0001213660

false

0001213660

2023-11-27

2023-11-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 27, 2023

| BIMI International Medical Inc. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-34890 |

|

02-0563302 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

725 5th Avenue, 15th Floor, 15-01

New York NY |

|

10022 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 212 542 0028

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, $0.001 par value |

|

BIMI |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On

November 27, 2023, BIMI International Medical Inc. (the “Company”) entered into warrant purchase agreements (the “Warrant

Purchase Agreements”) with certain of its warrant holders pursuant to which the Company agreed to buy back an aggregate of 7,066,913

warrants to purchase shares of common stock of the Company (the “Warrants”). The Warrants were issued on June 2, 2022, February

26, 2021 and November 22, 2021 in connection with prior financings.

Pursuant

to the Warrant Purchase Agreements, the Company agreed to pay $0.30 for each share of common stock underlying the Warrant, or an aggregate

purchase price of $2,120,073.80 to the Warrant holders within three (3) business days (for certain holders), or two (2) months (for certain

other holders), of the signing of the agreements. The Warrants will be deemed cancelled upon the receipt by the holders of the purchase

price.

The foregoing description

of the Warrant Purchase Agreements does not purport to be complete and is qualified in its entirety by reference to the Warrant Purchase

Agreements, the form of which is filed as Exhibit 4.1 hereto and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure set forth under Item 1.01 above

is incorporated herein by reference.

Item 8.01 Other Events

On November 28, 2023, the

Company issued a press release announcing the entry into the Warrant Purchase Agreements.

A

copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information under Items

1.01 and 8.01, including Exhibit 99.1, is deemed “furnished” and not “filed” under Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not

be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or

the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

The information in this Current

Report on Form 8-K, including Exhibit 99.1, may contain forward-looking statements based on management’s current expectations and

projections, which are intended to qualify for the safe harbor of Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended. The statements contained herein that are not historical facts are considered “forward-looking

statements.” Such forward-looking statements may be identified by, among other things, the use of forward-looking terminology such

as “believes,” “expects,” “may,” “will,” “should,” or “anticipates”

or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy that involve risks and uncertainties.

In particular, statements regarding the efficacy of investment in research and development are examples of such forward-looking statements.

The forward-looking statements include risks and uncertainties, including, but not limited to, the effect of political, economic, and

market conditions and geopolitical events; legislative and regulatory changes that affect our business; the availability of funds and

working capital; the actions and initiatives of current and potential competitors; investor sentiment; and our reputation. The Registrant

does not undertake any responsibility to publicly release any revisions to these forward-looking statements to take into account events

or circumstances that occur after the date of this report. The factors discussed herein are expressed from time to time in the Registrant’s

filings with the Securities and Exchange Commission available at http://www.sec.gov.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| Dated: November 28, 2023 |

BIMI International Medical Inc. |

| |

|

| |

By: |

/s/ Tiewei Song |

| |

Name: |

Tiewei Song |

| |

Title: |

Chief Executive Officer |

3

Exhibit 4.1

WARRANT

PURCHASE AGREEMENT

This Warrant Purchase Agreement

(the “Agreement”), dated as of November 24, 2023, is by and between BIMI International Medical Inc. (the “Buyer”

or the “Company”) and __________ (the “Seller” and together with the Buyer, each individually a

“Party” and collectively the “Parties”).

WITNESSETH:

WHEREAS, the Seller

owns certain warrants to purchase shares of common stock of the Company (the “Common Stock”), including ______ warrants

issued on February 26, 2021 (the “February Warrants”) and _________ warrants issued on November 22, 2021 (the “November

Warrants” and, together with the February Warrants, the “Warrants”). The February Warrants were issued in

connection with an amendment to certain warrants issued by the Buyer in May 2020 (the “February Transaction”) and

the November Warrants were issued by the Buyer in a private placement transaction in November 2021 (the “November Transaction,”

together with the February Transaction, the “BIMI Transactions”).

WHEREAS, the Seller

desires to sell, transfer, convey, assign and deliver to the Buyer, and the Buyer desires to purchase and acquire from the Seller all

the Warrants representing the right to purchase _______ shares of Common Stock.

Whereas,

the Seller owns ________ shares of Common Stock that are “restricted securities” as defined under the federal securities

laws (the “Restricted Shares”) and has agreed to sell the Restricted Shares to the Buyer’s largest shareholder

and Chairman of the Board in a separate private transaction expected to consummate simultaneously with the sale of the Warrants contemplated

hereunder.

NOW, THEREFORE, in consideration

of the premises and the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency

of which is hereby acknowledged, the Parties hereto hereby agree as follows:

SECTION 1. Sale and

Purchase of Warrants.

1.1 Sale of Warrants.

Subject to the terms and conditions of this Agreement, the Seller hereby agrees to sell and deliver to the Buyer, and the Buyer hereby

agrees to purchase the Warrants from the Seller.

1.2 Purchase Price.

In no event later than ________ following the date hereof, the Buyer shall pay to the Seller by wire transfer of immediately available

funds to an account or accounts designated by the Seller herein, an aggregate purchase price of $_________ (reflecting $0.30 for each

share underlying the Warrants) for the Warrants (the “Purchase Price”).

1.3 Delivery of Warrants

to Buyer. The Seller shall deliver the Warrants to the Buyer for cancellation as soon as practicable following the Closing Date, but

in no event later than five (5) business days following the Closing Date. Notwithstanding the foregoing, the Warrants shall be deemed

cancelled upon receipt by the Seller of the Purchaser Price.

1.4 Seller’s Waiver and Release. Except

with respect to any and all indemnification rights and obligations arising from or pursuant to the May 2020 SPA and the November 2021

SPA and the transactions contemplated thereby, which shall remain in full force and effect, upon receipt by the Seller of the Purchase

Price, the Seller shall (1) irrevocably waive and agree not to assert any and all claims for cash or otherwise that the Seller may now

have arising out of or relating to the Warrants or the BIMI Transactions and (2) on behalf of itself and all of its Related Parties, unconditionally

and irrevocably release and discharge the Buyer and all of its Related Parties from any and all claims, debts, obligations and liabilities,

whether known or unknown, contingent or non-contingent, at law or in equity, in each case now or hereafter arising from or in connection

with the Warrants or the BIMI Transactions. Upon receipt by the Seller of the Purchase Price, none of the Company and any of its Related

Parties will have any debt, obligation or liability to the Seller in connection with or resulting from the Warrants or the BIMI Transactions

other than indemnification obligations pursuant to the May 2020 SPA or the November 2021 SPA which shall survive the Closing Date. Upon

the Closing Date, the Buyer shall (1) irrevocably waive and agree not to assert any and all claims for cash or otherwise that the Buyer

may now have arising out of or relating to the Warrants or the BIMI Transactions and (2) on behalf of itself and all of its Related Parties,

unconditionally and irrevocably release and discharge the Seller and all of its Related Parties from any and all claims, debts, obligations

and liabilities, whether known or unknown, contingent or non-contingent, at law or in equity, in each case now or hereafter arising from

or in connection with the Warrants or the BIMI Transactions. Upon the Closing Date, none of the Company and any of its Related Parties

will have any debt, obligation or liability to the Seller in connection with or resulting from the Warrants or the BIMI Transactions other

than indemnification obligations pursuant to the May 2020 SPA or the November 2021 SPA which shall survive the Closing Date. “Related

Party” means with respect to a person, any or its affiliates, or any of its or its affiliate’s shareholders, directors,

officers, managers, members, partners, trustees, employees, attorneys, brokers or other agents, or representatives or any heir, personal

representative, successor, or assign of any of the foregoing.

SECTION

2. Representations and Warranties of the Seller. The Seller represents and warrant to the Buyer, as of the

date hereof and as of the Closing, as follows:

2.1 Organization and

Power. The Seller is duly organized, validly existing and in good standing under the laws of its jurisdiction of organization and

has the full right, power and authority to enter into this Agreement and to sell, transfer, convey, assign and deliver the Warrants to

the Buyer.

2.2 Authorization and

Enforceability. This Agreement has been duly authorized, executed and delivered by the Seller and constitutes the valid and binding

obligation of the Seller, enforceable in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency,

fraudulent transfer, moratorium or other similar laws relating to or affecting the rights of creditors generally and by equitable principles.

2.3 No Conflicts.

The execution, delivery and performance of this Agreement, the sale and delivery of the Warrants, and compliance with the provisions hereof

by the Seller, do not and will not, with or without the passage of time or the giving of notice or both, (a) violate any provision of

law, statute, ordinance, rule or regulation or any ruling, writ, injunction, order, judgment or decree of any court, administrative agency

or other governmental body, or (b) result in any breach of any of the terms, conditions or provisions of, or constitute a default (or

give rise to any right of termination, cancellation or acceleration) under, or result in the creation of any lien, security interest,

charge or encumbrance upon any of the properties or assets of the Seller, under the organizational documents of the Seller, or any note,

indenture, mortgage or lease, or any other material contract or other instrument, document or agreement, to which the Seller is a party

or by which it or any of its property is bound or affected.

2.4 No Prohibitions.

The Seller is not a party to, subject to or bound by any agreement or any judgment, order, writ, prohibition, injunction or decree of

any court or other governmental body which would prevent the execution or delivery of this Agreement by the Seller or the sale, transfer,

conveyance, assignment and delivery of the Warrants to the Buyer pursuant to the terms hereof.

2.5 Consents. All

consents, approvals or authorizations of, or registrations, filings or declarations with, any governmental authority, or any other person

required in connection with the execution, delivery and performance by the Seller of this Agreement or the transactions contemplated hereby

have been or will be obtained by the Seller and will be in full force and effect.

2.6 Good Title; No Liens.

The Seller is the sole owner of, and has good, valid and marketable title to, the Warrants, free and clear of any and all covenants, conditions,

restrictions, voting trust arrangements, shareholder agreements, liens, pledges, charges, security interests, encumbrances, options and

adverse claims or rights whatsoever (collectively, “Liens”). Upon consummation of the purchase contemplated hereby,

the Buyer will acquire from the Seller good, valid and marketable title to the Warrants, free and clear of all Liens.

2.7 Non-Affiliate.

The Seller does not, either alone or in association with others, directly or indirectly through one or more intermediaries, control the

Buyer, nor is the Seller, directly or indirectly through one or more intermediaries, controlled by or under common control with the Buyer

such that the Seller would be an “affiliate” of the Buyer within the meaning of the Securities Act or Rule 144 thereunder.

At no time on or after its acquisition of the Warrants has the Seller been an “affiliate” of the Buyer.

2.8 Bankruptcy.

The Seller is not under the jurisdiction of a court in a Title 11 or similar case (within the meaning of Bankruptcy Code Section 368(a)(3)(A)

(or related provisions)) or involved in any insolvency proceeding or reorganization.

SECTION

3. Representations and Warranties of the Buyer. The Buyer represents and warrants to the Seller, as of the

date hereof and as of the Closing, as follows:

3.1 Organization and

Power. The Buyer is duly organized, validly existing and in good standing under the laws of its jurisdiction of organization and has

the full right, power and authority to enter into this Agreement and to consummate the transactions contemplated hereunder.

3.2 Authorization and

Enforceability. This Agreement has been duly authorized, executed and delivered by the Buyer and constitutes the valid and binding

obligation of the Buyer, enforceable in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency,

fraudulent transfer, moratorium or other similar laws relating to or affecting the rights of creditors generally and by equitable principles.

3.3 No Conflicts.

The execution, delivery and performance of this Agreement, the purchase of the Warrant, and compliance with the provisions hereof by the

Buyer, do not and will not, with or without the passage of time or the giving of notice or both, (a) violate any provision of law, statute,

ordinance, rule or regulation or any ruling, writ, injunction, order, judgment or decree of any court, administrative agency or other

governmental body, or (b) result in any breach of any of the terms, conditions or provisions of, or constitute a default (or give rise

to any right of termination, cancellation or acceleration) under, or result in the creation of any lien, security interest, charge or

encumbrance upon any of the properties or assets of the Buyer, under the organizational documents of the Buyer, or any note, indenture,

mortgage or lease, or any other material contract or other instrument, document or agreement, to which the Buyer is a party or by which

it or any of its property is bound or affected.

3.4 No Prohibitions.

The Buyer is not a party to, subject to or bound by any agreement or any judgment, order, writ, prohibition, injunction or decree of any

court or other governmental body which would prevent the execution or delivery of this Agreement by the Buyer or the purchase of the Warrant

by the Buyer pursuant to the terms hereof.

3.5 Consents. All

consents, approvals or authorizations of, or registrations, filings or declarations with, any governmental authority, the Issuer or any

other person required in connection with the execution, delivery and performance by the Buyer of this Agreement or the transactions contemplated

hereby have been or will be obtained by the Buyer and will be in full force and effect.

3.6 Bankruptcy.

The Buyer is not under the jurisdiction of a court in a Title 11 or similar case (within the meaning of Bankruptcy Code Section 368(a)(3)(A)

(or related provisions)) or involved in any insolvency proceeding or reorganization.

Section

4. Certain Covenants

4.1

Disclosure of Transaction. The Buyer shall, on or before 9:30am New York time, on the first (1st) business day

after the date of this Agreement (or on the date of this Agreement, if such Agreement is signed prior to 9:30am New York time), issue

a press release reasonably acceptable to the Seller disclosing all the material terms of the transactions contemplated hereby. On or before

9:30 a.m., New York time, on the first (1st) business day after the date of this Agreement, the Company shall file a Current

Report on Form 8-K describing all the material terms of the transactions contemplated hereby in the form required by the U.S. Securities

Exchange Act of 1934, as amended and attaching this Agreement (the “8-K Filing”). From and after the 8-K Filing, the

Buyer shall have disclosed all material, non-public information (if any) provided to the Seller by the Buyer or any of its subsidiaries

or any of their respective officers, directors, employees or agents in connection with the transactions contemplated hereby. In addition,

effective upon the 8-K Filing, the Buyer acknowledges and agrees that any and all confidentiality or similar obligations under any agreement,

whether written or oral, between itself, any of its subsidiaries or any of their respective officers, directors, affiliates, employees

or agents, on the one hand, and any of the Seller or any of its affiliates, on the other hand, shall terminate. The Buyer shall not, and

the Buyer shall cause each of its subsidiaries and each of its and their respective officers, directors, employees and agents not to,

provide the Seller with any material, non-public information regarding the Buyer or any of its subsidiaries from and after the date hereof

without the express prior written consent of such Seller (which may be granted or withheld in such Seller’s sole discretion). In

the event of a breach of any of the foregoing or any other covenant or agreement contained in the transaction documents by the Buyer,

any of its subsidiaries, or any of its or their respective officers, directors, employees and agents (as determined in the reasonable

good faith judgment of the Seller), in addition to any other remedy provided in the transaction documents, such Seller shall have the

right to make a public disclosure, in the form of a press release, public advertisement or otherwise, of such breach or such material,

non-public information, as applicable, without the prior approval by the Buyer, any of its subsidiaries, or any of its or their respective

officers, directors, employees or agents. The Seller shall have no liability to the Buyer, any of its subsidiaries, or any of its or their

respective officers, directors, employees, affiliates, stockholders or agents, for any such disclosure. To the extent that the Buyer delivers

any material, non-public information to the Seller without the Seller’s consent, the Buyer hereby covenants and agrees that such

Seller shall not have any duty of confidentiality with respect to, or a duty not to trade on the basis of, such material, nonpublic information.

Without the prior written consent of the Seller (which may be granted or withheld in such Seller’s sole discretion), the Buyer shall

not (and shall cause each of its subsidiaries and affiliates to not) disclose the name of such Seller in any filing, announcement, release

or otherwise. Notwithstanding anything contained in this Agreement to the contrary and without implication that the contrary would otherwise

be true, the Buyer expressly acknowledges and agrees that the Seller shall not have (unless expressly agreed to after the date hereof

in a written definitive and binding agreement executed by the Buyer and the Seller, any duty of confidentiality with respect to, or a

duty not to trade on the basis of, any material, non-public information regarding the Buyer or any of its subsidiaries.

4.2. MFN. The Buyer hereby

represents and warrants as of the date hereof and covenants and agrees from and after the date hereof until one (1) year after the date

hereof (such period, the “MFN Period”), that none of the terms offered to any other holder of Warrants or any other

warrants to purchase shares of Common Stock issued in connection with the BIMI Transactions (each such holder, if any, an “Other

Holder”) (or any amendment, modification or waiver thereof), is or will be more favorable to such Other Holder than to the Seller

under this Agreement. If, and whenever during the MFN Period, the Buyer enters into any agreement with any Other Holder with terms that

are more favorable to such Other Holder than to the Seller under this Agreement, then (i) the Buyer shall provide notice thereof (the

“MFN Notice”) to the Seller promptly following the occurrence thereof and (ii) the terms and conditions of this Agreement

shall be, without any further action by the Seller or the Buyer, automatically amended and modified in an economically and legally equivalent

manner such that the Seller shall receive the benefit of the more favorable terms and/or conditions (as the case may be) set forth in

such other agreement (including, but not limited to, a greater purchase price, if applicable), provided that upon written notice to the

Buyer within seven (7) days after issuance to the Seller of the MFN Notice, the Seller may elect not to accept the benefit of any such

amended or modified term or condition, in which event the term or condition contained in this Agreement shall apply to the Seller as it

was in effect immediately prior to such amendment or modification as if such amendment or modification never occurred with respect to

the Seller. The provisions of this paragraph shall apply similarly and equally to any agreements with Other Holders during the MFN Period.

SECTION

5. Miscellaneous.

5.1 Survival of Representations,

Warranties and Covenants. The representations, warranties and covenants of each Party contained herein shall survive the Closing.

Each Party may rely on such representations, warranties and covenants irrespective of any investigation made, or notice or knowledge held

by, it or any other person.

5.2 Indemnification.

Each Party shall indemnify, defend and hold harmless the other Party, its members, partners, managers, directors, officers, employees,

attorneys, accountants, agents, successors and assigns from and against all liabilities, losses, and damages, together with all reasonable

costs and expenses related thereto (including, without limitation, legal fees and expenses) based upon or arising out of (a) any inaccuracy

or breach of any representation and warranty of such Party herein, and (b) any breach of any covenant and agreement of such Party herein.

5.3 Notices. All

notices and other communications by the Buyer or the Seller hereunder shall be in writing to the other Party and shall be deemed to have

been duly given when delivered in person or by an overnight courier service, or sent via facsimile or electronic transmission and verification

received, or when posted by the United States postal service, registered or certified mail, return receipt requested with postage prepaid,

at the address set forth on the signature page hereto or to such other addresses as a Party may from time to time designate to the other

Party by written notice thereof, effective only upon actual receipt.

5.4 Assignment.

This Agreement shall be binding on and inure to the benefit of the Parties hereto and their respective successors and assigns.

5.5 Entire Agreement.

This Agreement constitutes the entire agreement by the Parties hereto and supersedes any other agreement, whether written or oral, that

may have been made or entered into between them relating to the matters contemplated hereby.

5.6 Severability.

If any term of this Agreement shall be held to be illegal, invalid or unenforceable by a court of competent jurisdiction, it is the intention

of the Parties that the remaining terms hereof shall constitute their agreement with respect to the subject matter hereof and all such

remaining terms shall remain in full force and effect. To the extent legally permissible, any illegal, invalid or unenforceable provision

of this Agreement shall be replaced by a valid provision which will implement the commercial purpose of the illegal, invalid or unenforceable

provision of this Agreement.

5.7 Amendments and Waivers.

This Agreement may be amended, modified, superseded, or canceled, and any of the terms, representations, warranties or covenants hereof

may be waived, only by written instrument executed by both of the Parties hereto or, in the case of a waiver, by the Party waiving compliance.

5.8 Headings. The

headings of particular sections are inserted only for convenience and shall not be construed as a part of this Agreement or a limitation

on the scope of any of the terms or provisions of this Agreement.

5.9 Governing Law.

This Agreement shall be governed by and construed in accordance with the laws of the State of New York without regard to conflicts of

laws principles.

5.10 Submission to Jurisdiction.

Any judicial proceeding brought with respect to this Agreement must be brought in any court of competent jurisdiction in the State of

New York, the City of New York, Borough of Manhattan, and each Party: (i) accepts unconditionally, the exclusive jurisdiction of such

courts and any related appellate court, and agrees to be bound by any final, non-appealable judgment rendered thereby in connection with

this Agreement; (ii) irrevocably waives any objection it may now or hereafter have as to the venue of any such suit, action or proceeding

brought in such a court or that such court is an inconvenient forum provided, however, that such consent to jurisdiction

is solely for the purpose referred to in this Section and shall not be deemed to be a general submission to the jurisdiction of said courts

or the State of New York other than for such purpose; and (iii) agrees that process in any such action, in addition to any other method

permitted by law, may be served upon it by registered or certified mail, return receipt requested, addressed to such Party at the address

designated by such Party on the signature page hereof, and such service shall be deemed effective as if personal service had been made

upon it within the State of New York.

5.11 Waiver of Jury

Trial. The Parties hereby waive trial by jury in any judicial proceeding to which they are parties involving, directly or indirectly,

any matter arising out of, related to or in connection with this Agreement.

5.12 Counterparts.

This Agreement may be executed in one or more counterparts, each of which shall be an original, but all of which together shall constitute

one and the same instrument.

5.13 Independent Nature

of Seller’s Obligations and Rights. The Buyer acknowledges and agrees that the obligations of the Seller under this Agreement

are several and not joint with the obligations of any Other Holder (if any) under any other agreement related to the Buyer’s existing

warrants to purchase shares of Common Stock (such agreements, if any, the “Other Warrant Agreements”), and the Seller

shall not be responsible in any way for the performance of the obligations of any Other Holder under any such Other Warrant Agreement.

Nothing contained in this Agreement, and no action taken by the Seller pursuant hereto, shall be deemed to constitute the Seller and any

Other Holders as a partnership, an association, a joint venture or any other kind of entity, or create a presumption that the Seller and

any Other Holders are in any way acting in concert or as a group with respect to such obligations or the transactions contemplated by

this Agreement or any Other Warrant Agreements, if any, and the Buyer acknowledges that the Seller and the Other Holders are not acting

in concert or as a group with respect to such obligations or the transactions contemplated by this Agreement or any Other Warrant Agreement.

The Buyer and the Seller confirm that the Seller has independently participated in the negotiation of the transactions contemplated hereby

with the advice of its own counsel and advisors. The Seller shall be entitled to independently protect and enforce its rights, including,

without limitation, the rights arising out of this Agreement, and it shall not be necessary for any Other Holder to be joined as an additional

party in any proceeding for such purpose. Further, the each of the Buyer and the Seller acknowledge and agree that this Agreement is intended

for the benefit of the parties hereto and their respective permitted successors and assigns, and is not for the benefit of, nor may any

provision hereof be enforced by, any other person.

[signature page follows]

IN WITNESS WHEREOF, the

Parties hereto have duly executed this Agreement as of the date first above-written.

| Seller |

|

| |

|

|

| [ ] |

|

|

| |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

| Address: |

|

|

| Buyer |

|

| |

|

|

| BIMI International Medical Inc. |

|

| |

|

|

| By: |

|

|

| Name: |

Tiewei Song |

|

| Title: |

Chief Executive Officer |

|

Exhibit 99.1

BIMI Announces Buyback of Warrants

NEW YORK, NY, Nov. 28, 2023 (GLOBE NEWSWIRE) -- BIMI International Medical

Inc. (NASDAQ: BIMI, “BIMI”), a healthcare products and services provider, today announced its entry into material definitive

agreements with certain of its warrant holders, pursuant to which BIMI agreed to buy back an aggregate of 7,066,913 warrants to purchase

shares of common stock of the Company from these warrant holders. BIMI agreed to pay $0.30 for each share of common stock underlying the

warrant, or an aggregate purchase price of $2,120,073.80 to the warrant holders within three (3) business days (for certain sellers),

or two (2) months (for certain other sellers), of the signing of the agreements. The warrants will be deemed cancelled upon the receipt

by the sellers of the purchase price.

About BIMI International Medical Inc.

BIMI International Medical Inc. is a healthcare products and services

provider, offering a broad range of healthcare products and related services in the U.S. and Asia. For more information, please visit

www.usbimi.com.

Safe Harbor Statement

Certain matters discussed

in this news release are forward-looking statements that involve a number of risks and uncertainties including, but not limited to, the

Company’s ability to achieve profitable operations, its ability to continue to operate as a going concern, its ability to continue

to meet NASDAQ continued listing requirements, the effects of the spread of COVID-19, the demand for the Company’s products and

services in the People’s Republic of China, the continued positive results of the recently acquired Phenix Bio subsidiary, general

economic conditions and other risk factors detailed in the Company’s annual report and other filings with the United States Securities

and Exchange Commission.

IR Contact:

Investor Relations Department of BIMI International Medical Inc.

Tel: +1(949)-981-6274

Email: vinson@usbimi.com

v3.23.3

Cover

|

Nov. 27, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 27, 2023

|

| Entity File Number |

001-34890

|

| Entity Registrant Name |

BIMI International Medical Inc.

|

| Entity Central Index Key |

0001213660

|

| Entity Tax Identification Number |

02-0563302

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

725 5th Avenue

|

| Entity Address, Address Line Two |

15th Floor

|

| Entity Address, Address Line Three |

15-01

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10022

|

| City Area Code |

212

|

| Local Phone Number |

542 0028

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001 par value

|

| Trading Symbol |

BIMI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

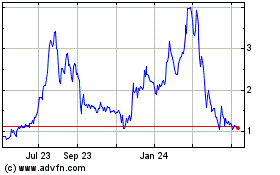

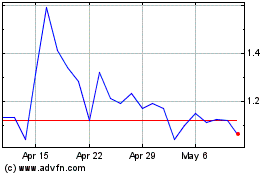

BIMI International Medical (NASDAQ:BIMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

BIMI International Medical (NASDAQ:BIMI)

Historical Stock Chart

From Apr 2023 to Apr 2024