false

0000045919

0000045919

2023-11-09

2023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________________________

FORM 8-K

___________________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

November 9, 2023

Date of Report (Date of Earliest Event Reported)

___________________________________________________

Harte Hanks, Inc.

(Exact Name of Registrant as Specified in its Charter)

___________________________________________________

|

Delaware

|

1-7120

|

74-1677284

|

| |

|

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

| |

|

|

|

1 Executive Drive, Suite 303

Chelmsford, MA 01824

(512) 434-1100

|

|

(Address of principal executive offices and Registrant’s telephone number, including area code)

|

___________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

HHS

|

NASDAQ

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 9th, 2023, Harte Hanks issued a press release announcing its financial results for the third quarter ended September 30, 2023. The full text of the press release is furnished with this Current Report as Exhibit 99.1 and is incorporated by reference herein.

The information contained in this Item 2.02 (including Exhibit 99.1) of this Current Report is furnished pursuant to this Item 2.02 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, notwithstanding any general incorporation by reference language in other Harte Hanks filings.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No

|

Description

|

| |

|

|

99.1

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

HARTE HANKS, INC.

|

|

| |

|

|

|

| |

|

|

|

|

Date: November 9th, 2023

|

By:

|

/s/ David Garrison

|

|

| |

|

Name: David Garrison

Title: Interim Chief Financial Officer

|

|

Exhibit 99.1

Harte Hanks Reports Fiscal 2023 Third Quarter Results

Announces “Elevate,” Transformative Plan

To Improve Revenue Growth and Profitability

Chelmsford, Massachusetts – November 9, 2023 - Harte Hanks, Inc. (NASDAQ: HHS), a leading global customer experience company focused on bringing companies closer to customers for 100 years, today announced financial results for the third quarter and nine-month periods ended September 30, 2023.

Kirk Davis, Chief Executive officer, said: “In reporting my first quarter since joining Harte Hanks in June, I undertook this role against a backdrop of uncertainty. In May, prior management reported reduced visibility and projected challenging year-over-year comparisons attributable to macroeconomic headwinds, customer weakness in the financial services and technology sectors, and substantial non-recurring revenue attributable to pandemic-related projects. The revised outlook came with a commitment to preserve profitability, and a reorganization was announced. While our revenue performance and comparisons reflect prior management's assessment, we maintain a strong balance sheet and cash position, no debt, a $25 million credit facility, and considerable potential as we plan for our 101st year of continuous service.”

“I’ve gained a deep understanding of our company’s position, capabilities, culture, and customers,”

continued Mr. Davis. “We excel in customer service, but we need a sales and marketing strategy and infrastructure capable of delivering consistent organic growth. What excites me is that there's a company-defining opportunity here. Improved sales execution and more effective marketing can meaningfully leverage our strengths and deliver tangible results."

“We’ve shared with our employees a transformative plan, Elevate, which launched in early October and includes a collaboration with the Kearney organization,” added Mr. Davis. “Kearney is a highly respected global consulting firm, and I’ve enjoyed great success working with the professionals at Kearney previously. Elevate is a sweeping endeavor aimed at materially improving our efficiency, revenue generation, profitability and employee experience. We are reengineering and expanding our sales and marketing organization, while planning to achieve a net cost reduction that improves our profitability. We're focused on creating a foundation for sustainable growth. It's our employees that will make it happen and we're equally focused on the experience we provide them."

"As we look to the future, we are focused on transforming our revenue operations under new sales leadership," continued Mr. Davis. “We recently announced two key appointments. Kelly Waller, Corporate Senior Vice President of Sales and Marketing, is an outstanding sales leader with specific expertise in global marketing, demand generation and client retention, all important areas for Harte Hanks. Ron Lee, Senior Vice President of Inside Sales, is a highly accomplished inside sales executive, with a track record of success. We have immediately focused on scaling our inside sales division, pursuing strategic partnerships and plans to expand our international sales coverage. We’re confident Kelly and Ron will revitalize our sales and marketing divisions, accelerate our pipeline development and drive improved performance.”

Third Quarter Financial Highlights

| |

●

|

Total revenues for Q3 2023 were $47.1 million, down 12.6% year over year compared to $53.9 million in Q3 2022. Included in 2023 was $2.2 million from InsideOut acquired in fourth quarter of 2022. Total Q3 revenues were essentially flat sequentially.

|

| |

●

|

Operating income was $2.9 million compared to $3.8 million in the prior-year quarter.

|

| |

●

|

Net income of $0.6 million, or $0.09 per basic and $0.08 per diluted share, compared to net income of $7.2 million, or $0.87 per basic and $0.83 per diluted share, in the prior year quarter. The third quarter of 2022 included $2.5 million in other income related to the sale of unused IP addresses.

|

| |

●

|

EBITDA was $3.9 million compared to $4.4 million in the same period in the prior year. Adjusted EBITDA, which excludes stock-based compensation and severance, was $4.2 million compared to $5.4 million.

|

Segment Highlights

| |

●

|

Customer Care, $14.0 million in revenue, 30% of total – Segment revenue decreased $3.4 million (19.4%) versus prior year and EBITDA totaled $2.0 million for the quarter, down 33.0% year-over-year. The InsideOut acquisition added $2.2 million to revenue in the quarter. The decrease in revenue is related to the early completion of larger promotional campaigns and programs. Management remains positive about the InsideOut acquisition.

|

| |

●

|

Fulfillment & Logistics Services, $22.5 million in revenue, 48% of total – Segment revenue decreased $965 thousand (4.1%) versus the prior year quarter and EBITDA totaled $2.9 million, up 2.8%. Revenue mix and a 4.4% decrease in operating expenses drove the improved EBITDA margins. The margin percentage continues to be impacted by variation in the revenue mix between lower margin logistics and the higher margin fulfillment services.

|

| |

●

|

Marketing Services, $10.6 million in revenue, 22% of total – Segment revenue declined $2.4 million (18.6%) compared to the prior year quarter and EBITDA for the quarter totaled $1.5 million vs. $1.9 million. Pressure on revenue was attributable to reduced project work in the financial services sector. We continue to see new project starts in pharmaceutical and retail businesses as we approach the holiday season.

|

Consolidated Third Quarter 2023 Results

Third quarter revenues were $47.1 million, down 12.6% from $53.9 million in the third quarter of 2022 due to decreased revenue in each of the Company’s operating segments.

Third quarter operating income was $2.9 million, compared to $3.8 million in the third quarter of 2022. The decrease resulted from a less favorable revenue mix and lower consolidated revenue.

Net income for the quarter was $0.6 million, or $0.09 per basic and $0.08 per diluted share, compared to net income of $7.2 million, or $0.87 per basic and $0.83 per diluted share, in the third quarter last year. Results this quarter included $848 thousand of pension expense, as well as $160 thousand in stock-based compensation. The prior-year third quarter included $511 thousand of pension expense, as well as $927 thousand in stock-based compensation, as well as $2.5 million in other income related to the sale of unused IP addresses.

Consolidated Year-to-Date 2023 Results

Year-to-date revenues were $142.0 million, down 6.3% from $151.5 million in the same period of 2022. Year-to-date operating income was $5.6 million, compared to operating income of $11.7 million. Net income for the first nine months was $407 thousand, or $0.06 per basic and $0.05 per diluted share, compared to net income of $15.0 million, or $1.81 per basic and $1.73 per diluted share, in the first nine months of last year.

Balance Sheet and Liquidity

Harte Hanks ended the quarter with $13.3 million in cash and cash equivalents and $24.2 million of capacity on its credit line. The Company has no outstanding debt as of September 30, 2023. The Company’s financial position continues to be strong, and it is well-positioned to execute on its long-term growth strategies in 2023 and beyond.

During the quarter, Harte Hanks repurchased 77,227 shares at an average price of $6.35 per share for a total of $490 thousand.

Conference Call Information

The Company will host a conference call and live webcast to discuss these results on Thursday, November 9, 2023 at 4:30 p.m. EST. Interested parties may access the webcast at https://bit.ly/402QcsG or may access the conference call by dialing 877-545-0320 in the United States or 973-528-0002 from outside the U.S. and using access code 163449.

A replay of the call can also be accessed via phone through November 23, 2023 by dialing (877) 481-4010 from the U.S., or (919) 882-2331 from outside the U.S. The conference call replay passcode is 49341.

About Harte Hanks:

Harte Hanks (NASDAQ: HHS) is a leading global customer experience company whose mission is to partner with clients to provide them with CX strategy, data-driven analytics and actionable insights combined with seamless program execution to better understand, attract and engage their customers.

Using its unparalleled resources and award-winning talent in the areas of Customer Care, Fulfillment and Logistics, and Marketing Services, Harte Hanks has a proven track record of driving results for some of the world’s premier brands, including Bank of America, GlaxoSmithKline, Unilever, Pfizer, HBOMax, Volvo, Ford, FedEx, Midea, Sony and IBM among others. Headquartered in Chelmsford, Massachusetts, Harte Hanks has over 2,500 employees in offices across the Americas, Europe, and Asia Pacific.

For more information, visit hartehanks.com

As used herein, “Harte Hanks” or “the Company” refers to Harte Hanks, Inc. and/or its applicable operating subsidiaries, as the context may require. Harte Hanks’ logo and name are trademarks of Harte Hanks, Inc.

Cautionary Note Regarding Forward-Looking Statements:

Our press release and related earnings conference call contain “forward-looking statements” within the meaning of U.S. federal securities laws. All such statements are qualified by this cautionary note, provided pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements other than historical facts are forward-looking and may be identified by words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “seeks,” “could,” “intends,” or words of similar meaning. These forward-looking statements are based on current information, expectations and estimates and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to vary materially from what is expressed in or indicated by the forward-looking statements. In that event, our business, financial condition, results of operations or liquidity could be materially adversely affected and investors in our securities could lose part or all of their investments. These risks, uncertainties, assumptions and other factors include: (a) local, national and international economic and business conditions, including (i) the outbreak of diseases, such as the COVID-19 coronavirus, which has curtailed travel to and from certain countries and geographic regions, created supply chain disruption and shortages, disrupted business operations and reduced consumer spending, (ii) market conditions that may adversely impact marketing expenditures, (iii) the impact of the Russia/Ukraine conflict on the global economy and our business, including impacts from related sanctions and export controls and (iv) the impact of economic environments and competitive pressures on the financial condition, marketing expenditures and activities of our clients and prospects; (b) the demand for our products and services by clients and prospective clients, including (i) the willingness of existing clients to maintain or increase their spending on products and services that are or remain profitable for us, and (ii) our ability to predict changes in client needs and preferences; (c) economic and other business factors that impact the industry verticals we serve, including competition and consolidation of current and prospective clients, vendors and partners in these verticals; (d) our ability to manage and timely adjust our facilities, capacity, workforce and cost structure to effectively serve our clients; (e) our ability to improve our processes and to provide new products and services in a timely and cost-effective manner though development, license, partnership or acquisition; (f) our ability to protect our facilities against security breaches and other interruptions and to protect sensitive personal information of our clients and their customers; (g) our ability to respond to increasing concern, regulation and legal action over consumer privacy issues, including changing requirements for collection, processing and use of information; (h) the impact of privacy and other regulations, including restrictions on unsolicited marketing communications and other consumer protection laws; (i) fluctuations in fuel prices, paper prices, postal rates and postal delivery schedules; (j) the number of shares, if any, that we may repurchase in connection with our repurchase program; (k) unanticipated developments regarding litigation or other contingent liabilities; (l) our ability to complete anticipated divestitures and reorganizations, including cost-saving initiatives; (m) our ability to realize the expected tax refunds; and (n) other factors discussed from time to time in our filings with the Securities and Exchange Commission, including under “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 which was filed on March 31, 2023. The forward-looking statements in this press release and our related earnings conference call are made only as of the date hereof, and we undertake no obligation to update publicly any forward-looking statement, even if new information becomes available or other events occur in the future.

Supplemental Non-GAAP Financial Measures:

The Company reports its financial results in accordance with generally accepted accounting principles (“GAAP”). However, the Company may use certain non-GAAP measures of financial performance in order to provide investors with a better understanding of operating results and underlying trends to assess the Company’s performance and liquidity in this press release and our related earnings conference call. We have presented herein a reconciliation of these measures to the most directly comparable GAAP financial measure.

The Company presents the non-GAAP financial measure “Adjusted Operating Income” as a useful measure to both management and investors in their analysis of the Company’s financial results because it facilitates a period-to-period comparison of Operating Income excluding stock-based compensation and severance. The most directly comparable measure for this non-GAAP financial measure is Operating Income.

The Company presents the non-GAAP financial measure “EBITDA” as a supplemental measure of operating performance in order to provide an improved understanding of underlying performance trends. The Company defines “EBITDA” as Net Income adjusted to exclude income tax expense, other expense (income), net, and depreciation and amortization expense. The Company defines “Adjusted EBITDA” as EBITDA adjusted to exclude stock-based compensation and severance. The most directly comparable measure for EBITDA and Adjusted EBITDA is Net Income. We believe EBITDA and Adjusted EBITDA are an important performance metric because it facilitates the analysis of our results, exclusive of certain non-cash items, including items which do not directly correlate to our business operations; however, we urge investors to review the reconciliation of non-GAAP EBITDA to the comparable GAAP Net Income, which is included in this press release, and not to rely on any single financial measure to evaluate the Company’s financial performance.

The use of non-GAAP measures do not serve as a substitute and should not be construed as a substitute for GAAP performance but should provide supplemental information concerning our performance that our investors and we find useful. The Company evaluates its operating performance based on several measures, including these non-GAAP financial measures. The Company believes that the presentation of these non-GAAP financial measures in this press release and earnings conference call presentations are useful supplemental financial measures of operating performance for investors because they facilitate investors’ ability to evaluate the operational strength of the Company’s business. However, there are limitations to the use of these non-GAAP measures, including that they may not be calculated the same by other companies in our industry limiting their use as a tool to compare results. Any supplemental non-GAAP financial measures referred to herein are not calculated in accordance with GAAP and they should not be considered in isolation or as substitutes for the most comparable GAAP financial measures.

1EBITDA is a non-GAAP financial measure. See “Supplemental Non-GAAP Financial Measures” below. EBITDA is also the Company’s measure of segment profitability.

Investor Relations Contact:

Rob Fink or Tom Baumann

646.809.4048 / 646.349.6641

FNK IR

HHS@fnkir.com

Source: Harte Hanks, Inc.

Harte Hanks, Inc.

Consolidated Statements of Operations (Unaudited)

| |

|

Three Months Ended

September 30,

|

|

|

Nine Months Ended

September 30,

|

|

|

In thousands, except per share data

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Revenues

|

|

$ |

47,119 |

|

|

$ |

53,886 |

|

|

$ |

142,001 |

|

|

$ |

151,500 |

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Labor

|

|

|

22,953 |

|

|

|

27,389 |

|

|

|

74,084 |

|

|

|

78,416 |

|

|

Production and distribution

|

|

|

15,378 |

|

|

|

16,175 |

|

|

|

43,158 |

|

|

|

42,400 |

|

|

Advertising, selling, general and administrative

|

|

|

4,922 |

|

|

|

5,970 |

|

|

|

16,071 |

|

|

|

17,243 |

|

|

Depreciation and amortization expense

|

|

|

952 |

|

|

|

579 |

|

|

|

3,051 |

|

|

|

1,763 |

|

|

Total operating expenses

|

|

|

44,205 |

|

|

|

50,113 |

|

|

|

136,364 |

|

|

|

139,822 |

|

|

Operating income

|

|

|

2,914 |

|

|

|

3,773 |

|

|

|

5,637 |

|

|

|

11,678 |

|

|

Other expense (income), net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense (income), net

|

|

|

1 |

|

|

|

84 |

|

|

|

(150 |

) |

|

|

313 |

|

|

Pension expense

|

|

|

848 |

|

|

|

511 |

|

|

|

2,545 |

|

|

|

1,533 |

|

|

Foreign currency gain

|

|

|

(331 |

) |

|

|

(2,790 |

) |

|

|

(26 |

) |

|

|

(5,582 |

) |

|

Other (income) expense, net

|

|

|

(134 |

) |

|

|

(2,417 |

) |

|

|

1,241 |

|

|

|

(1,902 |

) |

|

Total other expense (income), net

|

|

|

384 |

|

|

|

(4,612 |

) |

|

|

3,610 |

|

|

|

(5,638 |

) |

|

Income before income taxes

|

|

|

2,530 |

|

|

|

8,385 |

|

|

|

2,027 |

|

|

|

17,316 |

|

|

Income tax expense

|

|

|

1,912 |

|

|

|

1,219 |

|

|

|

1,620 |

|

|

|

2,344 |

|

|

Net income

|

|

|

618 |

|

|

|

7,166 |

|

|

|

407 |

|

|

|

14,972 |

|

|

Less: Preferred stock dividends

|

|

|

- |

|

|

|

125 |

|

|

|

- |

|

|

|

371 |

|

|

Less: Earnings attributable to participating securities.

|

|

|

- |

|

|

|

868 |

|

|

|

- |

|

|

|

1,817 |

|

|

Income attributable to common stockholders

|

|

$ |

618 |

|

|

$ |

6,173 |

|

|

$ |

407 |

|

|

$ |

12,784 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earning per common share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.09 |

|

|

$ |

0.87 |

|

|

$ |

0.06 |

|

|

$ |

1.81 |

|

|

Diluted

|

|

$ |

0.08 |

|

|

$ |

0.83 |

|

|

$ |

0.05 |

|

|

$ |

1.73 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

7,239 |

|

|

|

7,125 |

|

|

|

7,340 |

|

|

|

7,045 |

|

|

Diluted

|

|

|

7,314 |

|

|

|

7,524 |

|

|

|

7,509 |

|

|

|

7,418 |

|

Harte Hanks, Inc.

Condensed Consolidated Balance Sheets (Unaudited)

|

In thousands, except per share data

|

|

September 30, 2023

|

|

|

December 31, 2022

|

|

| |

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

13,288 |

|

|

$ |

10,364 |

|

|

Accounts receivable (less allowance for doubtful accounts of $170 and $163, respectively)

|

|

|

33,303 |

|

|

|

39,700 |

|

|

Unbilled accounts receivable

|

|

|

10,350 |

|

|

|

7,893 |

|

|

Contract assets

|

|

|

433 |

|

|

|

309 |

|

|

Prepaid expenses

|

|

|

2,722 |

|

|

|

2,176 |

|

|

Prepaid income tax and income tax receivable

|

|

|

1,221 |

|

|

|

4,262 |

|

|

Other current assets

|

|

|

878 |

|

|

|

1,607 |

|

|

Total current assets

|

|

|

62,195 |

|

|

|

66,311 |

|

| |

|

|

|

|

|

|

|

|

|

Net property, plant and equipment

|

|

|

9,279 |

|

|

|

10,523 |

|

|

Right-of-use assets

|

|

|

16,773 |

|

|

|

19,169 |

|

|

Other assets

|

|

|

22,565 |

|

|

|

23,981 |

|

|

Total assets

|

|

$ |

110,812 |

|

|

$ |

119,984 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$ |

18,547 |

|

|

$ |

22,465 |

|

|

Accrued payroll and related expenses

|

|

|

4,944 |

|

|

|

6,679 |

|

|

Deferred revenue and customer advances

|

|

|

5,681 |

|

|

|

4,590 |

|

|

Customer postage and program deposits

|

|

|

1,445 |

|

|

|

1,223 |

|

|

Other current liabilities

|

|

|

2,652 |

|

|

|

2,862 |

|

|

Short-term lease liabilities

|

|

|

5,446 |

|

|

|

5,747 |

|

|

Total current liabilities

|

|

|

38,715 |

|

|

|

43,566 |

|

| |

|

|

|

|

|

|

|

|

|

Pensions liabilities - Qualified plans

|

|

|

17,388 |

|

|

|

18,674 |

|

|

Pension liabilities - Nonqualified plan

|

|

|

18,510 |

|

|

|

19,098 |

|

|

Long-term lease liabilities, net of current portion

|

|

|

13,553 |

|

|

|

16,575 |

|

|

Other long-term liabilities

|

|

|

2,142 |

|

|

|

3,263 |

|

|

Total liabilities

|

|

|

90,308 |

|

|

|

101,176 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

12,221 |

|

|

|

12,221 |

|

|

Additional paid-in capital

|

|

|

160,213 |

|

|

|

218,411 |

|

|

Retained earnings

|

|

|

846,897 |

|

|

|

846,490 |

|

|

Less treasury stock

|

|

|

(953,591 |

) |

|

|

(1,010,012 |

) |

|

Accumulated other comprehensive loss

|

|

|

(45,236 |

) |

|

|

(48,302 |

) |

|

Total stockholders’ equity

|

|

|

20,504 |

|

|

|

18,808 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity

|

|

$ |

110,812 |

|

|

$ |

119,984 |

|

Harte Hanks, Inc.

Reconciliations of Non-GAAP Financial Measures (Unaudited)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

|

In thousands, except per share data

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net Income

|

|

$ |

618 |

|

|

$ |

7,166 |

|

|

|

407 |

|

|

$ |

14,972 |

|

|

Income tax expense

|

|

|

1,912 |

|

|

|

1,219 |

|

|

|

1,620 |

|

|

|

2,344 |

|

|

Other expense (income), net

|

|

|

384 |

|

|

|

(4,612 |

) |

|

|

3,610 |

|

|

|

(5,638 |

) |

|

Depreciation and amortization expense

|

|

|

952 |

|

|

|

579 |

|

|

|

3,051 |

|

|

|

1,763 |

|

|

EBITDA

|

|

$ |

3,866 |

|

|

$ |

4,352 |

|

|

$ |

8,688 |

|

|

$ |

13,441 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation

|

|

|

160 |

|

|

|

927 |

|

|

|

1,203 |

|

|

|

1,776 |

|

|

Severance

|

|

|

166 |

|

|

|

123 |

|

|

|

1,376 |

|

|

|

201 |

|

|

Adjusted EBITDA

|

|

$ |

4,192 |

|

|

$ |

5,402 |

|

|

$ |

11,267 |

|

|

$ |

15,418 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

$ |

2,914 |

|

|

$ |

3,773 |

|

|

$ |

5,637 |

|

|

$ |

11,678 |

|

|

Stock-based compensation

|

|

|

160 |

|

|

|

927 |

|

|

|

1,203 |

|

|

|

1,776 |

|

|

Severance

|

|

|

166 |

|

|

|

123 |

|

|

|

1,376 |

|

|

|

201 |

|

|

Adjusted operating income

|

|

$ |

3,240 |

|

|

$ |

4,823 |

|

|

$ |

8,216 |

|

|

$ |

13,655 |

|

|

Adjusted operating margin (a)

|

|

|

6.9 |

% |

|

|

9.0 |

% |

|

|

5.8 |

% |

|

|

9.0 |

% |

|

(a) Adjusted Operating Margin equals Adjusted Operating Income divided by Revenues.

|

Harte Hanks, Inc.

Statement of Operations by Segments (Unaudited)

|

Quarter ended September 30, 2023

|

|

Marketing

Services

|

|

|

Customer

Care

|

|

|

Fulfillment &

Logistics

Services

|

|

|

Unallocated

Corporate

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$ |

10,591 |

|

|

$ |

13,998 |

|

|

$ |

22,530 |

|

|

$ |

— |

|

|

$ |

47,119 |

|

|

Segment Operating Expense

|

|

$ |

8,370 |

|

|

$ |

11,339 |

|

|

$ |

18,995 |

|

|

$ |

4,549 |

|

|

$ |

43,253 |

|

|

Contribution margin (loss)

|

|

$ |

2,221 |

|

|

$ |

2,659 |

|

|

$ |

3,535 |

|

|

$ |

(4,549 |

) |

|

$ |

3,866 |

|

|

Shared Services

|

|

$ |

706 |

|

|

$ |

668 |

|

|

$ |

680 |

|

|

$ |

(2,054 |

) |

|

$ |

— |

|

|

EBITDA

|

|

$ |

1,515 |

|

|

$ |

1,991 |

|

|

$ |

2,855 |

|

|

$ |

(2,495 |

) |

|

$ |

3,866 |

|

|

Depreciation and Amortization Expense

|

|

$ |

71 |

|

|

$ |

253 |

|

|

$ |

249 |

|

|

$ |

379 |

|

|

$ |

952 |

|

|

Operating income (loss)

|

|

$ |

1,444 |

|

|

$ |

1,738 |

|

|

$ |

2,606 |

|

|

$ |

(2,874 |

) |

|

$ |

2,914 |

|

|

Quarter ended September 30, 2022

|

|

Marketing

Services

|

|

|

Customer

Care

|

|

|

Fulfillment &

Logistics

Services

|

|

|

Unallocated

Corporate

|

|

|

Total

|

|

|

2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$ |

13,016 |

|

|

$ |

17,375 |

|

|

$ |

23,495 |

|

|

$ |

— |

|

|

$ |

53,886 |

|

|

Segment Operating Expense

|

|

$ |

9,970 |

|

|

$ |

13,661 |

|

|

$ |

19,865 |

|

|

$ |

6,038 |

|

|

$ |

49,534 |

|

|

Contribution margin (loss)

|

|

$ |

3,046 |

|

|

$ |

3,714 |

|

|

$ |

3,630 |

|

|

$ |

(6,038 |

) |

|

$ |

4,352 |

|

|

Shared Services

|

|

$ |

1,125 |

|

|

$ |

743 |

|

|

$ |

853 |

|

|

$ |

(2,721 |

) |

|

$ |

— |

|

|

EBITDA

|

|

$ |

1,921 |

|

|

$ |

2,971 |

|

|

$ |

2,777 |

|

|

$ |

(3,317 |

) |

|

$ |

4,352 |

|

|

Depreciation and Amortization Expense

|

|

$ |

98 |

|

|

$ |

206 |

|

|

$ |

176 |

|

|

$ |

99 |

|

|

$ |

579 |

|

|

Operating income (loss)

|

|

$ |

1,823 |

|

|

$ |

2,765 |

|

|

$ |

2,601 |

|

|

$ |

(3,416 |

) |

|

$ |

3,773 |

|

v3.23.3

Document And Entity Information

|

Nov. 09, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Harte Hanks, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 09, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

1-7120

|

| Entity, Tax Identification Number |

74-1677284

|

| Entity, Address, Address Line One |

1 Executive Drive, Suite 303

|

| Entity, Address, City or Town |

Chelmsford

|

| Entity, Address, State or Province |

MA

|

| Entity, Address, Postal Zip Code |

01824

|

| City Area Code |

512

|

| Local Phone Number |

434-1100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

HHS

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000045919

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

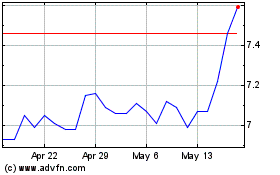

Harte Hanks (NASDAQ:HHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

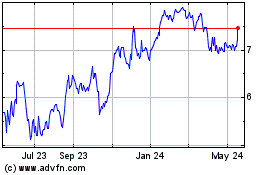

Harte Hanks (NASDAQ:HHS)

Historical Stock Chart

From Apr 2023 to Apr 2024