Clean Energy Technologies Reports Third Quarter 2023 Financial Results and Provides Business Update

November 28 2023 - 8:30AM

Clean Energy Technologies, Inc. (Nasdaq: CETY)

(“CETY” or the “Company”), a clean energy manufacturing and

services company, offering eco-friendly green energy solutions,

clean energy fuels, and alternative electric power for small and

mid-sized projects in North America, Europe, and Asia today

announced its third quarter 2023 unaudited financial results.

The company experienced sustained strong

revenue growth, consistently surpassing quarterly expectations for

the last three quarters.

Financial and corporate highlights for the nine

months ended September 30th, 2023, include the following:

- For the nine

months ended September 30, 2023, CETY’s total revenue amounted to

$11,701,118, a substantial increase from the $2,567,596 recorded

during the same period in 2022, reflecting a remarkable revenue

growth of 356%. This also represents a remarkable 339% growth over

its total revenue in 2022. This impressive increase can be

attributed to the success of the Vermont Renewable Gas Biomass

project in Lyndon and the substantial growth in Natural Gas (NG)

trading from CETY HK.

- For the nine

months ended on September 30, 2023, CETY’s gross profit amounted to

$1,427,629, as compared to $1,151,903 for the corresponding period

in 2022. Gross margins have improved from 11% in Q2 2023 to 12.2%

in Q3 2023. The fluctuations in natural gas (NG) prices during both

the winter and summer seasons had an impact on our profit margins.

Nevertheless, the sale of CETY’s waste-to-energy and waste-heat to

power systems significantly bolstered our profit margins.

- For the nine

months ended on September 30, 2023, CETY’s operating expenses

totaled $2,709,963, compared to $1,724,727 for the corresponding

period in 2022. This increase can be attributed to CETY’s expansion

in 2023, along with additional costs related to marketing and

business development, professional fees for legal and accounting

services, increased expenses for investor relations, higher

salaries for the new executives and directors, and additional

consulting engineering expenses.

- For the nine

months ended September 30, 2023, CETY incurred a net loss of

$2,460,489, as compared to $1,322,861 for the corresponding period

in 2022. This increase in net loss can be attributed to the rise in

operating expenses stemming from its recent expansion, as well as

interest and financing fees amounting to $1,707,690, which includes

financing fees and debt discount calculations associated with the

warrant. CETY is currently restructuring its debt to lower

financing costs in the future.

- CETY has

effectively converted $1.95 million of its note payable into

equity, marking a significant milestone for the company and

introducing a range of advantages. This conversion offers multiple

key benefits: Firstly, it enables the note to be converted at a 20%

discount to the market price, thereby closely aligning the

investor's interests with the company's performance. Furthermore,

the converted note no longer requires mandatory redemption in cash

and cannot default, significantly reducing financial pressures.

Additionally, the note will now receive a 15% dividend, replacing

the previous 15% interest rate, until the preferred shares are

converted or settled. Moreover, the converted securities will be

subject to customary transfer restrictions. Finally, the company

retains the option to settle the note using future capital raises

at its own discretion. Overall, these elements collectively

contribute to a highly favorable scenario for the company.

Management Discussion and Corporate

Strategy

CETY continued its aggressive growth strategy in

Q3 2023 and has achieved a significant milestone in its waste to

energy segment.

Vermont Renewable Gas LLC (VRG), an affiliate of

CETY, successfully secured a 20-year Power Purchasing Agreement

(PPA) with VEPP, Inc., a not-for-profit corporation that

administers two of Vermont’s Renewable Energy Programs under

contract with the Vermont Public Utility Commission. The PPA is

valued at $53 million. The project has entered its final permitting

stage and is expected to begin construction in Q1 2024, allowing

CETY to continuously recognize revenue from the $10 million EPC

contract already in place with VRG.

As temperatures fall, the natural gas (NG)

trading business is entering its high season and CETY expects

increased margins from fulfilling potential upstream shortfalls.

CETY has also stepped up its cross-selling efforts in China and

identified opportunities to deploy our waste to energy

technology.

HRS has finalized an agreement with RPG Energy

Group Inc. (“RPG”) and Stanley Black & Decker (“SBD”) to

design, build, and install a Clean Cycle waste heat recovery system

at SBD’s Martin Energy facility. CETY and RPG are well-positioned

to deploy this cutting-edge thermal waste conversion technology,

which will benefit Stanley Black & Decker's facility and its

environmental and sustainable goals. CETY will also work to

identify additional opportunities to expand the application of this

solution across Stanley Black & Decker's operations.

CETY’s Clean Cycle ORC will bring environmental

and sustainable benefits to Stanley Black & Decker’s facility.

This joint venture with RPG and Stanley Black & Decker will

significantly enhance the scalability of CETY’s heat recovery

solutions. Additionally, the investment tax credit also offers

customers increased incentive to implement waste heat generators

and other forms of energy recovery solutions. This is a great

opportunity to capitalize on, and the company is excited to see

future plants replicate this model.

About Clean Energy Technologies, Inc.

(CETY)

Headquartered in Costa Mesa, California,

Clean Energy Technologies (CETY) is a rising leader in the

zero-emission revolution by offering recyclable energy solutions,

clean energy fuels and alternative electric power for small and

mid-sized projects in North America, Europe, and Asia. We deliver

power from heat and biomass with zero emission and low cost. The

Company's principal products are Waste Heat Recovery Solutions

using our patented Clean CycleTM generator to create electricity.

Waste to Energy Solutions converting waste products created in

manufacturing, agriculture, wastewater treatment plants and other

industries to electricity and BioChar. Engineering, Consulting and

Project Management Solutions providing expertise and experience in

developing clean energy projects for municipal and industrial

customers and Engineering, Procurement and Construction (EPC)

companies. Our NG trading operations in China is to source and

supply Natural Gas to industries and municipalities located in

China.For more information, visit www.cetyinc.com .

Follow CETY on our social media channels:

Twitter | LinkedIn | Facebook

This summary should be read in conjunction with

the Company’s 10-Q for the fiscal quarter ended June 30, 2023 which

contains, among other matters, risk factors and financial footnotes

as well as a discussions of our business, operations and financial

matters located on the website of the Securities and Exchange

Commission at www.sec.gov.

Safe Harbor Statement

This news release may include forward-looking

statements within the meaning of section 27A of the United States

Securities Act of 1933, as amended, and Section 21E of the United

States Securities and Exchange Act of 1934, as amended, with

respect to achieving corporate objectives, developing additional

project interests, the Company's analysis of opportunities in the

acquisition and development of various project interests and

certain other matters. These statements are made under the "Safe

Harbor" provisions of the United States Private Securities

Litigation Reform Act of 1995 and involve risks and uncertainties

which could cause actual results to differ materially from those in

the forward-looking statements contained herein. Forward-looking

statements are neither historical facts nor assurances of future

performance. Instead, they are based only on the Company's current

beliefs, expectations and assumptions regarding the future of

CETY’s business, future plans and strategies, projections,

anticipated events and trends, the economy and other future

conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of the Company's control. Therefore, you should

not rely on any of these forward-looking statements.

Forward-looking statements can be identified by words such as:

"anticipate," "plan," "expect," "estimate," "strategy," "future,"

"likely," "may," "should," "will" and similar references to future

periods. Any forward-looking statement made by the Company in this

press release is based only on information currently available to

us and speaks only as of the date on which it is made. The Company

undertakes no obligation to publicly update any forward-looking

statement, whether written or oral, that may be made from time to

time, whether as a result of new information, future developments

or otherwise.

Clean Energy Technologies, Inc. Investor and Investment Media

inquiries:949-273-4990ir@cetyinc.com

Source: Clean Energy Technologies, Inc.

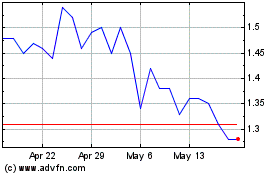

Clean Energy Technologies (NASDAQ:CETY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Clean Energy Technologies (NASDAQ:CETY)

Historical Stock Chart

From Apr 2023 to Apr 2024