UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the

Securities Exchange Act of 1934

(Amendment No. 1)

| Check the appropriate box: |

| ¨ |

|

Preliminary Information Statement |

| ¨ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| x |

|

Definitive Information Statement |

CARDIFF LEXINGTON CORPORATION

(Name of Registrant as Specified In Its Charter)

| Payment of Filing Fee (Check all boxes that apply): |

| |

|

| x |

|

No fee required |

| |

|

| ¨ |

|

Fee paid previously with preliminary materials |

| |

|

|

| ¨ |

|

Fee computed on table in exhibit required by Item 25(b) of Schedule 14A per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11 |

EXPLANATORY NOTE

On March 10, 2023, Cardiff Lexington Corporation

(the “Company”) filed a Definitive Information Statement on Schedule 14C with the Securities and Exchange Commission

(the “Information Statement”). The Information Statement related to stockholder approval of a 1-for-75,000 reverse

stock split of the Company’s outstanding common stock (the “Prior Reverse Split”).

Due to delays in obtaining FINRA clearance for

the Prior Reverse Split, the Company has not yet completed the Prior Reverse Split. Given the significant delay in implementing the Prior

Reverse Split and changes to the Company’s capitalization and stock price since it was approved, the Company decided to amend the

Prior Reverse Split and sought stockholder approval to authorize the board of directors, in its discretion, to implement one or more reverse

stock splits of the Company’s outstanding common stock at a ratio of not less than 1-for-2 and not more than 1-for-75,000 in the

aggregate, which such approval was obtained on November 21, 2023. Accordingly, the Company is filing a Revised Definitive Information

Statement on Schedule 14C, which amends and restates the Information Statement in its entirety, and will distribute this Revised Definitive

Information Statement to our stockholders.

3753

Howard Hughes Parkway, Suite 200

Las Vegas,

NV 89169

Notice of Action Taken Pursuant to Written Consent

of Stockholders

Dear Stockholder:

The accompanying Information Statement is furnished

to holders of shares of common stock of Cardiff Lexington Corporation (“we,” “us,” “our”

or “our company”) pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and Regulation 14C and Schedule 14C thereunder, in connection with an approval by written consent of the holders of our

voting stock.

The purpose of this Notice and Information Statement

is to notify our stockholders that, on November 21, 2023, we received written consents from stockholders to authorize the board of directors,

in its discretion, to implement one or more reverse stock splits of the Company’s outstanding common stock at a ratio of not less

than 1-for-2 and not more than 1-for-75,000 in the aggregate at any time prior to March 31, 2024.

Our board of directors approved such reverse stock

split and recommended that our stockholders approve it as well. In connection with the adoption of such reverse stock split, our board

of directors elected to seek the written consent of the holders of our outstanding voting shares in order to reduce associated costs and

implement such reverse stock split in a timely manner.

This Notice and the accompanying Information Statement

are being furnished to you to inform you that the reverse stock split has been approved by stockholders. The board of directors is

not soliciting your proxy in connection with the reverse stock split and proxies are not requested from stockholders.

| |

BY ORDER OF THE BOARD OF DIRECTORS, |

| |

|

| |

/s/ Daniel Thompson |

| |

Daniel Thompson |

| |

Chairman of the Board |

November 29, 2023

THE ACCOMPANYING INFORMATION STATEMENT IS BEING

MAILED

TO STOCKHOLDERS ON OR ABOUT NOVEMBER 30, 2023

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

CARDIFF LEXINGTON CORPORATION

3753 Howard

Hughes Parkway, Suite 200

Las Vegas,

NV 89169

INFORMATION STATEMENT

NO VOTE OR OTHER ACTION OF THE COMPANY’S

STOCKHOLDERS

IS REQUIRED IN CONNECTION WITH THIS INFORMATION

STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is first being mailed

on or about November 30, 2023 to the holders of record of the outstanding common stock of Cardiff Lexington Corporation, a Nevada corporation

(“we,” “us,” “our” or “our company”), as of the close of business

on November 21, 2023 (the “Record Date”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). This Information Statement relates to a written consent in lieu of a meeting, dated

November 21, 2023 (the “Written Consent”), of stockholders owning as of the Record Date at least a majority of the

outstanding shares of our common stock and preferred stock, voting together as a single class.

The Written Consent authorized the board of directors,

in its discretion, to implement one or more reverse stock splits of the Company’s outstanding common stock at a ratio of not less

than 1-for-2 and not more than 1-for-75,000 in the aggregate at any time prior to March 31, 2024.

Our board of directors and stockholders previously

approved a 1-for-75,000 reverse stock split on February 28, 2023, and on April 5, 2023, we filed a certificate of amendment to our amended

and restated articles of incorporation with the Nevada Secretary of State’s Office for such reverse stock split. However, due to

delays in obtaining FINRA clearance for this reverse stock split, we have not yet completed this reverse stock split. Given the significant

delay in implementing this reverse stock split and changes to our capitalization and stock price since it was approved, we decided to

amend this previously approved reverse stock split in order to provide for a range of reverse split ratios, which such amendment was approved

by stockholders via the Written Consent. Since we previously filed a certificate of amendment for the prior reverse stock split, we plan

to implement a new reverse stock split by filing a certificate of correction to the certificate of amendment (the “Certificate

of Correction”), the form of which is attached to this Information Statement as Appendix A. Alternatively, if for any

reason the Nevada Secretary of State’s Office does not accept the Certificate of Correction, we may effect a forward split or make

an alternative filing with the Nevada Secretary of State’s Office to effectuate a stock split within the desired range of ratios

approved by the Written Consent. If we elect to implement more than one reverse stock split, we will implement such additional reverse

stock splits by filing a certificate of amendment to our amended and restated articles of incorporation (each, a “Certificate

of Amendment”), the form of which is attached to this Information Statement as Appendix B.

The Written Consent is sufficient under the

Nevada Revised Statutes, our amended and restated articles of incorporation and our bylaws to approve the reverse stock split.

Accordingly, the reverse stock split will not be submitted to the other stockholders for a vote, and this Information Statement is

being furnished to such other stockholders to provide them with certain information concerning the Written Consent in accordance

with the requirements of the Exchange Act, and the regulations promulgated under the Exchange Act, including Regulation 14C.

We will, when permissible following the expiration

of the 20-day period mandated by Rule 14c of the Exchange Act and the provisions of the Nevada Revised Statutes, file the Certificate

of Correction with the Nevada Secretary of State’s Office.

AUTHORIZATION BY THE BOARD OF DIRECTORS AND

STOCKHOLDERS

On November 21, 2023, our board of directors unanimously

adopted resolutions to seek stockholder approval to authorize the board of directors, in its discretion, to implement one or more reverse

stock splits of the Company’s outstanding common stock at a ratio of not less than 1-for-2 and not more than 1-for-75,000 in the

aggregate at any time prior to March 31, 2024. In connection with the adoption of these resolutions, our board of directors elected to

seek the written consent of stockholders in order to reduce associated costs and implement the reverse stock split in a timely manner.

On November 21, 2023, Daniel Thompson, the Chairman of the Board, and Alex Cunningham, our Chief Executive Officer (the “Majority

Stockholders”), executed and delivered the Written Consent to us.

Pursuant to the Nevada Revised Statutes, our amended

and restated articles of incorporation and our bylaws, any action required or permitted to be taken at a meeting of the stockholders may

be taken without a meeting if, before or after the action, a written consent thereto is signed by stockholders holding at least a majority

of the voting power of our outstanding voting stock, except that if a different proportion of voting power is required for such an action

at a meeting, then that proportion of written consents is required.

Pursuant to the Nevada Revised Statutes, our amended

and restated articles of incorporation and our bylaws, approval of the reverse stock split at a meeting would require the affirmative

vote of at least a majority of the total number of shares of our outstanding common stock, series A preferred stock, series B preferred

stock, series C preferred stock, series E preferred stock, series I preferred stock, series J preferred stock, series L preferred stock

and series R preferred stock, voting together as a single class.

Holders of shares of our common stock, series

B preferred stock, series C preferred stock, series E preferred stock, series J preferred stock, series L preferred stock and series R

preferred stock are entitled to one (1) vote per share. Holders of shares of our series I preferred stock are entitled to five (5) votes

per share. Each share of series A preferred stock is entitled to a number of votes at any time equal to (i) 25% of the number of votes

then held or entitled to be made by all other equity securities of our company, including, without limitation, the common stock, plus

(ii) one (1).

As of the Record Date, we had issued and outstanding

1,496,475,613 shares of common stock, 2 shares of series A preferred stock, 2,134,478 shares of series B preferred stock, 123 shares of

series C preferred stock, 155,750 shares of series E preferred stock, 14,885,000 shares of series I preferred stock, 1,713,584 shares

of series J preferred stock, 319,493 shares of series L preferred stock and 165 shares of series R preferred stock. As of the Record Date,

the Majority Stockholders owned 50,008,255 shares of common stock, 2 shares of series A preferred stock, 19,312 shares of series B preferred

stock, 2 shares of series C preferred stock and 11,274,912 shares of series I preferred stock, or approximately 56.75% of the total votes

eligible to be cast.

Accordingly, we have obtained all necessary corporate

approvals. We are not seeking written consent from any other stockholder, and other stockholders will not be given an opportunity to vote

with respect to the actions described in this Information Statement. All necessary corporate approvals have been obtained. This Information

Statement is furnished solely for the purposes of advising stockholders of the action taken by Written Consent and giving stockholders

notice of such actions taken as required by the Exchange Act.

As the action taken by the Majority Stockholder

was by written consent, there will be no security holders’ meeting and representatives of the principal accountants for the current

year and for the most recently completed fiscal year will not have the opportunity to make a statement if they desire to do so and will

not be available to respond to appropriate questions from our stockholders.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding

beneficial ownership of our common stock as of the Record Date by (i) each of our executive officers and directors; (ii) all of our executive

officers and directors as a group; and (iii) each person who is known by us to beneficially own more than 5% of our common stock. Unless

otherwise specified, the address of each of the persons set forth below is in care of our company, 3753 Howard Hughes Parkway, Suite 200,

Las Vegas, NV 89169.

| Name and Address of Beneficial Owner |

Title of Class |

Amount and Nature of Beneficial Ownership(1) |

Percent of Class(2) |

| Daniel Thompson, Chairman of the Board(3) |

Common Stock |

444,123,364 |

28.19% |

| Alex Cunningham, Chief Executive Officer and Director(4) |

Common Stock |

450,110,181 |

28.57% |

| Zia Choe, Interim Chief Financial Officer(5) |

Common Stock |

6,300 |

* |

| All executive officers and directors (4 persons) |

Common Stock |

894,239,844 |

56.76% |

| Leonite Capital LLC(6) |

Common Stock |

109,000,600 |

6.92% |

* Less than 1%

| (1) | Beneficial Ownership is determined in accordance with the rules of the Securities and Exchange Commission

(the “SEC”) and generally includes voting or investment power with respect to securities. Except as otherwise indicated,

each of the beneficial owners listed above has direct ownership of and sole voting power and investment power with respect to our common

stock. |

| (2) | A total of 1,496,475,613 shares of common stock are considered to be outstanding pursuant to SEC Rule

13d-3(d)(1) as of the Record Date. For each beneficial owner above, any options exercisable within 60 days have been included in the denominator. |

| (3) | Includes (i) 25,004,127 shares of common stock, (ii) 1 share of series A preferred stock, which is entitled

to a number of votes at any time equal to 25% of the number of votes then held or entitled to be made by all other equity securities of

our company, plus one (equivalent to 351,306,053 votes as of the Record Date), (iii) 26,124 shares of common stock issuable upon the conversion

of 13,062 shares of series B preferred stock, (iv) 100,000 shares of common stock issuable upon the conversion of 1 share of series C

preferred stock and (v) 5,037,412 shares of series I preferred stock, which are entitled to five votes per share. |

| (4) | Includes (i) 25,004,128 shares of common stock, (ii) 1 share of series A preferred stock, which is entitled

to a number of votes at any time equal to 25% of the number of votes then held or entitled to be made by all other equity securities of

our company, plus one (equivalent to 351,306,053 votes as of the Record Date), (iii) 12,500 shares of common stock issuable upon the conversion

of 6,250 shares of series B preferred stock, (iv) 100,000 shares of common stock issuable upon the conversion of 1 share of series C preferred

stock and (v) 6,237,500 shares of series I preferred stock, which are entitled to five votes per share. |

| (5) | Represents 6,300 shares of common stock issuable upon the conversion of 3,150 shares of series B preferred

stock. |

| (6) | Based solely on the information set forth in the Schedule 13G filed with the SEC on November 16, 2023.

Avi Geller is the Chief Investment Officer of Leonite Capital LLC and has voting and investment power over the securities held by it.

Mr. Geller disclaims beneficial ownership of the shares held by Leonite Capital LLC except to the extent of his pecuniary interest, if

any, in such shares. |

We do not currently have any arrangements which

if consummated may result in a change of control of our company.

THE REVERSE STOCK SPLIT

General

On November 21, 2023, the Majority Stockholders

authorized the board of directors, in its discretion, to implement one or more reverse stock splits of the Company’s outstanding

common stock at a ratio of not less than 1-for-2 and not more than 1-for-75,000 in the aggregate at any time prior to March 31, 2024.

As noted above, our board of directors and stockholders

previously approved a 1-for-75,000 reverse stock split on February 28, 2023, and on April 5, 2023, we filed a certificate of amendment

to our amended and restated articles of incorporation with the Nevada Secretary of State’s Office for such reverse stock split.

However, due to delays in obtaining FINRA clearance for this reverse stock split, we have not yet completed this reverse stock split.

Given the significant delay in implementing this reverse stock split and changes to our capitalization and stock price since it was approved,

we decided to amend this previously approved reverse stock split in order to provide for a range of reverse split ratios, which such amendment

was approved by the Majority Stockholders. Since we previously filed a certificate of amendment for the prior reverse stock split, we

plan to implement a new reverse stock split by filing the Certificate of Correction, the form of which is attached to this Information

Statement as Appendix A. Alternatively, if for any reason the Nevada Secretary of State’s Office does not accept the Certificate

of Correction, we may effect a forward split or make an alternative filing with the Nevada Secretary of State’s Office to effectuate

a stock split within the desired range of ratios set forth above. If we elect to implement more than one reverse stock split, we will

implement such additional reverse stock splits by filing a Certificate of Amendment, the form of which is attached to this Information

Statement as Appendix B.

Reasons for the Reverse Stock Split

The primary purpose of the reverse stock split

is to increase the per share market price of our common stock. The reduction in the number of issued and outstanding shares of our common

stock as a result of the reverse stock split is, absent other factors, expected to proportionately increase the market price of our common

stock to a level above the current market trading price.

Our board also believes that one or more reverse

stock splits will enhance the acceptability and marketability of our common stock to the financial community and the investing public

and may mitigate any reluctance on the part of certain brokers and investors to trade in our common stock. Many institutional investors

have policies prohibiting them from holding stocks in their own portfolios which trade at prices below certain levels. These policies

reduce the number of potential investors in our common stock at its current market price. In addition, analysts at many leading brokerage

firms are reluctant to recommend stocks to their clients, or monitor the activity of stocks, that trade at a price per share below certain

levels. A variety of brokerage house policies and practices also tend to discourage individual brokers within those firms from dealing

in stocks that trade at a price per share below certain levels. Some of those policies and practices pertain to the payment of brokers’

commissions and to time-consuming procedures that function to make the handling of such stocks unattractive to brokers from an economic

standpoint. Additionally, because brokers’ commissions on such stocks generally represent a higher percentage of the stock price

than commissions on higher-priced stocks, the current share price of our common stock can result in an individual stockholder paying transaction

costs that represent a higher percentage of total share value than would be the case if our share price were higher. This factor may also

limit the willingness of institutions to purchase our common stock.

Factors Influencing the Board of Directors’

Discretion in Implementing the Reverse Stock Split

Our board of directors intends to implement one

or more reverse stock splits if it believes that such an action is in the best interests of our company and our stockholders. Such determination,

as well as the determination of the specific ratio to be utilized, will be based on factors such as existing and expected marketability

and liquidity of our common stock, prevailing market conditions and the likely effect on the market price of our common stock. Our board

will also consider factors such as the historical and projected performance of our common stock, our projected performance, prevailing

market and industry conditions and general economic trends, and will place emphasis on the expected closing price of our common stock

over the short and longer period following the effectiveness of the reverse stock split.

No further action on the part of our stockholders

would be required to either effect or abandon the reverse stock split. Notwithstanding approval of the reverse stock split proposal by

stockholders, our board may, in its discretion, determine to delay the effectiveness of one or more reverse stock splits up until March

31, 2024.

Effect of the Reverse Stock Split

The immediate effect of a reverse stock split

would be to reduce the number of shares of our common stock and to increase the trading price of our common stock. However, we cannot

predict the specific effect of any reverse stock split upon the market price of our common stock. Based on the data we have reviewed,

it appears that in some cases a reverse stock split improves stock performance while in other cases it does not, and in some cases a reverse

stock split improves overall market capitalization while in other cases it does not. There is no assurance that the trading price of our

common stock after the reverse stock split will rise in proportion to the reduction in the number of shares of our common stock outstanding

as a result of the reverse stock split. Also, there is no assurance that a reverse stock split will lead to a sustained increase in the

trading price of our common stock. The trading price of our common stock may change due to a variety of factors, such as our operating

results and other factors related to our business and general market conditions.

Additionally, the liquidity of trading in our

common stock may be harmed by the reverse stock split given the reduced number of shares that would be outstanding after the reverse stock

split, particularly if the expected increase in the per share stock price as a result of the reverse stock split is not sustained. In

addition, the reverse stock split may increase the number of stockholders who own odd lots (less than 100 shares) of our common stock.

Following the reverse stock split, the resulting per share stock price may nevertheless fail to attract institutional investors and may

not satisfy the investing guidelines of such investors and, consequently, the trading liquidity of our common stock may not improve.

As a summary and for illustrative purposes only,

the following table reflects the approximate number of shares of our common stock that would be outstanding as a result of the potential

reverse stock split ratios within the range above based on 1,496,475,613 shares of our common stock outstanding as of the Record Date,

without accounting for fractional shares, which will be rounded up to the nearest whole share:

| Proposed Ratio |

|

Shares Outstanding |

| 1-for-2 |

|

748,237,807 |

| 1-for-500 |

|

2,992,952 |

| 1-for-1,000 |

|

1,496,476 |

| 1-for-10,000 |

|

149,648 |

| 1-for-20,000 |

|

74,824 |

| 1-for-30,000 |

|

49,883 |

| 1-for-40,000 |

|

37,412 |

| 1-for-50,000 |

|

29,930 |

| 1-for-60,000 |

|

24,942 |

| 1-for-70,000 |

|

21,379 |

| 1-for-75,000 |

|

19,954 |

The resulting decrease in the number of shares

of our common stock outstanding could potentially impact the liquidity of our common stock, especially in the case of larger block trades.

Our stockholders should recognize that if a reverse

stock split is effected, they will own a smaller number of shares than they currently own (approximately equal to the number of shares

owned immediately prior to the reverse stock split divided by the selected block factor (i.e. two, three, four, etc.) and after giving

effect to the rounding up of fractional shares to the nearest whole share, as described below). The reverse stock split would not affect

any stockholder’s percentage ownership interests in our company or such stockholder’s proportionate voting power, except to

the extent that interests in fractional shares would be rounded up to the nearest whole share.

Fractional Shares

A reverse stock split will affect all of our stockholders

uniformly and would not affect any stockholder’s percentage ownership interests, except to the extent that a reverse stock split

results in such stockholder owning a fractional share. No fractional shares will be issued. Instead, stockholders that would otherwise

be entitled to receive a fractional share will have such fractional share rounded up to the nearest whole share.

Accounting Treatment

The par value of our common stock will remain

unchanged after a reverse stock split. As a result, on the effective date of each reverse stock split, the stated capital on the balance

sheet attributable to our common stock will be reduced proportionally from its present amount, and the additional paid-in capital account

will be increased by the amount by which the stated capital is reduced. The per share common stock net income or loss and any other per

share amount will be increased because there will be fewer shares of common stock outstanding and we will adjust historical per share

amounts set forth in our future financial statements. We do not anticipate that any other accounting consequences would arise as a result

of a reverse stock split.

Material U.S. Federal Income Tax Considerations

Related to the Reverse Stock Split

The following is a general summary of the material

U.S. federal income tax considerations related to a reverse stock split that may be relevant to U.S. Holders (as defined below) of our

common stock that hold our common stock as a “capital asset” (generally property held for investment), but does not purport

to be a complete analysis of all potential tax considerations. This summary is based on the provisions of the Internal Revenue Code of

1986, as amended, U.S. Treasury regulations promulgated thereunder, administrative rulings and judicial decisions, all as in effect on

the date hereof, and all of which are subject to change, possibly with retroactive effect. We have not sought and will not seek an opinion

of counsel or any rulings from the Internal Revenue Service regarding the matters discussed below. There can be no assurance the Internal

Revenue Service or a court will not take a contrary position with respect to the tax consequences of a reverse stock split described below.

This summary does not address all aspects of U.S.

federal income taxation that may be relevant to a holder in light of their personal circumstances. In addition, this summary does not

address the Medicare tax on certain investment income, U.S. federal estate or gift tax laws, any state, local or non-U.S. tax laws or

any tax treaties. This summary also does not address tax consequences applicable to investors that may be subject to special treatment

under the U.S. federal income tax laws, such as:

| · | persons that are not U.S. Holders; |

| · | U.S. Holders who hold common stock through non-U.S. brokers or other non-U.S. intermediaries; |

| · | banks, insurance companies or other financial institutions; |

| · | tax-exempt or governmental organizations; |

| · | dealers in securities or foreign currencies; |

| · | persons whose functional currency is not the U.S. dollar; |

| · | real estate investment trusts or regulated investment companies; |

| · | corporations that accumulate earnings to avoid U.S. federal income tax; |

| · | traders in securities that use the mark-to-market method of accounting for U.S. federal income tax purposes; |

| · | persons subject to the alternative minimum tax; |

| · | partnerships or other pass-through entities for U.S. federal income tax purposes or holders of interests

therein; |

| · | persons that acquired our common stock through the exercise of employee stock options or otherwise as

compensation or through a tax-qualified retirement plan; and |

| · | persons that hold our common stock as part of a straddle, appreciated financial position, synthetic security,

hedge, conversion transaction or other integrated investment or risk reduction transaction. |

THIS DISCUSSION IS FOR INFORMATIONAL PURPOSES

ONLY AND IS NOT INTENDED TO BE TAX ADVICE. THE TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT MAY NOT BE THE SAME FOR ALL HOLDERS OF OUR

COMMON STOCK. HOLDERS OF OUR COMMON STOCK ARE ENCOURAGED TO CONSULT THEIR TAX ADVISORS WITH RESPECT TO THE APPLICATION OF U.S. FEDERAL

INCOME TAX LAWS TO THEIR PARTICULAR SITUATION AS WELL AS ANY TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT ARISING UNDER OTHER U.S. FEDERAL

TAX LAWS (INCLUDING ESTATE AND GIFT TAX LAWS), UNDER THE LAWS OF ANY STATE, LOCAL OR NON-U.S. TAXING JURISDICTION OR UNDER ANY APPLICABLE

TAX TREATY.

For purposes of the discussion below, a “U.S.

Holder” is a beneficial owner of shares of our common stock that for U.S. federal income tax purposes is: (1) an individual

who is a citizen or resident of the United States; (2) a corporation (or other entity treated as a corporation for U.S. federal income

tax purposes) created or organized in or under the laws of the United States, any state thereof, or the District of Columbia; (3) an estate

the income of which is subject to U.S. federal income tax regardless of its source; or (4) a trust (a) the administration of which is

subject to the primary supervision of a U.S. court and which has one or more United States persons who have the authority to control all

substantial decisions of the trust or (b) which has made a valid election under applicable U.S. Treasury regulations to be treated as

a United States person.

If a partnership (including an entity or arrangement

treated as a partnership for U.S. federal income tax purposes) holds our common stock, the tax treatment of a partner in the partnership

generally will depend upon the status of the partner, upon the activities of the partnership and upon certain determinations made at the

partner level. Accordingly, we urge partners in partnerships (including entities or arrangements treated as partnerships for U.S. federal

income tax purposes) to consult their tax advisors regarding the U.S. federal income tax consequences of a reverse stock split to them.

A reverse stock split should be treated as a “recapitalization”

for U.S. federal income tax purposes. As a result, a U.S. Holder generally should not recognize gain or loss as a result of a reverse

stock split. A U.S. Holder’s aggregate tax basis in its post-reverse stock split shares of our common stock should equal the aggregate

tax basis of its pre-reverse stock split shares of our common stock, and such U.S. Holder’s holding period in its post-reverse stock

split shares of our common stock should include the holding period in its pre-reverse stock split shares of our common stock. A U.S. Holder

that holds shares of our common stock acquired on different dates and at different prices should consult its tax advisor with regard to

identifying the bases or holding periods of the particular shares of common stock it holds after a reverse stock split.

INTERESTS OF CERTAIN PERSONS

IN MATTERS TO BE ACTED UPON

Our directors and executive officers, and each

associate of the foregoing persons, have no substantial interests, directly or indirectly, in the reverse stock split, except to the extent

of their ownership of shares of common stock and securities convertible or exercisable for common stock.

DISSENTER’S RIGHTS

OF APPRAISAL

Neither the Nevada Revised Statutes nor our amended

and restated articles of incorporation provide holders of our common stock with dissenters’ or appraisal rights in connection with

the reverse stock split.

STOCKHOLDERS ENTITLED TO

INFORMATION STATEMENT

This Information Statement is being mailed to

you on or about November 30, 2023. We will pay all costs associated with the distribution of this information statement, including

the costs of printing and mailing. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable

expenses incurred by them in sending this Information Statement to the beneficial owners of our common stock.

Our board of directors established November 21,

2023 as the record date for the determination of stockholders entitled to receive this Information Statement.

DELIVERY OF DOCUMENTS TO

STOCKHOLDERS SHARING AN ADDRESS

We may deliver only one Information Statement

to multiple stockholders sharing an address, unless we have received contrary instructions from one or more of the stockholders. We will

promptly deliver a separate copy of this Information Statement to a stockholder at a shared address to which a single copy was delivered,

upon written or oral request to us at the following address and telephone number:

Cardiff Lexington Corporation

3753 Howard Hughes Parkway, Suite 200

Las Vegas, NV 89169

Attn: Corporate Secretary

Phone: (844) 628-2100

In addition, a stockholder can direct a notification

to us at the phone number and mailing address listed above that the stockholder wishes to receive a separate information statement in

the future. Stockholders sharing an address that receive multiple copies can request delivery of a single copy of the information statements

by contacting us at the phone number and mailing address listed above.

WHERE YOU CAN FIND MORE

INFORMATION

We file periodic reports, proxy statements and

other information with the SEC. Our SEC filings are available from the SEC’s website at www.sec.gov, which contains reports, proxy

and information statements and other information regarding issuers that file electronically with the SEC. Additionally, we will make

these filings available, free of charge, on our website at www.cardifflexington.com as soon as reasonably practicable after we electronically

file such materials with, or furnish them to, the SEC. The information on our website, other than these filings, is not, and should not

be, considered part of this Information Statement and is not incorporated by reference into this Information Statement.

Appendix A

Appendix B

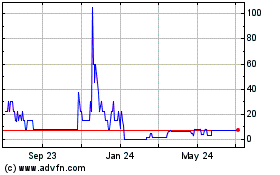

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

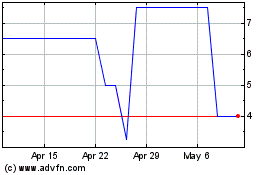

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Apr 2023 to Apr 2024