falseCRONOS GROUP INC.0001656472TorontoCanada001-38403Ontario00016564722023-11-272023-11-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 27, 2023

CRONOS GROUP INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

British Columbia, Canada | 001-38403 | N/A |

| (State or other jurisdiction | (Commission | (I.R.S. Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | |

| 111 Peter Street, Suite 300 | | |

Toronto , Ontario | | M5V 2H1 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (416) 504-0004

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s)

| Name of each exchange on which registered |

| Common Shares, no par value | CRON | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On November 26, 2023, a wholly owned subsidiary of Cronos Group Inc. (the “Company”) entered into an agreement (the “Sale Agreement”) with Future Farmco Canada Inc. (the “Buyer”) for the sale of its real property located at 4491 Concession 12 Sunnidale Road, Stayner, Ontario, Canada, L0M 1S0 (the “Peace Naturals Campus”). Pursuant to the terms of the Sale Agreement, the Buyer has agreed to acquire the Peace Naturals Campus for an aggregate purchase price of C$23 million in cash, subject to the terms and conditions set forth therein. The aggregate purchase price will be paid as follows: (a) C$100,000 will be paid in trust within two business days of the date of the Sale Agreement, (b) C$1,000,000 will be paid in trust within five business days of the waiver or satisfactions of the Buyer’s Condition, the Seller’s Condition and the Lease Condition (each, as defined below) and (c) the balance of the aggregate purchase price will be paid at the closing.

Closing of the transaction is subject to the satisfaction or waiver of certain conditions, including (a) Buyer having given written notice that the Buyer has satisfied itself in its sole, absolute and subjective discretion with respect to all aspects of the property, including title to the property, the physical condition of the property, zoning, environmental matters, financial matters including financing of the purchase price, and its review of the deliverables on or before the first business day that is 180 calendar days following the date of the Sale Agreement (the “Due Diligence Date”) (the “Buyer’s Condition”); (b) the Company having obtained all requisite approvals for the amendment of its licensed site perimeter from Health Canada on terms and conditions satisfactory to the Company, acting reasonably, prior to the end of the first business day following the later of: (i) 180 calendar days after the date of the Sale Agreement; or (ii) 75 calendar days after the satisfaction or waiver of the Buyer’s Condition (the “Approvals Date”) (the “Seller’s Condition”); and (c) the parties having agreed, no later than 75 calendar days following the date of the Sale Agreement (the “Lease Conditional Period”), to a form of lease to be entered into at closing for the Company to lease a portion of the Peace Naturals Campus (the “Lease Condition”).

If (a) the Buyer does not waive and is not satisfied in its sole, absolute and subjective discretion, with the Buyer’s Condition prior to the occurrence of the Due Diligence Date, (b) the Company does not waive and is not satisfied with the Seller’s Condition prior to the Approvals Date (as may be extended, described below), or (c) the Lease Condition is not satisfied during the Lease Conditional Period, all security deposit monies paid under the Sale Agreement will be returned to the Buyer without deduction or set-off, and the Sale Agreement shall automatically terminate. If the Seller’s Condition is not satisfied by the Approvals Date, either the Buyer or the Company may extend the Approvals Date for a period of up to 60 calendar days by written notice.

Closing is expected to occur on the first business day that falls 30 calendar days following the later of (i) the satisfaction or waiver of the Buyer’s Condition or (ii) the satisfaction or waiver of the Seller’s Condition.

As described above, at closing the parties expect to enter into a lease agreement with respect to portions of Building 4 on the Peace Naturals Campus. The lease will have an initial term of five years with one five-year renewal option that may be exercised by the Company. The Company has the right to terminate the lease with an effective date at any time after the second anniversary of the commencement date of the lease for any reason and without penalty, which the Company may exercise by providing written notice not less than 12 months prior to the termination date. The leased premises will be identified and agreed between the parties during the Lease Conditional Period. Additionally, during the Lease Conditional Period, the parties will identify certain shared areas and facilities on the Peace Naturals Campus such as, but not limited to, parking facilities, passageways, ramps, signage, landscaped areas, loading areas, access roads, driveways, entrances, exits and sidewalks, as more particularly set forth in the Lease. The Company will also have an option to lease Building 3 on the Peace Naturals Campus at any point during the term of the lease.

The foregoing description of the Sale Agreement does not purport to be complete and is qualified in its entirety by reference to the Sale Agreement, which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On November 27, 2023, the Company issued a press release announcing its entry into the Sale Agreement. A copy of the press release is attached as Exhibit 99.1 to, and is incorporated by reference in, this Current Report on Form 8-K.

The information in this Item 7.01, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such a filing or document.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1* | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File – The cover page from Cronos Group Inc.’s Current Report on Form 8-K filed on November 27, 2023 is formatted in Inline XBRL. |

* Certain information has been omitted pursuant to Item 601(b)(2) of Regulation S-K. The registrant agrees to furnish supplementally a copy of any such omitted schedule or other attachment to the SEC upon its request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | CRONOS GROUP INC. |

| | | |

| | | |

| Dated: November 27, 2023 | | By: | /s/ Michael Gorenstein |

| | | Name: Michael Gorenstein |

| | | Title: President and Chief Executive Officer |

Cronos Group Inc. enters into agreement for the sale-leaseback of its Stayner, Ontario facility TORONTO, November 27, 2023 (GLOBE NEWSWIRE) – Cronos Group Inc. (NASDAQ: CRON) (TSX: CRON) (“Cronos” or the “Company”) today announced that its wholly owned subsidiary entered into an agreement (the “Sale Agreement”) with Future Farmco Canada Inc. (the “Buyer”), a vertical farming company, for the sale and leaseback of its property located at 4491 Concession 12 Sunnidale Road, Stayner, Ontario, Canada, L0M 1S0 (the “Peace Naturals Campus”). Pursuant to the terms of the Sale Agreement, the Buyer has agreed to acquire the Peace Naturals Campus for C$23 million cash, subject to the terms and conditions set forth therein. The parties also plan to enter into a lease agreement upon closing for portions of the Peace Naturals Campus, ensuring continued operations. “The sale-leaseback of the Peace Naturals Campus supports Cronos’ goal to reduce costs across the Company,” said Mike Gorenstein, Chairman, President and CEO, Cronos. “More specifically, this sale will aid in improving the gross margin profile of our business, while lowering costs and increasing our agility. This sale only strengthens our industry-leading balance sheet and allows us to continue to pursue organic growth and future transactions that bolster Cronos’ existing value. We do not expect any interruption to our current operations and plan to carry out existing growth plans within our leased space at the facility.” Closing of the transaction is subject to certain conditions outlined in Cronos’ Form 8-K. Within 180 days of the Sale Agreement date, the Buyer must confirm in writing that it is satisfied with various aspects of the property and has secured financing for the transaction. Cronos must receive approval from Health Canada for site perimeter changes by the later of: (i) 180 calendar days after the date of the Sale Agreement; or (ii) 75 calendar days after the satisfaction or waiver of the Buyer’s condition described above. Additionally, both parties must agree on the terms of a lease within 75 days of the Sale Agreement date. The transaction is expected to close 30 calendar days after all conditions are satisfied or waived. At closing, the parties expect to enter into a lease agreement for portions of the Peace Naturals Campus, which will include a five-year term and one five-year renewal option that may be exercised by Cronos. Cronos will also have an option to lease certain additional space during the term of the lease. Cronos can choose to terminate the lease without penalty anytime after the second year by giving written notice at least 12 months prior to termination. The leased premises will be identified and agreed between both parties prior to closing. About Cronos Cronos is an innovative global cannabinoid company committed to building disruptive intellectual property by advancing cannabis research, technology and product development. With a passion to responsibly elevate the consumer experience, Cronos is building an iconic brand portfolio. Cronos’ diverse international brand portfolio includes Spinach®, PEACE NATURALS® and Lord Jones®. For more information about Cronos and its brands, please visit: thecronosgroup.com. Forward-looking Statements This press release may contain information that may constitute “forward-looking information” or “forward-looking statements” within the meaning of applicable Canadian and U.S. securities laws and court decisions (collectively, “Forward-looking Statements”). All information contained herein that is not clearly historical in nature may constitute Forward-looking Statements. In some cases, Forward-looking Statements can be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “plan”, “anticipate”, “intend”, “potential”, “estimate”, “believe” or the negative of these terms, or other similar expressions intended to identify Forward-looking Statements. Some of the Forward-looking

Statements contained in this press release include: the completion of the sale-leaseback of the Peace Naturals Campus and timing thereof; the Company’s receipt of required licenses or approvals for license amendments; the parties’ ability to agree on the portion of the Peace Naturals Campus to be leased by the Company and the terms of the lease; the duration in which the Company would lease a portion of the Peace Naturals Campus; the effect of the sale-leaseback transaction on the Company’s costs and gross margin profile; the impact of the transaction on the Company’s balance sheet and ability to pursue organic growth and future transactions that bolster existing value; and statements about Cronos’ intention to build an international iconic brand portfolio and develop disruptive intellectual property. Forward-looking Statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive risks, financial results, results, performance or achievements expressed or implied by those Forward- looking Statements and the Forward-looking Statements are not guarantees of future performance. A discussion of some of the material risks applicable to the Company can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and quarterly reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023, each of which has been filed on SEDAR and EDGAR and can be accessed at www.sedar.com and www.sec.gov/edgar, respectively. Any Forward-looking Statement included in this press release is made as of the date of this press release and, except as required by law, Cronos disclaims any obligation to update or revise any Forward-looking Statement. Readers are cautioned not to put undue reliance on any Forward-looking Statement. Investor Relations Contact Shayne Laidlaw investor.relations@thecronosgroup.com Media Relations Contact Emily Whalen media.relations@thecronosgroup.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

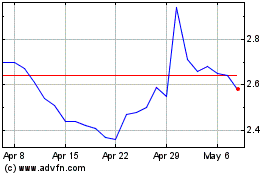

Cronos (NASDAQ:CRON)

Historical Stock Chart

From Mar 2024 to Apr 2024

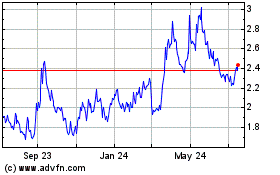

Cronos (NASDAQ:CRON)

Historical Stock Chart

From Apr 2023 to Apr 2024