0001772720false00017727202023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 9, 2023

Spruce Power Holding Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38971 | | 83-4109918 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

2000 S Colorado Blvd, Suite 2-825, Denver, CO | | 80222 |

| (Address of principal executive offices) | | (Zip Code) |

(866) 777-8235

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act

☒ Soliciting material pursuant to Rule 14a-12 under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | SPRU | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 9, 2023, Spruce Power Holding Corporation (the “Company”) issued a press release (the “Press Release”) announcing the Company’s results for the third quarter ended September 30, 2023. A copy of the Press Release is attached as Exhibit 99.1 to this report. The attached Exhibit 99.1 is furnished pursuant to Item 2.02 of Form 8-K.

The information in this Form 8-K, including Exhibit 99.1 furnished herewith, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

| | |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| SPRUCE POWER HOLDING CORPORATION |

| | |

Date: November 13, 2023 | By: | /s/ Jonathan M. Norling |

| Name: | Jonathan M. Norling |

| Title: | Chief Legal Officer |

Spruce Power Announces Record Revenue in Third Quarter 2023 Earnings Results

DENVER, COLORADO (November 9, 2023) – Spruce Power Holding Corporation (NYSE: SPRU) (“Spruce” or the “Company”), a leading owner and operator of distributed solar energy assets across the United States, today reported financial results for the quarter ended September 30, 2023.

Business Highlights

•Third quarter revenue reaches a record level of $23.3 million.

•By acquiring over 2,400 customer contracts in the third quarter, Spruce has grown its home solar assets and contracts to over 75,000, representing growth of 49% year-over-year.

•Announced resolution of the SEC's inquiry of XL Fleet Corp., and accrued estimated settlement amounts in the previously disclosed shareholder class action lawsuits related to XL Fleet Corp.

•Total cash increased to $193 million at quarter end. Subtracting $26 million of net total cash costs and reserves tied to legacy XL Fleet items results in pro-forma cash of $9.14 per share.

Management Commentary and Outlook

"Solid third quarter results reflect the continued execution of our low-cost customer acquisition strategy which included the addition of approximately 25,000 home solar assets and contracts this year. This growth enabled record business cash inflows during the third quarter,” said Christian Fong, Spruce’s Chief Executive Officer.

Mr. Fong continued, "Despite a challenged macroeconomic environment for the broader renewable energy industry, our strong liquidity, cash flow positive owner-operator model, and differentiated acquisition strategy position us for continued momentum."

Sarah Wells, Spruce's Chief Financial Officer, added "We delivered a strong third quarter as step-change growth in our portfolio of home solar assets and contracts continues to build our recurring cash flow base. Since our merger with XL Fleet, Spruce has been managing several legacy legal items that have resulted in an ongoing expense burden. We're pleased to move past these legacy XL Fleet issues and continue to focus on growing the positive cash flow from our core distributed energy business. We reiterate our expectation for business cash inflows of $120 to $130 million on an annual run rate basis."

Consolidated Financial Results

Revenues totaled $23.3 million for the third quarter of 2023, compared to $22.8 million for the second quarter of 2023. The sequential increase was primarily due to incremental revenues related to the Tredegar Acquisition and increased sales of renewable energy credits.

Core operating expenses (excluding depreciation), including both selling, general & administrative expenses ("SG&A") and operations & maintenance, were $15.9 million for the third quarter compared to $19.0 million for the second quarter of 2023. SG&A expense during the third quarter of 2023 was offset by approximately $2.7 million of insurance recoveries related to previously disclosed litigation matters.

Net loss attributable to stockholders was $19.3 million for the third quarter of 2023, and on an adjusted basis as defined below, net loss was $1.2 million for the third quarter of 2023.

Adjusted EBITDA and proceeds from investment in lease agreement, in the aggregate, was $14.9 million for the third quarter of 2023, compared to $13.8 million for the second quarter of 2023. Proceeds from investment in lease agreement represent cash flows from the Spruce Power 4 Portfolio.

Balance Sheet and Liquidity

The Company's total principal amount of outstanding debt as of September 30, 2023, was $656.7 million with a blended interest rate including the impact of hedge arrangements of 5.7%. All debt consists of project finance loans that are non-recourse to the Company itself.

Total cash as of September 30, 2023, was $192.7 million, including cash and cash equivalents of $154.2 million and restricted cash of $38.5 million. This is up from $192.1 million of total cash as of June 30, 2023, primarily due to strong performance from recent acquisitions. Note this quarter end cash balance does not yet subtract $26.3 million of net total cash costs and reserves tied to legacy XL Fleet items as described below.

Growth and Capital Allocation

Spruce is committed to maximizing long-term value for our shareholders through a disciplined approach that includes strategic acquisitions, capex projects, debt repayment, and shareholder return initiatives.

In August 2023, Spruce acquired a portfolio of over 2,400 residential solar systems and contracts, the Tredegar Acquisition, from a publicly traded, regulated utility company for approximately $20.9 million. Spruce funded the acquisition purchase price entirely through proceeds from the concurrent upsizing of an existing credit facility.

In September 2023, Spruce completed a buyout of an existing tax equity partnership for $0.1 million.

During the third quarter of 2023, Spruce repurchased 0.5 million shares of common stock at a weighted average price per share of $7.04 for a total cost of $3.5 million, inclusive of transaction costs. There was $45 million remaining under the Company's authorized $50 million common share repurchase program at the end of the third quarter of 2023.

Legal Proceedings

In September 2023, Spruce settled a civil enforcement action filed by the United States Securities and Exchange Commission ("SEC") related to the 2020 merger of Spruce's predecessor company, XL Fleet Corp. In October 2023, in connection with the settlement, the Company paid a civil monetary penalty of $11.0 million, which may be made available for eligible legacy shareholders to receive funds, net of costs, subject to discretion of the SEC. The Company accrued for the settlement amount as of September 30, 2023.

In September 2023, Spruce reached an agreement in principle with respect to the previously disclosed securities class action lawsuit filed in the federal district court for the Southern District of New York related to the 2020 merger of Spruce's predecessor company, XL Fleet Corp., to settle the matter for $19.5 million, subject to agreement on documentation and court approval. Net of $4.5 million in expected insurance proceed, the Company accrued $15.0 million for the settlement amount as of September 30, 2023.

In November 2023, Spruce determined it is able to estimate its exposure in the previously disclosed securities class action lawsuit filed in the Delaware Court of Chancery related to the 2020 merger of Spruce's predecessor company, XL Fleet Corp. Spruce estimates a settlement amount of approximately $0.3 million. The Company accrued for the settlement amount as of September 30, 2023.

Key Operating Metrics

As of September 30, 2023, Spruce owned cash flows from over 75,000 home solar assets and contracts across 18 U.S. States with an average remaining contract life of approximately 12 years. Combined portfolio generation for the three months ended September 30, 2023, was approximately 125 thousand MWh of power. In addition, the Company also serviced 5,000 third-party owned residential solar systems and third-party loans as of September 30, 2023. Gross Portfolio Value, on a PV6 basis as described below, was $973.0 million as of September 30, 2023.

Conference Call Information

The Spruce management team will host a conference call to discuss its third quarter 2023 financial results today at 2:30 p.m. Mountain Time. The call can be accessed live over the telephone by dialing (888) 210-2654 and referencing Conference ID 2486267. Alternatively, the call can be accessed via a live webcast accessible on the Events & Presentations page in the Investor Relations section of the Company’s website at www.sprucepower.com. A replay will be available shortly after the call and can be accessed by dialing (800) 770-2030. The passcode for the replay is 2486267. The replay will be available until November 23, 2023.

About Spruce Power

Spruce Power is a leading owner and operator of distributed solar energy assets across the United States. We provide subscription-based services that make it easy for homeowners to benefit from rooftop solar power and battery storage. Our power as-a-service model allows consumers to access new technology without making a significant upfront investment or incurring maintenance costs. Our company owns the cash flows from over 75,000 home solar assets and contracts across the United States. For additional information, please visit www.sprucepower.com.

Forward Looking Statements

Certain statements in this press release may constitute “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Forward-looking statements in this release include statements regarding future repurchases under the stock repurchase program, potential future acquisitions and debt reductions, and the Company's prospects for long-term growth in revenues, business cash inflows and earnings. Repurchases under the stock repurchase program will depend upon market prices, trading volume, available cash and other factors, and, therefore, there is no guarantee as to the number of shares that may be purchased. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of management and are not predictions of actual performance. Forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from the forward looking statements, including but not limited to: expectations regarding the growth of the solar industry, home electrification, electric vehicles and distributed energy resources; the ability to successfully integrate XL Fleet and Spruce; the ability to identify and complete future acquisitions; the ability to develop and market new products and services; the effects of pending and future legislation; the highly competitive nature of the Company’s business and markets; the ability to execute on and consummate business plans in anticipated time frames; litigation, complaints, product liability claims, government investigations and/or adverse publicity; cost increases or shortages in the components or chassis necessary to support the Company’s products and services; the introduction of new technologies; the impact of natural disasters and other events beyond our control, such as hurricanes or pandemics on the Company’s business, results of operations, financial condition, regulatory compliance and customer experience; privacy and data protection laws, privacy or data breaches, or the loss of data; general economic, financial, legal, political and business conditions and changes in domestic and foreign markets; risks related to the rollout of the Company’s business and the timing of expected business milestones; the effects of competition on the Company’s future business; the availability of capital; and the other risks discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 30, 2023, subsequent Quarterly Reports on Form 10-Q and other documents that the Company files with the SEC in the future. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. These forward-looking statements speak only as of the date hereof and the Company specifically disclaims any obligation to update these forward-looking statements.

Use of Non-GAAP Financial Information

To supplement its consolidated financial statements, which are prepared and presented in accordance with U.S. generally accepted accounting principles (“GAAP”), Spruce reports certain non-GAAP financial information, which have been reconciled to the nearest GAAP measures in the tables within this press release. This prospective financial information was not prepared with a view toward compliance with published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of prospective financial information or U.S. GAAP with respect to forward looking financial information. We believe that these non-GAAP measures, viewed in addition to and not in lieu of our reported GAAP results, provides useful information to investors by providing a more focused measure of operating results, enhances the overall understanding of past financial performance and future prospects, and allows for greater transparency with respect to key metrics used by management in its financial and operational decision making. The non-GAAP measures presented herein may not be comparable to similarly titled measures presented by other companies.

Earnings (Loss) Before Interest, Income Taxes, Depreciation, and Amortization (“EBITDA”):

We define EBITDA as our consolidated net income (loss) and adding back interest expense, income taxes, and depreciation and amortization. We believe EBITDA provides meaningful information to the performance of our business and therefore we use it to supplement our GAAP reporting. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results.

Adjusted EBITDA and Adjusted Net Income (Loss):

We believe that Adjusted EBITDA and Adjusted Net Income (loss), which excludes certain identified items that we do not consider to be part of our ongoing business, improves the comparability of year-to-year results, and is representative of our underlying performance. Management uses this information to assess and measure the performance of our operating segment. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the below reconciliations, and to provide an additional measure of performance.

Business Cash Inflows:

We define business cash inflows as receipts of cash from long-term customer contracts, proceeds from investment in SEMTH master lease agreement, cash flows from SRECs and proceeds from customer contract buyouts. Business cash inflows may also include interest earned on cash invested, servicing revenue from third-parties and other non-recurring one-time receipts.

Portfolio Value Metrics

We believe Portfolio Value Metrics are helpful to management, investors, and analysts to understand the value of our business and to evaluate the estimated remaining value of our customer contracts, including present value implied from future, uncontracted sales of solar renewable energy credits generated from assets that the Company owns today.

•Gross Portfolio Value reflects the remaining projected net cash flows from current customers discounted at 6% (“PV6”)

•Projected cash flows include the customer’s initial agreement plus renewal

| | | | | |

| ($ in millions) | As of September 30, 2023 |

Contracted Portfolio Value (1) | $ | 739 | |

Renewal Portfolio Value (2) | 217 | |

Uncontracted Renewable Energy Credits (3) | 17 | |

Gross Portfolio Value (4) | $ | 973 | |

(1) Contracted Portfolio Value represents the present value of the remaining net cash flows discounted at 6% during the initial term of the company’s customer agreements as of the measurement date. It is calculated as the present value of cash flows discounted at 6% that the company expects to receive from customers in future periods as set forth in customer agreements, after deducting expected operating and maintenance costs, equipment replacements costs, distributions to tax equity partners in consolidated joint venture partnership flip structures, and distributions to third party project equity investors. The calculation includes cash flows the company expects to receive in future periods from state incentive and rebate programs, contracted sales of solar renewable energy credits, and awarded net cash flows from grid service programs with utilities or grid operators.

(2) Renewal Portfolio Value is the forecasted net present value the company would receive upon or following the expiration of the initial customer agreement term, but before the 30th anniversary of the system’s activation in the form of cash payments during any applicable renewal period for customers as of the measurement date. The company calculates the Renewal Portfolio Value amount at the expiration of the initial contract term assuming either a system purchase or a renewal and a 30-year customer relationship (although the customer may renew for additional years, or purchase the system), at a contract rate equal to 90% of the customer’s contractual rate in effect at the end of the initial contract term. After the initial contract term, a majority of the company's customer agreements automatically renew on an annual basis and the rate is initially set at up to a 10% discount to then-prevailing utility power prices.

(3) Uncontracted sales of solar Renewable Energy Credits (RECs) based on forward market REC pricing curves, adjusted for liquidity discounts.

(4) Gross Portfolio Value represents the sum of Contracted Portfolio Value, Renewal Portfolio Value and Uncontracted RECs.

Spruce Power Holding Corporation

Consolidated Statements of Operations

For the Three Months Ended September 30, 2023 and 2022

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | |

| (In thousands, except per share and share amounts) | | 2023 | | 2022 | | | | |

| | | | | | | | |

| Revenues | | $ | 23,250 | | | $ | 5,080 | | | | | |

| Operating expenses: | | | | | | | | |

| Cost of revenues | | 9,810 | | | 1,974 | | | | | |

| Selling, general, and administrative expenses | | 12,391 | | | 27,018 | | | | | |

| Litigation settlements, net | | 26,339 | | | — | | | | | |

| (Gain) loss on asset disposal | | (773) | | | 270 | | | | | |

| Total operating expenses | | 47,767 | | | 29,262 | | | | | |

| Loss from operations | | (24,517) | | | (24,182) | | | | | |

| Other (income) expense: | | | | | | | | |

| Interest expense, net | | 2,937 | | | 2,122 | | | | | |

| Change in fair value of obligation to issue shares of common stock to sellers of World Energy | | — | | | (42) | | | | | |

| Change in fair value of warrant liabilities | | (70) | | | (646) | | | | | |

| Change in fair value of interest rate swaps | | (8,061) | | | (8,533) | | | | | |

| Other income, net | | (360) | | | (96) | | | | | |

| Net loss from continuing operations | | (18,963) | | | (16,987) | | | | | |

| Net loss from discontinued operations | | (204) | | | (4,599) | | | | | |

| Net loss | | (19,167) | | | (21,586) | | | | | |

| Less: Net income attributable to redeemable noncontrolling interests and noncontrolling interests | | 146 | | | 419 | | | | | |

| Net loss attributable to stockholders | | $ | (19,313) | | | $ | (22,005) | | | | | |

| Net loss attributable to stockholders per share, basic and diluted | | $ | (1.11) | | | $ | (1.23) | | | | | |

| Net loss from discontinued operations, basic and diluted | | $ | (0.01) | | | $ | (0.26) | | | | | |

| Weighted-average shares outstanding, basic and diluted | | 17,351,796 | | | 17,861,935 | | | | | |

Spruce Power Holding Corporation

Reconciliation of Non-GAAP Financial Measures

For the Three Months Ended September 30, 2023

| | | | | | | | | | |

| | Three Months Ended September 30, | | |

| (In thousands) | | 2023 | | |

Reconciliation of Net Loss to EBITDA and Adjusted EBITDA | | | | |

| Net loss attributable to stockholders | | $ | (19,313) | | | |

Net income attributable to redeemable noncontrolling interests and noncontrolling interests | | 146 | | | |

| Interest expense, net | | 2,937 | | | |

| Depreciation and amortization | | 5,324 | | | |

| EBITDA | | (10,906) | | | |

| Net loss from discontinued operations | | 204 | | | |

| Legal charges related to SEC investigation and shareholder lawsuits | | 24,451 | | | |

Gain on disposal of assets | | (773) | | | |

| Change in fair value of interest rate swaps | | (8,061) | | | |

| Meter upgrade campaign | | 1,254 | | | |

| Other one-time costs | | 572 | | | |

| Change in fair value warrant liabilities | | (71) | | | |

| Non-recurring acquisition/divestment expenses | | 355 | | | |

| Adjusted EBITDA | | $ | 7,025 | | | |

| | | | | | | | | | |

| | Three Months Ended September 30, | | |

| (In thousands) | | 2023 | | |

| Proceeds from investment related to SEMTH master lease agreement | | 7,898 | | | |

Spruce Power Holding Corporation

Reconciliation of Non-GAAP Financial Measures

For the Three Months Ended September 30, 2023

| | | | | | | | |

| | Three Months Ended September 30, |

| (In thousands) | | 2023 |

Reconciliation of Net Loss to Adjusted Net Loss | | |

Net loss attributable to stockholders | | $ | (19,313) | |

| Net income attributable to redeemable noncontrolling interests and noncontrolling interests | | 146 | |

| Net loss on discontinued operations | | 204 | |

| Legal charges related to SEC investigation and shareholder lawsuits | | 24,451 | |

Gain on disposal of assets | | (773) | |

| Change in fair value of interest rate swaps | | (8,061) | |

| Meter upgrade campaign | | 1,254 | |

| Other one-time costs | | 572 | |

| Change in fair value warrant liabilities | | (71) | |

| Non-recurring acquisition/divestment expenses | | 355 | |

| Adjusted Net Loss | | $ | (1,236) | |

Spruce Power Holding Corporation

Consolidated Balance Sheets

September 30, 2023 and December 31, 2022

| | | | | | | | | | | | | | |

| | As of |

| (In thousands, except share and per share amounts) | | September 30,

2023 | | December 31,

2022 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 154,209 | | | $ | 220,321 | |

| Restricted cash | | 38,524 | | | 19,823 | |

| Accounts receivable, net of allowance of $12.9 million and $12.2 million as of September 30, 2023 and December 31, 2022, respectively | | 12,572 | | | 8,336 | |

| Interest rate swap assets, current | | 13,799 | | | 10,183 | |

| Prepaid expenses and other current assets | | 9,481 | | | 5,316 | |

| Current assets of discontinued operations | | — | | | 10,977 | |

| Total current assets | | 228,585 | | | 274,956 | |

| Investment related to SEMTH master lease agreement | | 145,666 | | | — | |

| Property and equipment, net | | 488,387 | | | 396,168 | |

| Interest rate swap assets, non-current | | 29,819 | | | 22,069 | |

| Intangible assets, net | | 10,262 | | | — | |

| Deferred rent assets | | 2,114 | | | 1,626 | |

| Right-of-use assets, net | | 6,238 | | | 2,802 | |

| Goodwill | | 28,757 | | | 128,548 | |

| Other assets | | 257 | | | 383 | |

| Long-term assets of discontinued operations | | 33 | | | — | |

| Total assets | | $ | 940,118 | | | $ | 826,552 | |

| | | | |

| Liabilities, redeemable noncontrolling interests and stockholders’ equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 1,237 | | | $ | 2,904 | |

| Current portion of long-term debt | | 27,719 | | | 25,314 | |

| Accrued expenses and other current liabilities | | 51,568 | | | 21,509 | |

| Deferred revenue, current | | 108 | | | 39 | |

| Lease liability, current | | 1,126 | | | 834 | |

| Current liabilities of discontinued operations | | — | | | 9,097 | |

| Total current liabilities | | 81,758 | | | 59,697 | |

| Long-term debt, net of current portion | | 599,610 | | | 474,441 | |

| Deferred revenue, non-current | | 1,084 | | | 452 | |

| Lease liability, non-current | | 6,004 | | | 2,426 | |

| Warrant liabilities | | 38 | | | 256 | |

| Unfavorable solar renewable energy agreements, net | | 7,193 | | | — | |

| Other long-term liabilities | | 113 | | | 10 | |

Long-term liabilities of discontinued operations | | 183 | | | 294 | |

| | | | | | | | | | | | | | |

| Total liabilities | | 695,983 | | | 537,576 | |

| Commitments and contingencies | | | | |

| | | | |

| Redeemable noncontrolling interests | | — | | | 85 | |

| Stockholders’ equity: | | | | |

| Common stock, $0.0001 par value; 350,000,000 shares authorized at September 30, 2023 and December 31, 2022; 18,925,126 and 18,194,379 shares issued and outstanding at September 30, 2023, respectively, and 18,046,903 issued and outstanding at December 31, 2022 | | 14 | | | 14 | |

| Additional paid-in capital | | 474,502 | | | 473,277 | |

| | | | |

| Noncontrolling interests | | 2,438 | | | 8,942 | |

| Accumulated deficit | | (227,700) | | | (193,342) | |

| Treasury stock at cost, 730,747 shares and 0 at September 30, 2023 and December 31, 2022, respectively | | (5,119) | | | — | |

| Total stockholders’ equity | | 244,135 | | | 288,891 | |

| Total liabilities, redeemable noncontrolling interests and stockholders’ equity | | $ | 940,118 | | | $ | 826,552 | |

| | | | |

For More Information

Investor Contact: investors@sprucepower.com

Head of Investor Relations: Bronson Fleig

Media Contact: publicrelations@sprucepower.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

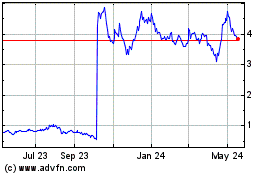

Spruce Power (NYSE:SPRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Spruce Power (NYSE:SPRU)

Historical Stock Chart

From Apr 2023 to Apr 2024