Filed

Pursuant to Rule 424(b)(3)

Registration

No. 333-273308

Prospectus

Supplement No. 3 to Prospectus dated October 17, 2023

Marizyme,

Inc.

Up

to 915,071,257 Shares of Common Stock

This

Prospectus Supplement No. 3 (“Prospectus Supplement No. 3”) relates to the Prospectus of Marizyme, Inc. (“we,”

“us,” “our,” or the “Company”), dated October 17, 2023 (Registration No. 333-268187) (the “Prospectus”),

relating to the resale of up to 915,071,257 shares of common stock, par value $0.001 per share (“common stock”), of the Company

that may be sold from time to time by the selling stockholders named in the Prospectus, which consist of:

| ● | 13,971,324

shares of outstanding common stock held by existing stockholders; |

| ● | 221,939,338

shares of common stock issuable upon the conversion of the Company’s outstanding 10%

Secured Convertible Promissory Notes (the “Convertible Notes”), assuming that

all convertible debts and other liabilities under the Convertible Notes are converted into

shares of common stock, without regard to any applicable limitations or restrictions; |

| ● | 380,986,336

shares of common stock issuable upon the exercise of the Company’s outstanding Class

C Common Stock Purchase Warrants, without regard to any applicable limitations or restrictions; |

| ● | 66,159,434

shares of common stock issuable upon the conversion of the Company’s outstanding 15%

Original Issue Discount Unsecured Subordinated Convertible Promissory Notes (the “OID

Convertible Notes”), assuming that the OID Convertible Notes are held until maturity

and that all convertible debts and other liabilities under the OID Convertible Notes are

converted into shares of common stock, without regard to any applicable limitations or restrictions; |

| ● | 84,546,202

shares of common stock issuable upon the exercise of the Company’s outstanding Class

E Common Stock Purchase Warrants, without regard to any applicable limitations or restrictions; |

| ● | 80,796,202

shares of common stock issuable upon the exercise of the Company’s outstanding Class

F Common Stock Purchase Warrants, without regard to any applicable limitations or restrictions;

and |

| ● | 66,672,421

shares of common stock issuable upon the exercise of the Company’s Placement Agent

Warrants, without regard to any applicable limitations or restrictions. |

Capitalized

terms used in this Prospectus Supplement No. 3 and not otherwise defined herein have the meanings specified in the Prospectus.

This

Prospectus Supplement No. 3 is being filed to include the information in our Current Report on Form 8-K which was filed with the Securities

and Exchange Commission (the “SEC”) on November 21, 2023.

This

Prospectus Supplement No. 3 should be read in conjunction with the Prospectus and Prospectus Supplement No. 1 filed with the SEC on October

24, 2023 and Prospectus Supplement No. 2 filed with the SEC on November 16, 2023 (the “Prior Supplements”) and is qualified

by reference to the Prospectus and the Prior Supplements, except to the extent that the information in this Prospectus Supplement No.

3 supersedes the information contained in the Prospectus and the Prior Supplements, and may not be delivered without the Prospectus and

the Prior Supplements.

Our

common stock is quoted for trading on the OTCQB tier of OTC Markets Group, Inc. (“OTCQB”) under the symbol “MRZM”.

On November 21, 2023, the last reported sale price of our common stock on the OTCQB was $0.10 per share. We have applied to list our

common stock under the symbol “MRZM” on the Nasdaq Capital Market tier operated by The Nasdaq Stock Market LLC. There can

be no guarantee that we will successfully list our common stock on the Nasdaq Capital Market. The registration of the selling stockholders’

resale of the Company’s common stock as described in the Prospectus was not conditioned upon our successful listing on the Nasdaq

Capital Market.

We

are a “smaller reporting company” under applicable federal securities laws and, as such, we have elected to comply with certain

reduced public company reporting requirements for the Prospectus and other filings.

INVESTING

IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY READ AND CONSIDER THE RISKS DESCRIBED IN OR INCORPORATED BY REFERENCE

INTO THE “RISK FACTORS” SECTION ON PAGE 12 OF THE PROSPECTUS.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this Prospectus Supplement No. 3 is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this Prospectus Supplement No. 3 is November 22, 2023.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 20, 2023

MARIZYME,

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-53223 |

|

82-5464863 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 555

Heritage Drive, Suite 205, Jupiter, Florida |

|

33458 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(561)

935-9955

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934.

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Not

applicable. |

|

|

|

|

Item

1.01 Entry into a Material Definitive Agreement.

Fifth

Closing of OID Units Private Placement

On

November 20, 2023, the Company conducted the fifth closing (the “Fifth OID Units Closing”) of a private placement (the “OID

Units Private Placement”) of up to $10,000,000 for an aggregate of up to 100,000,000 units (“OID Units”), under a unit

purchase agreement between the Company and each of nine investors (the “November 2023 OID Unit Purchase Agreement”). Each

investor represented that it is an “accredited investor” as such term is defined by Rule 501(a) of the Securities Act of

1933, as amended (the “Securities Act”). Pursuant to the November 2023 OID Unit Purchase Agreement, the Company issued OID

Units to each investor by delivering to such investor (i) an executed 15% original issue discount unsecured subordinated convertible

promissory note (each, an “OID Convertible Note” and collectively, the “OID Convertible Notes”), convertible

into shares of common stock plus additional shares based on accrued interest at $0.10 per share, subject to adjustment, (ii) an executed

Class E Common Stock Purchase Warrant for the purchase of 125% of the shares of common stock into which the respective OID Convertible

Note may be converted at $0.10 per share, subject to adjustment (each, a “Class E Warrant” and collectively, the “Class

E Warrants”), and (iii) an executed Class F Common Stock Purchase Warrant for the purchase of 125% of the shares of common stock

into which the respective OID Convertible Note may be converted at $0.20 per share, subject to adjustment (each, a “Class F Warrant,”

collectively the “Class F Warrants,” and each Class F Warrant together with each Class E Warrant collectively, the “Class

E and F Warrants”). The Company retained Univest Securities, LLC (“Univest”) as the Company’s exclusive placement

agent in connection with the sale of the OID Units under a Placement Agency Agreement, dated April 27, 2023 (the “April 2023 PAA”).

In addition to the rights set forth in the November 2023 OID Unit Purchase Agreement, the OID Convertible Notes, and the Class E and

F Warrants, each future holder of an OID Convertible Note, Class E Warrant or Class F Warrant may have rights under the Registration

Rights Agreement between the Company and each investor in the Fifth OID Units Closing, dated as of November 20, 2023 (the “November

2023 OID Unit Registration Rights Agreement”), as described below. However, each of the investors in the Fifth OID Units Closing

executed a Waiver and Consent waiving any rights that such investor may have under the November 2023 OID Unit Registration Rights Agreement

(each, a “Registration Rights Waiver”).

In

connection with the Fifth OID Units Closing, on November 20, 2023, six of the investors paid an aggregate subscription amount of $550,000,

and the Company issued to these investors 6,470,620 OID Units in aggregate consisting of (i) OID Convertible Notes in the aggregate principal

amount of $647,062, convertible into 6,470,620 shares of common stock plus additional shares based on accrued interest at $0.10 per share,

subject to adjustment, (ii) Class E Warrants for the purchase of 8,088,275 shares of common stock at $0.10 per share, subject to adjustment,

and (iii) Class F Warrants for the purchase of 8,088,275 shares of common stock at $0.20 per share, subject to adjustment. See below

for additional related discussion of these securities. In connection with the Fifth OID Units Closing, after deducting Univest’s

8% fee of $44,000 pursuant to the April 2023 PAA, the Company received net proceeds of $506,000.

Also

in connection with the Fifth OID Units Closing, three of the investors (collectively, the “Business Consultants”) each signed

a separate Cancellation and Exchange Agreement with the Company (collectively, the “November 2023 Cancellation Agreements”),

the Business Consultants agreed to cancel aggregate short-term indebtedness to the Business Consultants of $150,319, which arose in the

ordinary course of business for certain consulting services provided by the Business Consultants to the Company, in exchange for: (i)

the execution of the November 2023 OID Unit Purchase Agreement, (ii) the execution of the November 2023 OID Unit Registration Rights

Agreement, and (iii) the issuance of 1,768,470 OID Units in aggregate consisting of (a) three OID Convertible Notes in the aggregate

principal amount of $176,847 for a subscription equal to $150,319 (the amount of the indebtedness being cancelled), convertible into

1,768,470 shares of common stock in aggregate plus additional shares based on accrued interest at $0.10 per share, subject to adjustment

(collectively, the “November 2023 Debt Cancellation OID Convertible Notes”), (b) three Class E Warrants for the purchase

of 2,210,587 shares of common stock in aggregate at $0.10 per share, subject to adjustment (the “November 2023 Debt Cancellation

Class E Warrants”), and (c) three Class F Warrants for the purchase of 2,210,587 shares of common stock in aggregate at $0.20 per

share, subject to adjustment (the “November 2023 Debt Cancellation Class F Warrants”). The November 2023 Cancellation Agreements

contain a release of claims against the Company relating to the cancelled indebtedness.

The

November 2023 Debt Cancellation OID Convertible Notes, the November 2023 Debt Cancellation Class E Warrants and the November 2023 Debt

Cancellation Class F Warrants are subject to the terms and conditions of the November 2023 Cancellation Agreements. The Business Consultants’

rights under the November 2023 OID Unit Purchase Agreement and the November 2023 OID Unit Registration Rights Agreement are also subject

to the terms and conditions of the November 2023 Cancellation Agreements.

Univest

did not receive a fee in connection with the transactions conducted pursuant to the November 2023 Cancellation Agreements because there

were no related gross proceeds.

November

2023 OID Unit Purchase Agreement

The

November 2023 OID Unit Purchase Agreement provides a right of first offer to investor parties to any proposed offer or sale of equity

securities by the Company until the first anniversary of the first closing of the OID Units Private Placement (i.e., May 12, 2024).

The November 2023 OID Unit Purchase Agreement also contains certain liquidated damages provisions, including for any failure of the Company

to meet the requirements for the OID Convertible Notes or the Class E and Class F Warrants to be converted or exercised for non-restricted

shares of common stock under Rule 144 of the Securities Act (“Rule 144”), and on every 30th day (pro-rated for periods totaling

less than 30 days) thereafter, until cured or such Rule 144 requirements no longer apply, up to a maximum of 25% of each affected investor’s

subscription amount. The November 2023 OID Unit Purchase Agreement also contains a most-favored nations clause that provides that in

connection with any subsequent equity financing of the Company for consideration (a “Subsequent Financing”), each investor

may accept the securities and terms of the Subsequent Financing in substitution of the securities and terms of the November 2023 OID

Unit Purchase Agreement, upon notice from an investor, subject to the terms and conditions of the November 2023 OID Unit Purchase Agreement.

The November 2023 OID Unit Purchase Agreement, the OID Convertible Notes and the Class E and F Warrants will be amended to incorporate

the terms and forms of the securities sold in the Subsequent Financing upon the closing of the Subsequent Financing. The November 2023

OID Unit Purchase Agreement will terminate upon certain events including mutual written consent, by either party upon notice if a closing

has not occurred within 15 business days of the date of the agreement, an event of default under the OID Convertible Notes, the full

conversion or repayment of the OID Convertible Notes and the non-ownership of any shares of common stock issuable upon conversion of

the OID Convertible Notes or exercise of the Class E and F Warrants. The November 2023 OID Unit Purchase Agreement also contains indemnification

of the investors relating to claims relating to the transactions under the November 2023 OID Unit Purchase Agreement which will survive

termination. Each investor’s rights under the November 2023 OID Unit Purchase Agreement may be assigned to another “accredited

investor” as defined by Rule 501(a) of the Securities Act.

OID

Convertible Notes

The

OID Convertible Notes have a maturity date of August 20, 2024. The OID Convertible Notes accrue 10% of interest per annum on the outstanding

principal amount. The OID Convertible Notes will be unsecured and subordinated to any senior indebtedness of the Company. The OID Convertible

Notes’ principal and accrued interest may generally be converted at any time at a conversion price of $0.10 per share, subject

to adjustment, at the option of the holder, into shares of common stock, subject to certain limitations including: Only to the extent

that the holder (together with any other person with which the holder is considered to be part of a “group” under Section

13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or with which the holder otherwise files reports

under Section 13 and/or Section 16 of the Exchange Act) would not become the “beneficial owner” (as such term is defined

in the Exchange Act and the rules and regulations thereunder) of in excess of 4.99% of the number of shares of common stock outstanding,

or 9.99% if the holder becomes the beneficial owner of more than 4.99% of the outstanding shares of common stock (excluding from the

calculation of that percentage any common stock or other equity interests in the Company beneficially owned by virtue of the OID Convertible

Note or respective Class E and F Warrants), subject to a 61-day notice requirement. In the event the Company offers, sells, grants, issues,

or otherwise disposes of common stock or securities with rights to common stock, or announces the intention to do one of such things,

before the listing of the Company’s common stock on NYSE American LLC, The Nasdaq Stock Market LLC, or the New York Stock Exchange

(collectively, a “National Stock Exchange”), at a lower price per share than the OID Convertible Notes’ conversion

price while the OID Convertible Notes are outstanding, then generally the conversion price of the OID Convertible Notes will be lowered

to such price per share. This adjustment provision will apply one time only. The OID Convertible Notes also have customary antidilution

provisions in the event of stock splits, certain changes of control or similar transactions, and rights offerings. While the OID Convertible

Notes are outstanding and for 12 months after the Company lists its common stock on a National Stock Exchange, the Company may not exchange

or cooperate to exchange any indebtedness or securities, reduce or change the conversion, exercise or exchange price of any securities

convertible, exercisable or exchangeable for common stock, amend non-convertible debt to convertible debt, issue securities at a price

based on or varying with trading prices or quotations for the common stock or with a price reset term, or agree to sell securities at

a future determined price. Until 30 days after the OID Convertible Notes are converted or repaid in full, the Company may not sell any

securities in a capital or debt raising transaction or series of related transactions which grant to an investor the right to receive

additional securities based upon future transactions of the Company on terms more favorable than those granted to such investor in such

transaction or series of related transactions. The OID Convertible Notes may not be prepaid by the Company. In the event of default under

the OID Convertible Notes, subject to certain cure rights, interest under the OID Convertible Notes will increase to the lower of 18%

and the maximum legal interest rate, and the outstanding balance will become immediately due and payable. The OID Convertible Notes have

the registration rights set forth in the November 2023 OID Unit Registration Rights Agreement. However, each of the investors in the

Fifth OID Units Closing executed a Registration Rights Waiver waiving any rights that such investor may have under the OID Convertible

Notes or the November 2023 OID Unit Registration Rights Agreement. See “—November 2023 OID Unit Registration Rights Agreement”

below.

Class

E and F Warrants

The

Class E and F Warrants are generally exercisable until five years from the date of issuance. The exercise right is subject to a beneficial

ownership limitation such that shares of common stock may be received upon exercise only to the extent that the holder (together with

any other person with which the holder is considered to be part of a “group” under Section 13 of the Exchange Act or with

which the holder otherwise files reports under Section 13 and/or Section 16 of the Exchange Act) would not become the “beneficial

owner” (as such term is defined in the Exchange Act and the rules and regulations thereunder) of in excess of 4.99% of the shares

of common stock outstanding, subject to automatic increase to 9.99% if the holder becomes a beneficial owner of more than 4.99%, subject

to a 61-day notice requirement. This limitation does not apply to certain provisions of the Class E and F Warrants. The Class E and F

Warrants provide for exercise on a cashless net exercise basis if there is no effective registration statement registering or current

prospectus available for the resale of shares of common stock issuable under the Class E and F Warrants (a “Registration Default”)

after 180 days following the issue date (the “Registration Deadline”). In addition, for each 30 days following the Registration

Deadline, or portion of any 30-day period thereafter in which a Registration Default exists, the amount of shares issuable under the

Class E and F Warrants shall be automatically increased by 5%, prorated for a partial month, not to exceed in the aggregate an additional

25%. However, each of the investors in the Fifth OID Units Closing executed a Registration Rights Waiver waiving any registration rights

that such investor may have under the Class E and F Warrants, including any penalties for failure to comply with such registration rights.

In

the event the Company sells, grants, issues, or otherwise disposes of common stock or securities with rights to common stock, or announces

an intention to do so, at a lower effective price per share than the exercise prices of the Class E and F Warrants, while any such Class

E and F Warrants are outstanding, then generally the applicable Class E and F Warrants’ exercise price will be reduced to the greater

of such lower price or a floor price as determined by any applicable National Stock Exchange. The Class E and F Warrants have the registration

rights set forth in the respective OID Units Registration Rights Agreement. However, each of the investors in the Fifth OID Units Closing

executed a Registration Rights Waiver waiving any registration rights that such investor may have under the Class E and F Warrants or

the OID Units Registration Rights Agreement. The Class E and F Warrants also have customary antidilution provisions in the event of stock

splits, certain changes of control or similar transactions, and rights offerings. The Class E and F Warrants may be transferred subject

to their terms.

November

2023 OID Unit Registration Rights Agreement

Under

the November 2023 OID Unit Registration Rights Agreement, the Company is required to file a registration statement with the SEC registering

the resale of the shares of common stock issuable pursuant to conversion of the OID Convertible Notes and exercise of the Class E and

F Warrants within 67 days of the Fifth OID Units Closing and to cause the registration statement to become effective within 120 days

after such filing date. The Company must maintain the effectiveness of the registration statement until the earlier of the first anniversary

of its effectiveness date and the date that the shares registered for resale may be resold without volume or manner-of-sale restrictions

pursuant to Rule 144 and without the requirement for the Company to be in compliance with the current public information requirement

under Rule 144. If the Company fails to file the registration statement by the filing deadline or cause it to become effective by the

effectiveness deadline, or the registration statement ceases to be effective or the related prospectus becomes unavailable for resales

for more than 10 consecutive calendar days or more than an aggregate of 15 calendar days during any 12-month period, then on the date

of such failure and every 30 calendar days after such date until the failure is cured, the Company must pay to each investor partial

liquidated damages equal to 1% of the aggregate purchase price paid by such investor pursuant to the November 2023 OID Unit Purchase

Agreement, up to a maximum of 10% of the aggregate subscription amount paid by the investor. If the Company fails to pay the partial

liquidated damages within seven days of any such failure, the Company will pay interest thereon at a rate of the lesser of 18% per annum

or the maximum amount permitted under applicable law to each investor, accruing daily from the date such partial liquidated damages are

due until such amounts, plus all such interest thereon, are paid in full. Additional liquidated damages requirements will end when the

applicable failure is cured or Rule 144 becomes available for resale of all the shares of common stock otherwise required to be registered

for resale under the November 2023 OID Unit Registration Rights Agreement. Liquidated damages will not apply to a failure that is due

to limits imposed by the SEC’s interpretation of Rule 415 under the Securities Act. In addition, if there is not an effective registration

statement covering all shares of common stock subject to the registration rights under the November 2023 OID Unit Registration Rights

Agreement at any time when required and the Company proposes to file a registration statement to register certain other offerings, not

including an underwritten public offering of its securities for its own account or the account of others or certain other types of registration

statements, then the Company must provide notice to each investor party and holder of an OID Convertible Note, Class E Warrant or Class

F Warrant, and include the shares otherwise required to be registered under the November 2023 OID Unit Registration Rights Agreement

within 15 days of such notice, unless they are eligible for resale pursuant to Rule 144 (without volume restrictions or current public

information requirements). The November 2023 OID Unit Registration Rights Agreement contains related procedural and filing requirements

and investor notice and review rights as to certain events and filings relating to the registration statement. The Company will be responsible

for all fees and expenses relating to compliance with the November 2023 OID Unit Registration Rights Agreement, as well as up to $10,000

in reasonable attorney fees for the investors’ review of the registration statement. The November 2023 OID Unit Registration Rights

Agreement contains mutual indemnification provisions for claims relating to a registration statement. Each investor’s rights under

the November 2023 OID Unit Registration Rights Agreement may be assigned to another “accredited investor” as defined by Rule

501(a) of the Securities Act.

Holders

of rights to 67% or more of the shares issuable upon conversion of the OID Convertible Notes and exercise of the Class E and F Warrants

may agree to amend or waive the requirements of the November 2023 OID Unit Registration Rights Agreement.

Each

of the investors in the Fifth OID Units Closing executed a Registration Rights Waiver, which waived any rights that such investor may

have under the November 2023 OID Unit Registration Rights Agreement.

April

2023 PAA

Under

the April 2023 PAA, Univest acted as the Company’s exclusive placement agent in connection with the OID Units Private Placement.

The Company agreed to pay Univest a cash placement fee equal to 8% of the gross proceeds from the sale of the OID Units, 8% of the gross

proceeds from any exercise of the Class E and F Warrants, and certain Placement Agent Warrants. The Company further agreed to reimburse

Univest for the fees and expenses of its due diligence and legal counsel of up to $200,000. The April 2023 PAA provides indemnification

rights to Univest and its affiliates in the event of certain claims relating to the April 2023 PAA or related transactions. Under the

April 2023 PAA, Univest has the right to act as the Company’s sole placement agent or an underwriter for any future equity financing

occurring during the 18-month period following the consummation of the OID Units Private Placement. The term of the April 2023 PAA continues

until the completion of the OID Units Private Placement, subject to termination after July 31, 2023 upon 15 days’ notice, or earlier

in the case of termination for cause. Univest will also receive fees on the same basis as described above and Placement Agent Warrants

on the same basis as described below with respect to any private or public offering or other financing or capital raising transaction

of any kind of the Company within 12 months of the termination or expiration of the April 2023 PAA with an investor that Univest directly

or indirectly introduced to the Company during the term of the April 2023 PAA.

Placement

Agent Warrants

Under

the April 2023 PAA and the forms of Placement Agent Warrants agreed to in connection with the April 2023 PAA, the Company also agreed,

upon Univest’s payment of $100.00, to issue Placement Agent Warrants (the “OID Units Placement Agent Warrants”) to

Univest and/or its designee(s) at each closing of the OID Units Private Placement. The required OID Units Placement Agent Warrants will

consist of Placement Agent Warrants for the purchase of 8% of the aggregate number of shares of common stock initially issuable upon

conversion of the OID Convertible Notes, 8% of the aggregate number of shares of common stock initially issuable upon exercise of the

Class E Warrants at $0.10 per share, and 8% of the aggregate number of shares of common stock initially issuable upon exercise of the

Class F Warrants at $0.20 per share, subject to adjustment. On November 20, 2023, Univest made a payment to the Company of $100.00. Accordingly,

on November 20, 2023, OID Units Placement Agent Warrants were issued to Univest and its designee, Bradley Richmond, to purchase a total

of 593,215 and 889,822 shares of common stock at $0.10 per share, respectively, which in aggregate was equal to 8% of the shares issuable

upon conversion or exercise of the OID Convertible Notes and the Class E Warrants issued in the Fifth OID Units Closing, and a total

of 329,564 and 494,345 shares of common stock at $0.20 per share, respectively, which in aggregate was equal to 8% of the shares issuable

upon exercise of the Class F Warrants issued in the Fifth OID Units Closing.

Under

the terms of the OID Units Placement Agent Warrants, such warrants will be exercisable from the date of issuance until August 16, 2028,

which will be the five-year anniversary of the date of the effectiveness of the Certificate of Amendment Pursuant to Nevada Revised Statutes

78.380 & 78.390, as filed by the Company with the Secretary of State of the State of Nevada on August 16, 2023. The exercise right

will be subject to the following beneficial ownership limitation: Exercise is permitted only if it would not cause the holder (together

with its Affiliates (as defined by Rule 405 under the Securities Act), and any other persons acting as a group together with the holder

or any of the holder’s Affiliates), to beneficially own in excess of the percentage of the outstanding securities that are permitted

to be beneficially owned (as described below), which, for purposes of the limitation, includes shares issuable upon exercise of the OID

Units Placement Agent Warrants, excludes shares issuable upon exercise of the unexercised portion of the OID Units Placement Agent Warrants

and exercise or conversion of the unexercised or nonconverted portion of any other securities of the Company subject to an analogous

limitation on conversion or exercise beneficially owned by the holder or any of its Affiliates, and otherwise calculated in accordance

with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder. For purposes of the OID Units Placement

Agent Warrants, the number of outstanding shares of common stock shall be determined after giving effect to the conversion or exercise

of securities of the Company, including the exercised portion of the OID Units Placement Agent Warrants, by the holder or its Affiliates

since the date as of which such number of outstanding shares of Common Stock was reported. The maximum percentage of beneficial ownership

of the Company’s outstanding securities that applies to an exercise of each OID Units Placement Agent Warrant is 9.99% of the number

of shares of the common stock outstanding immediately after giving effect to the issuance of shares of common stock issuable upon exercise

of the OID Units Placement Agent Warrant. The holder, upon notice to the Company, may increase or decrease the percentage limit, provided

that the limitation in no event exceeds 9.99% of the number of shares of common stock outstanding immediately after giving effect to

the issuance of shares of common stock upon exercise of the OID Units Placement Agent Warrant. Any increase in the limitation will not

be effective until the 61st day after such notice is delivered to the Company.

The

OID Units Placement Agent Warrants provide for exercise by payment of cash or on a cashless net exercise basis. In the event the Company

sells, grants, issues, or otherwise disposes of common stock or securities with rights to common stock, or announces an intention to

do so, at a lower price per share than the applicable OID Units Placement Agent Warrants’ exercise price, before the listing of

the common stock on a National Stock Exchange, while such OID Units Placement Agent Warrants are outstanding, then the applicable OID

Units Placement Agent Warrants’ exercise price will be reduced to the greater of such lower price or a floor price as determined

by any applicable National Stock Exchange. The OID Units Placement Agent Warrants will provide for equivalent registration rights as

provided for under the Registration Rights Agreement, dated as of August 30, 2023, between the Company and the other signatories thereto.

However, each of Univest and Mr. Richmond executed a Registration Rights Waiver waiving any registration rights that they would otherwise

have under the OID Units Placement Agent Warrants or such Registration Rights Agreement. The OID Units Placement Agent Warrants will

also have customary antidilution provisions in the event of stock splits, certain changes of control or similar transactions, and rights

offerings. The OID Units Placement Agent Warrants will also provide mutual indemnification relating to claims relating to a registration

statement under which shares issuable upon exercise of the OID Units Placement Agent Warrants may be sold to the same or equivalent extent

as the indemnification provision contained in each Unit Purchase Agreement entered into in connection with the OID Units Private Placement.

The

foregoing description of the terms of each of the OID Convertible Notes issued for cash; the November 2023 Debt Cancellation OID Convertible

Notes; the Class E Warrants issued for cash; the November 2023 Debt Cancellation Class E Warrants; the Class F Warrants issued for cash;

the November 2023 Debt Cancellation Class F Warrants; the OID Units Placement Agent Warrants with respect to the OID Convertible Notes,

the Class E Warrants, and the Class F Warrants, respectively; the November 2023 OID Unit Purchase Agreement; the November 2023 OID Unit

Registration Rights Agreement; the November 2023 Cancellation Agreements; the April 2023 PAA; the Registration Rights Waiver executed

by an investor; and the Registration Rights Waiver executed by Univest and Mr. Richmond, is qualified in its entirety by reference to

the full text of such documents or forms of such documents which are filed or incorporated by reference as Exhibit 4.1, Exhibit 4.2,

Exhibit 4.3, Exhibit 4.4, Exhibit 4.5, Exhibit 4.6, Exhibit 4.7, Exhibit 4.8, Exhibit 4.9, Exhibit 10.1, Exhibit 10.2, Exhibit 10.3,

Exhibit 10.4, Exhibit 10.5, and Exhibit 10.6 respectively, to this Current Report on Form 8-K, and which are incorporated by reference

herein.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item

3.02. Unregistered Sales of Equity Securities.

The

information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02. The offer

of securities pursuant to the November 2023 OID Unit Purchase Agreement, the November 2023 Cancellation Agreements, and the April 2023

PAA, the sale of the OID Convertible Notes and shares of common stock issuable upon conversion of the OID Convertible Notes, the sale

of the Class E Warrants and shares of common stock issuable upon exercise of the Class E Warrants, the sale of the Class F Warrants and

shares of common stock issuable upon exercise of the Class F Warrants, and the offer of the OID Units Placement Agent Warrants and shares

of common stock issuable upon exercise of the OID Units Placement Agent Warrants described above was conducted as a private placement

pursuant to and in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and Rule 506(b) of Regulation

D promulgated thereunder (“Regulation D”) for transactions not involving a public offering. In connection with the execution

of the November 2023 OID Unit Purchase Agreement and the November 2023 Cancellation Agreements, each of the investor parties thereto

represented that it was an “accredited investor” as such term is defined in Rule 501(a) of Regulation D.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

| Exhibit

No. |

|

Description

of Exhibit |

| 4.1 |

|

Form of 15% Original Issue Discount Unsecured Subordinated Convertible Promissory Note issued by Marizyme, Inc. for cash, dated November 20, 2023 |

| 4.2 |

|

Form of 15% Original Issue Discount Unsecured Subordinated Convertible Promissory Note issued by Marizyme, Inc. for cancellation of certain indebtedness, dated November 20, 2023 |

| 4.3 |

|

Form of Class E Common Stock Purchase Warrant issued by Marizyme, Inc. for cash, dated November 20, 2023 |

| 4.4 |

|

Form of Class E Common Stock Purchase Warrant issued by Marizyme, Inc. for cancellation of certain indebtedness, dated November 20, 2023 |

| 4.5 |

|

Form of Class F Common Stock Purchase Warrant issued by Marizyme, Inc. for cash, dated November 20, 2023 |

| 4.6 |

|

Form of Class F Common Stock Purchase Warrant issued by Marizyme, Inc. for cancellation of certain indebtedness, dated November 20, 2023 |

| 4.7 |

|

Form of Placement Agent Warrant with respect to 15% Original Issue Discount Unsecured Subordinated Convertible Promissory Notes (incorporated by reference to Exhibit 4.7 to Form 8-K filed on September 5, 2023) |

| 4.8 |

|

Form of Placement Agent Warrant with respect to Class E Common Stock Purchase Warrants (incorporated by reference to Exhibit 4.8 to Form 8-K filed on September 5, 2023) |

| 4.9 |

|

Form of Placement Agent Warrant with respect to Class F Common Stock Purchase Warrants (incorporated by reference to Exhibit 4.9 to Form 8-K filed on September 5, 2023) |

| 10.1 |

|

Unit Purchase Agreement between Marizyme, Inc. and the investors identified on Appendix A thereto, dated as of November 20, 2023 |

| 10.2 |

|

Registration Rights Agreement between Marizyme, Inc. and the purchasers signatory thereto, dated as of November 20, 2023 |

| 10.3 |

|

Form of Cancellation and Exchange Agreement between Marizyme, Inc. and the creditor party thereto, dated as of November 20, 2023 |

| 10.4 |

|

Placement Agency Agreement between Marizyme, Inc. and Univest Securities, LLC, dated April 27, 2023 (incorporated by reference to Exhibit 10.3 to Form 8-K filed on May 18, 2023) |

| 10.5 |

|

Form of Waiver and Consent, dated as of November 20, 2023, between Marizyme, Inc. and each investor identified on Appendix A to the Unit Purchase Agreement between Marizyme, Inc. and the investors identified on Appendix A thereto, dated as of November , 2023 |

| 10.6 |

|

Form of Waiver and Consent, dated as of November 20, 2023, between Marizyme, Inc. and Univest Securities, LLC or its designee |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, Marizyme, Inc. has duly caused this current report to be signed on its behalf

by the undersigned hereunto duly authorized.

| Date:

November 21, 2023 |

MARIZYME,

INC. |

| |

|

| |

By: |

/s/

David Barthel |

| |

|

David

Barthel |

| |

|

Chief

Executive Officer |

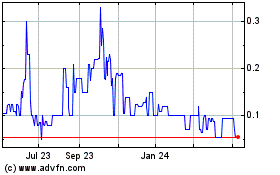

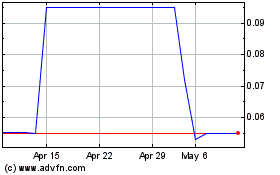

Marizyme (QB) (USOTC:MRZM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marizyme (QB) (USOTC:MRZM)

Historical Stock Chart

From Apr 2023 to Apr 2024