0000910638 False 0000910638 2023-12-04 2023-12-04 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 4, 2023

_______________________________

3D SYSTEMS CORPORATION

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 001-34220 | 95-4431352 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

333 Three D Systems Circle

Rock Hill, South Carolina 29730

(Address of Principal Executive Offices) (Zip Code)

(803) 326-3900

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | DDD | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 4.01. Changes in Registrants Certifying Accountant.

The Audit Committee of the Board of Directors (the “Audit Committee”) of 3D Systems Corporation (the “Company”), with the assistance of management, issued a Request for Proposal (“RFP”) regarding the Company’s engagement of an independent registered public accounting firm to audit the Company’s consolidated financial statements for its fiscal year ending December 31, 2024 (the “2024 Audit”). Thereafter, the Audit Committee conducted a comprehensive, competitive RFP process. The Audit Committee invited several firms to participate in this RFP process.

(a) Previous Independent Registered Public Accounting Firm

On December 4, 2023, the Audit Committee dismissed BDO USA, P.C. (“BDO”), which is currently serving as the Company’s independent registered public accounting firm, effective upon completion of its audit of the Company’s consolidated financial statements as of and for the fiscal year ending December 31, 2023 and the issuance of its reports thereon (the “2023 Audit”).

The audit reports of BDO on the Company’s consolidated financial statements for each of the two most recent fiscal years ended December 31, 2022 and December 31, 2021 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles.

During the Company’s two most recent fiscal years ended December 31, 2022 and December 31, 2021, and during the subsequent interim period from January 1, 2023 through December 4, 2023, there were no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions thereto) between the Company and BDO on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to BDO’s satisfaction, would have caused BDO to make reference to the subject matter of the disagreements in connection with its reports on the Company’s consolidated financial statements for such fiscal years.

During the Company’s two most recent fiscal years ended December 31, 2022 and December 31, 2021, and during the subsequent interim period from January 1, 2023 through December 4, 2023, there were no reportable events (as described in Item 304(a)(1)(v) of Regulation S-K), other than the two material weaknesses in the Company’s internal control over financial reporting that were initially disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020. These material weaknesses involved a failure to design or maintain effective controls in response to the risks of material misstatement, including designing and maintaining formal accounting policies, procedures, and controls over significant accounts and disclosures to achieve complete, accurate and timely financial accounting, reporting and disclosures, with respect to: (1) revenue, receivables, and deferred revenue, including the input of executed contract terms into the Company’s information systems that perform revenue recognition; and (2) the review of internally prepared reports and analyses utilized in the financial closing process. The Company is currently in the process of remediating the material weaknesses.

The Audit Committee discussed these matters with BDO, and the Company has authorized BDO to respond fully to any inquiries of Deloitte & Touche LLP (“Deloitte”) with respect to these matters.

In accordance with Item 304(a)(3) of Regulation S-K, the Company provided BDO with a copy of this Current Report on Form 8-K and requested that BDO furnish the Company with a letter addressed to the Securities and Exchange Commission stating whether it agrees with the statements made by the Company herein and, if not, stating the respects in which it does not agree. A copy of BDO’s letter, dated December 5, 2023, is attached as Exhibit 16.1 to this Current Report on Form 8-K.

(b) New Independent Registered Public Accounting Firm

On December 4, 2023, the Audit Committee approved the engagement of Deloitte as the Company’s independent registered public accounting firm for the Company’s 2024 Audit, subject to completion of Deloitte’s customary pre-acceptance and independence procedures and the execution of an engagement letter. The change in the Company’s independent registered public accounting firm from BDO to Deloitte will be effective upon the completion of the 2023 Audit.

During the two most recent fiscal years ended December 31, 2022 and December 31, 2021, and during the subsequent interim period from January 1, 2023 through December 4, 2023, neither the Company nor anyone on its behalf consulted with Deloitte regarding (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and neither a written report nor oral advice was provided to the Company that Deloitte concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue, (ii) any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instruction thereto), or (iii) any reportable event (as described in Item 304(a)(1)(v) of Regulation S-K).

Item 8.01. Other Events.

On December 6, 2023, the Company entered into separate, privately negotiated transactions with certain holders of the Company’s outstanding 0% Convertible Senior Notes due 2026 (the “Notes”), pursuant to which the Company will repurchase (the “Repurchases”) approximately $135 million aggregate principal amount of the Notes for an aggregate cash repurchase price of approximately $100 million.

The Repurchases are expected to close on or about December 13, 2023, subject to certain closing conditions. The Company intends to cancel the repurchased Notes. Following the closing of the Repurchases, approximately $325 million in aggregate principal amount of the Notes will remain outstanding, with terms unchanged.

The Company issued a press release announcing the Repurchases on December 6, 2023, a copy of which is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | 3D SYSTEMS CORPORATION |

| | | |

| | | |

| Date: December 6, 2023 | By: | /s/ Andrew M. Johnson |

| | | Andrew M. Johnson |

| | | Executive Vice President, Chief Legal Officer and Interim Chief Financial Officer |

| | | |

Exhibit 16.1

December 5, 2023

Securities and Exchange Commission

100 F Street N.E.

Washington, D.C. 20549

We have been furnished with a copy of the response to

Item 4.01 of Form 8-K for the event that occurred on December 4, 2023, to be filed by our client, 3D Systems Corporation. We agree with

the statements made in response to that Item insofar as they relate to our Firm.

Very truly yours,

/s/BDO USA, P.C.

EXHIBIT 99.1

3D Systems Announces Partial Repurchase of Convertible Senior Notes

- Repurchasing approximately $135 million of 0% coupon, convertible senior notes at 26% discount to par value

- Principal balance reduced from $460 million to approximately $325 million, due in 2026

- Reinforces balance sheet strength and maintains strong cash position to support operational needs and strategic investments

ROCK HILL, S.C., Dec. 06, 2023 (GLOBE NEWSWIRE) -- 3D Systems (NYSE:DDD) (“the Company”) today announced that it has entered into separate, privately negotiated repurchase agreements with a limited number of holders of its 0% Convertible Senior Notes due 2026 (the "Notes") to repurchase approximately $135 million aggregate principal amount of the Notes at a 26% discount to par value. The debt repurchase will be paid in cash from the Company’s balance sheet.

The repurchases are expected to close on December 13, 2023, subject to the satisfaction of customary closing conditions. Following such closings, approximately $325 million principal amount of the Notes will remain outstanding, from an initial issued principal balance of $460 million. This remaining debt will continue to be held at 0% interest and will fully mature in November 2026.

Commenting on the transaction, President and CEO Dr. Jeffrey Graves stated, “Today’s announced repurchase of approximately $135 million of our 2026 notes at a significant discount demonstrates proactive liability management and disciplined execution in the current environment. Opportunistically executing this transaction reduces our debt by nearly 30% and reinforces the strength of our balance sheet. Our current cash reserves remain some of the strongest in the industry and, coupled with our intense focus on cost optimization to drive sustainable profitability and enhanced cash generation, we believe 3D Systems is well positioned to deliver on the bright long-term future we see ahead.”

No Offer or Solicitation

This press release is neither an offer to sell nor a solicitation of an offer to buy any securities described above, nor will there be any offer, solicitation, or sale of any securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About 3D Systems

More than 35 years ago, 3D Systems brought the innovation of 3D printing to the manufacturing industry. Today, as the leading additive manufacturing solutions partner, we bring innovation, performance, and reliability to every interaction – empowering our customers to create products and business models never before possible. Thanks to our unique offering of hardware, software, materials, and services, each application-specific solution is powered by the expertise of our application engineers who collaborate with customers to transform how they deliver their products and services. 3D Systems’ solutions address a variety of advanced applications in healthcare and industrial markets such as medical and dental, aerospace & defense, automotive, and durable goods. More information on the Company is available at www.3DSystems.com.

Forward-Looking Statements

Certain statements made in this release that are not statements of historical or current facts, including statements regarding the expected closing the repurchases described herein, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. In many cases, forward looking statements can be identified by terms such as “believes,” “belief,” “expects,” “may,” “will,” “estimates,” “intends,” “anticipates” or “plans” or the negative of these terms or other comparable terminology. Forward-looking statements are based upon management’s beliefs, assumptions and current expectations and may include comments as to the Company’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside the control of the Company. The factors described under the headings “Forward-Looking Statements” and “Risk Factors” in the Company’s periodic filings with the Securities and Exchange Commission, as well as other factors, could cause actual results to differ materially from those reflected or predicted in forward-looking statements. Although management believes that the expectations reflected in the forward-looking statements are reasonable, forward-looking statements are not, and should not be relied upon as a guarantee of future performance or results, nor will they necessarily prove to be accurate indications of the times at which such performance or results will be achieved. The forward-looking statements included are made only as the date of the statement. 3D Systems undertakes no obligation to update or revise any forward-looking statements made by management or on its behalf, whether as a result of future developments, subsequent events or circumstances or otherwise, except as required by law.

Investor Contact: investor.relations@3dsystems.com

Media Contact: press@3dsystems.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

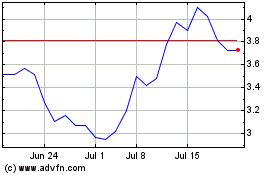

3D Systems (NYSE:DDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

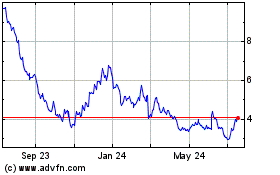

3D Systems (NYSE:DDD)

Historical Stock Chart

From Apr 2023 to Apr 2024