As filed with the Securities and Exchange Commission on November 16, 2023

Registration No. 333-_______

========================================================================================

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

APYX MEDICAL CORPORATION

(exact name of Registrant as specified in its charter)

| | | | | | | | |

Delaware (State or other jurisdiction of Incorporation or Organization) | | 11-2644611 (I.R.S. Employer Identification Number) |

5115 Ulmerton Road

Clearwater, Florida 33760

(Address of Principal Executive Offices including Zip Code)

Stock Option Agreement effective as of August 27, 2014, by and between Apyx Medical Corporation and Todd Hornsby

Stock Option Agreement effective as of November 3, 2014, by and between Apyx Medical Corporation and Shawn Roman

(Full title of the plan)

____________________________________________

Charles D. Goodwin II

Chief Executive Officer

Apyx Medical Corporation

5115 Ulmerton Road

Clearwater, Florida 33760

(727) 384-2323

(Name and address, including zip code, and telephone

number, including area code, of agent for service)

Copy to:

Adam P. Silvers, Esq.

Dominick Ragno, Esq.

Ruskin Moscou Faltischek, P.C.

1425 RXR Plaza, East Tower, 15th Floor

Uniondale, New York 11556

(516) 663-6600

(516) 663-6643 (facsimile)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer o (Do not check if a smaller reporting company) Smaller reporting company x

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

_________________________________________

EXPLANATORY NOTE

This Registration Statement on Form S-8 (this “Registration Statement”) is being filed for the purpose of registering up to an aggregate of 60,000 shares of common stock, par value $0.001 per share (the “Common Stock”) of Apyx Medical Corporation (the “Company”) for resale, consisting of an anticipated number of shares that may be issued upon the exercise of performance-based non-qualified stock options (the “Inducement Options”) that were granted to certain employees of the Company and previously vested based on the passage of time and subject to continued employment (through the applicable vesting date), pursuant to: (i) the Stock Option Agreement effective as of August 27, 2014, by and between Apyx Medical Corporation and Todd Hornsby (the “Hornsby Stock Option Agreement”); and (ii) the Stock Option Agreement effective as of November 3, 2014, by and between Apyx Medical Corporation and Shawn Roman (the “Roman Stock Option Agreement” and together with the Hornsby Stock Option Agreement, collectively, the “Plans”). The Inducement Options issued pursuant to the Plans were granted outside of the Company’s previously adopted and registered share incentive plans, but are subject to similar terms and conditions. The Plans, Inducement Options, and the shares to be issued thereunder were approved by the Company’s Board of Directors as an inducement to such employee’s acceptance of employment with the Company in accordance with the rules of the applicable exchange the Company was listed on at the time of such issuances.

This Registration Statement includes a prospectus (the “Reoffer Prospectus”) prepared in accordance with General Instruction C and in accordance with the requirements of Part I of Form S-3. This Reoffer Prospectus may be used for reoffers and resales of “restricted securities” and “control securities” (as such terms are defined in Section C of the General Instructions to Form S-8) by the selling stockholders and maybe used on a continuous or delayed basis in the future, by the selling stockholders. The registration of the shares of our Common Stock covered by the Reoffer Prospectus does not necessarily mean that any shares of our Common Stock will be sold by the selling stockholders. The second part of this Registration Statement contains information required in the Registration Statement pursuant to Part II of Form S-8.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the information specified in this Part I have been or will be sent or given to participants in the Plans as specified by Rule 428(b)(1) of the Securities Act of 1933, as amended (the “Securities Act”), in accordance with the rules and regulations of the Securities and Exchange Commission (the “Commission”). Such documents are not being filed with the Commission either as a part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities Act. These documents and the documents incorporated by reference into this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

Item 2. Registrants Information and Employee Plan Annual Information.

The written statement required by Item 2 of Part I is included in documents that will be delivered to participants in the plans covered by this Registration Statement pursuant to Rule 428(b) of the Securities Act. In accordance with the rules and regulations of the Commission and the instructions to Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act.

REOFFER PROSPECTUS

Apyx Medical Corporation

Up to an aggregate of 60,000 Shares of Common Stock

This reoffer prospectus (this “Reoffer Prospectus”) relates to the offer and sale from time to time by the selling stockholders named in this Reoffer Prospectus (the “Selling Stockholders”), or their permitted transferees, of up to an aggregate of 60,000 shares of common stock, par value $0.001 per share (the “Common Stock”), of Apyx Medical Corporation, a Delaware corporation (the “Company”, “Apyx”, “Apyx Medical”, “we”, “us”, “our”). This Reoffer Prospectus covers shares of Common Stock issuable to the Selling Stockholders pursuant to awards of performance-based non-qualified stock options (the “Inducement Options”) that were granted to certain employees of the Company and previously vested based on the passage of time and subject to continued employment (through the applicable vesting date), pursuant to: (i) the Stock Option Agreement effective as of August 27, 2014, by and between Apyx Medical Corporation and Todd Hornsby (the “Hornsby Stock Option Agreement”); and (ii) the Stock Option Agreement effective as of November 3, 2014, by and between Apyx Medical Corporation and Shawn Roman (the “Roman Stock Option Agreement” and together with the Hornsby Stock Option Agreement, collectively, the “Plans”). Specifically, this Reoffer Prospectus covers: (i) 30,000 shares of Common Stock that are issuable upon exercise of outstanding Inducement Options previously granted under the Hornsby Stock Option Agreement; and (ii) 30,000 shares of Common Stock that are issuable upon exercise of outstanding Inducement Options previously granted under the Roman Stock Option Agreement. We are not offering any shares of Common Stock and will not receive any proceeds from the sale of the shares of Common Stock by the Selling Stockholders pursuant to this Reoffer Prospectus. Todd Hornsby, one of the Selling Stockholders is an executive officer, and may be considered an “affiliate” of the Company (as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”)).

Subject to the satisfaction of any conditions to vesting of the shares of Common Stock offered hereby pursuant to the terms of the relevant agreements, and subject to any applicable restrictions, the Selling Stockholders may from time to time sell, transfer or otherwise dispose of any or all of the shares of Common Stock covered by this Reoffer Prospectus through underwriters or dealers, directly to a purchaser, or through broker-dealers or agents. If underwriters or dealers are used to sell the shares of Common Stock, we will name them and describe their compensation in a prospectus supplement. The shares of Common Stock may be sold in one or more transactions at fixed prices, prevailing market prices at the time of sale, prices related to the prevailing market prices, varying prices determined at the time of sale or negotiated prices. We do not know when or in what amount the Selling Stockholders may offer the shares of Common Stock for sale. The Selling Stockholders may sell any, all or none of the shares of Common Stock offered by this Reoffer Prospectus. See “Plan of Distribution” beginning on page 5 for more information about how the Selling Stockholders may sell or dispose of the shares of Common Stock covered by this Reoffer Prospectus. The Selling Stockholders will bear all sales commissions and similar expenses. We will bear all expenses of registration incurred in connection with this offering, including any other expenses incurred by us in connection with the registration and offering that are not borne by the Selling Stockholders.

Shares of Common Stock that are issued pursuant to the Inducement Stock Options granted to Mr. Hornsby will be “control securities” under the Securities Act before their sale under this Reoffer Prospectus. This Reoffer Prospectus has been prepared for the purposes of registering the shares of Common Stock under the Securities Act to allow for future sales by the Selling Stockholders on a continuous or delayed basis to the public without restriction, provided that the amount of

shares of Common Stock to be offered or resold under this Reoffer Prospectus by Mr. Hornsby or any other person with whom he is acting in concert for the purpose of selling shares of Common Stock, may not exceed, during any three-month period, the amount specified in Rule 144(e) under the Securities Act.

Investing in our Securities involves substantial risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 4 of this Reoffer Prospectus for the factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or determined if this Reoffer Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Reoffer Prospectus is November 16, 2023.

TABLE OF CONTENTS

You should read this prospectus, including all documents incorporated herein by reference, together with additional information described under “Where You Can Find More Information.”

You may obtain the information incorporated by reference without charge by following the instructions under “Where You Can Find More Information.”

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Reoffer Prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “aims,” “predicts,” “believes,” “seeks,” “estimates,” and similar expressions or variations of such words are intended to identify forward-looking statements. However, these are not the exclusive means of identifying forward-looking statements. Although forward-looking statements contained in this prospectus reflect our good faith judgment, such statements can only be based on facts and factors currently known to us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual outcomes may differ materially from the results and outcomes discussed in the forward-looking statements, including but not limited to risks, uncertainties and assumptions relating to the regulatory environment in which the Company is subject to, including the Company’s ability to gain requisite approvals for its products from the U.S. Food and Drug Administration and other governmental and regulatory bodies, both domestically and internationally; the impact of the FDA Safety Communication on our business and operations; factors relating to the effects of the COVID-19 pandemic; sudden or extreme volatility in commodity prices and availability, including supply chain disruptions; changes in general economic, business or demographic conditions or trends; changes in and effects of the geopolitical environment; liabilities and costs which the Company may incur from pending or threatened litigations, claims, disputes or investigations. You should review the risks and uncertainties referred to in this prospectus under the heading “Risk Factors.” You should not place undue reliance on forward-looking statements, which speak only as of the date of this prospectus. We undertake no obligation to update publicly any forward-looking statements in order to reflect any event or circumstance occurring after the date of this prospectus or currently unknown facts or conditions or the occurrence of unanticipated events. In addition, our past results are not necessarily indicative of future results, thus, we cannot guarantee future results, levels of activity, performance or achievements. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

•changes in general economic, business or demographic conditions or trends in the U.S. or throughout the world or changes in the political environment, including changes in GDP, military and trade wars, interest rates, economic recession and inflation;

•our ability to maintain sufficient liquidity, meet current debt covenants, and preserve working capital in order to maintain operations;

•our ability to conclude a sufficient number of attractive growth projects, deploy growth capital in amounts consistent with our objectives in the prosecution of those and achieve targeted risk-adjusted returns on any growth project, including the continued commercialization of our Helium Plasma Technology;

•the regulatory environment, including our ability to gain requisite approval from the U.S. Food and Drug Administration (“FDA”) and other governmental and regulatory bodies, both domestically and internationally, including the effects of the recent FDA Medical Device Safety Communication regarding an emerging safety signal of our products;

•our ability to estimate compliance costs, comply with any changes thereto, rates implemented by regulators, and our relationships and rights under, and contracts with, governmental agencies and authorities;

•disruptions or other extraordinary or force majeure events and the ability to insure against losses resulting from such events or disruptions, including disruptions caused by COVID-19 or other global pandemics;

•sudden or extreme volatility in commodity prices and availability, including supply chain disruptions;

•changes in competitive dynamics affecting our business and the medical device industry as a whole;

•technological innovations leading to increased competition in the medical device industry;

•changes in healthcare policy;

•our ability to make alternate arrangements to account for any disruptions or shutdowns that may affect suppliers’ facilities or the operations upon which our business is dependent;

•continued aggressive EPA state regulation of Ethylene oxide sterilization (EtO) commercial plants resulting in additional plant closures, leading to a reduced availability of our handpieces, which are commercially sterilized;

•our ability to implement operating and internal growth strategies;

•environmental risks, including the impact of climate change and weather conditions;

•the impact of weather events, including potentially hurricanes, tornadoes and/or seasonal extremes;

•unplanned outages and/or failures of technical and mechanical systems;

•cybersecurity breaches impacting critical systems or data; and

•work interruptions or other labor stoppages.

RISK FACTORS

Investing in our securities involves certain risks. You should carefully consider the risk factors contained in Item 1A under the caption “Risk Factors” and elsewhere in our annual report on Form 10-K for the fiscal year ended December 31, 2022, which is incorporated into this Reoffer Prospectus by reference, as updated by our annual or quarterly reports for subsequent fiscal years or fiscal quarters that we file with the Securities and Exchange Commission (the “SEC”) and that are so incorporated. See “Where You Can Find More Information” for information about how to obtain a copy of these documents. You should also carefully consider the risks and other information that may be contained in, or incorporated by reference into, any prospectus supplement relating to specific offerings of securities. Each of the referenced risks and uncertainties could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities. Additional risks and uncertainties not known to us or that we believe are immaterial may also adversely affect our business, operating results and financial condition and the value of an investment in our securities.

USE OF PROCEEDS

We will receive no proceeds from the sale of the shares of Common Stock by the Selling Stockholders.

DESCRIPTION OF COMMON STOCK

The description of the Company’s Common Stock contained in its Registration Statement on Form 8-A filed with the SEC on November 3, 2003, including any amendment or report filed for the purpose of updating such description, is incorporated herein by reference.

SELLING STOCKHOLDERS

The table below sets forth information concerning the resale of the shares by the Selling Stockholders. We will not receive any proceeds from the resale of the shares by the Selling Stockholders.

The table below sets forth, as of November 16, 2023 (the “Determination Date”), (i) the name of each person who is offering the resale of shares by this Reoffer Prospectus; (ii) the number of shares that each Selling Stockholder may offer for sale from time to time pursuant to this Reoffer Prospectus, whether or not such Selling Stockholder has a present intention to do so; and (iii) the number of shares (and the percentage, if 1% or greater) of Common Stock each person will own after the offering, assuming they sell all of the shares offered. Unless otherwise indicated, beneficial ownership is direct and the person indicated has sole voting and investment power. Unless otherwise indicated, the address for each Selling Stockholder listed in the table below is c/o Apyx Medical Corporation, 5115 Ulmerton Road, Clearwater, FL 33760.

The Selling Stockholders identified below may have sold, transferred or otherwise disposed of some or all of their shares since the date on which the information in the following table is presented in transactions exempt from or not subject to the registration requirements of the Securities Act. Information concerning the Selling Stockholders may change from time to time and, if necessary, we will amend or supplement this Reoffer Prospectus accordingly. We cannot give an estimate as to the number of shares of Common Stock that will actually be held by the Selling Stockholders upon termination of this offering because the Selling Stockholders may offer some or all of their Common Stock under the offering contemplated by this Reoffer Prospectus or acquire additional shares of Common Stock. The total number of shares that may be sold hereunder will not exceed the number of shares offered hereby. Please read the section entitled “Plan of Distribution” in this Reoffer Prospectus.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selling Stockholder | | Position with Company | | Shares of Common Stock Beneficially Owned Prior to this Offering (1)(2) | | Shares of Common Stock Offered for Resale in this Offering (2) | | Shares of Common Stock Beneficially Owned After this Offering (3) | | Percentage of Shares of Common Stock Beneficially Owned After this Offering (1)(3) |

| Todd Hornsby | | Executive Vice President | | 456,002 | | | 30,000 | | 426,002 | | | 1.2 | % |

| Shawn Roman | | Vice President | | 207,001 | | | 30,000 | | 177,001 | | | * |

*Less than 1%

1.Beneficial ownership and the percentage of shares of Common Stock beneficially owned is computed on the basis of 34,643,855 shares of Common Stock outstanding as of the Determination Date and determined in accordance with the rules and regulations of the SEC.

2.Includes shares of Common Stock issuable upon settlement of stock options, including those that will vest within 60 days from the Determination Date.

3.Assumes that all of the shares of Common Stock held by each Selling Stockholder and being offered under this Reoffer Prospectus are sold, and that no Selling Stockholder will acquire additional shares of Common Stock before the completion of this offering.

Other Material Relationships with the Selling Stockholders

Todd Hornsby Employment Agreement

On September 17, 2020, the Company entered into an Amended and Restated Employment Agreement, effective as of September 17, 2020, with Todd Hornsby, the Company’s Executive Vice President (the “Hornsby Agreement”). The Hornsby Agreement amends and restates Mr. Hornsby’s original employment agreement, dated as of January 1, 2018, in its entirety. The term of Mr. Hornsby’s employment under the Hornsby Agreement commenced as of the effective date thereof and shall continue until terminated in accordance with the terms of the Hornsby Agreement. Under the Hornsby Agreement, Mr. Hornsby will receive an initial annual base salary of $347,000, which shall be reviewed from time to time and may be increased, but not decreased, by the Committee in its sole and exclusive discretion. Mr. Hornsby shall be entitled to participate in (i) any bonus or incentive plan available to the Company’s executives generally, on such terms as the Committee may determine in its discretion, and (ii) the equity-based incentive plans of the Company, pursuant to which he may receive awards thereunder, as determined by the Company’s Board of Directors in its sole discretion from time to time and subject to the terms and conditions of such plans and any applicable award agreement.

In the event Mr. Hornsby’s employment is terminated as a result of death or disability, Mr. Hornsby or his estate shall be entitled to receive (i) any unpaid base salary earned and accrued prior to the date of termination, (ii) reimbursement for expenses incurred prior to the date of termination, (iii) a pro rata bonus for the year of termination, and, (iv) if Mr. Hornsby is eligible for and elects continuation benefits under COBRA, the Company will pay the employer portion of the COBRA coverage premium for the shorter of (x) the 12-month period following the date of termination, or (y) the time at which Mr. Hornsby becomes eligible for medical and dental benefits through another employer. In addition, Mr. Hornsby’s outstanding option grants shall continue to be treated in accordance with the terms of the applicable plan and award agreement, provided that the portion of Mr. Hornsby’s options (i) that were exercisable as of the effective date of the Hornsby Agreement and (ii) that would have become exercisable on the next anniversary of the effective date following the date of termination shall become and remain exercisable for a period of 12 months following the date of termination.

In the event Mr. Hornsby’s employment is terminated by the Company for cause or by Mr. Hornsby without good reason, Mr. Hornsby shall be entitled to receive any unpaid base salary earned and accrued prior to the date of termination, and reimbursement for expenses incurred prior to the date of termination. In addition, in the event Mr. Hornsby’s employment is terminated by Mr. Hornsby without good reason, Mr. Hornsby’s stock option grants shall continue to be treated in accordance with the terms of the applicable plan and award agreement, provided that the portion of Mr. Hornsby’s options which were exercisable as of the date of termination shall remain exercisable for a period of 3 months following the date of termination.

In the event Mr. Hornsby’s employment is terminated by Mr. Hornsby for good reason, by the Company without cause, or in connection with a change of control (as defined in the Hornsby Agreement), Mr. Hornsby shall be entitled to receive (i) any unpaid base salary and other benefits earned and accrued prior to the date of termination, (ii) reimbursement for expenses incurred prior to the date of termination, (iii) a pro rata bonus for the year of termination, (iv) continued payment of his base salary for the twelve (12) month period following the date of termination, and (v) if Mr. Hornsby is eligible for and elects continuation benefits under COBRA, the Company will pay the employer portion of the COBRA coverage premium for the shorter of (x) the 12-month period following the date of termination, or (y) the time at which Mr. Hornsby becomes eligible for medical and dental benefits through another employer. In addition, Mr. Hornsby’s outstanding option grants shall continue to be treated in accordance with the terms of the applicable plan and award agreement, provided that the portion of Mr. Hornsby’s options that (i) were exercisable as of the date of termination and (ii) would have become exercisable on the next anniversary of the effective date following the date of termination, shall become and remain exercisable for a period of 12 months following the date of termination.

The Hornsby Agreement contains customary non-competition, non-solicitation, and confidentiality provisions in favor of the Company.

PLAN OF DISTRIBUTION

The shares of Common Stock covered by this Reoffer Prospectus are being registered by Apyx for the account of the Selling Stockholders.

The shares of Common Stock offered may be sold from time to time directly by or on behalf of each Selling Stockholder in one or more transactions on The Nasdaq Global Select Market or any other stock exchange on which our Common Stock may be listed at the time of sale, in privately negotiated transactions, or through a combination of such methods, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at fixed prices (which may be changed) or at negotiated prices. The Selling Stockholders may sell shares through one or more agents, brokers or dealers or directly to purchasers. Such brokers or dealers may receive compensation in the form of commissions, discounts or concessions from the selling stockholders and/or purchasers of the shares or both. Such compensation as to a particular broker or dealer may be in excess of customary commissions.

In connection with their sales, a Selling Stockholder and any participating broker or dealer may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions they receive and the proceeds of any sale of shares may be deemed to be underwriting discounts and commissions under the Securities Act.

We are bearing all costs relating to the registration of the shares of Common Stock. Any commissions or other fees payable to brokers or dealers in connection with any sale of the shares will be borne by the Selling Stockholders or other party selling such shares. Sales of the shares must be made by the Selling Stockholders in compliance with all applicable state and federal securities laws and regulations, including the Securities Act. In addition to any shares sold hereunder, Selling Stockholders may sell shares of Common Stock in compliance with Rule 144. There is no assurance that the Selling Stockholders will sell all or a portion of the Common Stock offered hereby. The Selling Stockholders may agree to indemnify any broker, dealer or agent that participates in transactions involving sales of the shares against certain liabilities in connection with the offering of the shares arising under the Securities Act. We have notified the Selling Stockholders of the need to deliver a copy of this Reoffer Prospectus in connection with any sale of the shares.

The anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of our Common Stock and activities of the Selling Stockholders, which may limit the timing of purchases and sales of any of the shares of Common Stock by the Selling Stockholders and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of Common Stock to engage in passive market-making activities with respect to the shares of Common Stock. Passive market making involves transactions in which a market maker acts as both our underwriter and as a purchaser of our Common Stock in the secondary market. All of the foregoing may affect the marketability of the shares of Common Stock and the ability of any person or entity to engage in market-making activities with respect to the shares of Common Stock.

Once sold under the registration statement of which this prospectus forms a part, the shares of Common Stock will be freely tradable in the hands of persons other than our affiliates.

LEGAL MATTERS

Unless otherwise indicated in the applicable prospectus supplement, the validity of the shares of Common Stock offered by this Reoffer Prospectus, and any supplement thereto, will be passed upon for us by Ruskin Moscou Faltischek, P.C.

EXPERTS

The consolidated financial statements of Apyx Medical Corporation as of December 31, 2022 and 2021 and for each of the years in the two-year period ended December 31, 2022 incorporated in this Reoffer Prospectus by reference from the Apyx Medical Corporation Annual Report on Form 10-K for the year ended December 31, 2022 have been audited by RSM US LLP, an independent registered public accounting firm, as stated in their report thereon incorporated herein by reference, and have been incorporated in this Reoffer Prospectus and Registration Statement in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at www.sec.gov.

The registration statement and the documents referred to below under “Incorporation of Certain Information by Reference” are also available on our website at http://www.Apyxmedical.com. We have not incorporated by reference into this prospectus the information on our website, and you should not consider it to be a part of this prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The following documents, which have been filed by the Company with the SEC, are hereby incorporated into this Registration Statement of which this Reoffer Prospectus forms a part by reference:

•Our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 16, 2023;

•Our Quarterly Reports on Form 10-Q for its fiscal quarters ended March 31, 2023, June 30, 2023 and September 30, 2023, filed with the Commission on May 11, 2023, August 11, 2023 and November 9, 2023, respectively;

•Our Current Reports on Form 8-K, filed with the SEC on February 24, 2023, March 15, 2023, April 18, 2023, August 16, 2023 and November 9, 2023; and

•The description of the Company’s Common Stock contained in its Registration Statement on Form 8-A filed with the SEC on November 3, 2003, including any amendment or report filed for the purpose of updating such description.

All other reports and other documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part of this Registration Statement from the date of the filing of such reports and documents, except as to any portion of any future annual or quarterly report to stockholders or document or current report furnished under Items 2.02 or 7.01 of Form 8-K that is not deemed filed under such provisions.

For the purposes of this Registration Statement, any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

You should rely only on the information provided or incorporated by reference in this Registration Statement or any related prospectus. The Registrant has not authorized anyone to provide you with different information. You should not assume that the information in this Registration Statement or any related prospectus is accurate as of any date other than the date on the front of the document.

You may contact the Registrant in writing or orally to request copies of the above-referenced filings, without charge (excluding exhibits to such documents unless such exhibits are specifically incorporated by reference into the information incorporated into this Registration Statement). Requests for such information should be directed to:

Apyx Medical Corporation

5115 Ulmerton Road

Clearwater, FL 33760

Attention: Chief Financial Officer

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents By Reference

The following documents previously filed with the Commission by Apyx Medical Corporation (“we,” “us,” “our”, “Company”, “Registrant”, or “Apyx”) are hereby incorporated by reference in this Registration Statement:

(a)The Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Commission on March 16, 2023;

(b)The Company’s Quarterly Reports on Form 10-Q for its fiscal quarters ended March 31, 2023, June 30, 2023, and September 30, 2023 filed with the Commission on May 11, 2023, August 11, 2023, and November 9, 2023, respectively;

(c)The Company’s Current Reports on Form 8-K, filed with the Commission on February 24, 2023, March 15, 2023, April 18, 2023, August 16, 2023 and November 9, 2023 (except in each case for information contained therein which is furnished rather than filed); and

(d)The description of the Company’s Common Stock contained in its Registration Statement on Form 8-A filed with the Commission on November 3, 2003, including any amendment or report filed for the purpose of updating such description.

All other reports and other documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part of this Registration Statement from the date of the filing of such reports and documents, except as to any portion of any future annual or quarterly report to stockholders or document or current report furnished under Items 2.02 or 7.01 of Form 8-K that is not deemed filed under such provisions.

For the purposes of this Registration Statement, any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

You should rely only on the information provided or incorporated by reference in this Registration Statement or any related prospectus. The Registrant has not authorized anyone to provide you with different information. You should not assume that the information in this Registration Statement or any related prospectus is accurate as of any date other than the date on the front of the document.

You may contact the Registrant in writing or orally to request copies of the above-referenced filings, without charge (excluding exhibits to such documents unless such exhibits are specifically incorporated by reference into the information incorporated into this Registration Statement). Requests for such information should be directed to:

Apyx Medical Corporation

5115 Ulmerton Road

Clearwater, FL 33760

Attention: Chief Financial Officer

Item 4. Description of Securities

Not Applicable.

Item 5. Interests of Named Experts and Counsel

Not Applicable.

Item 6. Indemnification of Directors and Officers

Section 145 of the Delaware General Corporation Law (“DGCL”) states:

(a) A corporation shall have the power to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action arising by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner which the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had reasonable cause to believe that the person’s conduct was unlawful.

(b) A corporation shall have power to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that the person is or was a director, officer, employee or agent of the

corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust, or other enterprise against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement of such action or suit if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation and except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expense which the Court of Chancery or such other court shall deem proper.

As permitted under the DGCL, we have adopted provisions in our Certificate of Incorporation, as amended, and By-laws that limit or eliminate the personal liability of our directors for a breach of their fiduciary duty of care as a director. The duty of care generally requires that, when acting on behalf of the corporation, directors exercise an informed business judgment based on all material information reasonably available to them. Consequently, a director will not be personally liable to us or our stockholders for monetary damages or breach of fiduciary duty as a director, except for liability for:

| | | | | | | | | | | |

| • | | Any breach of the director’s duty of loyalty to us or our stockholders; |

| | | | | | | | | | | |

| • | | Any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

| | | | | | | | | | | |

| • | | Any act related to unlawful stock repurchases, redemptions or other distributions or payment of dividends under DGCL Section 174; or |

| | | | | | | | | | | |

| • | | Any transaction from which the director derived an improper personal benefit. |

These limitations of liability do not affect the availability of equitable remedies such as injunctive relief or rescission. Our Certificate of Incorporation, as amended, also authorizes us to indemnify our officers, directors and other agents to the fullest extent permitted under Delaware law.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the company pursuant to the foregoing provisions, or otherwise, we have been informed that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable.

Item 7. Exemption from Registration Claimed

Not Applicable.

Item 8. Exhibits

| | | | | | | | |

Exhibit Number | | Exhibit Description |

5.1* | | |

23.1* | | |

23.2* | | |

24.1* | | |

| 99.1* | | |

| 99.2* | | |

107* | | |

Item 9. Undertakings

(a)The undersigned Registrant hereby undertakes:

(1)To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i)To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

(iii)To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Registration Statement.

(2)That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b)The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in such Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Company certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Clearwater, Florida on the 16th day of November, 2023.

| | | | | |

Apyx Medical Corporation |

| |

| By: | /s/ Charles D. Goodwin II |

| Charles D. Goodwin II |

| Chief Executive Officer and Director |

POWER OF ATTORNEY

Each person whose signature appears below hereby constitutes and appoints Charles D. Goodwin II and Tara Semb as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent or his substitutes or substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

Name | | Title | | Date |

| Directors: | | | | |

| | | | |

/s/ CHARLES D. GOODWIN II | | Chief Executive Officer and Director | | November 16, 2023 |

| Charles D. Goodwin II | | | | |

| | | | |

| /s/ ANDREW MAKRIDES | | Chairman of the Board | | November 16, 2023 |

| Andrew Makrides | | | | |

| | | | |

| /s/ TARA SEMB | | Chief Financial Officer (Principal Accounting Officer and Principal Financial Officer), Treasurer and Secretary | | November 16, 2023 |

| Tara Semb | | | | |

| | | | |

| /s/ JOHN C. ANDRES | | Director | | November 16, 2023 |

| John C. Andres | | | | |

| | | | |

| /s/ LAWRENCE J. WALDMAN | | Director | | November 16, 2023 |

| Lawrence J. Waldman | | | | |

| | | | |

| /s/ MICHAEL GERAGHTY | | Director | | November 16, 2023 |

| Michael Geraghty | | | | |

| | | | |

| /s/ CRAIG SWANDAL | | Director | | November 16, 2023 |

| Craig Swandal | | | | |

| | | | |

| /s/ MINNIE BAYLOR-HENRY | | Director | | November 16, 2023 |

| Minnie Baylor-Henry | | | | |

| | | | |

| /s/ WENDY LEVINE | | Director | | November 16, 2023 |

| Wendy Levine | | | | |

Exhibit 107

Calculation of Filing Fee Table

FORM S-8

(Form Type)

APYX MEDICAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

Security Type | Security Class Title | Fee Calculation Rule | Amount Registered (1) | Proposed Maximum Offering Price Per Unit (2) | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

| Equity | Common Stock, par value $0.001 per share | Other | 30,000 | $4.30 | $129,000 | $0.00014760 | $19.04 |

| Equity | Common Stock, par value $0.001 per share | Other | 30,000 | $4.05 | $121,500 | $0.00014760 | $17.93 |

| Total Offering Amounts | | $250,500 | | $36.97 |

| Total Fee Offsets | | | | |

| Net Fee Due | | | | $36.97 |

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also covers any shares of the common stock, par value $0.001 per share (the “Common Stock”) of Apyx Medical Corporation (the “Company”) that may be issuable under the Plans as set forth herein by reason of any stock split, recapitalization, stock dividend or other similar transaction or capital adjustment effected without receipt of consideration or other similar transaction effected without receipt of consideration that increases the number of the Company’s outstanding shares of Common Stock.

(2) The offering price per share and the maximum aggregate offering price for shares issuable upon exercise of the Inducement Options are based on the exercise price of such options.

__________________________________________

Exhibit 5.1

Writer's Direct Dial: (516) 663-6600

Writer's Direct Fax: (516) 663-6643

November 16, 2023

Apyx Medical Corporation

5115 Ulmerton Road

Clearwater, Florida 33760

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

We have acted as counsel for Apyx Medical Corporation, a Delaware corporation (the “Company”), in connection with the preparation and filing with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Act”), of a Registration Statement on Form S-8 (the “Registration Statement”) relating to the registration of up to an aggregate of 60,000 shares (the “Shares”) of the Company’s common stock, $0.001 par value, pursuant to: (i) the Stock Option Agreement effective as of August 27, 2014, by and between the Company and Todd Hornsby (the “Hornsby Stock Option Agreement”); and (ii) the Stock Option Agreement effective as of November 3, 2014, by and between the Company and Shawn Roman (the “Roman Stock Option Agreement” and together with the Hornsby Stock Option Agreement, collectively, the “Plans”).

In arriving at the opinions expressed below, we have examined and relied on the following documents:

(i) the Registration Statement;

(ii) the Plans;

(iii) the Certificate of Incorporation of the Company, and all amendments thereto;

(iv) the By-Laws of the Company in force as of the date hereof; and

(v) certain resolutions of the Board of Directors of the Company.

In addition, we have examined and relied on the originals or copies certified or otherwise identified to our satisfaction of all such other records, documents and instruments of the Company and such other persons, and we have made such investigations of law, as we have deemed appropriate as a basis for the opinions expressed below. We have assumed the genuineness of all signatures and the authenticity of all documents submitted to us as originals and the conformity to the original documents of all documents submitted to us as certified or photostatic copies. In our examination, we have assumed the genuineness of all signatures, including electronic signatures, the legal capacity and competency of all natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as facsimile, electronic, certified or photocopied copies, and the authenticity of the originals of such copies. In making our examination of executed documents, we have assumed that the parties thereto, other than the Company, had the power, corporate or other, to enter into and perform all obligations thereunder and have also assumed the due authorization by all requisite action, corporate or other, and the execution and delivery by such parties of such documents and the validity and binding effect thereof on such parties. Furthermore, we have assumed that payment of the appropriate exercise price of the options issued under the Plans will be made at the time of exercise in accordance with the Plans.

Based upon the foregoing, we are of the opinion that the Shares, when issued upon the due exercise of the options, against payment therefore will be duly and validly authorized, and upon issuance and delivery in the manner contemplated by the Registration Statement and the Plans, the Shares will be validly issued, fully paid and non-assessable. We assume no obligation to supplement this opinion letter if any applicable law changes after the date hereof or if we become aware of any fact that might change the opinions expressed herein after the date hereof.

This opinion is intended solely for the benefit of the Company and, without our prior written consent, this opinion may not be furnished to (by summary or otherwise) or relied upon by any person, firm or entity and may not be quoted or copied in whole or in part or otherwise referred to in any other document or communication or filed with any governmental agency or person, except as set forth herein.

We consent to the filing of this opinion as Exhibit 5.1 to the Registration Statement and to the reference to our Firm in the Registration Statement. In giving this consent, we do not admit that we are within the category of persons whose consent is required by Section 7 of the Act.

Very truly yours,

/s/ Ruskin Moscou Faltischek P.C.

RUSKIN MOSCOU FALTISCHEK P.C.

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in this Registration Statement on Form S-8 and related Reoffer Prospectus of Apyx Medical Corporation of our report dated March 16, 2023, relating to the consolidated financial statements of Apyx Medical Corporation, appearing in the Annual Report on Form 10-K of Apyx Medical Corporation for the year ended December 31, 2022.

We also consent to the reference to our firm under the heading "Experts" in such Reoffer Prospectus.

/s/ RSM US LLP

Orlando, Florida

November 16, 2023

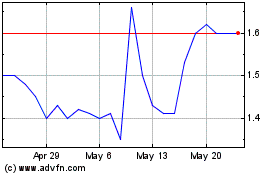

Apyx Medical (NASDAQ:APYX)

Historical Stock Chart

From Mar 2024 to Apr 2024

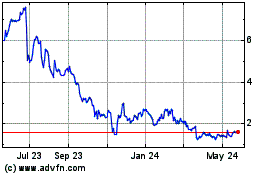

Apyx Medical (NASDAQ:APYX)

Historical Stock Chart

From Apr 2023 to Apr 2024