false

0001402945

0001402945

2023-11-14

2023-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 14, 2023

Progressive Care Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-52684

|

|

32-0186005

|

|

(State or Other Jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

File Number)

|

|

Identification No.)

|

400 Ansin Blvd., Suite A

Hallandale Beach, FL 33009

(Address of Principal Executive Offices) (Zip Code)

(305) 760-2053

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 2.02 Results of Operations and Financial Condition

On November 14, 2023, Progressive Care Inc. (the “Company”) issued a press release announcing its results of operations and financial condition for its most recent fiscal quarter ended September 30, 2023 (“Earnings Press Release”). A copy of the Earnings Press Release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information set forth under this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information set forth under this Item 2.02, including Exhibit 99.1, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, unless it is specifically incorporated by reference therein.

Item 7.01 Regulation FD Disclosure

On November 14, 2023, the Company issued the Earnings Press Release announcing its financial results for the three months ended September 30, 2023. The Earnings Press Release is posted on the Company’s website.

The information set forth under this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. The information set forth under this Item 7.01, including Exhibit 99.1, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act, or the Exchange Act, unless it is specifically incorporated by reference therein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

Description of Exhibit

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

Progressive Care Inc.

|

| |

|

| |

By

|

/s/ Charles M. Fernandez

|

| |

Name:

|

Charles M. Fernandez

|

| |

Title:

|

Chief Executive Officer

|

Date: November 14, 2023

Exhibit 99.1

Progressive Care Inc. Announces Record Third Quarter 2023 Revenues of $12.4 Million, an Increase of 22%, as Gross Margins Improve to 31% Over Third Quarter 2022 Results

Miami, FL – November 14, 2023 – Progressive Care Inc. (OTCQB: RXMD) (“Progressive Care” or the “Company”), a personalized healthcare services and technology provider, today announced financial results for its third quarter ended September 30, 2023. The Company reported record third quarter revenues of $12.4 million, a 22% increase in comparison to the prior year period, driven primarily by strong growth at its PharmcoRx pharmacies.

“We are thrilled with our third quarter results and the significant continued growth of Progressive Care, highlighted by strength in our pharmacy and 340B contract businesses. Our performance is a direct result of our commitment to improving outcomes for patients through medical adherence,” said Charles M. Fernandez, Chairman and CEO of Progressive Care Inc. “During a time when the broader pharmacy sector and the entire healthcare industry increasingly faces mounting pressures to improve care while reducing costs, our team continues to capitalize on the many growth opportunities in front of us including expanding our services for our existing patients and partnering with organizations that can provide us with the potential to reach large numbers of new customers.”

Third Quarter 2023 Financial Highlights:

|

●

|

Total revenues increased by approximately $2.2 million, or 22%, to approximately $12.4 million during the three months ended September 30, 2023, compared to approximately $10.1 million in the prior year period. Sequentially, total revenues increased by approximately 7% over revenue reported for the second quarter of 2023.

|

|

●

|

Prescription revenue, net of PBM fees, increased by approximately $1.1 million, or 13%, to approximately $9.9 million during the third quarter of 2023, compared to approximately $8.8 million in the prior year period.

|

|

●

|

340B contract revenue was approximately $2.5 million during the third quarter of 2023, an increase of approximately $1.3 million, compared to approximately $1.2 million in the prior year period. The increase was attributable to an increase in our existing 340B contracts.

|

|

●

|

Gross profit margin increased to approximately 31% from approximately 21% reported in the third quarter of 2022.

|

|

●

|

Cash balance as of September 30, 2023 was approximately $7.0 million as compared to approximately $6.7 million as of December 31, 2022.

|

Organizational Highlights and Recent Business Developments:

|

●

|

On June 30, 2023, NextPlat Corp (NASDAQ: NXPL, NXPLW) (“NextPlat”), Charles M. Fernandez, Chairman and Chief Executive Officer of the Company, and Rodney Barreto, Vice-Chairman of the Company, entered into a voting agreement whereby at any annual or special shareholders meeting of the Company’s stockholders Messrs. Fernandez and Barreto agreed to vote all of the common stock shares that they own in the same manner that NextPlat votes its Common Stock and equivalents. On July 1, 2023, NextPlat, Messrs. Fernandez and Barreto exercised common stock purchase warrants and were issued common stock shares by the Company. After the exercise of the common stock purchase warrants, NextPlat, Messrs. Fernandez and Barreto collectively owned 53% of the Company’s voting common stock. Collectively, the exercise of the common stock purchase warrants and the entry into the voting agreement constituted a change in control in Progressive Care. |

Mr. Fernandez concluded, “Our continued growth across our business combined with the rollout of new consumer services at our PharmcoRx pharmacies later this year, gives our team confidence in the growth potential of Progressive Care. Supported by a solid financial foundation, we continue to execute on our strategic plan and look forward to further capitalizing on the value we can deliver to patients, providers, and our shareholders.”

Summary Financial Results for the Three Months Ended September 30, 2023 and 2022

Note on Financial Presentation

In connection with the change in control on July 1, 2023, the application of push-down accounting created a new basis of accounting for all assets and liabilities based on their fair value at the date of acquisition. As a result, our financial results of operations subsequent to the acquisition on July 1, 2023 have been segregated to indicate pre-acquisition and post-acquisition periods. The pre-acquisition period through June 30, 2023 is referred to as the “Predecessor”. The post-acquisition period, July 1, 2023 and forward, includes the impact of push-down accounting and is referred to as the “Successor”.

| |

|

Successor |

|

|

Predecessor |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

|

Three Months Ended September 30, |

|

|

|

|

|

|

|

|

|

| |

|

2023 |

|

|

2022 |

|

|

$ Change |

|

|

% Change |

|

Total revenues, net |

|

$ |

12,359,450 |

|

|

$ |

10,143,881 |

|

|

$ |

2,215,569 |

|

|

|

22 |

% |

Total cost of revenue |

|

|

8,578,887 |

|

|

|

7,981,796 |

|

|

|

597,091 |

|

|

|

7 |

% |

Total gross profit |

|

|

3,780,563 |

|

|

|

2,162,085 |

|

|

|

1,618,478 |

|

|

|

75 |

% |

Operating expenses |

|

|

5,138,633 |

|

|

|

4,040,152 |

|

|

|

1,098,481 |

|

|

|

27 |

% |

Loss from operations |

|

|

(1,358,070 |

) |

|

|

(1,878,067 |

) |

|

|

519,997 |

|

|

|

(28 |

)% |

Other loss |

|

|

(16,678 |

) |

|

|

(7,084,561 |

) |

|

|

7,067,883 |

|

|

|

(100 |

)% |

Net loss attributable to common shareholders |

|

$ |

(1,374,748 |

) |

|

$ |

(8,962,628 |

) |

|

$ |

7,587,880 |

|

|

|

(85 |

)% |

We recognized overall revenue from operations of approximately $12.4 million and $10.1 million during the three months ended September 30, 2023 and 2022, respectively, an overall increase of approximately $2.2 million, or 22%. The increase in revenue was primarily attributable to an increase in prescription revenue, net of PBM fees of approximately $1.1 million and an increase in 340B contract revenue of approximately $1.3 million, which was offset by a decrease in COVID-19 testing revenue of approximately $0.2 million, when compared to the prior year period.

Sequentially, overall revenue increased approximately $0.8 million, or 7%, during the three months ended September 30, 2023, when compared to the three months ended June 30, 2023. The sequential increase in revenue quarter-over-quarter was attributable to our continued growth of 340B contract revenue, an increase of approximately 18%, and prescription revenue, net of PBM fees, an increase of approximately 4%, when compared to the second quarter of 2023. The number of prescriptions filled increased by approximately 3% during the third quarter of 2023, when compared to the second quarter of 2023.

We filled approximately 122,000 and 117,000 prescriptions during the three months ended September 30, 2023 and 2022, respectively, an increase of 4% year-over-year.

Gross profit margins increased from 21% for the three months ended September 30, 2022, to 31% for the three months ended September 30, 2023. The increase in gross profit margins during the third quarter of 2023, compared to the same period in 2022, was primarily attributable to the increase in 340B contract revenue, which has higher margins than revenue generated from pharmacy operations.

Loss from operations decreased by approximately $0.5 million for the three months ended September 30, 2023, when compared to the three months ended September 30, 2022, as a result of the increase in gross profit of approximately $1.6 million, partially offset by the increase in operating expenses of approximately $1.1 million.

Our operating expenses increased by approximately $1.1 million, or 27%, for the three months ended September 30, 2023, as compared to the three months ended September 30, 2022. The increase was primarily attributable to increases of approximately $0.6 million in the amortization (non-cash expense) of newly identifiable intangible assets because of the push-down accounting, approximately $0.3 million of increased franchise taxes, and approximately $0.2 million in salaries and wages, when compared to the prior year period.

Other loss decreased by approximately $7.1 million for the three months ended September 30, 2023, as compared to the same period in 2022. Other loss of approximately $7.1 million in the prior year period was attributable to NextPlat transaction-related expenses and losses, including the changes in fair value of derivative liabilities, day one losses on issuance of units and debt modification, and abandoned offering costs, offset by gains on debt settlement and grant revenue.

We had a net loss of approximately $1.4 million and $9.0 million for the three months ended September 30, 2023 and 2022, respectively. The decrease in net loss was attributable to the decrease in other loss due to the NextPlat transaction-related expenses and losses recognized in the prior year period.

Quarterly Report on Form 10-Q Available

The Company’s Quarterly Report on Form 10-Q, available at www.sec.gov and on the Company’s website, contains a thorough review of its financial results for the three months ended September 30, 2023.

Forward-Looking Statements

Forward-Looking Statements contained herein that are not based upon current or historical fact are forward-looking in nature and constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements reflect the Company’s expectations about its future operating results, performance, and opportunities that involve substantial risks and uncertainties. When used herein, the words “anticipate,” “believe,” “estimate,” “upcoming,” “plan,” “target,” “intend” and “expect” and similar expressions, as they relate to Progressive Care Inc., its subsidiaries, or its management, are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties, and other factors discussed in our Annual Report on Form 10-K and other SEC filings that could cause the Company’s actual results, performance, prospects, and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. You should not rely on these forward-looking statements, as actual outcomes and results may differ materially from those expressed or implied in the forward-looking statements as a result of such risks and uncertainties. All forward-looking statements in this press release are based on management’s beliefs and assumptions and on information currently available to Progressive Care, and Progressive Care does not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made.

About Progressive Care

Progressive Care Inc. (OTCQB: RXMD), through its subsidiaries, is a Florida health services organization and provider of Third-Party Administration (TPA), data management, COVID-19 related diagnostics and vaccinations, 340B contracted pharmacy services, prescription pharmaceuticals, compounded medications, provider of tele-pharmacy services, the sale of anti-retroviral medications, medication therapy management (MTM), the supply of prescription medications to long-term care facilities, and health practice risk management.

Investor Contact for Progressive Care

Michael Glickman

MWGCO, Inc.

917-397-2272

mike@mwgco.net

v3.23.3

Document And Entity Information

|

Nov. 14, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Progressive Care Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 14, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-52684

|

| Entity, Tax Identification Number |

32-0186005

|

| Entity, Address, Address Line One |

400 Ansin Blvd.

|

| Entity, Address, Address Line Two |

Suite A

|

| Entity, Address, City or Town |

Hallandale Beach

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

33009

|

| City Area Code |

305

|

| Local Phone Number |

760-2053

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

true

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001402945

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

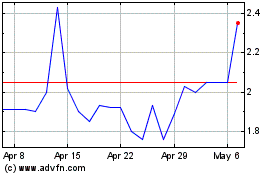

Progressive Care (QB) (USOTC:RXMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Progressive Care (QB) (USOTC:RXMD)

Historical Stock Chart

From Apr 2023 to Apr 2024