false

0001347858

0001347858

2023-11-20

2023-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 20, 2023

22nd Century Group, Inc.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

001-36338 |

98-0468420 |

(State or Other Jurisdiction of

Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

|

500 Seneca Street, Suite 508, Buffalo, New York

(Address of Principal Executive Office) |

14204

(Zip Code) |

Registrant’s

telephone number, including area code: (716) 270-1523

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

Registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading

Symbol |

Name

of Exchange on Which Registered |

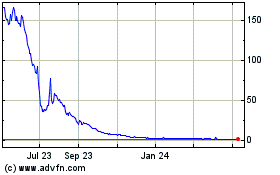

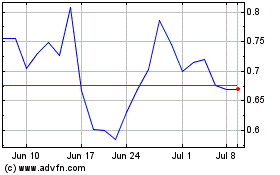

| Common

Stock, $0.00001 par value per share |

XXII |

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On November 20, 2023, 22nd Century Group, Inc.

(the “Company”) entered into an Equity Purchase Agreement (the “Purchase Agreement”) with Specialty

Acquisition Corporation, a Nevada corporation (the “Buyer”) pursuant to which the Company agreed to sell substantially

all of its GVB hemp/cannabis business (the “Purchased Interests”) for a purchase price of $2,250,000 (the “Purchase

Price”). There exists a material relationship between the Company and Buyer in that three of the Company’s employees will

be investors in, and be executive officers of, Buyer. As a result of this relationship, the Purchase Agreement is conditioned upon the

receipt of a fairness opinion to the effect that, the Purchase Price and other consideration is fair, from a financial point of view,

to the Company and its shareholders.

The Purchase Price consists of (i) a cash payment

of $1,000,000 to the Company at closing and (ii) a 12% secured promissory note issued by Buyer in an aggregate principal amount of $1,250,000,

subject to increase based on the amount of certain liabilities related to the GVB business (the “Closing Note”). The

Closing Note is payable in six equal monthly installments commencing on the fourth calendar month following the closing.

Pursuant to the terms of the Purchase Agreement,

the Company and Buyer will equally share in the liabilities related to the GVB assets that are not purchased, subject to certain conditions.

The Company is entitled to retain any insurance proceeds received in connection with the fire at the Grass Valley manufacturing facility,

up to $2,000,000 of which will be used to offset Buyer’s portion of such shared liabilities.

Additionally, the Company will fund the expenses

of the Purchased Interests up to $1,250,000 (the “Expense Cap”) from now through closing. If the Company and Buyer

agree to exceed the Expense Cap, Buyer will reimburse the Company for such excess expenses.

The Company expects to close the transaction in

early December 2023, subject to customary closing conditions including, approval by the Company’s Board of Directors, receipt of

a fairness opinion, Buyer obtaining $3 million of financing and receipt of third-party consents, including the consent of our senior lender.

The Company is currently in discussions with the senior lender to obtain such consent. No assurances can be given that the Buyer will

obtain the required financing or that the Company’s senior lender will consent to the transaction. Pursuant to the terms of the

Purchase Agreement, all of the Purchased Interests are expected to be transferred to the Buyer at closing on an “as is where is”

basis and both parties agreed to a general release of all claims either party may have except with respect to the Purchase Agreement or

the Closing Note.

The Purchase Agreement may be terminated at any

time prior to closing by (i) the mutual written consent of the Company and Buyer, (ii) the Company or Buyer if there has been a breach,

inaccuracy in or failure to perform any representation, warranty covenant or agreement made by the other party, (iii) the Company or Buyer

if certain conditions (other than financing) are not satisfied by December 7, 2023, (iv) the Company if Buyer fails to, or it becomes

apparent that it will not, obtain financing by December 7, 2023, and (v) Buyer if Buyer fails to, or it becomes apparent that it will

not, obtain financing by December 30, 2023.

The foregoing description of the Purchase Agreement

is qualified in its entirety by reference to the full text of the Purchase Agreement, which is filed as Exhibit 10.1 hereto.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, all of the

statements, expectations, and assumptions contained in this Form 8-K are forward-looking statements. Forward-looking statements typically

contain terms such as “anticipate,” “believe,” “consider,” “continue,” “could,”

“estimate,” “expect,” “explore,” “foresee,” “goal,” “guidance,”

“intend,” “likely,” “may,” “plan,” “potential,” “predict,” “preliminary,”

“probable,” “project,” “promising,” “seek,” “should,” “will,”

“would,” and similar expressions. Forward-looking statements include, but are not limited to, statements regarding (i) our

expectations regarding the conditions of the Purchase Agreement, (ii) our expectations on the timing and completion of the sale of our

hemp/cannabis business, including the GVB assets, and (iii) our expectations regarding our business interruption insurance claim. Actual

results might differ materially from those explicit or implicit in forward-looking statements. These forward-looking statements reflect

our current views about future events and involve assumptions which may be affected by risks and uncertainties in our business, as well

as other external factors, which could cause future results to materially differ from those expressed or implied in any forward-looking

statement. These risks include, but are not limited to: (1) the risk that the conditions of the Purchase Agreement are not met, (2) the

risk that the Purchase Agreement is terminated and (3) the other risks and uncertainties applicable to the Company and included in the

Company’s Annual Report on Form 10-K filed on March 9, 2023 and Quarterly Report on Form 10-Q filed May 9, 2023, August 14, 2023

and November 6, 2023. All information provided in this Form 8-K is as of the date hereof, and the Company assumes no obligation to and

does not intend to update these forward-looking statements, except as required by law.

| Item 7.01. |

Regulation FD Disclosure. |

On November 27, 2023, the Company issued a press release regarding

the Purchase Agreement, a copy of which is attached hereto as Exhibit 99.1.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| 22ND CENTURY GROUP, INC. |

| | |

| Date: November 27, 2023 | /s/ Peter Ferola |

| | Peter Ferola |

| | Chief Legal Officer |

Exhibit 10.1

[Execution Version]

Equity Purchase Agreement

by and among

22nd Century Group, Inc.,

ESI Holdings, LLC

and

Specialty Acquisition Corporation

dated as of

November 20, 2023

Equity

Purchase Agreement

This Equity Purchase Agreement

(this “Agreement”), dated as of November 20, 2023, is entered into by and between 22nd Century Group, Inc.,

a Nevada corporation (“22nd Century”), ESI Holdings, LLC, a Nevada limited liability company (“ESI,”

and together with 22nd Century, the “Seller”), and Specialty Acquisition Corporation, a Nevada corporation (the “Buyer”).

WHEREAS, Seller wishes to

sell to Buyer, and Buyer wishes to purchase from Seller, 100% of the issued and outstanding equity interests of (i) 22nd Century

Group Europe B.V., an Amsterdam private limited liability company (“Group Europe”) (ii) GV Farm Services, LLC,

an Oregon limited liability company (“Farm Services”), (iii) Evergreen State Holdings, LLC, an Oregon limited

liability company (“Evergreen”), (iv) Oregon Custom Supply, LLC, an Oregon limited liability company (“Custom

Supply”), (v) Central Oregon Processing, LLC, an Oregon limited liability company (“Central Processing”),

(vi) GVBiopharma UK Ltd., an England and Wales private limited company (“GVBiopharma”), (vii) RX Pharmatech

Ltd., an England and Wales private limited company (“Pharmatech”), and (viii) Prineville Solutions, LLC, an Oregon

limited liability company d/b/a “Prineville Refrigeration,” (“Prineville” and together with, Group Europe,

Farm Services, Evergreen, Custom Supply, Central Processing, GVBiopharma and Pharmatech, the “GVB Companies”), (the

“Purchased Interests”), subject to the terms and conditions set forth herein (the “Transaction”);

and

WHEREAS, Buyer previously

deposited Five Hundred Thousand Dollars ($500,000) in escrow (the “Deposit”) with Citibank, N.A. (the “Escrow

Agent”) to be held pursuant to the terms of that certain Escrow Agreement dated as of November 15, 2023 by and between

Buyer, Seller, and the Escrow Agent (the “Escrow Agreement”).

NOW, THEREFORE, in consideration

of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

Purchase and Sale

Section 1.01

Purchase and Sale. On the terms and subject to the conditions set forth herein, at the Closing (as defined herein), Seller shall

sell to Buyer, and Buyer shall purchase from Seller, all of Seller’s right, title, and interest in and to the Purchased Interests,

free and clear of any mortgage, pledge, lien, charge, security interest, claim or other encumbrance (“Encumbrance”).

Section 1.02

Purchase Price. The aggregate purchase price for

the Purchased Interests shall be Two Million Two Hundred Fifty Thousand Dollars ($2,250,000), plus the amounts of certain accounts payable

and pre-closing expenses, as contemplated in this Agreement, as may be adjusted by Section 1.03 (the “Purchase Price”).

The Purchase Price shall be paid by Buyer to Seller as follows:

(a)

Buyer shall cause the Escrow Agent to release the Deposit to Seller at Closing by wire transfer of immediately available funds

in accordance with the wire transfer instructions delivered by Seller to Buyer prior to the Closing.

(b)

Buyer shall deliver to Seller Five Hundred Thousand Dollars ($500,000) in cash (the “Closing Date Cash Payment”)

at Closing by wire transfer of immediately available funds in accordance with the wire transfer instructions delivered by Seller to Buyer

prior to the Closing.

(c)

Buyer shall deliver to Seller a secured promissory note, substantially in the form attached hereto as Exhibit A, in

the aggregate principal amount of (i) One Million Two Hundred Fifty Thousand Dollars ($1,250,000), plus (ii) 50%

of the accounts payable of ESI, PTB Investment Holdings, LLC and Bridgeway Distribution, LLC existing at Closing, if any (the “Closing

AP Liabilities”) (together, the “Closing Note”), the payment of which will be guaranteed by the GVB Companies

and secured by the Purchased Interests as set forth in the Closing Note. For the avoidance of doubt, the term “Closing AP Liabilities”

shall include any liabilities that existed at Closing but the amount of which was not fully known by the Company at Closing, provided,

that the amounts become known by the Company no later than thirty (30) days following Closing.

Section 1.03

Post-Closing Adjustment.

(a)

[**]

(b)

[**]

(c)

“Buyer’s Settlement Share” [**].

(d)

Upon the later of (i) [**],

and (ii) Seller’s receipt of the Insurance Proceeds, the parties shall determine the “Post-Closing Adjustment”,

which shall be an amount equal to (i) Buyer’s Settlement Share, less, (ii) the lesser of (x) the Insurance

Proceeds received

by Seller, and (y) Two Million Dollars ($2,000,000).

(e)

If the Post-Closing Adjustment is a negative number, Seller shall pay to Buyer an amount equal to the absolute value of the Post-Closing

Adjustment, up to a maximum amount equal to the Closing

AP Liabilities (the “Post-Closing Adjustment Offset”); provided, that Seller and Buyer agree that any amount owing by Seller

to Buyer pursuant to the foregoing provision shall first be set-off against and otherwise reduce the amounts owing by Buyer to Seller

under the Closing Note; provided, further, that if the amount of the Post-Closing Adjustment Offset is greater than the outstanding amount

of the Closing Note at the time such Post-Closing Adjustment is calculated, then Seller shall pay to Buyer the amount by which the Post-Closing

Adjustment Offset exceeds the outstanding amount of the Closing Note. If the Post-Closing Adjustment is a positive number, Buyer

shall pay to Seller an amount equal to the Post-Closing Adjustment. Any payments of the Post-Closing Adjustment shall be made in three

equal monthly installments commencing on the first business day of the month following the month in which the Post-Closing Adjustment

is finally determined.

(f)

Any payments made pursuant to this Section 1.03 shall be treated as an adjustment to the Purchase Price by the parties for

tax purposes to the maximum extent permitted by applicable law.

Section 1.04

Pre-Closing Expenses. Seller shall fund the costs and expenses of the GVB Companies incurred from November 7, 2023 through the

Closing (which, together with the expenses of ESI, PTB Investment Holdings, LLC and Bridgeway Distribution, LLC during such period (the

“Expense Period”), the “Pre-Closing Expenses”) up to One Million Two Hundred Fifty Thousand Dollars ($1,250,000)

(the “Expense Cap”). Seller shall have no obligation to fund any Pre-Closing Expenses above the Expense Cap. If the parties

agree, in writing, to exceed the Expense Cap during the Expense Period, Buyer shall pay to Seller the amount by which the Pre-Closing

Expenses exceed the Expense Cap within five (5) business days following Closing. Any payments made pursuant to this Section 1.04

shall be treated as an adjustment to the Purchase Price by the parties for tax purposes to the maximum extent permitted by applicable

law.

Section 1.05

Closing. The closing of the transactions contemplated

by this Agreement (the “Closing”) shall take place remotely (through the electronic exchange of documents and consideration

required to be delivered at the Closing), on a date to be specified by the parties hereto, which shall be no later than the second business

day after satisfaction (or waiver) of the conditions set forth in Article IV (not including conditions which are to be satisfied by actions

taken at the Closing, but subject to the satisfaction of such conditions), unless another time, date or place is agreed to in writing

by Buyer and Seller. The date on which the Closing actually occurs is referred to as the “Closing Date.” Notwithstanding

the foregoing, the parties hereto intend that the Closing shall be deemed to be effective, and the transactions contemplated by this Agreement

shall be deemed to occur simultaneously, at 12:01 a.m. (Eastern Time), on the Closing Date.

Section 1.06

Closing Deliverables.

(a)

Seller’s Deliveries. At the Closing, Seller

shall deliver or cause to be delivered to Buyer the following:

(i)

A properly completed and executed IRS Form W-9 from each Seller; and

(ii)

Such other documents, instruments or certificates as shall be reasonably requested by Buyer and its counsel.

(b)

Buyer's Deliveries. At the Closing, Buyer shall

deliver or cause to be delivered to Seller the following:

(i)

The Deposit, by wire transfer of immediately available funds to such bank account or other accounts as have been designated in

writing by Seller;

(ii)

The Closing Date Cash Payment by wire transfer of immediately available funds to such bank account or other accounts as have been

designated in writing by Seller;

(iii)

The Closing Note duly executed by Buyer, together with any security documents required thereunder; and

(iv)

Such other documents, instruments or certificates as shall be reasonably requested by Seller and its counsel.

Section 1.07

Withholding Tax. Notwithstanding anything herein to the contrary, Buyer and its agents and affiliates shall be entitled

to deduct and withhold from the Purchase Price and any other payments otherwise payable pursuant to this Agreement all amounts that Buyer

or such agent or affiliate is required to deduct and withhold under any provision of tax law; provided that Buyer shall use commercially

reasonable efforts to give Seller at least two (2) business days advance written notice prior to withholding any such amounts together

with an explanation of the legal basis for such withholding and shall reasonably cooperate with Seller to eliminate or minimize the amount

of any such withholding to the extent permitted under applicable law. All such withheld amounts shall be treated as delivered to Seller

hereunder to the extent properly remitted to the appropriate taxing authority.

Section 1.08

Allocation of Purchase Price. The Purchase Price and any and all other payments hereunder shall be allocated among the equity

of each of Group Europe, GVBiopharma and Pharmatech and the assets of each of the other GVB Companies for all purposes (including tax

and financial accounting) as shown on the allocation schedule to be agreed in good faith between the parties following the date hereof

(the “Allocation Schedule”); provided, that in the event Buyer makes a 338(g) election as contemplated under

Section 6.08 hereunder, the Purchase Price and any and all other payments hereunder shall be allocated amongst the assets of Group

Europe, GVBiopharma and Pharmatech and each of the other GVB Companies for all purposes (including tax and financial accounting) as shown

on the Allocation Schedule. The Allocation Schedule has been prepared in accordance with Section 1060 of the Internal Revenue Code of

1986, as amended (the “Code”). Buyer and the Sellers shall file all Tax Returns including, without limitation, Internal

Revenue Service Form 8594 (including any amendments thereto and any claims for refund in respect thereof) in a manner consistent with

the Allocation Schedule. Neither Buyer nor the Sellers shall take any position (whether in audits, returns or otherwise) that is inconsistent

with such allocation unless required to do pursuant to a “determination” within the meaning of Section 1313(a) of the

Code.

ARTICLE II

REPRESENTATIONS AND WARRANTIES OF SELLER

Seller represents and warrants

to Buyer that the statements contained in this Article II are true and correct as of the date hereof. For purposes of this Article II,

“Seller’s knowledge,” “knowledge of Seller,” and any similar phrases shall mean the actual knowledge of

any officer of Seller.

Section 2.01

Organization and Authority of Seller; Enforceability. 22nd Century is a corporation duly organized, validly existing, and in good

standing under the laws of the state of Nevada. ESI is a limited liability company duly organized, validly existing, and in good standing

under the laws of the state of Nevada. Each of 22nd Century and ESI has full corporate and company power and authority to enter into this

Agreement and the documents to be delivered hereunder, to carry out its respective obligations hereunder, and to consummate the transactions

contemplated hereby. The execution, delivery, and performance by each of 22nd Century and ESI of this Agreement and the documents to be

delivered hereunder and the consummation of the transactions contemplated hereby have been duly authorized by all requisite corporate

action on the part of such party. This Agreement and the documents to be delivered hereunder have been duly executed and delivered by

each of 22nd Century and ESI, and (assuming due authorization, execution, and delivery by Buyer) this Agreement and the documents to be

delivered hereunder constitute legal, valid, and binding obligations of each of 22nd Century and ESI, enforceable against 22nd Century

and ESI in accordance with their respective terms, except as may be limited by any bankruptcy, insolvency, reorganization, moratorium,

fraudulent conveyance, or other similar laws affecting the enforcement of creditors’ rights generally or by general principles of

equity.

Section 2.02

Good Standing. The GVB Companies are in good standing under the laws of their respective state of incorporation.

Section 2.03

No Conflicts; Consents. The execution, delivery and performance by each of 22nd Century and ESI of this Agreement and the documents

to be delivered hereunder, and the consummation of the transactions contemplated hereby, do not and will not: (a) violate or conflict

with any judgment, order, decree, statute, law, ordinance, rule or regulation applicable to 22nd Century or ESI; (b) conflict with,

or result in (with or without notice or lapse of time or both) any violation of, or default under, or give rise to a right of termination,

acceleration or modification of any obligation or loss of any benefit under, any contract or other instrument to which 22nd Century or

ESI is a party, or (c) result in the creation or imposition of any Encumbrance on the Purchased Interests. No consent, approval,

waiver or authorization is required to be obtained by 22nd Century or ESI from any person or entity in connection with the execution,

delivery and performance by 22nd Century and ESI of this Agreement and the consummation of the transactions contemplated hereby, other

than those that will be obtained at or prior to Closing or any disclosures required under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”).

Section 2.04

Ownership of Purchased Interests. Either 22nd Century or ESI, as applicable, is the sole legal, beneficial, record, and equitable

owner of the Purchased Interests, free and clear of all Encumbrances whatsoever. The Purchased Interests constitute 100% of the total

issued and outstanding membership interests or equity interest, as the case may be, in each of the GVB Companies. Upon consummation of

the transactions contemplated by this Agreement, Buyer shall own all of the Purchased Interests, free and clear of all Encumbrances (other

than Encumbrances created by Buyer). Other than the organizational documents of the GVB Companies (true and correct copies of which have

been provided to Buyer), there are no voting trusts, proxies or other agreements or understandings in effect with respect to the voting

or transfer of any of the Purchased Interests.

Section 2.05

Legal Proceedings. Except as set forth on Schedule A, there is no claim, action, suit, proceeding or governmental investigation

(“Action”) of any nature pending or, to Seller’s knowledge, threatened against or by 22nd Century or ESI (a) relating

to or affecting the Purchased Interests, or (b) that challenges or seeks to prevent, enjoin, or otherwise delay the transactions

contemplated by this Agreement, except any Action(s) that would not, individually or in the aggregate, have a material adverse effect

on 22nd Century’s or ESI’s ability to consummate the transactions contemplated hereby on a timely basis. To Seller’s

knowledge, no event has occurred or circumstances exist that may give rise or serve as a basis for any such Action.

Section 2.06

No Other Representations or Warranties. Except

for the representations and warranties contained in this Article II, none of Seller, any affiliate of Seller nor any other person makes

any representations or warranties, and Seller hereby disclaims any other representations or warranties, whether made by Seller or an affiliate

of Seller, or any of its respective representatives, with respect to the execution and delivery of this Agreement or any document delivered

to Buyer pursuant to this Agreement.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer represents and warrants

to Seller that the statements contained in this Article III are true and correct as of the date hereof. For purposes of this Article III,

“Buyer’s knowledge,” “knowledge of Buyer,” and any similar phrases shall mean the actual knowledge of any

officer of Buyer.

Section 3.01

Organization and Authority of Buyer; Enforceability. Buyer is a corporation duly organized, validly existing, and in good standing under

the laws of the state of Nevada. Buyer has full corporate power and authority to enter into this Agreement and the documents to be delivered

hereunder, to carry out its respective obligations hereunder, and to consummate the transactions contemplated hereby. The execution, delivery,

and performance by Buyer of this Agreement and the documents to be delivered hereunder and the consummation of the transactions contemplated

hereby have been duly authorized by all requisite corporate action on the part of Buyer. This Agreement and the documents to be delivered

hereunder have been duly executed and delivered by Buyer, and (assuming due authorization, execution, and delivery by Seller) this Agreement

and the documents to be delivered hereunder constitute legal, valid, and binding obligations of Buyer, enforceable against Seller in accordance

with their respective terms.

Section 3.02

No Conflicts; Consents. The execution, delivery,

and performance by Buyer of this Agreement and the documents to be delivered hereunder, and the consummation of the transactions contemplated

hereby, do not and will not: (a) violate or conflict with any judgment, order, decree, statute, law, ordinance, rule or regulation

applicable to Buyer; or (b) conflict with, or result in (with or without notice or lapse of time or both) any violation of, or default

under, or give rise to a right of termination, acceleration or modification of any obligation or loss of any benefit under, any contract

or other instrument to which Buyer is a party. No consent, approval, waiver or authorization is required to be obtained by Buyer from

any person or entity in connection with the execution, delivery, and performance by Buyer of this Agreement and the consummation of the

transactions contemplated hereby.

Section 3.03

Investment Purpose. Buyer is acquiring the Purchased Interests solely for its own account for investment purposes and not

with a view to, or for offer or sale in connection with, any distribution thereof. Buyer acknowledges that the Purchased Interests are

not registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws, and

that the Purchased Interests may not be transferred or sold except pursuant to the registration provisions of the Securities Act or pursuant

to an applicable exemption therefrom and subject to state securities laws and regulations, as applicable.

Section 3.04

Legal Proceedings. There is no Action pending or, to Buyer’s knowledge, threatened against, or by, Buyer or any affiliate

of Buyer that challenges or seeks to prevent, enjoin, or otherwise delay the transactions contemplated by this Agreement, except

any Actions that would not, individually or in the aggregate, have a material adverse effect on Buyer’s ability to consummate the

transactions contemplated hereby on a timely basis. To Buyer’s knowledge, no event has occurred or circumstances exist that may

give rise or serve as a basis for any such Action.

Section 3.05

Adequate Information;

No Reliance. Buyer acknowledges and agrees that (i) it has been furnished with all materials it considers relevant to making an investment

decision to enter into this Agreement and has had the opportunity to review Seller’s filings and submissions with the Securities

and Exchange Commission, including, without limitation, all information filed or furnished to the Exchange Act, (ii) Buyer, together

with its professional advisers, is a sophisticated and experienced investor and is capable of evaluating, to its satisfaction, the accounting,

tax, financial, legal, and other risks associated with the sale of the Purchased Interests, and Buyer has had the opportunity to consult

with its accounting, tax, financial, and legal advisors to be able to evaluate the risks involved in the sale of the Purchased Interests,

and (iii) it is not relying, and has not relied, upon any statement, advice (whether accounting, tax, financial, legal or other),

representation or warranty made by Seller or any of its affiliates or representatives, except for the representations and warranties made

by Seller in this Agreement.

Section 3.06

Non-Public

Information. Buyer acknowledges that (a) Seller now possesses and may hereafter possess certain non-public information concerning

Seller and their affiliates and/or the GVB Companies that may or may not be independently known to Buyer (the “Non-Public Information”)

which may constitute material information with respect to the foregoing, and (b) Seller is relying on this representation and would

not enter into a transaction to sell the Purchased Interests to Buyer absent this representation. Buyer agrees to purchase the Purchased

Interests from Seller notwithstanding that the Non-Public Information exists and Seller has not disclosed any Non-Public Information to

Buyer. Buyer acknowledges that it is a sophisticated buyer and with respect to the purchase, sale, and valuation of securities such as

the Purchased Interests and that Seller has no obligations to Buyer to disclose such Non-Public Information and no fiduciary obligations

to Buyer.

ARTICLE IV

Closing Conditions

Section 4.01

Conditions to Obligations of Buyer. The obligations of Buyer to consummate the Transaction are subject to the satisfaction

at or prior to Closing of the following conditions, any or all of which may be waived, in whole or in part, to the extent permitted by

applicable law, by Buyer:

(a)

No Order. No governmental entity, including any federal or state court of competent jurisdiction, shall have enacted, issued,

promulgated, enforced or entered any statute, rule, regulation, executive order, judgment, decree, injunction or other order which (i) is

final and non-appealable, (ii) is in effect, and (iii) has the effect of making illegal or otherwise prohibiting the performance

by Buyer and Seller of their respective obligations under this Agreement.

(b)

Representations and Warranties. The representations and warranties of Seller contained in this Agreement shall be true and

correct as of the date of this Agreement and at and as of the Effective Time with the same force and effect as if made at and as of the

Effective Time (other than those representations and warranties that address matters only as of a particular date or only with respect

to a specific period of time, which need only be true and correct as of such date or with respect to such period), except where the failure

of such representations and warranties to be true and correct (without giving effect to any “materiality” or “material

adverse effect” qualifiers set forth therein) would not reasonably be expected to have, either individually or in the aggregate,

a material adverse effect on the ability of Seller to consummate the transactions contemplated hereby.

(c)

Agreements and Covenants. Seller shall have performed or complied in all material respects with all agreements and covenants

required by this Agreement to be performed or complied with by it at or prior to the Closing.

(d)

Closing Deliverables. Seller shall have delivered or caused to be delivered the documentation required to be delivered by

Seller pursuant to Section 1.06.

(e)

Fairness Opinion. Seller shall have provided to Buyer a copy of an opinion from an investment bank to the effect that, as

of the Closing Date, the consideration to be paid to Seller pursuant to the terms of this Agreement is fair, from a financial point of

view, to Seller.

(f)

Release of Debt Obligations. Seller shall have received any required release or consent, as applicable with respect to any

outstanding indebtedness, including the 7% Original Issue Discount Secured Debentures of Seller and any security or guarantee documents

related thereto.

(g)

Financing. Buyer shall have received at least $3,000,000 from the initial closing of an equity financing of its preferred

stock, on terms acceptable to Buyer (the “Financing”).

Section 4.02

Conditions to Obligations of Seller. The obligations of Seller to consummate the Transaction are subject to the satisfaction

at or prior to the Closing of the following conditions, any or all of which may be waived, in whole or in part, to the extent permitted

by applicable law, by Seller:

(a)

No Order. No governmental entity, including any federal or state court of competent jurisdiction, shall have enacted, issued,

promulgated, enforced or entered any statute, rule, regulation, executive order, judgment, decree, injunction or other order which (i) is

final and non-appealable, (ii) is in effect, and (iii) has the effect of making illegal or otherwise prohibiting the performance

by Buyer and Seller of their respective obligations under this Agreement.

(b)

Representations and Warranties. The representations and warranties of Buyer contained in this Agreement shall be true and

correct as of the date of this Agreement and at and as of the Effective Time with the same force and effect as if made at and as of the

Effective Time (other than those representations and warranties that address matters only as of a particular date or only with respect

to a specific period of time, which need only be true and correct as of such date or with respect to such period), except where the failure

of such representations and warranties to be true and correct (without giving effect to any “materiality” or “material

adverse effect” qualifiers set forth therein) would not reasonably be expected to have, either individually or in the aggregate,

a material adverse effect on the ability of Buyer to consummate the transactions contemplated hereby.

(c)

Agreements and Covenants. Buyer shall have performed or complied in all material respects with all agreements and covenants

required by this Agreement to be performed or complied with by it at or prior to the Closing.

(d)

Closing Deliverables. Buyer shall have delivered or caused to be delivered the documentation required to be delivered by

Seller pursuant to Section 1.06.

(e)

Fairness Opinion. The board of directors of 22nd Century shall have received an opinion from an investment bank to the effect

that, as of the Closing Date, the consideration to be paid to Seller pursuant to the terms of this Agreement is fair, from a financial

point of view, to Seller.

(f)

Release of Debt Obligations. Seller shall have received any required release or consent, as applicable with respect to any

outstanding indebtedness, including the 7% Original Issue Discount Secured Debentures of Seller and any security or guarantee documents

related thereto.

Section 4.03

Waiver of Closing Conditions. Upon the occurrence of the Closing, any condition set forth in this Article IV that was not

satisfied as of the Closing shall be deemed to have been waived as of and from the Closing.

ARTICLE V

COVENANTS AND OTHER AGREEMENTS

Section 5.01

Conduct of Business Prior to the Closing.

From the date hereof until the Closing, except as otherwise provided in this Agreement or consented to in writing by Buyer (which

consent shall not be unreasonably withheld or delayed), Seller shall, and shall cause the GVB Companies to, (x) conduct the business

of the GVB Companies in the ordinary course of business consistent with past practice; (y) use reasonable best efforts to maintain

and preserve intact the current organization, business and franchise of the GVB Companies and to preserve the rights, franchises, goodwill

and relationships of its employees, customers, lenders, suppliers, regulators and others having business relationships with the GVB Companies;

and (z) not make, change or revoke any material tax election, change any annual accounting period, adopt or change any accounting method,

amended any tax return, enter into any closing agreement, settled any tax claim or assessment relating to any of the GVB Companies, surrender

any right to claim a refund of taxes, or consent to any extension or waiver of the limitation period applicable to any tax claim or assessment

relating to any of the GVB Companies.

Section 5.02

Insurance Proceeds. The parties acknowledge and agree that Seller and/or its subsidiaries or affiliates (excluding, for this purpose,

the GVB Companies and all of their subsidiaries) shall be the sole party entitled to any and all insurance proceeds (the “Insurance

Proceeds”) related to any claims in connection with the fire at the manufacturing facility located at 212 NE North Street, Grass

Valley, Oregon 97029, Sherman County (including, without limitation, for property damage and business interruption) and, for all income

and other tax purposes and financial statement reporting purposes, the GVB Companies shall be treated as having distributed and otherwise

assigned any and all rights of the GVB Companies to the Insurance Proceeds to Seller prior to the Closing. To the extent Buyer, or the

GVB Companies or any of their subsidiaries receive any such Insurance Proceeds after the Closing, such Insurance Proceeds shall be deemed

to have been received by Buyer or the GVB Companies or any of their subsidiaries solely as an agent for Seller and Buyer, or the GVB Companies

or any of their subsidiaries shall cause the Insurance Proceeds to be paid to Seller within two (2) days of receipt thereof. With respect

to the costs associated with the Insurance Proceeds, Seller shall bear the costs of the continued legal action associated with receipt

of such Insurance Proceeds. Seller shall reimburse Buyer for any third-party costs or actual net tax liabilities Buyer incurs as a result

of the receipt of the Insurance Proceeds. The parties agree and acknowledge that Seller shall be entitled exclusively to control, defend

and settle any claims in connection with the fire at the manufacturing facility.

Section 5.03

Pre-Closing Transfers. The parties agree that, prior to the Closing, the assets, liabilities and contracts (i) listed

on Schedule B attached hereto will be transferred from Seller to one or more of the GVB Companies, and (ii) the assets,

liabilities and contracts listed on Schedule C attached hereto will be transferred from the GVB Companies to Seller.

Section 5.04

Litigation. Each

of Buyer and Seller will cooperate fully, as and to the extent reasonably requested by the other party, in connection with the legal proceedings

listed on Schedule A.

Section 5.05

Location of Assets; Liabilities. If at any time

or from time to time after the Closing, (a) Seller and/or its subsidiaries receive or otherwise possess any asset that should belong

to the GVB Companies (including any contract), or any liability that should be allocated to the GVB Companies, on or prior to the Closing

Date exclusively related to the business of hemp-based cannabinoid extraction, refinement, contract manufacturing, and product development

(collectively, the “Business”) or (b) the GVB Companies receive or otherwise possess any asset that should belong

to Seller and/or any of its subsidiaries or affiliates, or any liability that should be allocated to Seller, on or prior to the Closing

Date not exclusively related to the Business, Seller shall, and shall cause its affiliates to, with respect to subsection (a), or Buyer

shall, and shall cause its affiliates to, with respect to subsection (b), as promptly as practicable: (i) transfer all right, title,

and interest in such asset to Buyer, the GVB Companies, their respective subsidiaries or as Buyer may direct, or to Seller or as Seller

may direct, as applicable, in each case for no additional consideration, and (ii) hold its right, title, and interest in and to such

asset in trust for the applicable transferee until such time as such transfer is completed.

Section 5.06

Employee Matters: For purposes of this Section 5.06, “Transferred Employees” means, (a) all employees of ESI who

accept offers of employment with Buyer or its affiliates, including the GVB Companies after Closing, and commence such employment immediately

after the Closing with Buyer or its affiliates and (b) employees who are absent due to vacation, family leave, short-term disability,

long-term disability, or other authorized leave of absence on the Closing Date but who accept such offer of employment and indicate an

intention to commence such employment with Buyer or its affiliates as of such employee’s return from vacation, family leave, short-term

disability, long-term disability or other authorized leave. Buyer or its affiliates, including the GVB Companies, shall extend offers

of employment to all Transferred Employees prior to and effective on the Closing Date. Such offers shall be made on the same terms and

conditions as the Transferred Employees current employment. Seller shall provide Buyer with access to their personnel records and personnel

files and such other information with respect to the Transferred Employees as Buyer may reasonably request, to the extent compliant with

applicable laws. Subject to Buyer’s right to terminate any Transferred Employees following the Closing, Buyer shall provide, or

shall cause one of its affiliates to provide, for a period of one (1) year from and after the Closing Date, each Transferred Employee

with compensation and benefits (excluding, for this purpose, equity-based compensation, long-term incentive awards, retention bonuses,

change in control-related payments, defined benefit pensions and retiree welfare benefits) that are no less favorable to those provided

to such Transferred Employee immediately prior to the Closing. Notwithstanding the foregoing or anything else in this Agreement, if Buyer

or one of its affiliates fails to make offers of employment to, or makes offers of employment that constitute an employment loss to, any

number of Transferred Employees that, if terminated by Seller upon the Closing, would trigger any obligations or liabilities under the

WARN Act, then Buyer shall be solely liable for any such obligations or liabilities. Without limiting the generality of the foregoing,

in the event that a Transferred Employee does not accept the offer of employment from Buyer or one of its affiliates, Buyer shall be required

to reimburse Seller for the total severance costs for such Transferred Employees. No provision in this Section 5.06 or otherwise

in this Agreement, whether express or implied, shall (i) create any third-party beneficiary or other rights in any employee or former

employee of Seller or any of its subsidiaries or affiliates (including any beneficiary or dependent thereof), or any other Person; or

(ii) create any rights to continued employment with Seller, Buyer or any of their respective subsidiaries or affiliates or in any

way limit the ability of Seller, Buyer or any of their respective subsidiaries or affiliates to terminate the employment of any individual

at any time and for any reason.

Section 5.07

Financing. Buyer shall use reasonable best efforts to take, or cause to be taken, all actions and do, or cause to be done,

as promptly as possible, all things necessary, proper or advisable, in each case, to the extent within the control of Buyer, to arrange,

obtain and consummate the Financing.

Section 5.08

Intercompany Balances. Seller and Buyer acknowledge and agree that any intercompany balances between Seller and any of its

affiliates on the one hand, and the GVB Companies on the other hand, shall be forgiven immediately at the Closing other than amounts related

to the Pre-Closing Expenses.

Section 5.09

Intercompany Services. Any and all services being provided by Seller and any of its affiliates to the GVB Companies prior

to the Closing shall have been terminated at the Closing.

ARTICLE VI

Financial and tax matters

Section 6.01

Pre-Closing Tax Returns Filed. Following the Closing, Seller will, at its own cost, prepare and timely file, or cause to

be prepared and timely filed, any income tax return with respect to any taxable period ending on or before the Closing Date (“Pre-Closing

Tax Period”) and Buyer shall cooperate with the filing of such income tax returns. Such income tax returns will be prepared

in a manner consistent with past practice, except to the extent otherwise required under applicable law. Seller will provide all such

income tax returns that are income tax returns to Buyer for review at least fifteen (15) days prior to the due date for such income tax

returns (including any applicable extensions), and Seller will reasonably and in good faith consider any comments made by Buyer before

the due date for such income tax returns with respect to such income tax returns that are consistent with the standard set forth in the

preceding sentence. Seller shall bear all costs, fees and expenses of preparing and filing such tax returns.

Section 6.02

Straddle Period Tax Returns Filed. Following the Closing, Buyer will, at its own cost, prepare and timely file, or cause

to be prepared and timely filed, any tax return of the GVB Companies with respect to any taxable period beginning before the Closing Date

and ending after the Closing Date (the “Straddle Period”). Such tax returns will be prepared in a manner consistent

with past practice, except to the extent otherwise required under applicable law. Buyer will provide all such tax returns that are income

tax returns to Seller for review at least fifteen (15) days prior to the due date for such tax returns (including any applicable extensions),

and Buyer will reasonably and in good faith consider any comments made by Seller before the due date for such tax returns with respect

to such tax returns that are consistent with the standard set forth in the preceding sentence. In connection with the filing of any such

tax return for a Straddle Period, the Seller shall pay or cause to be paid to Buyer Seller’s pro rata share of all taxes of the

GVB Companies shown on any Straddle Period tax return to the extent allocable to the portion of the Straddle Period through the end of

the Closing Date as determined in accordance with Section 6.03.

Section 6.03

Straddle Periods. For purposes of this Agreement, in the case of any Straddle Period, the amount of any taxes not based

upon or measured by income or gain, proceeds, receipts or expenses (e.g., payroll taxes or sales taxes) allocated to the portion of the

Straddle Period through the end of the Closing Date will be deemed to be the amount of such tax for the entire taxable period multiplied

by a fraction, the numerator of which is the number of days in the Straddle Period ending on the Closing Date and the denominator of which

is the number of days in such Straddle Period. The amount of taxes based upon or measured by income or gain, proceeds, receipts or expenses

for a Straddle Period that relate to the portion of the Straddle Period ending on the Closing Date will be determined based on an interim

closing of the books as of the close of business on the Closing Date; provided, however, that any item determined on an annual or periodic

basis (such as deductions for depreciation or real estate taxes) shall be apportioned on a daily basis in accordance with the preceding

fraction.

Section 6.04

Cooperation. Each of Buyer and Seller will cooperate fully, as and to the extent reasonably requested by the other party,

in connection with the filing of tax returns and any tax contest with respect to Pre-Closing Tax Periods. The parties acknowledge that,

following Closing, Buyer and Seller will have certain SEC reporting obligations that will involve and include the preclosing operations

and financial statements of 22nd Century and its subsidiaries. In connection with such SEC reporting obligations, Buyer and Seller shall

reasonably cooperate, and use their commercially reasonable efforts to cause their auditors to reasonably cooperate, in connection with

the preparation and filing of such obligations.

'

Section 6.05

Post-Closing Actions. Following the Closing Date, Buyer will not amend or cause to be amended any tax return, make or change

any tax election, agree to the extension or waiver of the statute of limitations period or take any other action that has the effect of

extending the period of assessment or collection, initiate discussions or examinations with any governmental entity, or make any voluntary

disclosures, or take any other similar action with respect to taxes or omit to take any action with respect to taxes, in each case with

respect to taxes of the GVB Companies that relates to a Pre-Closing Tax Period, and in each case except as required by applicable law

(as mutually agreed by Buyer and Seller, acting reasonably) or otherwise with the consent of Seller, which consent will not be unreasonably

withheld, delayed, or conditioned.

Section 6.06

Transfer Taxes. All taxes and fees (including any penalties and interest) incurred in connection with the Transaction shall

be borne and paid by the party to which it accrues under applicable law.

Section 6.07

Refunds. Seller shall be entitled to any refunds of any (i) Taxes paid by the GVB Companies for all Pre-Closing Tax Periods,

and (ii) with respect to any Straddle Period, Taxes paid by the Company attributable to the portion of such Straddle Period that ends

on and includes the Closing Date (including, in each case, any interest in respect thereof). Notwithstanding, Buyer shall not be obligated

to take any particular action or refrain from taking any particular action, in either case to obtain or maximize the amount of any such

refunds. Buyer shall use commercially reasonable efforts to cause the amount of any such refunds of taxes (including interest) to which

Seller is entitled, but which are received by any of the GVB Companies after the Closing Date, to be paid to Seller as soon as practicable

following such receipt or crediting to Seller by wire transfer of immediately available funds to the account designated by Seller.

Section 6.08

Section 338(g) Election. Notwithstanding anything to the contrary in this Agreement, Buyer shall in its sole discretion

be permitted to make, or cause its affiliates (including on or after the Closing Date, each of Group Europe, GVBiopharma, and Pharmatech)

to make, an election under Section 338(g) of the Code (or any similar provision under state or local tax law) with respect to the

purchase by Buyer of 100% of the equity of each such entity. Seller and each of Group Europe, GVBiopharma, and Pharmatech shall not take

any action inconsistent with such election and shall cooperate with Buyer to (i) complete all tax forms required in connection with

such election; and (ii) complete and deliver any notice required under Treasury Regulation Section 1.338-2(e)(4).

Section 6.09

Tax Sharing Arrangements. Any and all tax allocation, indemnity or sharing agreements binding any of the GVB Companies shall

be terminated as of the day before the Closing Date and, from and after the Closing Date, none of the GVB Companies shall be obligated

to make any payment to any person pursuant to any such agreement.

ARTICLE VII

General Release

Section 7.01

Mutual Release. In consideration of the covenants, agreements, and undertakings of each party under this Agreement and the

other agreements contemplated hereby, at the Closing, each party, on behalf of itself and its present and former, direct and indirect,

agents, representatives, successors and assigns (each, a “Releasing Party”) hereby releases, waives, and forever discharges

the other parties and their present and former, direct and indirect, parents, subsidiaries, officers, directors, managers, members, employees,

agents, representatives, successors and assigns (each, a “Released Party” and collectively, the “Released

Parties”) from and with respect to any and all actions, causes of action, suits, losses, liabilities, rights, debts, dues, sums

of money, accounts, reckonings, obligations, costs, expenses, liens, bonds, bills, specialties, covenants, contracts, controversies, agreements,

promises, variances, trespasses, damages, judgments, extents, executions, claims, and demands, of every kind and nature whatsoever, whether

now known or unknown, foreseen or unforeseen, matured or unmatured, suspected or unsuspected, in law, admiralty, or equity (collectively,

“Claims”) that any such Releasing Party now has, ever had or may in the future have against the Released Parties by

reason of any matter, cause or thing that has happened, developed or occurred, and any Claims that have arisen, before the Closing, including,

without limitation, any actual or alleged act, omission, transaction, practice, conduct, occurrence, or other matter, and each party shall

not seek to recover any amounts in connection therewith or thereunder from any Released Party. For the avoidance of doubt, this release

shall not release, waive, or forever discharge the parties from and with respect to any and all Claims arising from this Agreement, the

Notes or the Transaction.

ARTICLE VIII

TERMINATION

Section 8.01

Termination. This Agreement may be terminated at any time prior to the Closing:

(a)

by the mutual written consent of Seller and Buyer;

(b)

by Seller or Buyer if such party is not in material breach of this Agreement and there has been a material breach, inaccuracy in

or failure to perform any representation, warranty, covenant or agreement made by the other party;

(c)

by Seller or Buyer if any of the conditions to Closing shall not have been, or if it becomes apparent that any of such conditions

will not be, other than with respect to Section 4.01 (g), fulfilled by December 7, 2023;

(d)

by Seller if the condition of Section 4.01(g) shall not have been, or if it becomes apparent that it will not be, fulfilled by

December 7, 2023;

(e)

by Buyer if the condition of Section 4.01(g) shall not have been, or if it becomes apparent that it will not be, fulfilled by December

30, 2023.

Section 8.02

Effect of Termination. In the event of the termination of this Agreement, this Agreement shall forthwith become void and

there shall be no liability on the part of any party hereto except that nothing herein shall relieve any party hereto from liability for

any willful breach of any provision hereof. Promptly upon the termination of this Agreement for any reason, Buyer and Seller shall cause

the Escrow Agent to release the Deposit to Buyer by wire transfer of immediately available funds.

ARTICLE IX

Miscellaneous

Section 9.01

AS IS SALE. EXCEPT AS EXPRESSLY SET FORTH IN ARTICLE II, IT IS UNDERSTOOD AND AGREED THAT SELLER IS NOT MAKING, NOR HAS, AT ANY TIME,

MADE, ANY WARRANTIES OR REPRESENTATIONS OF ANY KIND OR CHARACTER, EXPRESS OR IMPLIED, WITH RESPECT TO ANY PORTION OF THE PURCHASED INTERESTS,

OR THE BUSINESS OR PROPERTY OF THE GVB COMPANIES. BUYER ACKNOWLEDGES AND AGREES THAT UPON THE CLOSING, 22ND CENTURY AND ESI SHALL SELL

AND CONVEY TO BUYER, AND BUYER SHALL ACCEPT, THE PURCHASED INTERESTS “AS IS, WHERE IS, WITH ALL FAULT,” EXCEPT TO THE EXTENT

EXPRESSLY PROVIDED OTHERWISE IN ARTICLE II.

Section 9.02

Expenses. All costs and expenses, including, without

limitation, fees and disbursements of counsel, financial advisors and accountants, incurred in connection with this Agreement and the

transactions contemplated hereby shall be paid by the party incurring such costs and expenses, whether or not the Closing shall have occurred;

provided, that, at Closing, Buyer shall pay the transaction expenses incurred by Seller, so long as the same have been consented

to by Buyer, such consent not to be unreasonably withheld, conditioned or delayed.

Section 9.03

Further Assurances. Following the Closing, each of the parties hereto shall, and shall cause their respective affiliates to, execute

and deliver such additional documents, instruments, conveyances, and assurances and take such further actions as may be reasonably required

to carry out the provisions hereof and give effect to the transactions contemplated by this Agreement.

Section 9.04

Notices. All notices, requests, consents, claims, demands, waivers, and other communications hereunder shall be in writing and

shall be deemed to have been given (a) when delivered by hand (with written confirmation of receipt); (b) when received by the

addressee if sent by a nationally recognized overnight courier (receipt requested); (c) on the date sent by e-mail (with confirmation

of transmission) if sent during normal business hours of the recipient, and on the next business day if sent after normal business hours

of the recipient or (d) on the third day after the date mailed, by certified or registered mail, return receipt requested, postage

prepaid. Such communications must be sent to the respective parties at the following addresses (or at such other address for a party as

shall be specified in a notice given in accordance with this Section 9.04):

| If to Buyer: |

Specialty

Acquisition Corporation

[**]

Attention: [**]

with a copy, which shall not constitute notice, to:

[**]

Attn: [**]

Email: [**]

|

| If to Seller: |

22nd Century Group, Inc.

500 Seneca Street, Suite 508

Buffalo, NY 14204

Attention: [**]

with a copy, which shall not constitute notice, to:

[**]

Attn: [**]

Email: [**]

|

Section 9.05

Headings. The headings in this Agreement are for reference only and shall not affect the interpretation of this Agreement.

Section 9.06

Severability. If any term or provision of this Agreement is invalid, illegal or unenforceable in any jurisdiction, such invalidity,

illegality or unenforceability shall not affect any other term or provision of this Agreement or invalidate or render unenforceable such

term or provision in any other jurisdiction. Upon such determination that any term or other provision is invalid, illegal or unenforceable,

the parties hereto shall negotiate in good faith to modify the Agreement so as to effect the original intent of the parties as closely

as possible in a mutually acceptable manner in order that the transactions contemplated hereby be consummated as originally contemplated

to the greatest extent possible.

Section 9.07

Entire Agreement. This Agreement and the documents to be delivered hereunder constitute the sole and entire agreement of the parties

to this Agreement with respect to the subject matter contained herein, and supersede all prior and contemporaneous understandings and

agreements, both written and oral, with respect to such subject matter.

Section 9.08

Successors and Assigns. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective

successors and permitted assigns. Neither party may assign its rights or obligations hereunder without the prior written consent of the

other party, which consent shall not be unreasonably withheld or delayed. No assignment shall relieve the assigning party of any of its

obligations hereunder.

Section 9.09

No Third-Party Beneficiaries. This Agreement is for the sole benefit of the parties hereto and their respective successors and

permitted assigns and nothing herein, express or implied, is intended to or shall confer upon any other person or entity any legal or

equitable right, benefit or remedy of any nature whatsoever under or by reason of this Agreement.

Section 9.10

Amendment and Modification. This Agreement may only be amended, modified or supplemented by an agreement in writing signed by each

party hereto.

Section 9.11

Waiver. No waiver by any party of any of the provisions

hereof shall be effective unless explicitly set forth in writing and signed by the party so waiving. No waiver by any party shall operate

or be construed as a waiver in respect of any failure, breach or default not expressly identified by such written waiver, whether of a

similar or different character, and whether occurring before or after that waiver. No failure to exercise, or delay in exercising, any

right, remedy, power or privilege arising from this Agreement shall operate or be construed as a waiver thereof; nor shall any single

or partial exercise of any right, remedy, power or privilege hereunder preclude any other or further exercise thereof or the exercise

of any other right, remedy, power or privilege.

Section 9.12

Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Nevada without

giving effect to any choice or conflict of law provision or rule (whether of the State of Nevada or any other jurisdiction).

Section 9.13

Submission to Jurisdiction. Any legal suit, action or proceeding arising out of or based upon this Agreement or the transactions

contemplated hereby may be instituted in the federal courts of the United States of America or the courts of the State of Nevada and each

party irrevocably submits to the exclusive jurisdiction of such courts in any such suit, action or proceeding.

Section 9.14

Waiver of Jury Trial. Each party acknowledges and agrees that any controversy which may arise under this Agreement is likely to

involve complicated and difficult issues and, therefore, each such party irrevocably and unconditionally waives any right it may have

to a trial by jury in respect of any legal action arising out of or relating to this Agreement or the transactions contemplated hereby.

Section 9.15

Specific Performance. The parties agree that irreparable damage would occur if any provision of this Agreement were not performed

in accordance with the terms hereof and that the parties shall be entitled to specific performance of the terms hereof, in addition to

any other remedy to which they are entitled at law or in equity. Each party hereto (a) agrees that it shall not oppose the granting

of such specific performance or relief and (b) hereby irrevocably waives any requirements for the security or posting of any bond

in connection with such relief.

Section 9.16

Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together

shall be deemed to be one and the same agreement. A signed copy of this Agreement delivered by facsimile, e-mail or other means of electronic

transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

[Signature

Page Follows]

IN WITNESS WHEREOF, the parties hereto have caused

this Agreement to be executed as of the date first written above by their respective officers thereunto duly authorized.

Buyer:

| |

Specialty acquisitioN corporation |

|

| |

a Nevada corporation |

|

| |

|

|

|

| |

By: |

/s/ William Spiegel |

|

| |

Name: |

William Spiegel |

|

| |

Title: |

Chief Operating Officer |

|

Seller:

| |

22nd Century Group, Inc. |

|

| |

a Nevada corporation |

|

| |

|

|

|

| |

By: |

/s/ Hugh Kinsman |

|

| |

Name: |

Hugh Kinsman |

|

| |

Title: |

Chief Financial Officer |

|

| |

ESI HOLDINGS, LLC |

|

| |

a Nevada limited liability company |

|

| |

|

|

|

| |

By: |

/s/ Hugh Kinsman |

|

| |

Name: |

Hugh Kinsman |

|

| |

Title: |

Chief Financial Officer |

|

[Signature Page to Equity Purchase Agreement]

Exhibit 99.1

22nd Century Group Enters into Agreement to

Sell Hemp/Cannabis Franchise

-Sale Expected to Result in Immediate and Significant

Reduction in Operating Costs and Cash Requirements-

BUFFALO,

N.Y., November 27, 2023 (Globe Newswire) — 22nd Century Group, Inc. (Nasdaq: XXII)

(the “Company” or “22nd Century”), a leading biotechnology company focused on utilizing advanced plant technologies

to improve health and wellness, today announced it has reached an agreement to sell substantially all of its GVB Biopharma (“GVB”)

hemp/cannabis operations to Specialty Acquisition Corporation, a Nevada corporation (the “Buyer”), an entity affiliated

with current GVB employees. The transaction is subject to certain approvals and Buyer obtaining financing.

Terms of the transaction include a cash payment

to the Company of $1 million at closing of the sale (the “Closing”) and a 12% secured promissory note for $1.25 million issued

by the Buyer and payable through six equal monthly installments of principal and accrued interest commencing the fourth calendar month

after the Closing. The parties will equally share liabilities related to any GVB entities not part of the transaction, subject to certain

conditions. The Company plans to use the proceeds from the sale to further deleverage its balance sheet.

22nd Century is also entitled to retain any insurance

proceeds received in connection with the fire at the Company’s Grass Valley manufacturing facility, a portion of which will be used

to offset Buyer’s portion of the shared liabilities. At present, damages being sought are approximately $9 million, subject to upward

revision the longer the disputed claim with the insurer remains unresolved, although the amount received will not be finalized until resolution

of the matter.

The sale is expected to close in early December

2023, subject to customary closing conditions including approval by 22nd Century’s Board of Directors, receipt of a fairness opinion,

Buyer obtaining $3 million of financing and receipt of third-party consents, including the consent of the Company’s senior lender.

The Company is currently in discussions with the senior lender to obtain such consent. No assurances can be given that the Buyer will

obtain the required financing or that the Company’s senior lender will provide the consent to the transaction.

“The sale of our hemp/cannabis franchise

will immediately and materially further reduce the cash and operating demands within our business,” stated John Miller, interim

Chief Executive Officer of 22nd Century. “The buyer will assume responsibility for payroll, lease, and other operational expenses,

along with future funding requirements for the hemp/cannabis business. We expect this transaction will substantially lower 22nd Century’s

operating expenses beyond the previously announced $15 million in cost savings initiatives on an annual basis. Additionally, we will retain

rights to the insurance proceeds, subject to certain offsets, effectively recouping cash that was invested into the continuity of the

hemp/cannabis business.”

“We

remain committed to determining the best path forward to create value for our shareholders. Including, evaluating strategic alternatives

with respect to our tobacco assets, notably our VLNÒ reduced

nicotine content products, as approved by the FDA for harm reduction as a modified risk tobacco product (MRTP),” said Miller.

About 22nd Century Group, Inc.

22nd Century Group, Inc. (Nasdaq: XXII)

is a leading agricultural biotechnology company focused on tobacco harm reduction, reduced nicotine tobacco and improving health and

wellness through plant science. With dozens of patents allowing it to control nicotine biosynthesis in the tobacco plant, the Company

has developed proprietary reduced nicotine content (RNC) tobacco plants and cigarettes, which have become the cornerstone of the FDA’s

Comprehensive Plan to address the widespread death and disease caused by smoking. The Company received the first and

only FDA Modified Risk Tobacco Product (MRTP) authorization for a combustible cigarette in December 2021. 22nd Century uses modern plant

breeding technologies, including genetic engineering, gene-editing, and molecular breeding to deliver solutions for the life science

and consumer products industries by creating new, proprietary plants with optimized alkaloid and flavonoid profiles as well as improved

yields and valuable agronomic traits.

Learn more at xxiicentury.com,

on Twitter, on LinkedIn, and on YouTube.

Learn

more about VLN® at tryvln.com.

###

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, all of the

statements, expectations, and assumptions contained in this press release are forward-looking statements, including but not limited to

our full year business outlook. Forward-looking statements typically contain terms such as “anticipate,” “believe,”

“consider,” “continue,” “could,” “estimate,” “expect,” “explore,”

“foresee,” “goal,” “guidance,” “intend,” “likely,” “may,” “plan,”

“potential,” “predict,” “preliminary,” “probable,” “project,” “promising,”

“seek,” “should,” “will,” “would,” and similar expressions. Forward-looking statements

include, but are not limited to, statements regarding (i) the sale of our hemp/cannabis business, including the GVB assets, (ii) our expectations

regarding our future operating expenses and cash flow, (iii) our expectations on the timing and completion of the sale of our hemp/cannabis

business, and (iv) our expectations for our business interruption insurance claim. Actual results might differ materially from those explicit

or implicit in forward-looking statements. Important factors that could cause actual results to differ materially are set forth in “Risk

Factors” in the Company’s Annual Report on Form 10-K filed on March 9, 2023 and Quarterly Reports on Form 10-Q filed May 9,

2023, August 14, 2023 and November 6, 2023. All information provided in this press release is as of the date hereof, and the Company assumes

no obligation to and does not intend to update these forward-looking statements, except as required by law.

Investor Relations & Media Contact

Matt Kreps

Investor Relations

22nd Century Group

mkreps@xxiicentury.com

214-597-8200

v3.23.3

Cover

|

Nov. 20, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 20, 2023

|

| Entity File Number |

001-36338

|

| Entity Registrant Name |

22nd Century Group, Inc.

|

| Entity Central Index Key |

0001347858

|

| Entity Tax Identification Number |

98-0468420

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

500 Seneca Street

|

| Entity Address, Address Line Two |

Suite 508

|

| Entity Address, City or Town |

Buffalo

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

14204

|

| City Area Code |

716

|

| Local Phone Number |

270-1523

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.00001 par value per share

|

| Trading Symbol |

XXII

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |