0001377789false06-3000013777892023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

Form 8-K

______________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2023

_______________________

AVIAT NETWORKS, INC.

(Exact name of registrant as specified in its charter)

______________________________________

| | | | | | | | | | | | | | |

Delaware | | 001-33278 | | 20-5961564 |

(State or other jurisdiction | | (Commission File | | (I.R.S. Employer |

of incorporation) | | Number) | | Identification No.) |

| | | | |

200 Parker Dr., Suite C100A, Austin, Texas 78728 |

(Address of principal executive offices, including zip code) |

| | | | |

| | (408)-941-7100 | | |

| Registrant’s telephone number, including area code | |

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | AVNW | | NASDAQ Stock Market LLC |

☐ Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.03 Amendments to the Articles of Incorporation or Bylaws; Change in Fiscal Year.

The fiscal year 2023 Annual Meeting of Stockholders of Aviat Networks, Inc. (the “Company”) was held on November 8, 2023 (the “Annual Meeting”). At the Annual Meeting, upon the recommendation of the board of directors of the Company (the “Board”), the Company’s stockholders approved an amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Current Certificate”) to reflect new Delaware law provisions regarding officer exculpation (the “Exculpation Amendment”) and approved the amendment and restatement of the Current Certificate to make certain additional, non-substantive amendments (the “Non-Substantive Amendments,” together with the Exculpation Amendment, the “Certificate Amendments”).

The Certificate Amendments became effective upon the filing of the Amended and Restated Certificate of Incorporation of the Company (the “A&R Certificate”) with the Secretary of State of Delaware on November 9, 2023. A description of the Certificate Amendments are provided in “Proposal No. 5 – Amendment of the Company’s Amended and Restated Certificate of Incorporation to Reflect New Delaware Law Provisions Regarding Officer Exculpation” and “Proposal No. 6 – Amendment and Restatement of the Company’s Current Certificate to Make Certain Additional, Non-Substantive Amendments” of the Company’s definitive proxy statement filed with the Securities and Exchange Commission on September 25, 2023 (the “Proxy Statement”), which description and text are incorporated herein by reference. The foregoing description of the terms of the Certificate Amendments and the description incorporated by reference from the Proxy Statement do not purport to be complete and are qualified in their entireties by the full text of the A&R Certificate, which is filed hereto as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

VOTING RESULTS OF FISCAL YEAR 2023 ANNUAL MEETING OF STOCKHOLDERS

For more information about the proposals set forth below, please see the Company’s Proxy Statement. A total of 9,984,341 (or approximately 85.2%) of the Company’s shares of common stock, par value $0.01 per share, that were issued, outstanding and entitled to vote at the Annual Meeting were represented in person or by proxy at the meeting. Set forth below are the final voting results for the proposals voted on at the Annual Meeting.

(1) Proposal 1 – Election of Directors.

Each of the following persons was duly elected by the Company’s stockholders until the 2024 Annual Meeting of Stockholders or until their successors are duly elected and qualified, with votes as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Number of Shares |

| Nominees: | | For | | Against | | Abstain | | Broker Non-Votes |

| John Mutch | | 8,009,738 | | 274,820 | | 2,875 | | 1,696,908 |

| Laxmi Akkaraju | | 8,234,694 | | 44,496 | | 8,243 | | 1,696,908 |

| Bryan Ingram | | 8,235,300 | | 44,115 | | 8,018 | | 1,696,908 |

| Michele Klein | | 8,177,796 | | 101,630 | | 8,007 | | 1,696,908 |

| Peter Smith | | 8,218,432 | | 66,250 | | 2,751 | | 1,696,908 |

| Bruce Taten | | 8,202,980 | | 76,238 | | 8,215 | | 1,696,908 |

(2) Proposal 2 – Ratification of Appointment of Independent Registered Public Accounting Firm. The ratification of the appointment by the Audit Committee of Deloitte & Touche, LLP as the Company’s independent registered public accounting firm for fiscal year 2024, was approved by the Company’s stockholders, with votes as follows:

| | | | | | | | | | | | | | | | | | | | |

| | Number of Shares |

| | For | | Against | | Abstain |

| Proposal 2 | | 9,935,081 | | 45,566 | | 3,694 |

(3) Proposal 3 – Advisory, Non-Binding Vote on Named Executive Officer Compensation. The advisory, non-binding vote to approve the Company’s named executive officer compensation, was approved by the Company’s stockholders, with votes as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Number of Shares |

| | For | | Against | | Abstain | | Broker Non-Votes |

| Proposal 3 | | 8,138,002 | | 131,075 | | 18,356 | | 1,696,908 |

(4) Proposal 4 – Approval of Amendment No. 1 to the Tax Benefit Preservation Plan. The Amendment No. 1 to the Amended and Restated Tax Benefit Preservation Plan, dated as of February 28, 2023, by and between the Company and Computershare Inc., as Rights Agent, was approved by the Company’s stockholders, with votes as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Number of Shares |

| | For | | Against | | Abstain | | Broker Non-Votes |

| Proposal 4 | | 7,860,699 | | 418,873 | | 7,861 | | 1,696,908 |

(5) Proposal 5 – Amendment of the Company’s Amended and Restated Certificate of Incorporation to Reflect New Delaware Law Provisions Regarding Officer Exculpation. The amendment to the Company’s Current Certificate to reflect new Delaware law provisions regarding officer exculpation, was approved by the Company’s stockholders, with votes as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Number of Shares |

| | For | | Against | | Abstain | | Broker Non-Votes |

| Proposal 5 | | 6,909,416 | | 1,372,645 | | 5,372 | | 1,696,908 |

(6) Proposal 6 – Amendment and Restatement of the Company’s Current Certificate to Make Certain Additional, Non-Substantive Amendments. The amendment and restatement of the Company’s Current Certificate to make certain additional, non-substantive amendments, was approved by the Company’s stockholders, with votes as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Number of Shares |

| | For | | Against | | Abstain | | Broker Non-Votes |

| Proposal 6 | | 8,242,278 | | 38,310 | | 6,845 | | 1,696,908 |

No other matters were submitted for stockholder action at the Annual Meeting.

Item 7.01 Regulation FD Disclosure.

On November 13, 2023, the Company issued a press release announcing the election of Laxmi Akkaraju to the Board and the departure of Jim Stoffel from the Company’s Board. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information in this Item 7.01, including Exhibit 99.1 hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are filed with this Current Report on Form 8-K:

| | | | | | | | | | | | | | |

| Exhibit No. | | Description | | |

| | | | |

| 3.1* | | |

| 99.1** | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Filed herewith.

** Furnished herewith.

SIGNATURE

| | | | | | | | | | | | | | | | | | | | |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| | | | | | |

| | AVIAT NETWORKS, INC. |

| | |

| Date: November 13, 2023 | | By: | | /s/ David M. Gray |

| | | | Name: | | David M. Gray |

| | | | Title: | | Senior Vice President and Chief Financial Officer |

Exhibit 3.1

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

AVIAT NETWORKS, INC.

Aviat Networks, Inc. (the “Corporation”), a corporation organized and existing under, and by virtue of, the General Corporation Law of the State of Delaware (“DGCL”) hereby certifies as follows:

(1)The name of the Corporation is Aviat Networks, Inc.

(2)The Corporation was originally incorporated under the name Harris Stratex Networks, Inc. The original certificate of incorporation of the Corporation was filed with the Secretary of the State of Delaware on October 5, 2006. The Amended and Restated Certificate of Incorporation of the Corporation was filed with the Secretary of State of Delaware on November 19, 2009, and was most recently amended on February 3, 2017 (the “Current Certificate of Incorporation”). A Certificate of Designations of Series A Junior Participating Preferred Stock was filed with the Secretary of State of Delaware on April 21, 2009, and was subsequently eliminated through a Certificate of Elimination filed with the Secretary of State of Delaware on September 7, 2016. A Certificate of Designations of Series A Participating Preferred Stock was filed with the Secretary of State of Delaware on September 7, 2016.

(3)This amended and restated certificate of incorporation which restates, integrates and amends the Corporation’s Current Certificate of Incorporation, as heretofore amended or supplemented, has been duly adopted by the board of directors of the Corporation (the “Board”) and by the stockholders of the Corporation in accordance with Sections 242 and 245 of the DGCL, and has been duly executed by an officer of the Corporation and filed in accordance with Section 103 of the DGCL.

(4)The text of the Amended and Restated Certificate of Incorporation shall read, in its entirety, as follows:

Article I

Name

The name of the Corporation is Aviat Networks, Inc.

Article II

Registered Agent

The address of the registered office of the Corporation in the State of Delaware is 251 Little Falls Drive, Wilmington, New Castle County, Delaware, 19808, and the name of its registered agent at that address is Corporation Service Company.

Article III

Purpose

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the DGCL.

Article IV

Capitalization

a.Capitalization. The total number of shares of all classes that this Corporation is authorized to issue is 350,000,000 shares, of which (i) 50,000,000 shares shall be designated as preferred stock, par value $0.01 per share (the “Preferred Stock”), and (ii) 300,000,000 shares shall be designated as common stock, par value $0.01 per share (the “Common Stock”).

b.Preferred Stock. Shares of Preferred Stock may be issued in one or more series from time to time by the Board, and the Board is expressly authorized to fix by resolution or resolutions the designations and the powers, preferences and rights, and the qualifications, limitations and restrictions thereof, of the shares of each series of Preferred Stock, including without limitation the following:

i.the distinctive serial designation of such series which shall distinguish it from other series;

ii.the number of shares included in such series;

iii.the dividend rate (or method of determining such rate) payable to the holders of the shares of such series, any conditions upon which such dividends shall be paid and the date or dates upon which such dividends shall be payable;

iv.whether dividends on the shares of such series shall be cumulative and, in the case of shares of any series having cumulative dividend rights, the date or dates or method of determining the date or dates from which dividends on the shares of such series shall be cumulative;

v.the amount or amounts which shall be payable out of the assets of the corporation to the holders of the shares of such series upon voluntary or involuntary liquidation, dissolution or winding up the Corporation, and the relative rights of priority, if any, of payment of the shares of such series;

vi.the price or prices at which, the period or periods within which and the terms and conditions upon which the shares of such series may be redeemed, in whole or in part, at the option of the Corporation or at the option of the holder or holders thereof or upon the happening of a specified event or events;

vii.the obligation, if any, of the Corporation to purchase or redeem shares of such series pursuant to a sinking fund or otherwise and the price or prices at which, the period or periods within which and the terms and conditions upon which the shares of

such series shall be redeemed or purchased, in whole or in part, pursuant to such obligation;

viii.whether or not the shares of such series shall be convertible or exchangeable, at any time or times at the option of the holder or holders thereof or at the option of the Corporation or upon happening of a specified event or events, into shares of any other class or classes of stock of the Corporation, and the price or prices or rate or rates of exchange or conversion and any adjustments applicable thereto; and

ix.whether or not the holders of the shares of such series shall have voting rights, in addition to the voting rights provided by law, and if so the terms of such voting rights.

Subject to the rights of the holders of any series of Preferred Stock, the number of authorized shares of any class or series of Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the outstanding shares of such class or series, voting together as a single class, irrespective of the provisions of Section 242(b)(2) of the DGCL. The Board has designated a series of its Series A Participating Preferred Stock pursuant to a Certificate of Designations duly filed with the Secretary of State of Delaware on September 7, 2016, a copy of which is attached hereto as Exhibit A and incorporated herein by reference.

Article V

Directors

The number of directors (the “Directors”) that shall constitute the whole Board shall be fixed from time to time pursuant to the amended and restated bylaws of the Corporation, as may be further amended from time to time (the “Bylaws”).

Article VI

Limitation of Liability

A director or officer of the Corporation shall not be liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director or officer, except to the extent that such exemption from liability or limitation thereof is not permitted under the DGCL as currently in effect or as the same may hereafter be amended. If the DGCL is hereafter amended to authorize corporate action further limiting or eliminating the liability of directors or officers to the Corporation or its stockholders, then without any further action by any individual, corporation (including not-for-profit), general or limited partnership, limited liability company, joint venture, estate, trust, association, organization, government entity or other entity of any kind or nature such liability shall be so limited or eliminated to the fullest extent permitted by the DGCL as so amended. No adoption, amendment, modification or repeal of this Article VI or any other provision of this Amended and Restated Certificate of Incorporation shall adversely affect any right or protection of a director or officer existing at the time of such adoption, amendment, modification or repeal with respect to acts or omissions occurring prior to such time. For the

purposes of this Article VI, “officer” shall have the meaning provided in Section 102(b)(7) of the DGCL, as it presently exists or may hereafter be amended from time to time.

Article VII

Bylaws

In furtherance and not in limitation of the powers conferred by statute, the Board is expressly authorized to adopt, repeal, alter, amend and rescind from time to time any or all of the Bylaws of the Corporation.

Article VIII

Amendment of Amended and Restated Certificate of Incorporation

This Corporation reserves the right to amend, alter, change or repeal any provision contained in this Amended and Restated Certificate of Incorporation, in the manner now or hereafter prescribed by statute, and all rights conferred on stockholders herein are granted subject to this reservation.

IN WITNESS WHEREOF, I have signed this Amended and Restated Certificate of Incorporation this 9th day of November, 2023.

AVIAT NETWORKS, INC.

By: /s/ Peter A. Smith

Name: Peter A. Smith

Title: Chief Executive Officer and President

Exhibit A

CERTIFICATE OF DESIGNATION OF RIGHTS, PREFERENCES AND PRIVILEGES

OF SERIES A PARTICIPATING PREFERRED STOCK OF

AVIAT NETWORKS, INC.

| | |

Pursuant to Section 151 of the

General Corporation Law of the State of Delaware |

Aviat Networks, Inc., a corporation organized and existing under the General Corporation Law of the State of Delaware (the “Corporation”), in accordance with the provisions of Section 103 thereof, does hereby certify:

That pursuant to the authority conferred upon the Board of Directors of the Corporation (the “Board”) by the Amended and Restated Certificate of Incorporation, as amended, on September 6, 2016, the Board adopted the following resolutions creating a series of preferred stock, par value $0.01 per share (“Preferred Stock”), of the Corporation designated as Series A Participating Preferred Stock:

RESOLVED: That pursuant to the authority vested in the Board by the Amended and Restated Certificate of Incorporation of the Corporation, as amended (the “Charter”), the Board does hereby provide for the issuance of a series of Preferred Stock of the Corporation and does hereby fix and herein state and express the designations, powers, preferences and relative and other special rights, and the qualifications, limitations and restrictions, of such series of Preferred Stock as follows:

Section 1. Designation and Amount. The shares of such series shall be designated as “Series A Participating Preferred Stock.” The Series A Participating Preferred Stock shall have a par value of $0.01 per share, and the number of shares constituting such series shall be 100,000. Such number of shares may be increased or decreased by resolution of the Board; provided, however, that no decrease shall reduce the number of shares of Series A Participating Preferred Stock to a number less than the number of shares then outstanding plus the number of shares reserved for issuance upon the exercise of outstanding options, rights or warrants or upon the exercise of any options, rights or warrants issuable upon conversion of any outstanding securities issued by the Corporation convertible into Series A Participating Preferred Stock.

Section 2. Proportional Adjustment. In the event that the Corporation shall at any time after the issuance of any share or shares of Series A Participating Preferred Stock (the “Rights Declaration Date”) (a) declare any dividend on the common stock of the Corporation, par value $0.01 per share (the “Common Stock”), payable in shares of Common Stock, (b) subdivide the outstanding Common Stock or (c) combine the outstanding Common Stock into a smaller number of shares, then in each such case the Corporation shall simultaneously effect a proportional adjustment to the number of outstanding shares of Series A Participating Preferred Stock by an amount the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that were outstanding immediately prior to such event.

Section 3. Dividends and Distributions.

(a) Subject to Section 2 and to the prior and superior rights of the holders of any shares of any series of Preferred Stock ranking prior and superior to the shares of Series A Participating Preferred Stock with respect to dividends, the holders of shares of Series A

Participating Preferred Stock shall be entitled to receive, when, as and if declared by the Board out of funds legally available for the purpose, quarterly dividends payable in cash on the last day of October, January, April and July in each year (each such date being referred to herein as a “Quarterly Dividend Payment Date”), commencing on the first Quarterly Dividend Payment Date after the first issuance of a share or fraction of a share of Series A Participating Preferred Stock, in an amount per share (rounded to the nearest cent) equal to the greater of (i) $1.00 and (ii) subject to Section 2, 1,000 times the aggregate per share amount of all cash dividends, and 1,000 times the aggregate per share amount (payable in kind) of all non-cash dividends or other distributions other than a dividend payable in shares of Common Stock or a subdivision of the outstanding shares of Common Stock (by reclassification or otherwise), declared on the Common Stock since the immediately preceding Quarterly Dividend Payment Date, or, with respect to the first Quarterly Dividend Payment Date, since the first issuance of any share or fraction of a share of Series A Participating Preferred Stock.

(b) The Corporation shall declare a dividend or distribution on the Series A Participating Preferred Stock as provided in paragraph (a) above immediately after it declares a dividend or distribution on the Common Stock (other than a dividend payable in shares of Common Stock); provided, however, that, in the event that no dividend or distribution shall have been declared on the Common Stock during the period between any Quarterly Dividend Payment Date and the next subsequent Quarterly Dividend Payment Date, a dividend of $1.00 per share on the Series A Participating Preferred Stock shall nevertheless be payable on such subsequent Quarterly Dividend Payment Date.

(c) Dividends shall begin to accrue and be cumulative on outstanding shares of Series A Participating Preferred Stock from the Quarterly Dividend Payment Date next preceding the date of issue of such shares of Series A Participating Preferred Stock, unless the date of issue of such shares is prior to the record date for the first Quarterly Dividend Payment Date, in which case dividends on such shares shall begin to accrue from the date of issue of such shares, or unless the date of issue is a Quarterly Dividend Payment Date or is a date after the record date for the determination of holders of shares of Series A Participating Preferred Stock entitled to receive a quarterly dividend and before such Quarterly Dividend Payment Date, in either of which events such dividends shall begin to accrue and be cumulative from such Quarterly Dividend Payment Date. Accrued but unpaid dividends shall not bear interest. Dividends paid on the shares of Series A Participating Preferred Stock in an amount less than the total amount of such dividends at the time accrued and payable on such shares shall be allocated pro rata on a share-by-share basis among all such shares at the time outstanding. The Board may fix a record date for the determination of holders of shares of Series A Participating Preferred Stock entitled to receive payment of a dividend or distribution declared thereon, which record date shall be no more than 60 days prior to the date fixed for the payment thereof.

Section 4. Voting Rights. The holders of shares of Series A Participating Preferred Stock shall have the following voting rights:

(a) Subject to the provision for adjustment hereinafter set forth, each share of Series A Participating Preferred Stock shall entitle the holder thereof to 1,000 votes on all matters submitted to a vote of the stockholders of the Corporation. In the event that the Corporation shall at any time after the Rights Declaration Date (i) declare any dividend on Common Stock payable in shares of Common Stock, (ii) subdivide the outstanding Common Stock or (iii) combine the outstanding Common Stock into a smaller number of shares, then in each such case the number of votes per share to which holders of shares of Series A Participating Preferred Stock were entitled immediately prior to such event shall be adjusted by multiplying such number by a fraction the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that were outstanding immediately prior to such event.

(b) Except as otherwise provided herein, in any other Certificate of Designation creating a series of Preferred Stock or any similar stock, the Charter or the Amended and Restated Bylaws of the Corporation (the “Bylaws”), or by law, the holders of shares of Series A Participating Preferred Stock and the holders of shares of Common Stock shall vote together as one class on all matters submitted to a vote of stockholders of the Corporation.

(c) Except as set forth herein or as required by law, the holders of Series A Participating Preferred Stock shall have no special voting rights and their consent shall not be required (except to the extent that they are entitled to vote with holders of Common Stock as set forth herein) for taking any corporate action.

(d) (i) If at any time dividends on any Series A Participating Preferred Stock shall be in arrears in an amount equal to six quarterly dividends thereon, then the occurrence of such contingency shall mark the beginning of a period (herein called a “default period”) that shall extend until such time as all accrued and unpaid dividends for all previous quarterly dividend periods and for the current quarterly dividend period on all shares of Series A Participating Preferred Stock then outstanding shall have been declared and paid or set apart for payment. During each default period, all holders of Preferred Stock (including holders of Series A Participating Preferred Stock) with dividends in arrears in an amount equal to six quarterly dividends thereon, voting as a class, irrespective of series, shall have the right to elect two directors.

(ii) During any default period, such voting right of the holders of Series A Participating Preferred Stock may be exercised initially at a special meeting called pursuant to subparagraph (iii) of this Section 4(d) or at any annual meeting of stockholders, and thereafter at annual meetings of stockholders; provided, however, that such voting right shall not be exercised unless the holders of at least one-third in number of shares of Preferred Stock outstanding shall be present in person or by proxy. The absence of a quorum of the holders of Common Stock shall not affect the exercise by the holders of Preferred Stock of such voting right. At any meeting at which the holders of Preferred Stock shall exercise such voting right initially during an existing default period, they shall have the right, voting as a class, to elect directors to fill such vacancies, if any, in the Board as may then exist up to two directors or, if such right is exercised at an annual meeting of stockholders, to elect two directors. If the number that may be so elected at any special meeting does not amount to the required number, the holders of Preferred Stock shall have the right to make such increase in the number of directors as shall be necessary to permit the election by them of the required number. After the holders of Preferred Stock shall have exercised their right to elect directors in any default period and during the continuance of such period, the number of directors shall not be increased or decreased except by vote of the holders of Preferred Stock as herein provided or pursuant to the rights of any equity securities ranking senior to or pari passu with the Series A Participating Preferred Stock.

(iii) Unless the holders of Preferred Stock shall, during an existing default period, have previously exercised their right to elect directors, the Board may order, or any stockholder or stockholders owning in the aggregate not less than 10% of the total number of shares of Preferred Stock outstanding, irrespective of series, may request, the calling of a special meeting of the holders of Preferred Stock, which meeting shall thereupon be called by the Chairman of the Board, Chief Executive Officer, President, Chief Financial Officer, Secretary, Assistant Secretary or any Senior Vice President of the Corporation. Notice of such meeting and of any annual meeting at which holders of Preferred Stock are entitled to vote pursuant to this paragraph (d)(iii) shall be given to each holder of record of Preferred Stock by mailing a copy of such notice to such holder at such holder’s last address as the same appears on the books of the Corporation. Such

meeting shall be called for a time not earlier than 20 days and not later than 60 days after such order or request, or in default of the calling of such meeting within 60 days after such order or request, such meeting may be called on similar notice by any stockholder or stockholders owning in the aggregate not less than 10% of the total number of shares of Preferred Stock outstanding. Notwithstanding the provisions of this paragraph (d)(iii), no such special meeting shall be called during the period within 60 days immediately preceding the date fixed for the next annual meeting of the stockholders.

(iv) In any default period, the holders of Common Stock and other classes of stock of the Corporation, if applicable, shall continue to be entitled to elect the whole number of directors until the holders of Preferred Stock shall have exercised their right to elect two directors voting as a class, after the exercise of which right (A) the directors so elected by the holders of Preferred Stock shall continue in office until their successors shall have been elected by such holders or until the expiration of the default period, and (B) any vacancy in the Board may (except as provided in subparagraph (ii) of this Section 4(d)) be filled by vote of a majority of the remaining directors theretofore elected by the holders of the class of stock that elected the director whose office shall have become vacant. References in this Section 4(d) to directors elected by the holders of a particular class of stock shall include directors elected by such directors to fill vacancies as provided in clause (B) of the foregoing sentence.

(v) Immediately upon the expiration of a default period, (A) the right of the holders of Preferred Stock as a class to elect directors shall cease, (B) the term of any directors elected by the holders of Preferred Stock as a class shall terminate and (C) the number of directors shall be such number as may be provided for in the Charter or the Bylaws irrespective of any increase made pursuant to the provisions of subparagraph (ii) of this Section 4(d) (such number being subject, however, to change thereafter in any manner provided by law or in the Charter or Bylaws). Any vacancies in the Board effected by the provisions of clauses (B) and (C) in the preceding sentence may be filled by a majority of the remaining directors.

Section 5. Certain Restrictions.

(a) The Corporation shall not declare any dividend on, make any distribution on, or redeem or purchase or otherwise acquire for consideration any shares of Common Stock after the first issuance of a share or fraction of a share of Series A Participating Preferred Stock unless concurrently therewith it shall declare a dividend on the Series A Participating Preferred Stock as required by Section 3 hereof.

(b) Whenever quarterly dividends or other dividends or distributions payable on the Series A Participating Preferred Stock as provided in Section 3 hereof are in arrears, thereafter and until all accrued and unpaid dividends and distributions, whether or not declared, on shares of Series A Participating Preferred Stock outstanding shall have been paid in full, the Corporation shall not:

(i) declare or pay dividends on, make any other distributions on, or redeem or purchase or otherwise acquire for consideration any shares of stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series A Participating Preferred Stock;

(ii) declare or pay dividends, or make any other distributions, on any shares of stock ranking on a parity (either as to dividends or upon liquidation, dissolution or winding up) with the Series A Participating Preferred Stock, except dividends paid ratably on the Series A Participating Preferred Stock and all such parity stock on which

dividends are payable or in arrears in proportion to the total amounts to which the holders of all such shares are then entitled;

(iii) redeem or purchase or otherwise acquire for consideration shares of any stock ranking on a parity (either as to dividends or upon liquidation, dissolution or winding up) with the Series A Participating Preferred Stock; provided, however, that the Corporation may at any time redeem, purchase or otherwise acquire shares of any such parity stock in exchange for shares of any stock of the Corporation ranking junior (either as to dividends or upon dissolution, liquidation or winding up) to the Series A Participating Preferred Stock; or

(iv) redeem or purchase or otherwise acquire for consideration any shares of Series A Participating Preferred Stock, or any shares of stock ranking on a parity with the Series A Participating Preferred Stock, except in accordance with a purchase offer made in writing or by publication (as determined by the Board) to all holders of such shares upon such terms as the Board, after consideration of the respective annual dividend rates and other relative rights and preferences of the respective series and classes, shall determine in good faith will result in fair and equitable treatment among the respective series or classes.

(c) The Corporation shall not permit any subsidiary of the Corporation to purchase or otherwise acquire for consideration any shares of stock of the Corporation unless the Corporation could, pursuant to paragraph (a) of this Section 5, purchase or otherwise acquire such shares at such time and in such manner.

Section 6. Reacquired Shares. Any shares of Series A Participating Preferred Stock purchased or otherwise acquired by the Corporation in any manner whatsoever shall be retired and cancelled promptly after the acquisition thereof. All such shares shall upon their cancellation become authorized but unissued shares of Preferred Stock and may be reissued as part of a new series of Preferred Stock to be created by resolution or resolutions of the Board, subject to the conditions and restrictions on issuance set forth herein, in the Charter or in any other Certificate of Designation creating a series of Preferred Stock or any similar stock or as otherwise required by law.

Section 7. Liquidation, Dissolution or Winding Up.

(a) Upon any liquidation (voluntary or otherwise), dissolution or winding up of the Corporation, no distribution shall be made to the holders of shares of stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series A Participating Preferred Stock unless, prior thereto, the holders of shares of Series A Participating Preferred Stock shall have received an amount equal to $1,000 per share of Series A Participating Preferred Stock, plus an amount equal to accrued and unpaid dividends and distributions thereon, whether or not declared, to the date of such payment (the “Series A Liquidation Preference”). Following the payment of the full amount of the Series A Liquidation Preference, no additional distributions shall be made to the holders of shares of Series A Participating Preferred Stock unless, prior thereto, the holders of shares of Common Stock shall have received an amount per share (the “Common Adjustment”) equal to the quotient obtained by dividing (i) the Series A Liquidation Preference by (ii) 1,000 (as appropriately adjusted to reflect events as stock splits, stock dividends and recapitalizations with respect to the Common Stock) (such number in clause (ii), the “Adjustment Number”). Following the payment of the full amount of the Series A Liquidation Preference and the Common Adjustment in respect of all outstanding shares of Series A Participating Preferred Stock and Common Stock, respectively, holders of Series A Participating Preferred Stock and holders of shares of Common Stock shall receive their ratable and proportionate share of the remaining assets to be distributed in the ratio of the Adjustment

Number to one with respect to such Preferred Stock and Common Stock, on a per share basis, respectively.

(b) In the event, however, that there are not sufficient assets available to permit payment in full of the Series A Liquidation Preference and the liquidation preferences of all other series of Preferred Stock, if any, that rank on a parity with the Series A Participating Preferred Stock, then such remaining assets shall be distributed ratably to the holders of such parity shares in proportion to their respective liquidation preferences. In the event, however, that there are not sufficient assets available to permit payment in full of the Common Adjustment, then such remaining assets shall be distributed ratably to the holders of Common Stock.

(c) In the event that the Corporation shall at any time after the Rights Declaration Date (i) declare any dividend on the Common Stock payable in shares of Common Stock, (ii) subdivide the outstanding Common Stock or (iii) combine the outstanding Common Stock into a smaller number of shares, then in each such case the Corporation shall simultaneously effect a proportional adjustment to the Adjustment Number in effect immediately prior to such event by an amount the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that were outstanding immediately prior to such event.

Section 8. Consolidation, Merger, etc. In the event that the Corporation shall enter into any consolidation, merger, combination, conversion, share exchange or other transaction in which the shares of Common Stock are exchanged for or changed into other stock, securities, cash and/or any other property (payable in kind), then in any such case the shares of Series A Participating Preferred Stock shall at the same time be similarly exchanged or changed in an amount per share (subject to Section 2) equal to 1,000 times the aggregate amount of stock, securities, cash and/or any other property (payable in kind), as the case may be, into which or for which each share of Common Stock is changed or exchanged.

Section 9. No Redemption. The shares of Series A Participating Preferred Stock shall not be redeemable.

Section 10. Ranking. The Series A Participating Preferred Stock shall rank junior to all other series of the Preferred Stock as to the payment of dividends and the distribution of assets, unless the terms of any such series shall provide otherwise.

Section 11. Amendment. At any time when any shares of Series A Participating Preferred Stock are outstanding, neither the Charter nor this Certificate of Designation shall be amended in any manner that would materially alter or change the powers, preferences or special rights of the Series A Participating Preferred Stock so as to affect them adversely without the affirmative vote of the holders of at least two-thirds of the outstanding shares of Series A Participating Preferred Stock, voting separately as a class.

Section 12. Fractional Shares. Series A Participating Preferred Stock may be issued in fractions of a share that shall entitle the holder, in proportion to such holder’s fractional shares, to exercise voting rights, receive dividends, participate in distributions and to have the benefit of all other rights of holders of Series A Participating Preferred Stock.

* * *

[Signature page follows]

IN WITNESS WHEREOF, the undersigned has executed this Certificate as of the 7th day of September, 2016.

By: /s/ Ralph S. Marimon

Name: Ralph S. Marimon

Title: Senior Vice President and Chief Financial Officer

Aviat Networks Elects Laxmi Akkaraju to Board of Directors

Jim Stoffel retires from Aviat Board after 16 years of service

Austin, Texas, November 13, 2023 -- Aviat Networks, Inc., (“Aviat Networks,” “Aviat,” or the “Company”), (Nasdaq: AVNW), the leading expert in wireless transport solutions, announced today that shareholders elected Laxmi Akkaraju to the Company’s Board of Directors effective November 8, 2023. Akkaraju, who is independent, will serve on the audit committee.

Ms. Akkaraju will replace Jim Stoffel, who is retiring from the Aviat Board of Directors after more than 16 years of service. During that time, he helped navigate Aviat from the merger that created the company through to its position today as the leading wireless transport company.

Laxmi Akkaraju is currently Chief Delivery Officer for Cognite, a global leader in industrial software, having previously served in Senior Vice President roles for Strategy and Customer Services. She is also a Board Member for the Moller Mobility Group and sits on the Advisory Board for Digital Norway and previously sat on the Advisory Board for BI Norwegian Business School. Prior to Cognite, Ms. Akkaraju was Chief Strategy Officer from 2017 to 2020 for the GSM Association (GSMA), a non-profit industry organization that represents the interests of mobile network operators worldwide, and held senior positions with EVRY, Mu Dynamics (now Spirent) and Holte Consulting. Ms. Akkaraju holds a Bachelor of Science in Civil Engineering from the University of New Mexico and a Master of Science in Civil Engineering from the University of Colorado Boulder.

“I would like to thank Jim Stoffel for his years of valued service and contributions as an Aviat board member. His leadership and knowledge have been a tremendous asset to the company.” said John Mutch, Chairman of Aviat Networks. “We are also excited to welcome Laxmi to our board. Laxmi brings a wealth of experience in telecom, strategy, international business, and leadership that will be beneficial to Aviat as we continue our strategy of growth, increased profitability, and creating shareholder value.”

About Aviat Networks, Inc.

Aviat Networks, Inc. is the leading expert in wireless transport and access solutions and works to provide dependable products, services and support to its customers. With more than one million systems sold into 170 countries worldwide, communications service providers and private network operators including state/local government, utility, federal government and defense organizations trust Aviat with their critical applications. Coupled with a long history of microwave innovations, Aviat provides a

comprehensive suite of localized professional and support services enabling customers to drastically simplify both their networks and their lives. For more than 70 years, the experts at Aviat have delivered high performance products, simplified operations, and the best overall customer experience. Aviat is headquartered in Austin, Texas. For more information, visit www.aviatnetworks.com or connect with Aviat Networks on Twitter, Facebook and LinkedIn.

Media Contact: Stuart Little, Aviat Networks, stuart.little@aviatnet.com

Investor Relations Contact: Andrew Fredrickson, Aviat Networks, andrew.fredrickson@aviatnet.com

v3.23.3

Cover

|

Nov. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 08, 2023

|

| Entity Registrant Name |

AVIAT NETWORKS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33278

|

| Entity Tax Identification Number |

20-5961564

|

| Entity Address, Address Line One |

200 Parker Dr., Suite C100A

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78728

|

| City Area Code |

(408)

|

| Local Phone Number |

941-7100

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

AVNW

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001377789

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--06-30

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

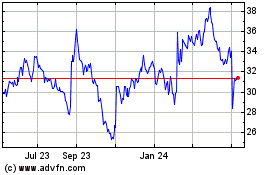

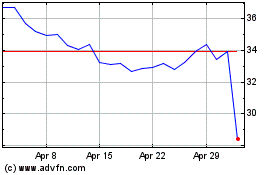

Aviat Networks (NASDAQ:AVNW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aviat Networks (NASDAQ:AVNW)

Historical Stock Chart

From Apr 2023 to Apr 2024