false

0001008586

0001008586

2023-12-01

2023-12-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 1, 2023

Streamline

Health Solutions, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

0-28132 |

|

31-1455414 |

(State or other jurisdiction of

incorporation) |

|

(Commission File

Number) |

|

(I.R.S. Employer

Identification No.) |

2400

Old Milton Pkwy., Box 1353

Alpharetta,

GA 30009

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (888) 997-8732

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, $0.01 par value |

|

STRM |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment

of Certain Officers; Compensatory Arrangements of Certain Officers. |

Compensation

Increase for Chief Executive Officer

On

December 1, 2023, the Compensation Committee of the Board of Directors (the “Compensation Committee”) approved an increase

to the annual base salary of Benjamin L. Stilwill from $280,000 to $350,000, effective December 4, 2023, in connection Mr. Stilwill’s

recent appointment as Chief Executive Officer of the Company.

Employment

Agreement with Interim Chief Financial Officer

As

previously reported on the Company’s Current Report on Form 8-K filed on October 16, 2023, the Company appointed Bryant “B.J.”

Reeves as Interim Chief Financial Officer, Principal Financial Officer and Principal Accounting Officer of the Company, effective October

13, 2023. In connection with his appointment, the Company and Mr. Reeves entered into an employment agreement (the “Employment

Agreement”), effective December 4, 2023.

The

term of the Employment Agreement is one (1) year, commencing December 4, 2023, and renews automatically for subsequent twelve (12)-month

periods, unless Mr. Reeves or the Company provides written notice at least sixty (60) calendar days prior to the end of the applicable

year to the other of his or its intention to not renew the employment. Mr. Reeves is entitled to an annual base salary of $185,000 and

is eligible for an annual incentive bonus (at target equal to twenty-five percent (25%) of his annual base salary), based on individual

and Company performance. Mr. Reeves is also eligible to receive the standard employee benefits made available by the Company to its employees

generally. Mr. Reeves was also granted a restricted stock award of 50,000 shares under the Streamline Health Solutions, Inc. Third Amended

and Restated 2013 Stock Incentive Plan following the execution of the Employment Agreement. The shares of restricted stock vest in three

(3) equal annual installments, subject to the continued employment of Mr. Reeves on each vesting date. The Employment Agreement contains

customary confidentiality provisions and non-competition covenants.

If

the Employment Agreement is terminated by the Company for death, Continued Disability, or Good Cause (each as defined in the Employment

Agreement), or if the Employment Agreement is not renewed by the Company or Mr. Reeves, Mr. Reeves will generally be entitled to (1)

accrued but unpaid salary through his termination date; (2) reimbursement of expenses incurred prior to his termination date; and (3)

any vested benefits earned by Mr. Reeves prior to his termination date (collectively, the “Accrued Obligations”). If the

Employment Agreement is terminated by the Company for reasons other than death, Continued Disability, or Good Cause, or if Mr. Reeves

terminates employment for Good Reason (as defined in the Employment Agreement), Mr. Reeves will be entitled to the Accrued Obligations

as well as post-termination severance benefits consisting of: (i) six (6) months base salary; (ii) a prorated portion of his annual bonus;

and (iii) an amount equal to six (6) times the monthly rate of the Company’s subsidy for coverage in its medical, dental and vision

plans for active employees.

In

the event of a Change in Control (as defined in the Employment Agreement) of the Company during the term of the Employment Agreement,

all stock options, restricted stock, and all other equity awards (if any) granted to Mr. Reeves that are outstanding immediately prior

to the Change in Control shall immediately vest in full as of the date of the Change in Control, subject to Mr. Reeves’ continued

employment with the Company through the date of such Change in Control.

The

foregoing description of the terms of the Employment Agreement does not purport to be complete and is qualified in its entirety by reference

to the full text of the Employment Agreement, which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

STREAMLINE

HEALTH SOLUTIONS, INC. |

| |

|

|

| Date:

December 7, 2023 |

By: |

/s/

Wyche T. “Tee” Green, III |

| |

|

Wyche

T. “Tee” Green, III |

| |

|

Executive

Chairman |

Exhibit

10.1

EMPLOYMENT

AGREEMENT

This

EMPLOYMENT AGREEMENT (together with Exhibit A attached hereto, the “Agreement”) is entered as of December

4th, 2023, by and between Streamline Health, LLC, a Delaware limited liability company with its headquarters in Alpharetta,

Georgia (the “Company”), and Bryant James Reeves, a resident of the state of Georgia (“Executive”).

RECITALS:

WHEREAS,

the Company is a wholly owned subsidiary of Streamline Health Solutions, Inc. (“STRM”);

WHEREAS,

the Company and Executive hereby agree that Executive will serve as an officer of the Company pursuant to the terms and conditions set

forth in this Agreement.

NOW,

THEREFORE, in consideration of the premises and the agreements contained herein, and for other good and valuable consideration, the

receipt and adequacy of which the parties hereby acknowledge, the parties agree as follows:

1.

EMPLOYMENT

The

Company hereby agrees to employ Executive, and Executive, in consideration of such employment and other consideration set forth herein,

hereby accepts employment, upon the terms and conditions set forth herein.

2.

POSITION AND DUTIES

During

the Term (as defined in Section 10 of this Agreement), Executive will be employed as Interim CFO may also serve as an officer or director

of affiliates of the Company for no additional compensation, as part of Executive’s services to the Company hereunder. While employed

hereunder, Executive will do all things necessary, legal and incident to the above positions, and otherwise will perform such executive-level

functions, as the President of Streamline Health, LLC (the “President”) or other person as may be designated by the

Company as are commensurate with Executive’s position, to whom Executive will report, or other person(s) the Board of Directors

of STRM (the “Board”) may establish from time to time.

3.

COMPENSATION AND BENEFITS

Subject

to such modifications as may be contemplated by Exhibit A attached hereto and approved from time to time by the Board or the Compensation

Committee of the Board of Directors of STRM (the “Committee”), and unless otherwise consented to by Executive, during

the Term, Executive will receive the compensation and benefits listed on the attached Exhibit A, which is incorporated herein

and expressly made a part of this Agreement. Such compensation and benefits will be paid and provided by the Company in accordance with

the Company’s regular payroll, compensation and benefits plans, programs and policies, as in effect from time to time.

4.

EXPENSES

The

Company will pay or reimburse Executive for all travel and out-of-pocket expenses reasonably incurred or paid by Executive in connection

with the performance of Executive’s duties as an employee of the Company upon compliance with the Company’s procedures for

expense reimbursement, including the presentation of expense statements or receipts or such other supporting documentation as the Company

may reasonably require. All expenses eligible for reimbursement in connection with the Executive’s employment with the Company

must be incurred by Executive during the term of employment and must be in accordance with the Company’s expense reimbursement

policies. The amount of reimbursable expenses incurred in one taxable year will not affect the expenses eligible for reimbursement in

any other taxable year. Each category of reimbursement will be paid as soon as administratively practicable, but in no event will any

such reimbursement be paid after the last day of the taxable year following the taxable year in which the expense was incurred. No right

to reimbursement is subject to liquidation or exchange for other benefits.

5.

BINDING AGREEMENT

The

Company warrants and represents to Executive that the Company, acting by the officer executing this Agreement on its behalf of the Company,

has the full right and authority to enter into this Agreement and to perform all of its obligations hereunder.

6.

OUTSIDE EMPLOYMENT

Executive

will devote Executive’s full time and attention to the performance of the duties incident to Executive’s position with the

Company, and will not have any other employment with any other enterprise or substantial responsibility for any enterprise which would

be inconsistent with Executive’s duty to devote Executive’s full time and attention to Company matters; provided, however,

that the foregoing will not prevent Executive from participation in any charitable or civic organization or, subject to President

consent, which consent will not be unreasonably withheld, from service in a non-executive capacity on the boards of directors of up to

two (2) other companies that does not interfere with Executive’s performance of the duties and responsibilities to be performed

by Executive under this Agreement.

7.

CONFIDENTIAL INFORMATION AND TRADE SECRETS

The

Company is in the business of providing solutions, including comprehensive suites of health information management solutions relating

to enterprise content management, computer assisted coding, business analytics, clinical analytics, patient scheduling and integrated

workflow systems, that help hospitals, physician groups and other healthcare organizations improve efficiencies and business processes

across the enterprise to enhance and protect revenues, offering a flexible, customizable way to optimize the clinical and financial performance

of any healthcare organization (the “Business”).

For

the purpose of this Agreement, “Confidential Information” will mean proprietary or confidential data, information,

documents, or materials (in oral, written, unwritten or electronic form) which belongs to or pertains to the Company’s Business

and which was disclosed to Executive or which Executive became aware of as a consequence of Executive’s relationship with the Company.

Confidential Information includes, without limitation, the Company’s services, processes, patents, systems, equipment, creations,

designs, formats, programming, discoveries, inventions, improvements, computer programs, data kept on computers, engineering, research,

development, applications, financial information, information regarding services and products in development, market information, including

test marketing or localized marketing, other information regarding processes or plans in development, trade secrets, training manuals,

know-how of the Company, and the customers, clients, suppliers and others with whom the Company does or has in the past done, business

(including any information about the identity of the Company’s customers or suppliers and written customer lists and customer prospect

lists), or information about customer requirements, transactions, work orders, pricing policies, plans or any other Confidential Information,

which the Company deems confidential and proprietary and which is generally not known to others outside the Company and which gives or

tends to give the Company a competitive advantage over persons who do not possess such information or the secrecy of which is otherwise

of value to the Company in the conduct of its business — regardless of when and by whom such information was developed or acquired,

and regardless of whether any of these are described in writing, reduced to practice, copyrightable or considered copyrightable, patentable

or considered patentable; provided, however, that “Confidential Information” will not include general industry

information or information which is publicly available or is otherwise in the public domain without breach of this Agreement, information

which Executive has lawfully acquired from a source other than through their employment with the Company, or information which is required

to be disclosed pursuant to any law, regulation or rule of any governmental body or authority or court order (in which event Executive

will immediately notify the Company of such requirement or order so as to give the Company an opportunity to seek a protective order

or other manner of protection prior to production or disclosure of the information). Executive acknowledges that Confidential Information

is novel and proprietary to and of considerable value to the Company.

Confidential

Information will also include confidential information of third parties, clients or prospective clients that has been provided to the

Company or to Executive in conjunction with Executive’s employment, which information the Company is obligated to treat as confidential.

Confidential Information does not include information voluntarily disclosed to the public by the Company, except where such public disclosure

has been made by the Executive without authorization from the Company, or which has been independently developed and disclosed by others,

or which has otherwise entered the public domain through lawful means.

Executive

acknowledges that all Confidential Information is the valuable, unique and special asset of the Company and that the Company owns the

sole and exclusive right, title and interest in and to this Confidential Information.

(a)

To the extent that the Confidential Information rises to the level of a trade secret under applicable law, then Executive will,

during Executive’s employment and for as long thereafter as the Confidential Information remains a trade secret (or for the

maximum period of time otherwise allowed under applicable law) protect and maintain the confidentiality of these trade secrets and

refrain from disclosing, copying or using the trade secrets without the Company’s prior written consent, except as necessary

in Executive’s performance of Executive’s duties while employed with the Company.

(b)

To the extent that the Confidential Information defined above does not rise to the level of a trade secret under applicable law,

Executive will not, during Executive’s employment and thereafter for a period of two (2) years, disclose, or cause to be

disclosed in any way, Confidential Information, or any part thereof, to any person, firm, corporation, association or any other

operation or entity, or use the Confidential Information on Executive’s own behalf, for any reason or purpose except as

necessary in the performance of her duties while employed with the Company. Executive further agrees that, during Executive’s

employment and thereafter for a period of two (2) years, Executive will not distribute, or cause to be distributed, Confidential

Information to any third person or permit the reproduction of Confidential Information, except on behalf of the Company in

Executive’s capacity as an employee of the Company. Executive will take all reasonable care to avoid unauthorized disclosure

or use of the Confidential Information. Executive agrees that all restrictions contained in this Section 7 are reasonable and valid

under the circumstances and hereby waives all defenses to the strict enforcement thereof by the Company.

Notwithstanding

the foregoing, nothing in this Agreement is intended to or will be used in any way to prevent Executive from testifying truthfully under

oath in a judicial proceeding or to limit Executive’s right to communicate with a government agency, as provided for, protected

under or warranted by applicable law. Further, Executive shall not be held criminally or civilly liable under any federal or state trade

secret law for the disclosure of a trade secret that (i) is made in confidence to a federal, state, or local government official, either

directly or indirectly, or to an attorney and solely for the purpose of reporting or investigating a suspected violation of law or (ii)

is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. In addition, if Executive

files a lawsuit for retaliation for reporting a suspected violation of law, Executive may disclose the trade secret to their attorney

and use the trade secret information in the court proceeding, as long as Executive files any document containing the trade secret under

seal and does not disclose the trade secret, except pursuant to court order.

Executive

agrees that, upon the request of the Company, or in any event immediately upon termination of their employment for whatever reason, Executive

will immediately deliver up to the Company or its designee all Confidential Information in Executive’s possession or control, and

all notes, records, memoranda, correspondence, files and other papers, and all copies thereof, relating to or containing Confidential

Information. Executive does not have, nor can Executive acquire, any property or other rights in Confidential Information.

8.

PROPERTY OF THE COMPANY

All

ideas, inventions, discoveries, proprietary information, know-how, processes and other developments and, more specifically, improvements

to existing inventions, conceived by Executive, alone or with others, during the term of Executive’s employment with the Company,

whether or not during working hours and whether or not while working on a specific project, that are within the scope of the Company’s

Business operations or that relate to any work or projects of the Company, shall be deemed to be a “work made for hire” (as

defined in the United States Copyright Act, 17 U.S.C.A. §101 et seq., as amended) to the greatest extend possible and are and will

remain the exclusive property of the Company. Inventions, improvements and discoveries relating to the Business of the Company conceived

or made by Executive, either alone or with others, while employed with the Company are conclusively and irrefutably presumed to have

been made during the period of employment and are the sole property of the Company. The Executive will promptly disclose in writing any

such matters to the Company but to no other person without the consent of the Company. Executive hereby assigns and agrees to assign

all right, title and interest in and to such matters to the Company. Executive will, upon request of the Company, execute such assignments

or other instruments and assist the Company in the obtaining, at the Company’s sole expense, of any patents, trademarks or similar

protection, if available, in the name of the Company.

9.

PROTECTIVE COVENANTS

(a) Non-Solicitation

of Customers, Clients, or Vendors. During Executive’s employment and for a period of two (2) years following the date of

any voluntary or involuntary termination of Executive’s employment for any reason, Executive agrees not to solicit, directly

or indirectly (including by assisting others), any business from any of the Company’s customers, clients, or vendors

(including actively sought prospective customers, clients, or vendors) with whom Executive has had material contact during the most

recent two (2) years prior to the solicitation for the purpose of providing products or services that are competitive with those

provided by the Company.

(b) Non-Piracy

of Employees. During Executive’s employment and for a period of two (2) years following the date of any voluntary or

involuntary termination of Executive’s employment for any reason, Executive covenants and agrees that Executive will not,

directly or indirectly, on Executive’s own behalf or on behalf of any other person or entity (i) solicit, recruit or hire (or

attempt to solicit, recruit or hire) or otherwise assist anyone in soliciting, recruiting or hiring, any employee or independent

contractor of the Company who performed work for the Company and with whom Executive had material business contact within the last

year of Executive’s employment with the Company to work for or provide services to any business that competes with the

Business, or (ii) otherwise encourage, solicit or support any such employee or independent contractor to leave their or their

employment or engagement with the Company or to violate the terms of any agreement or understanding between that individual and the

Company.

(c) Non-Compete.

During Executive’s employment with the Company and for a period of two (2) years following the date of any voluntary, or one

(1) year following the date of any involuntary, termination of Executive’s employment for any reason, Executive agrees not to,

directly or indirectly, either on Executive’s own behalf or on behalf of any other person or entity, in the Territory, compete

with the Company by performing services for any person or entity competitor engaging in competition with the Business, that are the

same as or similar to the duties performed by Executive during the most recent two (2)-year period, provided that the foregoing will

not prohibit Executive from owning not more than five percent (5%) of the outstanding stock of a corporation subject to the

reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The

“Territory” will be defined to be that geographic area comprised of the following states in the United States of

America, the District of Columbia, and the Canadian provinces of Quebec and Alberta:

| Alabama |

Indiana |

Nebraska |

South

Carolina |

| Alaska |

Iowa |

Nevada |

South

Dakota |

| Arizona |

Kansas |

New

Hampshire |

Tennessee |

| Arkansas |

Kentucky |

New

Jersey |

Texas |

| California |

Louisiana |

New

Mexico |

Utah |

| Colorado |

Maine |

New

York |

Vermont |

Connecticut

|

Maryland |

North

Carolina |

Virginia |

| Delaware |

|

|

|

| Florida |

Massachusetts |

North

Dakota |

Washington |

| Georgia |

Michigan |

Ohio |

West

Virginia |

| Hawaii |

Minnesota |

Oklahoma |

Wisconsin |

| Idaho |

Mississippi |

Oregon |

Wyoming |

| Illinois |

Missouri |

Pennsylvania |

|

| |

Montana |

Rhode

Island |

|

;

provided, however, that the Territory described herein is a good faith estimate of the geographic area that is now applicable as

the area in which the Company does business during the term of Executive’s employment, and the Company and Executive agree that

this non-compete covenant will ultimately be construed to cover only so much of such Territory as relates to the geographic areas in

which the Executive does business for and on behalf of the Company within the most recent two (2)-year period.

10.

TERM

Unless

earlier terminated pursuant to Section 11 herein, the term of this Agreement will be for a period beginning on the effective date specified

in Exhibit A and ending on 12/05/2024 (the “Initial Term”). Upon expiration of the Initial Term, this Agreement

will automatically renew in successive twelve (12)-month periods (each a “Renewal Period”), unless Executive or the

Company notifies the other party at least sixty (60) days prior to the end of the Initial Term or the applicable Renewal Period that

this Agreement will not be renewed. The Initial Term, and, if this Agreement is renewed in accordance with this Section 10, each Renewal

Period, will be included in the definition of “Term” for purposes of this Agreement. Unless waived in writing by the

Company, the requirements of Section 7 (Confidential Information and Trade Secrets), Section 8 (Property of the Company) and Section

9 (Protective Covenants) will survive the expiration or termination of this Agreement or Executive’s employment for any reason.

11.

TERMINATION

(a) Death.

This Agreement and Executive’s employment hereunder will be terminated on the death of Executive, effective as of the date of

Executive’s death. In such event, the Company will pay to the estate of Executive the sum of (i) accrued but unpaid Base

Salary (as defined in Exhibit A) earned prior to Executive’s death (to be paid in accordance with normal practices of the

Company or as otherwise required by law) and (ii) expenses incurred by Executive prior to their death for which Executive is

entitled to reimbursement under (and paid in accordance with) Section 4 herein, and Executive will be entitled to no severance or

other post-termination benefits.

(b) Continued

Disability. This Agreement and Executive’s employment hereunder may be terminated, at the option of the Company, upon a

Continued Disability (as defined herein) of Executive. For the purposes of this Agreement, and unless otherwise required under

Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), “Continued

Disability” will be defined as the inability or incapacity (either mental or physical) of Executive to continue to perform

Executive’s duties hereunder for a continuous period of one hundred twenty (120) working days, or if, during any calendar year

of the Term hereof because of disability, Executive was unable to perform Executive’s duties hereunder for a total period of

one hundred eighty (180) working days regardless of whether or not such days are consecutive. The determination as to whether

Executive is unable to perform the duties of Executive’s job will be made by the Board or the Committee in its reasonable

discretion; provided, however, that if Executive is not satisfied with the decision of the Board or the Committee, Executive

will submit to examination by three (3) competent physicians who practice in the metropolitan area in which the Company maintains

its principal executive office, one of whom will be selected by the Company, another of whom will be selected by Executive, with the

third to be selected by the physicians so selected. The determination of a majority of the physicians so selected will supersede the

determination of the Board or the Committee and will be final and conclusive. In the event of the termination of Executive’s

employment due to Continued Disability, the Company will provide to Executive (i) accrued but unpaid Base Salary earned through the

date of the Executive’s termination of employment (paid in accordance with the normal practices of the Company or as otherwise

required by law), (ii) expenses incurred by Executive prior to their termination of employment for which Executive is entitled to

reimbursement under (and paid in accordance with) Section 4 herein, and (iii) any vested benefits earned by the Executive under any

employee benefit plan of the Company or its affiliates under which he was participating immediately prior to the termination date,

which such benefits to be provided in accordance with the terms of the applicable employee benefit plan (the “Accrued

Obligations”), and Executive will be entitled to no severance or other post-termination benefits.

(c) Termination

by the Company for Good Cause, by Executive Other Than for Good Reason, or upon Non-Renewal of the Term by Company or Executive.

Notwithstanding any other provision of this Agreement, the Company may at any time terminate this Agreement and Executive’s

employment hereunder for Good Cause, Executive may at any time terminate her employment other than for Good Reason (as defined in

Section 11(d) herein), Company may notify Executive that it will not renew the Term, or Executive may notify the Company that he

will not renew the Term. For this purpose, “Good Cause” will include the following: the current use of illegal

drugs; conviction of any crime which involves moral turpitude, fraud or misrepresentation; commission of any act which would

constitute a felony or which adversely impacts the business or reputation of the Company; fraud; misappropriation or embezzlement of

Company funds or property; willful misconduct or grossly negligent or reckless conduct which is materially injurious to the

reputation, business or business relationships of the Company; material violation or default on any of the provisions of this

Agreement; or material and continuous failure to meet reasonable performance criteria or reasonable standards of conduct as

established from time to time by the Board, which failure continues for at least thirty (30) days after written notice from the

Company to Executive. Notice of a termination by the Company for Good Cause will be delivered in writing to Executive stating the

Good Cause for such action. If the employment of Executive is terminated by the Company for Good Cause, if Executive terminates

employment for any reason other than for Good Reason (including, but not limited to, resignation or retirement), or if Executive

notifies the Company he will not renew the Term, then, the Company will provide Executive (i) accrued but unpaid salary through the

termination date (paid in accordance with the normal practices of the Company or as otherwise required by law), (ii) expenses

incurred by Executive prior to their termination date for which Executive is entitled to reimbursement under (and paid in accordance

with) Section 4 herein and (iii) any vested benefits earned by the Executive under any employee benefit plan of the Company or its

affiliates under which he was participating immediately prior to the termination date, which such benefits to be provided in

accordance with the terms of the applicable employee benefit plan, and Executive will be entitled to no severance or other post-

termination benefits. For the sake of clarity, no election by the Company not to renew the Term will trigger any rights to severance

or other benefits.

(d) Termination

by the Company without Good Cause or by Executive for Good Reason. The Company may terminate this Agreement and

Executive’s employment at any time, including for reasons other than Good Cause (as “Good Cause” is defined

in Section 11(c) above. For the purposes herein, “Good Reason” will mean (i) a material diminution of

Executive’s base salary; (ii) a material diminution in Executive’s authority, duties, or responsibilities; or (iii) any

other action or inaction that constitutes a material breach of the terms of this Agreement; provided that Executive’s

termination will not be treated as for Good Reason unless Executive provides the Company with notice of the existence of the

condition claimed to constitute Good Reason within ninety (90) days of the initial existence of such condition and the Company fails

to remedy such condition within thirty (30) days following the Company’s receipt of such notice. In the event that (i) the

Company terminates the employment of Executive during the Term for reasons other than for Good Cause, death or Continued Disability

or (ii) Executive terminates employment for Good Reason, then Executive shall be entitled to the Accrued Obligations (as defined in

Section 11(b)) and, subject to Executive’s signing, delivering and not revoking a complete general release of all claims

against the Company in a form acceptable to the Company (the “Release”), which Release must be signed, delivered and not

revoked within the period set forth in the Release, and provided that Executive is not in default of her obligations under Section

7, 8, or 9 herein, the following:

(i)

Payment of an amount equal to six (6) months of Executive’s base salary in effect at the time of termination, payable in

accordance with the regular pay periods of the Company (but no less frequently than monthly and in equal installments) beginning on

the first payroll date following the date of termination of employment provided, however, that all payments otherwise due during the

first sixty (60) days following termination of employment shall be accumulated and, if the Release requirements have been met, paid

on the sixtieth (60th) day following termination of employment.

(ii)

Payment of the Annual Bonus (as defined in Exhibit A) at the rate of base pay and subject to attainment of annual performance goals

specified in Exhibit A for the fiscal year during which Executive terminates employment under this Section 11(d), prorated for the

number of months from the beginning of the fiscal year through the date of termination and payable at the same time the Annual Bonus

(if any) is normally payable as set forth in Exhibit A. For purposes of this provision, and by way of example, if Executive’s

employment is terminated under this Section 11(d)after the last day of a fiscal year but before the Annual Bonus (if any) for such

completed fiscal year is paid, Executive shall be entitled to receive the Annual Bonus (to the extent earned) for the full prior

fiscal year period as well as any Annual Bonus earned for any period within the new fiscal year prorated from the beginning of such

fiscal year through the date of termination. Any Annual Bonus payable under this Section 11(d) shall be paid in a lump sum in the

normal course of bonus payouts, if the Company is achieving the basic budgeted numbers through the date of termination (as

determined by the Committee or Company in its sole discretion), Executive will receive the Annual Bonus post-termination, accrued as

is applicable. The “basic budgeted numbers” for purposes of this provision are sales bookings, revenue and adjusted

EBITDA.

(iii)

Payment of an amount equal to the product of six (6) times the monthly rate of the Company’s

subsidy for coverage in its medical, dental and vision plans for active employees (including any applicable coverage for spouses and

dependents) in effect on the date of termination, payable in a lump sum on the sixtieth (60th) day following termination of employment.

The

payments set forth in Section 11(d)(i), (ii) and (iii) are collectively referred to as the “Severance Payments.” All

other rights the Executive may have, other than as set forth in this Section, shall terminate upon such termination.

12.

NOTIFICATION TO PROSPECTIVE EMPLOYERS

If

Executive seeks or is offered employment by any other company, firm or person during their employment or during the post- termination

restricted periods, he will notify the prospective employer of the existence and terms of the Confidential Information and Trade Secrets

provision in Section 7 and the Protective Covenants provision in Section 9 of this Agreement. Executive may disclose the language of

Sections 7 and 9 but may not disclose the remainder of this Agreement.

13.

CHANGE IN CONTROL

(a)

In the event of a Change in Control (as defined herein) of the Company during the Term,

(i) If

Executive has remained continuously employed with the Company through the date of the Change in Control, all stock options,

restricted stock, and all other equity awards (if any) granted to Executive that are outstanding immediately prior to the Change in

Control shall immediately vest in full as of the date of the Change in Control.

(ii) If,

during the Term and within ninety (90) days prior to or twelve (12) months following a Change in Control, the Company terminates the

employment of Executive for reasons other than for Good Cause, death or Continued Disability, then, Executive shall receive the

Accrued Obligations (as defined in Section 6(a), and, subject to the Release requirements set forth in Section 11(d) and provided

that Executive is not in default of her obligations under Section 7, 8, or 9 herein, (A) Executive shall be entitled to the

Severance Payments set forth in and pursuant to Section 11(d) and (B) all stock options, restricted stock, and other equity awards

(if any) granted to Executive that are outstanding immediately prior to the date of termination shall immediately vest in full as of

the date of termination and, with respect to any outstanding options, will remain exercisable by Executive from such vesting date

(i.e., the date of termination) until the earlier of: (x) the end of the applicable option period or (y) one hundred and eighty

(180) days from the date of Executive’s termination of employment.

(b)

For purposes of this Agreement, “Change in Control” means any of the following events:

(i) A

change in control of the direction and administration of the Company’s business of a nature that would be required to be

reported in response to Item 6(e) of Schedule 14A of Regulation 14A promulgated under the Exchange Act, as in effect on the date

hereof and any successor provision of the regulations under the Exchange Act, whether or not the Company is then subject to such

reporting requirements; or

(ii) Any

“person” (as such term is used in Section 13(d) and Section 14(d)(2) of the Exchange Act but excluding any

employee benefit plan of the Company) is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the

Exchange Act), directly or indirectly, of securities of the Company representing more than one half (1/2) of the combined voting

power of the Company’s outstanding securities then entitled to vote for the election of directors; or

(iii) The

Company sells all or substantially all of the assets of the Company; or

(iv) The

consummation of a merger, reorganization, consolidation or similar business combination that constitutes a change in control as

defined in the Company’s 2013 Second Amended and Restated Stock Incentive Plan or other successor stock plan or results in the

occurrence of any event described in Sections 13(b) (i), (ii) or (iii) above.

Notwithstanding

the foregoing, a Change in Control will not be deemed to have occurred unless such event would also be a Change in Control under Code

Section 409A or would otherwise be a permitted distribution event under Code Section 409A.

(c)

If any payment or distribution by the Company to or for the benefit of Executive, whether paid or payable or distributed or

distributable pursuant to the terms of this Agreement or otherwise pursuant to or by reason of any other agreement, policy, plan,

program or arrangement or the lapse or termination of any restriction on or the vesting or exercisability of any payment or benefit

(each a “Payment”), would be subject to the excise tax imposed by Section 4999 of the Code (or any successor

provision thereto) or to any similar tax imposed by state or local law (such tax or taxes are hereafter collectively referred to as

the “Excise Tax”), then the aggregate amount of Payments payable to Executive shall be reduced to the aggregate

amount of Payments that may be made to the Executive without incurring an excise tax (the “Safe-Harbor Amount”)

in accordance with the immediately following sentence. Any such reduction shall be made in the following order: (i) first, any

future cash payments (if any) shall be reduced (if necessary, to zero); (ii) second, any current cash payments shall be reduced (if

necessary, to zero); (iii) third, all non-cash payments (other than equity or equity derivative related payments) shall be reduced

(if necessary, to zero); and (iv) fourth, all equity or equity derivative payments shall be reduced.

14.

ACKNOWLEDGEMENTS

The

Company and Executive each hereby acknowledge and agree as follows:

(a)

The covenants, restrictions, agreements and obligations set forth herein are founded upon valuable consideration, and, with respect

to the covenants, restrictions, agreements and obligations set forth in Sections 7 and 9 hereof, are reasonable in duration, the

activities proscribed, and geographic scope;

(b)

In the event of a breach or threatened breach by Executive of any of the covenants, restrictions, agreements and obligations set

forth in Sections 7 or 9 hereof, monetary damages or the other remedies at law that may be available to the Company for such breach

or threatened breach will be inadequate and, without prejudice to the Company’s right to pursue any other remedies at law or

in equity available to it for such breach or threatened breach, including, without limitation, the recovery of damages from

Executive, the Company will be entitled to injunctive relief from a court of competent jurisdiction or the arbitrator;

and

(c)

The time period, proscribed activities, and geographical area set forth in the Confidential Information and Trade Secrets provision

in Section 7 or the Protective Covenants provision in Section 9 hereof are each divisible and separable, and, in the event that they

are judicially held invalid or unenforceable as to such time period, scope of activities, or geographical area, they will be valid

and enforceable to such extent and in such geographical area(s) and for such time period(s) which the court or arbitrator determines

to be reasonable and enforceable. Executive agrees that in the event any court of competent jurisdiction or arbitrator determines

that the covenants in Sections 7 and 9 are invalid or unenforceable to join with the Company in requesting that court or arbitrator

to construe the applicable provision by limiting or reducing it so as to be enforceable to the extent compatible with the then

applicable law. Furthermore, any period of restriction or covenant herein stated will not include any period of violation or period

of time required for litigation to enforce such restriction or covenant and Executive agrees that the time periods for the covenants

in Sections 7 and 9 of this Agreement shall be tolled during any period in which Executive is in violation of either of those

provisions.

15.

NOTICES

Any

notice or communication required or permitted hereunder will be given in writing and will be sufficiently given if delivered by email

or sent by overnight, nationally recognized courier to such party addressed as follows:

(a) In the case of the Company, if addressed to it as follows:

Streamline

Health Solutions, Inc.

2400

Old Milton Parkway Box #1353

Alpharetta,

GA 30009

Attn:

Chief People Officer

Email:

wendy.lovvorn@streamlinehealth.net

(b)

In the case of Executive, if addressed to Executive at the most recent address on file with the Company.

Any

such notice delivered personally or sent via mail will be deemed to have been received on the date it is delivered. Any address for the

giving of notice hereunder may be changed by notice in writing.

16.

ASSIGNMENT, SUCCESSORS AND ASSIGNS

This

Agreement will inure to the benefit of and be binding upon the parties hereto and their respective legal representatives, successors

and assigns. The Company may assign or otherwise transfer its rights under this Agreement to any successor or affiliated business or

corporation (whether by sale of stock, merger, consolidation, sale of assets or otherwise), but this Agreement may not be assigned, nor

may her duties hereunder be delegated, by Executive. In the event that the Company assigns or otherwise transfers its rights under this

Agreement to any successor or affiliated business or corporation (whether by sale of stock, merger, consolidation, sale of assets or

otherwise), for all purposes of this Agreement, the “Company” will then be deemed to include the successor or affiliated

business or corporation to which the Company, assigned or otherwise transferred its rights hereunder.

17.

MODIFICATION

This

Agreement may not be released, discharged, abandoned, changed or modified by the parties in any manner, except by an instrument in writing

signed by each of the parties hereto.

18.

SEVERABILITY AND WAIVER

The

invalidity or unenforceability of any particular provision of this Agreement will not affect any other provisions hereof, and the parties

will use their best efforts to substitute a valid, legal and enforceable provision, which, insofar as practical, implements the purpose

of this Agreement. If the parties are unable to reach such agreement, then the provisions will be modified as set forth in Section 14(c)

above. Any failure to enforce any provision of this Agreement will not constitute a waiver thereof or of any other provision hereof.

19.

COUNTERPARTS

This

Agreement may be signed in counterparts (and delivered via facsimile transmission or by digitally scanned signature delivered electronically),

and each of such counterparts will constitute an original document and such counterparts, taken together, will constitute one and the

same instrument.

20.

ENTIRE AGREEMENT

This

constitutes the entire agreement among the parties with respect to the subject matter of this Agreement and supersedes all prior and

contemporaneous agreements, understandings, and negotiations, whether written or oral, with respect to such subject matter.

21.

DISPUTE RESOLUTION

Except

as set forth in Section 14 above, and excluding ERISA health and disability plan claims, workers’ compensation claims, unemployment

compensation claims, claims related to sexual harassment or assault, claims to enforce the Confidential Information and Trade Secrets

provision in Section 7 or the Protective Covenants provision in Section 9 , or any other claims that cannot be required to be arbitrated

as a matter of law, any and all disputes arising out of or in connection with the execution, interpretation, performance or non-performance

of this Agreement or any agreement or other instrument between, involving or affecting the parties (including the validity, scope and

enforceability of this arbitration clause) (“Covered Claims”), will be submitted to and resolved by arbitration. The arbitration

will be conducted pursuant to the terms of the Federal Arbitration Act and the Employment Arbitration Rules and Mediation Procedures

of the American Arbitration Association effective at the time of filing, as supplemented by the terms of this Agreement. This Agreement

means that Streamline and Executive agree to use binding arbitration, instead of going to court, for any Covered Claims that arise between

Executive and Streamline or any of Streamline’s employees or agents. Executive understands and agrees that arbitration is the only

forum for resolving Covered Claims and that both Streamline and he are waiving the right to a trial before a judge or a jury in federal

or state court in favor of arbitration for them. Streamline and Executive agree that Covered Claims will be arbitrated only on an individual

basis, and that both Streamline and Executive waive the right to participate in or receive money or any other relief from any class,

collective or representative proceeding of Covered Claims. No party may bring a claim on behalf of other individuals, and any arbitrator

hearing a Covered Claim may not: (i) combine more than one individual’s claim or claims into a single case; (ii) participate in

or facilitate notification of others of potential claims; or (iii) arbitrate any form of a class, collective or representative proceeding.

Streamline will pay the arbitrator’s fees and expenses, including but not limited to travel fees, per diem costs, and any administrative

fees. In the event that Executive initiates an arbitration proceeding under this Agreement, Executive shall be liable for the AAA-mandated

portion of the filing fee not to exceed $300.00; Streamline shall pay the remainder of any filing fee in excess of that amount as set

forth in the applicable AAA Employment/Workplace Fee Schedule. The arbitrator shall have the authority to award the same damages or other

relief that would have been available in court pursuant to applicable law. Streamline and Executive agree that the arbitrator shall have

the additional right to rule on motions to dismiss and/or motions for summary judgment, applying the standards governing such motions

under the Federal Rules of Civil Procedure. Executive understands that the ability of the parties to obtain documents, witness statements,

and other discovery is generally more limited in arbitration than in court proceedings. Executive also understands that arbitration awards

are generally final and binding, and a party’s ability to have a court reverse or modify an arbitration award is very limited.

The arbitrator must issue an award in writing, setting forth the reasons for the arbitrator’s determination. The arbitrator’s

authority shall be limited to deciding the case submitted by the party bringing the arbitration and any counterclaims filed therein.

Therefore, no decision by any arbitrator under this Agreement shall serve as precedent in other arbitrations. If the arbitrator makes

an award, a judgment on the award may be entered in any court having jurisdiction. Either party may notify the other party at any time

of the existence of a controversy potentially requiring arbitration by certified mail, and the parties will attempt in good faith to

resolve their differences within fifteen (15) days after the receipt of such notice. If the dispute cannot be resolved within the fifteen-day

period, either party may file a written demand for arbitration with the American Arbitration Association. The place of arbitration will

be Atlanta, Georgia.

| /s/

Bryant James Reeves III |

|

/s/

Benjamin L. Stilwill |

| Initial

by Executive |

|

Initial

by the Company |

22.

GOVERNING LAW; FORUM SELECTION

The

provisions of this Agreement will be governed by and interpreted in accordance with the internal laws of the State of Georgia and the

laws of the United States applicable therein. Executive acknowledges and agrees that Executive is subject to personal jurisdiction in

state and federal courts in Georgia, and waives any objection thereto.

23.

CODE SECTION 409A

Notwithstanding

any other provision in this Agreement to the contrary, if and to the extent that Code Section 409A is deemed to apply to any benefit

under this Agreement, it is the general intention of the Company that such benefits will, to the extent practicable, comply with, or

be exempt from, Code Section 409A, and this Agreement will, to the extent practicable, be construed in accordance therewith. To the maximum

extent permitted under Code Section 409A and its corresponding regulations, Severance Payments under this Agreement are intended to meet

the requirements of the short-term deferral exemption under Code Section 409A and the “separation pay exception” under Treas.

Reg. §1.409A-1(b)(9)(iii). For purposes of the application of Treas. Reg. § 1.409A-1(b)(4) (or any successor provision), each

payment in a series of payments to the Executive will be deemed a separate payment. Deferrals of benefits distributable pursuant to this

Agreement that are otherwise exempt from Code Section 409A in a manner that would cause Code Section 409A to apply will not be permitted

unless such deferrals follow Code Section 409A. In the event that the Company (or a successor thereto) has any stock which is publicly

traded on an established securities market or otherwise and Executive is determined to be a “specified employee” (as

defined under Code Section 409A), any payment that is deemed to be deferred compensation under Code Section 409A to be made to the Executive

upon a separation from service may not be made before the date that is six (6) months after Executive’s separation from service

(or death, if earlier). To the extent that Executive becomes subject to the six (6)-month delay rule, all payments that would have been

made to Executive during the six (6) months following her separation from service that are not otherwise exempt from Code Section 409A,

if any, will be accumulated and paid to Executive during the seventh (7th) month following her separation from service, and any remaining

payments due will be made in their ordinary course as described in this Agreement. For the purposes herein, the phrase “termination

of employment” or similar phrases will be interpreted in accordance with the term “separation from service”

as defined under Code Section 409A if and to the extent required under Code Section 409A. Further, (i) in the event that Code Section

409A requires that any special terms, provisions or conditions be included in this Agreement, then such terms, provisions and conditions

will, to the extent practicable, be deemed to be made a part of this Agreement, and (ii) terms used in this Agreement will be construed

in accordance with Code Section 409A if and to the extent required. Further, in the event that this Agreement or any benefit thereunder

will be deemed not to comply with Code Section 409A, then neither the Company, the Board, STRM, the Committee nor its or their affiliates

designees or agents will be liable to any participant or other person for actions, decisions or determinations made in good faith.

24.

WITHHOLDING.

The

Company may withhold from any amounts payable under this Agreement such federal, state, local or foreign taxes as will be required to

be withheld pursuant to any applicable law or regulation.

25.

ATTORNEYS’ FEES.

If

the Company successfully enforces any right under this Agreement through legal process of any kind, then the Company shall be entitled

to recover from Executive its costs of such enforcement, including reasonable attorneys’ fees.

[Signature

page follows.]

IN

WITNESS WHEREOF, this Agreement has been executed by the parties hereto as of the date first above written.

| |

STREAMLINE HEALTH SOLUTIONS, INC. |

| |

|

|

| |

By: |

/s/

Benjamin L. Stilwill |

| |

Benjamin L. Stilwill |

| |

President & Chief Executive Officer |

| |

|

|

| |

EXECUTIVE |

| |

|

|

| |

By: |

/s/

Bryant James Reeves III |

| |

Bryant James Reeves III |

[Signature Page to - Employment Agreement]

EXHIBIT

A TO EMPLOYMENT AGREEMENT (THE “AGREEMENT”) DATED AS OF December 04, 2023, BETWEEN STREAMLINE HEALTH LLC AND Bryant

James Reeves — COMPENSATION AND BENEFITS

| 1. | Effective

Date. This agreement is dated December 4th, 2023 and is effective as

of December 4, 2023. |

| 2. | Base

Salary. Base Salary will be paid at an annualized

rate of $185,000,

which will be subject

to annual review and adjustment

by the Committee but

will not be

reduced below $185,000

without the consent of Executive (“Base Salary”). Such amounts

will be payable to Executive in accordance

with the normal payroll

practices of the Company,

but not less frequently than monthly. |

| 3. | Annual

Bonus.

During the

term of employment, Executive will be eligible to participate in and earn an annual bonus

of up to thirty percent (25%) of Executive’s then current Base Salary, subject to attainment

of annual performance goals determined by the Committee or Board and in accordance with the

terms of the Company’s or STRM’s executive bonus plan, as may be amended from

time to time. |

| 4. | Benefits.

Executive will be eligible to participate in

the Company’s or STRM’s benefit plans generally

made available by the Company or STRM to Company

employees, subject to all terms and

conditions of

such plans as they may be

amended from time to time. During the Term,

Executive will accrue vacation

days and

personal days totaling an aggregate

of twenty (20) days per

annum, prorated for fiscal year ended January

31, 2023, in accordance with the Company’s vacation policies, as in effect from time

to time. The Company reserves the right to amend or cancel any employee benefit plans

at any time in its sole discretion, subject to the terms of such employee benefit plan and

applicable law. |

| 5. | Grant

of

Restricted

Stock.

On or as soon as administratively feasible following the execution of this Agreement and

subject to approval of the Committee, Executive will receive

a grant of 50,000 shares of restricted stock. The vesting of such shares will occur

in three (3) equal annual installments over the first three years of continuous employment

under this Agreement. Such grant will be

made pursuant to, and otherwise subject

to, the terms and conditions

of the Streamline Health Solutions, Inc.

Third Amended and Restated 2013

Stock Incentive Plan and

the related restricted stock grant agreement. |

v3.23.3

Cover

|

Dec. 01, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 01, 2023

|

| Entity File Number |

0-28132

|

| Entity Registrant Name |

Streamline

Health Solutions, Inc.

|

| Entity Central Index Key |

0001008586

|

| Entity Tax Identification Number |

31-1455414

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2400

Old Milton Pkwy.

|

| Entity Address, Address Line Two |

Box 1353

|

| Entity Address, City or Town |

Alpharetta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30009

|

| City Area Code |

(888)

|

| Local Phone Number |

997-8732

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.01 par value

|

| Trading Symbol |

STRM

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

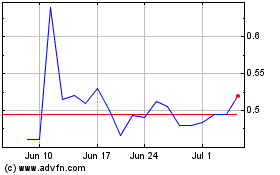

Streamline Health Soluti... (NASDAQ:STRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

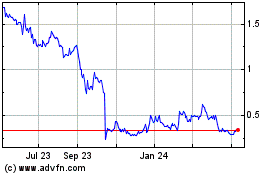

Streamline Health Soluti... (NASDAQ:STRM)

Historical Stock Chart

From Apr 2023 to Apr 2024