In the pre-market on Monday, U.S. index futures are showing a

downward trend. Investors are currently assessing the impact of the

recent change in the U.S. rating outlook. Additionally, there is

growing anticipation for the inflation data, set to be announced

tomorrow, which is influencing market decisions.

At 05:55 AM, Dow Jones futures (DOWI:DJI) fell 4 points, or

0.01%. S&P 500 futures fell 0.18% and Nasdaq-100 futures fell

0.23%. The yield on 10-year Treasury notes was at 4.63%.

In the commodities market, West Texas Intermediate crude oil for

December rose 0.08%, to $77.23 per barrel. Brent oil for January

rose 0.06% to around $81.48 per barrel. Iron ore with a 62%

concentration, traded on the Dalian exchange, rose 1.68%, priced at

$132.42 per ton.

On the economic agenda this Monday, investors await, at 08:50

AM, a speech by Fed Director Lisa Cook, while at 11:00 AM, the

monthly inflation expectation for October will be released.

Finally, last month’s budget balance will be announced at 14:00 PM,

with the consensus predicting a deficit of $30 billion.

Asian markets recorded gains, influenced by Japan’s economy,

especially after producer prices in October fell short of

expectations.

Meanwhile, in Europe, stock markets are showing positive

performance at the start of trading, reflecting recent statements

by Luis de Guindos, Vice President of the European Central Bank

(ECB). Guindos mentioned that despite inflation in the eurozone

gaining temporary momentum in the coming months due to the

calculation method used, economic growth in the region is expected

to remain moderate in the short term.

Even with a reduction in Treasuries at the beginning of the

week, U.S. markets may not benefit from it. This is due to Moody’s

action, which on Friday changed the U.S. AAA rating outlook from

stable to negative, citing concerns about the high fiscal deficit.

Concurrently, U.S. inflation and the meeting scheduled between Joe

Biden and Xi Jinping on Wednesday are also in investors’ focus.

This meeting between the two largest global powers aims to address

divergences, including their stances on wars and export control

policies.

At the close on Friday, the S&P 500 rose above 4,400 points

due to the performance of large technology companies. The Dow Jones

advanced 391.16 points, or 1.15%. The S&P 500 rose 67.89

points, or 1.56%. The Nasdaq surged 276.66 points, or 2.05%. Future

interest rates stabilized, with the yield on U.S. 10-year bonds

below 4.7%. FOMC members adopted a more cautious tone on interest

rate hikes. The U.S. consumer confidence index for November was

below expectations (60.4 vs. 63.7). Inflation expectations

increased (4.4% for next year, 3.2% for 5-10 years).

In Monday’s corporate earnings forefront, investors will be

attentive to reports from Monday.com

(NASDAQ:MNDY), Tyson Foods (NYSE:TSN),

Tower Semiconductor (NASDAQ:TSEM),

Intuitive Machines (NASDAQ:LUNR) before the market

opens. After the close, reports from Fisker

(NYSE:FSR), Rumble (NASDAQ:RUM),

Li-Cycle (NYSE:LICY), Terawulf

Inc (NASDAQ:WULF), Sper Therapeutics

(NASDAQ:SPRO), among others, are expected.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – Chinese smartphone maker

Xiaomi gained market value and success with its series 14, while

Apple‘s sales fell in China. Xiaomi is exploring

the electric vehicle sector and other business areas, with positive

growth prospects.

Alphabet (NASDAQ:GOOGL) – Alphabet’s Google is

in talks to invest hundreds of millions of dollars in Character.AI,

a growing AI chatbot startup. The investment would deepen the

existing partnership, and the company is also seeking venture

capital funding, potentially valuing it at over $5 billion.

Meta Platforms (NASDAQ:META),

Snap (NYSE:SNAP) – Meta

Platforms, owner of Facebook, and Snap

have been given until December 1st by the European Union to provide

more information on how they protect children from illegal and

harmful content, under threat of investigation and fines under new

EU online content rules.

Nvidia (NASDAQ:NVDA) – U.S. restrictions on

China have resulted in a “catch me if you can” game with

Nvidia and other companies, accelerating Chinese

innovation. The Global Times stated that this harms both countries

and forces the search for solutions to comply with regulations,

driving innovation in China.

Disney (NYSE:DIS) – The latest Marvel movie,

“The Marvels,” had a disappointing opening weekend, earning just

$47 million in the U.S., well below expectations. The actors’

strike and the evolution of public tastes were cited as possible

reasons for the weak performance. Disney postponed

other Marvel films and plans to cut production costs.

Booking.com (NASDAQ:BKNG) –

Booking.com agreed to pay about $100.25 million to

settle a tax dispute in Italy, related to VAT evasion on holiday

rentals from 2013 to 2019.

Airbnb (NASDAQ:ABNB) – This week, the European

Union and the European Parliament are expected to agree on lenient

rules for Airbnb. Some disagree with the Spanish

proposal to allow cities to ban Airbnb in certain

areas. Airbnb sees the EU rules as a milestone for

short-term rental companies and wishes to collaborate with cities

and governments to support sustainable tourism and protect housing.

This contrasts with the EU’s strict approach towards Big Techs.

Airbnb must provide data and face penalties for

non-compliance.

Livent (NYSE:LTHM) – U.S. lithium company

Livent will start meetings with Australian

investors of Allkem before a vote to approve a $10.6 billion merger

that would create the world’s third-largest producer.

Exxon Mobil (NYSE:XOM) – Exxon

Mobil plans to start lithium production for electric

vehicle batteries in Arkansas by 2026, partnering with Tetra

Technologies, seeking to expand its presence in the EV sector. The

company also controls areas for future lithium production in

Arkansas.

BP (NYSE:BP), Shell

(NYSE:SHEL), Edison (NYSE:ED) –

BP, Edison, and

Shell have asked the EU-U.S. to intervene in a

dispute with Venture Global LNG due to non-compliance with gas

supply contracts. The companies seek to pressure Venture Global LNG

to honor the signed contracts.

DR Horton (NYSE:DHI) – Homebuilder DR

Horton exceeded profit and revenue expectations, despite

concerns in the real estate sector. Its shares have risen 37.6%

this year. The lack of existing homes has boosted demand for new

homes, especially among first-time buyers. Horton reduced mortgage

rates and introduced lower-cost plans.

Moody’s (NYSE:MCO) – Moody’s

downgraded the U.S. credit rating outlook to “negative” due to

large fiscal deficits and declining debt affordability. This has

drawn criticism from the Biden administration and pressured

Congressional Republicans to move forward with funding legislation

to avoid a partial government shutdown.

Mizuho Financial Group (NYSE:MFG) –

Mizuho Financial Group raised its annual profit

forecast following solid first-half results, driven by gains in

investment banking and trading, as well as a cheaper yen.

Mizuho now forecasts a net profit of $4.2 billion

for the fiscal year, the highest in eight years. The CEO cited

overseas business and the acquisition of Greenhill as profit

drivers. On the other hand, a potential yen strengthening in the

second half poses a downside risk.

Berkshire Hathaway (NYSE:BRK.A) – Billionaire

investor Warren Buffett reportedly traded stocks in his personal

account at the same time his company Berkshire

Hathaway bought and sold the same stocks, according to a

ProPublica report. Based on leaked IRS data, the report alleges

that Buffett and Berkshire traded stocks,

including Walmart (NYSE:WMT), Wells

Fargo (NYSE:WFC), and Johnson &

Johnson (NYSE:JNJ) in 2009 and 2012. Buffett denied any

conflict of interest, stating he tries to avoid such situations.

Representatives from Berkshire Hathaway did not

immediately comment on the report.

BNY Mellon (NYSE:BK) – The Industrial and

Commercial Bank of China’s access to a U.S. Treasury securities

electronic settlement platform remains suspended following a

ransomware attack. BNY Mellon, the settlement

agent, disconnected the Chinese bank and awaits a third-party

assessment for reconnection. The ICBC confirmed the attack and is

investigating, while making progress in recovering its systems.

Citigroup (NYSE:C) – Citigroup

resumed the sale process of Bank Handlowy’s retail business in

Poland, said the CEO of Bank Handlowy, Elzbieta Czetwertynska, on

Friday, adding that talks with interested investors may begin in

the coming months.

Morgan Stanley (NYSE:MS) – Morgan

Stanley predicts the S&P 500 (SPI:SP500) will end 2024

at 4,500 points, representing a 2% increase from current levels,

with a recovery in profits and prospects for revenue growth and

margins. They foresee short-term challenges followed by a solid

recovery in 2025.

Goldman Sachs (NYSE:GS) – Investors are overly

concerned with the weakened outlook for U.S. corporate earnings,

which so far only follow a historical pattern, according to

strategists at Goldman Sachs. Estimates for

fourth-quarter earnings have fallen 4% since early October and are

setting a low bar for S&P 500 companies. Expectations for 2024

are also following a typical pattern, falling only 0.4% excluding

the health sector.

StoneCo (NASDAQ:STNE) –

StoneCo‘s shares rose 6.9% in Monday’s pre-market

due to growth in profits and revenues in the third quarter. The

Brazilian financial services company reported a profit of R$ 411.3

million, up from R$ 197.1 million the previous year. Revenue

increased 25%, reaching R$ 3.14 billion, driven by higher revenues

from the financial services platform.

Southwest Airlines (NYSE:LUV),

Boeing (NYSE:BA) – Southwest

Airlines expects FAA certification of the

Boeing 737 MAX 7 by April 2024, allowing flights

in October or November. Southwest is the largest customer of this

model. However, they converted some MAX 7 orders to the larger MAX

8 variant due to certification delays. Boeing expects MAX 7

certification by the end of this year.

Boeing (NYSE:BA) – Boeing is

up on Monday due to reports that the freeze on sales in China may

soon be lifted, with the Chinese government considering purchasing

Boeing 737 jets during the meeting between Biden and Xi Jinping.

Additionally, Germany’s SunExpress will buy up to 90 737 MAX jets,

and Emirates will order 90 777X jets. Boeing’s shares rose 3.75% in

pre-market, reaching $204.00. In other news, internal Boeing data

were leaked online on Friday by the Lockbit cybercrime group.

Boeing confirmed the incident and is investigating. Lockbit is

known for ransomware attacks on various organizations in the U.S.

and worldwide.

General Motors (NYSE:GM) – Members of the

United Auto Workers (UAW) union at the GM plant in Flint, Michigan,

voted against a proposed contract with the automaker, indicating

that the approval of the deal, which would significantly increase

GM’s costs, is not guaranteed. Other GM plants will vote on the

agreement in the coming weeks. The UAW’s agreement with GM grants a

25% increase in base salary by April 2028 and will raise the

maximum wage by 33%, reaching over $42 per hour.

Ford Motor (NYSE:F) – United Auto Workers (UAW)

production workers at Ford plants in Louisville and Kentucky

rejected a 4.5-year contract, while skilled workers supported it.

UAW Local 862 did not disclose the overall percentage of votes in

favor or the total number of votes.

Honda Motor (NYSE:HMC) – Honda announced an 11%

wage increase for production workers at its U.S. facilities,

following agreements between the UAW union and automakers. Honda

will also reduce the time to reach the maximum wage, in line with

concessions obtained by the UAW from other automakers.

Novo Nordisk (NYSE:NVO) – Novo Nordisk revealed

that the cardiac benefits of its obesity treatment, Wegovy, are not

limited to weight loss. The study suggests that other factors, such

as control of inflammation and glucose, contribute to

cardiovascular protection. The drug’s label may be updated to

include these benefits.

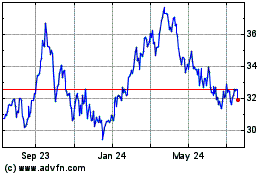

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

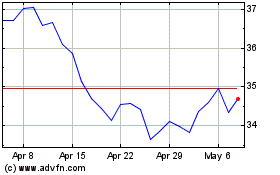

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024