0001377789false00013777892023-12-072023-12-070001377789us-gaap:CommonStockMember2023-12-072023-12-070001377789us-gaap:PreferredStockMember2023-12-072023-12-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

Form 8-K

______________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 7, 2023

_______________________

AVIAT NETWORKS, INC.

(Exact name of registrant as specified in its charter)

______________________________________

| | | | | | | | | | | | | | |

Delaware | | 001-33278 | | 20-5961564 |

(State or other jurisdiction | | (Commission File | | (I.R.S. Employer |

of incorporation) | | Number) | | Identification No.) |

| | | | |

200 Parker Dr., Suite C100A, Austin, Texas 78728 |

(Address of principal executive offices, including zip code) |

| | | | |

| | (408)-941-7100 | | |

| Registrant’s telephone number, including area code | |

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | AVNW | | NASDAQ Stock Market LLC |

| Preferred Share Purchase Rights | | | | NASDAQ Stock Market LLC |

☐ Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure.

On December 7, 2023, Aviat Networks, Inc. (“Aviat” or the “Company”) posted an updated investor relations presentation to its investor relations portion of its public website: www.investors.aviatnetworks.com. The Company will begin using the investor relations presentation in connection with presentations to existing and prospective investors. A copy of the investor relations presentation is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 7.01, including Exhibit 99.1 hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are filed with this Current Report on Form 8-K:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1* | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Forward-Looking Statements

The information contained in this Current Report on Form 8-K includes forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including Aviat’s beliefs and expectations regarding the Transaction with NEC, outlook, business conditions, new product solutions, customer positioning, future orders, bookings, new contracts, cost structure, profitability in fiscal 2024, process improvements, plans and objectives of management, realignment plans and review of strategic alternatives and expectations regarding future revenue, Adjusted EBITDA, operating income of earnings or loss per share. All statements, trend analyses and other information contained herein regarding the foregoing beliefs and expectations, as well as about the markets for the services and products of Aviat and trends in revenue, and other statements identified by the use of forward-looking terminology, including “anticipate,” “believe,” “plan,” “estimate,” “expect,” “goal,” “will,” “see,” “continue,” “delivering,” “view,” and “intend,” or the negative of these terms or other similar expressions, constitute forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, forward-looking statements are based on estimates reflecting the current beliefs, expectations and assumptions of the senior management of Aviat regarding the future of its business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Such forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Forward-looking statements should therefore be considered in light of various important factors, including those set forth in this document. Therefore, you should not rely on any of these forward-looking statements.

Important factors that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include the following: disruption the NEC Transaction may cause to customers, vendors, business partners and our ongoing business; our ability to integrate the operations of the acquired NEC Corporation businesses with our existing operations and fully realize the expected synergies of the NEC Transaction on the expected timeline; the impact of COVID-19; disruptions relating to the ongoing conflict between Russia and Ukraine and the conflict in Israel and surrounding areas; continued price and margin erosion in the microwave transmission industry; the impact of the volume, timing, and customer, product, and geographic mix of our product orders; our ability to meet financial covenant requirements; the timing of our receipt of payment; our ability to meet product development dates or anticipated cost reductions of products; our suppliers' inability to perform and deliver on time, component shortages, or other supply chain constraints; the effects of inflation; customer acceptance of new products; the ability of our subcontractors to timely perform; weakness in the global economy affecting customer spending; retention of our key personnel; our ability to manage and maintain key customer relationship; uncertain economic conditions in the telecommunications sector combined with operator and supplier consolidation; our failure to protect our intellectual property rights or defend against intellectual property infringement claims; the results of our restructuring efforts; the effects of currency and interest rate risks; the effects of current and future government regulations; general economic conditions, including uncertainty regarding the timing, pace and extent of an economic recovery in the United

States and other countries where we conduct business; the conduct of unethical business practices in developing countries; the impact of political turmoil in countries where we have significant business; our ability to realize the anticipated benefits of any proposed or recent acquisitions; the impact of tariffs, the adoption of trade restrictions affecting our products or suppliers, a United States withdrawal from or significant renegotiation of trade agreements, the occurrence of trade wars, the closing of border crossings, and other changes in trade regulations or relationships; our ability to implement our stock repurchase program or that it will enhance long-term stockholder value; and the impact of adverse developments affecting the financial services industry, including events or concerns involving liquidity, defaults or non-performance by financial institutions.

For more information regarding the risks and uncertainties for Aviat’s business, see “Risk Factors” in Aviat’s Form 10-K for the fiscal year ended June 30, 2023 filed with the U.S. Securities and Exchange Commission (“SEC”) on August 30, 2023, as well as other reports filed by Aviat with the SEC from time to time. Aviat undertakes no obligation to update publicly any forward-looking statement, whether written or oral, for any reason, except as required by law, even as new information becomes available or other events occur in the future.

SIGNATURE

| | | | | | | | | | | | | | | | | | | | |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| | | | | | |

| | AVIAT NETWORKS, INC. |

| | |

| Date: December 7, 2023 | | By: | | /s/ David M. Gray |

| | | | Name: | | David M. Gray |

| | | | Title: | | Senior Vice President and Chief Financial Officer |

Aviat Networks Investor Presentation Fiscal Q1 2024 December 7, 2023

The information contained in this presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 21E of the Securities Exchange Act and Section 27A of the Securities Act, including expectations regarding our results for the fiscal year 2024. All statements, trend analyses and other information contained herein about the markets for the services and products of Aviat Networks, Inc. and trends in revenue, as well as other statements identified by the use of forward-looking terminology, including "anticipate," "believe," "plan," "estimate," "expect," "goal," "will," "see," "continue," "delivering," "view," and "intend," or the negative of these terms or other similar expressions, constitute forward-looking statements. These forward-looking statements are based on estimates reflecting the current beliefs of the senior management of Aviat Networks, Inc. These forward- looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. For more information regarding the risks and uncertainties for our business, see "Risk Factors" in our most recent Form 10-K filed with the U.S. Securities and Exchange Commission ("SEC"), as well as other reports filed by Aviat Networks, Inc. with the SEC from time to time. Aviat Networks, Inc. undertakes no obligation to update publicly any forward-looking statement for any reason, except as required by law, even as new information becomes available or other events occur in the future. Forward-Looking Statements AVIAT NETWORKS

AVIAT NETWORKS Aviat Networks is the leading wireless transport and access solutions provider NASDAQ Listed: AVNW Headquartered in Austin, TX 3,000+ Customers Worldwide Global Manufacturing Capabilities Leading Technologies – 200+ Patents 3 Company Overview AviatCloudLTE Wireless Transport Access Routers Software Services End-to-End Portfolio North America 59% MEA 17% Europe 6% LATAM & APAC 18% Private Networks 67% Mobile Networks 33% R e v e n u e b y R e g io n R e v e n u e b y M a rk e t Revenue Summary Points of Excellence Lowest Total Cost of Ownership Mission Critical Solutions Leader Unrivaled Microwave Expertise Innovative Products and Services LTM Revenue: $353 Million

AVIAT NETWORKS4 A Long History of Wireless Leadership Invigorated by New Leadership and Consistent Execution Over 75 Years of Expertise 1944 Aviat Networks can trace its wireless beginnings back to Lenkurt Electric 2007 Harris Stratex Networks forms as the result of the merger between Harris MCD and Stratex Networks 2010 Harris Stratex rebrands as Aviat Networks 2020 New management leadership brings the company renewed customer focus and disciplined operating model 2022 Aviat Networks completes the acquisition of Redline Communications, adding access solutions to its portfolio 2023 Aviat Networks completes the acquisition of NEC Microwave Division Microwave Division

AVIAT NETWORKS5 Transaction Significantly Increases Aviat’s Scale and Strengthens Position as the Leading Microwave Specialist Company NEC Microwave Transaction Summary Transaction Overview Financing • Aviat Networks acquired the microwave backhaul business NEC Corporation for $65.5 million, structured as an asset purchase – Anticipate addition of $140 million in annual revenue • Transaction closed on November 30, 2023 • $23.4 million of Aviat shares priced at $31.74 – Subject to 12-month lock-up • $42.1 million cash to be funded by delayed draw term loan facility – 0.1x net debt Aviat’s standalone adjusted EBITDA Outlook • Expect first four quarters to contribute $140 million of annual revenue – Revenue to ramp with stronger contribution in first half of Aviat’s fiscal 2025 • Expect transaction to be accretive by fourth quarter of integration (Aviat’s fiscal 2025 second quarter) • Aviat to update fiscal 2024 annual guidance in upcoming fiscal 2024 second quarter earnings release

AVIAT NETWORKS6 Transaction Creates a Larger Company with Global Scale, Increased Operating Leverage, and Stronger Innovation and Ability to Serve Combined Financial Profile Scale Revenue $353M ~$140M Margins Gross Margin 36% ~30% Profitability Adj. EBITDA 14% ~0% A global provider of wireless transport products and services for 5G, rural broadband, and private networks A leader in wireless backhaul networks with extensive installed base and recognized Pasolink brand ~$493M ~33% Goal to improve margins through the Aviat Operating Model Combined business to reach 11-13% by end of Year 2 The leading global wireless transport specialist Leverage Net Debt / EBITDA -0.7x NA 0.1x net leverage on Aviat’s standalone adj. EBITDA Microwave Division Microwave Division Last Twelve Months Pro-Forma Pro-Forma

AVIAT NETWORKS Investment Opportunity 7 Global Investment in Mission Critical, 5G, and Rural Broadband Networks Underpin Strong and Growing Demand Environment $11 billion TAM serving private networks, mobile service providers, and rural broadband network operators around the world End-to-end portfolio including mission-critical access products and routers, best-in-class microwave radios, and innovative software solutions Relied on by customers globally to help design, plan, install, test, and operate their communication networks Consistent topline growth and profitability – 12% revenue CAGR since calendar 2019; TTM adjusted EBITDA margin of 14%; No debt Aviat Operating Model drives continuous improvement, operating leverage, and successful acquisitions Attractive Global Markets Unique Product Offering Leading Expertise Strong Financials & Balance Sheet Disciplined Business Operator

AVIAT NETWORKS Aviat’s Competitive Advantage vs. Microwave Specialists vs. Wireless Generalists Products ✓ Modular radio platform ✓ End-to-end offering of radios, multi- band, routers, access ✓ Better RF performance • Highly leveraged in chipsets • Difficult to create new product variants quickly • Unable to invest in routing and other products • Microwave not focus • Less responsive and agile to bringing radio solutions to market Software & Services ✓ Turnkey services portfolio (design, planning, install) ✓ Software innovations to ease network operations and total cost of ownership (AviatCloud, Assurance software) • Product focus and lack of software investment • Lack of experience and services make competing in private networks difficult • Lack focus on dedicated software solutions for transport networks Supply Chain ✓ Core competence – fast deliveries and disruptive go-to-market like the Aviat Store • Lack modularity limits supply chain flexibility • Unable to create new business models or react to Aviat innovations • Microwave supply chain not a priority vs. RAN • Cannot react to Aviat innovations 8 Aviat Provides More Innovation and Better Value Than Our Competitors Why Aviat Wins

AVIAT NETWORKS Wireless Transport and Access Markets Overview 9 Aviat Differentiation Aligned with Private Networks, 5G and Rural Broadband WIRELESS ACCESS Growth Markets STATE & LOCAL GOV’T UTILITY PUBLIC SAFETY 4G/5G MOBILE WIRELESS TRANSPORT Core Markets INDUSTRIAL LICENSED/ UNLICENSED PTP/PTMP INDUSTRIAL LICENSED PRIVATE LTE/5G FIBERRADIO ACCESS / CELLULAR Other applications » INDUSTRIAL MICROWAVE Aviat Differentiation Best in Class Wireless Transport Products Unique Software and Services Disruptive Supply Chain and Ecommerce HIGH FREQUENCY TRADING SCHOOL/ ENTERPRISE OIL/GAS/ OFFSHORE TRANSPORTATION ISP/WISPMINING AVIAT EQUIPMENT WISP

AVIAT NETWORKS Aviat Product Portfolio 10 Health Assurance (HAS) Continuously analyzes the network Detailed reports on network issues Reduces downtime Frequency Assurance (FAS) Monitors and reports interference Protects against WiFi-6E Improves link performance/uptime ProVision Plus Simplifies network management Easy trouble shooting with multi-layer visualization Quick provisioning allows for rapid deployment Portfolio Focused on Lowering Total Cost of Ownership All-Outdoor Systems WTM4000, EX-A/D, iX/A • Dual Transceiver design in a Single Compact Box • Available in Single- or Multi-Band • Full IP/ MPLS Capabilities • Software Upgradeable to 20 Gbps • 25GbE connectivity Single-Band Multi- Band MB-XD Markets: Mobile Service Providers, WISPs, Utilities, Public Safety, Oil & Gas, Mining, Transportation Microwave Routers CTR8000 Series • Microwave and IP in One Box • Fewer Devices for Microwave Transport and Routing • Compatible with All-indoor, Split-Mount, and Trunking Architectures • IP/ MPLS / Segment Routing • Up to 10 Gbps CTR 8540 CTR 8740 Markets: Mobile Service Providers, WISPs, Utilities, Public Safety, Oil & Gas, Mining, Transportation Split-Mount Systems iPasolink, IAG/P3 • 6 to 38GHz freq. band with carrier aggregation • Sub-band free ODU option • Modular and scalable indoor units • Standard and High Power Outdoor Units • No single point of failure configuration. • Multiband configuration • 10 Gbs interfaces Markets: Mobile Service Providers, Utilities, Public Safety, Oil & Gas, Mining, Transportation Wireless Transport Wireless Access Trunking Systems STR 4500, OBC2, 7000iP TRP • Split Mount, All-Indoor, and All-Outdoor Trunking Systems • Up to 16+0, 8+0 with SD • 10Gbps connectivity • Flexible aggregation options Markets: Mobile Service Providers, Utilities, Public Safety, Oil & Gas, Mining, Transportation RDL 6000 Private LTE • Power of a Macro in Small Cell footprint • Scalable EPC • Ruggedized • Low Power Consumption • Lower TCO RDL 3000 Virtual Fiber • Hardened • High-Capacity up to 440 Mbps • Nomadic Self- Aligning Antennas ATEX/Hazloc options • Backhaul Markets: Utilities, Public Safety, Oil & Gas, Mining, Transportation Indoor Radio IRU600, TRP, Eclipse • Ultra-High Tx Power, +37dBm • Compact/expandable antenna branching • Tough, Durable and Dependable • Comprehensive native TDM features • Strong Security (FIPS) Eclipse Markets: Utilities, Public Safety, Oil & Gas, Mining, Transportation

AVIAT NETWORKS How Aviat Lowers Total Cost of Ownership 11 1. Reduced Tower Footprint What: Lower power consumption, faster installation, smaller antennas, reduced tower loading, lower lease costs How: Fewer boxes, high system gain, Multi-Band 2. Capacity Scalability What: Less congestion, fewer truck rolls, less hardware How: Multi-Band, A2C+, on-demand capacity upgrades 3. Integrated Routing What: Reduced or zero indoor footprint, fewer boxes, simplified operations, lower power consumption How: All-Outdoor at the edge, CTR/WTM integrated IP/MPLS 4. Spectrum Fee Savings What: Reduced recurring spectrum fees How: Moving capacity from Microwave to E-Band and Multi-Band 5. Higher Network Reliability What: Better performance, increased resilience, fewer outages, faster fault-finding/restoration, lower OPEX How: High MTBF, High Availability Routing, Aviat Assurance Software (HAS, FAS) 6. Simplified Logistics What: Easy online design and ordering, fast delivery, Reduced inventory and warehouse costs How: Aviat Design, Aviat Store, regional stock, on- demand capacity and license upgrades

AVIAT NETWORKS Microwave is a Crucial Backhaul Technology 12 Microwave Fiber Speed to Deploy High Reliability Low Latency Terrain Flexibility Capacity Cost Per Link Per Foot Microwave / Millimeter Wave Fiber Satellite Copper Microwave Backhaul is Essential in Communication Networks Globally Wireless transport accounts for 60% of cellular transport links Source: Dell ‘Oro; Excludes North East Asia Microwave is ideally suited for mission- critical private networks, rural broadband, and challenging deployment environments Service providers rely on microwave in their networks to provide cost-effective and reliable bandwidth

AVIAT NETWORKS • Upgrade cycle in public safety, utilities and other private networks driven by increase bandwidth needs • Private LTE / 5G market to be $8B by 2027 • Aviat’s end-to-end product and services allow for increasing share of wallet capture and competitive advantage Aviat’s Market Opportunities 13 Aviat Networks is Capturing Additional Market Share Because of Its Innovative Portfolio and Focus on Lowest Total Cost of Ownership Private Networks Mobile Networks & 5G Rural Broadband • Early stages of global 5G upgrade cycle; mobile network data traffic expected to grow at 26% CAGR through 2028 • Wireless transport makes up 60% of cellular transport links • Microwave radio market for global 5G transport market expect to grow at a 39% CAGR through CY2025 • Over $70 billion in U.S. government funding programs to build out rural broadband networks • Microwave is a compelling solution for operators to lower total cost of ownership and increase speed to deploy • Aviat’s unique e-commerce platform allows for direct to network operator channel

AVIAT NETWORKS Public Safety and Security Oil & Gas Water Electric Utilities National / Regional Government Enterprise Private Network Summary 14 • Growth in Private LTE and Industrial IoT driven by video and modern applications • States and municipalities upgrading their public safety communications – State and local budgets remain healthy; growing public safety funding • American Rescue Plan Act (ARPA) funding of $350 billion for U.S. States’ water, sewer, public safety, and broadband infrastructure • Vendor outsourcing and declining microwave expertise creates share of wallet opportunities Aviat Offers a Compelling Value Proposition to Private Network Operators Growth Drivers Segments Addressed • Mission critical product differentiation – Highest powered radios – Ruggedized access products – IP/MPLS integration – Software innovations to simply network management (PV+, HAS, FAS) • Strong state relationships and global partners • Differentiated services offerings – Network design and testing – Install – Support – Managed services (incl. NOC) Aviat’s Leadership

AVIAT NETWORKS Mobile Networks & 5G Market Summary 15 • Mobile service provider market driven by increasing bandwidth demand in 4G and 5G networks – Data from global networks is anticipated to grow rapidly (26% CAGR) through 2028, driven by 5G adoption and expanding 4G networks • Aviat’s product portfolio enables operators to increase their network capacity while lowering total cost of ownership (TCO) – Single-box multi-band lowers tower leasing costs while increase capacity – Vendor-agnostic multi-band allows operators to utilize existing radios and layer on Aviat’s solution, lowering the barrier to entry for Aviat into a network – Multi-band XD enables longer distances between links which helps to minimize total network capex – Highest capacity radio available on the market (20 Gbps) • Aviat’s multi-band is up to $10,000/link lower TCO vs competitive multi-band offerings – Superior solution → Less hardware → Lowest TCO CY22 CY23 CY24 CY25 Demand for Wireless Transport Driven by Increasing Data Consumption Global 5G Wireless Transport Market Source: Dell ‘Oro 0 100 200 300 400 500 2022 2023 2024 2025 2026 2027 2028 E B p e r m o n th FWA 5G 2G/3G/4G $1.7B Market Global Mobile Network Data Traffic Source: Ericsson Mobility Report

AVIAT NETWORKS16 Large Investments in Broadband Infrastructure Creates Opportunities for Wireless Transport Rural Broadband Summary Over $70B in Available Funding Wireless Transport is the Solution Aviat E-Commerce Platform Leads Rural Broadband CAF II Rural Digital Opportunity Fund (RDOF) 5G Fund for Rural America Broadband Equity, Access, and Deployment (BEAD) Program USDA Reconnect Program $1.5 Billion $20 Billion $9 Billion $42.5 Billion $635 Million Wireless transport is ideal for rural communities and is lower cost, more reliable, and faster to deploy than fiber Growing number of Fixed Wireless Access (FWA) deployments favors wireless backhaul Estimate the USA rural broadband segment to be a ~$420M TAM in 2024 Aviat is uniquely suited to serve WISPs through its Aviat Store and AviatCloud applications like Design (network planning and product recommendation) and automated radio and license applications Aviat Networks ~35% Source: PCN data from Comsearch Leading wireless transport share of demand for North American ISPs

AVIAT NETWORKS17 Aviat Operating Model Supports Growth-Centric Culture by Leveraging Continuous Improvement and Driving Competitive Excellence Aviat Operating Model Framework Excellence in Customer Focus Innovation Talent Supply Chain O u r A c ti o n s We listen during the commercial and sales process to understand our customers’ needs and use our combined talents, skill and capabilities to create solutions that exceed expectations. We deliver innovative, high-quality solutions that meet key customer segment needs. Voice of customer informs investment decisions. Release to market within budget, timeframe and scope. We drive a performance culture and invest in our talent management programs to support evolving strategic business needs and implement organizational structures to facilitate results. We achieve a competitive advantage by delivering quality products with best-in-class lead- times. O u r P ro c e s s e s • Standard global VOC process • Sales Goal planning • eCommerce platform • AviatCare customer service and support • Aviat Operating System for software • New Product Introduction (NPI) process • Portfolio management • Agile development methodology • Performance Management Process • Career Framework • Talent Management Review • Employee Ownership Program • S&OP Planning • Next day delivery e-commerce • Order to Cash process • Strategic sourcing to meet customer objectives globally Continuous Improvement | We Strive Everyday… To improve, innovate and drive cost efficiency to achieve higher performance and to promote our continuous improvement culture

First Quarter Fiscal 2024 Financial Highlights and Historical Performance

AVIAT NETWORKS $10.7 $12.1 13.2% 13.8% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 16.0% 17.0% 18.0% 19.0% 20.0% $8.0 $8.5 $9.0 $9.5 $10.0 $10.5 $11.0 $11.5 $12.0 $12.5 $13.0 Q1 FY2023 Q1 FY2024 $81.3 $87.6 36.5% 36.6% 34.0% 35.0% 36.0% 37.0% 38.0% 39.0% 40.0% $70.0 $72.0 $74.0 $76.0 $78.0 $80.0 $82.0 $84.0 $86.0 $88.0 $90.0 Q1 FY2023 Q1 FY2024 First Quarter Fiscal 2024 Highlights 19 • Revenue of $87.6 million, up 7.8% compared to the same period last year • Record Q1 North America bookings • GAAP operating income of $5.5 million, up 41.8% year-over-year • Adjusted EBITDA up $12.1 million, up 13.1% compared to the same period last year • Non-GAAP earnings per share up 16.0% year- over-year • Strong profit growth from disciplined cost management and topline execution • Continued to demonstrate consistency and improvements in performance Laser Focused on Increasing Revenue, Capturing Aviat’s Differentiation, Driving Costs Out, and Increasing Overall Shareholder Value Revenue & Non-GAAP Gross Margin Adjusted EBITDA & Adj. EBITDA Margin $ in millions $ in millions

AVIAT NETWORKS First Quarter Fiscal 2024 Balance Sheet Highlights 20 • Robust cash generation, driven by profitability and lower working capital • No debt • Inventory levels reduced as Aviat consumed buffer stock that helped to navigate supply chain issues over the past two years Strong Balance Sheet; Consistent Performance Drives Cash Generation Asset / (Liability) Q2 FY22 Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 Q4 FY23 Q1 FY24 Actual Actual Actual Actual Actual Actual Actual Actual Cash Equivalents and Marketable Securities $42.3 $33.8 $47.8 $22.9 $21.4 $22.5 $22.2 $35.5 Third-Party Debt $0.0 $0.0 $0.0 $0.0 $0.0 ($6.2) $0.0 $0.0 Net Cash and Marketable Securities $42.3 $33.8 $47.8 $22.9 $21.4 $16.3 $22.2 $35.5 Accounts Receivable $69.1 $76.2 $73.2 $72.5 $91.4 $88.5 $101.7 $94.5 Unbilled Receivables $42.9 $45.7 $45.9 $50.4 $53.6 $63.3 $58.6 $61.0 Advance Payments and Unearned Revenue ($43.7) ($45.7) ($42.7) ($43.3) ($46.7) ($48.0) ($51.7) ($53.7) DSO’s 75 89 88 82 82 98 95 102 DSO’s net of Unbilled/Unearned 72 88 90 87 89 110 106 109 Accounts Payable ($43.5) ($40.6) ($42.4) ($48.2) ($59.8) ($61.7) ($60.1) ($61.8) DPO’s 76 81 76 80 84 103 95 100 Inventory $27.4 $30.5 $27.2 $35.0 $37.1 $40.9 $33.1 $30.7 Turns 7.5 6.5 6.9 6.7 6.5 5.5 6.3 7.0 ($’s in millions, except for DSO, DPO and Turns)

AVIAT NETWORKS Rolling Trailing Twelve Months Historical Performance 21 -$11 -$9 -$12 -$13 -$5 $2 $8 $9 $9 $7 $10 $10 $10 $9 $9 $12 $8 $12 $14 $18 $19 $31 $33 $34 $34 $36 $38 $39 $42 $44 $47 $48 R o lli n g T T M A d j. E B IT D A $313 $298 $269 $247 $245 $244 $242 $240 $233 $236 $243 $247 $250 $242 $244 $242 $233 $240 $239 $246 $251 $266 $275 $282 $289 $297 $303 $311 $324 $333 $347 $353 R o lli n g T T M R e v e n u e ($’s million) ($’s million)

AVIAT NETWORKS Cash Benefit of Historical Net Operating Losses (NOLs) 22 Cash Tax Savings Will Continue for the Foreseeable Future (>5 years) at Levels Commensurate with our Earnings Before Tax Performance • $490 million of gross NOLs • NOL’s reduce Aviat’s statutory federal and state blended tax rate of ~25% to an effective cash tax rate of ~5% – This saved Aviat $5.9 million in cash taxes in FY22 and $14.1 million in cash taxes in FY23 • Improved financial performance and outlook for Aviat resulted in a full release of the valuation allowance against U.S. NOLs in Q3 of fiscal 2021 – A one-time benefit of $92 million was recognized in Net Income and Deferred Tax Assets US, $304 Intl., $186 Total NOLs (M) $100 $98 $95 $92 $90 $89 $87 $86 Deferred Tax Asset on AVNW Balance Sheet

AVIAT NETWORKS23 GAAP to Non-GAAP Reconciliation RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (1) Condensed Consolidated Statements of Operations (Unaudited) % of % of % of % of Revenue Revenue Revenue Revenue GAAP gross margin $31,852 36.4% $29,454 36.3% GAAP net income (loss) $4,005 4.6% ($2,746) (3.4%) Share-based compensation 183 172 Share-based compensation 1,834 1,838 Merger and acquisition related expense 43 — Merger and acquisition related expense 2,715 1,516 Non-GAAP gross margin 32,078 36.6% 29,626 36.5% Restructuring charges 644 1,950 Other expense, net 802 2,659 GAAP research and development expenses $6,424 7.3% $6,087 7.5% Adjustment to reflect pro forma tax rate 341 3,577 Share-based compensation (146) (135) Non-GAAP net income $10,341 11.8% $8,794 10.8% Non-GAAP research and development expenses 6,278 7.2% 5,952 7.3% Diluted net income (loss) per share: GAAP selling and administrative expenses $19,237 22.0% $17,504 21.5% GAAP $0.34 ($0.25) Share-based compensation (1,505) (1,531) Non-GAAP $0.87 $0.75 Merger and acquisition related expense (2,672) (1,516) Non-GAAP selling and administrative expenses 15,060 17.2% 14,457 17.8% Shares used in computing diluted net income (loss) per share GAAP 11,943 11,200 GAAP operating income $5,547 6.3% $3,913 4.8% Non-GAAP 11,943 11,777 Share-based compensation 1,834 1,838 Merger and acquisition related expense 2,715 1,516 Adjusted EBITDA: Restructuring charges 644 1,950 GAAP net income (loss) $4,005 4.6% ($2,746) (3.4%) Non-GAAP operating income 10,740 12.3% 9,217 11.3% Depreciation and amortization of property, plant and equipment and intangible assets 1,344 1,468 Other expense, net 901 2,782 GAAP income tax provision $641 0.7% $3,877 4.8% Share-based compensation 1,834 1,838 Adjustment to reflect pro forma tax rate (341) (3,577) Merger and acquisition related expense 2,715 1,516 Non-GAAP income tax provision 300 0.3% 300 0.4% Restructuring charges 644 1,950 Provision for income taxes 641 3,877 Adjusted EBITDA $12,084 13.8% $10,685 13.2% (1) The adjustments above reconcile our GAAP financial results to the non-GAAP financial measures used by us. Our non-GAAP net income excluded share-based compensation, and other non-recurring charges (recovery). Adjusted EBITDA was determined by excluding depreciation and amortization on property, plant and equipment, interest, provision for or benefit from income taxes, and non-GAAP pre-tax adjustments, as set forth above, from GAAP net income. We believe that the presentation of these non-GAAP items provides meaningful supplemental information to investors, when viewed in conjunction with, and not in lieu of, our GAAP results. However, the non-GAAP financial measures have not been prepared under a comprehensive set of accounting rules or principles. Non-GAAP information should not be considered in isolation from, or as a substitute for, information prepared in accordance with GAAP. Moreover, there are material limitations associated with the use of non-GAAP financial measures. (In thousands, except percentages and per share amounts) Three Months Ended 29-Sep-2023 30-Sep-2022 (In thousands, except percentages and per share amounts) Three Months Ended 29-Sep-2023 30-Sep-2022

W W W . AV I AT N E T W O R K S . C O M

v3.23.3

Cover

|

Dec. 07, 2023 |

| Cover [Abstract] |

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001377789

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 07, 2023

|

| Entity Registrant Name |

AVIAT NETWORKS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33278

|

| Entity Tax Identification Number |

20-5961564

|

| Entity Address, Address Line One |

200 Parker Dr., Suite C100A

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78728

|

| City Area Code |

(408)

|

| Local Phone Number |

941-7100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

AVNW

|

| Security Exchange Name |

NASDAQ

|

| Preferred Stock |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Preferred Share Purchase Rights

|

| Security Exchange Name |

NASDAQ

|

| No Trading Symbol Flag |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

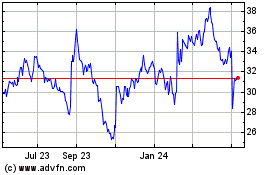

Aviat Networks (NASDAQ:AVNW)

Historical Stock Chart

From Mar 2024 to Apr 2024

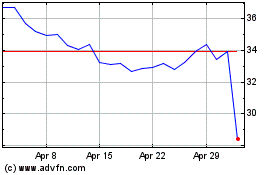

Aviat Networks (NASDAQ:AVNW)

Historical Stock Chart

From Apr 2023 to Apr 2024