Filed Pursuant to Rule 424(b)(3)

Registration No. 333-258340

PROSPECTUS SUPPLEMENT NO. 59

(to prospectus dated August 10, 2021)

Up to 19,300,751 Shares of Class A Common Stock Issuable Upon the Exercise of Warrants Up to 77,272,414 Shares of Class A Common Stock Up to 8,014,500 Warrants to Purchase Class A Common Stock

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated August 10, 2021 (as supplemented or amended from time to time, the “Prospectus”), with the information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission (“SEC”) on December 5, 2023 (the “Current Report”) other than the information included in Item 7.01 and Exhibit 99.1, which was furnished and not filed with the SEC. Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the issuance by us of up to an aggregate of 19,300,751 shares of Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”), which consists of (i) up to 8,014,500 shares of Class A Common Stock that are issuable upon the exercise of 8,014,500 warrants (the “private placement warrants”) issued in a private placement in connection with the initial public offering of Decarbonization Plus Acquisition Corporation (“DCRB”) and upon the conversion of a working capital loan by the Sponsor (as defined in the Prospectus) to DCRB and (ii) up to 11,286,251 shares of Class A Common Stock that are issuable upon the exercise of 11,286,251 warrants originally issued in DCRB’s initial public offering. The Prospectus and this prospectus supplement also relate to the offer and sale from time to time by the selling securityholders named in the Prospectus, or their permitted transferees, of (i) up to 77,272,414 shares of Class A Common Stock (including up to 5,293,958 shares of Class A Common Stock issuable upon the satisfaction of certain triggering events (as described in the Prospectus) and up to 326,048 shares of Class A Common Stock that may be issued upon exercise of the Ardour Warrants (as defined in the Prospectus)) and (ii) up to 8,014,500 private placement warrants.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Class A Common Stock and warrants are traded on the Nasdaq Global Select Market under the symbols “HYZN” and “HYZNW,” respectively. On December 5, 2023 the closing price of our Class A Common Stock was $1.06 and the closing price for our public warrants was $0.04.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 7 of the Prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is December 5, 2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 5, 2023

___________________________________

Hyzon Motors Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

| Delaware | 001-3962 | 82-2726724 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

475 Quaker Meeting House Road Honeoye Falls, NY | | 14472 |

| (Address of principal executive offices) | | (Zip Code) |

(585)-484-9337 |

(Registrant's telephone number, including area code) |

| Not Applicable |

| (Former name or former address, if changed since last report) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | HYZN | NASDAQ Capital Market |

| Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share | HYZNW | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 5, 2023, Hyzon Motors Inc. (“Hyzon” or the “Company”) announced the appointment of Dr. Christian Mohrdieck, age 66, as Chief Technology Officer, effective January 1, 2024. Shinichi Hirano, who has served as Chief Technology Officer since September 2021, will serve as advisor to Dr. Mohrdieck effective as of January 1, 2024. Mr. Hirano will then retire from the Company, effective as of January 31, 2024.

From 2021 to 2023, Dr. Mohrdieck served as Chief Commercial Officer for cellcentric GmbH & Co. KG (“cellcentric”), a fuel cell company that was formerly known as Daimler Truck Fuel Cell GmbH & Co. KG. As Chief Commercial Officer for cellcentric, he led fuel cell research and design, as well as production and sales. Prior to this role, from 2012 to 2021, Dr. Mohrdieck served as CEO and Director of Fuel Cell of Mercedes-Benz Fuel Cell GmbH, and Managing Director of Daimler Truck Fuel Cell GmbH & Co. KG, both of which are in the fuel cell business. In those roles, Dr. Mohrdieck supported, developed and led Daimler’s fuel cell program, forming the foundation of cellcentric. Before this, Dr. Mohrdieck held various research and management positions of increasing responsibility for over two decades working within the Daimler AG family of companies. He holds a Ph.D. in Solid State Physics from the Institute for Theoretical Physics of Kiel University, Germany, where he also earned a Bachelor of Science degree.

None of Dr. Mohrdieck’s prior employers are a parent, subsidiary, or other affiliate of the Company. Dr. Mohrdieck does not have a direct or indirect material interest in any transaction with the Company that requires disclosure pursuant to Item 404(a) of Regulation S-K, and there is no arrangement or understanding between Dr. Mohrdieck and any other person pursuant to which Dr. Mohrdieck was selected to serve as Hyzon’s Chief Technology Officer. Dr. Mohrdieck is not related to any member of the board of directors of Hyzon or any executive officer of the Company.

In connection with his appointment as Chief Technology Officer, the Company’s wholly owned subsidiary, Hyzon Motors Innovation GmbH, entered into an employment agreement with Dr. Mohrdieck (the “Agreement”), under which he will also serve as interim Managing Director of Hyzon Motors Europe. The Agreement provides for a base salary of €400,000 (approximately $435,000 in USD), a guaranteed bonus of a minimum of €280,000 (approximately $305,000 in USD) in respect of Dr. Mohrdieck’s first full calendar year of employment (to be reduced pro rata if Dr. Mohrdieck’s employment terminates before the end of the calendar year), and a one-time grant of 150,000 restricted stock units (“RSUs”), subject to the approval of this grant by the Company’s Compensation Committee, which will be granted under the Company’s 2021 Equity Incentive Plan (the “Plan”) and vest on the 12 month anniversary of the date of grant. Subject to the approval of the Company’s Compensation Committee, Dr. Mohrdieck will also receive a grant of 1,250,000 RSUs under the Company’s Plan that will vest equally over the course of four years with the grant date being Dr. Mohrdieck’s first date of employment. Both RSU awards shall be subject to the terms and conditions of the Plan and any RSU grant award document. Subject to availability and the laws of the Federal Republic of Germany, Dr. Mohrdieck will be entitled to participate in Hyzon Motors Innovation GmbH’s employee health/welfare and retirement benefit plans and programs. Subject to any limitation of German law, upon a termination of Dr. Mohrdieck’s employment without Cause or for Good Reason (each as defined in Appendix A of the Agreement and such termination, a “Qualifying Termination”), Dr. Mohrdieck will receive: (i) a lump sum payment equal to 18 months of Dr. Mohrdieck’s base salary (if such Qualifying Termination occurs within the 3 month period prior to or 12 month period following a change in control, a “Qualifying CIC Termination”) or 12 months of Dr. Mohrdieck’s base salary (if such Qualifying Termination is not a Qualifying CIC Termination), (ii) continued medical benefits for up to 18 months (if such Qualifying Termination is a Qualifying CIC Termination) or 12 months (if such Qualifying Termination is not a Qualifying CIC Termination) and (iii) (A) full acceleration of unvested equity-based awards (if such Qualifying Termination is a Qualifying CIC Termination) or (B) an additional 12 months of accelerated vesting of unvested equity-based awards (if such Qualifying Termination is not a Qualifying CIC Termination).

The foregoing description of the terms of the Agreement is not complete and is qualified in its entirety by reference to the full text of the Agreement, which the Company intends to file as an exhibit with its Annual Report for the year ending December 31, 2023.

Item 7.01. Regulation FD Disclosure.

On December 5, 2023, the Company furnished a press release regarding the appointment of Dr. Christian Mohrdieck as Chief Technology Officer, as described above in Item 5.02 of this Current Report on Form 8-K. The press release is attached hereto as Exhibit 99.1 and incorporated in this Item 7.01 by reference.

The information set forth in Item 7.01 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits:

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| HYZON MOTORS INC. |

| | |

| Date: December 5, 2023 | By: | /s/ Parker Meeks |

| Name: | Parker Meeks |

| Title: | Chief Executive Officer |

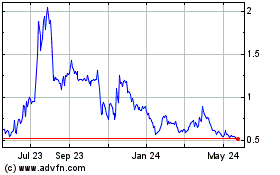

Hyzon Motors (NASDAQ:HYZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

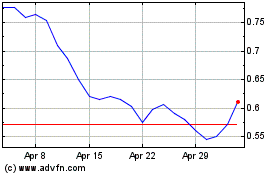

Hyzon Motors (NASDAQ:HYZN)

Historical Stock Chart

From Apr 2023 to Apr 2024