Form 8-K - Current report

November 20 2023 - 8:39AM

Edgar (US Regulatory)

0001065059False00010650592023-11-162023-11-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

_________________

Date of Report (Date of earliest event reported): November 16, 2023

Centrus Energy Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-14287 | 52-2107911 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

6901 Rockledge Drive, Suite 800

Bethesda, MD 20817

(301) 564-3200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Class A Common Stock, par value $0.10 per share | LEU | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 20, 2023, Centrus Energy Corp. (the “Company”) announced the transition of Chief Executive Officer from Daniel B. Poneman to Amir Vexler effective January 1, 2024. Mr. Poneman’s departure does not result from any disagreement with the Company on any matters relating to the Company's operations, policies or practices.

In connection with the above, on November 16, 2023, the Board of Directors (the “Board”) of the Company appointed Amir Vexler, age 50, to succeed Mr. Poneman as Chief Executive Officer of the Company, effective January 1, 2024. In this capacity, Mr. Vexler will also serve as the Company’s principal executive officer for purposes of all applicable rules, regulations and forms of the Securities and Exchange Commission. Mr. Vexler is expected to serve as an employee of the Company from December 4, 2023 until his appointment as Chief Executive Officer is effective on January 1, 2024. Prior to joining the Company, Mr. Vexler served as President and Chief Executive Officer of Orano USA, overseeing Orano’s U.S. sales of nuclear fuel, decommissioning services, used nuclear fuel management, and medical isotopes as well as engineering and technology services for the federal government, from April 2021 and President of Orano TN from December 2019. Prior to joining Orano TN, Mr. Vexler spent 20 years at General Electric Company, where he served in various leadership positions, most recently as Chief Executive Officer of Global Nuclear Fuel, a joint venture of General Electric Company and Hitachi. Mr. Vexler earned a Bachelor of Applied Science degree in Mechanical Engineering from the University of Toronto and a Master’s degree in Business Administration from Wilfrid Laurier University.

Mr. Vexler’s annual base salary for his service as Chief Executive Officer of the Company is expected to be $810,000 annually. Mr. Vexler also will be eligible to participate in the Company’s 2022 Executive Incentive Plan (the “EIP”), with an annual target bonus equal to 100% of Mr. Vexler’s base salary, which may be as much as 125% or as little as 0% of Mr. Vexler’s base salary, based on attainment of certain Company goals. The Company may elect to pay up to 10% of any annual bonus awarded to Mr. Vexler in fully vested shares of Common Stock pursuant to an applicable Company equity plan. Commencing in calendar year 2024, Mr. Vexler will be eligible to receive a long-term incentive cash award with a target award of 33% of Mr. Vexler’s base salary in accordance with the terms and conditions of the EIP. In connection with his appointment, Mr. Vexler will also receive a grant of 20,000 of the Company’s restricted stock units, which will vest in five equal annual installments beginning on December 4, 2024. Mr. Vexler is also expected to participate in the Company’s Executive Severance Benefits Plan and will be eligible to participate in the Company’s benefit plans that are available to executive officers of the Company generally.

There is no arrangement or understanding with any person pursuant to which Mr. Vexler is being appointed as Chief Executive Officer. There are no family relationships between Mr. Vexler and any director or executive officer of the Company, and he is not a party to any transaction requiring disclosure under Item 404(a) of Regulation S-K.

Item 7.01 Regulation FD Disclosure

On November 20, 2023, the Company issued a press release announcing the events described in Item 5.02 of this report. A copy of this press release is included as Exhibit 99.1 to this report.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act") or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act. A copy of the press release issued by the Company in relation to the services agreement is furnished herewith pursuant to Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | Centrus Energy Corp. | |

| | | | | |

| | | | | |

| Date: | November 20, 2023 | By: | /s/ Kevin J. Harrill | |

| | | | Kevin J. Harrill | |

| | | Senior Vice President, Chief Financial Officer, | |

| | | and Treasurer | |

Exhibit 99.1 Centrus Energy Announces CEO Transition Amir Vexler to Succeed Daniel Poneman as CEO in 2024 BETHESDA, MD – Centrus Energy Corp (NYSE American: LEU) announced today that Amir Vexler will succeed Daniel B. Poneman as Chief Executive Officer on January 1, 2024. Mr. Poneman joined Centrus on March 5, 2015, and over the past eight years has overseen the rebuilding of the Company’s order book, strengthening the balance sheet, and returning the Company to profitability in 2021. In October, Centrus inaugurated the first new U.S.-owned uranium enrichment plant to begin production in nearly 70 years and made its first delivery to the U.S. Department of Energy earlier this month. These achievements are reflected in the growth of the company’s total market capitalization 20-fold since 2015 to more than $800 million today and returns to shareholders almost five times higher than the S&P 500. Mikel Williams, Chairman of the Board of Directors, stated, “This transition comes at a time of strength for Centrus. On behalf of the board and our shareholders, I want to thank Dan for his outstanding leadership over the past eight years. The selection of Amir Vexler to succeed Dan next year reflects the culmination of our thorough succession planning process. Amir has a demonstrated track record of success as a CEO and a leader of nuclear fuel operations and is well-qualified to lead our continued growth and development in the years ahead.” “From the moment I arrived in Washington as a summer intern in 1975, I became deeply interested in the promise of nuclear energy and the importance of America’s global nuclear leadership – a cause that has been the focus of my professional life ever since,” Poneman said. “These past eight years have represented the culmination of that effort to restore America’s domestic uranium enrichment capability and leadership on the world stage. I am proud of the extraordinary work our dedicated team has done to strengthen our national security and build a domestic supply chain to fuel a new generation of advanced reactors around the world. I look forward to continuing to support the Company and its success going forward.” “I am thrilled to be joining Centrus at a pivotal time for the company and the industry,” said Vexler. “With production of High-Assay Low-Enriched Uranium beginning at the company’s plant in Ohio, Centrus is in prime position to help fuel the future of nuclear energy. Centrus has tremendous growth potential and a critical role to play in meeting America’s energy security and national security needs. I can’t wait to get started and look forward to what we will achieve together.” Amir Vexler brings extensive experience in the nuclear industry to Centrus, with a strong background in manufacturing, engineering services, commercial operations, and business development. He has served as President and Chief Executive Officer of Orano USA since 2021, overseeing Orano’s U.S. sales of nuclear fuel, decommissioning services, used nuclear fuel management, and medical isotopes as well as engineering and technology services for the federal government. Previously, he spent 20 years at General Electric Company, where he served in a number of leadership positions, including Chief Executive Officer, Chairman of the Board, and

Chief Operating Officer of Global Nuclear Fuels, a joint venture of GE and Hitachi in Wilmington, North Carolina. About Centrus Energy Centrus Energy is a trusted supplier of nuclear fuel and services for the nuclear power industry. Centrus provides value to its utility customers through the reliability and diversity of its supply sources – helping them meet the growing need for clean, affordable, carbon-free electricity. Since 1998, the Company has provided its utility customers with more than 1,750 reactor years of fuel, which is equivalent to 7 billion tons of coal. With world-class technical and engineering capabilities, Centrus is also advancing the next generation of centrifuge technologies so that America can restore its domestic uranium enrichment capability in the future. Find out more at www.centrusenergy.com. Forward Looking Statements This news release contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. In this context, forward-looking statements mean statements related to future events, which may impact our expected future business and financial performance, and often contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “will”, “should”, “could”, “would” or “may” and other words of similar meaning. These forward-looking statements are based on information available to us as of the date of this news release and represent management’s current views and assumptions. Forward-looking statements are not guarantees of future performance, events or results and involve known and unknown risks, uncertainties, and other factors, which may be beyond our control. For Centrus Energy Corp., particular risks and uncertainties that could cause our actual future results to differ materially from those expressed in our forward-looking statements include but are not limited to the following which are, and will be, and any worsening of the global business and economic environment as a result; risks related to component failure which prevent plant operations or HALEU production; risks related to the government’s inability to satisfy its obligations under the HALEU Operation Contract including supplying government furnished equipment under the HALEU Operation Contract and processing security clearances due to a government shutdown or other reasons; risks related to whether or when government funding or demand for high-assay low-enriched uranium (“HALEU”) for government or commercial uses will materialize; risks related to (i) our ability to perform and absorb costs under our agreement with the U.S. Department of Energy (“DOE”) to deploy and operate a cascade of centrifuges to demonstrate production of HALEU for advanced reactors (the “HALEU Operations Contract”), (ii) our ability to obtain contracts and funding to be able to continue operations and (iii) our ability to obtain and/or perform under other agreements; risks that (i) we may not obtain the full benefit of the HALEU Operation Contract and may not be able or allowed to operate the HALEU enrichment facility to produce HALEU after the completion of the HALEU Operation Contract or (ii) the HALEU enrichment facility may not be available to us as a future source of supply; risks related to actions, including reviews, that may be taken by the U.S. government, the Russian government, or other governments that could affect our ability to perform under our contractual obligations or the ability of our sources of supply to perform under their contractual obligations to us; risks related to uncertainty regarding our ability to commercially deploy a competitive enrichment technology; risks related to the fact that we face significant competition from major producers who may be less cost sensitive or are wholly or partially government owned; risks related to the impact of government regulation and policies including by the DOE and the U.S. Nuclear Regulatory Commission; and other risks and uncertainties discussed in this and our other filings with the SEC.

Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this news release. These factors may not constitute all factors that could cause actual results to differ from those discussed in any forward-looking statement. Accordingly, forward-looking statements should not be relied upon as a predictor of actual results. Readers are urged to carefully review and consider the various disclosures made in this news release and in our other filings with the SEC, including our Annual report on Form 10-K for the year ended December 31, 2022, and our other filings with the SEC that attempt to advise interested parties of the risks and factors that may affect our business. We do not undertake to update our forward-looking statements to reflect events or circumstances that may arise after the date of this news release, except as required by law. ### Contacts: Investors: Dan Leistikow at LeistikowD@centrusenergy.com Media: Lindsey Geisler at GeislerLR@centrusenergy.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

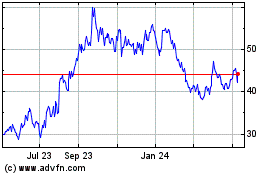

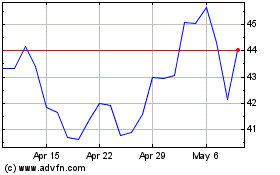

Centrus Energy (AMEX:LEU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Centrus Energy (AMEX:LEU)

Historical Stock Chart

From Apr 2023 to Apr 2024