false

0001360565

0001360565

2023-11-09

2023-11-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 9, 2023

WHERE

FOOD COMES FROM, INC.

(Exact

Name of Registrant as Specified in its Charter)

| Colorado |

|

001-40314 |

|

43-1802805 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification No.) |

| 202

6th Street, Suite 400 |

|

|

| Castle

Rock, Colorado |

|

80104 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(303)

895-3002

(Registrant’s

Telephone Number, Including Area Code)

Not

applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

WFCF |

|

The

NASDAQ Stock Market LLC |

| Item

2.02 |

Results

of Operations and Financial Condition |

Reference

is made to the Where Food Comes From, Inc. (the “Company”) press release on November 9, 2023 and conference call transcript,

attached hereto as Exhibits 99.1 and 99.2, respectively, and incorporated by reference herein (including, without limitation, the information

set forth in the cautionary statement contained in the press release and conference call transcript), relating to the Company’s

financial results for the three and nine month period ended September 30,

2023.

| Item

9.01 |

Financial

Statements and Exhibits |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

WHERE

FOOD COMES FROM, INC.

(Registrant) |

| |

|

| |

By:

|

/s/

Dannette Henning |

| Date:

November 13, 2023 |

|

Dannette

Henning |

| |

|

Chief

Financial Officer |

Exhibit

99.1

Where

Food Comes From, Inc. Reports 2023 Third Quarter Financial Results

Core

verification and certification revenue increases but total revenue decreases slightly based on lower hardware sales due primarily to

cyclical herd contraction

Third

Quarter Highlights – 2023 vs. 2022

| ● |

Verification

and certification revenue up 4% to $5.4 million from $5.2 million |

| ● |

Product

sales decline 23% to $1.2 million from $1.6 million |

| ● |

Total

revenue down 4% to $7.0 million from $7.3 million |

| ● |

Net

income decreased 8% to $723,000 from $785,000 |

| ● |

Diluted

EPS flat at $0.13 |

| ● |

Adjusted

EBITDA of $1.2 million vs. $1.3 million |

| ● |

Company

buys back $855,000 of its stock in Q3, or 60,537 shares; diluted share count drops to 5,658,000 from 6,016,000 year over year |

Nine-Month

Highlights – 2023 vs. 2022

| ● |

Verification

and certification revenue up 8% to $13.9 million from $12.9 million |

| ● |

Product

sales decline 10% to $3.1 million from $3.5 million |

| ● |

Total

revenue decreased 2% to $18.4 million from $18.8 million; decline includes impact of one-time $0.9 million contract award in Q1 2022 |

| ● |

Net

income of $1.4 million vs. $1.5 million |

| ● |

Diluted

EPS of $0.24 vs. $0.25 |

| ● |

Adjusted

EBITDA of $2.5 million vs. $2.8 million |

| ● |

Cash

generated from operations declined to $2.6 million from $3.0 million |

| ● |

Cash

& cash equivalents of $3.8 million vs. $4.4 million at 2022 year-end, reflecting impact of stock buybacks |

| ● |

Company

buys back more than $2.9 million of its stock through first nine months of 2023 |

CASTLE

ROCK, Colorado – November 9, 2023 – Where Food Comes From, Inc. (WFCF) (Nasdaq: WFCF), the most trusted resource for independent,

third-party verification of food production practices in North America, today announced financial results for its third quarter and nine-month

period ended September 30, 2023.

“Despite

continuing headwinds related to cyclical cattle trends, our core verification and certification revenue increased in both the third quarter

and nine-month period,” said John Saunders, chairman and CEO. “These increases reflect growth in our customer base and in

the number and type of verifications we are conducting. They also underscore continued momentum in consumer preferences for learning

more about how and by whom their food is produced. Lower overall revenue in the third quarter was attributable to a decline in hardware

sales due to reduced herd sizes. Hardware sales could continue to be lumpy over the next few quarters until herd sizes begin to cycle

back to higher levels. Lower hardware sales also weighed on gross margins, although we continued to deliver solid profitability in the

quarter and year-to-date period and will be well positioned to drive profit growth over the long term as we benefit from consumer preferences,

continued customer growth and high customer retention rates.

“More

recently, we announced another important milestone in our aquaculture initiative with the acquisition of Smart Catch™, a program

administered by our Postelsia division that promotes transparency and sustainability in seafood,” Saunders added. “Originally

a domestic program of the James Beard Foundation designed to link chefs to place-based seafood sustainability initiatives, Smart Catch

has tremendous potential for expansion into other areas of the seafood supply chain, including food service institutions, retailers,

seafood distributors, suppliers and producers around the world.”

Third

Quarter Results – 2023 vs. 2022

Revenue

in the third quarter ended September 30, 2023, declined 4% to $7.0 million from $7.3 million. The decline primarily reflected fewer cattle

in the supply chain due primarily to cyclical herd contraction.

Revenue

mix included:

| ● |

Verification

and certification services, up 4% to $5.4 million from $5.2 million. |

| ● |

Product

revenue, down 23% to $1.2 million from $1.6 million. |

| ● |

Consulting

revenue of $0.4 million versus $0.5 million. |

Gross

profit in the third quarter decreased to $2.9 million from $3.2 million.

Selling,

general and administrative expense was 9% lower year over year at $1.9 million compared to $2.1 million.

Operating

income was 12% lower at $0.9 million versus $1.1 million.

Net

income was $723,000, or $0.13 per diluted share, down 8% from $785,000, or $0.13 per diluted share.

Adjusted

EBITDA in the third quarter was down slightly at $1.2 million from $1.3 million.

The

Company bought back $855,000 of its common stock in the third quarter, or 60,537 shares. The diluted share count was reduced to 5,658,000

from 6,016,000 year over year.

Nine

Month Results – 2023 vs. 2022

Total

revenue through the first nine months of 2023 decreased 2% to $18.4 million from $18.8 million in the same period last year. The decrease

was due to lower hardware sales and the non-recurrence of a large contract award in the first quarter of 2022.

Revenue

mix included:

| ● |

Verification

and certification services, up 8% to $13.9 million from $12.9 million. |

| ● |

Product

revenue, down 10% to $3.1 million from $3.5 million. |

| ● |

Consulting

revenue of $1.3 million compared to $2.4 million in the prior year period when the Company booked a $0.9 million, non-recurring order

from a Japanese government entity. |

Gross

profit through nine months was $7.5 million versus $7.7 million in the year-ago period.

Selling,

general and administrative expense was essentially flat at $5.7 million.

Operating

income was lower at $1.8 million vs. $2.0 million.

Net

income through nine months was $1.4 million, or $0.24 per diluted share, compared to net income of $1.5 million, or $0.25 per diluted

share, in the same period last year.

Adjusted

EBITDA through nine months was $2.5 million versus $2.8 million a year ago.

The

cash and cash equivalents balance at September 30, 2023, declined to $3.8 million from $4.4 million at 2022 year-end due primarily to

the Company’s investment in its share repurchase program. Through the first nine months of 2023, the Company bought back more than

$2.9 million of its shares.

The

Company will conduct a conference call today at 10:00 a.m. Mountain Time.

Call-in

numbers for the conference call:

Domestic Toll Free: 1-877-407-8289

International: 1-201-689-8341

Conference Code: 13742404

Phone

replay:

A telephone replay of the conference call will be available through December 7, 2023, as follows:

Domestic Toll Free: 1-877-660-6853

International: 1-201-612-7415

Conference Code: 13742404

About

Where Food Comes From, Inc.

Where

Food Comes From, Inc. is America’s trusted resource for third party verification of food production practices. Through proprietary

technology and patented business processes, the Company estimates that it supports more than 17,500 farmers, ranchers, vineyards, wineries,

processors, retailers, distributors, trade associations, consumer brands and restaurants with a wide variety of value-added services.

Through its IMI Global, Validus Verification Services, SureHarvest, WFCF Organic, and Postelsia units, Where Food Comes From solutions

are used to verify food claims, optimize production practices and enable food supply chains with analytics and data driven insights.

In addition, the Company’s Where Food Comes From® retail and restaurant labeling program uses web-based customer education

tools to connect consumers to the sources of the food they purchase, increasing meaningful consumer engagement for our clients.

*Note

on non-GAAP Financial Measures

This

press release and the accompanying tables include a discussion of EBITDA and Adjusted EBITDA, which are non-GAAP financial measures provided

as a complement to the results provided in accordance with generally accepted accounting principles (“GAAP”). The term “EBITDA”

refers to a financial measure that we define as earnings (net income or loss) plus or minus net interest plus taxes, depreciation and

amortization. Adjusted EBITDA excludes from EBITDA stock-based compensation and, when appropriate, other items that management does not

utilize in assessing WFCF’s operating performance (as further described in the attached financial schedules). None of these non-GAAP

financial measures are recognized terms under GAAP and do not purport to be an alternative to net income as an indicator of operating

performance or any other GAAP measure. We have reconciled Adjusted EBITDA to GAAP net income in the Consolidated Statements of Income

table at the end of this release. We intend to continue to provide these non-GAAP financial measures as part of our future earnings discussions

and, therefore, the inclusion of these non-GAAP financial measures will provide consistency in our financial reporting.

CAUTIONARY

STATEMENT

This

news release contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act

of 1995, based on current expectations, estimates and projections that are subject to risk. Forward-looking statements are inherently

uncertain, and actual events could differ materially from the Company’s predictions. Important factors that could cause actual

events to vary from predictions include those discussed in our SEC filings. Specifically, statements in this news release about industry

leadership, expectations for hardware sales to be uneven, expectations for profit growth over the long term, expectations for consumer

trends to benefit the Company, potential to expand the Smart Catch program internationally, and demand for, and impact and efficacy of,

the Company’s products and services on the marketplace are forward-looking statements that are subject to a variety of factors,

including availability of capital, personnel and other resources; competition; governmental regulation of the agricultural industry;

the market for beef and other commodities; and other factors. Financial results for 2023 and the Company’s pace of stock buybacks

are not necessarily indicative of future results. Readers should not place undue reliance on these forward-looking statements. The Company

assumes no obligation to update its forward-looking statements to reflect new information or developments. For a more extensive discussion

of the Company’s business, please refer to the Company’s SEC filings at www.sec.gov.

Company

Contacts:

John

Saunders

Chief Executive Officer

303-895-3002

Jay

Pfeiffer

Director, Investor Relations

303-880-9000

jpfeiffer@wherefoodcomesfrom.com

Where

Food Comes From, Inc.

Statements

of Income (Unaudited)

| | |

Three months ended September 30, | | |

Nine months ended September 30, | |

| (Amounts in thousands, except per share amounts) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues: | |

| | |

| | |

| | |

| |

| Verification and certification service revenue | |

$ | 5,359 | | |

$ | 5,169 | | |

$ | 13,944 | | |

$ | 12,917 | |

| Product sales | |

| 1,221 | | |

| 1,588 | | |

| 3,130 | | |

| 3,473 | |

| Consulting revenue | |

| 431 | | |

| 508 | | |

| 1,330 | | |

| 2,362 | |

| Total revenues | |

| 7,011 | | |

| 7,265 | | |

| 18,404 | | |

| 18,752 | |

| Costs of revenues: | |

| | | |

| | | |

| | | |

| | |

| Costs of verification and certification services | |

| 3,123 | | |

| 2,900 | | |

| 8,055 | | |

| 7,261 | |

| Costs of products | |

| 681 | | |

| 826 | | |

| 1,804 | | |

| 1,885 | |

| Costs of consulting | |

| 341 | | |

| 359 | | |

| 1,030 | | |

| 1,899 | |

| Total costs of revenues | |

| 4,145 | | |

| 4,085 | | |

| 10,889 | | |

| 11,045 | |

| Gross profit | |

| 2,866 | | |

| 3,180 | | |

| 7,515 | | |

| 7,707 | |

| Selling, general and administrative expenses | |

| 1,920 | | |

| 2,106 | | |

| 5,741 | | |

| 5,697 | |

| Income from operations | |

| 946 | | |

| 1,074 | | |

| 1,774 | | |

| 2,010 | |

| Other income/(expense): | |

| | | |

| | | |

| | | |

| | |

| Dividend income from Progressive Beef | |

| 50 | | |

| 50 | | |

| 150 | | |

| 150 | |

| Gain on sale of assets | |

| - | | |

| - | | |

| 5 | | |

| - | |

| Impairment of digital assets | |

| - | | |

| (42 | ) | |

| | | |

| (42 | ) |

| Loss on foreign currency exchange | |

| (2 | ) | |

| - | | |

| (6 | ) | |

| (35 | ) |

| Other income, net | |

| 16 | | |

| 1 | | |

| 36 | | |

| 2 | |

| Interest expense | |

| (1 | ) | |

| - | | |

| (3 | ) | |

| (2 | ) |

| Income before income taxes | |

| 1,009 | | |

| 1,083 | | |

| 1,956 | | |

| 2,083 | |

| Income tax expense | |

| 286 | | |

| 298 | | |

| 580 | | |

| 579 | |

| Net income | |

$ | 723 | | |

$ | 785 | | |

$ | 1,376 | | |

$ | 1,504 | |

| | |

| | | |

| | | |

| | | |

| | |

| Per share - net income: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.13 | | |

$ | 0.13 | | |

$ | 0.25 | | |

$ | 0.25 | |

| Diluted | |

$ | 0.13 | | |

$ | 0.13 | | |

$ | 0.24 | | |

$ | 0.25 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 5,599 | | |

| 5,936 | | |

| 5,605 | | |

| 6,019 | |

| Diluted | |

| 5,658 | | |

| 6,016 | | |

| 5,669 | | |

| 6,101 | |

Where

Food Comes From, Inc.

Calculation

of Adjusted EBITDA*

(Unaudited)

| | |

Three months ended September 30, | | |

Nine months ended September 30, | |

| (Amounts in thousands) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Net income | |

$ | 723 | | |

$ | 785 | | |

$ | 1,376 | | |

$ | 1,504 | |

| Adjustments to EBITDA: | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 1 | | |

| - | | |

| 3 | | |

| 2 | |

| Income tax expense | |

| 286 | | |

| 298 | | |

| 580 | | |

| 579 | |

| Depreciation and amortization | |

| 153 | | |

| 191 | | |

| 488 | | |

| 583 | |

| EBITDA* | |

| 1,163 | | |

| 1,274 | | |

| 2,447 | | |

| 2,668 | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation | |

| 6 | | |

| 19 | | |

| 38 | | |

| 102 | |

| Impairment of digital assets | |

| - | | |

| 42 | | |

| - | | |

| 42 | |

| Cost of acquisitions | |

| - | | |

| - | | |

| - | | |

| - | |

| ADJUSTED EBITDA* | |

$ | 1,169 | | |

$ | 1,335 | | |

$ | 2,485 | | |

$ | 2,812 | |

*Use

of Non-GAAP Financial Measures: Non-GAAP results are presented only as a supplement to the financial statements and for use within

management’s discussion and analysis based on U.S. generally accepted accounting principles (GAAP). The non-GAAP financial information

is provided to enhance the reader’s understanding of the Company’s financial performance, but non-GAAP measures should not be considered

in isolation or as a substitute for financial measures calculated in accordance with GAAP. Reconciliations of the most directly comparable

GAAP measures to non-GAAP measures are provided herein.

All

of the items included in the reconciliation from net income to EBITDA and from EBITDA to Adjusted EBITDA are either (i) non-cash items

(e.g., depreciation, amortization of purchased intangibles, stock-based compensation, etc.) or (ii) items that management does not consider

to be useful in assessing the Company’s ongoing operating performance (e.g., M&A costs, income taxes, gain on sale of investments,

loss on disposal of assets, etc.). In the case of the non-cash items, management believes that investors can better assess the Company’s

operating performance if the measures are presented without such items because, unlike cash expenses, these adjustments do not affect

the Company’s ability to generate free cash flow or invest in its business.

We

use, and we believe investors benefit from the presentation of, EBITDA and Adjusted EBITDA in evaluating our operating performance because

it provides us and our investors with an additional tool to compare our operating performance on a consistent basis by removing the impact

of certain items that management believes do not directly reflect our core operations. We believe that EBITDA is useful to investors

and other external users of our financial statements in evaluating our operating performance because EBITDA is widely used by investors

to measure a company’s operating performance without regard to items such as interest expense, taxes, and depreciation and amortization,

which can vary substantially from company to company depending upon accounting methods and book value of assets, capital structure and

the method by which assets were acquired.

Because

not all companies use identical calculations, the Company’s presentation of non-GAAP financial measures may not be comparable to other

similarly titled measures of other companies. However, these measures can still be useful in evaluating the Company’s performance against

its peer companies because management believes the measures provide users with valuable insight into key components of GAAP financial

disclosures.

Where

Food Comes From, Inc.

Balance

Sheets

| | |

September 30, | | |

December 31, | |

| (Amounts in thousands, except per share amounts) | |

2023 | | |

2022 | |

| Assets | |

| (Unaudited) | | |

| (Audited) | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,813 | | |

$ | 4,368 | |

| Accounts receivable, net of allowance | |

| 2,291 | | |

| 2,172 | |

| Inventory | |

| 1,120 | | |

| 888 | |

| Prepaid expenses and other current assets | |

| 495 | | |

| 463 | |

| Total current assets | |

| 7,719 | | |

| 7,891 | |

| Property and equipment, net | |

| 848 | | |

| 998 | |

| Right-of-use assets, net | |

| 2,379 | | |

| 2,607 | |

| Equity investments | |

| 1,191 | | |

| 991 | |

| Intangible and other assets, net | |

| 2,097 | | |

| 2,340 | |

| Goodwill, net | |

| 2,946 | | |

| 2,946 | |

| Deferred tax assets, net | |

| 508 | | |

| 523 | |

| Total assets | |

$ | 17,688 | | |

$ | 18,296 | |

| | |

| | | |

| | |

| Liabilities and Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 722 | | |

$ | 640 | |

| Accrued expenses and other current liabilities | |

| 1,345 | | |

| 769 | |

| Deferred revenue | |

| 1,713 | | |

| 1,278 | |

| Current portion of finance lease obligations | |

| 13 | | |

| 9 | |

| Current portion of operating lease obligations | |

| 310 | | |

| 341 | |

| Total current liabilities | |

| 4,103 | | |

| 3,037 | |

| Finance lease obligations, net of current portion | |

| 44 | | |

| 37 | |

| Operating lease obligation, net of current portion | |

| 2,522 | | |

| 2,745 | |

| Total liabilities | |

| 6,669 | | |

| 5,819 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Preferred stock, $0.001 par value; 5,000 shares authorized; none issued or outstanding | |

| - | | |

| - | |

| Common stock, $0.001 par value; 95,000 shares authorized; 6,511 (2023) and 6,501 (2022) shares issued, and 5,574 (2023) and 5,775 (2022) shares outstanding | |

| 6 | | |

| 6 | |

| Additional paid-in-capital | |

| 12,232 | | |

| 12,145 | |

| Treasury stock of 937 (2023) and 727 (2022) shares | |

| (10,184 | ) | |

| (7,263 | ) |

| Retained earnings | |

| 8,965 | | |

| 7,589 | |

| Total equity | |

| 11,019 | | |

| 12,477 | |

| Total liabilities and stockholders’ equity | |

$ | 17,688 | | |

$ | 18,296 | |

Exhibit

99.2

Where

Food Comes From, Inc.

2023

Third Quarter Conference Call

Call

date: Thursday November 9, 2023

Call

time: 10:00 a.m. Mountain Time

Jay

Pfeiffer – Investor Relations

Good

morning and welcome to the Where Food Comes From 2023 third quarter earnings call.

Joining

me on the call today are CEO John Saunders, President Leann Saunders, and Chief Financial Officer Dannette Henning.

During

this call we’ll make forward-looking statements based on current expectations, estimates and projections that are subject to risk.

Statements about current and future financial performance, growth strategy, customers, business opportunities, market acceptance of our

products and services, and potential acquisitions are forward looking statements. Listeners should not place undue reliance on these

statements as there are many factors that could cause actual results to differ materially from our forward-looking statements. We encourage

you to review our publicly filed documents as well as our news releases and website for more information. Today we’ll also discuss

Adjusted EBITDA, a non-GAAP financial measure provided as a complement to GAAP results. Please refer to today’s earnings release

for important disclosures regarding non-GAAP measures.

I’ll

now turn the call over to John Saunders.

John

Saunders

Good

morning and thanks for joining the call today.

As

highlighted in our third quarter earnings release this morning, our core verification and certification revenue increased for both the

third quarter and nine-month period despite continuing headwinds primarily associated with smaller herd sizes related to cyclical cattle

trends.

These

increases were offset by lower hardware revenue, which resulted in a decline in total revenue for both periods. You might remember that

on our last call in August, I mentioned that headwinds were likely to persist for a while, so slightly lower overall revenue in Q3 was

not a surprise.

Nevertheless,

we continued to generate a lot of cash and deliver solid profitability in the quarter and year-to-date period. We also returned $855,000

in value to stockholders in the form of stock buybacks in the quarter with year-to-date buybacks totaling nearly $3.0 million. So, in

the context of challenges we’ve been facing on multiple fronts in recent quarters, we’re pretty pleased with our overall

performance and, as evidenced by our continued stock buybacks, confident in our future prospects.

Getting

back to our verification and certification business, which is by far our largest revenue segment: We achieved 4% growth in the quarter

and 8% growth through the first nine months of 2023. Within this segment, beef verification is the largest single component of revenue.

As herd sizes have shrunk over the past year or so – due to a combination of drought impact and normal cattle cycles – our

tag sales have declined as well.

So,

as I said, the initial audit and tagging process is the first step in a revenue continuum that follows each animal along its path to

the consumer. So, again, in the current environment of smaller herd sizes, there are fewer animals in the pipeline, and that, along with

lower tag sales, is a big factor in why overall revenue was slightly lower year-to-date.

The

good news is, we are steadily adding more cattle rancher customers and our audit activity is at an all-time high. We have a customer

retention rate well over 90% that we believe is unmatched in our industry. In addition, because we now audit to dozens of standards,

our revenue from non-cattle verification sources is also on the rise. This is something I like to highlight from time to time because

the size and diversity of our services mix is what really sets us apart. We are unique in the depth and breadth of our service base,

and that gives us an enormous competitive advantage that would be extremely hard, if not impossible, to duplicate.

Now

for some more detail on our Q3 results…

Total

revenue in third quarter declined 4% to $7.0 million from $7.3 million in the same quarter last year for reasons I’ve already detailed.

As

previously noted, our flagship verification and certification revenue was up 4% in the quarter to $5.4 million from $5.2 million.

That

increase was offset by product revenue that declined by $367,000 to $1.2 million from $1.6 million. Consulting revenue was $76,000 lower

at $431,000.

Gross

profit in the third quarter decreased to $2.9 million from $3.2 million.

SG&A

expense was 9% lower year over year at $1.9 million vs. $2.1 million in the same quarter last year.

Net

income was $723,000, or $0.13 per diluted share, compared to net income of $785,000, or $0.13 per diluted share, in Q3 a year ago.

Adjusted

EBITDA in the third quarter was down slightly at $1.2 million from $1.3 million.

Turning

to nine-month results…

Total

revenue decreased 2% to $18.4 million from $18.8 million in the same period last year. In addition to the impact of smaller herd sizes

and lower tag sales, this decline included the effect of a $0.9 million one-time consulting contract we booked in the first quarter of

2022 that skewed our year-over-year comparisons.

Revenue

mix through nine months included:

| ● |

Verification and certification services, up 8% to $13.9 million

from $12.9 million. |

| ● |

Product revenue, down 10% to $3.1 million from $3.5 million. |

| ● |

Consulting revenue of $1.3 million compared to $2.4 million

in the prior year period when we booked the aforementioned, one-time contract. |

Gross

profit through nine months was $7.5 million versus $7.7 million in the year-ago period.

SG&A

expense was flat at $5.7 million.

Net

income through nine months was $1.4 million, or $0.24 per diluted share, compared to net income of $1.5 million, or $0.25 per diluted

share, in the same period last year. So, I’ll reiterate, we’re pleased with our overall profitability in light of some of

the headwinds we’ve been dealing with.

Adjusted

EBITDA through nine months was $2.5 million versus $2.8 million a year ago.

Our

cash and cash equivalents balance at September 30, 2023, declined to $3.8 million from $4.4 million at 2022 year-end due primarily to

our investment in share repurchases.

Further

to that subject, on a year-to-date basis, we bought back more than $2.9 million of stock as we reduced our diluted share count by 432,000

to under 5.7 million shares.

Now

I’d like to switch gears and provide an update on our Smart Catch program, which has been an important strategic focus for us this

year.

Last

week we announced the acquisition of the Smart Catch program with the intention of accelerating the rollout and expanding the scope of

the program. To recap, Smart Catch was originally a program of the James Beard Foundation designed to promote transparency and sustainability

in seafood at the restaurant level. Specifically, it is designed to link chefs to place-based seafood sustainability initiatives. Since

inception, the program has been administered by our Postelsia division, and going forward, Postelsia will take the lead in driving our

growth plan.

We

announced the acquisition a couple of weeks ago in conjunction with our sponsorship of the LA Chef Conference, where we hosted a Sustainability

Summit to discuss global sustainability trends. The news was well received by hundreds of chefs in attendance who, like other players

in the food business, are paying a lot of attention to sustainability in response to broad interest by food consumers at both the restaurant

and retail levels.

One

thing we heard over and over in our discussions with chefs and other culinary influencers was the concept of evolving from “consumers

to contributors.” In other words, there is a growing desire in the chef community to move beyond simply consuming food to

actively participating in practices that contribute to higher levels of sustainability.

We

see Smart Catch as being an important part of that process. It reinforces our mission of advocating for high food standards and facilitating

the accessibility of responsible seafood choices for chefs and diners alike. We also see tremendous potential for expansion into other

areas of the seafood supply chain, including food service institutions, retailers, seafood distributors, suppliers and producers around

the world.

Although

the current focus is on seafood, we, as well as the chef community, are interested in expanding the program to other products. So, overall,

the LA Chef Conference was a great kickoff for us in our new role, and with dozens of similar conferences around the world every year,

we see these types of events as excellent opportunities to market the program and grow our customer base.

So,

with that, I’ll thank you again for joining the call today and open the call to questions. Operator…

Question

and Answer Session:

Question

1: Raphi Savitz

Hey

John. I think a few calls back you had referenced potential regulations that could drive increased demand for your tags. Just wanted

to see where that stood and what sort of outlook is there?

John

Saunders

Thanks

Raphi for the question. There hasn’t been any significant movement other than the closure of a comment period the USDA put out

to the public for comment and those results I think are being compiled. We hope to see something early next year in regard to the results,

but they haven’t published anything yet.

Raphi

Savitz

Got

it. And then maybe big picture. You’ve been with this business and you’ve built this business for a number of years at this

point. I guess, as you look to the future what are you most excited about?

John

Saunders

Good

question and it goes back and forth between things that are requiring attention immediately. I will tell you over the last 12 months

what we’ve seen is an increased focus on sustainability. And I think where we’re seeing the most interest is what’s

called Level 3 supply chain and valuations related to sustainability. Most specifically, the carbon footprint. I think that’s taking

most of the headlines these days. So, we find ourselves right at the middle of that because we are the ones in charge of keeping track

where the food comes from. So, it’s a core component and it’s foundational to most of the other attributes, but specifically,

the carbon footprint of an animal has to start when that animal is born. So full traceability is a requirement of being able to manage

whatever offsets or insets are being associated with that supply chain. And we find ourselves in the middle of a number of different

pilot projects and programs that are under the USDA’s Climate-Smart program sheerly because we are the ones maintaining the traceability

of the product.

Raphi

Savitz

Got

it. And any real change in competitive dynamics within auditing all of your tags?

John

Saunders

Not

really to speak of. I do think I spoke on our last call about the struggles we’re dealing with in finding talent and just keeping

our auditor staff. We find that’s the number one limiting factor for us right now is just being able to identify qualified individuals

that are able to handle the audits that we’re looking for.

Raphi

Savitz

Got

it. And just one last one if I can. Happy to see that you’ve been buying back stock this year. How do you think about your kind

of capital allocation at this point?

John

Saunders

Yes.

As I mentioned many times, we are constantly looking for any type of M&A opportunity that does bode well with what we’re doing.

And the Smart Catch program was one of those opportunities so investing quite a bit there. In lieu of those opportunities, we’re

going to continue to look at our stock very, very aggressively and to continue to buy back in lieu of having other opportunities. But

we still are looking at those Raphi so don’t think we’ve moved on from that. It’s just allocating the resources when

we can and getting the best bang for our buck.

Operator

This

concludes today’s conference. You may disconnect your lines at this time. Thank you for your participation.

v3.23.3

Cover

|

Nov. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity File Number |

001-40314

|

| Entity Registrant Name |

WHERE

FOOD COMES FROM, INC.

|

| Entity Central Index Key |

0001360565

|

| Entity Tax Identification Number |

43-1802805

|

| Entity Incorporation, State or Country Code |

CO

|

| Entity Address, Address Line One |

202

6th Street

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Castle

Rock

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80104

|

| City Area Code |

(303)

|

| Local Phone Number |

895-3002

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value

|

| Trading Symbol |

WFCF

|

| Security Exchange Name |

NASDAQ

|

| Entity Information, Former Legal or Registered Name |

Not

applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

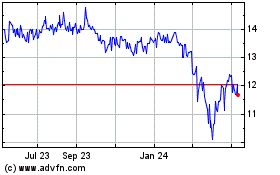

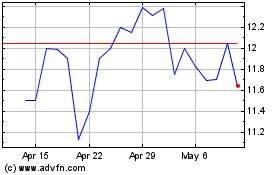

Where Food Comes From (NASDAQ:WFCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Where Food Comes From (NASDAQ:WFCF)

Historical Stock Chart

From Apr 2023 to Apr 2024