false

0001530766

0001530766

2023-12-06

2023-12-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 6, 2023

BioSig

Technologies, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38659 |

|

26-4333375 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

55

Greens Farms Road, 1st Floor

Westport,

Connecticut |

|

06880 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(203)

409-5444

(Registrant’s

telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

BSGM |

|

The

NASDAQ Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01 Regulation RD Disclosure.

On

December 6, 2023, BioSig Technologies, Inc. (the “Company”) issued a letter to shareholders, which is attached hereto as

Exhibit 99.1, providing highlights on the Company’s recent developments and updates. The Company undertakes no obligation to update,

supplement or amend the materials attached hereto as Exhibit 99.1.

In

accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01 of this Current Report on Form 8-K, including

Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by reference in

such a filing. Furthermore, the furnishing of information under Item 7.01 of this Current Report on Form 8-K is not intended to constitute

a determination by the Company that the information contained herein, including the exhibits hereto, is material or that the dissemination

of such information is required by Regulation FD.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

BIOSIG

TECHNOLOGIES, INC. |

| |

|

|

| Date:

December 6, 2023 |

By: |

/s/

Kenneth L. Londoner

|

| |

Name: |

Kenneth

L. Londoner

|

| |

Title: |

Executive

Chairman |

Exhibit

99.1

LETTER

TO SHAREHOLDERS

December

2023

Dear

fellow shareholders,

As

we approach the end of 2023, I want to share with you BioSig’s important achievements of the past 12 months, showcase our strengths

and strategies, address our challenges, and offer insights about the year ahead.

This

year, we completed BioSig’s business transition from a traditional medtech sales model with a technology enabling superior signal

visualization, to a subscription-based commercial model with a cardiac care platform poised to make game-changing improvements in how

electrophysiologists treat cardiac arrhythmia, a condition affecting more than six million Americans.

With

our subscription service, we debuted new PURE EP™ software features, including unique algorithms that unlock signal data for electrophysiologists

conducting even the most challenging ablation procedures. Since the launch of our version 7 (V7) software upgrade in August, two of the

top three U.S. health systems in cardiology—Cleveland Clinic and Mayo Clinic—have subscribed to our technology.

Leveraging

these successes, our primary goal for 2024 is to accelerate the adoption of our PURE EP™ Platform in existing and new target markets,

driving multiple avenues of potential value creation.

OUR

INNOVATION ENGINE

As

part of V7, our new Near Field Tracking (NFT) technology alerts the physician when to ablate tissue and when to stop ablating tissue

during an atrial fibrillation (AFib) procedure. To our knowledge, no other intracardiac signaling technology provider offers this level

of innovation.

This

functionality was developed in response to the needs communicated from leading electrophysiologists and physicians about next-level innovation

for our system. This inspired our creation of V7 NFT technology, which guides a physician through an AFib procedure and prompts when

to stop ablation to reduce risk for serious procedural complications. One such complication that EPs face is esophageal fistulas, a rare

but lethal complication with a 70% mortality risk. We believe our technology could play a critical role in reducing and/or eliminating

risk for such complications. With the highly-competitive and all-new inputs and features we have added, we expect V7 to be a significant

growth lever for our PURE EP™ Platform sales and adoption strategies.

Based

in part on our research findings, we believe that the NFT features can positively impact PURE EP™ Platform adoption around the

country. Since the V7 launch in August, followed by subsequent improvements, we’ve found that the NFT features are resonating with

a growing number of physicians at many leading hospitals due to the ease of use, effectiveness, time savings, and revenue-enhancing features—all

designed to improve workflow during the diagnosis and catheter ablation treatment for AFib. Also, with this latest software update and

the NFT features, additional reimbursement options may be applicable to hospitals when associated services are medically necessary.

DRIVING

CLINICAL EXCELLENCE

Favorable

clinical data helps drive product adoption. Data shows that our technology is well-positioned to drive clinical excellence.

Research

initiated and led by Cleveland Clinic’s world-class physician faculty was presented at this year’s Heart Rhythm Society meeting.

Our optimized ablation technique was tested in a pulmonary vein isolation (PVI) procedure, the most common catheter ablation treatment

for AFib. The results highlighted the PURE EP™ Platform’s ability to preserve raw signals that deliver real-time tissue feedback

when conducting ablation, enabling physicians to perform certain aspects of the procedure in one-third of the time as conventional methods.

Researchers

are expanding abstracts from this study into manuscripts for potential inclusion in leading scientific peer-reviewed publications. In

addition, several investigator-initiated studies are in progress at other institutions that will be presented in the second half of 2024.

We believe that the communication of this data, plus additional data from a pipeline of physician-initiated studies next year, will illuminate

the unique benefits of the PURE EP™ Platform by way of high-profile conference presentations, peer-to-peer networking, and, most

importantly, direct engagement with electrophysiologists and health centers.

A.I.

COLLABORATION

This

year, we advanced research and development for an artificial intelligence (A.I.) medical device platform through a majority-owned subsidiary,

BioSig AI Sciences, Inc. (BioSig AI) which initially began in 2019 and was later paused during the pandemic. In July 2023, we closed

a $2.2 million seed funding round for the subsidiary to support the development of this platform with certain collaborators.

The

integration of A.I. and machine learning in electrophysiology (EP) devices is powering substantial expected growth for this market, and

we intend to be a leader in developing applications of these technologies. BioSig AI’s foundational machine learning model is based

on integrated healthcare datasets, beginning with ECG and iECG data acquired by the PURE EP™ Platform. Electrophysiology-focused

technological solutions developed under the terms of the collaboration may be integrated into our PURE EP™ technology for potential

commercial application.

The

market opportunity is significant. According to Data Bridge Market Research, the market for artificial intelligence in healthcare, estimated

at $9.6 billion in 2022, is expected to reach nearly $273 billion by 2030, at a CAGR of 52% during the forecast period.1

ROBUST

IP & MANUFACTURING

Our

intellectual property is well protected. This year, we added five new patent awards, bringing our total number of patents to over 100.

These include utility patents, worldwide design patents, and U.S. and foreign utility patent applications covering various aspects of

the PURE EP™ Platform.

We

also have licenses to 11 patents and nine worldwide utility patent applications pending from the Mayo Foundation for Medical Education

and Research.

Additionally,

we have one allowed and one pending patent for BioSig AI.

During

the current quarter, we completed a manufacturing transition to Plexus, a world-class manufacturer that generates nearly half of its

over $3 billion of revenues from well-known healthcare and life sciences customers. We’re confident that Plexus will be able to

support future demands for the PURE EP™ Platform.

FINANCING

AND CAPITAL ALLOCATION

As

an early–stage commercial company, we rely on the capital markets to fund our operations. With broad market instability and economic

uncertainty over the past two years, the constrained funding environment has been incredibly challenging for early commercial-stage companies

like BioSig.

Medtech

equity financing declined 27% last year, its lowest point in seven years according to Ernst & Young, and a recent JPMorgan analyst

research report states that medtech trading this year is at the lowest levels of sentiment since the Great Recession in 2008 and 2009.2

The challenges for BioSig are real.

Despite

these headwinds, over the past 12 months, BioSig has raised over $20 million, primarily through private placements of our securities

and a recent registered direct offering.

We

are working hard to prioritize fundraising and capital allocation for commercial expansion and innovation in order to deliver durable

returns. We are committed to the conscientious use of capital to ensure funding for expanded commercialization, and we are strategic

about cost savings, especially in this current economy.

COMMITMENT

AND VISION

While

we are disappointed in the market valuation of our Company and performance of our stock this year, we remain deeply committed to improving

shareholder value through operational success. BioSig’s senior management and employees are all shareholders like you and share

the interest in durable returns.

2023

brought multiple new business leaders to our management team and our board who have delivered substantive contributions to our business

operations and strategies. We believe our software belongs in every EP lab, and we are making every effort to realize our belief.

BioSig’s

capacity for innovation is stronger than ever, and we believe our opportunities for sustainable growth are achievable. With

sound execution around our ramp-up of commercial placements and a sharp focus on building relationships

and brand awareness, we expect to deliver significant progress in the year ahead.

As

always, we greatly appreciate your interest and valued support of our mission to disrupt and uplift the industry’s standard for

cardiac care.

Sincerely,

Kenneth

L. Londoner, Chairman & CEO

1

Data Bridge Market Research. Global Artificial Intelligence in Healthcare Market – Industry Trends and Forecast to 2030.

January 2023.

2

Ernst & Young (EY), Pulse of the Industry medical technology report 2023

SAFE

HARBOR DISCLOSURE

This

shareholder letter contains “forward-looking statements.” Such statements may be preceded by the words “intends,”

“may,” “will,” “plans,” “expects,” “anticipates,” “projects,”

“predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential”

or similar words. Such statements include, but are not limited to, the intended use of proceeds from the registered direct offering.

Forward-looking statements are not guarantees of future performance, are based on certain assumptions and are subject to various known

and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted or quantified and

consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and

uncertainties include, without limitation, risks and uncertainties associated with (i) the geographic, social and economic impact of

COVID-19 on our ability to conduct our business and raise capital in the future when needed; (ii) our inability to manufacture our products

and product candidates on a commercial scale on our own, or in collaboration with third parties; (iii) difficulties in obtaining financing

on commercially reasonable terms; (iv) changes in the size and nature of our competition; (v) loss of one or more key executives or scientists;

(vi) difficulties in securing regulatory approval to market our products and product candidates; and (vii) market and other conditions.

More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set

forth in the Company’s filings with the SEC, including the Company’s Annual Report on Form 10-K and its Quarterly Reports

on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC’s website at http://www.sec.gov.

The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future

events or otherwise.

v3.23.3

Cover

|

Dec. 06, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 06, 2023

|

| Entity File Number |

001-38659

|

| Entity Registrant Name |

BioSig

Technologies, Inc.

|

| Entity Central Index Key |

0001530766

|

| Entity Tax Identification Number |

26-4333375

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

55

Greens Farms Road

|

| Entity Address, Address Line Two |

1st Floor

|

| Entity Address, City or Town |

Westport

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06880

|

| City Area Code |

(203)

|

| Local Phone Number |

409-5444

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

BSGM

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

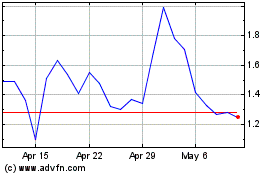

BioSig Technologies (NASDAQ:BSGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

BioSig Technologies (NASDAQ:BSGM)

Historical Stock Chart

From Apr 2023 to Apr 2024