false

0001081938

0001081938

2023-11-06

2023-11-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current

Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November

6, 2023

CannaPharmaRX,

Inc.

(Exact name of registrant as specified

in its charter)

| Delaware |

333-251016 |

27-4635140 |

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer ID No.) |

Suite

3600, 888-3rd Street SW

Calgary, Alberta, Canada T2P

5C5

(Address of principal executive offices,

including zip code)

(949) 652-6838

(Registrant’s Telephone Number,

including area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act: None

Securities registered pursuant to Section 12(g)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

CPMD |

OTC Markets |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b2 of the Securities Exchange Act of 1934 (§240.12b2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 4.01 |

Change in Registrant’s Certifying Accountant. |

(a) Resignation of Previous Independent Registered Public Accounting

Firm

On November 6, 2023, CannaPharmaRX, Inc.

(the “Company”, “we”, “us”) terminated our engagement with our independent registered public accounting

firm, BF Borgers CPA PC (“Borgers”), effective November 6, 2023. Borgers has served as our independent registered public accounting

firm since 2018.

During the years ended December 31, 2022 and 2021

and the subsequent interim period from January 1, 2023 to June 30, 2023,

| |

(i) |

there were no disagreements between the Company and Borgers on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to Borgers’s satisfaction, would have caused Borgers to make reference in connection with its opinion to the subject matter of the disagreement, and |

| |

(ii) |

there were no “reportable events,” as that term is described in Item 304(a)(1)(v) of Regulation S-K. |

The report of Borgers to our financial statements

for fiscal years ended December 31, 2022 and 2021 included in our Annual Report on Form 10-K for the year ended December 31, 2022,

did not contain an adverse opinion or a disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting

principle. The report had been prepared assuming that we would continue as a going concern and included an explanatory paragraph regarding

our ability to continue as a going concern as result of recurring loses from operations, a significant accumulated deficit and consistent

negative cash flows.

We have provided Borgers with a copy of the foregoing

disclosures it is making in this Current Report on Form 8-K prior to its filing and requested, in accordance with applicable practices,

that Borgers furnish a letter addressed to the Securities and Exchange Commission stating whether it agrees with the statements made herein.

Attached as Exhibit 9.01 is a copy of Borgers’s letter, dated November 13, 2023 stating that it agrees with such statements.

(b) Engagement of New Independent Registered

Public Accounting Firm

On November 3, 2023, we engaged GreenGrowth CPAs

(“GreenGrowth”) as our new independent registered public accountant for the fiscal year ending December 31, 2023 and to provide

services with respect to the filing of our 10-Q for the period ending September 30, 2023. This decision was approved by our full Board

of Directors.

During the fiscal years ended December 31,

2022 and 2021 and through the period ending June 30, 2023, neither the Company nor anyone on our behalf consulted with GreenGrowth regarding

(1) the application of accounting principles to a specified transaction, completed or proposed, or the type of audit opinion that

might be rendered on our financial statements, and neither a written report nor oral advice was provided to us that GreenGrowth concluded

was an important factor considered by us in reaching a decision as to any accounting, auditing or financial reporting issue, or (2) any

matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions)

or a reportable event (as described in Item 304(a)(1)(v) of Regulation S-K).

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly

caused this report to be signed on its behalf by the undersigned, hereunto duly

authorized.

| |

CANNAPHARMARX, INC. |

| |

|

| November 13, 2023 |

By: |

/s/ Dean Medwid |

| |

|

Dean Medwid

CEO |

Exhibit 9.01

|

5400 W Cedar Ave

Lakewood, CO 80226

Telephone: 303.953.1454

Fax: 303.945.7991 |

November

13, 2023

United

States Securities and Exchange Commission

Office of the Chief Accountant

100

F Street, N.E.

Washington, D.C. 20549

Re: CannaPharmaRX,

Inc.

Ladies and Gentleman:

We have

read the statements under item 4.01 in the Form 8-K dated November 6, 2023, of CannaPharmaRX, Inc. (the “Company”) to be

filed with the Securities and Exchange Commission and we agree with such statements therein as related to our firm. We have no basis

to, and therefore, do not agree or disagree with the other statements made by the Company in the Form 8-K.

Sincerely,

/s/ BF

Borgers CPA PC

BF Borgers

CPA PC

Certified Public Accountants

Lakewood, CO

Exhibit 9.02

| |

|

CannaPharmaRx

Inc.

Audit

Engagement Letter |

Thank you

for choosing GreenGrowth CPAs (“we” or “our”) to provide audit services as described below (“Services”)

for CannaPharmaRx Inc. (“Client”) shown and signed at the end of this Engagement Letter (“Engagement Letter”).

This Engagement Letter describes the scope of GreenGrowth CPAs Services, the respective responsibilities of GreenGrowth CPAs and Client,

our fees, and other terms and conditions under which we will provide the Services.

SCOPE OF SERVICES

We will audit

Client’s consolidated financial statements which comprise the balance sheets for the year ended December 31, 2023 (“FY23”),

and the related statements of income, shareholders equity, and cash flows for the year then ended, and a summary of significant accounting

policies and other explanatory information prepared in accordance with United States Generally Accepted Accounting Principles (“US

GAAP”).

We will review the Client’s

consolidated financial statements which comprise the balance sheets for periods ended September 30, 2023 (“Q3 FY23”), March

31, 2024 (“Q1 FY24”), June 30, 2024 (“Q2 FY24”), and the related consolidated statements of income, shareholders

equity, and cash flows and a summary of significant accounting policies and other explanatory information prepared in accordance with

US GAAP.

AUDIT OBJECTIVE

The objective

of our audit is the expression of an objective opinion about whether your financial statements are fairly presented, in all material respects,

in conformity with US GAAP. Our audit will be conducted in accordance with PCAOB and will include tests of your accounting records and

other procedures we consider necessary for us to obtain the reasonable assurances required to express an opinion as described above. We

will issue a written report upon completion of our audit of Client’s financial statements. Our report will be addressed to your

board of directors. We cannot provide any assurance that an unqualified opinion will be expressed. Circumstances may arise in which it

is necessary, under our professional standards, for us to modify our opinion or add what is known as an “emphasis-of-matter”

or “other-matter” paragraph. If our opinion is other than unqualified, we will discuss the reasons with you in advance. If,

for any reason, we are unable to complete the audit or are unable to form or have not formed an opinion, we may decline to express an

opinion, issue a disclaimer of opinion, or withdraw from this engagement.

AUDIT PROCEDURES

Our procedures will include tests

of documentary evidence supporting the transactions recorded in the accounts, and direct confirmation of certain assets and liabilities.

We may also request written representations from your attorneys as part of the engagement, including confirmation that your business operates

in accordance with state and local laws and regulations. At the conclusion of our audit, we will require certain written representations

from Client’s management regarding the financialstatements and related matters. Such written representations are a critical part

of the audit that we will perform, and we are unable to finalize our engagement or report and express our opinion without these written

representations.

An audit includes

examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Accordingly, our audit will

involve professional judgment about the number andtypes of transactions to be examined and the areas to be tested. An audit also

includes evaluating the appropriateness of accounting policies and practices implemented, and the reasonableness of significant

accounting estimates made by Client’s management, as well as evaluating the overall presentation and fairness of the financial

statements. We will plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of

material misstatement, whether such material misstatements arise from (1) errors or omissions, (2) under reporting or recognition of

revenue, (3) fraudulent financial reporting, (4) misappropriation of assets or inventory, or (5) violationsof laws or governmental

regulations that are attributable to Client or its management or employees acting on behalf of Client.

| |

|

CannaPharmaRx

Inc.

Audit

Engagement Letter |

Because of the inherent limitations

of an audit, combined with the inherent limitations of internal controls, and because we will not perform a detailed examination of all

transactions, there is a risk that material misstatements may exist and not be detected by us, even though the audit is properly planned

and performed in accordance with PCAOB auditing. In addition, an audit is not designed to detect immaterial misstatements or violations

of laws or governmental regulations that do not have a direct andmaterial effect on the financial statements. However, we will inform

the appropriate level of management of any material errors, under reporting of revenue, fraudulent financial reporting, or misappropriation

of assets or inventory that comes to our attention. We will also inform the appropriate level of management of any violations of laws

or governmental regulations that come to our attention.

Our responsibility as auditors is

limited to the period covered by our audit as stated above and does not extend to any later periods for which we are not engaged as auditors.

Our audit will include obtaining

an understanding of the Company and its environment (including internal controls) sufficient to assess the risks of a material misstatement

of the financial statements, to design the nature, timing, and extent of further audit procedures, and form our opinion. An audit is not

designed to provide assurance on the quality of internal controls, to identify deficiencies or weaknesses in internal control, or to detect

fraud or theft of assets. However, during the audit, we will communicate to you and those responsible for internal controls related matters

that are required to be communicated under professional standards.

We may from time to time, and depending

on the circumstances, use third-party service providers in serving your account. GreenGrowth CPAs remains responsible for the work of

any such third- party service providers.

REVIEW OBJECTIVE

The objective of a review conducted

in accordance with the PCAOB standards is to obtain limited assurance that there are no material modifications that should be made to

the financial statements in order for them to be in conformity with US GAAP. We will issue a written report upon completion of our review

of Client’s financial statements. Our report will be addressed to your board of directors.

Our ability to issue any report as

a result of this engagement and the wording thereof will, of course, be dependent on the facts and circumstances at the date of our report.

If, for any reason, we are unable to complete our review, we may decline to issue any report as a result of this engagement. If we are

unable to complete our review or if any report to be issued by us as a result of this engagement requires modification, the reasons for

this will be discussed with the Board of Directors and the Company’s management.

REVIEW PROCEDURES

We are responsible for conducting this engagement in accordance

with the review standards. A review includes primarily applying analytical procedures to the Company’s financial data and making

inquiries of Company management. A review is substantially less in scope than an audit, the objective of which is the expression of an

opinion regarding the financial statements as a whole.

A review does not

contemplate obtaining: an understanding of the Company’s internal control; assessing fraud risk; tests of accounting records

by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source

documents (e.g., cancelled checks or bank images); or other procedures ordinarily performed in an audit. Accordingly, we will not

express an opinion regarding the financial statements as a whole. Also, a review cannot be relied upon to disclose errors, fraud, or

illegal acts that may exist. We may from time to time, and depending on the circumstances, use third-party service providers in

serving your account. GreenGrowth CPAs remains responsible for the work of any such third- party service providers.

| |

|

CannaPharmaRx

Inc.

Audit

Engagement Letter |

MANAGEMENT RESPONSIBILITIES &

ACKNOWLEDGEMENTS

Client is responsible for designing,

establishing, implementing, and maintaining internal controls, including monitoring ongoing business activities; for the selection and

application of accounting principles and financial reporting framework; and sound accounting policies and practices, including accurately

recording cash transactions, accounting for inventory, and the prevention and detection of theft. Client confirms that its senior management

possess suitable skill, knowledge, and experience to prepare and fairly represent the financial statements in conformity with US GAAP

and are responsible for the same. Client is also responsible for making all financial records and related information available to us,

and for the accuracy and completeness of that information. Client is also responsible for providing us with (1) access to all information

of which it is aware that is relevant to the preparation and fair presentation of the financial statements, (2) additional information

that we may request for the purpose of the audit, and (3) unrestricted access to persons within Client’s organization from whom

we determine it necessary to obtain audit evidence.

As part of our engagement, we may

propose corrections or adjustments to your financial statements. Nonetheless, your responsibilities include reviewing and understanding

such proposed corrections or adjustments and making the necessary changes to the financial statements to correct material misstatements

and confirming to GreenGrowth CPAs in the management representation letter that the effects of any uncorrected misstatements identified

by GreenGrowth CPAs during the current engagement and pertaining to the latest period presented are immaterial, both individually and

in the aggregate, to the financial statements taken as a whole.

Client is responsible for the

design and implementation of programs and controls to prevent and detect theft and fraud, and for informing us about all known, suspected,

or alleged fraud or theft affecting the Client’s organization involving management, employees who have significant roles in internal

control, and others where the fraud or theft could have a material effect on the financial statements. Client responsibilities include

informing GreenGrowth CPAs of its knowledge of any allegations of fraud or theft or suspected fraud or theft affecting Client. In addition,

Client is responsible for (1) identifying federal, state, or local laws applicable to Client’s business, and (2) ensuring that Client’s

employees and contractors comply with such applicable laws and regulations. Client is responsible for the preparation of the supplementary

information in conformity with US GAAP. Client agrees to include our report on the supplementary information in any document that contains,

and indicates that GreenGrowth CPAs has reported on, the supplementary information. Client also agrees to include the audited financial

statements with any presentation of the supplementary information that includes our report thereon.

USE AND CONFIDENTIALITY INFORMATION

GreenGrowth CPAs agrees to hold

Client’s confidential information in strict confidence and not to disclose such confidential information to any third party or to

use it for any purpose other than as specifically authorized by Client. GreenGrowth CPAs agrees that it will not disclose confidential

information to its affiliates, subsidiaries, parent entities, or other subsidiaries of any parent entity without the prior written consent

of Client. GreenGrowth CPAs agrees that it will employ all reasonable steps to protect the confidential information of Client from unauthorized

or inadvertent disclosure, including without limitation all steps that it takes to protect its own information that it considers proprietary.

GreenGrowth CPAs agrees that it will ensure that all contractors, agents or otherthird parties as to whom permission has been granted

to share confidential information will comply with the terms of this paragraph.

| |

|

CannaPharmaRx

Inc.

Audit

Engagement Letter |

FEES AND EXPENSES

Our fees for the Audit of the Consolidated

Financial Statements are $52,000. The timeline for billings will be as follow:

| · | $23,400 due on January 10, 2024 upon start of work |

| · | $23,400 due on February 10, 2024 |

| · | $5,200 due on March 10, 2024 upon completion of work, prior to issuance |

Our fees for the Interim Reviews of the Consolidated

Financial Statements are $9,500 per review. The timeline for billings will be as follow:

| · | $4,750 due on October 10, 2023 |

| · | $4,750 due on November 10, 2023 prior to issuance |

| · | $4,750 due on April 10, 2024 |

| · | $4,750 due on May 10, 2024 prior to issuance |

| · | $4,750 due on July 10, 2024 |

| · | $4,750 due on August 10, 2024 prior to issuance |

The fees are not dependent or

contingent on the findings or results of the Services, nor are amounts refundable. You agree to pay all fees and expenses incurred whether

or not we issue an audit report. Once GreenGrowth CPAs has completed work as described within our engagement letter, we will reach out

to indicate next steps and what is needed (review of draft documents, final payment etc.). If we are unable to connect/reach you after

20 days, we will issue a final invoice with all work completed and send your final invoice. If payment is not received for this updated

final invoice, we will work with an internal and/or 3rd party revenue collection agent/company.

Any additional services provided

to the Client outside of the Service described herein will be bill at our hourly rate of $300 per hour for such services.

Client is responsible for our

professional fees and reasonable costs related to providing the service, such as travel costs, administrative costs associated with sending

confirmations. In addition, Client is responsible for our professional fees and reasonable costs related to subpoenas, or giving an interview

or deposition incurred which is related to the Services.

The Client is responsible for

reimbursement of all engagement related expenses, including but not limited to expenses incurred for background checks, use of confirmation.com,

third party pre-issuance quality review, and third party engagement quality review services.

PAYMENT

We accept payment via ACH wire transfer

to the following account:

| |

Preferred Bank |

Account Name: GreenGrowth CPAs |

| |

|

|

| |

10250 Constellation Blvd Suite 100 |

Account Number:

004009983 |

| |

Los Angeles CA 90067-0000 |

Routing Number: 122042205 |

In the event that payment is not received upon the

invoice reaching its due date, we reserve the right to take actions to collect, including but not limited to, charging of interest

at the rate of 1.5% per month (equating to an annualized rate of 18%), the refusal to perform additional work or services until your

account is brought current, and/or termination of our relationship with you. Additionally, if non-payment persists after the due

date, any unpaid balance may be transferred to a collection agency, which holds the authority to apply collection fees in accordance

with their policies. Any collection fees incurred by the collection agency will be paid by Client.

| |

|

CannaPharmaRx

Inc.

Audit

Engagement Letter |

TERMINATION

Client may terminate this Engagement

Letter at any time and for any reason with written notice to GreenGrowth CPAs. Notice of termination will be effective upon receipt. Upon

receipt of notice of termination, GreenGrowth CPAs will cease all work on requested services, refund any unused portion of the Initial

Deposit or subsequent retainer amount, provide the description of services performed in accordance with the provisions of the paragraph

above, and return any Confidential Information to Client. Termination for any reason will not affect Client’s obligation to pay

us any outstanding fees and expenses incurred prior to termination, or our obligation to transfer files to and otherwise cooperate with

successor service providers. The confidentiality provisions of this Engagement Letter will survive termination.

GreenGrowth CPAs may terminate

this Engagement Letter with ten 10 days written notice if Client fails to fulfill any of its material obligations, including, without

limitation, its obligation to pay the fees specified in this Engagement Letter, or provide the required information. In addition, GreenGrowth

CPAs may terminate this Engagement Letter at any time if Client fails to meet GreenGrowth CPAs’s client acceptance and retention

policy.

INDEPENDENCE MATTERS

PCAOB Rule 3526, Communication

with Audit Committees Concerning Independence, requires that we disclose to you in writing, at least annually, all relationships between

our firm and any affiliates and your company and its related entities or persons in financial reporting oversight roles at your company

that may reasonably be thought to bear on independence.

The following is a description of

such relationships of which we are aware that are relevant to our audit of the Company’s financial statements for the year ending

December 31, 2023:

- We are aware of no such relationships.

We confirm that we are independent

of the Company in compliance with PCAOB Rule 3520 and within the meaning of the federal securities laws administered by the Securities

and Exchange Commission. As further required by PCAOB Rule 3526, we will be pleased to discuss the potential effects of such relationships

on our independence with respect to the Company with you should you desire.

This letter is intended solely

for use by you and other members of the Board of Directors in your consideration of our independence as auditors, and should not be used

for any other purpose.

| |

|

CannaPharmaRx

Inc.

Audit

Engagement Letter |

GENERAL

Warranty &

Limitations. The Services performed under this Engagement Letter are professional in nature. GreenGrowth CPAs warrants it will

perform the Services in good faith, with due care, and in accordance with professional standards. GreenGrowth CPAs specifically

disclaims all other warranties, either express or implied, and makes no guarantee regarding the results of the Services and/or the

use byyou or any permitted third party. As your exclusive remedy for any failure to meet its warranty obligations, GreenGrowth CPAs

will use diligent efforts to correct such failure, or, at its option, return the professional fees paid to GreenGrowth CPAs with

respect to the associated Services, but not to exceed the amount of actual and direct damages resulting from our failure to meet our

obligations or theamount paid to GreenGrowth CPAs. In no event will GreenGrowth CPAs be liable for any indirect, consequential,

special, exemplary, or punitive damages. Any claim or action by either party, regardless of its nature, arising out of or relating

to any matter under the Engagement Letter must be brought with 24 months after the party first knows or has reason to know that the

claim or cause of action exists, unless otherwise provided by applicable law. Client will indemnify and hold harmless GreenGrowth

CPAs, its subcontractors and their personnel from any and all costs, expenses, settlements or penalties (“Liability”)

related to any proceeding initiated by a third party, including, without limitation, the criminal prosecution or threat of

prosecution by federal state and local government authorities, except tothe extent that such Liability results from GreenGrowth

CPAs’s gross negligence or intentional misconduct.

Complete Agreement. This

Engagement Letter constitutes the entire agreement between Client and GreenGrowth CPAs with respect to this engagement, supersedes all

other oral and written representations, understandings or agreements relating to this engagement, and may not be amended except by the

mutual written agreement of the Client and GreenGrowth CPAs.

Assignment. Client may not

assign the Engagement Letter to any other party without GreenGrowth CPAs’s prior written consent, except that you may assign the

Engagement Letter to any party that acquires your organization. This Engagement Letter are binding on GreenGrowth CPAs and your successors

and permitted assigns. Except as expressly provided in the Engagement Letter, there are no third-party beneficiaries.

Governing Law & Venue.

This Engagement Letter and all matters relating to the Services are governed by the laws of the State of California. Any legal action

related to the Services not otherwise resolved by the parties will be brought exclusively in the appropriate court located in San Diego

County, California.

Waiver & Enforceability.

No waiver of any breach of this Engagement Letter will be effective unless in writing and signed by the applicable party. No waiver of

one breach is a waiver of any other or subsequent breach. If any provision of this Engagement Letter is found to be unenforceable, the

enforceability of other provisions will not be affected; and the unenforceable provision will be modifiedto the extent necessary to render

it enforceable, preserving to the fullest extent permissible the intent of the parties. Please indicate your acceptance of this agreement

by responding with your acknowledgement.

We sincerely appreciate the opportunity to serve you.

Please date and sign this letter to acknowledge your agreement with, and acceptance of your responsibilities, and the terms of this engagement.

| /s/ Devin Fouse |

11/3/2023 |

| GreenGrowth CPA’s |

Date |

| |

|

| |

|

| /s/ Dean Medwid |

11/3/2023 |

|

Dean Medwid |

Date |

| Director & Chief Executive Officer |

|

| |

|

v3.23.3

Cover

|

Nov. 06, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 06, 2023

|

| Entity File Number |

333-251016

|

| Entity Registrant Name |

CannaPharmaRX,

Inc.

|

| Entity Central Index Key |

0001081938

|

| Entity Tax Identification Number |

27-4635140

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

Suite

3600

|

| Entity Address, Address Line Two |

888-3rd Street SW

|

| Entity Address, City or Town |

Calgary

|

| Entity Address, State or Province |

AB

|

| Entity Address, Country |

CA

|

| Entity Address, Postal Zip Code |

T2P

5C5

|

| City Area Code |

(949)

|

| Local Phone Number |

652-6838

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

CPMD

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

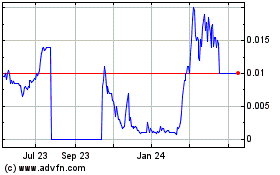

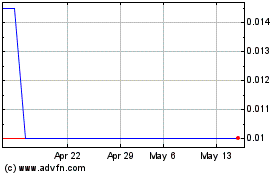

Cannapharmarx (CE) (USOTC:CPMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cannapharmarx (CE) (USOTC:CPMD)

Historical Stock Chart

From Apr 2023 to Apr 2024