false

0000811212

0000811212

2023-11-13

2023-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2023

THERMOGENESIS HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

333-82900

|

|

94-3018487

|

|

(State or Other Jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of Incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

2711 Citrus Road, Rancho Cordova, California

|

|

95742

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (916) 858-5100

(Former Name or Former Address, if Changed Since Last Report)

N/A

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.001 par value

|

THMO

|

Nasdaq Capital Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 13, 2023, ThermoGenesis Holdings, Inc. (the “Company”) issued a press release announcing its results of operations and financial condition for the third quarter of calendar year 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Information contained in this Item 2.02 and in Exhibit 99.1 attached to this Current Report on Form 8-K is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, or incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, except as shall be expressly set forth in such a filing.

Item 9.01. Financial Statements and Exhibits.

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

THERMOGENESIS HOLDINGS, INC.

|

| |

|

(Registrant)

|

| |

|

|

|

Dated: November 13, 2023

|

|

/s/ Jeffery Cauble

|

| |

|

Jeffery Cauble,

Chief Financial Officer

|

Exhibit 99.1

ThermoGenesis Holdings Announces Third Quarter 2023 Financial Results and Provides Corporate Update

Conference Call to be Held Today at 1:30 p.m. PT/4:30 p.m. ET

RANCHO CORDOVA, Calif., November 13, 2023 -- ThermoGenesis Holdings, Inc. (Nasdaq: THMO), a market leader in automated cell processing tools and services in the cell and gene therapy field, today reported financial and operating results for the third quarter ended September 30, 2023, and provided a corporate business update.

“In October, we were pleased to have completed the build-out of our 35,500+ square foot, state-of-the-art facility in Sacramento, which represents the cornerstone of our planned business expansion into a high performance, integrated contract development and manufacturing organization (CDMO) in the cell and gene therapy field,” commented Chris Xu, Ph.D., Chief Executive Officer of ThermoGenesis. “Our grand opening celebration was attended by several prominent officials from the greater Sacramento area, who helped us to unveil our twelve (12) new, ISO class-7 ReadyStart cGMP cleanroom suites and IncuStart Wet Labs. This all-encompassing CDMO facility will provide a flexible option, enabling companies to achieve their anticipated milestones faster and more efficiently. Additionally, the ability to leverage ThermoGenesis’ strong expertise in regulatory affairs and product commercialization will help accelerate the development of our customers’ products, allowing them to focus on their science, while ThermoGenesis will manage the regulatory and quality compliance requirements associated with running a cGMP facility.”

Financial Results for the Third Quarter Ended September 30, 2023

Net revenues for the three months ended September 30, 2023, were $2,194,000, compared to $2,115,000 for the quarter ended September 30, 2022. The increase was driven by additional AXP disposable sales in the quarter ended September 30, 2023.

Gross profit was $395,000 or 18% of net revenues for the three months ended September 30, 2023, compared to $437,000 or 21% of net revenues for three months ended September 30, 2022. The decrease was driven by excess manufacturing charges incurred as a result of reallocating resources to the completion of the Company’s CDMO facility in the third quarter of 2023.

Selling, general and administrative expenses were $1,686,000 for the three months ended September 30, 2023, compared to $1,982,000 for the three months ended September 30, 2022, a decrease of $296,000 or 15%. The decrease was driven primarily by lower employee benefit expenses and lower investor relations expenses.

Research and development expenses were $266,000 for the three months ended September 30, 2023, as compared to $470,000 for the three months ended September 30, 2022, a decrease of $204,000 or 43%. The decrease was primarily due to lower project expenses and personnel expenses during the quarter.

Interest expense for the three months ended September 30, 2023, was $2,118,000 compared to $1,391,000, for the three months ended September 30, 2022, an increase of $727,000. The increase was driven by additional amortization expense in the three months ended September 30, 2023 as compared to the same period in 2022.

Net loss attributable to common stockholders was $3,615,000 for the three months ended September 30, 2023, or $(1.44) per share, based on 2,503,631 weighted average basic and diluted common shares outstanding. This compares to a net loss attributable to common stockholders of $3,240,000, or $(4.66) per share, based on 694,795 weighted average basic and diluted common shares outstanding for the three months ended September 30, 2022.

At September 30, 2023, the Company had cash and cash equivalents totaling $4,018,000, compared with cash and cash equivalents of $4,177,000 at December 31, 2022.

Conference Call and Webcast Information

ThermoGenesis will host a conference call today at 1:30 p.m. PT/4:30 p.m. ET. To participate in the conference call, please dial 1-844-889-4331 (domestic), 1-412-380-7406 (international) or 1-866-605-3852 (Canada). To access a live webcast of the call, please visit: https://thermogenesis.com/investors/news-and-events/events-webcasts.

A webcast replay will also be available on ThermoGenesis’ website for three months. To access the replay, please visit: https://thermogenesis.com/investors/news-and-events/events-webcasts.

About ThermoGenesis Holdings, Inc.

Since its inception over 35 years ago, ThermoGenesis Holdings, Inc. has become a leading developer and marketer of a range of commercialized, automated technologies for CAR-T and other cell-based therapies, clinical biobanking, point-of-care applications, and automation for immuno-oncology, including its semi-automated, functionally closed CAR-TXpress™ platform, which streamlines the manufacturing process for the emerging CAR-T immunotherapy market. The Company has recently shifted its focus to the research, development, and manufacturing of immunotherapies and regenerative medicine solutions, with the goal of becoming a high-performance, integrated contract development and manufacturing organization (CDMO), specializing in cell and gene therapy For more information about ThermoGenesis, please visit: www.thermogenesis.com.

For more information about the new ReadyStart and IncuStart facility please visit: www.readystartcleanrooms.com and www.incustartwetlabs.com

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. The forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements contained herein. When used in this press release, the words "anticipate," "believe," "estimate," "expect" and similar expressions as they relate to the Company or its management are intended to identify such forward-looking statements. Actual results, performance or achievements could differ materially from the results expressed in or implied by these forward-looking statements. Readers should be aware of important factors that, in some cases, have affected, and in the future could affect, actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of the Company. These factors include without limitation, the ability to obtain capital and other financing in the amounts and at the times needed to launch new products and services and grow our CDMO business, market acceptance of new products and services, the nature and timing of regulatory approvals for both new products and existing products for which the Company proposes new claims, realization of forecasted revenues, expenses and income, initiatives by competitors, price pressures, failure to meet FDA regulated requirements governing the Company’s products and operations (including the potential for product recalls associated with such regulations), risks associated with initiating manufacturing for new products, failure to meet Foreign Corrupt Practice Act regulations, legal proceedings, risks associated with expanding into the Company’s planned CDMO business, uncertainty associated with the COVID-19 pandemic and other potential pandemics, and other risk factors listed from time to time in our reports with the Securities and Exchange Commission (“SEC”), including, in particular, those set forth in ThermoGenesis Holdings’ Form 10-K for the year ended December 31, 2022.

Company Contact:

Wendy Samford

916-858-5191

ir@thermogenesis.com

Investor Contact:

Paula Schwartz, Rx Communications

917-322-2216

pschwartz@rxir.com

Financials

ThermoGenesis Holdings, Inc.

Condensed Consolidated Balance Sheets

| |

|

September 30,

2023

|

|

|

December 31,

2022

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

4,018,000 |

|

|

$ |

4,177,000 |

|

|

Accounts receivable, net

|

|

|

368,000 |

|

|

|

1,865,000 |

|

|

Inventories

|

|

|

1,821,000 |

|

|

|

3,334,000 |

|

|

Prepaid expenses and other current assets

|

|

|

718,000 |

|

|

|

1,508,000 |

|

|

Total current assets

|

|

|

6,925,000 |

|

|

|

10,884,000 |

|

| |

|

|

|

|

|

|

|

|

|

Inventories, non-current

|

|

|

772,000 |

|

|

|

1,003,000 |

|

|

Equipment and leasehold improvements, net

|

|

|

2,523,000 |

|

|

|

1,254,000 |

|

|

Right-of-use operating lease assets, net

|

|

|

190,000 |

|

|

|

372,000 |

|

|

Right-of-use operating lease assets – related party, net

|

|

|

3,213,000 |

|

|

|

3,550,000 |

|

|

Goodwill

|

|

|

781,000 |

|

|

|

781,000 |

|

|

Intangible assets, net

|

|

|

1,262,000 |

|

|

|

1,286,000 |

|

|

Other assets

|

|

|

255,000 |

|

|

|

256,000 |

|

|

Total assets

|

|

$ |

15,921,000 |

|

|

$ |

19,386,000 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

591,000 |

|

|

$ |

820,000 |

|

|

Other current liabilities

|

|

|

8,299,000 |

|

|

|

10,689,000 |

|

|

Total current liabilities

|

|

|

8,890,000 |

|

|

|

11,509,000 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term liabilities

|

|

|

3,768,000 |

|

|

|

4,554,000 |

|

| |

|

|

|

|

|

|

|

|

|

Total equity

|

|

|

3,263,000 |

|

|

|

3,323,000 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and equity

|

|

$ |

15,921,000 |

|

|

$ |

19,386,000 |

|

ThermoGenesis Holdings, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| |

|

Three Months Ended

September 30,

|

|

|

Nine Months Ended

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net revenues

|

|

$ |

2,194,000 |

|

|

$ |

2,115,000 |

|

|

$ |

7,039,000 |

|

|

$ |

7,807,000 |

|

|

Cost of revenues

|

|

|

1,799,000 |

|

|

|

1,678,000 |

|

|

|

5,070,000 |

|

|

|

5,491,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

395,000 |

|

|

|

437,000 |

|

|

|

1,969,000 |

|

|

|

2,316,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

1,686,000 |

|

|

|

1,982,000 |

|

|

|

5,346,000 |

|

|

|

5,665,000 |

|

|

Research and development

|

|

|

266,000 |

|

|

|

470,000 |

|

|

|

955,000 |

|

|

|

1,317,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

1,952,000 |

|

|

|

2,452,000 |

|

|

|

6,301,000 |

|

|

|

6,982,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(1,557,000 |

) |

|

|

(2,015,000 |

) |

|

|

(4,332,000 |

) |

|

|

(4,666,000 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(2,118,000 |

) |

|

|

(1,391,000 |

) |

|

|

(6,689,000 |

) |

|

|

(3,572,000 |

) |

|

Other income (expenses)

|

|

|

22,000 |

|

|

|

3,000 |

|

|

|

27,000 |

|

|

|

(1,000 |

) |

|

Loss on retirement of debt

|

|

|

(87,000 |

) |

|

|

-- |

|

|

|

(326,000 |

) |

|

|

-- |

|

|

Total other expense

|

|

|

(2,183,000 |

) |

|

|

(1,388,000 |

) |

|

|

(6,988,000 |

) |

|

|

(3,573,000 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(3,740,000 |

) |

|

|

(3,403,000 |

) |

|

|

(11,320,000 |

) |

|

|

(8,239,000 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss attributable to noncontrolling interests

|

|

|

(125,000 |

) |

|

|

(163,000 |

) |

|

|

(359,000 |

) |

|

|

(402,000 |

) |

|

Net loss attributable to common stockholders

|

|

$ |

(3,615,000 |

) |

|

$ |

(3,240,000 |

) |

|

$ |

(10,961,000 |

) |

|

$ |

(7,837,000 |

) |

ThermoGenesis Holdings, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| |

|

Nine Months Ended

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

$ |

(1,678,000 |

) |

|

$ |

(6,101,000 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

(1,541,000 |

) |

|

|

(308,000 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

3,061,000 |

|

|

|

3,037,000 |

|

| |

|

|

|

|

|

|

|

|

|

Effects of foreign currency rate changes on cash and cash equivalents

|

|

|

(1,000 |

) |

|

|

(5,000 |

) |

| |

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash, cash equivalents and restricted cash

|

|

|

(159,000 |

) |

|

|

(3,377,000 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of period

|

|

|

4,177,000 |

|

|

|

7,280,000 |

|

|

Cash and cash equivalents at end of period

|

|

$ |

4,018,000 |

|

|

$ |

3,903,000 |

|

v3.23.3

Document And Entity Information

|

Nov. 13, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

THERMOGENESIS HOLDINGS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 13, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

333-82900

|

| Entity, Tax Identification Number |

94-3018487

|

| Entity, Address, Address Line One |

2711 Citrus Road

|

| Entity, Address, City or Town |

Rancho Cordova

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

95742

|

| City Area Code |

916

|

| Local Phone Number |

858-5100

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

THMO

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000811212

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

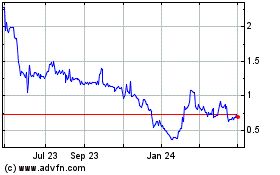

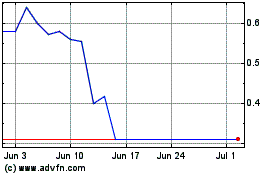

ThermoGenesis (NASDAQ:THMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

ThermoGenesis (NASDAQ:THMO)

Historical Stock Chart

From Apr 2023 to Apr 2024