In the pre-market on Wednesday, U.S. index futures showed a

slight increase, with investors awaiting the latest monetary policy

decision from the Federal Reserve.

At 05:30 AM, the Dow Jones (DOWI:DJI) futures

rose 42 points, or 0.11%. S&P 500 futures rose

0.11% and Nasdaq-100 futures rose 0.14%. The

10-year Treasury yield was at 4.191%.

In the commodities market, West Texas Intermediate crude oil for

January fell 0.06%, to US$ 68.57 per barrel. Brent crude for

February fell 0.12%, close to US$ 73.15 per barrel. Iron ore with a

concentration of 62%, traded on the Dalian exchange, fell 1.35%, to

US$ 133.26 per ton.

On Wednesday’s economic agenda, investors await at 08:30 AM the

Producer Price Index (PPI) for November. At 10:30 AM, the oil

inventories of the week until 12/08 will be released. At 14:00 PM,

the U.S. Central Bank will announce its decision, followed by a

press conference with Fed Chairman Jerome Powell at 14:30. The Fed

is expected to maintain interest rates in the range of 5.25% to

5.5%, but investors will also analyze Powell’s comments for clues

about when rate cuts can be expected.

European markets are slightly up. Tomorrow, the European Central

Bank (ECB), the Bank of England (BoE), and the Swiss National Bank

will announce their interest rate decisions, following the Federal

Reserve’s (Fed) announcement. Additionally, recent statistics

released by the Office for National Statistics reveal that the UK

economy contracted by 0.3% in October. This drop was driven by

declines observed in key sectors such as services, production, and

construction.

In Asian stock markets, there was a mixed variation, with the

Shanghai SE (China) index registering a drop of 1.15%. The Nikkei

(Japan) recorded a slight increase of 0.25%. The Hang Seng Index

(Hong Kong) fell 0.89%. The Kospi (South Korea) decreased by 0.97%.

The ASX 200 (Australia) showed an increase of 0.31%. The Chinese

government recently announced its economic targets for 2024, which

include stimulating domestic demand, prioritizing the development

of key sectors, and addressing the real estate sector crisis. These

initiatives, announced by Beijing, are in line with market

expectations, as analyzed by BofA Global Research. However, no

major fiscal stimulus or significant interest rate reduction is

expected.

On Tuesday’s close, U.S. stocks continued their recent trend of

gains, with the main indices closing at their highest levels in

over a year. The Dow Jones rose 0.48% to

36,577.94, the S&P 500 increased 0.46% to

4,643.70, and the Nasdaq gained 0.70% to

14,533.40. This positive momentum came after a report from the

Labor Department that showed a slight increase in U.S. consumer

prices in November, fueling optimism about future interest rates.

Although the Fed is expected to keep rates unchanged, the markets

are attentive to indications of rate cuts next year.

On the corporate earnings front for Wednesday, investors will be

paying attention to reports from ABM (NYSE:ABM).

IPG Phototronics (NASDAQ:PLAB),

Cognyte (NASDAQ:CGNT), and

VersaBank (NASDAQ:VBNK), before the market opens.

After the close, reports from Adobe (NASDAQ:ADBE),

Amtech Systems (NASDAQ:ASYS), Nordson

Corp (NASDAQ:NDSN), among others, will be observed.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – Apple has provided rivals

access to its tap-and-go mobile payment systems in an attempt to

resolve EU antitrust charges. The European Commission will assess

the offer after seeking feedback from competitors and customers

next month. Apple also faces charges of hindering the promotion of

App Store alternatives.

Foxconn (USOTC:FXCOF) – Foxconn received

approval to invest over $1 billion in its Indian factory, which

will produce Apple (NASDAQ:AAPL) products. Foxconn plans to spend

about $2.7 billion at the site as part of its efforts to expand

production outside China. Apple and its partners are speeding up

the creation of a supply chain in India, as Chinese companies face

regulatory challenges and political tensions.

Meta Platforms (NASDAQ:META) – Meta, the owner

of Facebook and Instagram, faces copyright infringement allegations

for using thousands of pirated books to train its AI model Llama.

Internal documents reveal discussions about legality. The lawsuit

has been consolidated with others filed by authors, including Sarah

Silverman and Michael Chabon.

Alphabet (NASDAQ:GOOGL), Meta

Platforms (NASDAQ:META), Qualcomm

(NASDAQ:QCOM) – Google (Alphabet), Meta, Qualcomm, and seven other

technology companies formed the Coalition for Open Digital

Ecosystems (CODE) to promote more open systems, innovation, and

cooperation in Europe, in response to new EU rules, including the

Digital Markets Act (DMA).

Advanced Micro Devices (NASDAQ:AMD) – AMD’s

stock rose for the fourth consecutive day on Tuesday, nearing its

highest close in almost a year. The prices closed at $137.61, close

to the January 2022 closing. Shares are up 0.34% in Wednesday’s

pre-market.

TE Connectivity (NYSE:TEL) – The electrical

component company announced that its board approved a $1.5 billion

increase in its stock buyback program.

Alibaba (NYSE:BABA) – Alibaba’s cloud unit lost

its commercial director, Cai Yinghua, amid internal restructuring

and uncertainty following the decision to back off from the $11

billion business separation. The company appointed new executives

in an attempt to revitalize the cloud division.

Netflix (NASDAQ:NFLX), Disney

(NYSE:DIS) – According to Reuters, Netflix will lead U.S. ad

revenue in 2024, with a 50.3% increase to about $1 billion, due to

price hikes and password-sharing restrictions. Disney+ will

register a 16.1% increase to about $912 million, seeking to regain

ground.

AMC Entertainment (NYSE:AMC) – AMC

Entertainment completed a stock offering, raising about $350

million. The move aims to reduce the company’s debt, which exceeded

$5 billion in 2022. This brings AMC’s total raised since September

1 to $675 million and $865 million in the 2023 calendar year.

Nokia (NYSE:NOK) – Nokia downgraded its

operating margin target to at least 13% by 2026, due to losing a

deal with AT&T (NYSE:T). The company still sees a path to the

previous target but considered it prudent to revise due to market

conditions. Additionally, Nokia and Deutsche Telekom made a deal to

use ORAN technology in Germany, marking Nokia’s return to DT’s

commercial networks since being absent since 2017. The project is

underway and will be extended next year.

DoubleVerify (NYSE:DV) – The digital media

analytics company received an Overweight rating and a target price

of $40 from Morgan Stanley in its initial assessment.

Visa (NYSE:V), Mastercard

(NYSE:MA) – The UK payment regulator proposed a temporary cap on

cross-border interchange fees charged by Mastercard and Visa in

transactions between the UK and the European single market. This

aims to protect businesses from excessive payments, following a

market review that identified undue fee increases.

Blackstone (NYSE:BX) – The casino and gaming

regulator of Victoria, Australia, is investigating Blackstone-owned

Crown Resorts regarding allegations that CEO Ciaran Carruthers

allowed drunk customers and even a minor into the casino. The

investigation is ongoing.

Bain Capital (NYSE:BCSF) – Bain Capital sold a

$448 million stake in Indian bank Axis Bank in a block trade. Bain

affiliates offered 33.4 million shares, representing 1.1% of Axis

Bank, at 1,119.70 rupees per share, a 1% discount to the closing

price. In addition, Bain Capital agreed to acquire a controlling

stake in Swedish infrastructure projects and services company Eleda

from Altor, with Altor retaining a minority stake. Founders and

management will reinvest significantly in the company. Eleda

generates over $1.44 billion in annual revenues. Financial terms

were not disclosed.

Goldman Sachs (NYSE:GS) – Goldman Sachs’ global

head of commodities, Ed Emerson, will retire in March after more

than 24 years at the firm. Xiao Qin and Nitin Jindal will jointly

lead the commodities business.

Starbucks (NASDAQ:SBUX) – A judge in São Paulo

approved bankruptcy protection for SouthRock Capital, which manages

Starbucks cafes and TGI Fridays restaurants in Brazil. SouthRock

will continue restructuring its operations, including Starbucks and

TGI Fridays stores, but does not affect Subway and Eataly.

Farfetch (NYSE:FTCH) – The post-pandemic

slowdown affects European luxury companies, including LVMH

(USOTC:LVMUY) and Kering (EU:KER), but Farfetch, a pioneer in

e-commerce, suffers more. The company faces stock drops, credit

downgrades, and competition from brands seeking distribution

control. Rumors suggest sale or going private.

Cal-Maine (NASDAQ:CALM) – Cal-Maine Foods

detected the avian flu virus at one of its facilities in Kansas,

affecting 1.6% of the flock. Production was temporarily halted, and

the company states there’s no immediate threat to public health or

the food supply. Investors will be updated in the January quarterly

results.

Kroger (NYSE:KR) – Six U.S. lawmakers expressed

opposition to Kroger’s $24.6 billion acquisition of Albertsons

(NYSE:ACI), claiming the proposed store divestitures won’t solve

antitrust issues and could harm consumers, workers, and the food

sector. The FTC is still reviewing the deal. Additionally, Kroger

announced that its associates will return to offices in February

2024, attending three to four days a week, citing greater

efficiency and collaboration. About 5,800 associates in Cincinnati

and other locations will be affected by the change.

Blend Labs (NYSE:BLND) – Shares of fintech

company Blend Labs rose 5.71% in Wednesday’s pre-market to $1.85,

after Keefe Bruyette raised its target price from $1.50 to $1.85

and maintained a Market Perform rating for the shares.

Camping World (NYSE:CWH) – Roth MKM analysts

initiated coverage of Camping World shares with a Buy rating and

set a target price of $30.

Choice Hotels (NYSE:CHH) – Choice Hotels

International launched a hostile offer for Wyndham Hotels &

Resorts (NYSE:WH), valued at about $7.2 billion. Choice is ready

for a boardroom battle as it seeks to combine two of the largest

operators of budget hotels in the U.S.

Booking Holdings (NASDAQ:BKNG) – Booking

Holdings Inc. is witnessing travel normalization in the Middle East

following the conflict between Israel and Hamas. CEO Glenn Fogel

reported an increase in hotel bookings, flights, and travel

activities, similar to what occurred in Eastern Europe after the

Russia-Ukraine crisis in 2022. Although the situation remains

volatile, this development is a positive sign for the travel

industry.

SunPower (NASDAQ:SPWR) – SunPower’s shares fell

7.6% on Tuesday after the company announced an amendment to its

credit agreement with lenders, due to challenges related to higher

interest rates, inflation, and regulatory changes in 2023. The

company received financing commitments from Sol Holding worth $25

million. Shares are stable in Wednesday’s pre-market.

Uber (NYSE:UBER) – Uber and Carrefour (EU:CA)

are collaborating to provide Uber drivers access to Carrefour’s

electric vehicle (EV) charging stations in France. Uber will invest

300,000 euros to enable EV charging for its VTC drivers and will

offer preferential rates at Carrefour’s charging network starting

January 1.

General Motors (NYSE:GM) – GM and Komatsu plan

to develop a hydrogen fuel cell power module for Komatsu’s 930E

electric mining truck. The goal is to test a prototype of the

hydrogen fuel cell-powered truck by mid-decade.

Tesla (NASDAQ:TSLA) – The rear-wheel drive and

long-range Tesla Model 3 vehicles will lose the federal tax credit

of up to $7,500 from December 31, due to new guidelines from the

U.S. Inflation Reduction Act, seeking to reduce China’s dependence

in the electric vehicle supply chain. Tesla advised to make

deliveries by December 31 to obtain the full tax credit. Elsewhere,

Tesla received approval from Mexico’s Federal Ministry of the

Environment to build its “gigafactory” in Nuevo Leon. The land

covers about 261 hectares, with estimated costs of over $5 billion.

Elon Musk expressed concern about the economy, but the Nuevo Leon

government will invest more than $130 million in supporting

infrastructure. Additionally, Tesla shared a video on Tuesday

showcasing improvements in its humanoid robot prototype called

“Optimus”. The robot is now lighter, with the ability to handle

delicate objects and tactile detection in its fingers. The goal is

to enable the robot to perform dangerous or monotonous tasks in

place of humans.

SpaceX – Elon Musk’s SpaceX plans to sell

preferred shares at $97 each in a public offering, raising the

value of the space and satellite company to about $180 billion,

making it one of the most valuable private companies in the

world.

Boeing (NYSE:BA) – Boeing delivered 56 planes

in November, approaching its annual targets. The deliveries

included 45 737 MAX, one P-8, two 777 freighters, two 767s, and six

787 Dreamliners. The company is close to its annual delivery goals.

In other news, the Federal Aviation Administration (FAA) proposed

three directives for inspections and component replacements on

Boeing 737NG airplanes following a fatal incident involving

Southwest Airlines (NYSE:LUV) fan blades in 2018. The directives

affect 1,979 airplanes registered in the U.S. and 6,666 worldwide,

aiming to enhance safety. Additionally, Boeing is making

significant cuts to its strategic teams, halving the number of

planners working in major divisions, as it faces industrial

pressures. This move aims to redirect more resources to its

operations. The company has faced financial challenges in recent

years and is seeking internal restructuring.

L3Harris (NYSE:LHX) – U.S. defense company

L3Harris announced the suspension of its merger and acquisition

activities to strengthen its balance sheet and outperform analysts’

estimates, targeting a revenue of about $21 billion by 2024. The

company will also prioritize investments in research and

development, debt reduction, and share buyback.

Amgen (NASDAQ:AMGN) – Amgen announced an

increase in its dividend, rising to $2.25 per share, marking the

12th consecutive year of increase. The dividend will be paid on

March 7 to shareholders registered by February 16.

Pfizer (NYSE:PFE) – Pfizer plans to complete

the acquisition of Seagen for $43 billion this week, creating a new

oncology division. Pfizer will also reorganize its commercial

businesses, and commercial director Angela Hwang will leave the

position. Pfizer will donate royalty rights from Bavencio cancer

drug sales to the American Association for Cancer Research.

Moderna (NASDAQ:MRNA) – Moderna announced that

its commercial director, Arpa Garay, has left the position. CEO

Stephane Bancel will assume sales and marketing responsibilities as

the company deals with weak Covid-19 vaccine sales.

Illumina (NASDAQ:ILMN) – Illumina accused the

EU of overstepping its powers by reviewing the merger with Grail,

while the EU claimed the company was trying to rewrite merger

rules. This highlights the EU’s determination to apply Article 22

to review large company deals, even below the EU merger revenue

thresholds.

Caribou Biosciences (NASDAQ:CRBU) – Shares of

the genetic editing company rose 2.83% in Wednesday’s pre-market

following the FDA’s approval of the lymphoma trial design.

Novo Nordisk (NYSE:NVO) – Shares of Zealand

Pharma (CHIX:ZEALC) outperform those of Novo Nordisk, with a 63%

increase in market value on the Copenhagen stock exchange this

year, driven by unique mechanism weight loss drugs. Zealand focuses

on obesity and develops treatments based on amylin analogs.

Investors see potential in a growing weight loss market.

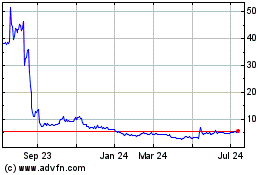

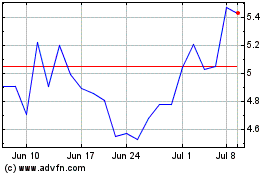

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024