0001510964false00015109642023-12-072023-12-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 7, 2023

CV SCIENCES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 000-54677 | 80-0944970 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

9530 Padgett Street, Suite 107

San Diego, California 92126

(Address of principal executive offices)

(866) 290-2157

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| N/A | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 7, 2023, CV Sciences, Inc. (the “Company”), entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”) by and among the Company, Cultured Foods Sp. z.o.o., a limited liability company organized under the laws of Poland (“Cultured Foods”), Brian Carl McWhorter (the “Member”) and Barbara McWhorter, pursuant to which the Company purchased all of the outstanding equity interests in Cultured Foods, resulting in Cultured Foods becoming a wholly owned subsidiary of the Company (the “Acquisition”). Cultured Foods is a leading European manufacturer and distributor of plant-based, protein products. The Acquisition closed on December 7, 2023 (the “Closing Date”).

In consideration for the Acquisition, at closing, the Company (i) made a cash payment of $175,000 to the Member, less a $17,500 holdback (the “Holdback Amount”) and certain other adjustments provided for in the Purchase Agreement (the “Closing Payment”), and (ii) issued an aggregate of 7,074,270 restricted shares of Company common stock to the Member, valued at $250,000 based on the three day volume weighted average price of the Company’s common stock on the three trading days prior to closing (the “Closing Shares,” and together with the Closing Payment, the “Closing Consideration”). The Closing Payment is subject to adjustment, upward or downward, based on post-closing adjustments to the net working capital of Cultured Foods within 120 days of closing, as reflected in the Final Working Capital Statement (as defined in the Purchase Agreement). Additionally, within 90 days following the final determination of the Final Working Capital Statement (the “Receivables Date”), the Company shall be entitled to recover from the Member an amount equal to the unpaid balance, as of the Receivables Date, of all accounts receivable which were included in as assets in the Final Working Capital Statement.

The Company shall release the Holdback Amount, less any amounts owed to the Company by the Member pursuant to the Purchase Agreement, including without limitation as a result of the post-closing adjustments discussed above, to the Member one year from the Closing Date.

In addition to the Closing Consideration, and as further consideration for the Acquisition, the Company shall make an additional cash payment to the Member in the form of an earn-out (the “Earnout Amount”), which shall be based on Company revenues generated in fiscal 2024 and will be calculated as follows:

•If the Company’s Net Revenue is at least $500,000, then the Earnout Amount will be $110,000.

•If the Company’s Net Revenue is at least $450,000 but less than $500,000, then the Earnout Amount will be $75,000.

•If the Company’s Net Revenue is at least $400,000 but less than $450,000, then the Earnout Amount will be $50,000.

•If the Company’s Net Revenue is at least $300,000 but less than $400,000, then the Earnout Amount will be $20,000.

•If the Company’s Net Revenue (as defined in the Purchase Agreement) is less than $300,000, then the Earnout Amount will be $0.

The Earnout Payment shall be paid within 10 business days after the final determination of the Company’s Net Revenue for fiscal 2024, as determined in accordance with the Purchase Agreement.

Pursuant to the Purchase Agreement, the Member agreed that he will not, on any single trading day sell, transfer or otherwise dispose of any Company common stock, including the Closing Shares, in an aggregate amount exceeding the greater of (i) 15% of the of the Company’s common stock sold in the aggregate based on the greater of the current or proceeding trading day, and (ii) $3,000 in gross value; provided, however, that in the event that the Company enters into a leak-out agreement with any third party on terms more favorable than the foregoing, the Member shall be afforded the same more favorable terms offered to such third party.

Additionally, for a period of one year following the Closing Date, the Member and Ms. McWhorter, including their affiliates, shall be prohibited from engaging in certain competitive and/or solicitation activities within the United States and the European Union, as more particularly set forth in the Purchase Agreement.

The Purchase Agreement contains standard representations, warranties, covenants, indemnification and other terms customary in similar transactions.

The foregoing description of the Purchase Agreement and the transactions contemplated thereby does not purport to be complete, and is qualified in its entirety by reference to the complete text of such Purchase Agreement, a copy of which will be filed as an exhibit to the Company’s next periodic report.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 of this Current Report on Form 8-K (this “Current Report”) regarding the issuance of the Closing Shares is incorporated by reference into this Item 3.02.

The issuance of the shares of the Company’s common stock in connection with the Acquisition is exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on exemptions from the registration requirements of the Securities Act in transactions not involved in a public offering pursuant to Section 4(a)(2) and/or Regulation D of the Securities Act.

Item 7.01 Regulation FD Disclosure.

On December 12, 2023, the Company issued a press release announcing the Acquisition. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information set forth under Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be incorporated by reference into any filing under the Securities Act or the Exchange Act, regardless of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such a filing. This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is required to be disclosed solely by Regulation FD.

Forward Looking Statements

This Current Report, including Exhibit 99.1 attached hereto, contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this Current Report, including statements regarding the Purchase Agreement, the Acquisition, business strategy, and plans are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In addition, projections, assumptions and estimates of the Company’s future performance and the future performance of the markets in which the Company operates are necessarily subject to a high degree of uncertainty and risk. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “would,” “could,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this Current Report are only predictions. These forward-looking statements speak only as of the date of this Current Report and are subject to a number of risks, uncertainties and assumptions. The events and circumstances reflected in such forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law, the Company does not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Exhibit | | Description |

| |

99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 12, 2023

| | | | | |

| | CV SCIENCES, INC. |

| | |

| | |

| | |

| | By: /s/ Joseph Dowling |

| | Joseph Dowling |

| | Chief Executive Officer |

Exhibit 99.1

CV Sciences, Inc. Acquires Cultured Foods To Enter Plant-Based Food Market

Opening Door For European Distribution

San Diego, CA – December 12, 2023 (PR NEWSWIRE) - CV Sciences, Inc. (OTCQB:CVSI) (the “Company”, “CV Sciences”, “our”, “us” or “we”), a preeminent consumer wellness company specializing in hemp extracts and other proven science-backed, natural ingredients and products, today announced that it has consummated its purchase of Cultured Foods, a leading manufacturer and distributor of alternative plant-based vegan foods. Cultured Foods produces a variety of curated plant-based products, currently sold in 15 different European countries, with its base of operations in Warsaw, Poland. The acquisition creates opportunity for importation of these specialty foods to the US and establishes a European base of operations for the sale and distribution of +PlusCBD products, opening doors to numerous new retail and distributor partners. In addition, it helps accelerate CV Sciences transition to a more diverse global health and wellness company. The acquisition was structured as an equity purchase, where the Company will operate Cultured Foods as its wholly-owned subsidiary.

“We are thrilled that Cultured Foods and all of its employees are joining CV Sciences as a first key milestone to transition to a global health and wellness company. The acquisition synergies will allow us to leverage our key assets including U.S. distribution and B2B expertise to drive long-term growth and shareholder value. Our immediate plan is to leverage our B2B distribution network and bring convenient and sustainable plant-based foods into the US natural product channel while working with Cultured Foods to grow their business in the European market. The global vegan food market is expected to grow 5 times by 2030 with millennials and flexitarians as the driving force behind soaring vegan food sales,” said Joseph Dowling, Chief Executive Officer of CV Sciences. “In addition, we plan to leverage the Cultured Foods infrastructure to introduce select products from our flagship brand PlusCBD™ across all of Europe as laws allow, providing for significant expansion and opportunity to grow our company mindshare.”

The total consideration for the acquisition of Cultured Foods is up to $535,000, consisting of (i) a cash payment made at the closing of $175,000 (the “Closing Payment”), (ii) the delivery at the closing of 7,074,270 shares of CV Sciences’ common stock, having a value of $250,000 as priced at the three (3) day Volume Weighted Average Price (VWAP) of CV Sciences’ common stock, and (ii) the potential payment of up to $110,000 in the form of an earn-out if the business of Cultured Foods meets certain performance thresholds during the first year subsequent to the closing. The Closing Payment was subject to

adjustment based on certain working capital calculations and the subtraction of certain indebtedness of Cultured Foods at the closing.

Following the closing, Cultured Foods’ founder, Ms. Barbara McWhorter, will continue as general manager of the European manufacturing and distribution business. The acquisition is expected to be accretive in its first year and contribute to scaling economics thereafter. On December 11, 2023, CV Sciences, Inc. filed a Current Report on Form 8-K which includes a description of the material terms of the transaction. Investors are encouraged to read such filing in its entirety.

About CV Sciences, Inc.

CV Sciences, Inc. (OTCQB:CVSI) is a consumer wellness company specializing in nutraceuticals and plant-based foods. The Company’s hemp extracts and other proven, science-backed, natural ingredients and products are sold through a range of sales channels from B2B to B2C. The Company's PlusCBD™ branded products are sold at select retail locations throughout the U.S. and are the top-selling brands of hemp extracts in the natural products market, according to SPINS, the leading provider of syndicated data and insights for the natural, organic and specialty products industry. With a commitment to science, PlusCBD™ product benefits in healthy people are supported by human clinical research data, in addition to three published clinical case studies available on PubMed.gov. PlusCBD™ was the first hemp extract supplement brand to invest in the scientific evidence necessary to receive self-affirmed Generally Recognized as Safe (GRAS) status. The Company’s plant-based food products are sold under the Cultured Foods brand. CV Sciences, Inc. has primary offices and facilities in San Diego, California, and Warsaw, Poland. The Company also operates a drug development program focused on developing and commercializing CBD-based novel therapeutics. Additional information is available from OTCMarkets.com or by visiting www.cvsciences.com.

Contact Information

ir@cvsciences.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

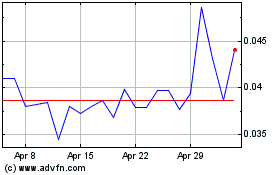

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Apr 2023 to Apr 2024