In the coming week, the October reading of the U.S. core

personal consumption expenditures price index, the Fed’s preferred

inflation gauge, will be the main highlight. Also, market

participants will be eyeing a spate of economic data, including the

U.S. CB Consumer Confidence, S&P/CS HPI Composite – 20 n.s.a.,

Richmond Manufacturing Index, GDP (preliminary), GDP Price Index

(preliminary), Wholesale Inventories (preliminary), Crude Oil

Inventories, Initial Jobless Claims, Personal Income, Personal

Spending, Pending Home Sales, S&P Global Manufacturing PMI, and

ISM Manufacturing PMI.

Meanwhile, Federal Reserve Chairman Jerome Powell will

participate in a fireside chat at Spelman College on Friday.

In addition, several other Fed officials will be making

appearances this week, including Goolsbee, Waller, Bowman, Mester,

and Williams.

In other news, sales revenue from online shopping on Black

Friday achieved a record high of $9.8 billion, reflecting a 7.5%

increase compared to the previous year, according to a report from

Adobe.

Today, all eyes are focused on U.S. New Home Sales data in a

couple of hours. Economists, on average, forecast that October New

Home Sales will come in at 721K, compared to the previous value of

759K.

Also, investors are likely to focus on the U.S. Building Permits

data, which was at 1.471M in September. Economists foresee the

October figure to be 1.487M.

In the bond markets, United States 10-year rates are at 4.481%,

down -0.04%.

Pre-Market U.S. Stock Movers

Crown Castle International Corp (NYSE:CCI) rose

over +4% in pre-market trading following a report from the Wall

Street Journal stating that activist investor Elliott Investment

Management plans to engage with the company to try to boost its

share price after taking a more than $2 billion stake.

YPF Sociedad Anonima (NYSE:YPF) climbed more

than +4% in pre-market trading after Goldman Sachs upgraded the

stock to Neutral from Sell.

Shopify (NYSE:SHOP) gained over +2% in

pre-market trading after the company said that its merchants set a

Black Friday record with a combined $4.1 billion in sales,

representing a 22% increase over last year.

Roku (NASDAQ:ROKU) rose more than +1% in

pre-market trading after Cannonball Research upgraded the stock to

Buy from Neutral.

PotlatchDeltic Corp (NASDAQ:PCH) fell over -2%

in pre-market trading after Raymond James downgraded the stock to

Market Perform from Strong Buy.

Foot Locker (NYSE:FL) slid more than -3% in

pre-market trading after Citi downgraded the stock to Sell from

Neutral.

Today’s U.S. Earnings Spotlight: Monday – November

27th

Zscaler (ZS), Mueller Water Products (MWA), Up Fintech (TIGR),

Cerence (CRNC), Anavex Life Sciences (AVXL), Procaps (PROC), Cango

(CANG).

ANALYST RECOMMENDATIONS

Alexandria Real Estate Equities: JP Morgan

maintains its overweight rating and reduces the target price from

$132 to $118.

Ametek: Cowen downgrades to market perform from

outperform with a price target reduced from $165 to $160.

Apple: Baptista Research downgrades to hold

from outperform with a price target reduced from $210 to

$208.90.

Arista Networks: Haitong International Research

Ltd initiates an Outperform recommendation with a target price of

$240.

Astrazeneca: Wolfe Research maintains its

outperform rating and reduces the target price from $82 to $75.

Canadian National Railway Company: Deutsche

Bank downgrades to hold from buy with a target price reduced from

$125 to $121.

Canadian Pacific Kansas City Limited: Deutsche

Bank downgrades to hold from buy with a price target reduced from

$85 to $77.

Corteva: Berenberg downgrades to hold from buy

with a price target reduced from $63 to $52.

Factset Research Systems: Morningstar maintains

its sell recommendation and raises the target price from $375 to

$390.

Fedex Corporation: Deutsche Bank maintains its

buy recommendation and raises the target price from $295 to

$338.

Micron Technology: Morgan Stanley maintains its

underweight recommendation and raises the target price from $58.50

to $71.50.

Norfolk Southern Corporation: Deutsche Bank

maintains its buy recommendation and raises the target price from

$233 to $258.

Old Dominion Freight Line: Deutsche Bank

downgrades to hold from buy with a price target reduced from $475

to $386.

Pinterest: New Street Research LLP initiates a

Buy recommendation with a target price of $48.

Shell: Morgan Stanley initiates a market weight

recommendation with a target price of $69.50.

Synopsys: KeyBanc Capital Markets maintains its

overweight recommendation and raises the target price from $540 to

$600.

Uber Technologies: Gordon Haskett maintains its

buy recommendation and raises the target price from $55 to $64.

Union Pacific Corporation: Deutsche Bank

maintains its buy recommendation and raises the target price from

$235 to $242.

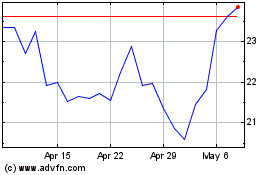

Foot Locker (NYSE:FL)

Historical Stock Chart

From Mar 2024 to Apr 2024

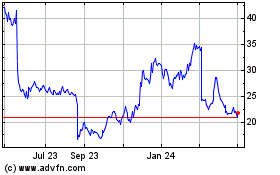

Foot Locker (NYSE:FL)

Historical Stock Chart

From Apr 2023 to Apr 2024