UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. ________)*

Collective Audience, Inc.

(Name of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

193939 105

(CUSIP Number)

Brent Suen

85 Broad Street 16-079

New York, NY 10004

808-829-1057

(Name, Address and Telephone Number of Persons

Authorized to Receive Notices and Communications)

November 2, 2023

(Date of Event which Requires Filing of this

Statement)

If the filing person

has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this

schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. o

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are

to be sent.

* The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

CUSIP No. 193939

105

| 1 |

NAME OF REPORTING PERSONS

Logiq, Inc. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

|

(a) ☐

(b) ☐

|

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

SC |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

6,038,000* |

| 8 |

SHARED VOTING POWER

0* |

| 9 |

SOLE DISPOSITIVE POWER

6,038,000* |

| 10 |

SHARED DISPOSITIVE POWER

0* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,038,000 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE

INSTRUCTIONS)

N/A

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

45.60%(1) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO |

| |

|

|

|

|

* Calculated in the manner set forth in Item 5

(1) Assumes 13,220,263 shares of common stock outstanding as of the date

of this statement on Schedule 13D, based on 13,220,263 shares of common stock deemed to be issued and outstanding as of November 2, 2023.

ITEM 1. SECURITY AND ISSUER

This statement on Schedule 13D (“Schedule 13D”)

relates to the common stock, par value $0.0001 per share (the “Common Stock”) of Collective Audience, Inc. a Delaware corporation

(the “Issuer”).

The address of the principal executive offices of

the Issuer is: 85 Broad Street, 16-079, New York, New York 10004.

ITEM 2. IDENTITY AND BACKGROUND

(a) Name

This Schedule 13D is filed by Logiq, Inc., a Delaware

corporation (the “Reporting Person”).

(b) Residence

or Business Address

The address of the principal business and principal

office for the Reporting Person is: 85 Broad Street, 16-079, New York, New York 10004.

(c) Present

Principal Occupation or Employment and the Name, Principal Business and Address of any Corporation or Other Organization in Which Such

Employment Is Conducted

The Reporting Person is a U.S.-based provider of e-commerce

and digital customer acquisition solutions by simplifying digital advertising.

During the past five years, neither the Reporting

Person nor, to the best of the Reporting Person’s knowledge, any of its directors or executive officers has been convicted in a

criminal proceeding (excluding traffic violations or similar misdemeanors).

During the past five years, neither the Reporting

Person nor, to the best of the Reporting Person’s knowledge, any of its directors or executive officers has been a party to a civil

proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment,

decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws

or finding any violation with respect to such laws.

The Reporting Person is organized under the laws of

the State of Delaware. The citizenship of each of the Reporting Person’s directors and executive officers is listed on Schedule

A.

ITEM 3. SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

Merger Agreement and Related Transactions

As previously announced, on September 9, 2022, Abri

SPAC I, Inc., a Delaware corporation (“Abri”), Abri Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary

of Abri (“Merger Sub”), Logiq, Inc., a Delaware corporation (“Logiq or “DLQ Parent”) whose

common stock is quoted on OTCQX Market under the ticker symbol “LGIQ” and, DLQ, Inc., a Nevada corporation and wholly owned

subsidiary of DLQ Parent (“DLQ”) entered into a Merger Agreement (the “Merger Agreement”)

On November 2, 2023 (the “Closing Date”),

the Business Combination, among other transactions contemplated by the Merger Agreement, was completed (the “Closing”).

Upon Closing, Abri changed it’s name to “Collective Audience, Inc”, and the symbol changed to “CAUD”.

At Closing, pursuant to the terms of the Merger Agreement

and after giving effect to the redemptions of shares of Abri Common Stock The total consideration paid at Closing (the “Merger

Consideration”) by Abri to Logiq was 11,400,000 shares of Abri common stock valued at $114 million (the “Consideration

Shares”);

Concurrent with Closing,

upon issuance of the Consideration Shares, Logiq declared a share dividend of 3,762,000 Consideration Shares (representing 33% of the

total Consideration Shares) to the DLQ Parent stockholders (the “Logiq Dividend”) of record as of October 24, 2023

(the “Dividend Record Date”). The remaining 53% (the 6,038,000 shares represented herein) of Consideration Shares

were issued to Logiq, are subject to an 11-month lock-up (the “Lock-up Agreement”), and will be deposited into a separate

escrow account, and such escrow (the “Escrow Agreement”) which will be released once the DLQ Investors recoup their

original investment amounts.

The descriptions of the Merger Agreement, Lock-up

Agreement and Escrow Agreement contained herein do not purport to be complete and are qualified in their entirety by reference to the

full text of each of the Merger Agreement, Lock-up Agreement and Escrow Agreement, copies of which are attached hereto as Exhibits 1 through

7 and are incorporated herein by reference.

ITEM 4. PURPOSE OF TRANSACTION

The Reporting Person acquired the securities described

in this Schedule 13D for investment purposes, and the Reporting Person intends to review its investment in the Issuer on a continuing

basis. Any actions the Reporting Person might undertake may be made at any time and from time to time without prior notice and will be

dependent upon the Reporting Person’s review of numerous factors, including, but not limited to: an ongoing evaluation of the Issuer’s

business, financial condition, operations and prospects; price levels of the Issuer’s securities; general market, industry and economic

conditions; the relative attractiveness of alternative business and investment opportunities; and other future developments.

The information set forth above under Item 3 of this

Schedule 13D is incorporated herein by reference.

Except as set forth in the Merger Agreement, and to

the extent the foregoing may be deemed a plan or proposal, the Reporting Person has no present plan or proposal which relates to, or could

result in, any of the events referred to in paragraphs (a) through (j), inclusive, of Item 4 of Schedule 13D. The Reporting Person may,

at any time and from time to time, review or reconsider its position and/or change its purpose.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

The beneficial ownership of the Issuer’s Common stock is based on

13,220,263 shares of common stock deemed to be issued and outstanding as of November 2, 2023.

(a) and (b) The responses of the Reporting Person

to rows 7, 8, 9, 10, 11, and 13 on the cover page of this Schedule 13D are incorporated herein by reference.

(c) Neither the Reporting Person, nor any of the persons

listed in Schedule A, has effected any transactions in the Issuer’s securities within the past 60 days.

(d) Not Applicable.

(e) Not Applicable.

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS

OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

Other than as set forth in Item 3 of this Schedule

13D, the Reporting Person is not subject to any contracts, arrangements, understandings or relationships with respect to the securities

of the Issuer.

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

The following documents are filed as exhibits

|

Exhibit No. |

|

Description |

| |

|

| 1 |

|

Merger Agreement dated as of September 9, 2022 by and among Logiq, Inc., DLQ Inc., Abri SPAC I, Inc. and Abri Merger Sub, Inc.. (incorporated by reference to Exhibit 2.1 to the Issuer’s Current Report on Form 8-K, filed with the Commission on September 12, 2022). |

| 2 |

|

First Amendment to the Merger Agreement dated as of May 1, 2023, by and among Logiq, Inc., Abri SPAC I, Inc., Abri Merger Sub, Inc., and DLQ, Inc. (incorporated by reference to Exhibit 2.2 to the Issuer’s Current Report on Form 8-K, filed with the Commission on May 2, 2023). |

| 3 |

|

Second Amendment to the Merger Agreement dated as of June 8, 2023, by and among Logiq, Inc., Abri SPAC I, Inc., Abri Merger Sub, Inc., and DLQ, Inc. (incorporated by reference to Exhibit 2.3 to the Issuer’s Current Report on Form 8-K, filed with the Commission on June 9, 2023). |

| 4 |

|

Third Amendment to the Merger Agreement dated as of July 20, 2023, by and among Logiq, Inc., Abri SPAC I, Inc., Abri Merger Sub, Inc., and DLQ, Inc. (incorporated by reference to Exhibit 2.4 to the Issuer’s Current Report on Form 8-K, filed with the Commission on July 25, 2023). |

| 5 |

|

Fourth Amendment to the Merger Agreement dated as of August 28, 2023 by and among Logiq, Inc., Abri SPAC I, Inc., Abri Merger Sub, Inc., and DLQ, Inc. (incorporated by reference to Exhibit 2.5 to the Issuer’s Current Report on Form 8-K, filed with the Commission on August 31, 2023). |

| 6 |

|

Lock-up Agreement |

| 7 |

|

Form of Escrow Agreement between Logiq, Inc, and Continental Stock Transfer |

SIGNATURE

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| Date: November 13, 2023 |

|

LOGIQ, INC. |

| |

|

| |

By: |

/s/ Brent Suen |

| |

Name: |

Brent Suen |

| |

Title: |

Chief Executive Officer |

Schedule A

DIRECTORS AND EXECUTIVE

OFFICERS OF THE REPORTING PERSON

LOGIQ, INC.

| Name and Position | |

Principal Occupation or Employment Name and Position and Principal Business Address* | |

| Citizenship | | |

Transactions effected during the past 60 days |

Brent Suen (President, Chief Executive Officer, Director) | |

CAUD | |

| USA | | |

None |

| | |

| |

| | | |

|

Peter Bordes (Director) | |

LGIQ | |

| USA | | |

None |

| | |

| |

| | | |

|

Christopher Andrews (Chief Operating Officer) | |

LGIQ | |

| USA | | |

None |

| | |

| |

| | | |

|

Ross O’Brien (Director) | |

LGIQ | |

| USA | | |

None |

| | |

| |

| | | |

|

Lionel Choong (Chief Financial Officer) | |

LGIQ | |

| Malaysia | | |

None |

*For each individual with a principal occupation at Logiq, Inc. (“LGIQ”),

their position is listed below their name, and their principal business address is the address of LGIQ provided above.

Exhibit 6

LOCK-UP AGREEMENT

THIS LOCK-UP AGREEMENT (this

“Agreement”) is dated as of November 2, 2023 by and between the undersigned stockholder (the “Holder”)

and Collective Audience (f/k/a Abri SPAC I, Inc.), a Delaware corporation (the “Parent”).

A. Parent, Abri Merger Sub

Inc., a Delaware corporation and wholly-owned subsidiary of the Parent, DLQ, Inc., a Nevada corporation (the “Company”)

and Logiq, Inc., a Delaware corporation and the parent of the Company (“DLQ Parent”) entered into a Merger Agreement

dated as of September 9, 2022 (the “Merger Agreement”). Capitalized terms used, but not otherwise defined herein,

shall have the meanings ascribed to such terms in the Merger Agreement.

B. Pursuant to the Merger

Agreement, Parent will become the 100% stockholder of the Company.

C. The Holder is either (i)

the record and/or beneficial owner of certain shares of Company Common Stock, which will be exchanged for shares of Parent Common Stock

pursuant to the Merger Agreement or (ii) a member of management of DLQ Parent that receives Dividend Shares of Parent Common Stock as

provided in the Merger Agreement.

D. As a condition of, and

as a material inducement for the Parent and the Company to enter into and consummate the transactions contemplated by the Merger Agreement,

the Holder has agreed to execute and deliver this Agreement, which shall be effective as of the Closing Date of the Merger.

NOW, THEREFORE, for and in

consideration of the mutual covenants and agreements set forth herein, and other good and valuable consideration, the receipt and sufficiency

of which is hereby acknowledged, the parties, intending to be legally bound, agree as follows:

AGREEMENT

1. Lock-up.

(a) Subject to Section 1(b)

below, during the Lock-up Period, the Holder agrees that it, he or she will not offer, sell, contract to sell, pledge or otherwise dispose

of, directly or indirectly, any of the Lock-up Shares (as defined below), enter into a transaction that would have the same effect, or

enter into any swap, hedge or other arrangement that transfers, in whole or in part, any of the economic consequences of ownership of

the Lock-up Shares or otherwise, publicly disclose the intention to make any offer, sale, pledge or disposition, or to enter into any

transaction, swap, hedge or other arrangement, or engage in any Short Sales (as defined below) with respect to the Lock-up Shares.

(b) In furtherance of the foregoing,

during the Lock-up Period, the Parent will (i) place a stop order on all the Lock-up Shares, including those which may be covered by a

registration statement, and (ii) notify the Parent’s transfer agent in writing of the stop order and the restrictions on the Lock-up

Shares under this Agreement and direct the Parent’s transfer agent not to process any attempts by the Holder to resell or transfer

any Lock-up Shares, except in compliance with this Agreement.

(c) For purposes hereof, “Short

Sales” include, without limitation, all “short sales” as defined in Rule 200 of Regulation SHO under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), and all types of direct and indirect stock pledges, forward

sale contracts, options, puts, calls, swaps and similar arrangements (including on a total return basis), and sales and other transactions

through non-U.S. broker dealers or foreign regulated brokers.

(d) The term “Lock-up

Period” means the date that is eleven (11) months after the Closing Date (as defined in the Merger Agreement).

2. Beneficial Ownership.

The Holder hereby represents and warrants that it does not beneficially own, directly or through its nominees (as determined in accordance

with Section 13(d) of the Exchange Act, and the rules and regulations promulgated thereunder), any shares of Parent Common Stock, or any

economic interest in or derivative of such shares, other than those shares of Parent Common Stock issued pursuant to the Merger Agreement.

For purposes of this Agreement, the Merger Consideration Shares (other than the Dividend Shares being distributed by DLQ Parent to it

stockholders concurrent with the Closing) beneficially owned by the Holder, together with any other shares of Parent Common Stock, and

including any securities convertible into, or exchangeable for, or representing the rights to receive Parent Common Stock, if any, acquired

during the Lock-up Period are collectively referred to as the “Lock-up Shares,” provided, however,

that such Lock-up Shares shall not include shares of Parent Common Stock acquired by such Holder in open market transactions during the

Lock-up Period. For the avoidance of doubt, notwithstanding anything contained in this paragraph, the parties have agreed that the Dividend

Shares distributed to members of management are Lock-up Shares.

Notwithstanding the foregoing,

and subject to the conditions below, the undersigned may transfer Lock-up Shares in connection with (a) transfers or distributions to

the Holder’s direct or indirect affiliates (within the meaning of Rule 405 under the Securities Act of 1933, as amended (the “Securities

Act”)) or to the estates of any of the foregoing; (b) any transfers exempt from registration under the Securities Act; (c)

transfers by bona fide gift to a member of the Holder’s immediate family or to a trust, the beneficiary of which is the Holder or

a member of the Holder’s immediate family for estate planning purposes; (d) by virtue of the laws of descent and distribution upon

death of the Holder; (e) pursuant to a qualified domestic relations order; (f) transfers to the Parent’s officers, directors or

their affiliates; (g) transfers pursuant to a bona fide third-party tender offer, merger, stock sale, recapitalization, consolidation

or other transaction involving a change of control of Parent; provided, however, that in the event that such tender offer,

merger, recapitalization, consolidation or other such transaction is not completed, the Lock-up Shares subject to this Agreement shall

remain subject to this Agreement; (h) the establishment of a trading plan pursuant to Rule 10b5-1 promulgated under the Exchange Act;

provided, however, that such plan does not provide for the transfer of Lock-up Shares during the Lock-up Period; (i) transfers

to satisfy tax withholding obligations in connection with the exercise of options to purchase shares of Parent Common Stock or the vesting

of stock-based awards or shares of Parent Common Stock issued pursuant to that certain Management Earnout Agreement; and (j) transfers

in payment on a “net exercise” or “cashless” basis of the exercise or purchase price with respect to the exercise

of options to purchase shares of Parent Common Stock; provided, however, that, in the case of any transfer pursuant to the

foregoing (a) through (f) clauses, it shall be a condition to any such transfer that (i) the transferee/donee agrees in writing (a copy

of which shall be provided by the Holder to the parties hereto and to Continental Stock and Transfer Company), to be bound by the terms

of this Agreement (including, without limitation, the restrictions set forth in the preceding sentence) to the same extent as if the transferee/donee

were a party hereto; and (ii) each party (donor, donee, transferor or transferee) shall not be required by law (including without limitation

the disclosure requirements of the Securities Act and the Exchange Act) to make, and shall agree to not voluntarily make, any filing or

public announcement of the transfer or disposition prior to the expiration of the Lock-up Period. The Holder hereby covenants to Parent

that the Holder will give notice to Parent of any transfer of Lock-up Shares pursuant to this Section 2 of the Agreement, with such notice

given in accordance with Section 5 of this Agreement.

3. Representations and

Warranties. Each of the parties hereto, by their respective execution and delivery of this Agreement, hereby represents and warrants

to the other that (a) such party has the full right, capacity and authority to enter into, deliver and perform its respective obligations

under this Agreement, (b) this Agreement has been duly executed and delivered by such party and is a binding and enforceable obligation

of such party and, enforceable against such party in accordance with the terms of this Agreement, and (c) the execution, delivery and

performance of such party’s obligations under this Agreement will not conflict with or breach the terms of any other agreement,

contract, commitment or understanding to which such party is a party or to which the assets or securities of such party are bound. The

Holder has independently evaluated the merits of his/her/its decision to enter into and deliver this Agreement, and such Holder confirms

that he/she/it has not relied on the advice of Company, Company’s legal counsel, or any other person.

4. No Additional Fees/Payment.

Other than the consideration specifically referenced herein, the parties hereto agree that No fee, payment or additional consideration

in any form has been or will be paid to the Holder in connection with this Agreement.

5.

Notices. Any notices required or permitted to be sent hereunder shall be sent in writing, addressed as specified below, and shall

be deemed given: (a) if by hand or recognized courier service, by 4:00PM on a Business Day, addresse’s day and time, on the date

of delivery, and otherwise on the first Business Day after such delivery; (b) if by email, on the date that transmission is confirmed

electronically, if by 4:00PM on a Business Day, addressee’s day and time, and otherwise on the first Business Day after the date

of such confirmation; or (c) five days after mailing by certified or registered mail, return receipt requested. Notices shall be addressed

to the respective parties as follows (excluding telephone numbers, which are for convenience only), or to such other address as a party

shall specify to the others in accordance with these notice provisions:

(a) If to Company, to:

DLQ, Inc.

with a copy (which shall not constitute notice) to:

Procopio, Cory, Hargreaves, & Savitch LLP

12544 High Bluff Drive, Suite 400

San Diego, California 92130

Attn: Christopher Tinen, Esq.

if to Parent or Merger Sub (prior to

the Closing):

Abri SPAC I, Inc.

9663

Santa Monica Blvd., No. 1091

Beverly

Hills, CA 90210

Attn:

Jeffrey Tirman, Chief Executive Officer

E-mail: jtirman@abriadv.com

with a copy (which shall not constitute notice) to:

Loeb & Loeb LLP

345

Park Ave

New York,

NY 10154

Attention:

Mitchell S. Nussbaum

Fax:

212.504.3013

E-mail:

mnussbaum@loeb.com

(b) If to the Holder, to the

address set forth on the Holder’s signature page hereto, with a copy, which shall not constitute notice, to:

Abri Ventures I, LLC.

9663

Santa Monica Blvd., No. 1091

Beverly

Hills, CA 90210

Attn:

Jeffrey Tirman, Chief Executive Officer

E-mail:

jtirman@abriadv.com

or to such other address(es) as any party may

have furnished to the others in writing in accordance herewith.

6. Enumeration and Headings.

The enumeration and headings contained in this Agreement are for convenience of reference only and shall not control or affect the meaning

or construction of any of the provisions of this Agreement.

7. Counterparts. This

Agreement may be executed in facsimile and in any number of counterparts, each of which when so executed and delivered shall be deemed

an original, but all of which shall together constitute one and the same agreement. This Agreement shall become effective upon delivery

to each party of an executed counterpart or the earlier delivery to each party of original, photocopied or electronically transmitted

signature pages that together (but need not individually) bear the signatures of all other parties.

8. Successors and Assigns.

This Agreement and the terms, covenants, provisions and conditions hereof shall be binding upon, and shall inure to the benefit of, the

respective heirs, successors and assigns of the parties hereto. The Holder hereby acknowledges and agrees that this Agreement is entered

into for the benefit of and is enforceable by Company and its successors and assigns.

9. Severability. If

any provision of this Agreement is held to be invalid or unenforceable for any reason, such provision will be conformed to prevailing

law rather than voided, if possible, in order to achieve the intent of the parties and, in any event, the remaining provisions of this

Agreement shall remain in full force and effect and shall be binding upon the parties hereto.

10. Amendment. This

Agreement may be amended or modified by written agreement executed by each of the parties hereto.

11. Further Assurances.

Each party shall do and perform, or cause to be done and performed, all such further acts and things, and shall execute and deliver all

such other agreements, certificates, instruments and documents, as any other party may reasonably request in order to carry out the intent

and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

12. No Strict Construction.

The language used in this Agreement will be deemed to be the language chosen by the parties to express their mutual intent, and No rules

of strict construction will be applied against any party.

13.

Dispute Resolution. Section 12.15 (Waiver of Jury Trial) and 12.16 (Submission to Jurisdiction) of the Merger Agreement is incorporated

by reference herein to apply with full force to any disputes arising under this Agreement.

14. Governing Law.

Section 12.7 (Governing Law) of the Merger Agreement is incorporated by reference herein to apply with full force to any disputes arising

under this Agreement.

15. Controlling Agreement.

To the extent the terms of this Agreement (as amended, supplemented, restated or otherwise modified from time to time) directly conflicts

with any provision in the Merger Agreement, the terms of this Agreement shall control.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties

hereto have caused this Lock-up Agreement to be duly executed by their respective authorized signatories as of the date first indicated

above.

| |

Abri SPAC I., Inc. |

| |

|

| |

By: |

|

| |

Name: |

Jeffrey Tirman |

| |

Title: |

Chief Executive Officer |

| |

Logiq, Inc.: |

| |

|

| |

By: |

|

| |

Name |

Brent Suen |

| |

Title: |

Chief Executive Officer and Director |

| |

Chris Andrews |

| |

|

| |

By: |

|

| |

|

| |

Lionel Choong |

| |

|

| |

By: |

|

| |

|

| |

Ross O’Brien |

| |

|

| |

By: |

|

| |

|

| |

Robb Billy |

| |

|

| |

By: |

|

| |

|

| |

Brent Suen |

| |

|

| |

By: |

|

Exhibit

7

ESCROW

AGREEMENT

THIS

ESCROW AGREEMENT (“Agreement”) is made and entered into as of October [30] ,2023 by and between: DLQ, Inc. a corporation

(“Parent”); and Brent Suen, as joint representatives (the “Stockholder Representatives”), of the Persons identified

from time to time on Schedule 1 hereto; and Continental Stock Transfer & Trust Company, a New York corporation (the “Escrow

Agent”).

WHEREAS,

Parent, Abri SPAC I, Inc., a Delaware corporation (“Abri”), Abri Merger Sub Inc., a Delaware corporation, and Parent have

entered into that certain Merger Agreement dated as of September 09, 2022 (together with all exhibits, schedules and annexes thereto,

as amended, modified or supplemented from time to time in accordance with its terms, the “Underlying Agreement”) to complete

a business combination with Parent surviving as a wholly owned subsidiary of Parent (the “Merger”);

NOW

THEREFORE, in consideration of the foregoing and of the mutual covenants hereinafter set forth, the parties hereto agree as follows:

(a)

Parent hereby appoints the Escrow Agent as its escrow agent for the purposes set forth herein, and the Escrow Agent hereby accepts such

appointment under the terms and conditions set forth herein.

(b)

All capitalized terms with respect to the Escrow Agent shall be defined herein. The Escrow Agent shall act only in accordance with the

terms and conditions contained in this Agreement and shall have no duties or obligations with respect to the Underlying Agreement.

(a)

Logiq, Inc. agrees to deposit with the Escrow Agent 1,500,000 common shares of Collective Audience, Inc. (f/k/a Abri SPAC I, Inc.) (the

“Escrow Shares” on the date hereof. The Escrow Agent shall hold the Escrow Shares as a book-entry position registered in

the name of Continental Stock Transfer and Trust as Escrow Agent for the benefit of DLQ, Inc.

(b)

During the term of this Agreement, DLQ, Inc. shall not have, or have the right to exercise any voting rights with respect to any of the

Escrow Shares. With respect to any matter for which the Escrow Shares are permitted to vote, the Escrow Agent shall vote, or cause to

be voted the Escrow Shares in the same proportion that the number of common shares of Collective Audience, Inc. owned by all other shareholders

of Collective Audience, Inc. are voted. In the absence of notice from Collective Audience, Inc. as to the proportion that the number

of common shares of Collective Audience, Inc. owned by all other shareholders of Collective Audience, Inc. are voted, the Escrow Agent

shall not vote any of the shares comprising the Escrow Shares.

(i)

Any dividends paid with respect to the Escrow Shares shall be deemed part of the Escrow and be delivered to the Escrow Agent to be held

in a bank account and be deposited in a non-interest-bearing account to be maintained by the Escrow Agent in the name of the Escrow Agent.

(ii)

In the event of any stock split, reverse stock split, stock dividend, recapitalization, reorganization, merger, consolidation, combination,

exchange of shares, liquidation, spin-off or other similar change in capitalization or event, or any distribution to holders of the common

stock. of Collective Audience, Inc. other than a regular cash dividend, the Escrow Shares shall be appropriately adjusted on a pro rata

basis and consistent with the terms of the Agreements.

| 3. | Disposition

and Termination |

(a)

The Escrow Agent shall administer the Escrow Shares in accordance with written instructions provided by DLQ, Inc. to the Escrow Agent

from time to time (an “Instruction”) directing the Escrow Agent to pay or release the Escrow Shares, or any portion

thereof, as set forth in such Instruction. . The Escrow Agent shall make distributions of the Escrow Shares only in accordance with an

Instruction.

(b)

Upon the delivery of all of the Escrow Shares by the Escrow Agent in accordance with the terms of this Agreement (including this Section

3), this Agreement shall terminate, subject to the provisions of Section 7.

(a)

The Escrow Agent shall have only those duties as are specifically and expressly provided herein, which shall be deemed purely ministerial

in nature, and no other duties shall be implied. The Escrow Agent shall neither be responsible for, nor chargeable with, knowledge of,

nor have any requirements to comply with, the terms and conditions of any other agreement, instrument or document betweenand any other

person or entity, in connection herewith, if any, including without limitation the Underlying Agreement or nor shall the Escrow Agent

be required to determine if any person or entity has complied with any such agreements, nor shall any additional obligations of the Escrow

Agent be inferred from the terms of such agreements, even though reference thereto may be made in this Agreement.

(b)

In the event of any conflict between the terms and provisions of this Agreement, those of the Underlying Agreement, any schedule or exhibit

attached to this Agreement, or any other agreement between Parent and any other Person or entity, the terms and conditions of this Agreement

shall control. The Escrow Agent may rely upon and shall not be liable for acting or refraining from acting upon any written notice, document,

instruction or request furnished to it hereunder and believed by it to be genuine and to have been signed or presented by the without

inquiry and without requiring substantiating evidence of any kind. The Escrow Agent shall not be liable to any beneficiary or other person

for refraining from acting upon any instruction setting forth, claiming, containing, objecting to, or related to the transfer or distribution

of the Escrow Asset, or any portion thereof, unless such instruction shall have been delivered to the Escrow Agent in accordance with

Section 10 below and the Escrow Agent has been able to satisfy any applicable security procedures as may be required hereunder

and as set forth in Section 10. The Escrow Agent shall be under no duty to inquire into or investigate the validity, accuracy

or content of any such document, notice, instruction or request. The Escrow Agent shall have no duty to solicit any payments which may

be due nor shall the Escrow Agent have any duty or obligation to confirm or verify the accuracy or correctness of any amounts deposited

with it hereunder.

The

Escrow Agent shall not be liable for any action taken, suffered or omitted to be taken by it in good faith except to the extent that

a final adjudication of a court of competent jurisdiction determines that the Escrow Agent’s gross negligence or willful misconduct

was the primary cause of any loss to either Parent or the beneficiary. The Escrow Agent may execute any of its powers and perform any

of its duties hereunder directly or through affiliates or agents. The Escrow Agent may consult with counsel, accountants and other skilled

persons to be selected and retained by it. The Escrow Agent shall not be liable for any action taken, suffered or omitted to be taken

by it in accordance with, or in reliance upon, the advice or opinion of any such counsel, accountants or other skilled persons except

to the extent that a final adjudication of a court of competent jurisdiction determines that the Escrow Agent’s gross negligence

or willful misconduct was the primary cause .of any loss to either or the beneficiary. In the event that the Escrow Agent shall be

uncertain or believe there is some ambiguity as to its duties or rights hereunder or shall receive instructions, claims or demands from

hereto which, in its opinion, conflict with any of the provisions of this Agreement, it shall be entitled to refrain from taking any

action and its sole obligation shall be to keep safely all property held in escrow until it shall be given a direction in writing which

eliminates such ambiguity or uncertainty to the satisfaction of the Escrow Agent or by a final and non- appealable order or judgment

of a court of competent jurisdiction agrees to pursue any redress or recourse in connection with any dispute without making the Escrow

Agent a party to the same.

(a)

The Escrow Agent may resign and be discharged from its duties or obligations hereunder by giving thirty (30) days’ advance notice

in writing of such resignation to specifying a date when such resignation shall take effect, provided that such resignation shall

not take effect until a successor escrow agent has been appointed in accordance with this Section 5. If Parent has failed to appoint

a successor escrow agent prior to the expiration of thirty (30) days following receipt of the notice of resignation, the Escrow Agent

may petition any court of competent jurisdiction for the appointment of a successor escrow agent or for other appropriate relief, and

any such resulting appointment shall be binding upon all of the parties hereto. The Escrow Agent’s sole responsibility after such

thirty (30) day notice period expires shall be to hold the Escrow Asset (without any obligation to reinvest the same) and to deliver

the same to a designated substitute escrow agent, if any, or in accordance with the directions of a final order or judgment of a court

of competent jurisdiction, at which time of delivery the Escrow Agent’s obligations hereunder shall cease and terminate, subject

to the provisions of Section 7 below. In accordance with Section 7 below, the Escrow Agent shall have the right to withhold,

as security, an amount of shares equal to any dollar amount due and owing to the Escrow Agent, plus any costs and expenses the Escrow

Agent shall reasonably believe may be incurred by the Escrow Agent in connection with the termination of this Agreement.

(b)

Any entity into which the Escrow Agent may be merged or converted or with which it may be consolidated, or any entity to which all or

substantially all the escrow business may be transferred, shall be the Escrow Agent under this Agreement without further act.

| 6. | Compensation

and Reimbursement |

The

Escrow Agent shall be entitled to compensation for its services under this Agreement as Escrow Agent and for reimbursement for its reasonable

out-of-pocket costs and expenses, in the amounts and payable as set forth on Schedule 2. The Escrow Agent shall also be entitled

to payment of any amounts to which the Escrow Agent is entitled under the indemnification provisions contained herein as set forth in

Section 7. The obligations of Parent set forth in this Section 6 shall survive the resignation, replacement or removal

of the Escrow Agent or the termination of this Agreement.

| a) | The

Escrow Agent shall be indemnified and held harmless by Parent from and against any expenses,

including counsel fees and disbursements, or loss suffered by the Escrow Agent in connection

with any action, suit or other proceeding involving any claim which in any way, directly

or indirectly, arises out of or relates to this Agreement, the services of the Escrow Agent

hereunder, other than expenses or losses arising from the gross negligence or willful misconduct

of the Escrow Agent. Promptly after the receipt by the Escrow Agent of notice of any demand

or claim or the commencement of any action, suit or proceeding, the Escrow Agent shall notify

the other parties hereto in writing. In the event of the receipt of such notice, the Escrow

Agent, in its sole discretion, may commence an action in the nature of interpleader in the

any state or federal court located in New York County, State of New York. |

| b) | The

Escrow Agent shall not be liable for any action taken or omitted by it in good faith and

in the exercise of its own best judgment, and may rely conclusively and shall be protected

in acting upon any order, notice, demand, certificate, opinion or advice of counsel (including

counsel chosen by the Escrow Agent), statement, instrument, report or other paper or document

(not only as to its due execution and the validity and effectiveness of its provisions, but

also as to the truth and acceptability of any information therein contained) which is believed

by the Escrow Agent to be genuine and to be signed or presented by the proper person or persons.

The Escrow Agent shall not be bound by any notice or demand, or any waiver, modification,

termination or rescission of this Agreement unless evidenced by a writing delivered to the

Escrow Agent signed by the proper party or parties and, if the duties or rights of the Escrow

Agent are affected, unless it shall have given its prior written consent thereto. |

| c) | The

Escrow Agent shall not be liable for any action taken by it in good faith and believed by

it to be authorized or within the rights or powers conferred upon it by this Agreement, and

may consult with counsel of its own choice and shall have full and complete authorization

and indemnification, for any action taken or suffered by it hereunder in good faith and in

accordance with the opinion of such counsel. |

| d) | This

Section 7 shall survive termination of this Agreement or the resignation, replacement

or removal of the Escrow Agent for any reason. |

| 8. | Patriot

Act Disclosure/Taxpayer Identification Numbers/Tax Reporting |

(a)Patriot

Act Disclosure. Section 326 of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct

Terrorism Act of 2001 (“USA PATRIOT Act”) requires the Escrow Agent to implement reasonable procedures to verify the

identity of any person that opens a new account with it. Accordingly, Parent acknowledges that Section 326 of the USA PATRIOT Act and

the Escrow Agent’s identity verification procedures require the Escrow Agent to obtain information which may be used to confirm

identity including without limitation name, address and organizational documents (“identifying information”).agrees

to provide the Escrow Agent with and consent to the Escrow Agent obtaining from third parties any such identifying information required

as a condition of opening an account with or using any service provided by the Escrow Agent. (b)(ii) such underlying transaction does

not constitute an installment sale requiring any tax reporting or withholding of imputed interest or original issue discount to the IRS

or other taxing authority.

All

communications hereunder shall be in writing and except for communications from Stockholder Representative setting forth, claiming, containing,

objecting to, or in any way related to the full or partial transfer or distribution of the Escrow Asset, including but not limited to

transfer instructions (all of which shall be specifically governed by Section 10 below), all notices and communications hereunder

shall be deemed to have been duly given and made if in writing and if (i) served by personal delivery upon the party for whom it is intended,

(ii) delivered by registered or certified mail, return receipt requested, or by Federal Express or similar overnight courier, or (iii)

sent by facsimile or email, provided that the receipt of such facsimile or email is promptly confirmed, by telephone, electronically

or otherwise, to the party at the address set forth below, or such other address as may be designated in writing hereafter, in the same

manner, by such party:

If

to the Escrow Agent:

Continental

Stock Transfer and Trust

One State Street — 30th Floor

New

York, New York 10004

Facsimile No: (212) 616-7615

Attention:

Notwithstanding

the above, in the case of communications delivered to the Escrow Agent, such communications shall be deemed to have been given on the

date received by an officer of the Escrow Agent or any employee of the Escrow Agent who reports directly to any such officer at the above-referenced

office. In the event that the Escrow Agent, in its sole discretion, shall determine that an emergency exists, the Escrow Agent may use

such other means of communication as the Escrow Agent deems appropriate. For purposes of this Agreement, “Business Day” shall

mean any day other than a Saturday, Sunday or any other day on which the Escrow Agent located at the notice address set forth above is

authorized or required by law or executive order to remain closed.

Notwithstanding

anything to the contrary as set forth in Section 9, any instructions setting forth, claiming, containing, objecting to, or in

any way related to the transfer or distribution, including but not limited to any transfer instructions that may otherwise be set forth

in a written instruction permitted pursuant to Section 3 of this Agreement, may be given to the Escrow Agent only by confirmed

facsimile or other electronic transmission (including e-mail) and no instruction for or related to the transfer or distribution of the

Escrow Asset, or any portion thereof, shall be deemed delivered and effective unless the Escrow Agent actually shall have received such

instruction by facsimile or other electronic transmission (including e-mail) at the number or e-mail address provided toby the Escrow

Agent in accordance with Section 9 and as further evidenced by a confirmed transmittal to that number.

In

the event transfer instructions are so received by the Escrow Agent by facsimile or other electronic transmission (including e-mail),

the Escrow Agent is authorized to seek confirmation of such instructions by telephone call-back to the person or persons designated on

Schedule 1 hereto, and the Escrow Agent may rely upon the confirmation of anyone purporting to be the person or persons so designated.

The persons and telephone numbers for call-backs may be changed only in a writing actually received and acknowledged by the Escrow Agent.

If the Escrow Agent is unable to contact any of the authorized representatives identified in Schedule 1, the Escrow Agent is hereby

authorized both to receive written instructions from and seek confirmation of such instructions by officers of (collectively, the “Senior

Officers”), as the case may be, which shall include the titles of Chief Executive Officer, General Counsel, Chief Financial

Officer, President or Executive Vice President, as the Escrow Agent may select. Such Senior Officer shall deliver to the Escrow Agent

a fully executed incumbency certificate, and the Escrow Agent may rely upon the confirmation of anyone purporting to be any such officer.

Parent

acknowledges that the Escrow Agent is authorized to deliver the Escrow Shares to the custodian account or recipient designated by Parent

or Stockholder Representative in writing.

| 11. | Compliance

with Court Orders. |

In

the event that any escrow property shall be attached, garnished or levied upon by any court order, or the delivery thereof shall be stayed

or enjoined by an order of a court, or any order, judgment or decree shall be made or entered by any court order affecting the property

deposited under this Agreement, the Escrow Agent is hereby expressly authorized, in its sole discretion, to obey and comply with all

writs, orders or decrees so entered or issued, which it is advised by opinion of legal counsel of its own choosing is binding upon it,

whether with or without jurisdiction, and in the event that the Escrow Agent reasonably obeys or complies with any such writ, order or

decree it shall not be liable to any of the parties hereto or to any other person, entity, firm or corporation, by reason of such compliance

notwithstanding such writ, order or decree be subsequently reversed, modified, annulled, set aside or vacated.

Except

for changes to transfer instructions as provided in Section 10, the provisions of this Agreement may be waived, altered, amended

or supplemented, in whole or in part, only by a writing signed by the Escrow Agent and . Neither this Agreement nor any right or interest

hereunder may be assigned in whole or in part by the Escrow Agent or except as provided in Section 5, without the prior consent

of the Escrow Agent and This Agreement shall be governed by and construed under the laws of the State of New York. Each of and the

Escrow Agent irrevocably waives any objection on the grounds of venue, forum non-convenience or any similar grounds and irrevocably consents

to service of process by mail or in any other manner permitted by applicable law and consents to the jurisdiction of any court of the

State of New York or United States federal court, in each case, sitting in New York County, New York. To the extent that in any jurisdiction

any party may now or hereafter be entitled to claim for itself or its assets, immunity from suit, execution attachment (before or after

judgment), or other legal process, such party shall not claim, and it hereby irrevocably waives, such immunity. The parties further hereby

waive any right to a trial by jury with respect to any lawsuit or judicial proceeding arising or relating to this Agreement. No party

to this Agreement is liable to any other party for losses due to, or if it is unable to perform its obligations under the terms of this

Agreement because of, acts of God, fire, war, terrorism, floods, strikes, electrical outages, equipment or transmission failure, or other

causes reasonably beyond its control. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original,

but all of which together shall constitute one and the same instrument. All signatures of the parties to this Agreement may be transmitted

by facsimile or other electronic transmission (including e-mail), and such facsimile or other electronic transmission (including e-mail)

will, for all purposes, be deemed to be the original signature of such party whose signature it reproduces, and will be binding upon

such party. If any provision of this Agreement is determined to be prohibited or unenforceable by reason of any applicable law of a jurisdiction,

then such provision shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating

the remaining provisions thereof, and any such prohibition or unenforceability in such jurisdiction shall not invalidate or render unenforceable

such provisions in any other jurisdiction. A person who is not a party to this Agreement shall have no right to enforce any term of this

Agreement. The parties represent, warrant and covenant that each document, notice, instruction or request provided by such party to the

other party shall comply with applicable laws and regulations. Where, however, the conflicting provisions of any such applicable law

may be waived, they are hereby irrevocably waived by the parties hereto to the fullest extent permitted by law, to the end that this

Agreement shall be enforced as written. Except as expressly provided in Section 7 above, nothing in this Agreement, whether express

or implied, shall be construed to give to any person or entity other than the Escrow Agent and any legal or equitable right, remedy,

interest or claim under or in respect of this Agreement or the Escrow Asset escrowed hereunder.

[REMAINDEROFPAGEINTENTIONALLYLEFTBLANK]

IN

WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date set forth above.

DLQ,

INC.

| By: |

|

|

| Name: |

Brent Suen |

|

| Title: |

Chief Executive

Officer |

|

| Telephone: |

|

|

ESCROW

AGENT:

CONTINENTAL

STOCK TRANSFER AND TRUST

Schedule

1

| Name |

|

Telephone

Number |

|

Signature |

| Brent Suent |

|

808-829-1057 |

|

|

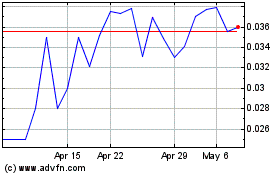

Logiq (PK) (USOTC:LGIQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

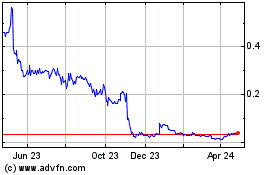

Logiq (PK) (USOTC:LGIQ)

Historical Stock Chart

From Apr 2023 to Apr 2024