SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

November 30, 2023

Date of Report (Date of earliest event reported)

REPUBLIC FIRST BANCORP, INC.

(Exact name of registrant as specified in its charter)

|

Pennsylvania

|

000-17007

|

23-2486815

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

| |

|

|

|

50 South 16th Street, Suite 2400, Philadelphia, Pennsylvania

|

19102

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(215) 735-4422

Registrant’s telephone number, including area code

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☒

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on

Which Registered

|

|

Common Stock

|

FRBK

|

OTC Expert Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

Securities Purchase Agreement

As previously reported on the Current Report on Form 8-K filed by Republic First Bancorp, Inc. (the “Company”) on November 2, 2023, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”), dated October 27, 2023, with George E. Norcross, III, Gregory B. Braca, Philip A. Norcross, Alessandra T. Norcross and Alexander S. Norcross (each, including its successors and assigns, a “Purchaser” and collectively, the “Purchasers”), pursuant to which the Company agreed to sell shares of the Company’s common stock, par value $0.01 per share, at a purchase price of $0.05 per share (the “Common Stock”), and shares of a newly-issued series of Series B convertible perpetual preferred stock, par value $0.01 per share, at a purchase price of $50.00 per share (the “Series B Preferred Stock” and together with the Common Stock, the “Securities”) (collectively, the “Private Placement”). On November 30, 2023, in order to facilitate the receipt of regulatory approvals, the Company’s filing of its Annual Report on Form 10-K for the year ended December 31, 2022, and to satisfy other closing conditions as set forth in the Purchase Agreement, the Company and the Purchasers entered into a First Amendment to Securities Purchase Agreement (the “Amendment”), pursuant to which the parties agreed to extend the Outside Date (as defined in the Purchase Agreement) to February 29, 2024 and to hold a special shareholders' meeting no later than February 16, 2024.

On November 30, 2023, to facilitate the closing of the Private Placement, cash sufficient to fund the purchase of $435,750 worth of Common Stock and $34,564,250 worth of Series B Preferred Stock pursuant to the Purchase Agreement was deposited into an escrow account.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement, a copy of which was previously filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K on November 2, 2023.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by the full text of the Amendment, a copy of which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Item 8.01 Other Events.

On November 30, 2023, the Company’s board of directors (the “Board”) determined to postpone the Company’s 2022 annual meeting of shareholders (including any meeting of shareholders held in lieu thereof, and any adjournments, postponements or continuations thereof, the “2022 Annual Meeting”), previously scheduled for Tuesday, December 19, 2023. The 2022 Annual Meeting will be held on a date and in a manner and at a time and location to be announced. The Board will set a new record date for determining shareholders entitled to receive notice of, and vote at, the 2022 Annual Meeting, which will be disclosed at a later time.

The Company will also establish a new deadline for receipt of shareholder proposals pursuant to Rule 14a-8 (“Rule 14a-8”) under the Securities and Exchange Act of 1934, as amended, that is a reasonable time before the Company expects to begin to print and send its proxy materials.

The Company will also announce a new date by which shareholders wishing to bring business before the 2022 Annual Meeting outside of Rule 14a-8 or to nominate a person for election to the Board at the 2022 Annual Meeting must submit timely notice thereof to the Company in order for such matters to be considered at the 2022 Annual Meeting in accordance with the requirements of the Company’s Amended and Restated By-Laws.

On November 30, 2023, the Company announced the execution of the First Amendment and further announced that, to facilitate the closing of the Private Placement, cash sufficient to fund the purchase of $435,750 worth of Common Stock and $34,564,250 worth of Series B Preferred Stock pursuant to the Purchase Agreement was deposited into an escrow account (the “Press Release”). A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated into this Item 8.01 by reference.

Forward-Looking Statements

The Company may from time to time make written or oral “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In general, forward-looking statements can be identified through use of words such as “would be,” “could be,” “should be,” “probability,” “risk,” “target,” “objective,” “may,” “will,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,” “seek,” “expect” or the negative of these terms or other comparable terminology, and include statements related to the expected timing, completion, financial benefits, and other effects of a proposed transaction. Forward-looking statements are not historical facts and represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial conditions to differ materially from those expressed in or implied by such statements.

Factors that could cause or contribute to such differences include, but are not limited to, the risk that the Private Placement may not be consummated in a timely manner or at all; the possibility that any or all of the various conditions to the consummation of the Private Placement may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals); the ability of the Company to obtain the necessary shareholder approvals; the amount of costs, fees and expenses, including any unexpected costs, fees and expenses, related to the Private Placement; the level of control of the Purchasers will have over the Company upon consummation of the Private Placement and shareholder approval; our pro forma capital position and ratios following consummation of the proposed investment and any additional investments; the assumptions used in our capital analysis; the Company’s failure to maintain an effective system of financial controls over financial reporting and procedures related to the structure and operation of its corporate governance and the Company’s ability to remediate material weaknesses in its internal controls over financial reporting; general economic conditions, including recent adverse developments in the banking industry highlighted by high-profile bank failures and the potential impact of such developments on customer confidence, liquidity and regulatory responses to these developments; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; our securities portfolio and the valuation of our securities; our ability to access cost-effective funding; the effect of changes in accounting principles, policies and guidelines as well as estimates and assumptions used in the preparation of our financial statements; geopolitical conflict, including acts or threats of terrorism, action taken by the U.S. or other governments in response to acts or threats of terrorism and/or military conflicts, including the war between Russia and Ukraine and the war in the Middle East, which could impact business and economic conditions in the United States and abroad; interest rate, liquidity, economic, market, credit, operational, and inflation risks associated with our business, including the speed and predictability of changes in these risks; the adequacy of our allowance for credit losses and our methodology for determining such allowance; adverse changes in our loan portfolio and credit risk-related losses and expenses; concentrations within our loan portfolio, including our exposure to commercial real estate loans; changes to our primary service area; our ability to identify, negotiate, secure and develop new branch locations and renew, modify, or terminate leases or dispose of properties for existing branch locations effectively; business conditions in the financial services industry, including competitive pressure among financial services companies, new service and product offerings by competitors, price pressures and similar items; our ability to attract and retain deposits and to access other sources of liquidity, particularly in a rising or high interest rate environment, and the quality and composition of our deposits; loan demand; the regulatory environment, including evolving banking industry standards, changes in legislation or regulation; rapidly changing technology; our ability to regain compliance with Nasdaq Listing Rules; the failure to maintain current technologies; the effects of any cyber threats, attacks or events, or fraudulent activity, including those that involve our third-party vendors and service providers; failure to attract or retain key employees; fluctuations in real estate values; regulatory, legal or judicial proceedings and litigation liabilities, including costs and expenses related to settlements and judgments; and other economic, competitive, governmental, regulatory and technological factors affecting our operations, pricing, products and services. You should carefully review the risk factors described in the Annual Report on Form 10-K for the year ended December 31, 2021, and other documents the Company files from time to time with the Securities and Exchange Commission (the “SEC”). The Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company, except as may be required by applicable law or regulations.

Important Additional Information

The Company intends to file a definitive proxy statement with the SEC in connection with a meeting of its shareholders (the “Shareholder Meeting”) and, in connection therewith, the Company, certain of its directors and executive officers will be participants in the solicitation of proxies from the Company’s shareholders in connection with such meeting. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE SHAREHOLDER MEETING. The Company’s definitive proxy statement for the 2021 annual meeting of shareholders contains information regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive officers in the Company’s securities. Information regarding subsequent changes to their holdings of the Company’s securities can be found in the SEC filings on Forms 3, 4, and 5, which are available on the Company’s website at http://investors.myrepublicbank.com/ or through the SEC’s website at www.sec.gov. Information can also be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, on file with the SEC. Updated information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the definitive proxy statement and other materials to be filed with the SEC in connection with the Shareholder Meeting. Shareholders will be able to obtain the definitive proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the Company’s website at http://investors.myrepublicbank.com.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: November 30, 2023

|

REPUBLIC FIRST BANCORP, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Brian F. Doran

|

|

|

|

Name:

|

Brian F. Doran

|

|

|

|

Title:

|

Executive Vice President and General Counsel

|

|

Exhibit 10.1

FIRST AMENDMENT TO

SECURITIES PURCHASE AGREEMENT

This First Amendment to Securities Purchase Agreement (this “Amendment”) is dated as of November 30, 2023 (the “Effective Date”), by and among Republic First Bancorp, Inc., a Pennsylvania corporation (the “Company”), and each purchaser identified on the signature pages hereto (each, including its successors and assigns, a “Purchaser” and collectively, the “Purchasers”). Capitalized terms used and not otherwise defined herein shall have the respective meanings ascribed to them in the Purchase Agreement (as defined below).

WHEREAS, the Company and the Purchasers are parties to that certain Securities Purchase Agreement, dated October 27, 2023 (the “Purchase Agreement”), and desire to amend the Purchase Agreement as set forth herein; and

WHEREAS, each Purchaser has deposited such Purchaser’s Subscription Amount in an escrow account to be released to the Company upon consummation of the transactions contemplated by the Transaction Documents.

NOW, THEREFORE, intending to be legally bound hereby and in consideration of the mutual covenants contained in this Amendment, and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the Company and the Purchasers hereby agree as follows:

1. Amendments. The parties hereby agree to the following amendments to the Purchase Agreement as of the Effective Date:

(a) Section 1.1. The definition of “Outside Date” in Section 1.1 of the Purchase Agreement is hereby amended and restated to read, in its entirety, as follows:

“Outside Date” means January 31, 2024; provided that if the Closing has not occurred on the Outside Date, unless each Purchaser, by written notice to the Company, elects not to extend the Outside Date, the Outside Date shall automatically be extended to not later than February 29, 2024. Notwithstanding the foregoing, if the Closing has not occurred on the Outside Date due to the Purchasers not obtaining the Bank Regulatory Approvals by such date, the Outside Date shall be automatically extended to not later than February 29, 2024. If the Outside Date is so extended, all references in this Agreement to the “Outside Date” will be to the Outside Date as extended.

(b) Section 4.20(a). The first sentence of Section 4.20(a) of the Purchase Agreement is hereby amended and restated to read, in its entirety, as follows:

“(a) As soon as practicable (and in any event no later than February 16, 2024), the Company shall duly call, give notice of, establish a record date for, convene and hold a special meeting of its shareholders, the date of such meeting which has been approved by the Initial Investors (the “Shareholders’ Meeting”), for the purpose of voting upon approval and adoption of (i) the increase in the number of authorized shares of Common Stock under the Articles of Incorporation to 3,000,000,000, (ii) the restoration of voting rights as provided pursuant to Subchapter 25G of the PBCL for all Common Stock of the Company acquired by the Purchasers or otherwise owned by the Purchasers or any of their respective Affiliates which could be considered “control shares” under Subchapter 25G (the “Control-Share Voting Restoration”), and (iii) approval of the acquisition of equity securities of the Company by Purchasers or any of their respective Affiliates and the disposition of any equity security of the Company now or hereafter owned by the Purchasers or any of their respective Affiliates, in each case for purposes of Subchapter 25H of the PBCL (the “Disgorgement Approval”, and the approvals contemplated by clauses (i) to (iii), collectively, the “Shareholder Approval”).”

2. No Other Amendments. Except as expressly modified by this Amendment, the Purchase Agreement remains in full force and effect.

3. Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Amendment shall be governed by and construed in accordance with the internal Laws of the Commonwealth of Pennsylvania applicable to contracts made and to be performed entirely within such Commonwealth. Each party agrees that all Proceedings concerning the interpretation, enforcement and defense of the transactions contemplated by this Amendment and any other Transaction Documents (whether brought against a party hereto or its respective Affiliates, employees or agents) shall occur, on an exclusive basis, in the Court of Common Pleas of Delaware County, Pennsylvania, the Court of Common Pleas of Montgomery County, Pennsylvania, or the United States District Court for the Eastern District of Pennsylvania (the “Pennsylvania Courts”). Each party hereto hereby irrevocably submits to the exclusive jurisdiction of the Pennsylvania Courts for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed herein (including with respect to the enforcement of any of the Transaction Documents), and hereby irrevocably waives, and agrees not to assert in any Proceeding, any claim that it is not personally subject to the jurisdiction of any such Pennsylvania Court, or that such Proceeding has been commenced in an improper or inconvenient forum. Each party hereto hereby irrevocably waives personal service of process and consents to process being served in any such Proceeding by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices to it under this Amendment and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner permitted by Law. EACH PARTY HERETO HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS AMENDMENT.

4. Amendments; Waivers; No Additional Consideration. No amendment or waiver of any provision of this Amendment will be effective unless made in writing and signed by a duly authorized representative of the Company and duly authorized representatives of Purchasers representing a majority of the Subscription Amount of the Purchasers at the time of such amendment or waiver. No waiver of any default with respect to any provision, condition, or requirement of this Amendment shall be deemed to be a continuing waiver in the future or a waiver of any subsequent default or a waiver of any other provision, condition, or requirement hereof, nor shall any delay or omission of any party to exercise any right hereunder in any manner impair the exercise of any such right. No consideration shall be offered or paid to any Purchaser to amend or consent to a waiver or modification of any provision of any Transaction Document unless the same consideration is also offered to all Purchasers who then hold Shares.

5. Construction. The headings herein are for convenience only, do not constitute a part of this Amendment and shall not be deemed to limit or affect any of the provisions hereof. The language used in this Amendment will be deemed to be the language chosen by the parties to express their mutual intent, and no rules of strict construction will be applied against any party. This Amendment shall be construed as if drafted jointly by the parties, and no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any provisions of this Amendment or any of the Transaction Documents. If Philip A. Norcross is not able to exercise any right under this Amendment for any reason, then George E. Norcross shall be permitted to exercise such right during the time in which Philip A. Norcross is not able to exercise such right, and if George E. Norcross is not able to exercise any such right, then Gregory B. Braca shall be permitted to exercise such right during the time in which neither Philip A. Norcross nor George E. Norcross is able to exercise such right.

6. Successors and Assigns. The provisions of this Amendment shall inure to the benefit of and be binding upon the parties and their respective successors and permitted assigns. This Amendment, or any rights or obligations hereunder, may not be assigned by the Company without the prior written consent of each Purchaser. Except as otherwise provided in Section 4.18 and Section 4.19 of the Purchase Agreement, any Purchaser may assign its rights (together with its obligations) hereunder in whole or in part to any investment fund that is an Affiliate of such Purchaser in compliance with the Transaction Documents and applicable Law, provided such transferee shall agree in writing to be bound, with respect to the transferred Securities, by the terms and conditions of the Purchase Agreement that apply to the “Purchasers” and/or the “Initial Investors” (as applicable).

7. Execution. This Amendment may be executed in two or more counterparts, all of which when taken together shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to the other parties, it being understood that the parties need not sign the same counterpart. In the event that any signature is delivered by facsimile transmission, or by e mail delivery of a “.pdf” format data file, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile signature page were an original thereof.

8. Severability. If any provision of this Amendment is held to be invalid or unenforceable in any respect, the validity and enforceability of the remaining terms and provisions of this Amendment shall not in any way be affected or impaired thereby and the parties will attempt in good faith to agree upon a valid and enforceable provision that is a reasonable and equitable substitute therefor, and upon so agreeing, shall incorporate such substitute provision in this Amendment.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF, the parties hereto have caused this First Amendment to Securities Purchase Agreement to be duly executed by their respective authorized signatories as of the date first indicated above.

| |

REPUBLIC FIRST BANCORP, INC.

By: /s/ Thomas X. Geisel

Name: Thomas X. Geisel

Title: Chief Executive Officer

|

[Signature Page to First Amendment to Securities Purchase Agreement]

| |

PURCHASER: |

|

| |

|

|

| |

|

|

| |

/s/ George E. Norcross |

|

| |

George E. Norcross |

|

[Signature Page to First Amendment to Securities Purchase Agreement]

| |

PURCHASER: |

|

| |

|

|

| |

|

|

| |

/s/ Gregory Braca |

|

| |

Gregory Braca |

|

[Signature Page to First Amendment to Securities Purchase Agreement]

| |

PURCHASER: |

|

| |

|

|

| |

|

|

| |

/s/ Philip A. Norcross |

|

| |

Philip A. Norcross |

|

[Signature Page to First Amendment to Securities Purchase Agreement]

| |

PURCHASER: |

|

| |

|

|

| |

|

|

| |

/s/ Alessandra Norcross |

|

| |

Alessandra Norcross |

|

[Signature Page to First Amendment to Securities Purchase Agreement]

| |

PURCHASER: |

|

| |

|

|

| |

|

|

| |

/s/ Alexander Norcross |

|

| |

Alexander Norcross |

|

[Signature Page to First Amendment to Securities Purchase Agreement]

Exhibit 99.1

Republic First Bancorp and Norcross Braca Group Provide Update on Closing of $35 Million Capital Investment

PHILADELPHIA, November 30, 2023 (GLOBE NEWSWIRE) – Republic First Bancorp, Inc. (OTCEM: FRBK) (“Republic” or the “Company”), the parent company of Republic First Bank d/b/a Republic Bank, and George E. Norcross, III, Gregory B. Braca, Philip A. Norcross, Lexie Norcross, and other Norcross family members and affiliates (collectively, the “Norcross Braca Group”), today provided an updated timeline for the closing of the Norcross Braca Group’s previously announced $35 million capital investment in the Company.

The parties have agreed to extend the outside date for closing the investment to February 29, 2024, subject to the closing conditions outlined in the securities purchase agreement filed with the Securities and Exchange Commission on November 2, 2023. Republic will now hold a special meeting of stockholders no later than February 16, 2024 to facilitate the approval of the transaction.

Further solidifying the investment, the Norcross Braca Group today deposited $35 million into an escrow account, which is to be released to the Company upon closing.

“We have made significant progress on what has been a complicated transaction, which is why we fully funded our $35 million investment into an escrow account -- we will be able to move forward quickly when all requirements have been met and closing conditions have been satisfied,” said George E. Norcross, III. “We look forward to completing the transaction in the coming weeks so we can make the changes needed to set Republic First up for long term success for the benefit of its customers and clients, employees and shareholders.”

Thomas X. Geisel, President and Chief Executive Officer of Republic, commented, “While we proceed toward closing this transaction to strengthen the Company’s capital position, our team continues to work on making sustainable process and operational efficiency improvements, while maintaining Republic Bank’s focus on providing a high level of service and responsiveness for our customers and communities. Phil and Greg have been valuable additions as Observers to the Board since we announced the investment and the continuation of our plan to raise a total of $75 million to $100 million in capital.”

Republic also announced that the Company’s 2022 annual meeting, which had previously been scheduled for December 19, 2023, will be postponed to better align with the timing of the transaction close. The 2022 annual meeting will be held at a time and date to be announced, along with the record date for determining shareholders entitled to receive notice of and vote at this meeting.

About Republic Bank

Republic Bank is the operating name for Republic First Bank. Republic First Bank is a full-service, state-chartered commercial bank, whose deposits are insured up to the applicable limits by the Federal Deposit Insurance Corporation (FDIC). The Bank provides diversified financial products through its 32 offices located in Atlantic, Burlington, Camden, and Gloucester Counties in New Jersey; Bucks, Delaware, Montgomery and Philadelphia Counties in Pennsylvania and New York County in New York. For more information about Republic Bank, please visit myrepublicbank.com.

Forward Looking Statements

The Company may from time to time make written or oral “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In general, forward-looking statements can be identified through use of words such as “would be,” “could be,” “should be,” “probability,” “risk,” “target,” “objective,” “may,” “will,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,” “seek,” “expect” or the negative of these terms or other comparable terminology, and include statements related to the expected timing, completion, financial benefits, and other effects of a proposed transaction. Forward-looking statements are not historical facts and represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial conditions to differ materially from those expressed in or implied by such statements.

Factors that could cause or contribute to such differences include, but are not limited to, the risk that the investment may not be consummated in a timely manner or at all; the possibility that any or all of the various conditions to the consummation of the investment may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals); the ability of the Company to obtain the necessary shareholder approvals; the amount of costs, fees and expenses, including any unexpected costs, fees and expenses, related to the investment; the level of control the Norcross Braca Group will have over the Company upon consummation of the investment and shareholder approval; our pro forma capital position and ratios following consummation of the proposed investment and any additional investments; the assumptions used in our capital analysis; the Company’s failure to maintain an effective system of financial controls over financial reporting and procedures related to the structure and operation of its corporate governance and the Company’s ability to remediate material weaknesses in its internal controls over financial reporting; general economic conditions, including recent adverse developments in the banking industry highlighted by high-profile bank failures and the potential impact of such developments on customer confidence, liquidity and regulatory responses to these developments; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; our securities portfolio and the valuation of our securities; our ability to access cost-effective funding; the effect of changes in accounting principles, policies and guidelines as well as estimates and assumptions used in the preparation of our financial statements; geopolitical conflict, including acts or threats of terrorism, action taken by the U.S. or other governments in response to acts or threats of terrorism and/or military conflicts, including the war between Russia and Ukraine and the war in the Middle East, which could impact business and economic conditions in the United States and abroad; interest rate, liquidity, economic, market, credit, operational, and inflation risks associated with our business, including the speed and predictability of changes in these risks; the adequacy of our allowance for credit losses and our methodology for determining such allowance; adverse changes in our loan portfolio and credit risk-related losses and expenses; concentrations within our loan portfolio, including our exposure to commercial real estate loans; changes to our primary service area; our ability to identify, negotiate, secure and develop new branch locations and renew, modify, or terminate leases or dispose of properties for existing branch locations effectively; business conditions in the financial services industry, including competitive pressure among financial services companies, new service and product offerings by competitors, price pressures and similar items; our ability to attract and retain deposits and to access other sources of liquidity, particularly in a rising or high interest rate environment, and the quality and composition of our deposits; loan demand; the regulatory environment, including evolving banking industry standards, changes in legislation or regulation; rapidly changing technology; our ability to regain compliance with Nasdaq Listing Rules; the failure to maintain current technologies; the effects of any cyber threats, attacks or events, or fraudulent activity, including those that involve our third-party vendors and service providers; failure to attract or retain key employees; fluctuations in real estate values; regulatory, legal or judicial proceedings and litigation liabilities, including costs and expenses related to settlements and judgments; and other economic, competitive, governmental, regulatory and technological factors affecting our operations, pricing, products and services. You should carefully review the risk factors described in the Annual Report on Form 10-K for the year ended December 31, 2021, and other documents the Company files from time to time with the Securities and Exchange Commission (the “SEC”). The Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company, except as may be required by applicable law or regulations.

Contacts

For Republic:

Longacre Square Partners

Joe Germani / Greg Marose, (646) 277-8813

frbk@Longacresquare.com

For the Norcross Braca Group:

The Echo Group, LLC

Daniel F. Fee, Esq., (215) 704-3160

dan@echo-group.com

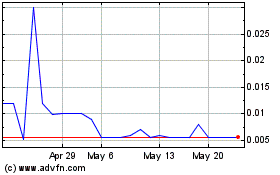

Republic First Bancorp (CE) (USOTC:FRBK)

Historical Stock Chart

From Apr 2024 to May 2024

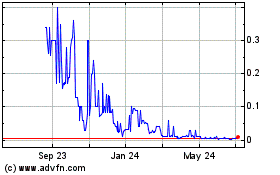

Republic First Bancorp (CE) (USOTC:FRBK)

Historical Stock Chart

From May 2023 to May 2024