0001606698FALSE00016066982023-11-162023-11-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

___________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) November 16, 2023

Alpine 4 Holdings, Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-40913 | | 46-5482689 |

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) | | (COMMISSION FILE NO.) | | (IRS EMPLOYEE IDENTIFICATION NO.) |

2525 E Arizona Biltmore Circle, Suite 237

Phoenix, AZ 85016

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

480-702-2431

(ISSUER TELEPHONE NUMBER)

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock | ALPP | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On November 16, 2023, Alpine 4 Holdings, Inc., a Delaware corporation (the “Company”), received a notice (the “Notice”) from The Nasdaq Stock Market LLC (“Nasdaq”) indicating that, as a result of not having filed the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, with the SEC on time, the Company was not in compliance with Nasdaq Listing Rule 5250(c)(1) (the “Listing Rule”), which requires timely filing of all required periodic financial reports with the SEC.

The Notice indicated that under Nasdaq Listing Rules, the Company has 60 calendar days to submit a plan to regain compliance with the Listing Rule. If Nasdaq accepts the Company’s plan, Nasdaq can grant an exception of up to 180 calendar days from the filing date for the Form 10-Q to regain compliance. The Company currently plans to file the Form 10-Q as soon as practicable and to submit a plan to Nasdaq detailing the Company’s plan to regain compliance with the Listing Rule.

The Notice has no immediate impact on the listing of the Company’s Common Stock, which will continue to be listed and traded on The Nasdaq Capital Market under the symbol “ALPP,” subject to the Company’s compliance with the requirements outlined above.

As previously reported, the Quarterly Report on Form 10-Q for the period ended September 30, 2023, could not be filed within the prescribed period because the Company’s independent accountants have recently requested certain additional information and supporting documentation in order to complete their review procedures of the Company’s quarterly financial statements. The Company is currently providing such information and documentation and will work to file the quarterly report as soon as possible.

Forward-looking Statements

This Report contains forward-looking statements that involve risks and uncertainties. For example, forward-looking statements include statements regarding the timing of the filing of the Form 10-Q, the submission of a plan to regain compliance with the Listing Rule, and Nasdaq’s potential acceptance of such a plan. Actual results could differ materially from the results projected in or implied by the forward-looking statements made in this report. Factors that might cause these differences include, but are not limited to: the possibility of unanticipated delays that will prevent the filing of the Form 10-Q within the allotted 60-day period, the risk that the work necessary to complete the Form 10-Q is greater than anticipated or may involve the resolution of additional issues identified during the review process, the potential inability to file a plan to regain compliance in a timely manner, the risk of potential additional violations of Listing Rule 5250(c)(1), the risk that the Company may not respond adequately to further inquiries from Nasdaq, and the risk that Nasdaq will not accept any plan to regain compliance and will delist the Company's Class A common stock. Other risk factors that may impact these forward-looking statements are discussed in more detail in the Company’s 2022 Annual Report on Form 10-K filed with the SEC on May 5, 2023. Copies of the Company’s 2022 Annual Report and other periodic reports are available through the Company's Investor Relations department and website, alpine4.com. The Company expressly disclaims any obligation or intention to update these forward-looking statements to reflect new information and developments.

Item 7.01 Regulation FD Disclosure

A press release, dated November 22, 2023, disclosing the Company’s receipt of the Notice referenced above is attached hereto as Exhibit 99.1.

The information furnished in this Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1 attached hereto) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| | | | | | | | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Alpine 4 Holdings, Inc.

By: /s/ Kent B. Wilson

Kent B. Wilson

Chief Executive Officer, President

(Principal Executive Officer)

Date: November 22, 2023

Alpine 4 Holdings (ALPP) Announces Receipt of Nasdaq Notice of Additional Staff Determination

PHOENIX, AZ / ACCESSWIRE / November 22, 2023 / Alpine 4 Holdings, Inc. (Nasdaq: ALPP), a leading operator and owner of small market businesses, announced that on November 16, 2023, it received a staff determination notice from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) advising that Nasdaq had not received Alpine 4’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023 (the "Quarterly Report"), and that as such, Alpine 4 was not in compliance with Nasdaq Listing Rule 5250(c)(1) (the " Listing Rule").

Alpine 4 has 60 calendar days from November 16, 2023, to submit to Nasdaq a plan outlining Alpine 4's anticipated steps to regain compliance with the Listing Rule. Alpine 4 plans to submit the plan explaining the strategy to make the required SEC filings, and to regain compliance with the Listing Rule.

Alpine 4 plans to file the Quarterly Report as soon as practicable and will provide such information to Nasdaq as part of the proposed plan.

Forward-Looking Statements:

This press release contains forward-looking statements that involve risks and uncertainties. For example, forward-looking statements include statements regarding the timing of the filing of the Form 10-Q, the submission of a plan to regain compliance with the Listing Rule, and Nasdaq’s potential acceptance of such a plan. Actual results could differ materially from the results projected in or implied by the forward-looking statements made in this press release. Factors that might cause these differences include, but are not limited to: the possibility of unanticipated delays that will prevent the filing of the Form 10-Q within the allotted 60-day period, the risk that the work necessary to complete the Form 10-Q is greater than anticipated or may involve the resolution of additional issues identified during the review process, the potential inability to file a plan to regain compliance in a timely manner, the risk of potential additional violations of Listing Rule 5250(c)(1), the risk that the Company may not respond adequately to further inquiries from Nasdaq, and the risk that Nasdaq will not accept any plan to regain compliance and will delist the Company's Class A common stock. Other risk factors that may impact these forward-looking statements are discussed in more detail in the Company's 2022 Annual Report on Form 10-K filed with the SEC on May 5, 2023. Copies of the 2022 Annual Report and other periodic reports are available through the Company's Investor Relations department and website, alpine4.com. The Company expressly disclaims any obligation or intention to update these forward-looking statements to reflect new information and developments.

Contact:

Investor Relations

investorrelations@alpine4.com

www.alpine4.com

SOURCE: Alpine 4 Holdings, Inc.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

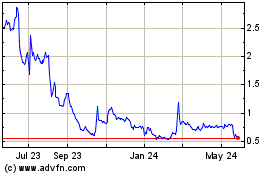

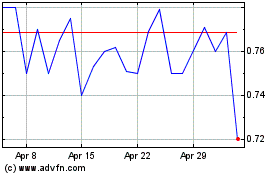

Alpine 4 (NASDAQ:ALPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alpine 4 (NASDAQ:ALPP)

Historical Stock Chart

From Apr 2023 to Apr 2024