing Date, the Holder has and will have good and marketable title to the Exchange Securities, free and clear of all liens, securities interests, pledges, hypothecations, encumbrances and other adverse claims of third parties, and the Holder covenants and agrees that if the Closing (as defined in the Series F SPA) occurs, to deliver such title to the Exchange Securities to the Company on the Closing Date.

4. Miscellaneous.

(a) Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Warrant shall be determined in accordance with the provisions of the Series F SPA.

(b) Entire Agreement. This Agreement and the Series F SPA contain the entire agreement between the parties regarding the subject matter hereof and supersedes all prior agreements or understandings between the parties with respect thereto.

(c) Successors. This Agreement will inure to the benefit of any successor in interest to a party or any person that after the date hereof may acquire any subsidiary or division of a party.

(d) Counterparts. This Agreement may be executed in counterparts, each of which will be deemed an original, and all of which will constitute the same agreement.

[INSERT IF APPLICABLE: (e) Cancellation of Prior Exchange Agreement. Upon execution of this Agreement, the Prior Exchange Agreement is null and void and any exchange contemplated thereby will not take effect.]

[Signature Page(s) Follow this Page]]

IN WITNESS WHEREOF, the parties hereto have caused this Exchange to be duly executed by their respective authorized signatories as of the date below.

MITESCO, INC.

By:

Name: Lawrence Diamond

Title: Chief Executive Officer

[HOLDER]

By:

Name:

Title:

[Signature Page to Mitesco Preferred Exchange Agreement]

Schedule I

Series F Preferred Exchange Value Calculation

|

|

|

|

Invested

|

|

|

Stated Value

|

|

|

Dividends

|

|

|

Total Values of

exchange Securities

|

|

|

Preferred F Value

|

|

|

# of Preferred F Shares

|

|

| |

|

|

|

|

|

|

|

1.05 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Howe Trust

|

|

|

$ |

500,000 |

|

|

$ |

525,000 |

|

|

$ |

67,315.00 |

|

|

$ |

592,315.00 |

|

|

$ |

1,000.00 |

|

|

|

593.00 |

|

Exhibit 10.3

ACCRUED SALARY EXCHANGE AGREEMENT

THIS ACCRUED SALARY EXCHANGE AGREEMENT, is dated as of December 7, 2023 (this “Agreement”), by and among Mitesco, Inc., a Delaware corporation (the “Company”), and

Michael Howe (the “Holder”).

WHEREAS, the Holder owns an aggregate of:

2) Accured Salary (debt) in the amount of $39,299.99 (the “Exchange Securities”);

WHEREAS, pursuant to the terms of a Securities Purchase Agreement, dated on or about the date hereof (the “Series F SPA”), the Company is conducting an offering of shares of its Series F 12% PIK Convertible Perpetual Preferred Stock, par value $0.01 per share (the “Series F Shares”), having the terms and provisions set forth in the form of Certificate of Designations, Preferences and Rights of the Series F Convertible Perpetual Preferred Stock of the Company, attached hereto as Exhibit A;

WHEREAS¸ the Holder wishes to exchange its Exchange Securities for Series F Shares, and the Company wishes to issue to the Holder Series F Shares in such exchange, all in accordance with the terms and conditions of this Agreement;

WHEREAS¸ substantially simultaneously with its execution and delivery of this Agreement, the Holder has executed and delivered (as an “Investor” thereunder) a Series F SPA (the “Series F SPA”); and

WHEREAS, the exchange provided for hereby is being made in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”);

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound hereby, agree as follows:

1. Exchange. Effective on the Closing Date under (and as defined in) the Series F SPA, the Holder shall exchange all its Exchange Securities and the amounts owing thereunder for a number of Series F Shares equal to the applicable Series F Convertible Notes Exchange Value. The Holder shall exchange the Exchange Securities owned by it by surrendering to the Company such Exchange Securities (and the corresponding certificates, if any, evidencing the same) (the “Holder Deliveries”). Upon the later to occur of such surrender and the Closing Date under the Holder’s Series F SPA, the Company shall issue to the Holder a number of Series F Shares equal to the Series F Convertible Notes Exchange Value. In connection with such exchange, the Company and the Holder agree that the Holder shall execute the Series F SPA, as an “Investor” thereunder, and that the Holder’s surrender of the Holder Deliveries shall constitute the Holder’s payment of its Subscription Amount (as defined in the Series F SPA, clause (ii)) under the Series F SPA. On the Closing Date upon the issuance of the Series F Shares to the Holder, the Exchange Securities shall be canceled on the books of the Company and all of the Holder’s rights with respect thereto shall automatically cease and terminate, and the Holder, by executing and becoming a party to this Agreement, shall be deemed to have consented to the cancellation of the Holder’s Exchange Securities. For purposes of this Agreement, the “Series F Convertible Notes Exchange Value” shall be a number of Series F Shares (based on their liquidation preference of $1,000) equal to 165%1 of the principal amount of the Exchange Securities (including any payoff bonus or accrued interest), rounded up, as detailed on Schedule I.

2. Representations and Warranties of the Company. The Company hereby represents and warrants to the Holder that:

1 If Holder invests a dollar amount of new money into Series F of ≥20% of pre-“bump” Series F Convertible Notes Exchange Value, the Holder shall receive a number of Series F Shares (based on their liquidation preference of $1,000) equal to 230% of their new money investment.

(a) the Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware;

(b) all corporate action on the part of the Company necessary for the authorization, execution and delivery of this Agreement, and the performance of all obligations hereunder, have been taken on or prior to the date hereof. This Agreement has been validly authorized, executed and delivered by the Company, and constitutes the legal, valid and binding obligations of the Company, enforceable against them in accordance with their terms, except as such enforceability may be limited by general principles of equity or by applicable bankruptcy, insolvency, reorganization, moratorium, liquidation and other similar laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies; and

(c) the Series F Shares issued in accordance herewith and under the Series F SPA have been duly authorized and validly issued and are fully paid and non-assessable.

3. Representations and Warranties of the Holder. The Holder hereby represents and warrants to the Company that:

(a) the Holder is a Delaware limited partnership duly organized, validly existing and in good standing under the laws of its jurisdiction of organization;

(b) all actions on the part of the Holder necessary for the authorization, execution and delivery of this Agreement, and the performance of all obligations hereunder, have been taken on or prior to the date hereof; this Agreement is validly authorized, executed and delivered by the Holder and constitutes the legal, valid and binding obligations of the Holder, enforceable against the Holder in accordance with its terms, except as such enforcement may be limited by general principles of equity or by applicable bankruptcy, insolvency, reorganization, moratorium, liquidation and other similar laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies;

(c) the Holder is acquiring the Series F Shares for its own account only and not with view towards, or for sale in connection with, the public sale or distribution thereof;

(d) the Holder is an “accredited investor” as that term is defined in Rule 501 of Regulation D, as promulgated under the Securities Act;

(e) the Holder understands that the Series F Shares are being issued to it in reliance on specific exemptions from the registration requirements of United States federal and state securities laws and that the Company is relying in part upon the truth and accuracy of, and the Holder’s compliance with, the representations, warranties, acknowledgements, and understandings of the Holder set forth herein in order to determine the availability of such exemptions and the eligibility of the Holder to acquire the Series F Shares;

(f) the Holder and its advisors, if any, have been furnished with all materials relating to the business, finances and operations of the Company and materials relating to the offer and issuance of the Series F Shares; the Holder has had the opportunity to review the Company’s filings with the Securities and Exchange Commission; the Holder and its advisors, if any, have been afforded the opportunity to ask questions of the Company; neither such inquiries nor any other due diligence investigations conducted by the Holder or its advisors, if any, or its representatives shall modify, amend or affect the Holder’s right to rely on the Company’s representations and warranties contained herein; the Holder has sought such accounting, legal and tax advice as it has considered necessary to make an informed investment decision with respect to its acquisition of the Series F Shares; the Holder is relying solely on its own accounting,

legal and tax advisors, and not on any statements of the Company or any of its agents or representatives, for such accounting, legal and tax advice with respect to its acquisition of the Series F Shares and the transactions contemplated by this Agreement;

(g) the Holder understands that no United States federal or state agency or any other government or governmental agency has passed on or made any recommendation or endorsement of the Series F Shares or the fairness or suitability of the investment nor have such authorities passed upon or endorsed the merits of the offering of the Series F Shares;

(h) the Holder: understands, acknowledges and agrees that upon its consummation of the transactions contemplated by this Agreement on the Closing Date, (i) any and all Exchange Securities owned by it will be automatically cancelled, in each instance without further action on the part of the Company or the Holder except as otherwise set forth herein, and (ii) the Holder y surrenders and waives all rights that it has in respect of all of its Exchange Securities (and, for the avoidance of doubt, until such time Holder is not surrendering or waiving any such rights;

(i) notwithstanding anything else contained in this Agreement or the Series F SPA, the Holder shall have any all rights in, to and under the Exchange Securities owned by it, until the exchange is consummated on the Closing; and

(j) on the date hereof and at all times through the Closing Date, the Holder has and will have good and marketable title to the Exchange Securities, free and clear of all liens, securities interests, pledges, hypothecations, encumbrances and other adverse claims of third parties, and the Holder covenants and agrees that if the Closing (as defined in the Series F SPA) occurs, to deliver such title to the Exchange Securities to the Company on the Closing Date.

4. Miscellaneous.

(a) Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Warrant shall be determined in accordance with the provisions of the Series F SPA.

(b) Entire Agreement. This Agreement and the Series F SPA contain the entire agreement between the parties regarding the subject matter hereof and supersedes all prior agreements or understandings between the parties with respect thereto.

(c) Successors. This Agreement will inure to the benefit of any successor in interest to a party or any person that after the date hereof may acquire any subsidiary or division of a party.

(d) Counterparts. This Agreement may be executed in counterparts, each of which will be deemed an original, and all of which will constitute the same agreement.

(e) Cancellation of Prior Exchange Agreement. Upon execution of this Agreement, the Prior Exchange Agreement is null and void and any exchange contemplated thereby will not take effect.]

[Signature Page(s) Follow this Page]]

IN WITNESS WHEREOF, the parties hereto have caused this Exchange to be duly executed by their respective authorized signatories as of the date below.

MITESCO, INC.

By:

Name: Lawrence Diamond

Title: Chief Executive Officer

Investor:

Email: howe.michaelc@gmail.com

Address:

Phone:

By:

Name: Michael Howe

Title:

Date:

Schedule I

Series F Convertible Notes Exchange Value Calculation

|

Promissory Note

|

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Accrued Salary

|

$39,299.99

|

|

| |

|

|

|

Total Value of Exchange Securities

|

$39,299.99

|

|

|

Conversion Premium (65%)

|

$25,544.99

|

65% of total value of Exchange Securities

|

|

Total of Value with Conversion Premium

|

$64,844.98

|

|

|

Series F Shares

($1000/ share rounded up to next whole share)

|

65

|

Shares of Series F Preferred

|

| |

|

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

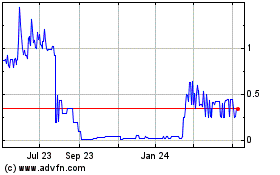

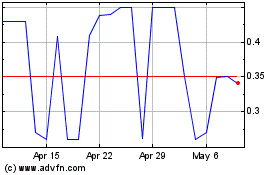

Mitesco (PK) (USOTC:MITI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mitesco (PK) (USOTC:MITI)

Historical Stock Chart

From Apr 2023 to Apr 2024