0001819615FALSE00018196152023-11-092023-11-090001819615us-gaap:CommonStockMember2023-11-092023-11-090001819615us-gaap:WarrantMember2023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 9, 2023

Clever Leaves Holdings Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| British Columbia, Canada | | 001-39820 | | Not Applicable |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Bodega 19-B Parque Industrial Tibitoc P.H, Tocancipá - Cundinamarca, Colombia | | N/A |

| (Address of principal executive offices) | | (Zip Code) |

(561) 634-7430

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol (s) | | Name of each exchange on which registered |

| Common shares without par value | | CLVR | | The Nasdaq Stock Market LLC |

| Warrants, each warrant exercisable for1/30th common share at an exercise price of $11.50 | | CLVRW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2023, Clever Leaves Holdings Inc. issued a press release announcing its financial results for the third quarter ended September 30, 2023. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in this Item 2.02, including the related information set forth in the earnings press release attached hereto as Exhibit 99.1 and incorporated by reference herein, is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by the specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Clever Leaves Holdings Inc. |

| |

| | By: | /s/ Henry R. Hague, III |

| | Name: | Henry R. Hague, III |

| | Title: | Chief Financial Officer |

| | | (Authorized Officer and Principal Financial Officer) |

Date: November 9, 2023

Clever Leaves Reports Third Quarter 2023 Results

- Q3 Revenue Increased 33% Year-Over-Year, Propelled by 135% Year-Over-Year Growth in Cannabinoid Revenue, Along with 6% Year-Over-Year Growth in Non-Cannabinoid Revenue -

- Q3 Adjusted EBITDA Improved Year-Over-Year to $(2.6) Million Compared to $(3.7) Million, Reflecting Revenue Growth and Continued Aggressive Expense Reductions -

- Cash Balance at October 31, 2023 was $6.2 Million, with $1.9 Million in Subsequent Capital Received from the November Sale of the Company’s Remaining Stake in Cansativa -

- Updated Full Year 2023 Guidance Reflects Revenue Timing Shifts, Revenue Mix, and Adjusted EBITDA Improvement from Continued Operating Efficiencies -

TOCANCIPÁ, COLOMBIA, November 9, 2023 – Clever Leaves Holdings Inc. (NASDAQ: CLVR, CLVRW) (“Clever Leaves” or the “Company”), a global medicinal cannabis company, is reporting financial and operating results for the third quarter ended September 30, 2023. All financial information is provided in US dollars unless otherwise indicated.

“Our third quarter results reflect our commitment to enhancing our commercial strategy and Colombian production, as well as optimizing our expenses,” said Andres Fajardo, CEO of Clever Leaves. “On the cannabinoid side of our business, demand for our extracts increased, resulting in overall year-over-year revenue growth of 135% increase in cannabinoid revenue. We also grew revenue by 6% year-over-year in our non-cannabinoid Herbal Brands business and maintained the segment’s gross margin performance, driven by higher sales, stabilized raw material and labor costs, and general and administrative cost efficiencies. Within this segment, we continue to strengthen our relationships with the Food Drug Mass channel, optimize our go-to-market model for the specialty channel, and grow our Direct-to-Consumer sales.

“As a result of the measures we have previously implemented to preserve cash, we have continued to drive year-over-year reductions in our operating expenses and cash burn. In fact, our quarter-end cash balance of $6.5 million reflects a sequential gain relative to our $5.1 million balance at the end of the second quarter, benefited by the $2.7 million in proceeds we received from the sale of our Portuguese processing assets in July and ATM shares issuances. At October 31, our cash balance was $6.2 million, and we have since received $1.9 million in net proceeds from the sale of our remaining stake in Cansativa this month. Moving into the remainder of 2023, we are focused on accelerating expansion in our core cannabinoid markets, reflecting a combination of high-quality extracts and increasing diversified and genetically differentiated flower, continued cost reductions via the continued streamlining of our operational infrastructure, and continued exploration of monetization of non-core assets.”

Third Quarter 2023 Summary vs. Same Year-Ago Quarter1

•Revenue in the third quarter of 2023 increased 33% to $3.8 million compared to $2.9 million for the same period in 2022. The improvement was driven by an increase in cannabinoid segment revenues of 135% to $1.4 million compared to $0.6 million for the same period in 2022. The increase in cannabinoid segment revenues was primarily driven by continued extract sales strength in Australia and Brazil. Non-cannabinoid revenues increased 6% year-over-year.

•All-in cost per gram of dry flower was $0.75, compared to $0.52 in the prior year period. The increase is attributable to the Company's ongoing extraction and processing costs on existing inventory, along with costs associated with ramping Colombian flower exports. The Company also implemented meaningful cultivation changes to improve its flower quality and properties, as well as meet more stringent market and regulatory requirements.

•Gross profit, including a $0.3 million inventory provision, increased 49% to $1.9 million, compared to a $1.3 million gross profit in the year-ago quarter, which included a $0.6 million inventory provision. Adjusted gross profit (a non-GAAP financial measure defined and reconciled herein), which excluded such inventory provisions, increased 19% to $2.2 million compared to $1.9 million. The increase in gross profit reflects the revenue growth generated during the quarter, along with stabilized pricing for both raw materials and labor in the non-cannabinoid segment.

•Gross margin increased 550 basis points to 50.8% compared to 45.3% last year. Adjusted gross margin (a non-GAAP financial measure defined and reconciled herein), which excluded inventory provisions, was 57.7% compared to 64.7%.

•Operating expenses in the third quarter of 2023 improved to $5.3 million compared to $25.6 million for the same period in 2022, which included a $19.0 million intangible asset impairment charge related to the Company’s Colombian cannabis license. Excluding the year-ago impairment charge, operating expenses decreased by 20% year-over-year, reflecting the continued benefits of the cost reduction and restructuring initiatives the Company previously implemented.

•Net loss was $5.1 million compared to a net loss of $20.2 million in the prior year period. Net loss in the third quarter of 2023 included a $3.7 million impairment charge related to the sale of the Company’s remaining stake in Cansativa subsequent to the end of the third quarter. Net loss in the year-ago quarter included the previously mentioned $19.0 million asset impairment charge.

•Adjusted EBITDA (a non-GAAP financial measure defined and reconciled herein) improved to $(2.6) million compared to $(3.7) million. The improvement reflects the aforementioned benefits of the Company’s cost reductions and restructuring initiatives previously implemented.

•Cash, cash equivalents and restricted cash were $6.5 million at September 30, 2023, compared to $12.9 million at December 31, 2022. The decrease was primarily attributable to continued operating losses and working capital needs, partially offset from the sale of non-core assets and ATM issuances.

Fajardo continued: “Building upon the traction we have generated throughout the year, we sustained a strong focus on our target cannabinoid markets. Increasing demand in Australia and Brazil continued to drive extract sales as we capitalize on our growing supply partnerships, including in Israel and our

1 Due to the cessation of the Company’s production operations in Portugal, as well as the ongoing wind-down process for these operations, Clever Leaves has determined that these operations meet the "discontinued operations" criteria as of March 31, 2023, in accordance with Accounting Standards Codification (ASC) 205, Presentation of Financial Statements. As a result, the Company’s Consolidated Balance Sheets and Consolidated Statements of Operations, and the notes to the Consolidated Financial Statements, have been restated for all periods presented to reflect the discontinuation of these operations in accordance with ASC 205. For additional detail on this presentation, please refer to the Company’s Form 10-Q for the fiscal period ended September 30, 2023.

approved product shipments to Brazil. We also focused on leveraging our partnership with Australian Natural Therapeutics Group to ramp sales of our dry flower in Australia.

“Furthermore, we are continuing to expand our commercial flower portfolio and are aiming to complete two new strains by year-end. As part of our previously announced partnership with Praetorian Global, we have already achieved significant milestones in our initial cultivation collaboration. We believe these strains will help accelerate our market penetration into Germany, the United Kingdom, and other markets. Looking ahead, we are focused on optimizing our flower characteristics and expanding our product portfolio in 2024 to best meet market demand.

“Moving into the fourth quarter, our goal is to continue expanding sales of our cannabinoid products, optimize our capital efficiency and cost structure, and enhance our product quality and diversity out of Colombian production operations. We believe we are well positioned to achieve all of these goals to drive sustainable future growth.”

Revised 2023 Outlook

Clever Leaves is refining its full year 2023 financial outlook to reflect the year-to-date phasing and mix of its segment-level revenues, along with key improvements to its cost and capital structure. The Company now expects its full year revenue to range between $17 million and $18 million, with an adjusted gross margin of between 55% and 57%, compared to its prior forecast of between $19 million and $22 million, with an adjusted gross margin of between 58% and 63%. The revisions primarily reflect timing variability across the Company’s cannabinoid markets, mainly Brazil as a result of the timing in the issuance of internal quotas and Israel as a result of the recent geopolitical complexities facing the nation. The revisions also reflect softness experienced in the first half of the year in the specialty channel of Clever Leaves’ non-cannabinoid segment.

Pursuant to the savings generated from prior cost reduction and restructuring initiatives, the Company now anticipates its 2023 adjusted EBITDA performance for the year to range between $(11.0) million and $(10.0) million, compared to its prior forecast of between $(13.6) million and $(10.6) million. This new range reflects the significant cost reductions implemented during the course of the year. Clever Leaves is also reducing its range of annual capital expenditures in 2023 to approximately $0.2 million to $0.3 million, as compared to its prior forecast of between approximately $0.5 million to $0.7 million. The new range reflects the minimal maintenance needs of its mature Colombian production infrastructure and represents a nearly 80% reduction compared to its annual capital expenditures in 2022.

Conference Call

Clever Leaves will conduct a conference call today at 5:00 p.m. Eastern time to discuss its results for the third quarter ended September 30, 2023.

Clever Leaves management will host the conference call, followed by a question-and-answer session.

Conference Call Date: Thursday, November 9, 2023

Time: 5:00 p.m. Eastern time

Toll-free dial-in number: 1-855-238-2333

International dial-in number: 1-412-317-5222

Conference ID: 10183148

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Group at 949-574-3860.

The conference call will be broadcast live and available for replay here.

A telephonic replay of the conference call will also be available after 8:00 p.m. Eastern time on the same day through November 16, 2023.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 10183148

About Clever Leaves Holdings Inc.

Clever Leaves is a global medical cannabis company. Its operations in Colombia produce EU GMP cannabinoid active pharmaceutical ingredients (API) and finished products in flower and extract form to a growing base of B2B customers around the globe. Clever Leaves aims to disrupt the traditional cannabis production industry by leveraging environmentally sustainable, ESG-friendly, industrial-scale and low-cost production methods, with the world’s most stringent pharmaceutical quality certifications. Clever Leaves announces material information to the public through a variety of means, including filings with the U.S. Securities and Exchange Commission (the “SEC”), press releases, public conference calls, and its website (https://cleverleaves.com). Clever Leaves uses these channels, as well as social media, including its Twitter account (@clever_leaves), and its LinkedIn page (https://www.linkedin.com/company/clever-leaves), to communicate with investors and the public about Clever Leaves, its products, and other matters. Therefore, Clever Leaves encourages investors, the media, and others interested in Clever Leaves to review the information it makes public in these locations, as such information could be deemed to be material information. Information on or that can be accessed through Clever Leaves’ websites or these social media channels is not part of this release, and references to Clever Leaves’ website addresses and social media channels are inactive textual references only.

Non-GAAP Financial Measures

In this press release, Clever Leaves refers to certain non-GAAP financial measures including Adjusted EBITDA, Adjusted Gross Profit and Adjusted Gross Margin. Adjusted EBITDA, Adjusted Gross Profit and Adjusted Gross Margin do not have standardized meanings prescribed by GAAP and are therefore unlikely to be comparable to similar measures presented by other companies. Adjusted EBITDA is defined as income/loss from continuing operations before interest, taxes, depreciation and amortization, share-based compensation expense, restructuring expenses, foreign exchange gain/loss, gains/losses on the early extinguishment of debt, gain/loss on remeasurement of warrant liability, equity investment share of gain/loss, other expense/income and income/loss from discontinued operations. Adjusted Gross Profit (and the related Adjusted Gross Margin measure) is defined as gross profit excluding inventory provision. Adjusted EBITDA, Adjusted Gross Profit and Adjusted Gross Margin also exclude the impact of certain non-recurring items that are not directly attributable to the underlying operating performance. Clever Leaves considers Adjusted EBITDA, Adjusted Gross Profit and Adjusted Gross Margin to be meaningful indicators of the performance of its core business. Adjusted EBITDA, Adjusted Gross Profit and Adjusted Gross Margin should neither be considered in isolation nor as a substitute for the financial measures prepared in accordance with U.S. GAAP. For reconciliations of Adjusted EBITDA, Adjusted Gross Profit and Adjusted Gross Margin to the most directly comparable U.S. GAAP measures, see the relevant schedules provided with this press release. We have not provided or reconciled the non-GAAP forward-looking information to their corresponding GAAP measures because the exact amounts for these items are not currently determinable without unreasonable efforts but may be significant.

Forward-Looking Statements

This press release includes certain statements that are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “aim,” “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “evolve,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “opportunity,” “outlook,” “pipeline,” “plan,” “predict,” “potential,” “projected,” “seek,” “seem,” “should,” “will,” “would” and similar expressions (or the negative versions of such words or expressions) that predict or indicate future events or trends or that are not statements of historical matters. Such forward-looking statements as well as our outlook for 2023 are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking statements. Important factors that may affect actual results or the achievability of the

Company’s expectations include, but are not limited to: (i) our ability to continue as a going concern; (ii) our ability to maintain the listing of our securities on Nasdaq; (iii) our ability to implement our restructuring initiatives; (iv) expectations with respect to future operating and financial performance and growth, including if or when Clever Leaves will become profitable; (v) Clever Leaves’ ability to execute its business plans and strategy and to receive regulatory approvals (including its goals in its five key markets and goals for entry into the United Kingdom); (vi) Clever Leaves’ ability to capitalize on expected market opportunities, including the timing and extent to which cannabis is legalized in various jurisdictions; (vii) global economic and business conditions, including recent economic sanctions against Russia and their effects on the global economy; (viii) geopolitical events (including the ongoing military conflict between Russia and Ukraine as well as the war between Israel and Hamas), natural disasters, acts of God and pandemics, including the economic and operational disruptions and other effects of COVID-19; (ix) regulatory developments in key markets for the Company's products, including international regulatory agency coordination and increased quality standards imposed by certain health regulatory agencies, and failure to otherwise comply with laws and regulations; (x) uncertainty with respect to the requirements applicable to certain cannabis products as well as the permissibility of sample shipments, and other risks and uncertainties; (xi) consumer, legislative, and regulatory sentiment or perception regarding Clever Leaves’ products; (xii) lack of regulatory approval and market acceptance of Clever Leaves’ new products which may impede its ability to successfully commercialize its products; (xiii) the extent to which Clever Leaves’ is able to monetize its existing THC market quota within Colombia; (xiv) demand for Clever Leaves’ products and Clever Leaves’ ability to meet demand for its products and negotiate agreements with existing and new customers; (xv) developing product enhancements and formulations with commercial value and appeal; (xvi) product liability claims exposure; (xvii) lack of a history and experience operating a business on a large scale and across multiple jurisdictions; (xviii) limited experience operating as a public company; (xix) changes in currency exchange rates and interest rates; (xx) weather and agricultural conditions and their impact on the Company’s cultivation and construction plans, (xxi) Clever Leaves’ ability to hire and retain skilled personnel in the jurisdictions where it operates; (xxii) Clever Leaves’ ability to remediate a material weakness in its internal control cover financial reporting and to develop and maintain effective internal and disclosure controls; (xxiii) potential litigation; (xxiv) access to additional financing; and (xxv) completion of our construction initiatives on time and on budget. The foregoing list of factors is not exclusive. Additional information concerning certain of these and other risk factors is contained in Clever Leaves’ most recent filings with the SEC. All subsequent written and oral forward-looking statements concerning Clever Leaves and attributable to Clever Leaves or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Clever Leaves expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in its expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

Clever Leaves Investor Inquiries:

Cody Slach or Jackie Keshner

Gateway Group, Inc.

+1-949-574-3860

CLVR@Gateway-grp.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

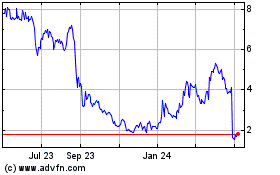

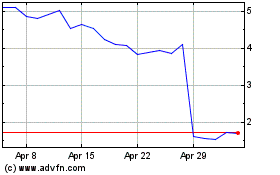

Clever Leaves (NASDAQ:CLVR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Clever Leaves (NASDAQ:CLVR)

Historical Stock Chart

From Apr 2023 to Apr 2024