false

0001396536

0001396536

2023-11-14

2023-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

——————

FORM 8-K

——————

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 14, 2023

——————

Duos Technologies Group, Inc.

(Exact name of registrant as specified in its

charter)

——————

| Florida |

001-39227 |

65-0493217 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

7660 Centurion Parkway, Suite 100, Jacksonville,

Florida 32256

(Address of Principal Executive Offices) (Zip

Code)

(904) 296-2807

(Registrant’s telephone number, including

area code)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock (par value $0.001 per share) |

|

DUOT |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results

of Operations and Financial Condition.

On November 14, 2023, Duos Technologies Group,

Inc. (the "Company") issued a press release announcing the financial and operating results of the Company for the

quarter and nine months ended September 30, 2023. The text of the press release is furnished as Exhibit 99.1 and incorporated

herein by reference.

Additionally, on November 14, 2023, the Company

held an earnings phone call open to the public (the "Earnings Call"). Mr. Chuck Ferry, the Company's Chief Executive

Officer, along with Mr. Andrew W. Murphy, the Company's Chief Financial Officer, discussed the financial and operating results of

the Company for the quarter and nine months ended September 30, 2023. The transcript of the Earnings Call is furnished as Exhibit

99.2 and incorporated herein by reference.

Item 7.01.

Regulation FD Disclosure.

The information

set forth in Item 2.02 of this Current Report on Form 8-K is incorporated by reference into this Item 7.01.

The information

in Item 2.02 and Item 7.01 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, is being furnished and shall not be deemed

"filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as

expressly set forth by specific reference in such filing.

The press release and transcript

of the Earnings Call may also be found on our website at https://www.duostechnologies.com/.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

DUOS TECHNOLOGIES GROUP, INC. |

| |

|

|

| |

|

|

| Dated: November 15, 2023 |

By: |

/s/ Andrew W. Murphy |

| |

|

Andrew W. Murphy

Chief Financial Officer |

| |

|

Exhibit 99.1

Duos Technologies Group Reports Third Quarter 2023

Results

JACKSONVILLE, FL /

Globe Newswire / November 14, 2023 - Duos Technologies Group, Inc.

(“Duos” or the “Company”) (Nasdaq: DUOT), a provider of machine vision and artificial intelligence that

analyzes fast moving vehicles, reported financial results for the third quarter (“Q3 2023”) ended September 30, 2023.

Third Quarter 2023 and Recent Operational

Highlights

| · | Implemented first subscription services agreement with a passenger transit operator. In connection with

the agreement, Duos will offer access to its RIP and artificial intelligence detection models for key inspection points. The agreement,

renewable annually, is initially valued at more than $300,000 and encompasses customer training, setup and ongoing railcar data services

across three existing, active portals. |

| · | Performed 2.3 million comprehensive railcar scans in the third quarter across 13 portals. This metric encompasses all railcars scanned

at locations across the U.S., Canada, and Mexico. |

| · | Upgraded the Company’s centraco® and truevue360™ systems

to enable near “real-time” reporting and facilitate immediate alerts to on-board personnel of any issue that is deemed critical. |

| · | Appointed power and logistics industry veteran Christopher King as Chief Commercial Officer. King joins

Duos with over 20 years of operational and commercial leadership experience within the energy and supply chain sectors. In this role,

King will be focused on commercial and technical delivery in support of current and prospective customers as well as building an intensified

growth strategy and strengthening the Company’s technical strategic partners as it expands its offerings and transitions to a recurring

subscription model. |

| · | As of the end of the third quarter, the Company had $6.4 million of revenue in backlog and expects $1.0

million to $2.0 million to be recognized during the remainder of 2023. |

| · | Strengthened industry collaborations with Dell Technologies and NVIDIA to support AI development and achieve

significant increases in performance at near “real-time” reporting. |

Third Quarter 2023 Financial Results

It should be noted that the following Financial Results represent the

consolidation of the Company with its subsidiaries Duos Technologies, Inc. and TrueVue360, Inc.

Total revenue for Q3 2023 decreased 62% to

$1.53 million compared to $4.02 million in the third quarter of 2022 (“Q3 2022”). Total revenue for Q3 2023 represents an

aggregate of approximately $706,000 of technology systems revenue and approximately $825,000 in recurring services and consulting revenue.

The decrease in total revenue was primarily attributed to a combination of factors. Those factors include delays during Q3 2023, which

were outside of the Company’s control, related to the ongoing production and delivery of two high-speed RIPs as well as year-over-year

timing differences with two freight RIPs under construction during Q3 2022. These timing differences contributed to the year-over-year

variance along with one-time services for major site improvements occurring in Q3 2022 also contributing to the change in services and

consulting revenues in Q3 2023. The Company sees opportunities to continue to expand its programs with existing customers during the current

year and beyond. In spite of the timing delays putting pressure on the quarterly results, management remains confident in the long-term

potential of the RIP product.

Cost of revenues for Q3 2023 decreased 55%

to $1.30 million compared to $2.92 million for Q3 2022. The decrease in cost of revenues

was mainly attributable to the Company remaining in the production and manufacturing phase of the two high-speed RIPs just noted in Q3

2023 while being in the installation phase for the two freight RIPs in Q3 2022.

Gross margin for Q3 2023 decreased 79% to

$227,000 compared to $1.10 million for Q3 2022. The decrease in gross margin was driven by the two previously noted project discrepancies,

in Q3 2023 and Q3 2022, respectively.

Operating expenses for Q3 2023 increased 8%

to $3.20 million compared to $2.97 million for Q3 2022. Sales and marketing costs saw a marginal increase primarily as a result of increased

staffing within the team, while research and development expenses increased by 37% for prospective technologies testing. Overall, the

Company continues to focus on stabilizing operating expenses while meeting the increased needs of its customers.

Net operating loss for Q3 2023 totaled $2.97

million compared to net operating loss of $1.87 million for Q3 2022. The increase in loss from operations was primarily the result of

lower revenues recorded in the current quarter as a consequence of delays in going to field.

Net loss for Q3 2023 totaled $2.95 million

compared to net loss of $1.93 million for Q3 2022. The increase in net loss was mostly attributable to the lower revenues associated with

the timing of project delays noted previously.

Cash and cash equivalents at September 30,

2023 totaled $3.27 million compared to $1.12 million at December 31, 2022. As of quarter end, the Company had an additional $259,000 in

receivables. Duos also held $1.53 million in inventory as of September 30, 2023, consisting primarily of long-lead items for future RIP

installations.

Nine Month 2023 Financial Results

Total revenue decreased

35% to $5.95 million from $9.08 million in the same period last year. Total revenue for the first nine months of 2023 represents an aggregate

of approximately $3.40 million of technology systems revenue and approximately $2.54 million in recurring services and consulting revenue.

The decrease in total revenue was primarily due to the previously noted timing differences. The Company remains optimistic about its long-term

outlook and sees opportunities to continue to expand its programs with existing customers during the current year and beyond through its

growing artificial intelligence catalogue and improved services and maintenance. Despite this positive outlook, a longer commercial cycle

paired with still-protracted supply chain timelines may result in revenue recognition pushing further into 2024. The Company remains focused

on revenue and margin performance in the current environment.

Cost of revenues decreased 24% to $4.94

million from $6.47 million in the same period last year. The decrease in cost of revenues was mainly attributable to project timing discrepancies

in the respective periods previously noted.

Gross margin decreased 61% to $1.01 million

from $2.60 million in the same period last year. The decrease in gross margin was driven by project timing discrepancies in the respective

periods previously noted.

Operating expenses increased 9% to $9.27

million from $8.51 million in the same period last year. The Company managed to maintain its costs for sales and marketing and research

and development at a consistent level, while observing a slight rise in general and administration costs. This increase can be primarily

attributed to a combination of the timing of personnel incentives awarded in 2023 compared to the same period in 2022 and increased amortization

charges stemming from increased investment in artificial intelligence algorithms.

Net operating loss totaled $8.27 million compared

to net operating loss of $5.91 million in the same period last year. The increase in loss from operations was primarily the result of

lower revenues recorded in the first nine months of 2023 as a consequence of the delays noted previously.

Net loss totaled $8.08 million compared

to a net loss of $5.91 million in the same period last year. The increase in net loss was mostly attributable to the lower revenues associated

with the timing discrepancies noted previously.

Financial Outlook

At the end of the third quarter, the Company’s

contracts in backlog represented approximately $6.4 million in revenue, of which approximately $1.0 to $2.0 million is expected to be

recognized during the remainder of 2023. The balance of contract backlog is comprised of multi-year service and software agreements as

well as project revenues spanning into fiscal 2024. The Company also expects a near-term intake of $5.0 million to $7.0 million in multi-year

service and artificial intelligence renewals and contract modifications, which are anticipated to close by the end of this year or early

2024.

Based on the factors previously noted, including

project delays out of the Company’s control, additional delays in customers’ extended budgeting cycles and other macroeconomic

challenges, Duos is withdrawing its previously provided guidance for the full year 2023. The Company will reevaluate providing financial

projections on an ongoing basis and may provide an updated outlook at a later date.

Management Commentary

“Our results for the third quarter were impacted

by several external factors, underscoring the challenges of operating a capex-focused business and further reinforcing our ongoing efforts

to focus on a primarily subscription-based model in the future,” said Duos Chief Executive Officer Chuck Ferry. “These challenges

included a postponement of installation for a major transit system in the Northeast U.S., additional planned projects being pushed out

for budgetary reasons and temporary delays in the initial rollout of our subscription business, the last of which has now been addressed,

enabling us to monetize our first subscription agreement. In response, we have proactively initiated cost reductions in several non-essential

areas to lessen the cash burn during this transition phase while revenues are lower than originally anticipated.

“Commercially, we have a high level of interest

from all Class 1 railroads as well as several short lines and passenger railroads. We currently have active proposals in evaluation with

a handful of different rail carriers for several dozen portals both within our core market in North America and abroad. Regarding subscriptions,

we expect to begin executing a subscription with a large railcar group in the near future, and we are in discussions with another dozen

prospective subscribers. Our current backlog is $6.4 million, and we have another $5 million to $7 million in near-term renewals and contract

modifications, which we anticipate closing in late Q4 2023 and into early Q1 2024.

“Our goal is that the Duos Railcar Inspection

Portal becomes the industry standard for machine vision wayside detection, and I believe that we are a Company that has the leadership

position in the rail sector under that premise. Our transition over the next 12 to 18 months into a recurring revenue business model puts

us in a very strong position to give an expected high return on investment. Despite our current short-term revenue challenges, the Company

remains in a strong financial position with sufficient cash for operations, meaningful near-term business opportunities, and, most importantly,

a growing acceptance of Duos’ technology that will set the stage for the growth that we are anticipating to take Duos to its next

evolution.”

Conference Call

The Company’s management will host a conference

call today, November 14, 2023, at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results, followed by a question-and-answer

period.

Date: Tuesday, November 14, 2023

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

U.S. dial-in: 866-682-6100

International dial-in: 862-298-0702

Confirmation: 13742203

Please call the conference telephone number 5-10

minutes prior to the start time of the conference call. An operator will register your name and organization.

If you have any difficulty connecting with the conference

call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast live via telephone and available

for online replay via the investor section of the Company's website here.

About Duos Technologies Group, Inc.

Duos Technologies Group, Inc. (Nasdaq: DUOT), based

in Jacksonville, Florida, through its wholly owned subsidiary, Duos Technologies, Inc., designs, develops, deploys and operates intelligent

vision based technology solutions supporting rail, logistics, intermodal and government customers that streamline operations, improve

safety and reduce costs. The Company provides cutting edge solutions that automate the mechanical and security inspection of fast-moving

trains, trucks and automobiles through a broad range of proprietary hardware, software, information technology and artificial intelligence.

For more information, visit www.duostech.com.

Forward- Looking Statements

This news release includes forward-looking statements

regarding the Company's financial results and estimates and business prospects that involve substantial risks and uncertainties that could

cause actual results to differ materially. Forward-looking statements relate to future events and typically address the Company's expected

future business and financial performance. The forward-looking statements in this news release relate to, among other things, information

regarding anticipated timing for the installation, development and delivery dates of our systems; anticipated entry into additional contracts;

anticipated effects of macro-economic factors (including effects relating to supply chain disruptions and inflation); timing with respect

to revenue recognition; trends in the rate at which our costs increase relative to increases in our revenue; anticipated reductions in

costs due to changes in the Company's organizational structure; potential increases in revenue, including increases in recurring revenue;

potential changes in gross margin (including the timing thereof); statements regarding our backlog and potential revenues deriving therefrom;

and statements about future profitability and potential growth of the Company. Words such as "believe," "expect,"

"anticipate," "should," "plan," "aim," "will," "may," "should,"

"could," "intend," "estimate," "project," "forecast," "target," "potential"

and other words and terms of similar meaning, typically identify such forward-looking statements. Forward-looking statements involve risks

and uncertainties and there are important factors that could cause actual results to differ materially from those expressed or implied

by these forward-looking statements. These factors include, but are not limited to, the Company's ability to continue as a going concern,

the Company's ability to generate sufficient cash to continue and expand operations, the competitive environment generally and in the

Company's specific market areas, changes in technology, the availability of and the terms of financing, changes in costs and availability

of goods and services, economic conditions in general and in the Company's specific market areas, changes in federal, state and/or local

government laws and regulations potentially affecting the use of the Company's technology, changes in operating strategy or development

plans and the ability to attract and retain qualified personnel. The Company cautions that the foregoing list of risks, uncertainties

and factors is not exclusive. Additional information concerning these and other risk factors is contained in the Company's most recently

filed Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other filings filed

by the Company with the U.S. Securities and Exchange Commission (the "SEC"), which are available at the SEC's website, http://www.sec.gov.

The Company believes its plans, intentions and expectations reflected in or suggested by these forward-looking statements are based on

reasonable assumptions. No assurance, however, can be given that the Company will achieve or realize these plans, intentions or expectations.

Indeed, it is likely that some of the Company's assumptions may prove to be incorrect. The Company's actual results and financial position

may vary from those projected or implied in the forward-looking statements and the variances may be material. Each forward-looking statement

speaks only as of the date of the particular statement. We do not undertake or accept any obligation or undertaking to release publicly

any updates or revisions to any forward-looking statements to reflect any change in our expectations or any change in events, conditions

or circumstances on which any forward-looking statement is based, except as required by law. All subsequent written and oral forward-looking

statements concerning the Company or other matters attributable to the Company or any person acting on its behalf are expressly qualified

in their entirety by the cautionary statements above.

Contacts

Corporate

Fei Kwong, Director, Corporate Communications

Duos Technologies Group, Inc. (Nasdaq: DUOT)

904-652-1625

fk@duostech.com

Investor Relations

Matt Glover or Tom Colton

Gateway Group

949-574-3860

DUOT@gateway-grp.com

DUOS TECHNOLOGIES GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

| | | |

| | | |

| | | |

| | |

| | |

For the Three Months Ended | | |

For the Three Months Ended | | |

For the Nine Months Ended | | |

For the Nine Months Ended | |

| | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| REVENUES: | |

| | | |

| | | |

| | | |

| | |

| Technology systems | |

$ | 705,849 | | |

$ | 2,709,899 | | |

$ | 3,404,107 | | |

$ | 6,273,213 | |

| Services and consulting | |

| 825,074 | | |

| 1,312,339 | | |

| 2,541,163 | | |

| 2,805,483 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Revenues | |

| 1,530,923 | | |

| 4,022,238 | | |

| 5,945,270 | | |

| 9,078,696 | |

| | |

| | | |

| | | |

| | | |

| | |

| COST OF REVENUES: | |

| | | |

| | | |

| | | |

| | |

| Technology systems | |

| 883,836 | | |

| 2,176,761 | | |

| 3,723,151 | | |

| 5,016,551 | |

| Services and consulting | |

| 420,499 | | |

| 745,925 | | |

| 1,217,022 | | |

| 1,457,913 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Cost of Revenues | |

| 1,304,335 | | |

| 2,922,686 | | |

| 4,940,173 | | |

| 6,474,464 | |

| | |

| | | |

| | | |

| | | |

| | |

| GROSS MARGIN | |

| 226,588 | | |

| 1,099,552 | | |

| 1,005,097 | | |

| 2,604,232 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES: | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing | |

| 353,386 | | |

| 297,057 | | |

| 962,040 | | |

| 956,937 | |

| Research and development | |

| 450,006 | | |

| 329,424 | | |

| 1,392,692 | | |

| 1,296,480 | |

| General and administration | |

| 2,394,173 | | |

| 2,342,089 | | |

| 6,916,390 | | |

| 6,255,926 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Operating Expenses | |

| 3,197,565 | | |

| 2,968,570 | | |

| 9,271,122 | | |

| 8,509,343 | |

| | |

| | | |

| | | |

| | | |

| | |

| LOSS FROM OPERATIONS | |

| (2,970,977 | ) | |

| (1,869,018 | ) | |

| (8,266,025 | ) | |

| (5,905,111 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSES): | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (1,406 | ) | |

| (2,057 | ) | |

| (5,816 | ) | |

| (7,943 | ) |

| Other income, net | |

| 24,647 | | |

| (53,993 | ) | |

| 191,022 | | |

| 698 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Other Income (Expenses) | |

| 23,241 | | |

| (56,050 | ) | |

| 185,206 | | |

| (7,245 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS | |

$ | (2,947,736 | ) | |

$ | (1,925,068 | ) | |

$ | (8,080,819 | ) | |

$ | (5,912,356 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted Net Loss Per Share | |

$ | (0.41 | ) | |

$ | (0.30 | ) | |

$ | (1.12 | ) | |

$ | (1.01 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Shares-Basic and Diluted | |

| 7,240,632 | | |

| 6,450,180 | | |

| 7,189,256 | | |

| 5,859,375 | |

DUOS TECHNOLOGIES GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| | |

| | | |

| | |

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

| (Unaudited) | | |

| | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash | |

$ | 3,266,916 | | |

$ | 1,121,092 | |

| Accounts receivable, net | |

| 258,874 | | |

| 3,418,263 | |

| Contract assets | |

| 1,346,731 | | |

| 425,722 | |

| Inventory | |

| 1,525,913 | | |

| 1,428,360 | |

| Prepaid expenses and other current assets | |

| 355,978 | | |

| 441,320 | |

| | |

| | | |

| | |

| Total Current Assets | |

| 6,754,412 | | |

| 6,834,757 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 555,485 | | |

| 629,490 | |

| Operating lease right of use asset | |

| 4,454,714 | | |

| 4,689,931 | |

| Security deposit | |

| 550,000 | | |

| 600,000 | |

| | |

| | | |

| | |

| OTHER ASSETS: | |

| | | |

| | |

| Note receivable, net | |

| 151,875 | | |

| — | |

| Patents and trademarks, net | |

| 121,051 | | |

| 69,733 | |

| Software development costs, net | |

| 793,618 | | |

| 265,208 | |

| Total Other Assets | |

| 1,066,544 | | |

| 334,941 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 13,381,155 | | |

$ | 13,089,119 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable | |

$ | 619,765 | | |

$ | 2,290,390 | |

| Notes payable - financing agreements | |

| 137,816 | | |

| 74,575 | |

| Accrued expenses | |

| 275,277 | | |

| 453,023 | |

| Equipment financing payable-current portion | |

| — | | |

| 22,851 | |

| Operating lease obligations-current portion | |

| 774,306 | | |

| 696,869 | |

| Contract liabilities | |

| 1,588,928 | | |

| 957,997 | |

| | |

| | | |

| | |

| Total Current Liabilities | |

| 3,396,092 | | |

| 4,495,705 | |

| | |

| | | |

| | |

| Operating lease obligations, less current portion | |

| 4,310,853 | | |

| 4,542,943 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 7,706,945 | | |

| 9,038,648 | |

| | |

| | | |

| | |

| Commitments and Contingencies (Note 4) | |

| — | | |

| — | |

| | |

| | | |

| | |

| STOCKHOLDERS' EQUITY: | |

| | | |

| | |

| Preferred stock: $0.001 par value, 10,000,000 authorized, 9,441,000 shares available to be designated | |

| — | | |

| — | |

| Series A redeemable convertible preferred stock, $10 stated value per share, 500,000 shares designated; 0 and 0 issued and outstanding at September 30, 2023 and December 31, 2022, respectively, convertible into common stock at $6.30 per share | |

| — | | |

| — | |

| Series B convertible preferred stock, $1,000 stated value per share, 15,000 shares designated; 0 and 0 issued and outstanding at September 30, 2023 and December 31, 2022, respectively, convertible into common stock at $7 per share | |

| — | | |

| — | |

| Series C convertible preferred stock, $1,000 stated value per share, 5,000 shares designated; 0 and 0 issued and outstanding at September 30, 2023 and December 31, 2022, respectively, convertible into common stock at $5.50 per share | |

| — | | |

| — | |

| Series D convertible preferred stock, $1,000 stated value per share, 4,000 shares designated; 1,299 and 1,299 issued and outstanding at September 30, 2023 and December 31, 2022, respectively, convertible into common stock at $3 per share | |

| 1 | | |

| 1 | |

| Series E convertible preferred stock, $1,000 stated value per share, 30,000 shares designated; 4,000 and 0 issued and outstanding at September 30, 2023 and December 31, 2022, respectively, convertible into common stock at $3 per share | |

| 4 | | |

| — | |

| Series F convertible preferred stock, $1,000 stated value per share, 5,000 shares designated; 5,000 and 0 issued and outstanding at September 30, 2023 and December 31, 2022, respectively, convertible into common stock at $6.20 per share | |

| 5 | | |

| — | |

| Common stock: $0.001 par value; 500,000,000 shares authorized, 7,248,455 and 7,156,856 shares issued, 7,247,131 and 7,155,552 shares outstanding at September 30, 2023 and December 31, 2022, respectively | |

| 7,248 | | |

| 7,156 | |

| Additional paid-in-capital | |

| 66,267,057 | | |

| 56,562,600 | |

| Accumulated deficit | |

| (60,442,653 | ) | |

| (52,361,834 | ) |

| Sub-total | |

| 5,831,662 | | |

| 4,207,923 | |

| Less: Treasury stock (1,324 shares of common stock at September 30, 2023 and December 31, 2022) | |

| (157,452 | ) | |

| (157,452 | ) |

| Total Stockholders' Equity | |

| 5,674,210 | | |

| 4,050,471 | |

| | |

| | | |

| | |

| Total Liabilities and Stockholders' Equity | |

$ | 13,381,155 | | |

$ | 13,089,119 | |

DUOS TECHNOLOGIES GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

| | | |

| | |

| | |

For the Nine Months

Ended | |

| | |

September

30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Cash from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (8,080,819 | ) | |

$ | (5,912,356 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 393,057 | | |

| 225,825 | |

| Stock based compensation | |

| 499,590 | | |

| 592,177 | |

| Stock issued for services | |

| 105,565 | | |

| 120,000 | |

| Amortization of operating lease right of use asset | |

| 235,217 | | |

| 198,790 | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 3,159,389 | | |

| (454,431 | ) |

| Note receivable | |

| (151,875 | ) | |

| — | |

| Contract assets | |

| (921,009 | ) | |

| (820,938 | ) |

| Inventory | |

| (97,552 | ) | |

| (395,787 | ) |

| Security deposit | |

| 50,000 | | |

| — | |

| Prepaid expenses and other current assets | |

| 543,793 | | |

| 15,539 | |

| Accounts payable | |

| (1,670,625 | ) | |

| 605,129 | |

| Accrued expenses | |

| (178,081 | ) | |

| (136,180 | ) |

| Operating lease obligation | |

| (154,653 | ) | |

| 60,668 | |

| Contract liabilities | |

| 630,931 | | |

| 2,051,109 | |

| | |

| | | |

| | |

| Net cash used in operating activities | |

| (5,637,072 | ) | |

| (3,850,455 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of patents/trademarks | |

| (58,208 | ) | |

| (17,490 | ) |

| Purchase of software development | |

| (640,609 | ) | |

| (87,700 | ) |

| Purchase of fixed assets | |

| (199,618 | ) | |

| (311,327 | ) |

| | |

| | | |

| | |

| Net cash used in investing activities | |

| (898,435 | ) | |

| (416,517 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Repayments of insurance and equipment financing | |

| (395,221 | ) | |

| (303,492 | ) |

| Repayment of finance lease | |

| (22,851 | ) | |

| (69,325 | ) |

| Proceeds from common stock issued | |

| — | | |

| 8,550,002 | |

| Stock issuance cost | |

| (17,645 | ) | |

| (837,467 | ) |

| Proceeds from shares issued under Employee Stock Purchase Plan | |

| 117,048 | | |

| — | |

| Proceeds from preferred stock issued | |

| 9,000,000 | | |

| 999,000 | |

| | |

| | | |

| | |

| Net cash provided by financing activities | |

| 8,681,331 | | |

| 8,338,718 | |

| | |

| | | |

| | |

| Net increase in cash | |

| 2,145,824 | | |

| 4,071,746 | |

| Cash, beginning of period | |

| 1,121,092 | | |

| 893,720 | |

| Cash, end of period | |

$ | 3,266,916 | | |

$ | 4,965,466 | |

| | |

| | | |

| | |

| Supplemental Disclosure of Cash Flow Information: | |

| | | |

| | |

| Interest paid | |

$ | 5,816 | | |

$ | 8,045 | |

| Taxes paid | |

$ | — | | |

$ | 1,264 | |

| | |

| | | |

| | |

| Supplemental Non-Cash Investing and Financing Activities: | |

| | | |

| | |

| Notes issued for financing of insurance premiums | |

$ | 458,452 | | |

$ | 353,244 | |

Exhibit 99.2

Duos Technologies Group, Inc.

Third Quarter 2023 Earnings Conference Call

November 14, 2023

Chuck Ferry, Chief Executive Officer

Andrew Murphy, Chief Financial Officer

Q&A Participants

Owen Rickert - Northland Securities

Rafiq Khalid - Ascendiant Capital

Operator

Good afternoon. Welcome to Duos Technologies Third

Quarter 2023 Earnings Conference Call.

Joining us on today's call are Duos' CEO, Chuck Ferry,

and CFO, Andrew Murphy. Following their remarks, we will open the call for your questions. Then, before we conclude today's call, I'll

provide the necessary cautions regarding the forward-looking statements made by management during this call.

Now, I would like to turn the call over to Duos'

CEO, Chuck Ferry. Sir, please proceed.

Chuck Ferry

Welcome, everyone, and thank you for joining us.

Earlier today, we issued a press release announcing our financial results for the third quarter, as well as other operational highlights.

A copy of the press release is available in the Investor Relations section of our website.

I encourage all listeners to view that release, as

well as our 10-Q filing with the SEC to better understand some of the details we'll be discussing during our call.

Today, I'm going to discuss my assessment that the

company is in the best position it has ever been to achieve our strategy and long-term value, despite some short-term financial headwinds,

which Andrew will walk us through in a moment.

I want to remind everyone that we believe Duos is

currently the North American rail industry leader in machine vision and artificial intelligence wayside detection technology.

Three of the six Class 1 railroads, plus Ferromex

and Amtrak, use our railcar inspection solution with strong results. During the third quarter, we scanned 2.3 million railcars. And subsequent

to the end of the quarter, I'm happy to report our detections are now deployed with all of our railroad customers. While full adoption

of machine vision wayside technology, paired with AI, is going more slowly than we would like, there is strong consensus among industry

leaders that this technology will be fully adopted in the coming years, as the rail industry makes continued safety improvements.

We believe that Duos is in a strong position with the support of our current rail customers to be in the leading edge of this adoption.

What is critical for us in the coming 12 to 18 months

is the transition from a volatile CapEx only business to a machine vision artificial intelligence subscription business with steady recurring

revenue. We'll discuss our plan and the critical milestones to lead this, after we review the financial results. Andrew.

Andrew Murphy

Thank you, Chuck. As we have discussed in previous

calls, Duos has historically operated with periods of intermittent growth, interspersed with temporary lulls, as large new contracts begin

the execution cycle and progress through various stages of development.

More recently, we've discussed the strategic shift

of the business toward a recurring revenue model given the volatility and previously noted forecast challenges of our legacy CapEx focused

structure. Our results for Q3 exemplify this volatility and revenue underscoring the challenges in a CapEx model and support our ongoing

efforts to focus on primarily subscription based model in the future.

To be clear, the business is in a strong position,

both fundamentally and financially. However, contract timing represents Duos' biggest threat to predictability. This makes quarter-over-quarter

comparisons not necessarily meaningful to the current position of the company.

As a result, the focus of today's call is an assessment

of where we currently stand in our long-term vision and strategy to transform our business into a sustainable, predictable leading technology

company. For that reason, I will be brief in my commentary to allow for analysis on the strategic vision.

Now, let's get into our results for the third quarter.

Total revenue for the third quarter of 2023 was $1.53 million and $5.95 million for the first nine months of 2023. This was a decrease

in total revenue on a year-over-year basis for both periods, driven by a combination of factors including customer driven delays on key

projects, originally slated to be completed late in the third quarter, 2023, and timing of new CapEx projects.

Gross margin was $227,000 for the third quarter of

2023 and $1.01 million for the first nine months of 2023. This represents a decrease in revenue on a year-over-year basis, largely driven

by the same period over period drivers noted in revenue.

Operating expenses for the third quarter were $3.2

million and $9.27 million for the first nine months of 2023.

Of note, expenses were essentially flat from Q2 2023,

to Q3 2023. And the company has implemented several expense reductions which will manifest themselves in the fourth quarter of 2023, and

beyond.

Net operating loss for the third quarter totaled

$2.97 million and $8.27 million for the nine months ended September 30 2023. The loss from operations was primarily the result of continued

lower revenues recorded in the third quarter and year-to-date, as a consequence of the project delays previously noted. This had a similar

impact on overall net loss.

For the three months ended September 30 2023 and

2022, net loss per common share was $0.41 and $0.30, respectively. For the nine months ended September 30 2023 and 2022, net loss per

common share was $1.12, and $1.01, respectively.

Let's now discuss the balance sheet. We ended the

quarter with approximately $3.27 million in cash and cash equivalents. We have an additional $0.25 million in receivables, as well as

$1.35 million in contract assets, together constituting over $1.6 million in future cash flow, as well as $1.5 million of inventory consisting

primarily of long lead items for two pending RIP installations.

Subsequent to the end of the quarter, in early November,

the company took in net proceeds of $2.5 million for the sale of Series E Convertible Preferred Stock with an existing investor.

As of this call, the company has approximately $4.1

million in cash and cash equivalents. Duos continues to have the support of our long-term shareholders who recognize the strategic path

the company is pursuing, as evidenced by its most recent capital infusion, and we appreciate their continued support as we implement our

subscription platform.

At the end of the third quarter, our contracts and

backlog represented approximately $6.4 million in revenue, and we have approximately $5 million to $7 million in near term renewals and

contract modifications, providing additional visibility in future revenue performance and cash receipts.

We remain encouraged by the long-term nature of our

contracts and believe our maintenance and artificial intelligence services ensure that the railcar inspection portals are critical to

three of the six Class 1 railroads and our other major transit and freight operators ongoing network operations.

The net effect of the aforementioned timing challenges

during 2023 is that we will not be able to book sufficient revenue to meet our guidance range and, thus, are withdrawing full year 2023

revenue guidance. While the near term results have been lower than expected, I am confident in the long-term vision and progression towards

those objectives.

As noted, we are sufficiently capitalized to execute

our near term plans. The business has no debt, and we hold inventory on the balance sheet to execute anticipated projects. This flexibility

gives us bandwidth to take advantage of contracts that are pending and expected to be signed in the next few months, as well as convert

some of the key subscriptions and CapEx projects in our pipeline.

This financial position, coupled with our expected

success of our strategic initiatives, will position the company for growth of its recurring revenues and positive overall outlook. In

summary, we are financially positioned to execute our current plans, and we have visibility to near term cash from the combination of

backlog and forthcoming change orders.

That concludes my financial commentary. And I'll

now pass it back over to Chuck.

Chuck Ferry

Thank you, Andrew. Let's briefly discuss where we

are as a company right now. Our current customers and many potential new customers have told us that, technically, our railcar inspection

portal is the best-in-class in terms of performance, reliability and standardization of the hardware, software, IT infrastructure, and

artificial intelligence.

Major advancements have been made in AI development.

And I'm pleased to say that all of Duos’ customers are using our AI detections catalog of 40 plus use cases with excellent results.

In some applications, our customers are using the portals and detections catalog to obtain regulatory waivers.

We have continued to invest in research and development

to stay at the forefront of the industry. This coming year, we will deploy a new thermal undercarriage examiner, a new 360 degree wheel

and brake inspection system and a new hot bearing detector system, all of which can be integrated into the existing railcar inspection

portal.

Another key technical breakthrough deployed to the

track edge is a system update whereby the portals can acquire, compute and present inspection results in as little as 60 seconds after

the railcar passes through the portal, which allows for instant notification to train crews, dispatchers and railroad mechanical teams.

This achievement has been publicly recognized by

two of our technical partners, Dell Computers and NVIDIA. Another compelling feature is that our machine vision AI safety data is exchangeable

and can be uniformly distributed amongst the stakeholders of the larger rail network in near real time.

Commercially, we have a lot of high level interest--we

have a high level of interest for all the Class 1s, several short lines and passenger railroads. Our backlog at the end of the quarter

of approximately $6.4 million, with another $5 million to $7 million of near term contract modifications, as well as multiyear service

extensions expected on next two quarters with existing customers further emphasizes the long-term value in the RIP program.

We currently have active proposals and evaluation

with a handful of different rail carriers, for dozens of new portals, which also includes larger international opportunities. As we've

always stated, the closing cycle for new CapEx deals is slow and episodic. That is exactly why we've decided to shift our focus to the

subscription model, which does a couple of things. First, it doesn't change our original total addressable market of 150 portals to effectively

cover the North American network.

Second, it now adds hundreds of car owners, lessors

and shippers, many of whom have shown strong interest in using our safety data to more effectively manage the maintenance of their fleet,

to improve safety and overall car utilization rates.

We currently have two subscription customers, one

is a passenger rail carrier, and the other is one of the largest car operating companies in North America. We are also in discussions

with a dozen other prospective subscribers. I expect that with support from our partners, our subscriptions will grow significantly in

the near future to promote a safer rail network.

So now let me outline our plan and the key milestones

to watch that will, ultimately, set our course for a profitable business.

The first key milestone is partnering with existing

customers where we already have portals, which will enable us to offer subscriptions to car owners and shippers. We were also in discussions

to build a first subscription portal where we will own and operate it at one of the nation's busiest interchange points for hard hazardous

cargo.

As you can imagine, post East Palestine, there has

been renewed interest across the industry to share safety data from wayside detection systems. In this concept, a rail carrier benefits

by having cars arrive on its network in better mechanical condition, which is both safer and an enabler to improve overall car utilization

rate.

The carriers can also benefit by seeing the railcars

before they accept them and interchange with them.

The second is continuing our commercial efforts with

the other Class 1s not using our technology. I recently read a government report on lessons learned from the implementation of positive

train control.

The primary challenge was to achieve interoperability

and the ability to easily exchange data amongst carriers and other stakeholders. As with the adoption of any safety technology, the long

game is to have this interoperability and do it with minimal investment across all stakeholders.

The third is to continue to work with our railroad

partners to gain support from key industry stakeholders, such as the American Association of Railroads, the Federal Rail Administration,

labor unions, and others.

The fourth is to work with our partners on a southern

border strategy. One of our Class 1 partners is already using our technology which is highly capable of identifying illegal riders for

waiver application to move to rail commerce faster and more securely across the southern border, as nearshoring becomes a more critical

issue for the United States.

We are currently in discussions with our rail partners

and federal rail, federal and state law enforcement agencies to expand the use of our technology to better enable these organizations

to securely move commerce across the border.

The final milestone is to expand our solution internationally.

We already have several proposals in active evaluation for a handful of portals and have several additional opportunities that we're working

on in our commercial pipeline.

To be clear, our plan is that the Duos railcar inspection

portal becomes the industry standard for machine vision and wayside detection, enabled with AI. The portals will be installed across the

entire North American rail network and, eventually, around the globe, whether owned by Duos or our customers and operate them for the

sharing of safety data amongst the Class 1s, short lines, passenger, regulatory, other federal state and local authorities.

Portals would form part of an overall safety management

system where data from all wayside detection systems, onboard telemetry data and other real track network data can be viewed in a single

system.

Highly functional analytics and AI will be applied

and the information used by human operators to make decisions and take actions in near real time. If we are successful in achieving our

goal, we would have 100 to 150 portals installed on a North American network, all allowing for data access via subscriptions. Under this

model, the business would generate annual recurring revenues that are many factors above our current CapEx focused business model.

So, what are the risks to achieving our goals? Primary

risks are project delays and timing of revenue recognition and cash collection. The current CapEx model remains episodic and difficult

to forecast, but will continue to be a part of our revenue structure in the foreseeable future.

We have shown we can manage through this in the past,

and we will continue to see this kind of pressure as we transition to a subscription model. Another risk is the speed with which the industry

will adopt this cutting edge technology.

As I've said, there is broad consensus across all

railroad stakeholders that technology such as ours is needed and will be widely implemented. The impending Railway Safety Act, whether

it passes or not, has spurred the entire industry to get even more focused on safety. Our technology can also be a key technical enabler

for our rail operators and law enforcement agencies at the southern border.

In closing, I want to highlight that I believe our

company has a leadership position in the rail sector, with machine vision and AI wayside detection. Our transition over the next 12 to

18 months into a recurring revenue business model, selling into a growing demand for this technology puts us in a very strong position

to give an unexpected high return on investment to our loyal shareholders.

I also believe that despite our current short-term

revenue challenges, the company remains in good financial position with sufficient cash from operations and near term business opportunities

that will accomplish the key milestones I discussed earlier and provide a good return to our shareholders.

And with that, we're ready to open the call for your

questions. Operator, would you please provide the appropriate instructions?

Operator

Thank you. The floor is now open for questions. If

you do have a question, please press “*”, “1” on your telephone keypad, at this time. If your question has been

answered, you can remove yourself from the queue by pressing “1”. Again, ladies and gentlemen, it’s “*”,

“1”. Please hold while we poll for questions.

Our first question comes from Mike Latimore from

Northland Securities. Go ahead, Mike.

Owen Rickert

Hey, guys. This is Owen Rickert on for Mike. tonight.

First question, is the postponement of deployments with the large transit customer a cancellation? And if not a cancellation, will deployments

occur in ’24?

Chuck Ferry

Yeah, thanks for the question. To be real clear,

it is not, I say again not, a cancellation, it is a delay. For that customer right there that's up along the northeast corridor, what's

going on is you've got two large tunnel projects and a bridge project that are north of our portal locations. And project delays out of

our control at those three sites have caused delays around the civil works, and some of the other preparatory works to insert those portals.

So, we're definitely expecting to complete those

portals in the coming year. But again, I think that customer is managing themselves through some project delays. And unfortunately, we

are being impacted from that.

That being said, I want to add that that customer

has worked very closely with us and has actually added a number of additional contract modifications and other modifications to add additional

work in the form of subscriptions, that is actually added to the overall value of that customer. So while we're--while the delays are

frustrating for us, it has actually added to the overall value to the overall backlog for the company.

Owen Rickert

Got it, thanks. And then what are you guys assuming

for sales cycles on subscription deals? And how many subscription customers are you expecting to land in fiscal year ‘24?

Chuck Ferry

Yeah, as we talked before, the sales cycle for a

normal CapEx sale is oftentimes, it'll run 12 to 18 months, which is a long cycle. In the subscription cycle, we've already been through

this; that sales cycle is shorter. I would probably place at about anywhere from three to nine months, depending on the customer.

We already have two solid subscription customers

now. And we're already talking to a dozen or so others. Each of them has their own separate set of situations. So, I would expect we would

probably add at least six to 12 additional subscription customers over the course of 2024, at a minimum, as we progress.

Owen Rickert

Okay, and then last one. Do many customers want to

see a few more subscription examples up and running before deciding to go the subscription route?

Chuck Ferry

Look, I’ll try to categorize like this; I’ll

just try to be very transparent. The type of data, the type of safety data, which is machine vision, and artificial intelligence driven,

is pretty new to this industry. A lot of the car owners and shippers have not previously had access to this data.

Now, the Class 1 carriers have had access to this

data now for a couple of years; certainly our three main customers. And I believe as we go forward, our current Class 1 customers will

actually help and assist in kind of talking about the use of that data and help us actually drive bringing on those subscription customers.

I will say that the current shippers and car owners

are kind of looking at as to how the Class 1 customers use that data. And in the discussions that we're having, which are very detailed

and very technical, there's a lot of excitement for how they can use it, and how they can use that to make sure as an enabler to keep

their core utilization rates higher at this point.

Owen Rickert

Got it. Thanks, guys.

Chuck Ferry

Thanks for the questions.

Operator

And our next question comes from Rafiq Khalid from

Ascendiant Capital. Go ahead.

Rafiq Khalid

Hi, it’s Rafiq for Edward Woo. Two questions.

First one, can you talk a little bit about, or expand on your international marketing efforts? And then the second one, do you see any

change in demand when there's a government shutdown or upcoming elections?

Chuck Ferry

Yeah, so on the first question, particularly over

the last year, we've taken a lot of inquiries, internationally. These inquiries have come in from Europe, they've come in from Australia,

they've come in from the Middle East, and we've also seen inquiries come in, obviously, from Canada and Mexico, but also down in Latin

America. In terms of marketing, we've approached it one of two ways. Number one, we're very fortunate that we haven't done a lot of international

marketing directly, but we've still taken an increase.

So, I think that comes from having a good website

and I think having an overall good reputation within the Class 1, the American, North American Class 1 network. A lot of times the calls

come in, after they've queried some of our customers, so that's really helpful.

We have taken in some of our leads, if you will,

internationally, from our technology partners, both Dell Computers and NVIDIA, which we're very thankful for. And then the third pathway,

internationally, has been working with partners. There are some larger wayside detection and rail vendor partners. I don't want to name

them publicly, right now.

But we are partnered with one or two of the larger

rail vendors in the international market that have a good international footprint, where we've partnered with them on some of these international

opportunities. So, we're excited to do that. And it certainly, in that partnership, allows us to be a little bit more aggressive in some

of the requests for proposals that are currently under evaluation.

On the second question, the government shutdown.

As you know, I spent a number of years in the Army so we used to be always very careful to watch government shutdowns. They can be very

disruptive to not only employees but also their families. In our case, a government shutdown, I do not see that impacting our business,

at this time.

Again, most of our business is with commercial entities

that are not at least directly impacted by that. Our one true government customer right now, as it stands, last time we were threatened

with the shutdown or gone through shutdowns, it did not impact us. If we had an extended shutdown, our one passenger rail customer, it

could impact them.

But right now, I don't really--I'm not particularly

concerned about it. Andrew, unless you see it differently, that's kind of my take on it.

Andrew Murphy

No, I think that's a very consistent approach with

what we've seen so far with that customer.

Rafiq Khalid

Thank you for taking my question.

Chuck Ferry

Okay, any other questions I’d appreciate, we'll

answer for you.

Operator

Again, ladies and gentlemen, it’s “*”,

“1” to ask a question on the phone. Please hold while we poll. And at this time, this concludes our question and answer session.

I would now like to turn the floor back over to Mr. Ferry for his closing remarks.

Chuck Ferry

Thanks, Operator. I appreciate your support today,

and thank you, everyone, for joining us. And thank you, especially, for our shareholders that are on the call, today.

Operator

Before we conclude today's call, I would like to

provide Duos' Safe Harbor statement that includes important cautions regarding forward-looking statements made during this call. The earnings

call contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking terminology such as believes, expects,

may, will, should, anticipates, plans and their opposites or similar expressions are intended to identify forward-looking statements.

We caution you that these statements are not guarantees

of future performance or events and are subject to a number of uncertainties, risks and other influences, many of which are beyond our

control, which may influence the accuracy of the statements and the projections upon which the statements are based, and could cause Duos

Technologies Group Inc.'s actual results to differ, materially, from those anticipated by the forward-looking statements.

These risks and uncertainties include, but are not

limited to, those described in Item 1A in Duos' Annual Report on Form 10-K, which is expressly incorporated herein by reference, and other

factors as may periodically be described in Duos' filings with the SEC.

Thank you for joining us today for Duos Technologies

Group's third quarter 2023 conference call. You may now disconnect. And have a nice day.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

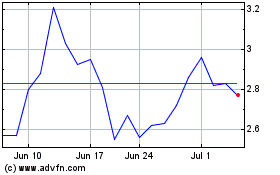

Duos Technologies (NASDAQ:DUOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Duos Technologies (NASDAQ:DUOT)

Historical Stock Chart

From Apr 2023 to Apr 2024