| PROSPECTUS |

|

Rule 424(b)(3) |

| |

|

Registration No. 333-275724 |

CUENTAS INC.

1,275,747 Shares of Common Stock

Offered by the Selling Shareholders

This prospectus relates

to the resale of up to 1,275,747 shares of common stock, par value $0.001 per share, of Cuentas Inc. (“we,” “us,”

“our,” “Cuentas” or the “Company”), consisting of (i) up to 1,232,606 shares issuable upon exercise

of a warrant (the “Inducement Warrant”) to purchase shares of common stock at an exercise price of $3.30 per share issued

by us to an institutional investor named herein as a selling shareholder on August 24, 2023 as an inducement to the exercise at a reduced

exercise price of $3.30 per share of outstanding warrants to purchase a total of 616,303 shares of the Company’s common stock (the

“Existing Warrants”), and (ii) up to 43,141 shares of common stock issuable upon exercise of warrants (the “August

2023 PA Warrants”) issued to the designees of H.C. Wainwright & Co. LLC (“Wainwright”), placement agent for the

issuance of the Inducement Warrant, named herein as selling shareholders. The Existing Warrants included warrants to purchase 324,928

shares of common stock issued on August 8, 2022 having an initial exercise price of $7.67 per share and warrants to purchase 291,375

shares of common stock issued on February 8, 2023 having an initial exercise price of $17.16 per share.

This registration does not

mean that the selling shareholders will actually offer or sell any of these shares. We will not receive any proceeds from the resale of

any of the shares of common stock being registered hereby sold by the selling shareholders. However, we may receive proceeds from the

exercise of the Inducement Warrant and the August 2023 PA Warrants held by the selling shareholders.

Our common stock is listed on The NASDAQ Capital

Market under the symbol “CUEN.” We also have a class of warrants that are listed on The NASDAQ Capital Market under the symbol

“CUENW.” The last reported sale prices of our common stock and listed warrants on The NASDAQ Capital Market on November

29, 2023 were $1.24 per share and $0.0201 per warrant.

Following the effectiveness

of the registration statement of which this prospectus forms a part, the sale and distribution of securities offered hereby may be effected

from time to time in one or more transactions that may take place on Nasdaq (or such other market or quotation system on which our common

stock is then listed or quoted), including ordinary brokers’ transactions, privately negotiated transactions or through sales to

one or more dealers for resale of such securities as principals, at market prices prevailing at the time of sale, at prices related to

such prevailing market prices or at negotiated prices. Usual and customary or specifically negotiated brokerage fees or commissions may

be paid by the selling shareholders. The selling shareholders and intermediaries through whom such securities are sold may be deemed “underwriters”

within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the securities offered

hereby, and any profits realized or commissions received may be deemed underwriting compensation.

This prospectus describes

the general manner in which shares of common stock may be offered and sold by any selling shareholders. When the selling shareholders

sell shares of common stock under this prospectus, we may, if necessary and required by law, provide a prospectus supplement that will

contain specific information about the terms of that offering. Any prospectus supplement may also add to, update, modify or replace information

contained in this prospectus. We urge you to read carefully this prospectus, any prospectus supplement and any documents we incorporate

by reference into this prospectus before you make your investment decision.

All share and per share information

in this prospectus gives effect to a 1-for-13 reverse stock split effected on March 24, 2023.

Investing in our

common stock is highly speculative and involves a significant degree of risk. See “Risk Factors” beginning on

page 6 of this prospectus and in the documents incorporated by reference in this prospectus for a discussion of information that

should be considered before making a decision to purchase our common stock.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 30, 2023

TABLE OF CONTENTS

Please read this prospectus

carefully. It describes our business, our financial condition and our results of operations. We have prepared this prospectus so that

you will have the information necessary to make an informed investment decision. You should rely only on the information contained in

this prospectus. We have not authorized anyone to provide you with any information or to make any representations about us, the securities

being offered pursuant to this prospectus or any other matter discussed in this prospectus, other than the information and representations

contained in this prospectus. If any other information or representation is given or made, such information or representation may not

be relied upon as having been authorized by us.

The information contained

in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any

sale of our common stock. Neither the delivery of this prospectus nor any distribution of securities in accordance with this prospectus

shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus. This prospectus

will be updated and made available for delivery to the extent required by the federal securities laws.

We further note that the representations,

warranties and covenants made by us in any document that is filed as an exhibit to the registration statement of which this prospectus

is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk

among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations,

warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should

not be relied on as accurately representing the current state of our affairs.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This prospectus and the documents

incorporated herein by reference contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements include information concerning our future results of operations and financial position, strategy and

plans, and our expectations for future operations. Forward-looking statements include all statements that are not historical facts and,

in some cases, can be identified by terms such as “anticipate,” “believe,” “continue,” “could,”

“design,” “estimate,” “expect,” “intend,” “may,” “plan,” “possible,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would” or the negative version of these words and similar expressions.

Forward-looking statements

involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be

materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including

those described in “Risk Factors” included elsewhere in this prospectus and in the documents that are incorporated

by reference herein. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking

statements represent our beliefs and assumptions only as of the date of this prospectus, or, in the case of any document incorporated

by reference herein in this prospectus, as of the date of such document. In light of the significant uncertainties in these forward-looking

statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our

objectives and plans in any specified time frame, or at all. You should read this prospectus and the documents incorporated by reference

herein completely and with the understanding that our actual future results may be materially different from what we expect.

These forward-looking statements include, but are

not limited to, statements concerning the following:

| ● | our

ability to implement our business plan, including equity investments in real estate projects in Florida in which we have limited experience

and the risks relating to those type of investments; |

| ● | our

ability to attract key personnel; |

| ● | our

ability to operate profitably; |

| ● | our

ability to efficiently and effectively finance our operations; |

| ● | our

ability to raise additional financing for working capital; |

| ● | our

ability to efficiently manage our operations; |

| ● | that

our accounting policies and methods may require management to make estimates about matters that are inherently uncertain; |

| ● | changes

in the legal, regulatory and legislative environments in the markets in which we operate; and |

| ● | adverse

state or federal legislation or regulation that increases the costs of compliance, or adverse findings by a regulator with respect to

existing operations; |

| ● | our

ability to upgrade the Cuentas Mobile App and digital distribution system and make it completely functionable; and |

| ● | our ability to maintain our listing on NASDAQ. |

These statements are only

predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors”

or elsewhere in this prospectus, which may cause our or our industry’s actual results, levels of activity, performance or achievements

expressed or implied by these forward-looking statements. Moreover, we operate in a highly regulated, very competitive, and rapidly changing

environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact

of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially

from those contained in any forward-looking statements.

We have based these forward-looking

statements largely on our current expectations about future events and financial trends that we believe may affect our financial condition,

results of operations, business strategy, short term and long term business operations, and financial needs. These forward-looking statements

are subject to certain risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward

looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this

prospectus, and in particular, the risks discussed below and under the heading “Risk Factors” and those discussed in other

documents we file with the SEC. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed

in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking

statement.

You should not place undue

reliance on any forward-looking statement, each of which applies only as of the date of this prospectus. Any forward-looking statement

you read in this prospectus reflects our current views with respect to future events and is subject to these and other risks, uncertainties

and assumptions relating to our operations, operating results, growth strategy and liquidity. We assume no obligation to publicly update

or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those

anticipated in these forward-looking statements, even if new information becomes available in the future, except as otherwise required

by applicable law. You are advised, however, to consult any further disclosures we make on related subjects in our reports on Forms 10-Q,

8-K and 10-K filed with the SEC. You should understand that it is not possible to predict or identify all risk factors. Consequently,

you should not consider any such list to be a complete set of all potential risks or uncertainties.

PROSPECTUS SUMMARY

This summary highlights

selected information contained elsewhere in this prospectus and the documents incorporated by reference herein, including our consolidated

financial statements and related notes. You should carefully consider, among other things, the matters discussed in the sections entitled

“Risk Factors” included in or incorporated by reference in this prospectus. Unless the context requires otherwise,

references in this prospectus to “we,” “us,” “our,” “Cuentas,” “our company,”

or similar terminology refer to Cuentas Inc. All share and per share information in this prospectus gives effect to a 1-for-13 reverse

stock split effected on March 24, 2023.

Overview of Our Business

Our business is mainly focused

on using proprietary technologies to integrate FinTech (Financial Technology), e-finance and e-commerce services into solutions that

deliver mobile financial services, prepaid debit and digital content services to the unbanked, under-banked and underserved populations

nationally in the USA. The Cuentas Platform integrates Cuentas Mobile, the Company’s Telecommunications solution, with its

core financial services offerings to help entire communities enter the modern financial marketplace. Our General Purpose Reloadable (GPR)

“Debit Card allows customers to purchase prepaid products

and services, including third party digital content, gift cards, remittances, mobile phone topups and other digital services. An agreement

with Interactive Communications International, Inc. (“InComm”) a leading processor of general purpose reloadable (“GPR”)

debit cards, enables us to market and distribute a line of prepaid digital content and gift cards targeted towards the Latin American

market. Cuentas is able to purchase InComm’s prepaid digital content and gift cards at a discount and resell these same products

in real time through its mobile app and through the Cuentas SDI network of over 31,000 bodegas. Cuentas is able to offer these digital

products to the public through its mobile app and the Cuentas SDI distribution network, many at discounted prices, while making a small

profit margin which varies from product to product. The prepaid digital content and gift cards include Amazon Cash, XBox, PlayStation,

Nintendo, Karma Koin, Transit System Loads & Reloads (LA TAP, NY Transit, Grand Rapids, CT GO), Burger King, Cabela’s, Bass

Pro Shops, AT&T, Verizon, Mango Mobile, Black Wireless and other prepaid wireless carriers in the United States.

Since the first quarter of

2023, we have made a number of equity investments in real estate projects in Florida under the name Cuentas Casa. Cuentas Casa partners

with leading edge developers and construction technology companies to create sustainable, inclusive and affordable residential communities

specifically designed to provide high quality housing alternatives at extremely competitive pricing. Our goal is to source land zoned

and ready for development of multi-family buildings in strategic areas where rental prices are increasing dramatically, placing financial

stress and pressure on working class families. Our real estate investments are intended to broaden our reach into the unbanked, underbanked

and underserved communities by using a patented, low cost, sustainable technology that should allow us to provide reasonably priced rental

apartments to working class residents who have been priced out of rental communities due to severe rent hikes in Florida and other areas

in the United States. Cuentas has made investments in affordable housing projects for the development of approximately 1,550 apartments.

We believe that providing affordable apartments to the Hispanic Latino and other immigrant communities in Florida will enable us to introduce

them our fintech solutions and generate revenue.

Our wholly-owned subsidiary,

Meimoun and Mammon, LLC (“M&M”), provides wholesale and retail telecommunications services. Tel 3, a division of our company,

is a retail long distance calling platform which provides prepaid calling cards to consumers directly and operates in a complimentary

space as M&M. We also own 50% of CUENTASMAX LLC, which installs WiFi6 shared network (“WSN”) systems in locations in the

New York metropolitan tristate area using access points and small cells to provide users with access to the WSN.

Recent Developments

Efforts to Upgrade our Technology Platform

and Increase Sales of our Fintech Products and Services Through Cuentas-SDI and Introduction of New Fintech Solutions

In April 2023, CIMA, which

provided maintenance and support services for our technology platform, shut down access to the platform as we were transitioning to a

new, improved platform. During the first quarter of 2023, we reduced product availability to Cuentas-SDI to allow Cuentas-SDI to catch

up on its payments and during the second quarter of 2023 we curtailed all services to Cuentas-SDI and marketing initiatives with Cuentas-SDI

due to its inability to reduce its debt significantly. These disruptions to our fintech solutions and technology business were a major

reason for the decline in revenue between the Q1-Q2 periods in 2022 and 2023.

In May 2023, The OLB Group (NASDAQ: OLB) (“OLB”) terminated

a Software Licensing and Transaction Sharing Agreement with the Company for the purpose of upgrading the Cuentas Mobile App and digital

distribution system. In June 2023, OLB acquired 80.01% of Cuentas-SDI. In July 2023, the Company and Cuentas-SDI settled certain payment

issues and renewed discussions and cooperation to re-open the digital distribution network and systems through Cuentas-SDI’s convenience

store distribution network of over 31,000 locations, including many across the New York, New Jersey and Connecticut tri-state area.

Investments

in Real Estate Developments in Florida

Lakewood Village

On March 7, 2023 the

Company acquired a six percent (6%) equity interest in Lakewood Village from Core Development Holdings Corporation

(“Core”), pursuant to a Membership Interest Purchase Agreement (“MIPA”), in exchange for 295,282 shares of

Common Stock, representing approximately19.99% of the then outstanding shares of Common Stock. Core holds approximately 29.3% of

4280 Lakewood Road Manager, LLC (“Lakewood Manager”), which in turn owns 86.45% of the membership interests in 4280

Lakewood Road, LLC (“4280 Project”), an affordable multi-family real estate project located in Lake Worth, Florida. As a

result of the transaction, the Company acquired $700,000 of equity in the Lakewood Manager. Lakewood Manager, an affiliate of RENCo

USA, Inc. (“Renco”), is constructing the 4280 Lakewood Project with RENCO Structural Building System, a proprietary

composite structural system distributed by Renco. Lakewood Village is the first sustainable rental housing project developed in the

US using a patented MCFR Mineral Composite Fiber Reinforced Construction Technology that has been approved for hurricane-prone areas

as such in Florida. The Lakewood Village project is an affordable multi-family real estate development located in Lake Worth, Palm

Beach County, Florida, consisting of 96 apartments that have two and three bedrooms. An independent appraisal valued the project,

once completed, at approximately $25 million, equating the Company’s equity position at approximately $1.5 million.

Supply Agreement with Renco USA

In March 2023, the Company

entered a 10 year supply agreement with Renco to provide Renco’s patented building materials for new, sustainable rental housing

projects. Renco’s patented MCFR (Mineral Composite Fiber Reinforced) Construction System provides cost efficiency, reduced build

time, and sustainable benefits. Renco’s system is hurricane proof up to Category 5, which is a major benefit for developing housing

projects in the South Florida market and other hurricane prone areas where we are planning to develop projects. Renco’s system is

also earthquake resistant. Renco has the exclusive rights in the USA to the patented building process. The Renco Wall, Floor and Roofing

System is a unique MCFR Building System that creates interlocking, fiber reinforced, composite building blocks and other construction

related products that can be connected in an almost limitless variety of designs. Renco’s system can be used to create homes, apartment

buildings, hotels, office buildings, warehouses, infrastructure products and more.

Operating Agreement with Brookville Development

Partners, LLC

On April 13, 2023, the Company

entered into an Operating Agreement to be a majority member in Brooksville Development Partners, LLC (“Brooksville”) with

two minority members for the purpose of acquiring land for the development of a residential apartment community consisting of approximately

360 apartments. All real and personal property owned by Brooksville will be owned by Brooksville as an entity. One of the minority members

will be the manager of the project.

On April 28, 2023, the Company

and minority partners in Brooksville closed on the transaction to acquire a 21.8 acre site for development of the Brooksville project.

The Company deposited as an initial capital contribution $2,000,000 into a title insurance escrow account which was released from escrow

by the Title Agent to fund the balance of the purchase price of the vacant land, together with a $3.05 million bank loan from Republic

Bank of Chicago. Brooksville owns the vacant land, free and clear of any liens, claims and encumbrances with the sole exception being

the Republic Bank loan. The Company is currently a 63% interest holder in Brooksville but that may change in the future if the Company

is not able to raise sufficient financing to complete the project.

February Offering and Private Placement

On February 8, 2023, the Company

sold to Armistice Capital Master Fund Ltd., an institutional investor, in a registered direct offering (the “Registered Offering”),

an aggregate of (i) 163,344 shares of the Company’s common stock (“Common Stock”) and (ii) pre-funded warrants to purchase

up to 128,031 shares of Common Stock (the “Pre-Funded Warrants” and such shares of Common Stock issuable upon exercise of

the Pre-Funded Warrants, the “Pre-Funded Warrant Shares”) pursuant to a Securities Purchase Agreement dated February 6, 2023

(the “Purchase Agreement”). In a concurrent private placement, the Company sold to Armistice Capital Master Fund Ltd. warrants

(the “Purchase Warrants”) to purchase 291,375 shares of Common Stock (the shares of Common Stock issuable upon exercise of

the Purchase Warrants, the “Purchase Warrant Shares”). The combined purchase price per Share and Purchase Warrant was $17.16

and the combined purchase price per Pre-Funded Warrant and Purchase Warrant was $17.16.

The Pre-Funded Warrants were

sold, in lieu of shares of Common Stock, to any investor whose purchase of shares of Common Stock in the Registered Offering would otherwise

result in such investor, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at such investor’s

option upon issuance, 9.99%) of the Company’s outstanding Common Stock immediately following the consummation of the Registered

Offering. Each Pre-Funded Warrant represented the right to purchase one share of Common Stock at an exercise price of $0.0001 per share.

Armistice Capital Master Fund Ltd. exercised 67,800 Pre-Funded Warrants on February 8, 2023 and the remaining 60,231 Pre-Funded Warrants

on March 13, 2023.

The Purchase Warrants, which

had an exercise price of $17.16 per share, were exercisable commencing on August 8, 2023 and were to expire on August 6, 2028. On August

24, 2023, the exercise price of the Purchase Warrants was reduced to $3.30 pursuant to the Inducement Letter, described below.

H.C. Wainwright & Co.,

LLC (“Wainwright”) acted as exclusive placement agent for the February Offering pursuant to an engagement agreement between

the Company and Wainwright dated as of December 13, 2022. As compensation for such placement agent services, the Company paid Wainwright

an aggregate cash fee equal to 7.0% of the gross proceeds received by the Company from the offering, plus a management fee equal to 1.0%

of the gross proceeds received by the Company from the offerings, a non-accountable expense of $65,000 and $15,950 for clearing expenses.

The Company also issued to designees of Wainwright warrants to purchase 20,396 shares of Common Stock (the “February 2023 PA Warrants”

and the shares of Common Stock issuable upon exercise of the February 2023 PA Warrants, the “February 2023 PA Warrant Shares”).

The February 2023 PA Warrants, which have an exercise price of $23.17 per share, became exercisable on August 8, 2023 and will expire

on February 6, 2028.

The Purchase Warrant Shares

and the February 2023 PA Warrant Shares were registered for sale by the selling shareholders in a registration statement on Form S-1 filed

on August 1, 2023 and declared effective on August 9, 2023. The net proceeds to the Company from the Registered Offering and concurrent

private placement, after deducting the Placement Agent’s fees and expenses and the Company’s offering expenses, were approximately

$4.3 million.

Inducement Letter for the Exercise of the

Existing Warrants in Consideration for the Issuance of the Inducement Warrant

On August 21, 2023, the Company offered to reduce the exercise price

of warrants to purchase 616,303 shares of Common Stock held by one of the selling shareholders (the “Existing Warrants”),

including warrants to purchase 324,928 shares of Common Stock that initially had an exercise price of $7.67 per share, issued on August

8, 2022, and warrants to purchase 291,375 shares of Common Stock that initially had an exercise price of $17.16 per share, issued on February

8, 2023, to $3.30 per share as an inducement to the exercise of the Existing Warrants, provided the selling shareholder agreed to exercise

for cash the Existing Warrants in consideration for the Company’s agreement to issue a new warrant (the “Inducement Warrant”)

to purchase 1,232,606 shares of Common Stock (the “Warrant Exercise and Inducement Transaction”). On August 24, 2023, the

selling shareholder exercised the Existing Warrants and in consideration for such exercise the Company issued the Inducement Warrant to

the selling shareholder. The Inducement Warrant has an exercise price of $3.30 per share, subject to certain anti-dilution adjustments,

is exercisable for five and a half years commencing on the date shareholders of the Company approve the issuance of the Inducement Warrant

(“Shareholder Approval”) under applicable rules of Nasdaq, or if such Shareholder Approval is not required, commencing on

the date of issuance.

Wainwright acted as the exclusive placement agent in connection with

the Warrant Exercise and Inducement Transaction. The Company paid Wainwright a cash fee of $142,366 (7.0% of the gross proceeds received

from the exercise of the Existing Warrants) as well as a management fee of $20,338 (1.0% of the gross proceeds from the exercise of the

Existing Warrants). In addition, the Company paid Wainwright $65,000 for non-accountable expenses and $15,950 as a closing fee. The Company

also issued to designees of Wainwright warrants (the “August 2023 PA Warrants”) to purchase up to 43,141 shares of Common

Stock which have the same terms as the Inducement Warrant, except for an exercise price equal to $4.455 per share.

The Company will use the net

proceeds from the exercise of the Existing Warrants, and the Inducement Warrant and the August 2023 PA Warrants when exercised, for general

corporate and working capital purposes or for other purposes that the Board of Directors, in its good faith, deems to be in the best interest

of the Company.

Reverse Stock Split

On March 24, 2023, the

Company completed a 1-for-13 reverse stock split of its Common Stock. As a result of the reverse stock split, the following changes

have occurred (i) every thirteen shares of Common Stock have been combined into one share of Common Stock; (ii) the number of

authorized shares of Common Stock was proportionately reduced; (iii) the number of shares of Common Stock underlying each common

stock option or common stock warrant have been proportionately decreased on a 1-for-13 basis, and (iv) the exercise price of each

such outstanding stock option and common warrant has been proportionately increased on a 1-for-13 basis. Accordingly, all option

numbers, share numbers, warrant numbers, share prices, warrant prices, exercise prices and losses per share have been adjusted in

this prospectus, including the consolidated financial statements included herein, on a retroactive basis, to reflect this 1-for-13

reverse stock split. The reverse split was effected to cure a failure to comply with the minimum bid price requirement under Nasdaq

Listing Rule 5550(a)(2) for continued listing.

Corporate Information

We were incorporated in Florida

on September 21, 2005. Our principal executive offices are located at 235 Lincoln Rd., Suite 210, Miami Beach, Florida 33139, and our

telephone number is (800) 611-3622. Our corporate website address is www.cuentas.com. The information contained on or accessible through

our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference

only.

The Offering

| Common Stock Outstanding: |

|

2,730,058 shares |

| |

|

|

Common Stock Offered by

Selling Shareholders: |

|

1,275,747 shares |

| |

|

|

Common Stock Outstanding

After the Offering: |

|

4,005,805 shares (assuming the exercise of the Inducement Warrant and the August 2023 PA Warrants). |

| |

|

|

| Use of Proceeds: |

|

We will not receive any proceeds from the sale of the Common Stock by the selling shareholders. We may receive proceeds upon the exercise of the Inducement Warrant or the August 2023 PA Warrants (to the extent the registration statement of which this prospectus is a part is then effective and, if applicable, the “cashless exercise” provision is not utilized by the holder). Any proceeds will be used for general corporate and working capital or for other purposes that the Board of Directors, in its good faith, deems to be in the best interest of the Company. There can be no assurance that the Inducement Warrant or any of the August 2023 PA Warrants will be exercised. See “Use of Proceeds.” |

| |

|

|

| Listing of Securities: |

|

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “CUEN.” A class of our warrants is listed on the Nasdaq Capital Market under the symbol “CUENW” (the “Public Warrants”). |

| |

|

|

| Risk Factors: |

|

An investment in our company is highly speculative and involves a significant degree of risk. See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our securities. |

Risks Associated with Our Business

Our business is subject

to many significant risks, as more fully described in the section entitled “Risk Factors” immediately following this

prospectus summary. You should read and carefully consider these risks, together with the risks set forth under the section entitled

“Risk Factors” and all of the other information in this prospectus, including the financial statements and the related

notes included elsewhere in this prospectus, as well as the documents incorporated by reference into this prospectus, before

deciding whether to invest in our common stock. If any of the risks discussed in or incorporated by reference into this prospectus

actually occur, our business, financial condition or operating results could be materially and adversely affected. In particular,

our risks include, but are not limited to, the following:

| ● | our

ability to implement our business plan relating to our fintech solutions and technology to provide e-banking and e-commerce services

and our recent equity investments in real estate projects in Florida; |

| ● | our

ability to attract key personnel; |

| ● | our

ability to operate profitably; |

| ● | our

ability to efficiently and effectively finance our operations; |

| ● | our

ability to raise additional financing for working capital; |

| ● | our

ability to efficiently manage our operations; |

| ● | that

our accounting policies and methods may require management to make estimates about matters that are inherently uncertain; |

| ● | our

ability to consummate future acquisitions or strategic transactions; |

| ● | changes

in the legal, regulatory and legislative environments in the markets in which we operate; |

| ● | adverse

state or federal legislation or regulation that increases the costs of compliance, or adverse findings by a regulator with respect to

existing operations; |

| ● | our

ability to upgrade the Cuentas Mobile App and digital distribution system and make it completely functionable; and |

| ● | Our ability to maintain our listing on NASDAQ. |

RISK FACTORS

Investing

in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below and in

our Registration Statement on Form S-1 (File No. 333-273552) filed on August 1, 2023 and declared effective on August 9, 2023, and the

other documents incorporated into this prospectus in their entirety, together with all of the other information contained in this prospectus

or any document incorporated by reference herein. The risks described in this prospectus or any document incorporated by reference herein

are not the only risks facing us, but those that we consider to be material. There may be other unknown or unpredictable economic, business,

competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance

may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future

periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be adversely

affected, which could cause the trading price of our Common Stock to decline, resulting in a loss of all or part of your investment.

Our failure to

meet the continued listing requirements of Nasdaq could result in a de-listing of our Common Stock.

If

we fail to satisfy the continued listing requirements of Nasdaq, such as the corporate governance, minimum closing bid price or minimum

shareholders’ equity requirements, Nasdaq may take steps to de-list our securities. Such a de-listing would likely have a negative

effect on the price of our Common Stock and would impair your ability to sell or purchase our Common Stock when you wish to do so. In

the event of a de-listing, we would take actions to restore our compliance with Nasdaq’s listing requirements, but we can provide

no assurance that any such action taken by us would allow our Common Stock to become listed again, stabilize the market price or improve

the liquidity of our Common Stock, prevent our Common Stock from dropping below the Nasdaq minimum bid price requirement or prevent future

non-compliance with Nasdaq’s other continued listing requirements. We effected a 1-for 13 reverse stock split of our Common Stock

on March 24, 2023 to bring us in compliance with Nasdaq’s minimum bid price requirements.

On

August 18, 2023, we received a deficiency letter from Nasdaq Regulation stating that based upon our Quarterly Report on Form 10-Q for

the period ended June 30, 2023 which reported shareholders’ equity of $1,471,000, we were not

in compliance with Nasdaq Marketplace Rule 5550(b)(1) which requires us to maintain

shareholders’ equity of not less than $2,500,000 for continued listing on The Nasdaq Capital Market (the “Minimum Shareholders’ Equity Requirement”). Under

Nasdaq Rules the Company had until October 2, 2023 to submit a plan to regain compliance.

On

October 3 2023, the Company received a Staff Determination Letter from Nasdaq Regulation stating that due to the Company’s

failure by October 2, 2023, to submit a plan to regain compliance with Nasdaq Listing Rule 5550(b)(1), the Minimum

Shareholders’ Equity Requirement, the Company would be subject to delisting unless it timely requests a hearing before a

Nasdaq Hearings Panel (the “Panel”). The Company filed a request for a hearing before the Panel which has been scheduled

to be held on December 7, 2023. The hearing request will stay any suspension or delisting action through the hearing and the

expiration of any additional extension granted by the Panel following the hearing. In that regard, pursuant to the Nasdaq Listing

Rules, the Panel has the discretion to grant the Company an extension not to exceed April 1, 2024. Notwithstanding, there can be no

assurance that the Panel will grant the Company an extension or that the Company will ultimately regain compliance with all

applicable requirements for continued listing on The Nasdaq Capital Market.

USE OF PROCEEDS

We will not receive any proceeds

from the sale of the Common Stock by the selling shareholders. We may receive proceeds upon the exercise of the Inducement Warrant and

the 2023 August PA Warrants (to the extent the registration statement of which this prospectus is a part is then effective and, if applicable,

the “cashless exercise” provision is not utilized by the holder). Any proceeds will be used for general corporate and working

capital or for other purposes that the Board of Directors, in its good faith, deems to be in the best interest of the Company. There can

be no assurance that the Inducement Warrant or any of the August 2023 PA Warrants will be exercised.

DIVIDEND POLICY

We have never declared or

paid any cash dividend on our capital stock. We do not anticipate paying any cash dividends in the foreseeable future and we intend to

retain all of our earnings, if any, to finance our growth and operations and to fund the expansion of our business. Payment of any dividends

will be made in the discretion of our Board of Directors, after its taking into account various factors, including our financial condition,

operating results, current and anticipated cash needs and plans for expansion. Any dividends that may be declared or paid on our Common

Stock, must also be paid in the same consideration or manner, as the case may be, on our shares of preferred stock, if any.

DETERMINATION OF OFFERING PRICE

The selling shareholders will

offer Common Stock at the prevailing market prices or privately negotiated prices.

The offering price of our

Common Stock by the selling shareholders does not necessarily bear any relationship to our book value, assets, past operating results,

financial condition or any other established criteria of value. The facts considered in determining the offering price were our financial

condition and prospects, our limited operating history and the general condition of the securities market.

In addition, there is no assurance

that our Common Stock will trade at market prices in excess of the offering price as prices for common stock in any public market will

be determined in the marketplace and may be influenced by many factors, including the depth and liquidity.

SELLING SHAREHOLDERS

The following table sets forth certain information concerning the selling

shareholders and the shares of Common Stock owned by them and offered by them in this prospectus. Except as indicated in the footnotes

to the following table, each of the selling shareholders named in the table has sole voting and investment power with respect to the shares

set forth opposite its name. The percentage of ownership of the selling shareholders in the following table is based upon 2,730,058 shares

of Common Stock outstanding as of November 17, 2023.

The shares of Common Stock

being registered for resale hereby include 1,232,606 shares issuable upon exercise of the Inducement Warrant issued to one of the selling

shareholders on August 24, 2023 in consideration for exercise of outstanding warrants to purchase shares of Common Stock that initially

had an exercise price of $7.67 per share issued on August 8, 2022, and warrants to purchase shares of Common Stock that initially had

an exercise price of $17.16 per share, issued on February 8, 2023 (together, the “Existing Warrants”). On August 24, 2023

the selling shareholder exercised for cash the Existing Warrants to purchase an aggregate of 616,303 shares of Common Stock at a reduced

exercised price of $3.30 per share, in consideration for the Inducement Warrant. We are registering the shares issuable upon exercise

of the Inducement Warrant pursuant to our agreement to do so in the Inducement Letter. We will pay the expenses relating to such registration,

other than brokerage commissions in connection with the sale of those shares by the selling shareholder. In addition, we are registering

for resale the August 2023 PA Warrants to purchase up to 43,141 shares of Common Stock issued to the designees of Wainwright which have

the same terms as the Inducement Warrant, except for an exercise price equal to $4.455 per share.

Except as set forth in this prospectus and except for certain ownership

of our securities, the selling shareholders have not had any material relationship with us within the past three years.

All information with respect to share ownership has been furnished

by the selling shareholders. The Common Stock being offered is being registered to permit secondary trading of the shares and the selling

shareholders may offer all or part of the Common Stock owned by them for resale from time to time. Other than as described in the footnotes

below, the selling shareholders do not have any family relationships with our officers, directors or controlling shareholders.

The term “selling shareholder”

also includes any transferees, pledges, donees, or other successors in interest to the selling shareholder named in the table below. To

our knowledge, subject to applicable community property laws, each person named in the table has sole voting and investment power with

respect to the Common Stock set forth opposite such person’s name. We will file a supplement to this prospectus (or a post-effective

amendment hereto, if necessary) to name successors to any named selling shareholder who is able to use this prospectus to resell the securities

registered hereby.

| Name of Selling Shareholder | |

Number of

Shares

Owned

Prior to

Offering(1) | | |

Maximum

Number of

Shares

to be Sold

Pursuant

to this

Prospectus(1) | | |

Number of

Shares

Owned

After

Offering(2) | | |

Percentage of

Shares

Owned

After

Offering(3) | |

| Armistice Capital Master Fund Ltd. (4) | |

| 1,232,606 | | |

| 1,232,606 | | |

| 0 | | |

| -- | |

| Michael Vasinkevich (5) | |

| 55,328 | | |

| 27,664 | | |

| 27,664 | | |

| * | |

| Noam Rubinstein (5) | |

| 27,179 | | |

| 13,589 | | |

| 13,590 | | |

| * | |

| Craig Schwabe (5) | |

| 2,912 | | |

| 1,456 | | |

| 1,456 | | |

| * | |

| Charles Worthman (5) | |

| 863 | | |

| 432 | | |

| 431 | | |

| * | |

| (1) | Includes shares of

Common Stock known by us to be held by such selling shareholder as of the date of the prospectus

that are issuable upon exercise of warrants, including the Inducement Warrant and the August

2023 PA Warrants that are being registered hereunder, without giving effect to any beneficial

ownership limitations that may exist on such warrants. Assumes shareholder approval for the

exercise of the warrants in accordance with Nasdaq rules is obtained at the Company’s

Annual Meeting of Shareholders scheduled to be held on December 20, 2023. This column does

not include any other securities that a selling shareholder may hold, including any other

warrants that such selling shareholder may hold, that are not applicable to this prospectus. |

| (2) | Assumes the sale of

all shares offered pursuant to this prospectus. The shares owned after the completion of

this offering, issuable upon exercise of warrants previously issued, have been registered

for resale pursuant to registration statements on Form S-3 (File No. 333-267268) declared

effective on September 22, 2022 and Form S-1 (File No. 333-273552) declared effective on

August 7, 2023. |

| (3) | The warrants owned

by each selling shareholder are subject to a 4.99% beneficial ownership limitation, which

limitations prohibits the selling shareholder from exercising any portion of the warrants

if, following such exercise, the selling shareholder’s ownership of our shares of Common

Stock would exceed the applicable ownership limitation. |

| (4) | The securities to

be sold pursuant to this prospectus consist of 1,232,606 Warrant Shares, all of which are

directly held by Armistice Capital Master Fund Ltd. (the “Master Fund”), a Cayman

Islands exempted company, and may be deemed to be indirectly beneficially owned by Armistice

Capital, LLC (“Armistice”), as the investment manager of the Master Fund; and

(ii) Steven Boyd, as the Managing Member of Armistice Capital. Armistice and Steven

Boyd disclaim beneficial ownership of the reported securities except to the extent of their

respective pecuniary interest therein. The Inducement Warrant is subject to a

4.99% beneficial ownership limitation, which limitations prohibit the Master Fund from exercising

any portion of the Inducement Warrant if, following such exercise, the Master Fund’s

ownership of our shares of Common Stock would exceed the beneficial ownership limitation.

The address of the Master Fund is c/o Armistice Capital, LLC, 510 Madison Avenue, Seventh

Floor, New York, NY 10022. |

| (5) | The selling shareholder

is affiliated with H.C. Wainwright & Co., LLC, a registered broker dealer, and has a

registered address of c/o H.C. Wainwright & Co., LLC, 430 Park Ave, 3rd Floor,

New York, NY 10022. H.C. Wainwright & Co., LLC acted as placement agent in the Warrant

Exercise and Inducement Transaction and earned the August 2023 PA Warrants as part of its

compensation related to the Private Placement. The selling shareholder acquired the August

2023 PA Warrant in the ordinary course of business and, at the time the PA Warrant was acquired,

the selling shareholder had no agreements or understanding, directly or indirectly with any

person to distribute securities. |

PLAN OF DISTRIBUTION

We are registering the shares

issuable upon exercise of the Inducement Warrant and the August 2023 PA Warrants to permit the resale of these shares of Common Stock

by the holders thereof (and such holders’ successors and assigns) from time to time after the date of this prospectus. We will not

receive any of the proceeds from the sale by the selling shareholders of the shares of Common Stock. We will bear all fees and expenses

incident to our obligation to register the shares of Common Stock.

The selling shareholders may

sell all or a portion of the shares of Common Stock owned by them and offered hereby from time to time directly or through one or more

underwriters, broker-dealers or agents. If the shares of Common Stock are sold through underwriters or broker-dealers, the selling shareholders

will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of Common Stock may be sold in

one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time

of sale, or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions,

| |

● |

on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale; |

| |

|

|

| |

● |

in the over-the-counter market; |

| |

|

|

| |

● |

in transactions otherwise than on these exchanges or systems or in the over-the-counter market; |

| |

|

|

| |

● |

through the writing of options, whether such options are listed on an options exchange or otherwise; |

| |

|

|

| |

● |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately negotiated transactions; |

| |

|

|

| |

● |

short sales; |

| |

|

|

| |

● |

sales pursuant to Rule 144; |

| |

● |

broker-dealers may agree with the selling securityholders to sell a specified number of such shares at a stipulated price per share; |

| |

|

|

| |

● |

a combination of any such methods of sale; and |

| |

|

|

| |

● |

any other method permitted pursuant to applicable law. |

If the selling shareholders

effect such transactions by selling shares of Common Stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers

or agents may receive commissions in the form of discounts, concessions or commissions from the selling shareholders or commissions from

purchasers of the shares of Common Stock for whom they may act as agent or to whom they may sell as principal (which discounts, concessions

or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions

involved). In connection with sales of the shares of Common Stock or otherwise, the selling shareholders may enter into hedging transactions

with broker-dealers, which may in turn engage in short sales of the shares of Common Stock in the course of hedging in positions they

assume. The selling shareholders may also sell shares of Common Stock short and deliver shares of Common Stock covered by this prospectus

to close out short positions and to return borrowed shares in connection with such short sales. The selling shareholders may also loan

or pledge shares of Common Stock to broker-dealers that in turn may sell such shares.

The selling shareholders

may pledge or grant a security interest in some or all of the shares of Common Stock owned by them and, if they default in the performance

of their secured obligations, the pledgees or secured parties may offer and sell the shares of Common Stock from time to time pursuant

to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act, amending,

if necessary, the list of selling shareholders to include the pledgee, transferee or other successors in interest as selling shareholders

under this prospectus. The selling shareholders also may transfer and donate the shares of Common Stock in other circumstances in which

case the transferees, donees, pledgees or other successors in interest will be the selling owners for purposes of this prospectus.

The selling shareholders

and any broker-dealer participating in the distribution of the shares of Common Stock may be deemed to be “underwriters” within

the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be

deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of the shares of Common

Stock is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of shares of Common

Stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions

and other terms constituting compensation from the selling shareholders and any discounts, commissions or concessions allowed or reallowed

or paid to broker-dealers.

Under the securities laws

of some states, the shares of Common Stock may be sold in such states only through registered or licensed brokers or dealers. In addition,

in some states the shares of Common Stock may not be sold unless such shares have been registered or qualified for sale in such state

or an exemption from registration or qualification is available and is complied with.

There can be no assurance

that any selling shareholder will sell any or all of the shares of Common Stock registered pursuant to the registration statement, of

which this prospectus forms a part.

The selling shareholders

and any other person participating in such distribution will be subject to applicable provisions of the Exchange Act and the rules and

regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit the timing of purchases and sales

of any of the shares of Common Stock by the selling shareholders and any other participating person. Regulation M may also restrict the

ability of any person engaged in the distribution of the shares of Common Stock to engage in market-making activities with respect to

the shares of Common Stock. All of the foregoing may affect the marketability of the shares of Common Stock and the ability of any person

or entity to engage in market-making activities with respect to the shares of Common Stock.

Once sold under the registration

statement, of which this prospectus forms a part, the shares of Common Stock will be freely tradable in the hands of persons other than

our affiliates.

LEGAL MATTERS

Certain legal matters with

respect to the shares of Common Stock offered hereby will be passed upon by Ellenoff Grossman & Schole LLP, New York, New York.

EXPERTS

The financial statements of

Cuentas Inc. as of December 31, 2022 and the year ended December 31, 2022 have been audited by Yarel + Partners, Certified Public Accountants

(ISR.), an independent registered public accounting firm, as stated in their report, which is incorporated herein by reference, which

report includes an explanatory paragraph relating to our ability to continue as a going concern. Such financial statements have been incorporated

by reference in this prospectus and registration statement in reliance on the report of such firm given upon their authority as experts

in accounting and auditing.

The financial statements of

Cuentas Inc. as of December 31, 2021 and the year ended December 31, 2021 have been audited by Halperin Ilanit, CPA, an independent registered

public accounting firm, as stated in their report, which is incorporated herein by reference herein, which report includes an explanatory

paragraph relating to our ability to continue as a going concern. Such financial statements have been incorporated by reference in this

prospectus and registration statement in reliance upon the report of, and upon the authority of Halperin Ilanit, CPA as experts in accounting

and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC

this registration statement under the Securities Act of 1933, as amended (the “Securities Act”) covering the Common Stock

to be offered and sold by this prospectus and any applicable prospectus supplement. This prospectus does not contain all of the information

included in the registration statement, some of which is contained in exhibits to the registration statement. In addition, we are subject

to the information and periodic and current reporting requirements of the Exchange Act, and in accordance therewith, we file periodic

and current reports, proxy statements and other information with the SEC.

You may access our annual reports

on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements on Schedule 14A and amendments

or supplements to those reports and statements, filed with the SEC, free of charge at our website at www.cuentas.com or

by means of the SEC’s website at www.sec.gov. The information found on, or that can be accessed from or that is hyperlinked

to, our website or the SEC’s website is not part of this prospectus and you should not rely on that information when making a decision

to invest in our Common Stock.

Any statement made in this

prospectus and any prospectus supplement, periodic and current reports, proxy statements and other information filed or furnished with

the SEC concerning the contents of any contract, agreement or other document is only a summary of the actual contract, agreement or other

document. If we have filed any contract, document, agreement or other document as an exhibit to such filing or furnishing, you should

read the exhibit for a more complete understanding of the document or matter involved. Each statement regarding a contract, agreement

or other document is qualified in its entirety by reference to the actual document.

Upon written or oral request,

we will provide without charge to each person to whom a copy of the prospectus is delivered a copy of the documents incorporated by reference

herein (other than exhibits to such documents unless such exhibits are specifically incorporated by reference herein). You may request

a copy of these filings, at no cost, by writing or calling us at the contact information set forth below. We have authorized no one to

provide you with any information that differs from that contained in this prospectus. Accordingly, we take no responsibility for any other

information that others may give you. You should not assume that the information in this prospectus is accurate as of any date other than

the date of the front cover of this prospectus.

Cuentas Inc.

235 Lincoln Rd., Suite 210

Miami Beach, Florida 33139

Telephone number: (800) 611-3622

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate

by reference” the information we file with them, which means that we can disclose important information to you by referring you

to those documents. The information incorporated by reference herein is considered to be part of this prospectus, and information that

we file later with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed

below (except the information contained in such documents to the extent “furnished” and not “filed”) and any future

filings we make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act (except the information contained in such

documents to the extent “furnished” and not “filed”):

| |

● |

our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC on March 31, 2023. |

| |

● |

our Quarterly Report on

Form 10-Q for the fiscal quarter ended March 31,

2023 filed with the SEC on May 15, 2023; for the second fiscal quarter ended June 30, 2023 filed with the SEC on August 14, 2023; and for the third fiscal quarter ended September 30, 2023 filed with the SEC on November 20, 2023; |

| |

● |

our Current Reports on

Form 8-K as filed with the SEC on March

30, 2023 (Items 5.03 and 9.01); April

13 2023 (Items 801 and 9.01); April

18, 2023 (Items 8.01 and 9.01); May

4, 2023 (Items 1.01 and 9.01); June

22, 2013 (Items 5.02 and 9.01); August

18, 2023 (Items 3.01 and 9.01); August

22, 2023 (Items 1.01, 3.02 and 9.01) and August

22, 2023 (Items 5.02 and 9.01); October 4, 2023 (Item 3.01); October 16, 2023 (Item 5.02) and October 19, 2023 (Items 1.01, 7.01 and 9.01); and |

| |

● |

the Description of Cuentas

Capital Stock section contained in our Registration Statement on Form S-1 filed with the SEC on August 1, 2023, and declared effective on August 9, 2023. |

We will provide without charge

upon written or oral request a copy of any or all of the documents that are incorporated by reference herein into this prospectus, other

than exhibits which are specifically incorporated by reference herein into such documents. Requests should be directed to Cuentas Inc.,

235 Lincoln Rd., Suite 210, Miami Beach, Florida 33139. Our telephone number is (800) 611-3622.

Any statement contained in

a document incorporated or deemed to be incorporated by reference herein into this prospectus shall be deemed to be modified or superseded

for the purposes of this prospectus to the extent that a statement contained in this prospectus (or in any document incorporated by reference

herein therein) or in any other subsequently filed document that is or is deemed to be incorporated by reference herein into this prospectus

modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this prospectus.

1,275,747 Shares

Common Stock

To be Sold by the Selling Shareholders

PROSPECTUS

November 30, 2023

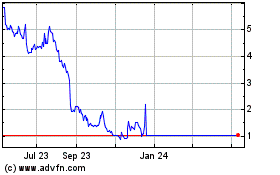

Cuentas (NASDAQ:CUEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

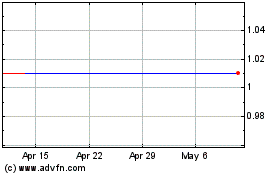

Cuentas (NASDAQ:CUEN)

Historical Stock Chart

From Apr 2023 to Apr 2024