false

0001401395

0001401395

2023-11-07

2023-11-07

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2023

|

NEPTUNE WELLNESS SOLUTIONS INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Québec

|

|

001-33526

|

|

98-1504882

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

545 Promenade du Centropolis

Suite 100

Laval, Québec

Canada

|

|

H7T 0A3

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (450) 687-2262

|

N/A

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

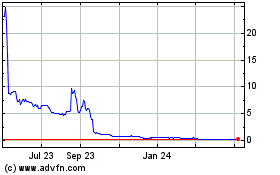

Common Shares, without par value

|

NEPT

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On November 7, 2023, Neptune Wellness Solutions Inc. (the “Company”), NH Expansion Credit Fund Holdings LP (“MSEC”) and Sprout Foods, Inc., a partially-owned subsidiary of the Company (“Sprout”) entered into a Restructuring Agreement (the “Restructuring Agreement”) relating to the conversion of certain debts owed by Sprout to Neptune into shares of common stock of Sprout, in accordance with the terms of a previously disclosed exchange option. Following the Restructuring Agreement, Neptune increased its ownership in Sprout from 50.1% to approximately 89.5%.

In connection with the Restructuring Agreement, a portion of the debt was transferred to MSEC and converted into shares of Sprout common stock, and MSEC was further granted a warrant to purchase up to 92,495 common shares of the Company (the “Warrant”) at an exercise price of $0.01 per share, expiring April 7, 2028. In addition, Sprout and MSEC entered into a Third Amended and Restated Secured Promissory Note (the “Secured Promissory Note”), amending and restating that certain Second Amended and Restated Secured Promissory Note previously issued by Sprout in favor of MSEC, to reflect, among other things, that Neptune’s guaranty of the Secured Promissory Note had been released.

The foregoing summaries of the Restructuring Agreement, Warrant and Restructuring Agreement do not purport to be complete and are subject to, and qualified in their entirety by, such documents (or, as applicable, forms of such documents) attached as Exhibits 10.1, 4.1 and 10.2, respectively, to this Report on Form 8-K (the “Report”) and incorporated by reference herein.

|

Item 3.02

|

Unregistered Sale of Equity Securities

|

The information contained in Item 1.01 of this Report is incorporated by reference into this Item 3.02.

|

Item 7.01

|

Regulation FD Disclosure

|

On November 8, 2023, the Company issued a press release announcing the execution of the Restructuring Agreement. A copy of the press release is attached as Exhibit 99.1 to this Report and is incorporated by reference herein. The information set forth and incorporated by reference in this Item 7.01 shall not be deemed to be “filed” with the SEC for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, and the Company does not incorporate it by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act.

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits

The following exhibits are filed with this Current Report on Form 8-K

|

Exhibit

Number

|

|

Description

|

|

4.1

|

|

|

|

10.1

|

|

|

|

10.2

|

|

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NEPTUNE WELLNESS SOLUTIONS INC.

|

| |

|

|

Date: November 13, 2023

|

By:

|

/s/ John S. Wirt

|

| |

Name:

|

John S. Wirt

|

| |

Title:

|

Chief Legal Officer

|

NEITHER THIS WARRANT NOR THE COMMON SHARES ISSUABLE UPON EXERCISE OF THIS WARRANT HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY APPLICABLE STATE SECURITIES LAWS. SUCH SECURITIES HAVE BEEN ACQUIRED FOR INVESTMENT PURPOSES AND MAY NOT BE OFFERED FOR SALE, SOLD, DELIVERED AFTER SALE, TRANSFERRED, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT FILED BY THE ISSUER WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION COVERING SUCH SECURITIES UNDER THE SECURITIES ACT OR AN OPINION OF COUNSEL SATISFACTORY TO THE ISSUER THAT SUCH REGISTRATION IS NOT REQUIRED.

WARRANT TO PURCHASE COMMON SHARES

OF

NEPTUNE WELLNESS SOLUTIONS INC.

|

No. P-1

|

92,495 Shares of Common Stock

|

This is to Certify That, FOR VALUE RECEIVED, NH Expansion Credit Fund Holdings LP, or its assigns (“Holder”), is entitled to purchase, subject to the provisions of this Warrant, from Neptune Wellness Solutions Inc., a Quebec corporation (the “Company”), 92,495 shares of fully paid, validly issued and nonassessable common shares of the Company (“Common Shares”) at an exercise price of $0.01 per share. The number of shares of Common Shares to be received upon the exercise of this Warrant and the price to be paid for each share of Common Shares may be adjusted from time to time as hereinafter set forth. The shares of Common Shares deliverable upon such exercise, and as adjusted from time to time pursuant to Section (g) hereof or as otherwise provided herein, are hereinafter sometimes referred to as “Warrant Shares” and the exercise price per share of Common Shares acquirable upon exercise hereof as in effect at any time and as adjusted from time to time is hereinafter sometimes referred to as the “Exercise Price.”

This Warrant to Purchase Common Shares (this “Warrant”) is being issued pursuant to that certain Restructuring Agreement, dated as of November 3, 2023 to which the Company and the Holder are parties (the “Restructuring Agreement”). Capitalized terms used but not defined herein shall have the meanings given to them in the Purchase Agreement.

(a) EXERCISE OF WARRANT.

(1) This Warrant may be exercised in whole or in part at any time or from time to time from the date hereof up to and including April 7, 2028 (the “Exercise Period”); provided, however, that (A) if either such day is a day on which banking institutions in the State of New York are authorized by law to close, then on the next succeeding day which shall not be such a day, and (B) in the event of any merger, consolidation or sale of all or substantially all the assets of the Company as an entirety, resulting in any distribution to the Company’s shareholders, prior to termination of the Exercise Period, or any reclassification or recapitalization or similar transaction (each of the foregoing, a “Major Transaction”), the Holder shall have the right to exercise this Warrant commencing at such time through the termination of the Exercise Period into the kind and amount of shares and other securities and property (including cash) receivable had the Holder exercised this Warrant immediately prior to such Major Transaction or any record date established to determine the receipt of any payment or distribution in respect thereof. Subject to Section (a)(2), below, this Warrant may be exercised by presentation and surrender hereof to the Company at its principal office with the Purchase Form annexed hereto duly executed and accompanied by payment of the Exercise Price for the number of Warrant Shares specified in such form. As soon as practicable after each such exercise of this Warrant, but not later than three (3) business days following the receipt of good and available funds, the Company shall issue and deliver to the Holder a certificate or certificates for the Warrant Shares issuable upon such exercise, registered in the name of the Holder or its designee. If this Warrant should be exercised in part only, the Company shall, upon surrender of this Warrant for cancellation, execute and deliver a new Warrant evidencing the rights of the Holder thereof to purchase the balance of the Warrant Shares purchasable hereunder. As of the end of business on the date of receipt by the Company of this Warrant at its office in proper form for exercise, the Holder shall be deemed to be the holder of record of the shares of Common Shares or other property issuable upon such exercise, notwithstanding that the stock transfer books of the Company shall then be closed or that certificates representing such shares or other property shall not then be physically delivered to the Holder.

(2) At any time during the Exercise Period, the Holder may, at its option, exercise this Warrant on a cashless basis by exchanging this Warrant, in whole or in part (a “Warrant Exchange”), into the number of Warrant Shares determined in accordance with this Section (a)(2), by surrendering this Warrant at the principal office of the Company or at the office of its stock transfer agent, accompanied by a notice stating such Holder’s intent to effect such exchange, the number of Warrant Shares to be exchanged and the date on which the Holder requests that such Warrant Exchange occur (the “Notice of Exchange”). The Warrant Exchange shall take place on the date specified in the Notice of Exchange or, if later, the date the Notice of Exchange is received by the Company (the “Exchange Date”). Certificates for the shares issuable upon such Warrant Exchange and, if this Warrant should be exercised in part only, a new Warrant evidencing the rights of the Holder thereof to purchase the balance of the Warrant Shares purchasable hereunder, shall be issued as of the Exchange Date and delivered to the Holder within seven (7) days following the Exchange Date. In connection with any Warrant Exchange, this Warrant shall represent the right to subscribe for and acquire the number of Warrant Shares equal to (i) the number of Warrant Shares specified by the Holder in its Notice of Exchange (the “Total Number”) less (ii) the number of Warrant Shares equal to the quotient obtained by dividing (A) the product of the Total Number and the existing Exercise Price by (B) Fair Market Value of a share of Common Shares. “Fair Market Value” shall equal (x) the lesser of (i) the closing price or last sale price of a share of Common Stock reported for the business day immediately preceding the date of the Notice of Exchange; or (ii) the average closing trading price of the Common Shares as reported on the relevant market or exchange (or, if not then traded on a market or exchange but listed for quotation on the over-the-counter bulletin board, on the over-the-counter bulletin board) for the five (5) trading days immediately preceding the date of the Notice of Exchange; or (y) if the Common Shares are not listed or admitted to trading on any market or exchange or listed for quotation on the over-the-counter bulletin board, and the average price cannot be determined as contemplated above, the Fair Market Value of the Common Shares shall be as reasonably determined in good faith by the Company’s Board of Directors with the concurrence of the Holder.

(b) REPRESENTATIONS OF HOLDER. The Holder (i) is an “accredited investor,” as defined in Rule 501 promulgated under the Securities Act of 1933, as amended (the “1933 Act”), (ii) understands the risks of, and other considerations relating to, a purchase of this Warrant, (iii) understands that the Warrants and/or the Warrant Shares may not be sold, transferred, hypothecated or pledged, except pursuant to an effective registration statement under the 1933 Act and under any applicable state securities law, or pursuant to an available exemption from the registration requirements of the 1933 Act and any applicable state securities laws, in all cases established to the satisfaction of the Company, and (v) the Holder has been given the opportunity to obtain such additional information that it believes is necessary.

(c) RESERVATION OF SHARES. The Company shall at all times reserve for issuance and/or delivery upon exercise of the this Warrant such number of shares of Common Shares as shall be required for issuance and delivery upon exercise of this Warrant.

(d) FRACTIONAL SHARES. No fractional shares or strips representing fractional shares shall be issued upon the exercise of this Warrant. With respect to any fraction of a share called for upon any exercise hereof, the Company shall pay to the Holder an amount in cash equal to such fraction multiplied by the Fair Market Value of a share of Common Shares.

(e) LOSS OR DESTRUCTION OF WARRANT. Upon receipt by the Company of evidence satisfactory to it of the loss, theft, destruction or mutilation of this Warrant, and (in the case of loss, theft or destruction) of reasonably satisfactory indemnification, and upon surrender and cancellation of this Warrant, if mutilated, the Company will execute and deliver a new Warrant of like tenor and date. Any such new Warrant executed and delivered shall constitute an additional contractual obligation on the part of the Company, whether or not this Warrant so lost, stolen, destroyed, or mutilated shall be at any time enforceable by anyone.

(f) RIGHTS OF THE HOLDER. The Holder shall not, by virtue hereof, be entitled to any rights of a shareholder in the Company, either at law or equity, and the rights of the Holder are limited to those expressed in this Warrant and are not enforceable against the Company except to the extent set forth herein.

(g) ANTI-DILUTION PROVISIONS. In case the Company shall hereafter (i) declare a dividend or make a distribution on its outstanding Common Shares in shares of Common Shares, (ii) subdivide or reclassify its outstanding Common Shares into a greater number of shares, or (iii) combine or reclassify its outstanding Common Shares into a smaller number of shares, the Exercise Price in effect at the time of the record date for such dividend or distribution or of the effective date of such subdivision, combination or reclassification shall be adjusted so that it shall equal the price determined by multiplying the Exercise Price by a fraction, the denominator of which shall be the number of shares of Common Shares outstanding after giving effect to such action, and the numerator of which shall be the number of shares of Common Shares outstanding immediately prior to such action. The number of shares of Common Shares that the Holder shall thereafter, on the exercise hereof, be entitled to receive shall be adjusted to a number determined by multiplying the number of shares of Common Shares that would otherwise (but for the provisions of this Section (g)) be issuable on such exercise by a fraction of which (i) the numerator is the Exercise Price that would otherwise (but for the provisions of this Section (g)) be in effect, and (ii) the denominator is the Exercise Price in effect on the date of such exercise (taking into account the provisions of this Section (g)). Notwithstanding the foregoing, in no event shall the Exercise Price be less than the par value of the Common Shares. Adjustment pursuant to this Section shall be made successively whenever any event listed above shall occur.

(h) NOTICES TO WARRANT HOLDERS. So long as this Warrant shall be outstanding, (i) if the Company shall pay any dividend or make any distribution upon the Common Shares or (ii) if the Company shall offer to the holders of Common Shares for subscription or purchase by them any share of any class or any other rights or (iii) if any capital reorganization of the Company, reclassification of the capital stock of the Company, consolidation or merger of the Company with or into another corporation, sale, lease or transfer of all or substantially all of the property and assets of the Company to another corporation, or voluntary or involuntary dissolution, liquidation or winding up of the Company shall be effected, then in any such case, the Company shall cause to be mailed to the Holder, at least twenty days prior the earlier of the dates specified in (x) and (y) below, as the case may be, a notice containing a brief description of the proposed action and stating the date on which (x) a record is to be taken for the purpose of such dividend, distribution or rights, or (y) such reclassification, reorganization, consolidation, merger, conveyance, lease, dissolution, liquidation or winding up is to take place and the date, if any is to be fixed, as of which the holders of Common Shares or other securities shall receive cash or other property deliverable upon such reclassification, reorganization, consolidation, merger, conveyance, dissolution, liquidation or winding up.

(i) RECLASSIFICATION, REORGANIZATION OR MERGER. In case of any reclassification, capital reorganization or other change of outstanding Common Shares of the Company, or in case of any consolidation or merger of the Company with or into another corporation (other than a merger with a subsidiary in which merger the Company is the continuing corporation or a merger in which the Common Shares of the Company outstanding immediately prior thereto represents immediately thereafter (either by remaining outstanding or by being converted into voting securities of the surviving or acquiring entity) 50% or more of the combined voting power and economic interests in the Company or such surviving or acquiring entity outstanding immediately after such transaction and economic interests in the Company or such surviving or acquiring entity outstanding immediately after such transaction and which does not result in any reclassification, capital reorganization or other change of outstanding Common Shares of the class issuable upon exercise of this Warrant) or in case of any sale, lease or conveyance to another corporation of the property of the Company in the entirety (a “Reorganization”), the Company shall, as a condition precedent to such transaction, cause effective provisions to be made so that the Holder shall have the right thereafter by exercising this Warrant at any time prior to the expiration of the Warrant, to purchase the kind and amount of shares of stock and other securities and property receivable upon such reclassification, capital reorganization and other change, consolidation, merger, sale or conveyance by a holder of the number of shares of Common Shares that might have been purchased upon exercise of this Warrant immediately prior to such Reorganization. Any such provision shall include provision for adjustments which shall be as nearly equivalent as may be practicable to the adjustments provided for in this Warrant. The foregoing provisions of this Section (i) shall similarly apply to successive reclassifications, capital reorganizations and changes of Common Shares and to successive consolidations, mergers, sales or conveyances. In the event that in connection with any such capital reorganization or reclassification, consolidation, merger, sale or conveyance, additional Common Shares shall be issued in exchange, conversion, substitution or payment, in whole or in part, for a security of the Company other than Common Shares, any such issue shall be treated as an issue of Common Shares covered by the provisions of Section (i) hereof.

(j) NO NET-CASH SETTLEMENT. Except as expressly provided herein, in no event will the Holder be entitled to receive a net-cash settlement or other consideration in lieu of physical settlement in securities.

(k) MODIFICATION OF AGREEMENT. The provisions of this Warrant may from time to time be amended, modified or waived, by the Company and the holder of this Warrant.

(l) TRANSFER OF WARRANT. This Warrant shall inure to the benefit of the successors to and assigns of the Holder; provided, however, this Warrant may not be pledged, sold, assigned or otherwise transferred, directly or indirectly, by operation of law, change of control, or otherwise, except in compliance with applicable registration requirements of securities laws or an available exemption therefrom. Notwithstanding the foregoing, Holder may transfer this Warrant to an affiliate and such affiliate may make subsequent assignments to its affiliates. This Warrant and all rights hereunder are registrable at the office or agency of the Company referred to below by the Holder in person or by its duly authorized attorney, upon surrender of this Warrant properly endorsed accompanied by an assignment form in a form approved by the Company, duly executed by the transferring Holder and the transferee.

(m) REGISTER OF WARRANTS. The Company shall maintain, at the principal office of the Company (or such other office as it may designate by notice to the Holder), a register in which the Company shall record the name and address of the person in whose name this Warrant has been issued, as well as the name and address of each successor and prior owner of such Warrant. The Company shall be entitled to treat the Person in whose name this Warrant is so registered as the sole and absolute owner of this Warrant for all purposes.

(n) WARRANT AGENT. The Company may, by written notice to the Holder, appoint the transfer agent and registrar for the Common Shares as the Company’s agent for the purpose of issuing Common Shares (or other securities) on the exercise of this Warrant pursuant to paragraph(a), and the Company may, by written notice to the Holder, appoint an agent having an office in the United States of America for the purpose of replacing this Warrant pursuant to paragraph (e), or any of the foregoing, and thereafter any such replacement shall be made at such office by such agent.

(o) NOTICES, ETC. All notices and other communications from the Company to the Holder shall be mailed by first class certified mail, postage prepaid, at such address as may have been furnished to the Company in writing by the Holder or at the address shown for the Holder on the register of Warrants referred to in paragraph (m).

(p) ATTORNEY'S FEES. In the event of any dispute between the parties concerning the terms and provisions of this Warrant, the party prevailing in such dispute shall be entitled to collect from the other party all costs incurred in such dispute, including reasonable attorneys' fees.

(q) COUNTERPARTS; FACSIMILE/ELECTRONIC SIGNATURES. This Warrant may be executed in counterparts, all of which together shall constitute one and the same agreement. Any signature page delivered electronically or by facsimile shall be binding to the same extent as an original signature page with regards to any agreement subject to the terms hereof or any amendment thereto.

(r) GOVERNING LAW. This Warrant shall be governed by and construed in accordance with the laws of the State of New York, without giving effect to its principles regarding conflicts of law.

[Signatures appear on the following page.]

IN WITNESS WHEREOF, the Company has caused this Warrant to be executed by its officer thereunto duly authorized as of the date first above indicated.

| |

|

|

|

NEPTUNE WELLNESS SOLUTIONS

INC.

|

| |

|

|

By:

|

|

/s/ Lisa Gainsborg

|

| |

|

Name: Lisa Gainsborg

|

| |

|

Title: Interim Chief Financial Officer

|

PURCHASE FORM / EXCHANGE NOTICE [circle one]

| |

(1)

|

The undersigned hereby irrevocably elects to exercise the within Warrant to the extent of purchasing Common Shares of Neptune Wellness Solutions Inc. (or such number of shares of Common Shares or other securities or property to which the undersigned is entitled in lieu thereof or in addition thereto under the provisions of the Warrant).

|

| |

(2)

|

The undersigned hereby elects to make payment (Please check one):

|

| |

☐

|

on a cashless basis pursuant to the provisions of Section (a)(2) of the Warrant.

|

| |

☐

|

with the enclosed bank draft, certified check or money order payable to the Company in payment of the exercise price determined under, and on the terms specified in, the Warrant.

|

| |

(3)

|

The undersigned hereby irrevocably directs that the said shares be issued and delivered as follows:

|

|

Name(s) in Full

|

|

Address(es)

|

|

Number of Shares

|

|

S.S. or IRS #

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

(4)

|

If the Warrant was not exercised in full, please check the following:

|

The undersigned hereby irrevocably directs that any remaining portion of the warrant be issued and delivered as follows:

|

Name(s) in Full

|

|

Address(es)

|

|

Number of Shares

|

|

S.S. or IRS #

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

| |

Signature of Holder

|

| |

|

| |

|

| |

Print Name

|

THE SECURITIES ACQUIRED PURSUANT TO THIS AGREEMENT WILL NOT BE REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR ANY OTHER APPLICABLE STATE SECURITIES LAWS AND MAY NOT BE OFFERED OR SOLD UNLESS REGISTERED THEREUNDER OR UNLESS AN EXEMPTION FROM SUCH REGISTRATION IS AVAILABLE.

RESTRUCTURING AGREEMENT

This RESTRUCTURING AGREEMENT (this “Agreement”), dated as of November 3, 2023 is entered into by and among NH Expansion Credit Fund Holdings LP (“MSEC”), Neptune Growth Ventures, Inc., a Delaware corporation (“NGV”), Neptune Wellness Solutions Inc., a Quebec corporation (“Neptune”) and Sprout Foods, Inc., a Delaware corporation (the “Company”).

WHEREAS, MSEC, Neptune and the Company entered into that certain Summary Restructuring Option Term Sheet, dated as of August 16, 2023 (the “Term Sheet”);

WHEREAS, as contemplated by the Term Sheet, Neptune may effect a Spinout (as defined in the Term Sheet) of the Company, which would result in the Company, currently a majority-owned subsidiary of Neptune, becoming a separate, publicly traded company;

WHEREAS, the aggregate principal amount outstanding of Secured Promissory Notes issued by the Company to NGV on July 13, 2022 and November 15, 2022, including accrued interest and management fees payable to NGV, is $18,292,377.65 (the “NGV Notes”);

WHEREAS, pursuant to the Term Sheet, NGV has the right to convert the NGV Notes into shares of common stock, par value $0.001 per share (the “Company Common Stock”), of the Company (the “Conversion”); and

WHEREAS, as contemplated by the Term Sheet, on the date hereof, each of MSEC and the other investors specified on Schedule I attached hereto, are entering into an amendment to their respective Secured Promissory Notes (the “Amended Promissory Notes”) issued by the Company (the “Amendments”) to, among other things, extend the maturity date of such notes and eliminate Neptune’s guaranty in respect of the indebtedness evidenced by such notes.

NOW, THEREFORE, in order to implement the foregoing and in consideration of the mutual representations, warranties, covenants and agreements contained herein and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto agree as follows.

| |

1.

|

Transfer, Conversion and Conditional Purchase Obligation.

|

1.1 Transfer. NGV hereby transfers to MSEC, and MSEC accepts, $2,000,000 in aggregate principal amount of the NGV Notes (the “Transferred Notes”), including the right to convert such Transferred Notes into Company Common Stock as provided for in the Term Sheet. The Company acknowledges and agrees to the transfer of said NGV Notes to MSEC.

1.2 Conversion.

| |

(i)

|

Effective on the date hereof, NGV elects, and the Company agrees, to convert the NGV Notes, less the Transferred Notes, into 404,246,663 shares of Company Common Stock (the “NGV Shares”). Upon such Conversion, the NGV Notes, less the Transferred Notes, including any accrued interest thereon, shall be deemed to be fully paid, satisfied and cancelled.

|

| |

(ii)

|

Effective on the date hereof, MSEC elects, and the Company agrees, to convert the Transferred Notes into 26,713,262 shares of Company Common Stock (the “MSEC Shares”). Upon such Conversion, the Transferred Notes, including any accrued interest thereon, shall be deemed to be fully paid, satisfied and cancelled.

|

1.3 Issuance of Neptune Warrants. Neptune shall issue to MSEC warrants to purchase 92,495 common shares, no par value, of Neptune (the “Neptune Common Shares”) at an exercise price equal to $0.01 per share in the form attached hereto as Exhibit A (the “Warrant”).

1.4 Closing. The closing of the transactions contemplated hereby shall occur on the date hereof (the “Closing”). The Closing shall take place at such place as may be determined by the Company, NGV and MSEC.

1.5 Closing Deliverables. At or prior to the Closing, (i) the Company shall deliver to MSEC and NGV (A) evidence, reasonably satisfactory to MSEC and NGV, that the Certificate of Incorporation of the Company has been amended to increase the authorized capital of the Company to permit the issuance of the NGV Shares and MSEC Shares contemplated by the Conversion, and (B) one or more certificates or book entries representing Company Common Stock issued by the Company in the amount of the NGV Shares and the MSEC Shares, pursuant to Section 1.2 of this Agreement, (ii) the Company shall have received fully executed copies of the Amendments, and (iii) Neptune shall have received an agreement confirming termination of the Amended and Restated Unconditional Guaranty dated August 10, 2022. At or prior to the Closing, Neptune shall deliver the Warrant to MSEC.

1.6 Conditional Purchase Obligation. If the Spinout is not completed prior to the maturity date of the Amended Promissory Notes (as extended by the Amendments), then Neptune shall purchase from MSEC all of the shares of Company Common Stock held by MSEC as of the date of the Term Sheet (the “Purchased Shares”), at a price of $0.20 per share, payable in cash by Neptune contemporaneously with the retirement of such Amended Promissory Notes. MSEC shall deliver to Neptune all necessary transfer documentation in the form reasonably acceptable to Neptune to effect the transfer of the Purchased Shares to Neptune upon payment therefor in accordance with this Section 1.6.

2. Representations and Warranties of the Company. The Company hereby represents and warrants to MSEC and NGV as follows:

2.1 Organizational Matters. The Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware, having full corporate power and authority to own its properties and to carry on its business as conducted.

2.2 Authority. The Company has the requisite corporate power and authority to enter into and deliver this Agreement, perform its obligations herein, and consummate the transactions contemplated hereby. The Company has duly executed and delivered this Agreement. This Agreement is a valid, legal and binding obligation of the Company enforceable against the Company in accordance with its terms, except to the extent that enforceability may be limited by applicable bankruptcy, insolvency or similar laws affecting the enforcement of creditors’ rights generally and subject to general principles of equity (regardless of whether such enforcement is considered in a proceeding at law or in equity).

2.3 Shares Duly Authorized; Capitalization. All of the shares of Company Common Stock to be issued to MSEC and NGV pursuant to this Agreement, when issued and delivered in accordance with the terms of this Agreement, will be duly authorized, validly issued, fully paid and non-assessable and shall be free and clear of all liens and restrictions, other than restrictions under applicable federal and state securities laws and under the Third Amended and Restated Stockholders’ Agreement by and among the Company, MSEC, NGV, and the other stockholders listed on the signature pages thereto (as amended from time to time, the “Amended and Restated Stockholders’ Agreement”). The outstanding capital stock of the Company, immediately after giving effect to the Conversion contemplated hereunder, is as is set forth on Schedule II attached hereto.

2.4 Governmental Authorization; Consents. The execution, delivery and performance by the Company of this Agreement and the consummation by the Company of the transactions contemplated hereby will not require any consent, approval, action, order, authorization, or permit of, or registration or filing with, any governmental body, agency, official or authority, other than (a) such as may be required under any applicable state securities laws and (b) other consents, approvals, actions, orders, authorizations, registrations, declarations, filings and permits which, if not obtained or made, would not have a material adverse effect on the Company or the ability of the Company to consummate the transactions contemplated by this Agreement.

2.5 Non-Contravention. The execution, delivery and performance by the Company of this Agreement and the consummation by the Company of the transactions contemplated hereby do not and will not (a) contravene or conflict with the Company’s Certificate of Incorporation, as amended or amended and restated, or (b) assuming compliance with the matters referred to in Section 2.4 hereof and the truthfulness of the representations of MSEC and NGV, contravene or conflict with, or constitute a violation of any provision of, any law binding upon or applicable to the Company or by which any of its properties is bound or affected.

| |

3.

|

Representations and Warranties of MSEC and NGV.

|

MSEC and NGV (each separately referred to as the “Investor” for purposes of Sections 3 and 6 of this Agreement) each hereby represents and warrants to the Company and Neptune as to itself as of the date hereof as follows:

3.1 Authority. The Investor has the requisite power and authority to deliver this Agreement, perform its obligations herein, and consummate the transactions contemplated hereby. The Investor has duly executed and delivered this Agreement and has obtained the necessary authorization, if any, to execute and deliver this Agreement and to perform its obligations herein and to consummate the transactions contemplated hereby. This Agreement is a valid, legal and binding obligation of the Investor, enforceable against it in accordance with its terms, except to the extent that enforceability may be limited by applicable bankruptcy, insolvency or similar laws affecting the enforcement of creditors rights generally and subject to general principles of equity (regardless of whether such enforcement is considered in a proceeding at law or in equity).

3.2 Governmental Authorization; Consents. The execution, delivery and performance by the Investor of this Agreement, and the consummation by the Investor of the transactions contemplated hereby will not require any consent, approval, action, order, authorization, or permit of, or registration or filing with, any governmental body, agency, official or authority, other than (i) such as may be required under any applicable state securities laws, and (ii) other consents, waivers, approvals, actions, orders, authorizations, registrations, declarations, filings and permits which, if not obtained or made, would not have a material adverse effect on the Investor or the ability of the Investor to consummate the transactions contemplated by this Agreement.

3.3 Non-Contravention. The execution, delivery and performance of this Agreement by the Investor and the consummation by the Investor of the transactions contemplated hereby do not and will not (i) contravene or conflict with the Investor’s governing documents or agreements, (ii) contravene or conflict with, or constitute a violation of any provision of, any law binding upon or applicable to either Investor or by which any of its properties or assets are bound or affected, or (iii) conflict with or result in a breach or violation of any provision of, or constitute a default under (or an event that with or without notice or lapse of time, or both, could reasonably be expected to become a default), or otherwise give rise (with or without notice or lapse of time or both) to a right of termination, amendment, cancellation or acceleration under, any note, bond, mortgage, indenture, lease, franchise, permit or other agreement or instrument to which the Investor is a party or by which the Investor or any of its properties or assets are bound or affected, except, in the case of clauses (ii) and (iii), any items that have not had, and would not reasonably be expected to have, individually or in the aggregate, a material adverse effect on the ability of Investor to consummate the transactions contemplated by this Agreement.

3.4 Intent. The Investor is acquiring the Company Common Stock to be acquired by the Investor hereunder (i) for investment purposes only and not for the purpose of resale or distribution, and (ii) for its own account and not for any other person. The Investor has not entered into any written or oral agreement with any person to sell, transfer or otherwise dispose of the Company Common Stock to be acquired by the Investor hereunder.

3.5 Accredited Investor. The Investor is an “accredited investor” (as such term is defined in Rule 501(a) of Regulation D of the Securities Act of 1933, as amended (the “Securities Act”)).

3.6 No Registration. The Investor understands and agrees that the Company Common Stock to be acquired by the Investor hereunder are being, or will be, acquired in a transaction not involving any public offering within the meaning of the Securities Act, in reliance on an exemption therefrom. The Investor understands that the Company Common Stock to be acquired by the Investor hereunder have not been, and will not be, approved or disapproved by the Securities and Exchange Commission or by any other federal or state agency, and that no such agency has passed on the accuracy or adequacy of disclosures made to the Investor by the Company. No federal or state governmental agency has passed on or made any recommendation or endorsement of the Company Common Stock to be acquired by the Investor hereunder or an investment in the Company.

3.7 Limitations on Disposition and Resale. The Investor understands and acknowledges that the Company Common Stock to be acquired by the Investor hereunder have not been registered under the Securities Act or the securities laws of any state and, unless such shares are so registered, they may not be offered, sold, transferred or otherwise disposed of except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and any applicable securities laws of any state or foreign jurisdiction. The Investor understands that the Investor may not be able to liquidate its investment in the Company and agrees not to sell, transfer or otherwise dispose of the Company Common Stock to be acquired by the Investor hereunder unless such Company Common Stock have been so registered or an exemption from the requirement of registration is available under the Securities Act and any applicable state securities laws. The Investor further acknowledges and agrees that the ability to dispose of the Company Common Stock to be acquired by the Investor hereunder will be subject to restrictions contained in the Amended and Restated Stockholders’ Agreement. The Investor recognizes that there will not be any public trading market for the Company Common Stock to be acquired by the Investor hereunder, and, as a result, the Investor may be unable to sell or dispose of such Company Common Stock.

3.8 Investment Experience. The Investor has such knowledge and experience in financial and business matters so that the Investor is capable of evaluating the merits and risks of its investment in the Company. The Investor (i) has the capacity to protect its own interests in connection with the transactions contemplated by this Agreement, (ii) is able to bear the risk of investment in the Company, and (iii) is able, without impairing its financial condition, to hold the Company Common Stock to be acquired by the Investor hereunder for an indefinite period of time and to suffer a complete loss of its investment.

3.9 Representations Relied Upon by The Investor. The Investor is acquiring the Company Common Stock to be acquired by the Investor hereunder without having been furnished any representations or warranties of any kind whatsoever with respect to the business and financial condition of the Company, other than the representations contained in this Agreement.

3.10 Information Regarding the Company. The Investor acknowledges that (i) the Company has made available, a reasonable time prior to the date of this Agreement, information concerning the Company sufficient for Investor to make an informed decision regarding an investment in the Company and an opportunity to ask questions and receive answers concerning the Company Common Stock to be acquired by the Investor hereunder; (ii) the Company has made available, a reasonable time prior to the date of this Agreement, the opportunity to obtain any additional information that the Company possesses or can acquire without unreasonable effort or expense deemed necessary by Investor to verify the accuracy of the information provided, and Investor has received such additional information requested; and (iii) Investor has not relied on the Company or any of its respective affiliates, officers, employees or representatives in connection with its investigation or the accuracy of the information provided or in making any investment decision. Neither such inquiries nor any other due diligence investigations conducted by Investor or its advisors, if any, or its representatives shall modify, amend or affect Investor’s right to rely on the Company’s representations and warranties contained in Section 2 above.

3.11 No Reliance. The Investor has not looked to, or relied in any manner upon, the Company, or any of its respective affiliates, directors, officers, employees or representatives for advice about tax, financial or legal consequences of a purchase of or investment in the Company Common Stock to be acquired by the Investor hereunder, and none of the Company or any of its affiliates, directors, officers, employees or representatives has made or is making any representations to the Investor about, or guaranties of, tax, financial or legal outcomes of a purchase of or an investment in the Company Common Stock to be acquired by the Investor hereunder. The Investor has reviewed with its own tax advisors the federal, state and local tax consequences of this investment in the Company Common Stock to be acquired by the Investor hereunder and the transactions contemplated by this Agreement. The Investor understands that it (and not the Company) shall be responsible for its own tax liability that may arise as a result of this investment or the transactions contemplated by this Agreement. The Investor has had the opportunity to consult with its own legal counsel in connection with the Investor’s investment in the Company Common Stock to be acquired by the Investor hereunder and acknowledges that it is relying solely on its own legal counsel and not on the Company or its agents for legal advice with respect to this investment or the transactions contemplated by this Agreement.

| |

4.

|

Representations and Warranties of MSEC to Neptune.

|

MSEC hereby represents and warrants to Neptune as to itself as of the date hereof as follows:

4.1 Restatement of Representations and Warranties. Neptune may rely on the representations and warranties made to the Company by MSEC in Section 3 of this Agreement, with such representations and warranties deemed to refer to (i) the Warrant and the Neptune Common Shares underlying the Warrant in lieu of the Company Common Stock, and (ii) Neptune in lieu of the Company.

4.2 Canadian Accredited Investor. In addition to the other representations and warranties specified above, MSEC is an “accredited investor” as that term is defined in National Instrument 45-106 – Prospectus and Registration Exemptions.

| |

5.

|

Representations and Warranties of Neptune to MSEC.

|

Neptune hereby represents and warrants to MSEC as to itself as of the date hereof as follows:

5.1 Organizational Matters. Neptune is a corporation duly organized, validly existing and in good standing under the Business Corporations Act of Québec, having full corporate power and authority to own its properties and to carry on its business as conducted.

5.2 Authority. Neptune has the requisite corporate power and authority to enter into and deliver this Agreement, perform its obligations herein, and consummate the transactions contemplated hereby, including the issuance of the Warrant. Neptune has duly executed and delivered this Agreement. This Agreement is a valid, legal and binding obligation of Neptune enforceable against Neptune in accordance with its terms, except to the extent that enforceability may be limited by applicable bankruptcy, insolvency or similar laws affecting the enforcement of creditors’ rights generally and subject to general principles of equity (regardless of whether such enforcement is considered in a proceeding at law or in equity).

5.3 Shares Duly Authorized. All of the shares of Neptune Common Shares underlying the Warrant to be issued to MSEC pursuant to this Agreement, when issued and delivered in accordance with the terms of this Agreement and upon valid exercise of the Warrant in accordance with the terms thereof, will be duly authorized, validly issued, fully paid and non-assessable and shall be free and clear of all liens and restrictions, other than restrictions under applicable federal and state securities laws.

5.4 Governmental Authorization; Consents. The execution, delivery and performance by Neptune of this Agreement and the consummation by Neptune of the transactions contemplated hereby will not require any consent, approval, action, order, authorization, or permit of, or registration or filing with, any governmental body, agency, official or authority, other than (a) such as may be required under any applicable state securities laws and (b) other consents, approvals, actions, orders, authorizations, registrations, declarations, filings and permits which, if not obtained or made, would not have a material adverse effect on Neptune or the ability of Neptune to consummate the transactions contemplated by this Agreement.

5.5 Non-Contravention. The execution, delivery and performance by Neptune of this Agreement and the consummation by Neptune of the transactions contemplated hereby do not and will not (a) contravene or conflict with Neptune’s Articles of Incorporation, as amended or amended and restated, or (b) assuming compliance with the matters referred to in Section 2.4 hereof and the truthfulness of the representations of the other parties contained herein, contravene or conflict with, or constitute a violation of any provision of, any law binding upon or applicable to Neptune or by which any of its properties is bound or affected.

| |

6.

|

Delivery of Tax Documentation.

|

6.1 Tax Forms. The Investor shall deliver such documentation prescribed by applicable law or reasonably requested by the Company as will enable the Company to determine whether or not the Investor is subject to U.S. tax withholding or information reporting requirements. The Company may withhold taxes from payments to the Investor in order to comply with U.S. withholding laws, unless the Investor provides appropriate documentation confirming an exception or reduction to U.S. withholding tax requirements. In addition, the Investor shall deliver to the Company at the time or times prescribed by law and at such time or times reasonably requested by the Company such documentation prescribed by applicable law and such additional documentation reasonably requested by the Company as may be necessary for the Company to comply with its obligations under FATCA and to determine that the Investor has complied with the Investor’s obligations under FATCA or to determine the amount to deduct and withhold from a payment to the Investor.

6.2 Deliverables by U.S. Persons. Without limiting the foregoing Section 6.1, the Investor shall deliver to the Company on or prior to the Closing, and from time to time thereafter upon the reasonable request of the Company, an executed IRS Form W-9 certifying that the Investor is exempt from U.S. federal backup withholding tax.

| |

6.3

|

Definitions. For purposes of this Agreement:

|

| |

(i)

|

“Code” means the Internal Revenue Code of 1986, as amended.

|

| |

(ii)

|

“FATCA” means Sections 1471 through 1474 of the Code, as of the date of this Agreement and any current or future regulations or official interpretations thereof and any agreements entered into pursuant to Section 1471(b)(1) of the Code.

|

| |

(iii)

|

“U.S. Person” means any individual or entity that is a “United States Person” as defined in Section 7701(a)(30) of the Code.

|

7. Approvals; Amendment to Charter. The parties acknowledge that certain approvals are required pursuant to the provisions of the Amended and Restated Stockholders’ Agreement in connection with the transactions contemplated by this Agreement, and that such provisions are for the benefit of MSEC. MSEC hereby agrees to indemnify the other parties hereto with respect to any losses, damages or expenses sustained by such parties arising out of any claims of any third party investors of the Company in connection with the Conversion. In furtherance of the foregoing, MSEC hereby authorizes and approves, as required by Section 17 of the Amended and Restated Stockholders’ Agreement, an amendment to the Certificate of Incorporation of the Company, which amendment shall replace Article FOURTH in its entirety with the following:

“The total number of shares of all classes of stock which the Corporation shall have authority to issue is 500,000,000 shares of Common Stock, $0.001 par value per share (“Common Stock”).”

8. Amendment to Stockholders’ Agreement. As contemplated by the Term Sheet, in connection with and contingent upon the completion of the Spinout, MSEC would have certain board observer rights, consultation rights with respect to director nominees and approval rights with respect to the management incentive compensation, and the parties acknowledge that the existing Amended and Restated Stockholders’ Agreement would need to be amended or amended and restated to provide for such rights and to reflect the public company nature of the Company post-Spinout. As such, in connection with the Spinout, the parties hereto agree to use their respective reasonable best efforts to obtain any required consents or approvals of any stockholders party to the Amended and Restated Stockholders’ Agreement whose consent or approval is required in connection with any such amendment or amendment and restatement, which agreement, as amended or amended and restated, would be in the form reasonably acceptable to each party hereto.

9. Amendment of Other Holders Notes. MSEC, NGV and Sprout will use their commercially reasonable best efforts to cause the other Holders (as defined in that certain Intercreditor Agreement dated as of August 10, 2022, by and among MSEC, NGV and the other parties thereto) to agree to the terms and conditions of the Amended Promissory Note.

10. Survival. The representations, warranties and covenants contained in this Agreement shall survive the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby.

11. GOVERNING LAW. THIS AGREEMENT SHALL BE GOVERNED BY, CONSTRUED IN ACCORDANCE WITH, AND ENFORCED UNDER, THE LAW OF THE STATE OF DELAWARE APPLICABLE TO AGREEMENTS OR INSTRUMENTS ENTERED INTO AND PERFORMED ENTIRELY WITHIN SUCH STATE WITHOUT REGARD TO ANY CONFLICTS OF LAW PRINCIPLES THAT WOULD RESULT IN THE APPLICATION OF ANY OTHER JURISDICTION.

12. Severability. If any provision of this Agreement or the application thereof to any person or circumstance is held invalid or unenforceable to any extent, the remainder of this Agreement and the application of that provision to other persons or circumstances shall not be affected thereby, and that provision shall be enforced to the greatest extent permitted by law.

13. Assignment. None of MSEC, Neptune, NGV and the Company shall have the right or the power to assign or delegate any provision of this Agreement except with the prior written consent of each other party. This Agreement shall be binding upon and shall inure to the benefit of the parties’ respective successors, permitted assigns, executors and administrators.

14. Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original and all of which shall constitute one and the same document. This Agreement may be executed by facsimile signature by any party hereto and such signature shall be deemed binding without delivery of an original signature being thereafter required.

15. Entire Agreement. This Agreement, together with the Term Sheet, constitutes the entire agreement between the parties hereto with respect to the subject matter hereof and may be amended only in a writing executed by the party to be bound thereby.

16. Termination of Agreement. This Agreement may be terminated by the mutual written consent of the parties hereto.

17. Further Assurances. Subject to the terms and conditions provided herein, each party hereto agrees to use all commercially reasonable efforts to take, or cause to be taken, all action, and to do, or cause to be done, all things necessary, proper or advisable, whether under applicable laws and regulations or otherwise, in order to consummate and make effective the transactions contemplated by this Agreement.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

| |

|

|

|

|

|

|

| |

|

|

|

SPROUT FOODS, INC.

|

| |

|

|

|

| |

|

|

|

By:

|

|

/s/ John S. Wirt

|

| |

|

|

|

Name:

|

|

|

| |

|

|

|

Title:

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

NEPTUNE GROWTH VENTURES, INC.

|

| |

|

|

|

| |

|

|

|

By:

|

|

/s/ John S. Wirt

|

| |

|

|

|

Name:

|

|

|

| |

|

|

|

Title:

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

NEPTUNE WELLNESS SOLUTIONS INC.

|

| |

|

|

|

| |

|

|

|

By:

|

|

/s/ Lisa Gainsborg

|

| |

|

|

|

Name:

|

|

|

| |

|

|

|

Title:

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

NH EXPANSION CREDIT FUND HOLDINGS, LP

|

| |

|

|

|

| |

|

|

|

By:

|

|

/s/ Lincoln Isetta

|

| |

|

|

|

Name:

|

|

Lincoln Isetta

|

| |

|

|

|

Title:

|

|

Managing Partner

|

| |

|

|

|

|

|

|

THE SECURITIES REPRESENTED BY THIS INSTRUMENT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (“SECURITIES ACT”), OR REGISTERED OR QUALIFIED UNDER ANY STATE SECURITIES LAWS AND HAVE BEEN TAKEN FOR INVESTMENT PURPOSES ONLY AND NOT WITH A VIEW TO OR FOR SALE IN CONNECTION WITH ANY DISTRIBUTION THEREOF. THE SECURITIES MAY NOT BE SOLD, OFFERED FOR SALE OR OTHERWISE TRANSFERRED IN THE ABSENCE OF REGISTRATION UNDER THE SECURITIES ACT AND REGISTRATION OR OTHER QUALIFICATION UNDER APPLICABLE STATE SECURITIES LAWS, OR AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY THAT THE REGISTRATION OR OTHER QUALIFICATION IS NOT REQUIRED.

_____________________

No. SC-200

November 6, 2023

THIRD AMENDED AND RESTATED

SECURED PROMISSORY NOTE

SPROUT FOODS, INC., a Delaware corporation (the “Company”), for value received, promises to pay to the order of NH EXPANSION CREDIT FUND HOLDINGS LP or its permitted assign(s) of all or any portion thereof (each, a “Holder” and collectively, the “Holders”) the aggregate sum of Thirteen Million Dollars and No Cents ($13,000,000), together with any accrued and unpaid interest hereon, each as set out below. The outstanding principal balance of this Third Amended and Restated Secured Promissory Note (this “Note”) shall bear interest at the rate of (i) fifteen percent (15.00%) per annum through and including June 30, 2024, which shall be compounded by being added to the principal amount of this Note on each Payment Date and (ii) from and after July 1, 2024 and continuing until this Note is repaid in full in accordance with the terms hereof, (a) seven and one-half percent (7.50%), which shall be compounded by being added to the principal amount of this Note on each Payment Date and (b) seven and one-half percent (7.50%) due and payable in cash on each Payment Date; provided, however, that upon an Event of Default (as defined below) and while such Event of Default is continuing, this Note shall bear interest at the rate per annum equal to five percent (5.0%) above the rate that is otherwise applicable hereto, compounded weekly. Interest will be calculated on the basis of a 360 day year for the actual number of days elapsed.

Subject to the terms and conditions of this Note, this Note amends and restates in its entirety, without novation, that certain Second Amended and Restated Secured Promissory Note (the “Original Note”) issued by the Company to the Holder dated as of April 18, 2023 (the “Original Issue Date”).

1.    REPAYMENT

(a) Payment of Principal and Interest. The Company shall pay interest on and, when applicable pursuant to the terms of this Note, interest shall be added to the principal amount of this Note, quarterly in arrears on the last day of each fiscal quarter during the term hereof (each, a “Payment Date”). Upon the Maturity Date (as defined below), an amount (the “Maturity Payment”) equal to the sum of (x) all unpaid principal then outstanding on this Note plus (y) all accrued and unpaid interest outstanding under this Note (including interest paid or payable upon repayment), shall be due and payable in cash, in one lump sum, unless required to be repaid sooner under the provisions of this Note. The “Maturity Date” means the earlier to occur of: (i) June 30, 2025; or (ii) the occurrence and continuance beyond any applicable grace or cure period of any Event of Default. All payments under this Note will be made in cash in currency of the United States of America, for the benefit of Holder, and will be made by wire transfer of immediately available funds to an account that Holder gives to the Company by written notice made under the provisions of this Note. Any and all payments under this Note shall be made free and clear of, and without deduction or withholding for, any and all present or future federal, state, local and foreign taxes, levies, deductions, charges or withholdings, and all liabilities with respect thereto. Nothing herein shall in any way limit or restrict Section 1(e) below.

(b) Prepayment. This Note may be prepaid in whole or in part, from time to time, without premium or penalty, by the Company in its sole discretion.

(c) Application of Payments. Payments on this Note will be applied first to fees, costs and expenses payable under this Note, second to accrued interest, and the balance to the remaining amounts due hereunder. Despite anything to the contrary set out in this Note, the amounts due and payable will not exceed the maximum non-usurious rate of interest as in effect from time to time. If Holder receives any sums under this Note which constitute interest in an amount in excess of that permitted to be paid under applicable law, then, all such sums constituting interest in excess of that permitted to be paid under applicable law shall, at Holder’s option, either be credited to the payment of principal owing hereunder or returned to the Company.

2.    DEFINITIONS; PREPAYMENT

(a) Definitions. The following terms will have the following meanings:

(i)“ Affirmation” means that certain Affirmation of Intercreditor Agreement, in substantially the form attached hereto as Annex X.

(ii)“ Business Day” means any day that is not a Saturday, Sunday or a day on which banks in New York City are closed.

(iii)“ Collateral” means any and all properties, rights and assets of the Company described on Exhibit A.

(iv) [Reserved].

(v)“ Intercreditor Agreement” means that certain Intercreditor Agreement dated as of August 10, 2022, by and between the Pari Passu Lenders and Holder, in form and content reasonably acceptable to Holder; as affirmed pursuant to the Affirmation.

(vi)“ Neptune” means Neptune Wellness Solutions Inc., a Quebec corporation.

(vii)“ Pari Passu Indebtedness” shall mean all principal, interest, fees, expenses and other amounts now or in the future owing to the Pari Passu Lenders on terms acceptable to Holder, provided that the aggregate principal amount outstanding thereunder shall not exceed Thirty Seven Million Five Hundred Thousand Dollars ($37,500,000). “Pari Passu Lenders” shall mean the lenders providing Pari Passu Indebtedness under that certain First Amendment to Stock Purchase Agreement dated on or about April 18, 2023 by and among the Company, Neptune Growth Ventures Inc. and the other Stockholders (as defined therein) signatory thereto (or another purchase agreement), including but not limited to Neptune, on terms acceptable to Holder.

(viii)“ Person” means any individual, partnership, limited liability company, corporation, association, cooperative, trust, estate or other entity.

(ix) [Reserved].

(x) [Reserved].

(xi)“ Restated Certificate” means the Company’s Tenth Amended and Restated Certificate of Incorporation dated February 10, 2021, as it may be amended from time to time.

(b) Prepayment. At any time and from time to time prior to the Maturity Date, the Company, may elect to repay all or any part of the then-outstanding principal and interest due on this Note in full in cash.

3.    CREATION AND GRANT OF SECURITY INTEREST

(a) The Company hereby grants to Holder, to secure the payment and performance in full of all of the obligations under this Note (the “Obligations”), a continuing security interest in, and pledges to Holder the Collateral, wherever located, whether now owned or hereafter acquired or arising, and all proceeds and products thereof. The Company hereby authorizes Holder to file financing statements, without notice to the Company, at the Company’s expense, with all appropriate jurisdictions to perfect or protect Holder’s interest or rights hereunder. If this Note is terminated, Holder’s lien and security interest in the Collateral granted hereunder shall continue until the Obligations (other than inchoate indemnity obligations) are repaid in full in cash (or repaid in full in accordance with the terms hereof). Upon payment in full in cash of the Obligations (other than inchoate indemnity obligations) and/or repaid in Conversion Shares in whole of the Obligations in accordance with the terms hereof, or any combination thereof, Holder’s lien and security interest shall be automatically released and all rights therein shall revert to the Company.

(b) Without limiting the foregoing: the Company hereby pledges, assigns and grants to Holder, a security interest in one hundred percent (100%) of the issued and outstanding capital stock, membership units or other securities owned or held of record by the Company or any subsidiary of the Company, in any subsidiary (the “Shares”), together with all proceeds and substitutions thereof, all cash, stock and other moneys and property paid thereon, all rights to subscribe for securities declared or granted in connection therewith, and all other cash and noncash proceeds of the foregoing, as security for the performance of the Obligations. Subject to the written consent of the Pari Passu Lenders, the certificate or certificates for the Shares (if any) will be delivered to Holder, accompanied by an instrument of assignment duly executed in blank by the Company; until such time as such certificate(s) for the Shares (if any) shall be delivered to Holder, the parties acknowledge and agree that Neptune shall hold such certificates as bailee for perfection of Holder’s and the other Pari Passu Lenders’ security interest in such Shares. Upon the occurrence and during the continuance of an Event of Default hereunder, Holder may effect the transfer of any securities included in the Collateral (including but not limited to the Shares) into the name of Holder and cause new (as applicable) certificates representing such securities to be issued in the name of Holder or its transferee. The Company will execute and deliver such documents, and take or cause to be taken such actions, as Holder may reasonably request to perfect or continue the perfection of Holder’s security interest in the Shares. Unless an Event of Default shall have occurred and be continuing, the Company shall be entitled to exercise any voting rights with respect to the Shares and to give consents, waivers and ratifications in respect thereof, provided that no vote shall be cast or consent, waiver or ratification given or action taken which would be inconsistent with any of the terms of this Note or which would constitute or create any violation of any of such terms. All such rights to vote and give consents, waivers and ratifications shall terminate upon the occurrence and continuance of an Event of Default.

4.    INTERCREDITOR AGREEMENT

The Company covenants and agrees, and each Holder of this Note by its acceptance hereof, likewise covenants and agrees, that any and all amounts due under this Note are payable on a pro rata and pari passu basis with the Pari Passu Indebtedness, all of which indebtedness (to Holder and the Pari Passu Lenders) shall be senior in payment and priority to all other indebtedness of the Company.

5.    COVENANTS OF THE COMPANY

(a) The Company shall maintain unrestricted cash in a deposit account, subject to a control agreement in favor of, and in form and content reasonable acceptable to, Holder, in the minimum amount of Five Hundred Thousand Dollars ($500,000.00).

(b) The Company will not, by amendment of its Restated Certificate, by-laws or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Company, but will at all times in good faith assist in the carrying out of all the provisions of this Note.

(c) The Company will not grant (or permit to be granted) any security in any assets of the Company or any subsidiary to any third party (other than the holders of the Pari Passu Indebtedness) after the date hereof without the prior written consent of Holder, except for purchase money security interests and capital equipment lease agreements incurred in the ordinary course of business.

(d) So long as this Note is outstanding the Company will not, and it will not permit any direct or indirect subsidiary of the Company to, in each case without the prior written consent of Holder, issue, incur, assume, create, guaranty or have outstanding any indebtedness for borrowed money, in each case other than (i) the Company’s Pari Passu Indebtedness, (ii) equipment leases, including, without limitation, financing leases for capital equipment, provided that any liens or security interests granted in connection therewith are limited to the assets so financed, (iii) purchase money security indebtedness, (iv) working capital lines of credit secured exclusive by purchase orders, accounts receivables and inventory as collateral, and/or (v) unsecured convertible debt financing which is subordinate to this Note; provided that the aggregate amount of indebtedness incurred in connection with (ii) through (iv) above shall not exceed Two Hundred Fifty Thousand Dollars ($250,000).

(e) The Company shall take all such further actions and execute all such further documents and instruments as Holder may at any time reasonably determine to be necessary or desirable to further carry out and consummate the transactions contemplated by this Note and the documentation relating thereto.

(f) The Company will notify Holder (1) before the Company files for bankruptcy or makes a general assignment for the benefit of creditors, or (2) immediately if any creditor or group of creditors files a petition with a U.S. bankruptcy court seeking to declare the Company bankrupt or insolvent or the Company receives any threat, orally or in writing, that a creditor or group of creditors intends to file a petition against the Company in U.S. bankruptcy court seeking to declare the Company bankrupt or insolvent.

6.    EVENTS OF DEFAULT

The occurrence of any of the following events shall be an event of default under this Note (each an “Event of Default”):

(a) Failure to Pay. The Company shall fail to pay (i) any principal or interest when due or (ii) any other amount required under the terms of this Note within three (3) Business Days of the date when due and payable or declared due and payable, in each case of (i) and (ii), whether by acceleration or otherwise; or

(b) Breaches of Covenants. The Company or any subsidiary shall materially fail to observe or perform any covenant, obligation, condition or agreement contained in this Note; or

(c) Default on Other Indebtedness; Judgments. Any default or event of default shall have occurred with respect to any other indebtedness of the Company in excess of $250,000 (including the Pari Passu Indebtedness), and the effect of such default has caused such indebtedness to become due prior to its stated maturity; one or more judgments, orders, or decrees for the payment of money in an amount, individually or in the aggregate, of at least $250,000 shall be rendered against the Company and shall remain unsatisfied, unvacated, or unstayed for a period of ten (10) days after the entry thereof; or

(d) Voluntary Bankruptcy or Insolvency Proceedings. The Company shall (i) apply for or consent to the appointment of a receiver, trustee, liquidator or custodian of itself or of all or a substantial part of its property, (ii) be unable, or admit in writing its inability, to pay its debts generally as they mature, (iii) make a general assignment for the benefit of its or any of its creditors, (iv) be dissolved or liquidated in full or in part, (v) become insolvent (as such term may be defined or interpreted under any applicable statute), (vi) commence a voluntary case or other proceeding seeking liquidation, reorganization or other relief with respect to itself or its debts under any bankruptcy, insolvency or other similar law now or hereafter in effect or consent to any such relief or to the appointment of or taking possession of its property by any official in an involuntary case or other proceeding commenced against it, or (vii) take any action for the purpose of effecting any of the foregoing; or

(e) Involuntary Bankruptcy or Insolvency Proceedings. Proceedings for the appointment of a receiver, trustee, liquidator or custodian of the Company or of all or a substantial part of the property thereof, or an involuntary case or other proceedings seeking liquidation, reorganization or other relief with respect to the Company or the debts thereof under any bankruptcy, insolvency or other similar law now or hereafter in effect shall be commenced and an order for relief entered or such proceeding shall not be dismissed or discharged within sixty (60) days of commencement; or

(f) Material Adverse Change; Any circumstance occurs which could reasonably be expected to have is (a) a material impairment in the perfection or applicable priority of Holder’s lien and security interest in the Collateral, or in the value of such Collateral; (b) a material adverse change in the business, operations, or condition (financial or otherwise) of the Company and its Subsidiaries taken as a whole; or (c) a material impairment of the prospect of repayment of any portion of the Obligations; or

(g) Breaches of Representations and Warranties. Any representation or warranty made by the Company in this Note shall be untrue in any material respect when made; or

(h) [Reserved].

7.    REMEDIES

(a) Balance Due. On the occurrence and continuation of an Event of Default, the Maturity Payment and all other amounts under this Note will, at the option of Holder, unless earlier repaid in Repayment Shares in accordance with the terms of this Note, become immediately due and payable WITHOUT DEMAND, PRESENTMENT, PROTEST OR NOTICE OF DEMAND, NONPAYMENT OR DISHONOR, ALL OF WHICH ARE EXPRESSLY WAIVED BY THE COMPANY, and Holder will have, in addition to any other rights and remedies provided for in this Note, all of the rights and remedies of a creditor at law or in equity. Notwithstanding the foregoing, upon the occurrence of an Event of Default as described in Section 5(d) or 5(e) above, the Maturity Payment and all other amounts under this Note shall automatically become immediately due and payable without any action by Holder.

(b) Rights as a Secured Creditor. On the occurrence and continuation of an Event of Default, Holder shall have all rights and remedies of a secured lender, at law or in equity, whether pursuant to Article 9 of the Uniform Commercial Code then in effect or otherwise.

8.    MISCELLANEOUS

(a) Delays or Omissions. No delay or omission to exercise any right, power or remedy accruing to a party upon any breach or default of the other party under this Note shall impair any such right, power or remedy of the party nor shall it be construed to be a waiver of any such breach or default, or an acquiescence therein, or of or in any similar breach or default thereafter occurring; nor shall any waiver of any single breach or default be deemed a waiver of any other breach or default therefore or thereafter occurring. Any waiver, permit, consent or approval of any kind or character on the part of a party of any breach or default under this Note or any waiver on the part of a party of any provisions or conditions of this Note must be made in writing and shall be effective only to the extent specifically set forth in such writing. All remedies, either under this Note or by law or otherwise afforded to the parties, shall be cumulative and not alternative.

(b) Amendment Provision. This Note and any provision of it may only be amended, and the observance of any term of this Note may be waived (either generally or in a particular instance and either retroactively or prospectively), only upon the written consent of the Company and Holder.

(c) Severability. The invalidity or unenforceability of any provision of this Note shall not affect the validity or enforceability of any other provision of this Note. Any provision of this Note held invalid or unenforceable only in part or degree will remain in full force and effect to the extent not held invalid or unenforceable.