Senseonics Holdings, Inc. (NYSE American: SENS), a medical

technology company focused on the development and manufacturing of

long-term, implantable continuous glucose monitoring (CGM) systems

for people with diabetes, today reported financial results for the

quarter ended September 30, 2023.

Recent Highlights & Accomplishments:

- Generated revenue of $6.1 million in the third quarter of

2023

- Announced the last patient completion of the 365-day ENHANCE

Pivotal Clinical Study adult cohort

- Launched with our global commercial partner Ascensia Diabetes

Care, a new direct to consumer U.S. advertising campaign, ‘The CGM

for Real Life’ to increase awareness of Eversense’s unique

benefits

- Entered into a $50 million non-dilutive loan facility with

Hercules Capital, Inc. and drew down an initial $25 million,

further strengthening the balance sheet

“The third quarter was marked by milestones across our

development programs, commercial collaboration with Ascensia, and

continued progress in strengthening our balance sheet,” said Tim

Goodnow, PhD, President and Chief Executive Officer of Senseonics.

“Completing the adult cohort of the ENHANCE 365-day pivotal trial,

launching a new advertising campaign and finalizing a new loan

facility all help position us to advance our plans to grow adoption

of Eversense, the world’s only long term CGM.”

Third Quarter 2023 Results:

Total revenue for the third quarter of 2023 was $6.1 million

compared to $4.6 million for the third quarter of 2022. U.S.

revenue was $3.9 million in the third quarter of 2023 compared to

$1.9 million in the prior year period, and revenue outside the U.S.

was $2.2 million in the third quarter of 2023 compared to $2.7

million in the prior year period.

Third quarter 2023 gross profit of $1.2 million increased from

$0.8 million in gross profit for the third quarter of 2022. The

increase in gross margin was primarily driven by an increase to

revenue as volumes increased.

Third quarter 2023 sales and marketing and general and

administrative expenses increased by $0.1 million year-over-year,

to $7.4 million. The consistency was the result of efforts to

manage other general and administrative costs across the

organization.

Third quarter 2023 research and development expenses increased

by $1.8 million year-over-year, to $12.8 million. The increase was

primarily due to investments in our product pipeline for

development and clinical trials of next generation

technologies.

Net loss was $24.1 million, or $0.04 per share, in the third

quarter of 2023 compared to a net loss of $60.4 million, or $0.13

per share, in the third quarter of 2022. Net income increased by

$36.3 million due to the accounting for embedded derivatives, fair

value adjustments and the exchange of a portion of the 2025

notes.

Cash, cash equivalents, short and long-term investments were

$125.4 million and outstanding indebtedness was $45.8 million as of

September 30, 2023.

2023 Financial Outlook

Senseonics expects full year 2023 global net revenue to be at

the midpoint of the $20 million to $24 million range.

Conference Call and Webcast Information:

Company management will host a conference call at 4:30 pm

(Eastern Time) today, November 9, 2023, to discuss these financial

results and recent business developments. This conference call can

be accessed live by telephone or through Senseonics' website.

Live

Teleconference Information:

Dial in number: 888-317-6003

Entry Number: 1409312

International dial in: 412-317-6061

Live Webcast

Information:

Visit http://www.senseonics.com and select

the "Investor Relations" section

A replay of the call can be accessed on Senseonics' website

http://www.senseonics.com under "Investor Relations."

About Senseonics

Senseonics Holdings, Inc. ("Senseonics") is a medical technology

company focused on the development and manufacturing of glucose

monitoring products designed to transform lives in the global

diabetes community with differentiated, long-term implantable

glucose management technology. Senseonics' CGM systems, Eversense®,

Eversense® XL and Eversense® E3 include a small sensor inserted

completely under the skin that communicates with a smart

transmitter worn over the sensor. The glucose data are

automatically sent every 5 minutes to a mobile app on the user's

smartphone.

Forward Looking Statements

Any statements in this press release about future expectations,

plans and prospects for Senseonics, including the revenue

projections under "2023 Financial Outlook," statements about the

commercial launch of Eversense® E3, statements regarding increasing

patient access and patient and provider adoption, statements

regarding advancing development programs and the pipeline,

statements regarding strengthening the Eversense® brand, and other

statements containing the words "believe," “expect,” “intend,”

“may,” “projects,” “will,” “planned,” and similar expressions,

constitute forward-looking statements within the meaning of The

Private Securities Litigation Reform Act of 1995. Actual results

may differ materially from those indicated by such forward-looking

statements as a result of various important factors, including:

uncertainties inherent in the commercial launch of Eversense® E3

CGM system and commercial expansion of the Eversense product,

uncertainties inherent in the expansion of Ascensia Diabetes Care’s

U.S. salesforce and its commercial initiatives, uncertainties

inherent in partnering with the Nurse Practitioner Group and that

partner’s assumption of certain clinical and administrative

activities, uncertainties in insurer, regulatory and administrative

processes and decisions, uncertainties inherent in the development

and registration of new technology, uncertainties relating to the

current economic environment and such other factors as are set

forth in the risk factors detailed in Senseonics’ Annual Report on

Form 10-K for the year ended December 31, 2022, the Quarterly

Report on Form 10-Q for the quarter ended September 30, 2023 and

Senseonics’ other filings with the SEC under the heading “Risk

Factors.” In addition, the forward-looking statements included in

this press release represent Senseonics’ views as of the date

hereof. Senseonics anticipates that subsequent events and

developments will cause Senseonics’ views to change. However, while

Senseonics may elect to update these forward-looking statements at

some point in the future, Senseonics specifically disclaims any

obligation to do so except as required by law. These

forward-looking statements should not be relied upon as

representing Senseonics’ views as of any date subsequent to the

date hereof.

Senseonics Holdings,

Inc.

Condensed Consolidated Balance

Sheets

(in thousands, except share

and per share data)

September 30,

December 31,

2023

2022

(unaudited)

Assets

Current assets:

Cash and cash equivalents

$

55,759

$

35,793

Short term investments, net

69,648

108,222

Accounts receivable, net

701

127

Accounts receivable, net - related

parties

2,749

2,324

Inventory, net

9,726

7,306

Prepaid expenses and other current

assets

7,557

7,428

Total current assets

146,140

161,200

Deposits and other assets

6,991

3,108

Long term investments, net

—

12,253

Property and equipment, net

934

1,112

Total assets

$

154,065

$

177,673

Liabilities and Stockholders’ Equity

(Deficit)

Current liabilities:

Accounts payable

$

2,669

$

419

Accrued expenses and other current

liabilities

14,356

14,616

Accrued expenses and other current

liabilities, related parties

277

837

Note payable, current portion, net

—

15,579

Derivative liability, current portion

—

20

Total current liabilities

17,302

31,471

Long-term debt and notes payables, net

40,485

56,383

Derivative liabilities

245

52,050

Other liabilities

6,312

2,689

Total liabilities

64,344

142,593

Preferred stock and additional

paid-in-capital, subject to possible redemption: $0.001 par value

per share; 12,000 shares and 12,000 shares issued and outstanding

as of September 30, 2023 and December 31, 2022

37,656

37,656

Total temporary equity

37,656

37,656

Commitments and contingencies

Stockholders’ equity (deficit):

Common stock, $0.001 par value per share;

900,000,000 shares authorized as of September 30, 2023 and December

31, 2022; 528,176,273 shares and 479,637,138 shares issued and

outstanding as of September 30, 2023 and December 31, 2022

528

480

Additional paid-in capital

903,665

806,488

Accumulated other comprehensive loss

(59

)

(678

)

Accumulated deficit

(852,069

)

(808,866

)

Total stockholders’ equity (deficit)

52,065

(2,576

)

Total liabilities and stockholders’

equity

$

154,065

$

177,673

Senseonics Holdings,

Inc.

Unaudited Condensed

Consolidated Statements of Operations and Comprehensive Income

(Loss)

(in thousands, except share

and per share data)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Revenue, net

$

426

$

126

$

1,176

$

555

Revenue, net - related parties

5,671

4,496

13,184

10,263

Total revenue

6,097

4,622

14,360

10,818

Cost of sales

4,925

3,866

12,358

8,711

Gross profit

1,172

756

2,002

2,107

Expenses:

Research and development expenses

12,769

10,985

38,003

28,088

Selling, general and administrative

expenses

7,425

7,340

22,598

23,785

Operating loss

(19,022

)

(17,569

)

(58,599

)

(49,766

)

Other income (expense), net:

Interest income

1,460

544

3,879

878

Gain (Loss) on fair value adjustment of

option

—

(8,592

)

—

41,333

Exchange related gain (loss), net

(4,569

)

—

14,207

—

Interest expense

(2,425

)

(4,801

)

(9,388

)

(13,806

)

Gain (Loss) on change in fair value of

derivatives

438

(28,948

)

6,505

152,169

Impairment cost, net

—

(984

)

—

(138

)

Other income (expense)

15

(41

)

194

(112

)

Total other (expense) income, net

(5,081

)

(42,822

)

15,397

180,324

Net (Loss) Income

(24,103

)

(60,391

)

(43,202

)

130,558

Other comprehensive income (loss)

Unrealized gain (loss) on marketable

securities

61

(57

)

619

(973

)

Total other comprehensive gain (loss)

61

(57

)

619

(973

)

Total comprehensive (loss) income

$

(24,042

)

$

(60,448

)

$

(42,583

)

$

129,585

Basic net (loss) income per common

share

$

(0.04

)

$

(0.13

)

$

(0.08

)

$

0.28

Basic weighted-average shares

outstanding

592,452,262

472,475,747

552,703,546

464,244,736

Diluted net loss per common share

$

(0.04

)

$

(0.13

)

$

(0.08

)

$

(0.10

)

Diluted weighted-average shares

outstanding

592,452,262

472,475,747

552,703,546

608,345,713

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231109303594/en/

Investor Contact Philip Taylor Gilmartin Group

415-937-5406 Investors@senseonics.com

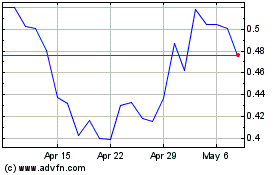

Senseonics (AMEX:SENS)

Historical Stock Chart

From Mar 2024 to Apr 2024

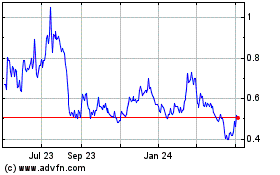

Senseonics (AMEX:SENS)

Historical Stock Chart

From Apr 2023 to Apr 2024