UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE

14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant |

|

☒ |

| Filed by a Party other than the Registrant |

|

☐ |

Check

the appropriate box:

| ☐ |

|

Preliminary Proxy Statement |

| |

|

|

| ☐ |

|

Confidential, for Use of the Commission Only (as Permitted

by Rule 14a-6(e)(2)) |

| |

|

|

| ☒ |

|

Definitive Proxy Statement |

| |

|

|

| ☐ |

|

Definitive Additional Materials |

| |

|

|

| ☐ |

|

Solicitation Material Pursuant to Rule 14a-11(c) or

rule 14a-12 |

Cuentas

Inc.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

|

No fee required. |

| |

|

|

| ☐ |

|

Fee paid previously with preliminary materials. |

| |

|

|

| ☐ |

|

Fee computed on table in exhibit required by Item 25(b)

per Exchange Act Rules 14a-6(i)(1) and 0-11 |

CUENTAS

INC.

235 Lincoln Road, Suite 210

Miami Beach, FL 33139

December 6, 2023

To

the Shareholders of Cuentas Inc.:

You

are cordially invited to attend the 2023 Annual Meeting of Shareholders (the “Annual Meeting”) of Cuentas Inc. (the

“Company”) to be held at the Company’s principal executive office located at 235 Lincoln Rd., Suite 210,

Miami Beach, Florida, 33139, on Wednesday, December 20, 2023 at 10:00 AM Eastern Time, for the following purposes:

| 1. | To elect Arik Maimon, Michael De Prado, Adiv Baruch, Lexi Terrero and Haim Yeffet as directors (the “Director Nominees”) to serve on the Company’s Board of Directors

(the “Board”) for a one-year term that expires at the 2024 Annual Meeting of Shareholders, or until their

successors are elected and qualified; |

| 2. | The

approval, pursuant to Nasdaq listing rules, of the issuance of up to 1,232,606 shares of

our common stock upon the exercise of our common stock purchase warrant (the “Inducement

Warrant”) issued to an institutional investor in connection with the Warrant Exercise

and Inducement Letter dated August 21, 2023 and the issuance of up to 43,141shares of common

stock upon the exercise of the placement agent warrants issued to the designees of H.C. Wainwright

& Co. (the “Inducement Warrant Exercise Proposal”); |

| 3. | The approval of an amendment to our Amended and Restated Articles of

Incorporation, as amended, to increase the number of authorized shares of common stock from 27,692,307 to 100,000,000 shares (the “Authorized

Common Stock Proposal”); |

| 4. | The

approval of the Cuentas 2023 Share Incentive Plan (the “2023 Plan Proposal”); |

| 5. | To

ratify the appointment by the Board of Yarel + Partners, Certified Public Accountants (ISR.),

as the Company’s independent registered public accounting firm for the fiscal year

ending December 31, 2024; |

| 6. | The

approval of a proposal to adjourn the Annual Meeting to a later date, if necessary or appropriate,

to permit further solicitation and vote of proxies in the event that there are insufficient

votes for, or otherwise in connection with, the approval of the Inducement Warrant Exercise

Proposal, the Authorized Common Stock Proposal or the 2023 Plan Proposal (the “Adjournment

Proposal”); and |

| 7. | To

transact such other business as may properly come before the Annual Meeting or any adjournment

thereof. |

THE

BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES,

A VOTE “FOR” the Approval of each of the INDUCEMENT Warrant Exercise proposal, the Authorized common stock proposaL,

the 2023 plan proposal AND THE ADJOURNMENT PROPOSAL, and “FOR” the RATIFICATION OF THE APPOINTMENT OF THE COMPANY’S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2024.

The

Board has fixed the close of business on Friday, November 17, 2023 as the record date (the “Record Date”) for the

determination of shareholders entitled to notice of, and to vote at, the Annual Meeting or any postponement or adjournment thereof. Accordingly,

only shareholders of record at the close of business on the Record Date are entitled to notice of, and shall be entitled to vote at,

the Annual Meeting or any postponement or adjournment thereof.

Your

vote is important. You are requested to carefully read the Proxy Statement and accompanying Notice of Annual Meeting for a more complete

statement of matters to be considered at the Annual Meeting.

| |

Sincerely yours, |

| |

|

| |

/s/ Arik

Maimon |

| |

Arik Maimon |

| |

Chairman of the Board |

| |

Cuentas Inc. |

IMPORTANT

WHETHER

OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE READ THE PROXY STATEMENT AND PROMPTLY

VOTE YOUR PROXY VIA THE INTERNET, BY TELEPHONE OR, IF YOU RECEIVED A PRINTED FORM OF PROXY IN THE MAIL, BY COMPLETING, DATING, SIGNING

AND RETURNING THE ENCLOSED PROXY IN ORDER TO ASSURE REPRESENTATION OF YOUR SHARES AT THE ANNUAL MEETING. YOUR PROXY,

GIVEN THROUGH THE RETURN OF THE PROXY CARD, MAY BE REVOKED PRIOR TO ITS EXERCISE BY FILING WITH OUR CORPORATE SECRETARY PRIOR TO THE

ANNUAL MEETING A WRITTEN NOTICE OF REVOCATION OR A DULY EXECUTED PROXY BEARING A LATER DATE, OR BY ATTENDING THE ANNUAL MEETING AND VOTING.

IF

YOU HAVE ALREADY VOTED OR DELIVERED YOUR PROXY FOR THE ANNUAL MEETING, YOUR VOTE WILL BE COUNTED, AND YOU DO NOT HAVE TO VOTE YOUR SHARES

AGAIN. IF YOU WISH TO CHANGE YOUR VOTE, YOU SHOULD REVOTE YOUR SHARES.

THE PROXY STATEMENT, OUR

FORM OF PROXY CARD, AND OUR ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2022 ARE BEING MAILED TO SHAREHOLDERS

ON OR DECEMBER 6, 2023.

CUENTAS

INC.

235 Lincoln Road, Suite 210

Miami Beach, FL 33139

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

To

be held on Wednesday, December 20, 2023

This

proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”)

of Cuentas Inc. (the “Company”) for use at the 2023 Annual Meeting of Shareholders of the Company and at all adjournments

and postponements thereof (the “Annual Meeting”). The Annual Meeting will be held at 10:00 AM Eastern Time on

Wednesday, December 20, 2023 at the Company’s principal executive office located at 235 Lincoln Rd., Suite 210, Miami Beach, Florida,

33139, for the following purposes:

| 1. | To elect Arik Maimon, Michael De Prado, Adiv Baruch, Lexi Terrero

and Haim Yeffet as directors (the “Director Nominees”) to serve on the Company’s Board of Directors (the

“Board”) for a one-year term that expires at the 2024 Annual Meeting of Shareholders, or until their

successors are elected and qualified; |

| 2. | The

approval, pursuant to Nasdaq listing rules, of the issuance of up to 1,232,606 shares of

our common stock upon the exercise of our common stock purchase warrant (the “Inducement

Warrant”) issued to an institutional investor in connection with the Warrant Exercise

and Inducement Letter dated August 21, 2023 and the issuance of up to 43,141shares of common

stock upon the exercise of the placement agent warrants issued to the designees of H.C. Wainwright

& Co. (the “Inducement Warrant Exercise Proposal”); |

| 3. | The approval of an amendment to our Amended and Restated Articles of

Incorporation, as amended, to increase the number of authorized shares of common stock from 27,692,307 to 100,000,000 shares (the “Authorized

Common Stock Proposal”); |

| 4. | The

approval of the Cuentas 2023 Share Incentive Plan (the “2023 Plan Proposal”); |

| 5. | To

ratify the appointment by the Board of Yarel + Partners, Certified Public Accountants (ISR.),

as the Company’s independent registered public accounting firm for the fiscal year

ending December 31, 2024; |

| 6. | The

approval of a proposal to adjourn the Annual Meeting to a later date, if necessary or appropriate,

to permit further solicitation and vote of proxies in the event that there are insufficient

votes for, or otherwise in connection with, the approval of the Inducement Warrant Exercise

Proposal, the Authorized Common Stock Proposal or the 2023 Plan Proposal (the “Adjournment

Proposal”); and |

| 7. | To

transact such other business as may properly come before the Annual Meeting or any adjournment

thereof. |

The

Board unanimously recommends a vote “FOR” the election of each of the director nominees, “FOR” the approval

of each of the Inducement Warrant Exercise Proposal, the Authorized Common Stock Proposal, the 2023 Plan Proposal and the Adjournment

Proposal, and “FOR” the ratification of the appointment of Yarel + Partners, Certified Public Accountants (ISR.), as

the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024.

Shareholders

of record of our common stock at the close of business on November 17, 2023 (the “Record Date”) will be entitled to

notice of, and are cordially invited to, attend the Annual Meeting and to attend any adjournment or postponement thereof. However,

to assure your representation at the Annual Meeting, please vote your proxy via the internet, by telephone, or by completing, dating,

signing and returning the enclosed proxy. Whether or not you expect to attend the Annual Meeting, please read the Proxy Statement

and then promptly vote your proxy in order to ensure your representation at the Annual Meeting.

You may cast your vote by visiting http://www.cuentas.com/vote.

You may also have access to the materials for the Annual Meeting by visiting the website: https://cuentas.com. You

will need to use the control number appearing on your proxy card to vote prior to or at the Annual Meeting.

Each

share of common stock entitles the holder thereof to one vote. A complete list of shareholders of record entitled to vote at this Annual

Meeting will be available for ten days before this Annual Meeting at the principal executive office of the Company for inspection

by shareholders during ordinary business hours for any purpose germane to this Annual Meeting.

You

are urged to review carefully the information contained in the enclosed proxy statement prior to deciding how to vote your shares.

This notice and the attached

proxy statement are first being disseminated to shareholders on or about December 6, 2023.

| |

BY ORDER OF

THE BOARD OF DIRECTORS |

| |

|

| |

/s/ Arik

Maimon |

| |

Arik Maimon |

| |

Chairman of the Board |

| |

Cuentas Inc. |

IF YOU RETURN YOUR PROXY

CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED IN FAVOR OF EACH OF THE DIRECTOR NOMINEES, THE INDUCEMENT

WARRANT EXERCISE PROPOSAL, THE AUTHORIZED COMMON STOCK PROPOSAL, THE 2023 PLAN PROPOSAL, THE RATIFICATION OF THE APPOINTMENT OF YAREL

+ PARTNERS, CERTIFIED PUBLIC ACCOUNTANTS (ISR.), AS THE COMPANY’S INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2024 AND THE ADJOURNMENT PROPOSAL

TABLE

OF CONTENTS

PROXY

STATEMENT

CUENTAS

INC.

ANNUAL MEETING OF SHAREHOLDERS

to be held at 10:00 AM Eastern Time on Wednesday, December 20, 2023

QUESTIONS

AND ANSWERS ABOUT THESE PROXY MATERIALS

Why

am I receiving this Proxy Statement?

This Proxy Statement describes

the proposals on which the Board of Directors of the Company (the “Board”) would like you, as a stockholder, to vote

on at the 2023 Annual Meeting of Shareholders of the Company (the “Annual Meeting”) to be held at the Company’s

principal executive office located at 235 Lincoln Rd., Suite 210, Miami Beach, Florida, 33139, on Wednesday, December 20, 2023 at 10:00 AM

Eastern time, and at any postponement(s) or adjournment(s) thereof. These materials were first sent or given to shareholders

on or about December 6, 2023. This proxy statement gives you information on these proposals so that you can make an informed decision.

In this proxy statement,

we refer to Cuentas Inc. as the “Company”, “we”, “us” or “our” or similar terminology.

What

is included in these materials?

These

materials include:

| ● | This

Proxy Statement for the Annual Meeting; |

| ● | The

Company’s Annual Report on Form 10-K for the year ended December 31, 2022; and |

| ● | The

proxy card or voting instruction form for the Annual Meeting. |

Who

can vote at the Annual Meeting of Shareholders?

Holders of record of our common stock as of the close of business on November 17, 2023, the record date for the Annual Meeting (the “Record

Date”), will be entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements thereof. Holders

of record of shares of common stock are entitled to vote on all matters brought before the Annual Meeting.

As of the Record Date, there were 2,730,058 shares of common stock

outstanding and entitled to vote. Holders are entitled to one vote for each share of common stock outstanding as of the Record Date.

You

do not need to attend the Annual Meeting to vote your shares. Instead, you may vote your shares by marking, signing, dating and returning

the enclosed proxy card or voting through the internet.

What

is the proxy card?

The

proxy card enables you to appoint Arik Maimon, our Chief Executive Officer and Chairman of the Board, and Michael De Prado, our President

and Vice Chairman of the Board, as your representatives at the Annual Meeting. By completing and returning the proxy card or voting online

as described herein, you are authorizing Mr. Maimon and Mr. De Prado to vote your shares at the Annual Meeting in accordance

with your instructions on the proxy card. This way, your shares will be voted whether or not you attend the Annual Meeting. Even if you

plan to attend the Annual Meeting, we think that it is a good idea to complete and return your proxy card before the Annual Meeting date

just in case your plans change. If a proposal comes up for vote at the Annual Meeting that is not on the proxy card, the proxies will

vote your shares, under your proxy, according to their best judgment. The proxy card (or voter information form) will also contain your

control number. You will need to use the control number appearing on your proxy card to vote prior to or at the Annual Meeting.

What

am I voting on?

You

are being asked to vote on the following proposals:

| 1. | To elect Arik Maimon, Michael De Prado, Adiv Baruch, Lexi Terrero

and Haim Yeffet as directors (the “Director Nominees”) to serve on the Company’s Board for a

one-year term that expires at the 2024 Annual Meeting of Shareholders, or until their successors are elected and qualified; |

| 2. | To

approve, pursuant to Nasdaq listing rules, the issuance of up to 1,232,606 shares of our

common stock upon the exercise of our common stock purchase warrant (the “Inducement

Warrant”) issued to an institutional investor in connection with the Warrant Exercise

and Inducement Letter dated August 21, 2023 and the issuance of up to 43,141shares of common

stock upon the exercise of the placement agent warrants issued to the designees of H.C. Wainwright

& Co. (the “Inducement Warrant Exercise Proposal”); |

| 3. | To approve an amendment to our Amended and Restated Articles of Incorporation,

as amended, to increase the number of authorized shares of common stock from 27,692,307 to 100,000,000 shares (the “Authorized

Common Stock Proposal”); |

| 4. | To

approve the Cuentas 2023 Share Incentive Plan (the “2023 Plan Proposal”),

a copy of which is annexed to this Proxy Statement as Appendix A; |

| 5. | To

ratify the appointment by the Board of Yarel + Partners, Certified Public Accountants (ISR.),

as the Company’s independent registered public accounting firm for the fiscal year

ending December 31, 2024; |

| 6. | To

approve a proposal to adjourn the Annual Meeting to a later date, if necessary or appropriate,

to permit further solicitation and vote of proxies in the event that there are insufficient

votes for, or otherwise in connection with, the approval of the Inducement Warrant Exercise

Proposal, the Authorized Common Stock Proposal or the 2023 Plan Proposal (the “Adjournment

Proposal”); and |

| 7. | To

transact such other business as may properly come before the Annual Meeting or any adjournment

thereof. |

How

does the Board recommend that I vote?

Our

Board unanimously recommends that the shareholders vote “FOR” all of the Director Nominees, “FOR” the

approval of the Inducement Warrant Exercise Proposal, “FOR” the approval of the Authorized Common Stock Proposal,

“FOR” the approval of the 2023 Plan Proposal, “FOR” the ratification of the appointment of the

Yarel + Partners as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024

and “FOR” the Adjournment Proposal.

What

is the difference between holding shares as a shareholder of record and as a beneficial owner?

Most

of our shareholders hold their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates

in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Shareholder

of Record

If,

on the Record Date, your shares were registered directly in your name with our transfer agent, Olde Monmouth Stock Transfer Co., Inc.,

you are a “shareholder of record” who may vote at the Annual Meeting, and we are sending these proxy materials directly to

you. As the shareholder of record, you have the right to direct the voting of your shares as described below. Whether or not you plan

to attend the Annual Meeting, please complete, date and sign the enclosed proxy card to ensure that your vote is counted.

Beneficial

Owner

If,

on the Record Date, your shares were held in an account at a brokerage firm or at a bank or other nominee holder, you are considered

the beneficial owner of shares held “in street name,” and these proxy materials are being forwarded to you by or at the direction

of your broker or nominee who is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial

owner, you have the right to vote your shares and to attend the Annual Meeting as described below. Whether or not you plan to attend

the Annual Meeting, please vote prior to the Annual Meeting as described below to ensure that your vote is counted.

How

do I vote my shares?

There

are four ways to vote:

| (1) | Via

the Internet. Use the internet to vote by going to the internet address listed on your proxy card. If you vote in this manner,

your “proxy,” whose name is listed on the proxy card, will vote your shares as you instruct on the proxy card. If you sign

and return the proxy card or submit an electronic vote but do not give instructions on how to vote your shares, your shares will be voted

as recommended by the Board. |

| (2) | Via

telephone. Using a touch-tone telephone, you may transmit your voting instructions to the number provided on your proxy

card. Have your proxy card in hand as you will be prompted to enter your control number to create and submit a telephonic vote. |

| (3) | In

person. You may vote by attending the Annual Meeting in person. |

| (4) | By

Mail. You may vote by mail. If you are a record holder, you may vote by proxy by filling out the proxy card and sending it back

in the envelope provided. If you are a beneficial holder you may vote by proxy by filling out the vote instruction form and sending it

back in the envelope provided by your brokerage firm, bank, broker-dealer or other similar organization that holds your shares. |

What

does it mean if I receive more than one proxy card?

You

may have multiple accounts at the transfer agent and/or with brokerage firms. Please sign and return all proxy cards to ensure that all

of your shares are voted.

What

if I change my mind after I return my proxy?

You

may revoke your proxy and change your vote at any time before the polls close at the Annual Meeting. You may do this by:

| ● | sending

a written notice to Matthew Schulman, our Compliance Officer, stating that you would like to revoke your proxy of a particular date; |

| ● | signing

another proxy card with a later date and returning it before the polls close at the Annual Meeting; or |

| ● | voting at the Annual Meeting |

Please

note, however, that if your shares are held of record by a brokerage firm, bank or other nominee, you may need to instruct your broker,

bank or other nominee that you wish to change your vote by following the procedures on the voting form provided to you by the broker,

bank or other nominee.

Will

my shares be voted if I do not sign and return my proxy card?

If

your shares are held in your name and you do not sign and return your proxy card, your shares will not be voted unless you vote at the

Annual Meeting. If you hold your shares in the name of a broker, bank or other nominee, your nominee may determine to vote your shares

at its own discretion on certain routine matters, such as the ratification of Yarel + Partners as the Company’s independent registered

public accounting firm for the year ending December 31, 2024, absent instructions from you. However, due to voting rules that may prevent

your bank or broker from voting your uninstructed shares on a discretionary basis in the election of directors and other non-routine matters,

such as the approval of the Inducement Warrant Exercise Proposal, it is important that you cast your vote.

How

may I vote with respect to each proposal and how are votes counted?

Your voting options will

be dependent on the particular proposal for which you wish to cast a vote. With respect to Proposal No. 1 (the election of directors),

you may vote “for” all of the Director Nominees or “withhold” authority to vote for one or all of the Director

Nominees. With respect to Proposal Nos. 2, 3, 4, 5 and 6, you may vote “for” or “against” the proposal or

you may “abstain” from casting a vote on such proposal. Abstentions, votes marked “withheld” and broker non-votes will

be counted for the purpose of determining whether a quorum is present at the Annual Meeting.

Broker

non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner

and instructions are not given. These matters are referred to as “non-routine” matters. The election of the directors, the

vote on the Inducement Warrant Exercise Proposal and the approval of the 2023 Plan are “non-routine.” Thus, in tabulating

the voting result for these proposals, shares that constitute broker non-votes are not considered votes cast on that proposal. The

ratification of the appointment of ratification of Yarel + Partners as the Company’s independent registered public accounting firm

for the year ending December 31, 2024 (Proposal No. 5) and the Adjournment Proposal (Proposal No. 6) are “routine” matters

and therefore a broker may vote on those matters without instructions from the beneficial owner as long as instructions are not given.

How

many votes are required to elect the Director Nominees as directors of the Company?

In the election of directors,

the five persons receiving the highest number of affirmative votes at the Annual Meeting will be elected.

How

many votes are required to approve the Inducement Warrant Exercise Proposal?

The

affirmative vote of a majority of the shares of common stock present at the Annual Meeting by proxy and that have voted is required for

approval of the Inducement Warrant Exercise Proposal. With respect to an abstention, the shares will be considered present and entitled

to vote at the Annual Meeting, but they will have no effect on the vote of this proposal.

How

many votes are required to approve the Authorized Common Stock Proposal?

The

affirmative vote of by the holders of a majority of the outstanding shares of common stock entitled to vote on this matter at the Annual

Meeting is required for approval of the Authorized Common Stock Proposal. With respect to an abstention, the shares will be considered

present and entitled to vote at the Annual Meeting, but they will not be counted as a vote to approve this proposal.

How

many votes are required to approve the 2023 Plan?

The

affirmative vote of a majority of the shares of common stock present at the Annual Meeting by proxy and that have voted is required for

approval of the 2023 Plan. With respect to an abstention, the shares will be considered present and entitled to vote at the Annual Meeting,

but they will have no effect on the vote of this proposal.

How

many votes are required to ratify the appointment of the Company’s independent public accountants?

The

affirmative vote of a majority of the shares of common stock present at the Annual Meeting by proxy and that have voted is required to

ratify the appointment of Yarel + Partners as our independent registered public accounting firm for the year ending December 31,

2024. With respect to an abstention, the shares will be considered present and entitled to vote at the Annual Meeting, but they will

have no effect on the vote of this proposal.

How

many votes are required to approve the Adjournment Proposal?

The

affirmative vote of a majority of the votes present at the Annual Meeting by proxy and that have voted is required for approval of the

Adjournment Proposal. With respect to an abstention, the shares will be considered present and entitled to vote at the Annual Meeting,

but they will have no effect on the vote of this proposal.

What

happens if I don’t indicate how to vote my proxy?

If you just sign your proxy

card without providing further instructions, your shares will be counted as a “For” vote for all of the Director Nominees,

“For” the approval of the Inducement Warrant Exercise Proposal, “For” the Authorized Common Stock

Proposal, “For” the 2023 Plan, “for” the ratification of the appointment of Yarel + Partners as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2024 and “For” the Adjournment

Proposal.

Is

my vote kept confidential?

Proxies,

ballots and voting tabulations identifying shareholders are kept confidential and will not be disclosed except as may be necessary to

meet legal requirements.

Where

do I find the voting results of the Annual Meeting?

We

will announce voting results at the Annual Meeting and file a Current Report on Form 8-K announcing the voting results of the

Annual Meeting.

Who

can help answer my questions?

You

can contact our corporate Compliance Officer, Matthew Schulman, at 1 (800)-611-3622 or by sending a letter to Mr. Schulman

at the offices of the Company at 235 Lincoln Road, Suite 210, Miami Beach, FL 33139 with any questions about proposals described

in this Proxy Statement or how to execute your vote.

THE

ANNUAL MEETING

General

This Proxy Statement is being furnished to you, as a shareholder of

Cuentas Inc., as part of the solicitation of proxies by our Board for use at the Annual Meeting to be held on Wednesday, December 20,

2023, and any adjournment or postponement thereof. This Proxy Statement is first being furnished to shareholders on or about December

6, 2023. This Proxy Statement provides you with information you need to know to be able to vote or instruct your proxy how to vote at

the Annual Meeting.

Date,

Time, Place of Annual Meeting

The

Annual Meeting will be held on Wednesday, December 20, 2023 at 10:00 AM Eastern, or such other date, time and place to which the

Annual Meeting may be adjourned or postponed. The meeting will be held at the Company’s principal executive office located at 235

Lincoln Rd., Suite 210, Miami Beach, Florida, 33139.

Purpose

of the Annual Meeting

At

the Annual Meeting, the Company will ask shareholders to consider and vote upon the following proposals:

| 1. | To

elect the Director Nominees to serve on the Board for a one-year term that expires at

the 2024 Annual Meeting of Shareholders, or until their successors are elected and qualified; |

| 2. | To

approve, pursuant to Nasdaq listing rules, the issuance of up to 1,232,606 shares of our

common stock upon the exercise of our common stock purchase warrant (the “Inducement

Warrant”) issued to an institutional investor in connection with the Warrant Exercise

and Inducement Letter dated August 21, 2023 and the issuance of up to and 43,141shares of

common stock upon exercise of the placement agent warrants issued to the designees of H.C.

Wainwright & Co. (the “Inducement Warrant Exercise Proposal”); |

| 3. | To approve an amendment to our Amended and Restated Articles of Incorporation,

as amended, to increase the number of authorized shares of common stock from 27,692,307 to 100,000,000 shares (the “Authorized

Common Stock Proposal”); |

| 4. | To

approve the Cuentas 2023 Share Incentive Plan (the “2023 Plan Proposal”); |

| 5. | To

ratify the appointment by the Board of Yarel + Partners, Certified Public Accountants (ISR.),

as the Company’s independent registered public accounting firm for the fiscal year

ending December 31, 2024; |

| 6. | To

approve a proposal to adjourn the Annual Meeting to a later date, if necessary or appropriate,

to permit further solicitation and vote of proxies in the event that there are insufficient

votes for, or otherwise in connection with, the approval of the Inducement Warrant Exercise

Proposal, the Authorized Common Stock Proposal or the 2023 Plan Proposal (the “Adjournment

Proposal”); and |

| 7. | To

transact such other business as may properly come before the Annual Meeting or any adjournment

thereof. |

Recommendations

of the Board

After

careful consideration of each nominee for director, the Board unanimously recommends a vote “FOR” the election of each of

the director nominees, “FOR” the approval of each of the Inducement Warrant Exercise Proposal, the Authorized Common

Stock Proposal, the 2023 Plan Proposal and the Adjournment Proposal, and “FOR” the ratification of the appointment of Yarel

+ Partners, Certified Public Accountants (ISR.), as the Company’s independent registered public accounting firm for the fiscal

year ending December 31, 2024.

Record

Date and Voting Power

Our Board fixed the close of business on November 17, 2023, as the

record date for the determination of the outstanding shares of common stock entitled to notice of, and to vote on, the matters presented

at the Annual Meeting. As of the Record Date, there were 2,730,058 shares of common stock outstanding. Each share of common stock

entitles the holder thereof to one vote. Accordingly, a total of 2,730,058 votes may be cast at the Annual Meeting.

Quorum

and Required Vote

A

quorum of shareholders is necessary to hold a valid meeting. A quorum will be present at the meeting if a majority of the common stock

outstanding and entitled to vote at the Annual Meeting is represented at the Annual Meeting or by proxy. Abstentions, votes marked “withheld”

and broker non-votes will count as present for purposes of establishing a quorum.

In the election of directors

(Proposal No.1), the five persons receiving the highest number of affirmative votes cast at the Annual Meeting will be elected. Votes marked

“withheld” and broker non-votes will have no effect on the election of directors.

The

affirmative vote of a majority of the shares of common stock present at the Annual Meeting by proxy and that have voted is required for

approval of the Inducement Warrant Exercise Proposal (Proposal No. 2), the 2023 Plan Proposal (Proposal No. 4), the ratification of the

appointment of Yarel + Partners (ISR) as the Company’s independent registered public accounting firm for the fiscal year ending

December 31, 2024 (Proposal No. 5) and the Adjournment Proposal (Proposal No. 6). Shares of common stock represented by executed proxies

received by the Company will be counted for purposes of establishing a quorum at the Annual Meeting, regardless of how or whether such

shares are voted on any specific proposal.

The

affirmative vote of by the holders of a majority of the outstanding shares of common stock entitled to vote on the Authorized Common

Stock Proposal (Proposal No. 3) is required for approval. With respect to an abstention, the shares will be considered present and entitled

to vote at the Annual Meeting, but they will not be considered as a vote to approve this proposal.

Brokers

may use their discretion to vote shares held by them of record for the approval of the Authorized Common Stock Proposal (Proposal No.

3) and the Adjournment Proposal (Proposal No. 6) and ratification of the appointment of Yarel + Partners (ISR) as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal No. 5) if they have not been provided

with voting instructions from the beneficial owner of the shares of common stock.

Voting

There

are four ways to vote:

1. Via

the Internet. Use the internet to vote by going to the internet address listed on your proxy card; have your

proxy card in hand as you will be prompted to enter your control number to create and submit an electronic vote. If you vote in this

manner, your “proxy,” whose name is listed on the proxy card, will vote your shares as you instruct on the proxy card. If

you sign and return the proxy card or submit an electronic vote but do not give instructions on how to vote your shares, your shares

will be voted as recommended by the Board.

2. Via

Telephone. Using a touch-tone telephone, you may transmit your voting instructions to the number provided

on your proxy card. Have your proxy card in hand as you will be prompted to enter your control number to create and submit a telephonic

vote.

3. In

person. If you are a stockholder of record, you may vote in person at the Annual Meeting. The Company will

give you a ballot when you arrive. However, if you hold your shares in street name, you must bring to the Annual Meeting a valid proxy

from the broker, bank or other nominee holding your shares that confirms your beneficial ownership of the shares and gives you the right

to vote your shares. Holding shares in street name means you hold them through a brokerage firm, bank or other nominee, and therefore

the shares are not held in your individual name. We encourage you to examine your proxy card closely to make sure you are voting all

of your shares in the Company.

4. By

mail. You may vote by mail. If you are a record holder, you may vote by proxy by filling out the proxy card

and sending it back in the envelope provided. If you are a beneficial holder you may vote by proxy by filling out the vote instruction

form and sending it back in the envelope provided by your brokerage firm, bank, broker-dealer or other similar organization that

holds your shares.

While

we know of no other matters to be acted upon at this year’s Annual Meeting, it is possible that other matters may be presented

at the Annual Meeting. If that happens and you have signed and not revoked a proxy card, your proxy will vote on such other matters in

accordance with his best judgment.

Expenses

The

expense of preparing, printing and mailing this Proxy Statement, exhibits and the proxies solicited hereby will be borne by the Company.

In addition to the use of the mails, proxies may be solicited by officers, directors and regular employees of the Company, without additional

remuneration, by personal interviews, telephone, email or facsimile transmission. The Company will also request brokerage firms, nominees,

custodians and fiduciaries to forward proxy materials to the beneficial owners of shares of Common Stock held of record and will provide

reimbursements for the cost of forwarding the material in accordance with customary charges.

Revocability

of Proxies

Proxies

given by shareholders of record for use at the Annual Meeting may be revoked at any time prior to the exercise of the powers conferred.

In addition to revocation in any other manner permitted by law, shareholders of record giving a proxy may revoke the proxy by an instrument

in writing, executed by the shareholder or his attorney authorized in writing or, if the shareholder is a corporation, under its corporate

seal, by an officer or attorney thereof duly authorized, and deposited either at the corporate headquarters of the Company at any time

up to and including the last business day preceding the day of the Annual Meeting, or any adjournments thereof, at which the

proxy is to be used, or with the chairman of such Annual Meeting on the day of the Annual Meeting or adjournments thereof, and upon

either of such deposits the proxy is revoked.

No

Right of Appraisal

None

of Florida law, our Articles of Incorporation, or our Bylaws, each as amended, provide for appraisal or other similar rights for dissenting

shareholders in connection with any of the proposals to be voted upon at this Annual Meeting. Accordingly, our shareholders will have

no right to dissent and obtain payment for their shares.

Who

Can Answer Your Questions About Voting Your Shares

You

can contact our Compliance Officer, Matthew Schulman, at 1 (800)-611-3622 or by sending a letter to Mr. Schulman at offices

of the Company at 235 Lincoln Road, Suite 210, Miami Beach, FL 33139 with any questions about proposals described in this Proxy

Statement or how to execute your vote.

Principal

Offices

The

principal executive offices of the Company are located at 235 Lincoln Road, Suite 210, Miami Beach, FL 33139. The Company’s

telephone number at such address is 1 (800) 611-3622.

ALL

PROXIES RECEIVED WILL BE VOTED IN ACCORDANCE WITH THE CHOICES SPECIFIED ON SUCH PROXIES. PROXIES WILL BE VOTED IN FAVOR OF A PROPOSAL

IF NO CONTRARY SPECIFICATION IS MADE. ALL VALID PROXIES OBTAINED WILL BE VOTED AT THE DISCRETION OF THE PERSONS NAMED IN THE PROXY

WITH RESPECT TO ANY OTHER BUSINESS THAT MAY COME BEFORE THE MEETING. THE BOARD UNANIMOUSLY RECOMMENDS

A VOTE “FOR” THE APPROVAL OF EACH DIRECTOR NOMINEE, “FOR” THE APPROVAL OF EACH OF THE INDUCEMENT

WARRANT EXERCISE PROPOSAL, THE AUTHORIZED COMMON STOCK PROPOSAL, THE 2023 PLAN PROPOSAL AND THE ADJOURNMENT PROPOSAL, AND “FOR”

THE RATIFICATION OF THE APPOINTMENT OF YAREL + PARTNERS, CERTIFIED PUBLIC ACCOUNTANTS (ISR.), AS THE COMPANY’S INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2024.

PROPOSAL NO.

1

ELECTION OF DIRECTORS

Introduction

At the Annual Meeting,

five directors are to be elected, each to serve until the next Annual Meeting of Shareholders and until his or her successor shall

be elected and shall qualify. Each of the current directors (other than Sara Sooy) has been nominated for re-election to the Board.

All of the Director Nominees are available for election as members of the Board. If for any reason a Director Nominee becomes

unavailable for election, the proxies solicited by the Board will be voted for a substitute nominee selected by the Board.

The

enclosed proxy, if returned, and unless indicated to the contrary, will be voted for the election of each of the Director Nominees.

Director

Nominees

| Name |

|

Age |

|

Director Since |

| Arik Maimon |

|

48 |

|

2016 |

| Michael De Prado |

|

54 |

|

2016 |

| Adiv Baruch |

|

61 |

|

May 2016 |

| Lexi Terrero |

|

51 |

|

December 2022 |

| Haim Yeffet |

|

73 |

|

February 2023 |

The

following sets forth the biographical background information for all of our Director Nominees:

Arik Maimon, our Chairman,

is a founder, the Chief Executive Officer and Chairman of the Board. Mr. Maimon served as the Company’s CEO from 2016 to February 2021

and as Interim CEO from February 2021 to August 2023. In addition to co-founding the Company, Mr. Maimon founded the

Company’s subsidiaries Cuentas Mobile, and M&M. Prior to founding the Company and its subsidiaries, Mr. Maimon founded

and ran successful telecommunications companies operating primarily in the United States and Mexico. In 1998, Mr. Maimon founded

and ran a privately-held wholesaler of long-distance telecommunications services which, later, under Mr. Maimon’s

management, grew from a start up to a profitable enterprise with more than $100 million in annual revenues. Mr. Maimon serves

on the Company’s Board of Directors due to the perspective and experience he brings as our co-founder, Chairman and Chief Executive

Officer.

Michael

A. De Prado is a founder, the President and Vice Chairman of the Board. Mr. De Prado also served as its President

from 2016 to February 2021, and as Interim President from February 2021 to August 2023. Prior to founding the Company, Mr. De

Prado spent 20 years in executive positions at various levels of responsibility in the banking, technology, and telecommunications

industries. As President of Sales at telecommunications company Radiant/Ntera, Mr. De Prado grew Radiant/Ntera’s sales to

more than $200 million in annual revenues. At theglobe.com, Mr. De Prado served as President, reporting directing to Michael

S. Egan. Mr. De Prado serves on the Company’s Board of Directors due to the perspective and experience he brings as our

co-founder and President.

Adiv

Baruch is a global leader anchors in the Israeli high-tech industry as well as the Chairman of Israeli Export and International

cooperation Institute and several private and public companies. Mr. Baruch has over 28 years of experience in equity investment

and operation management under distress. Mr. Baruch also serves as chairman of Jerusalem Technology Investments Ltd. He also currently

serves as Chairman of Maayan Ventures, a platform for investments in innovative technology companies. Mr. Baruch has served as a

director of the Bank of Jerusalem, and he served as CEO of BOS Better Online Solutions, which, under this leadership, grew into a highly

successful company traded on Nasdaq under the symbol BOSC. Throughout his career, he has championed development and support of new

talent in the high tech and entrepreneurial arenas. He is a Technion graduate and the Chairman of the Institute of Innovation and Technology

of Israel. Mr. Baruch is qualified to serve as a director of the Company because of the perspective and experience he brings to

our Board.

Lexi

Terrero is a marketing and financial executive with over 15 years of experience in digital media, investor relations and private

equity. Ms. Terrero is qualified to serve as a director of the Company because of her deep industry knowledge of marketing and business

development, sales development, raising capital, finance, and operational management. She received a BS in Finance and an MBA in Interdisciplinary

Business from St. Johns University in New York City.

Haim

Yeffet has owned and managed 10 restaurants and served as the CEO of a public company. He is involved in his condo board at

the Alexander in Miami Beach, and has served as the Vice President and as Secretary for the association for the last three years. Mr.

Yeffet is qualified to serve as a director of the Company because of his business experience, including his experience as CEO of a public

company.

In

addition to the foregoing, we believe that each of the Director Nominees that is nominated for reelection is well-qualified to serve

as a member of our Board due to their prior experience and work with and on our Board.

We

believe that the collective skills, experiences and qualifications of our directors provide our Board with the expertise and experience

necessary to advance the interests of our shareholders. In selecting directors, the Board considers candidates that possess qualifications

and expertise that will enhance the composition of the Board, including the considerations set forth below. The considerations set forth

below are not meant as minimum qualifications, but rather as guidelines in weighing all of a candidate’s qualifications and expertise.

In addition to the individual attributes of each of our current directors described below, we believe that our directors should have

the highest professional and personal ethics and values, consistent with our longstanding values and standards. They should have broad

experience at the policy-making level in business, exhibit commitment to enhancing stockholder value and have sufficient time to

carry out their duties and to provide insight and practical wisdom based on their past experience.

Family

Relationships

There

are no family relationships, or other arrangements or understandings between or among any of the directors, director nominees, executive

officers or other person pursuant to which such person was selected to serve as a director or officer.

Election

of Directors and Officers

Directors

are elected to serve until the next annual meeting of shareholders and until their successors have been elected and qualified. Officers

are appointed to serve until the meeting of the Board following the next annual meeting of shareholders and until their successors have

been elected and qualified.

Involvement

in Certain Legal Proceedings

No

executive officer or director of the Company has been the subject of any order, judgment, or decree of any court of competent jurisdiction,

or any regulatory agency permanently or temporarily enjoining, barring suspending or otherwise limiting him/her from acting as an investment

advisor, underwriter, broker or dealer in the securities industry, or as an affiliated person, director or employee of an investment

company, bank, savings and loan association, or insurance company or from engaging in or continuing any conduct or practice in connection

with any such activity or in connection with the purchase or sale of any securities.

No

executive officer or director of the Company has been convicted in any criminal proceeding (excluding traffic violations) or is the subject

of a criminal proceeding which is currently pending.

No

executive officer or director of the Company is the subject of any pending legal proceedings.

Required

Vote

In the election of directors,

the five persons receiving the highest number of affirmative votes cast at the Annual Meeting will be elected.

Recommendation

of the Board

THE

BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” ELECTION OF EACH OF THE NOMINEES FOR DIRECTOR.

Board

Leadership Structure and Risk Oversight

Although

we have not adopted a formal policy on whether the Chairman and Chief Executive Officer positions should be separate or combined, we

have traditionally determined that it is in our best interests and in the best interests of our shareholders to combine these roles.

Arik Maimon is our Chairman and Chief Executive Officer. Due to our small size, we believe it is currently most effective to have the

Chairman and Chief Executive Officer positions combined. A combined structure provides the Company with a single leader who represents

the Company to our shareholders, regulators, business partners and other shareholders, among other reasons set forth below.

| ● | This

structure creates efficiency in the preparation of the meeting agendas and related Board materials as the Company’s Chief Executive

Officer works directly with those individuals preparing the necessary Board materials and is more connected to the overall daily operations

of the Company. Agendas are also prepared with the permitted input of the full Board of Directors allowing for any concerns or risks

of any individual director to be discussed as deemed appropriate. The Board believes that the Company has benefited from this structure,

and Mr. Maimon’s continuation in the combined role of Chairman and Chief Executive Officer is in the best interest of the shareholders. |

| ● | The

Company believes that the combined structure is necessary and allows for efficient and effective oversight, given the Company’s

relatively small size, its corporate strategy and focus. |

The

Board of Directors does not have a specific role in risk oversight of the Company. The Chairman and Chief Executive Officer and other

executive officers and employees of the Company provide the Board of Directors with information regarding the Company’s risks.

Board

of Directors and Board Committees

Board

of Directors

We

currently have six directors serving on our Board of Directors. A majority of the authorized number of directors constitutes a quorum

of the Board for the transaction of business.

Director

Independence

Of

our current directors, we have determined that Messrs. Baruch and Yeffet as well as Ms. Sooy and Ms. Terrero are “independent”

as defined by applicable rules and regulations. The Company is in the process to interviewing additional potential Independent Directors

to fill additional board positions with goals of Gender, Age and Racial diversity as well as Cyber protection experience as indicated

by the SEC to be important goals.

Diversity

of Board Members

Under

Nasdaq’s Board Diversity Rule, all operating companies listed on Nasdaq’s U.S. Exchange are required to publicly disclose

diversity statistics for their Board of Directors.

| Board Diversity Matrix as of November 17, 2023 |

| Total Number of Directors | |

6 |

| | |

Male | |

Female | |

Did not Disclose |

| Demographic | |

4 | |

2 | |

— |

| African American or Black | |

| |

| |

|

| Alaskan Native or Native American | |

| |

| |

|

| Asian | |

| |

| |

|

| Hispanic or Latinx | |

1 | |

2 | |

|

| Native Hawaiian or Pacific Islander | |

| |

| |

|

| White | |

1 | |

| |

|

| Two or more races or Ethnicities | |

| |

| |

|

| Did not disclose | |

2 | |

| |

|

Director

Compensation

Non-employee

directors receive $50,000 per annum and the chairman of the Audit Committee and Compensation Committee receives an additional

$16,000 per annum. The following table sets forth certain information concerning the annual compensation of our independent

directors during the last two fiscal years.

| Name and Principal Position | |

Year | | |

Fee | | |

Bonus | | |

Option Awards | | |

Share Compensation | | |

Nonqualified Deferred Compensation Earnings | | |

All Other Compensation | | |

Total Compensation | |

| Adiv Baruch | |

| 2022 | | |

$ | 67,000 | | |

$ | - | | |

$ | 110,781 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 177,781 | |

| | |

| 2021 | | |

| 56,750 | | |

$ | - | | |

$ | 155,093 | | |

$ | 154,841 | | |

$ | - | | |

$ | - | | |

$ | 366,684 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sara Sooy | |

| 2022 | | |

$ | 31,250 | | |

$ | - | | |

$ | 81,250 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 112,500 | |

| | |

| 2021 | | |

| - | | |

$ | - | | |

| | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Lexi Terrero | |

| 2022 | | |

$ | - | | |

$ | - | | |

| | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| | |

| 2021 | | |

$ | - | | |

$ | - | | |

| | | |

$ | - | | |

$ | - | | |

$ | | | |

$ | - | |

Ms.

Terrero was appointed a director on December 30, 2022 and Mr. Yeffet was appointed a director on February 2, 2023.

Board

Committees

Our

Board of Directors has established two standing committees-Audit and Compensation. All standing committees operate under a charter that

has been approved by our Board of Directors. In addition, in lieu of a Nominating and Corporate Governance committee, our Board of Directors

has designated the independent directors of the Board of Directors by resolution to select, or recommended for the Board of Director’s

selection, any and all nominees to the Board of Directors (see Nomination of Directors below).

Audit

Committee

Our

Board of Directors has an Audit Committee, composed of Mr. Baruch, Mr. Yeffet and Ms. Terrero, each of whom are independent directors as

defined in accordance with section Rule 10A-3 of the Exchange Act and the rules of Nasdaq. Mr. Baruch serves as chairman of the Audit

Committee.

Our

Audit Committee oversees our corporate accounting, financial reporting practices and the audits of financial statements. For this purpose,

the Audit Committee has a charter (which will be reviewed annually) and performs several functions. The Audit Committee:

| |

● |

evaluates the independence and performance

of, and assesses the qualifications of, our independent auditor and engages such independent auditor; |

| |

|

|

| |

● |

approves the plan and fees

for the annual audit, quarterly reviews, tax and other audit-related services and approves in advance any non-audit service and fees

therefor to be provided by the independent auditor; |

| |

|

|

| |

● |

monitors the independence of the independent auditor

and the rotation of partners of the independent auditor on our engagement team as required by law; |

| |

● |

reviews the financial statements

to be included in our annual report on Form 10-K and quarterly Reports on Form 10-Q and reviews with management and the independent

auditors the results of the annual audit and reviews of our quarterly financial statements; |

| |

|

|

| |

● |

oversees all aspects of our systems of internal accounting

and financial reporting control and corporate governance functions on behalf of the board; and |

| |

|

|

| |

● |

provides oversight assistance in connection with legal,

ethical and risk management compliance programs established by management and the board, including compliance with requirements of

Sarbanes-Oxley and makes recommendations to the Board of Directors regarding corporate governance issues and policy decisions. |

The Audit Committee has a

charter, which is reviewed annually. There were three meetings of the Audit Committee held during fiscal year 2022.

Compensation Committee

Our Board of Directors has

a Compensation Committee composed of Messrs. Baruch and Yeffet, each of whom is independent in accordance with rules

of Nasdaq. Mr. Baruch is the chairman of the Compensation Committee. Our Compensation Committee reviews or recommends the compensation

arrangements for our management and employees and also assists the Board of Directors in reviewing and approving matters such as company

benefit and insurance plans, including monitoring the performance thereof. The Compensation Committee has a charter, which will be reviewed

annually. There was one meeting of the Compensation Committee held during fiscal year 2022.

Nomination

of Directors

Our

Board of Directors, by resolution of the full Board of Directors addressing the nominations process and such related matters as may be

required under the federal securities laws, has charged the independent directors constituting a majority of our Board of Directors with

the responsibility of reviewing our corporate governance policies and with proposing potential director nominees to the Board of Directors

for consideration. The independent directors will consider director nominees recommended by security holders.

Attendance

at Meetings of the Board of Directors and its Committees

There were 12 meetings, exclusive

of actions by unanimous written consent, of the Board held during fiscal year 2022. Each of our directors attended at least 75% of the

meetings of the Board and the committees on which they were a member during fiscal 2022.

Attendance at Annual Meeting of Shareholders

The Company has not adopted

a policy concerning attendance of directors at Annual Meetings of Shareholders. two of the five directors nominated for election at the

2022 Annual Meeting of Shareholders attended the meeting.

Code

of Ethics

We have adopted a formal code of ethics that applies to our principal

executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. We

will provide a copy of our code of ethics to any person without charge, upon request. For a copy of our code of ethics write to Compliance

Officer, Cuentas Inc., 235 Lincoln Road, Suite 210, Miami Beach, Florida, 33139.

Shareholder

Communications

Although

we do not have a formal policy regarding communications with the Board, shareholders may communicate with the Board by writing to us

at 235 Lincoln Rd., Suite 210, Miami Beach, FL 33139, Attention: Shareholder Communication. Shareholders who would like their submission

directed to a member of the Board may so specify, and the communication will be forwarded, as appropriate.

Executive

Compensation

Summary

Compensation Table

The

following table sets forth certain information concerning the annual compensation of our Chief Executive Officer and our other executive

officers during the last two fiscal years.

| (a) Name and Principal Position | |

(b)

Year | | |

(c)

Salary | | |

(d)

Bonus | | |

(f)

Option

Awards | | |

(g)

Non-equity

incentive plan

compensation | | |

(h)

Nonqualified

deferred

compensation

earnings | | |

(i)

All Other

Compensation | | |

(j)

Total

Compensation | |

| Arik Maimon | |

2022 | | |

$ | 295,000 | | |

$ | 150,000 | | |

$ | 257,895 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 702,895 | |

Executive Chairman

and Interim CEO | |

2021 | | |

$ | 295,000 | | |

$ | - | | |

$ | 326,667 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 621,667 | |

| Michael De Prado | |

2022 | | |

$ | 275,000 | | |

$ | 150,000 | | |

$ | 193,421 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 638,421 | |

Executive

Vice Chairman | |

2021 | | |

$ | 268,400 | | |

$ | - | | |

$ | 245,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 513,400 | |

| Ran Daniel | |

2022 | | |

$ | 245,000 | | |

$ | - | | |

$ | 128,947 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 373,943 | |

| CFO | |

2021 | | |

$ | 274,196 | | |

$ | - | | |

$ | 163,333 | | |

$ | - | | |

$ | - | | |

$ | 77,400 | | |

$ | 514,929 | |

Pay

Versus Performance Disclosure

The

following table sets forth the pay versus performance for our Named Executive Officers for each of the fiscal years ended December 31,

2022 and 2021.

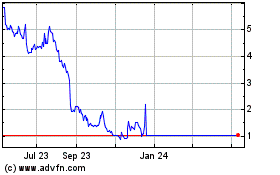

| Year | |

Summary Compensation Table Total for Arik Maimon,

PEO | | |

Compensation Actually Paid to Arik Maimon, PEO* | | |

Average Summary Compensation Table Total for Non-PEO

NEOs (1) | | |

Average Compensation Actually Paid to Non-PEO NEOs

(1)* | | |

Value of Initial Fixed $100 Investment Based On Total

Shareholder Return (2) | | |

Value of Initial Fixed $100 Investment Based On Net

Income | |

| (a) | |

(b) | | |

(c) | | |

(d) | | |

(e) | | |

(f) | | |

(g) | |

| 2022 | |

| 702,895 | | |

| 445,000 | | |

| 506,182 | | |

| 344,998 | | |

| (98 | ) | |

| | |

| 2021 | |

| 621,667 | | |

| 295,000 | | |

| 435,777 | | |

| 219,457 | | |

| (88 | ) | |

| | |

| 2020 | |

| 1,053,333 | | |

| 800,000 | | |

| 706,810 | | |

| 605,476 | | |

| (41 | ) | |

| | |

| * | “Compensation Actually Paid” to our PEO and Non-PEO NEOs

represents the “Total” compensation reported in the Summary Compensation Table less the “Stock Awards” reported

in the Summary Compensation Table for the applicable fiscal year as determined in accordance with SEC rules. |

| (1) | Michael De Prado and Ran Daniel were our only Non-PEO named

executive officers in 2021 and 2022. |

| (2) | Assumes a $100 fixed investment as of year-end 2020 and

continuing through year-end 2021 or 2022, respectively. |

Relationships

Between Performance Measures and Compensation Actually Paid

The

following graphs further illustrate the relationship between the pay and performance figures that are included in the pay versus performance

tabular disclosure above. As noted above, “Compensation Actually Paid” for purposes of the tabular disclosure and the following

graphs was calculated in accordance with SEC rules.

Executive

Compensation Policies as They Relate to Risk Management

The

Compensation Committee and management have considered whether our compensation policies might encourage inappropriate risk taking by

the Company’s executive officers and other employees. The Compensation Committee has determined that the current compensation structure

aligns the interests of the executive officers with those of the Company without providing rewards for excessive risk taking by awarding

a mix of fixed and performance based or discretionary bonuses with the performance-based compensation focused on profits as opposed

to revenue growth.

The

Compensation Committee working with management adopts a plan each year intended to award members of our management including executive

officers for meeting or exceeding targeted goals, The Committee believes the amounts to be paid to Messrs. Maimon and De Prado and Daniel

for services rendered in fiscal 2023 are appropriate in light of our financial performance in 2022.

Share

Incentive Plans

2021

Plan

On

June 17, 2021 the Board of the Company approved the Cuentas Inc. 2021 Share Incentive Plan (the “2021 Plan”). which was approved

by the shareholders during the Annual Shareholders Meeting held on December 15, 2021. The maximum number of shares of stock reserved

and available for issuance under the 2021 Plan is 118,078 shares. The 2021 Plan is designed to enable the flexibility to grant equity

awards to the Company’s officers, employees, directors and consultants as determined by the Company’s Compensation Committee.

The

Company issued 119,229 stock options in 2021 and 38,461 in 2022 to executive officers and non-employee directors.

2023

Plan

On

November 17. 2023, the Board of the Company approved the Cuentas Inc. 2023 Share Incentive Plan (the “2023 Plan”). Shareholders

are requested to vote upon approval of the 2023 Plan at the Annual Meeting. See Proposal No. 4. The maximum number of shares of stock

reserved and available for issuance under the 2023 Plan is 1,000,000 shares, subject to annual increases of up to 5% of the outstanding

shares on January 1 of each year commencing January 1, 2025. The 2023 Plan is designed to enable the flexibility to grant equity awards

to the Company’s officers, employees, directors and consultants as determined by the Company’s Compensation Committee. The

Company has not granted any awards under the 2023 Plan.

Outstanding

Equity Awards at Fiscal Year End

The

following table sets forth information concerning the outstanding equity awards of each of the Named Executive Officers as of December

31, 2022:

Name

(a) | |

Number of Securities Underlying Unexercised Options (#) Exercisable (b) | | |

Number of Securities Underlying Unexercised Options (#) Unexercisable (c) | | |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) (d) | | |

Option Exercise Price ($) (e) | | |

Option

Expiration

Date (f) | |

Number of Shares or Units of Stock That Have Not Vested (#) (g) (9) | | |

Market Value of Shares or Units of Stock That Have Not Vested ($) (h) | | |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) (i) | | |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (#) (j) | |

| Arik Maimon | |

| 20,616 | | |

| - | | |

| - | | |

$ | 5.12 | | |

3,385 options at March 29,2025 ,1,846 at September 12, 2023 and 15,385 at November 2, 2031 | |

| - | | |

| - | | |

| - | | |

$ | 257,895 | |

| Michael De Prado | |

| 14,246 | | |

| - | | |

| - | | |

$ | 5.00 | | |

$2,708 at March 29,2025 and 11,538 at November 2, 2031 | |

| | | |

| | | |

| - | | |

$ | 193,421 | |

| Ran Daniel | |

| 9,230 | | |

| - | | |

| - | | |

| 3.20 | | |

1,538 options at April 6, 2024 and 7,692 at November 2, 2031 | |

| - | | |

| - | | |

| - | | |

$ | 128,947 | |

Founder/Executive

Chairman Compensation Agreement with Arik Maimon, and Founder/Executive Vice-Chairman Compensation Agreement with Michael De Prado

On

August 26, 2021, the Company and Arik Maimon entered into a Founder/Executive Chairman Compensation Agreement (the “Chairman Compensation

Agreement”). Additionally, on August 26, 2021, the Company and Michael De Prado entered into a Founder/Executive Vice-Chairman

Compensation Agreement (the “Vice-Chairman Compensation Agreement” and collectively with the Chairman Compensation Agreement,

the “Chairman Compensation Agreements”). The term of each of these Chairman Compensation Agreements became effective as of

August 26, 2021 and replaced any prior arrangements or employment agreements between the Company and each of Mr. Maimon and Mr. De Prado

(each such individual, an “Executive” and together, the “Executives”). Each of these agreements was replaced

by new employment agreements with Messrs. Maimon and De Prado described below, effective August 21, 2023.

Under

the terms of the Chairman Compensation Agreements, the Executives agreed to be employed by the Company for an initial continuous twelve-month

term beginning on the effective date of August 26, 2021, and ending on August 25, 2022. The initial term would be automatically extended

for additional one (1) year periods on the same terms and conditions as set out in the Chairman Compensation Agreements; however, the

Chairman Compensation Agreements, respectively, would not renew automatically if either the Company or the respective Executive provide

a written notice to the other of a decision not to renew, which notice must be given at least ninety (90) days prior to the end of the

initial term or any subsequently renewed one (1) year term. Pursuant to the terms of the Chairman Compensation Agreement, Mr. Maimon

received an annual base salary of two hundred ninety-five thousand dollars ($295,000) per year, and pursuant to the terms of the Vice-Chairman

Compensation Agreement, Mr. De Prado received an annual base salary of two hundred seventy-five thousand dollars ($275,000) per year,

and was eligible for an annual incentive payment of up to one hundred percent (100%) of their respective base salary, which annual incentive

payment shall be based on the Company’s performance as compared to the goals established by the Company’s Board of Directors

in consultation with each Executive, respectively. This annual incentive was based upon a twelve (12) month performance period commencing

on January 1 through December 31 of that calendar year, with the Executives’ entitlement to the annual incentive and the amount

of such award, if any, remaining subject to the good faith discretion of the Board of Directors. Any such annual incentive was to have

been paid by the end of the second quarter following the calendar year to which each respective Executive’s performance relates.

Pursuant to the terms of the Chairman Compensation Agreements, each Executive had the option to have any such earned annual incentive

be paid in fully vested shares of the Company’s Common Stock, but must have elected such option by the end of the first quarter

following the relevant performance calendar year period. In the event of a change in control of the Company, as defined under the terms

of the Chairman Compensation Agreements, that takes place (i) during the term of the Chairman Compensation Agreement or (ii) prior to

the date which is twenty-four (24) months from the effective date of the Chairman Compensation Agreements, if the Executive’s employment

otherwise terminates prior to such date (other than if the Executive’s employment was terminated for cause or the Executive resigned

his employment without good reason, as such terms are defined under the Chairman Compensation Agreements), each respective Executive

shall be entitled to a bonus payment equal to two and one-half percent (2.5%) of the cash consideration received by the shareholders

of the Company in the change in control transaction. Under the Chairman Compensation Agreements, each Executive was subject to certain

obligations and restrictive covenants, including, but not limited to: confidentiality, non-competition, non-solicitation, and non-disparagement,

among others. The Chairman Compensation Agreements are each governed by the laws of the State of Florida. The Chairman Compensation Agreements

could be terminated by the Company for cause or without cause, and by each respective Executive for good reason or without good reason,

as such terms are defined under the Chairman Compensation Agreements. On August 19, 2022, the Company’s Board of Directors approved

a motion to appoint Arik Maimon as Interim CEO (in addition to his current position as Chairman of the Board) and Michael De Prado as

Interim President (in addition to his current position as Vice Chairman of the Board). Both Arik Maimon and Michael De Prado agreed to

assume these positions with no additional compensation.

On

March 9, 2023 the Board of Directors of the Company approved an annual Incentive of $150,000 for Michael De Prado for fiscal year 2022

and $150,000 for Arik Maimon for fiscal year 2022. Those annual Incentives were paid on March 10, 2023. On March 9, 2023 the Board of

Directors of the Company approved an annual Incentive of $150,000 for Michael De Prado for fiscal year 2022 and $150,000 for Arik Maimon

for fiscal year 2022. Those annual Incentives were paid on March 10, 2023.

On

March 9, 2023, the Board of Directors of the Company approved a Retention Bonus to be included in the negotiation of an employment agreement

or amended employment agreement for Shalom Arik Maimon and Michael De Prado.

New

Employment Agreement with Arik Maimon

On

August 21, 2023, the Company entered into a new employment agreement with Arik Maimon pursuant to which Mr. Maimon agreed to serve as

Executive Chairman and Chief Executive Officer of the Company (the “Maimon Employment Agreement”). Capitalized terms used

herein without definition shall have the meanings assigned to them in the Maimon Employment Agreement”). The following description

of the Maimon Employment Agreement is qualified in its entirety by reference to the full text of the Maimon Employment Agreement, a copy

of which is attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on August 22, 2023, and is incorporated herein

by reference.

Term:

Five years (the “Term”), subject to the early termination provisions of the Maimon Employment Agreement, commencing August

21, 2023 (the “Effective Date”).

Early

Termination: Upon Mr. Maimon’s death, or by the Company for Cause, Mr. Maimon’s adjudicated incompetency or adjudicated bankruptcy,

the date upon which the Company gives Mr. Maimon notice of termination on account of Disability, and by Mr. Maimon in the event of an

Adverse Change in Executive’s Employment Circumstances.

Base

Salary: Pursuant to the terms of the Maimon Employment Agreement, Mr. Maimon will receive an annual base salary of two hundred ninety-five

thousand dollars ($295,000) per year, subject to increase by the Company’s by Board of Directors upon the recommendation of the

Compensation Committee of the Company’s Board of Directors.

Discretionary

Annual Performance-Based Bonus: Mr. Maimon is eligible to receive a discretionary annual performance-based payment of up to one hundred

percent (100%) of his base salary, which performance-based payment shall be determined by the Compensation Committee of the Board of

Directors based on the Company’s performance as compared to the goals established by the Compensation Committee and the Company’s

management, including the Annual Budget (as defined in the Maimon Employment Agreement, in consultation with Mr. Maimon At the discretion

of the Compensation Committee, this review may be performed each fiscal quarter but not less than semi-annually, and the Performance-Based

Bonus awarded, if any, may be paid accordingly. The Performance-Based Bonus shall be prorated for any partial fiscal year in which the

Executive was employed by the Company. Executive shall not be entitled to receive any portion of the Annual Incentive Bonus for any year

in which his employment is terminated for Cause. Pursuant to the terms of the Maimon Employment Agreement, The Bonus shall be prorated,

based on each fiscal quarter of employment, for any partial fiscal year. Notwithstanding the limitation on the payment in cash of the

Performance-Based Bonus, the Compensation Committee based upon certain criteria specified in the Maimon Employment Agreement may at its

discretion award Mr. Maimon stock or stock options as an additional Performance-Based Bonus in addition to the cash component but only

an annual basis and only for fiscal years in which the Company’s financial results substantially exceed the Annual Budget.

Stock