Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

November 09 2023 - 6:06AM

Edgar (US Regulatory)

No.1-7628

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF NOVEMBER 2023

COMMISSION FILE NUMBER: 1-07628

HONDA GIKEN KOGYO KABUSHIKI KAISHA

(Name of registrant)

HONDA

MOTOR CO., LTD.

(Translation of registrant’s name into English)

1-1, Minami-Aoyama 2-chome,

Minato-ku, Tokyo 107-8556, Japan

(Address of principal

executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this

report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| HONDA GIKEN KOGYO KABUSHIKI KAISHA (HONDA MOTOR CO., LTD.) |

|

| /s/ Masaharu Hirose |

| Masaharu Hirose |

| General Manager |

| Finance Division |

| Honda Motor Co., Ltd. |

Date: November 9, 2023

November 9, 2023

HONDA MOTOR CO., LTD. REPORTS

CONSOLIDATED FINANCIAL

RESULTS

FOR THE FISCAL SECOND QUARTER AND

THE

FISCAL FIRST HALF YEAR ENDED SEPTEMBER 30, 2023

Tokyo, November 9, 2023 — Honda Motor Co., Ltd. today announced its consolidated financial

results for the fiscal second quarter and the fiscal first half year ended September 30, 2023.

—1—

[1] Condensed Consolidated Statements of Financial Position

March 31, 2023 and September 30, 2023

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Mar. 31, 2023 |

|

|

Sep. 30, 2023 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

3,803,014 |

|

|

|

4,440,513 |

|

| Trade receivables |

|

|

1,060,271 |

|

|

|

1,080,383 |

|

| Receivables from financial services |

|

|

1,899,493 |

|

|

|

2,245,322 |

|

| Other financial assets |

|

|

263,892 |

|

|

|

176,801 |

|

| Inventories |

|

|

2,167,184 |

|

|

|

2,355,959 |

|

| Other current assets |

|

|

384,494 |

|

|

|

399,154 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

9,578,348 |

|

|

|

10,698,132 |

|

|

|

|

|

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

|

|

| Investments accounted for using the equity method |

|

|

915,946 |

|

|

|

1,065,636 |

|

| Receivables from financial services |

|

|

3,995,259 |

|

|

|

5,075,054 |

|

| Other financial assets |

|

|

855,070 |

|

|

|

964,151 |

|

| Equipment on operating leases |

|

|

4,726,292 |

|

|

|

5,069,161 |

|

| Property, plant and equipment |

|

|

3,168,109 |

|

|

|

3,229,919 |

|

| Intangible assets |

|

|

870,900 |

|

|

|

922,122 |

|

| Deferred tax assets |

|

|

105,792 |

|

|

|

125,688 |

|

| Other non-current assets |

|

|

454,351 |

|

|

|

526,740 |

|

|

|

|

|

|

|

|

|

|

| Total non-current assets |

|

|

15,091,719 |

|

|

|

16,978,471 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

24,670,067 |

|

|

|

27,676,603 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and Equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Trade payables |

|

|

1,426,333 |

|

|

|

1,433,191 |

|

| Financing liabilities |

|

|

3,291,195 |

|

|

|

3,755,650 |

|

| Accrued expenses |

|

|

419,570 |

|

|

|

450,583 |

|

| Other financial liabilities |

|

|

324,110 |

|

|

|

411,764 |

|

| Income taxes payable |

|

|

86,252 |

|

|

|

107,982 |

|

| Provisions |

|

|

362,701 |

|

|

|

440,982 |

|

| Other current liabilities |

|

|

741,963 |

|

|

|

790,698 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

6,652,124 |

|

|

|

7,390,850 |

|

|

|

|

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

| Financing liabilities |

|

|

4,373,973 |

|

|

|

5,254,792 |

|

| Other financial liabilities |

|

|

288,736 |

|

|

|

308,222 |

|

| Retirement benefit liabilities |

|

|

255,852 |

|

|

|

284,354 |

|

| Provisions |

|

|

270,169 |

|

|

|

298,826 |

|

| Deferred tax liabilities |

|

|

877,300 |

|

|

|

947,149 |

|

| Other non-current liabilities |

|

|

449,622 |

|

|

|

514,437 |

|

|

|

|

|

|

|

|

|

|

| Total non-current liabilities |

|

|

6,515,652 |

|

|

|

7,607,780 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

13,167,776 |

|

|

|

14,998,630 |

|

|

|

|

|

|

|

|

|

|

| Equity: |

|

|

|

|

|

|

|

|

| Common stock |

|

|

86,067 |

|

|

|

86,067 |

|

| Capital surplus |

|

|

185,589 |

|

|

|

185,458 |

|

| Treasury stock |

|

|

(484,931 |

) |

|

|

(629,546 |

) |

| Retained earnings |

|

|

9,980,128 |

|

|

|

10,496,889 |

|

| Other components of equity |

|

|

1,417,397 |

|

|

|

2,225,307 |

|

|

|

|

|

|

|

|

|

|

| Equity attributable to owners of the parent |

|

|

11,184,250 |

|

|

|

12,364,175 |

|

| Non-controlling interests |

|

|

318,041 |

|

|

|

313,798 |

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

11,502,291 |

|

|

|

12,677,973 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

|

24,670,067 |

|

|

|

27,676,603 |

|

|

|

|

|

|

|

|

|

|

—2—

[2] Condensed Consolidated Statements of Income and Condensed Consolidated Statements of Comprehensive

Income

Condensed Consolidated Statements of Income

For the six months ended September 30, 2022 and 2023

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Six months ended

Sep. 30, 2022 |

|

|

Six months ended

Sep. 30, 2023 |

|

| Sales revenue |

|

|

8,085,304 |

|

|

|

9,609,392 |

|

| Operating costs and expenses: |

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

(6,505,911 |

) |

|

|

(7,521,751 |

) |

| Selling, general and administrative |

|

|

(744,778 |

) |

|

|

(986,874 |

) |

| Research and development |

|

|

(381,163 |

) |

|

|

(404,194 |

) |

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

|

|

(7,631,852 |

) |

|

|

(8,912,819 |

) |

|

|

|

|

|

|

|

|

|

| Operating profit |

|

|

453,452 |

|

|

|

696,573 |

|

|

|

|

|

|

|

|

|

|

| Share of profit of investments accounted for using the equity method |

|

|

82,946 |

|

|

|

66,724 |

|

| Finance income and finance costs: |

|

|

|

|

|

|

|

|

| Interest income |

|

|

25,025 |

|

|

|

77,845 |

|

| Interest expense |

|

|

(15,650 |

) |

|

|

(19,895 |

) |

| Other, net |

|

|

(29,942 |

) |

|

|

58,038 |

|

|

|

|

|

|

|

|

|

|

| Total finance income and finance costs |

|

|

(20,567 |

) |

|

|

115,988 |

|

|

|

|

|

|

|

|

|

|

| Profit before income taxes |

|

|

515,831 |

|

|

|

879,285 |

|

| Income tax expense |

|

|

(147,092 |

) |

|

|

(225,360 |

) |

|

|

|

|

|

|

|

|

|

| Profit for the period |

|

|

368,739 |

|

|

|

653,925 |

|

|

|

|

|

|

|

|

|

|

| Profit for the period attributable to: |

|

|

|

|

|

|

|

|

| Owners of the parent |

|

|

338,514 |

|

|

|

616,301 |

|

| Non-controlling interests |

|

|

30,225 |

|

|

|

37,624 |

|

|

|

| |

|

Yen |

|

| Earnings per share attributable to owners of the parent |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

66.03 |

|

|

|

124.63 |

|

—3—

Condensed Consolidated Statements of Comprehensive Income

For the six months ended September 30, 2022 and 2023

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Six months ended

Sep. 30, 2022 |

|

|

Six months ended

Sep. 30, 2023 |

|

| Profit for the period |

|

|

368,739 |

|

|

|

653,925 |

|

| Other comprehensive income, net of tax: |

|

|

|

|

|

|

|

|

| Items that will not be reclassified to profit or loss |

|

|

|

|

|

|

|

|

| Remeasurements of defined benefit plans |

|

|

(11 |

) |

|

|

4 |

|

| Net changes in revaluation of financial assets measured at fair value through other comprehensive

income |

|

|

(27,735 |

) |

|

|

753 |

|

| Share of other comprehensive income of investments accounted for using the equity method |

|

|

(1,109 |

) |

|

|

5,280 |

|

| Items that may be reclassified subsequently to profit or loss |

|

|

|

|

|

|

|

|

| Net changes in revaluation of financial assets measured at fair value through other comprehensive

income |

|

|

(893 |

) |

|

|

(429 |

) |

| Exchange differences on translating foreign operations |

|

|

917,707 |

|

|

|

768,426 |

|

| Share of other comprehensive income of investments accounted for using the equity method |

|

|

69,148 |

|

|

|

51,933 |

|

|

|

|

|

|

|

|

|

|

| Total other comprehensive income, net of tax |

|

|

957,107 |

|

|

|

825,967 |

|

|

|

|

|

|

|

|

|

|

| Comprehensive income for the period |

|

|

1,325,846 |

|

|

|

1,479,892 |

|

|

|

|

|

|

|

|

|

|

| Comprehensive income for the period attributable to: |

|

|

|

|

|

|

|

|

| Owners of the parent |

|

|

1,276,881 |

|

|

|

1,424,586 |

|

| Non-controlling interests |

|

|

48,965 |

|

|

|

55,306 |

|

—4—

Condensed Consolidated Statements of Income

For the three months ended September 30, 2022 and 2023

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Three months ended

Sep. 30, 2022 |

|

|

Three months ended

Sep. 30, 2023 |

|

| Sales revenue |

|

|

4,255,754 |

|

|

|

4,984,396 |

|

| Operating costs and expenses: |

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

(3,441,741 |

) |

|

|

(3,893,860 |

) |

| Selling, general and administrative |

|

|

(383,205 |

) |

|

|

(582,171 |

) |

| Research and development |

|

|

(199,572 |

) |

|

|

(206,239 |

) |

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

|

|

(4,024,518 |

) |

|

|

(4,682,270 |

) |

|

|

|

|

|

|

|

|

|

| Operating profit |

|

|

231,236 |

|

|

|

302,126 |

|

|

|

|

|

|

|

|

|

|

| Share of profit of investments accounted for using the equity method |

|

|

60,337 |

|

|

|

23,871 |

|

| Finance income and finance costs: |

|

|

|

|

|

|

|

|

| Interest income |

|

|

15,893 |

|

|

|

44,990 |

|

| Interest expense |

|

|

(8,223 |

) |

|

|

(10,853 |

) |

| Other, net |

|

|

(20,816 |

) |

|

|

4,227 |

|

|

|

|

|

|

|

|

|

|

| Total finance income and finance costs |

|

|

(13,146 |

) |

|

|

38,364 |

|

|

|

|

|

|

|

|

|

|

| Profit before income taxes |

|

|

278,427 |

|

|

|

364,361 |

|

| Income tax expense |

|

|

(73,268 |

) |

|

|

(93,381 |

) |

|

|

|

|

|

|

|

|

|

| Profit for the period |

|

|

205,159 |

|

|

|

270,980 |

|

|

|

|

|

|

|

|

|

|

| Profit for the period attributable to: |

|

|

|

|

|

|

|

|

| Owners of the parent |

|

|

189,295 |

|

|

|

253,232 |

|

| Non-controlling interests |

|

|

15,864 |

|

|

|

17,748 |

|

|

|

| |

|

Yen |

|

| Earnings per share attributable to owners of the parent |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

36.95 |

|

|

|

51.49 |

|

—5—

Condensed Consolidated Statements of Comprehensive Income

For the three months ended September 30, 2022 and 2023

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Three months ended

Sep. 30, 2022 |

|

|

Three months ended

Sep. 30, 2023 |

|

| Profit for the period |

|

|

205,159 |

|

|

|

270,980 |

|

| Other comprehensive income, net of tax: |

|

|

|

|

|

|

|

|

| Items that will not be reclassified to profit or loss |

|

|

|

|

|

|

|

|

| Remeasurements of defined benefit plans |

|

|

(8 |

) |

|

|

(2 |

) |

| Net changes in revaluation of financial assets measured at fair value through other comprehensive

income |

|

|

(40,167 |

) |

|

|

(14,956 |

) |

| Share of other comprehensive income of investments accounted for using the equity method |

|

|

(665 |

) |

|

|

2,455 |

|

| Items that may be reclassified subsequently to profit or loss |

|

|

|

|

|

|

|

|

| Net changes in revaluation of financial assets measured at fair value through other comprehensive

income |

|

|

(557 |

) |

|

|

(274 |

) |

| Exchange differences on translating foreign operations |

|

|

268,761 |

|

|

|

187,182 |

|

| Share of other comprehensive income of investments accounted for using the equity method |

|

|

22,592 |

|

|

|

28,084 |

|

|

|

|

|

|

|

|

|

|

| Total other comprehensive income, net of tax |

|

|

249,956 |

|

|

|

202,489 |

|

|

|

|

|

|

|

|

|

|

| Comprehensive income for the period |

|

|

455,115 |

|

|

|

473,469 |

|

|

|

|

|

|

|

|

|

|

| Comprehensive income for the period attributable to: |

|

|

|

|

|

|

|

|

| Owners of the parent |

|

|

435,831 |

|

|

|

452,049 |

|

| Non-controlling interests |

|

|

19,284 |

|

|

|

21,420 |

|

—6—

[3] Condensed Consolidated Statements of Changes in Equity

For the six months ended September 30, 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Equity attributable to owners of the parent |

|

|

Non-controlling

interests |

|

|

Total

equity |

|

| |

|

Common

stock |

|

|

Capital

surplus |

|

|

Treasury

stock |

|

|

Retained

earnings |

|

|

Other

components

of equity |

|

|

Total |

|

| Balance as of April 1, 2022 |

|

|

86,067 |

|

|

|

185,495 |

|

|

|

(328,309 |

) |

|

|

9,539,133 |

|

|

|

990,438 |

|

|

|

10,472,824 |

|

|

|

299,722 |

|

|

|

10,772,546 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

338,514 |

|

|

|

|

|

|

|

338,514 |

|

|

|

30,225 |

|

|

|

368,739 |

|

| Other comprehensive income, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

938,367 |

|

|

|

938,367 |

|

|

|

18,740 |

|

|

|

957,107 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

338,514 |

|

|

|

938,367 |

|

|

|

1,276,881 |

|

|

|

48,965 |

|

|

|

1,325,846 |

|

| Reclassification to retained earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(45 |

) |

|

|

45 |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

| Transactions with owners and other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(111,256 |

) |

|

|

|

|

|

|

(111,256 |

) |

|

|

(47,493 |

) |

|

|

(158,749 |

) |

| Purchases of treasury stock |

|

|

|

|

|

|

|

|

|

|

(29,004 |

) |

|

|

|

|

|

|

|

|

|

|

(29,004 |

) |

|

|

|

|

|

|

(29,004 |

) |

| Disposal of treasury stock |

|

|

|

|

|

|

|

|

|

|

263 |

|

|

|

|

|

|

|

|

|

|

|

263 |

|

|

|

|

|

|

|

263 |

|

| Share-based payment transactions |

|

|

|

|

|

|

(42 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(42 |

) |

|

|

|

|

|

|

(42 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total transactions with owners and other |

|

|

|

|

|

|

(42 |

) |

|

|

(28,741 |

) |

|

|

(111,256 |

) |

|

|

|

|

|

|

(140,039 |

) |

|

|

(47,493 |

) |

|

|

(187,532 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of September 30, 2022 |

|

|

86,067 |

|

|

|

185,453 |

|

|

|

(357,050 |

) |

|

|

9,766,346 |

|

|

|

1,928,850 |

|

|

|

11,609,666 |

|

|

|

301,194 |

|

|

|

11,910,860 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the six months ended September 30, 2023 |

|

|

|

| |

|

Yen (millions) |

|

| |

|

Equity attributable to owners of the parent |

|

|

Non-controlling

interests |

|

|

Total

equity |

|

| |

|

Common

stock |

|

|

Capital

surplus |

|

|

Treasury

stock |

|

|

Retained

earnings |

|

|

Other

components

of equity |

|

|

Total |

|

| Balance as of April 1, 2023 |

|

|

86,067 |

|

|

|

185,589 |

|

|

|

(484,931 |

) |

|

|

9,980,128 |

|

|

|

1,417,397 |

|

|

|

11,184,250 |

|

|

|

318,041 |

|

|

|

11,502,291 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

616,301 |

|

|

|

|

|

|

|

616,301 |

|

|

|

37,624 |

|

|

|

653,925 |

|

| Other comprehensive income, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

808,285 |

|

|

|

808,285 |

|

|

|

17,682 |

|

|

|

825,967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

616,301 |

|

|

|

808,285 |

|

|

|

1,424,586 |

|

|

|

55,306 |

|

|

|

1,479,892 |

|

| Reclassification to retained earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

375 |

|

|

|

(375 |

) |

|

|

— |

|

|

|

|

|

|

|

— |

|

| Transactions with owners and other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(99,915 |

) |

|

|

|

|

|

|

(99,915 |

) |

|

|

(59,549 |

) |

|

|

(159,464 |

) |

| Purchases of treasury stock |

|

|

|

|

|

|

|

|

|

|

(145,009 |

) |

|

|

|

|

|

|

|

|

|

|

(145,009 |

) |

|

|

|

|

|

|

(145,009 |

) |

| Disposal of treasury stock |

|

|

|

|

|

|

|

|

|

|

394 |

|

|

|

|

|

|

|

|

|

|

|

394 |

|

|

|

|

|

|

|

394 |

|

| Share-based payment transactions |

|

|

|

|

|

|

(131 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(131 |

) |

|

|

|

|

|

|

(131 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total transactions with owners and other |

|

|

|

|

|

|

(131 |

) |

|

|

(144,615 |

) |

|

|

(99,915 |

) |

|

|

|

|

|

|

(244,661 |

) |

|

|

(59,549 |

) |

|

|

(304,210 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of September 30, 2023 |

|

|

86,067 |

|

|

|

185,458 |

|

|

|

(629,546 |

) |

|

|

10,496,889 |

|

|

|

2,225,307 |

|

|

|

12,364,175 |

|

|

|

313,798 |

|

|

|

12,677,973 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—7—

[4] Condensed Consolidated Statements of Cash Flows

For the six months ended September 30, 2022 and 2023

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Six months ended

Sep. 30, 2022 |

|

|

Six months ended

Sep. 30, 2023 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Profit before income taxes |

|

|

515,831 |

|

|

|

879,285 |

|

| Depreciation, amortization and impairment losses excluding equipment on operating leases |

|

|

357,304 |

|

|

|

373,775 |

|

| Share of profit of investments accounted for using the equity method |

|

|

(82,946 |

) |

|

|

(66,724 |

) |

| Finance income and finance costs, net |

|

|

(69,589 |

) |

|

|

(92,349 |

) |

| Interest income and interest costs from financial services, net |

|

|

(75,593 |

) |

|

|

(75,284 |

) |

| Changes in assets and liabilities |

|

|

|

|

|

|

|

|

| Trade receivables |

|

|

32,586 |

|

|

|

24,114 |

|

| Inventories |

|

|

(129,729 |

) |

|

|

(905 |

) |

| Trade payables |

|

|

(49,839 |

) |

|

|

(69,898 |

) |

| Accrued expenses |

|

|

(62,296 |

) |

|

|

(16,454 |

) |

| Provisions and retirement benefit liabilities |

|

|

(8,720 |

) |

|

|

65,507 |

|

| Receivables from financial services |

|

|

302,319 |

|

|

|

(728,165 |

) |

| Equipment on operating leases |

|

|

493,778 |

|

|

|

95,596 |

|

| Other assets and liabilities |

|

|

165,071 |

|

|

|

6,255 |

|

| Other, net |

|

|

1,465 |

|

|

|

(44,023 |

) |

| Dividends received |

|

|

131,572 |

|

|

|

126,630 |

|

| Interest received |

|

|

143,741 |

|

|

|

255,998 |

|

| Interest paid |

|

|

(68,304 |

) |

|

|

(110,717 |

) |

| Income taxes paid, net of refunds |

|

|

(255,317 |

) |

|

|

(242,689 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

1,341,334 |

|

|

|

379,952 |

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Payments for additions to property, plant and equipment |

|

|

(249,421 |

) |

|

|

(141,404 |

) |

| Payments for additions to and internally developed intangible assets |

|

|

(76,441 |

) |

|

|

(97,504 |

) |

| Proceeds from sales of property, plant and equipment and intangible assets |

|

|

13,623 |

|

|

|

4,239 |

|

| Proceeds from sales of subsidiaries, net of cash and cash equivalents disposed of |

|

|

— |

|

|

|

(2,940 |

) |

| Payments for acquisitions of investments accounted for using the equity method |

|

|

(10,340 |

) |

|

|

(38,734 |

) |

| Payments for acquisitions of other financial assets |

|

|

(322,025 |

) |

|

|

(118,990 |

) |

| Proceeds from sales and redemptions of other financial assets |

|

|

215,952 |

|

|

|

106,207 |

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(428,652 |

) |

|

|

(289,126 |

) |

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Proceeds from short-term financing liabilities |

|

|

4,219,027 |

|

|

|

6,065,976 |

|

| Repayments of short-term financing liabilities |

|

|

(4,152,744 |

) |

|

|

(5,805,967 |

) |

| Proceeds from long-term financing liabilities |

|

|

362,289 |

|

|

|

1,498,319 |

|

| Repayments of long-term financing liabilities |

|

|

(1,165,699 |

) |

|

|

(1,185,750 |

) |

| Dividends paid to owners of the parent |

|

|

(111,256 |

) |

|

|

(99,915 |

) |

| Dividends paid to non-controlling interests |

|

|

(36,752 |

) |

|

|

(45,228 |

) |

| Purchases and sales of treasury stock, net |

|

|

(28,741 |

) |

|

|

(144,615 |

) |

| Repayments of lease liabilities |

|

|

(38,890 |

) |

|

|

(39,773 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) financing activities |

|

|

(952,766 |

) |

|

|

243,047 |

|

| Effect of exchange rate changes on cash and cash equivalents |

|

|

300,501 |

|

|

|

303,626 |

|

|

|

|

|

|

|

|

|

|

| Net change in cash and cash equivalents |

|

|

260,417 |

|

|

|

637,499 |

|

| Cash and cash equivalents at beginning of year |

|

|

3,674,931 |

|

|

|

3,803,014 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

|

3,935,348 |

|

|

|

4,440,513 |

|

|

|

|

|

|

|

|

|

|

—8—

[5] Assumptions for Going Concern

None

[6] Notes to Consolidated Financial Statements

[A] Segment Information

Based on Honda’s

organizational structure and characteristics of products and services, Honda discloses segment information in four categories: Reportable segments of Motorcycle business, Automobile business and Financial services business, and other segments that

are not reportable. The other segments are combined and disclosed in Power products and other businesses. Segment information is based on the components of Honda for which separate financial information is available that is evaluated regularly by

the chief operating decision maker in deciding how to allocate resources and in assessing performance. The accounting policies used for segment information are consistent with the accounting policies used in the Company’s condensed consolidated

interim financial statements.

Principal products and services, and functions of each segment are as follows:

|

|

|

|

|

| Segment |

|

Principal products and services |

|

Functions |

| Motorcycle Business |

|

Motorcycles, all-terrain vehicles (ATVs), side-by-sides (SxS) and relevant parts |

|

Research and development Manufacturing

Sales and related services |

|

|

|

| Automobile Business |

|

Automobiles and relevant parts |

|

Research and development Manufacturing

Sales and related services |

|

|

|

| Financial Services Business |

|

Financial services |

|

Retail loan and lease related to Honda products

Others |

|

|

|

| Power Products and Other Businesses |

|

Power products and relevant parts, and others |

|

Research and development Manufacturing

Sales and related services Others |

Segment information based on products and services

As of and for the six months ended September 30, 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Motorcycle

Business |

|

|

Automobile

Business |

|

|

Financial

Services

Business |

|

|

Power Products

and

Other

Businesses |

|

|

Segment

Total |

|

|

Reconciling

Items |

|

|

Consolidated |

|

| Sales revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External customers |

|

|

1,412,682 |

|

|

|

4,920,192 |

|

|

|

1,527,915 |

|

|

|

224,515 |

|

|

|

8,085,304 |

|

|

|

— |

|

|

|

8,085,304 |

|

| Intersegment |

|

|

— |

|

|

|

83,742 |

|

|

|

1,181 |

|

|

|

11,575 |

|

|

|

96,498 |

|

|

|

(96,498 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

1,412,682 |

|

|

|

5,003,934 |

|

|

|

1,529,096 |

|

|

|

236,090 |

|

|

|

8,181,802 |

|

|

|

(96,498 |

) |

|

|

8,085,304 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss) |

|

|

224,775 |

|

|

|

63,568 |

|

|

|

153,049 |

|

|

|

12,060 |

|

|

|

453,452 |

|

|

|

— |

|

|

|

453,452 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment assets |

|

|

1,614,071 |

|

|

|

10,241,643 |

|

|

|

12,041,882 |

|

|

|

469,044 |

|

|

|

24,366,640 |

|

|

|

1,461,253 |

|

|

|

25,827,893 |

|

| Depreciation and amortization |

|

|

33,600 |

|

|

|

282,801 |

|

|

|

465,827 |

|

|

|

9,615 |

|

|

|

791,843 |

|

|

|

— |

|

|

|

791,843 |

|

| Capital expenditures |

|

|

20,451 |

|

|

|

304,206 |

|

|

|

712,321 |

|

|

|

5,779 |

|

|

|

1,042,757 |

|

|

|

— |

|

|

|

1,042,757 |

|

|

| As of and for the six months ended September 30, 2023 |

|

|

|

| |

|

Yen (millions) |

|

| |

|

Motorcycle

Business |

|

|

Automobile

Business |

|

|

Financial

Services

Business |

|

|

Power Products

and

Other

Businesses |

|

|

Segment

Total |

|

|

Reconciling

Items |

|

|

Consolidated |

|

| Sales revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External customers |

|

|

1,572,558 |

|

|

|

6,262,289 |

|

|

|

1,576,608 |

|

|

|

197,937 |

|

|

|

9,609,392 |

|

|

|

— |

|

|

|

9,609,392 |

|

| Intersegment |

|

|

— |

|

|

|

84,816 |

|

|

|

1,256 |

|

|

|

16,387 |

|

|

|

102,459 |

|

|

|

(102,459 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

1,572,558 |

|

|

|

6,347,105 |

|

|

|

1,577,864 |

|

|

|

214,324 |

|

|

|

9,711,851 |

|

|

|

(102,459 |

) |

|

|

9,609,392 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss) |

|

|

253,384 |

|

|

|

301,380 |

|

|

|

137,002 |

|

|

|

4,807 |

|

|

|

696,573 |

|

|

|

— |

|

|

|

696,573 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment assets |

|

|

1,803,540 |

|

|

|

10,962,398 |

|

|

|

12,977,324 |

|

|

|

511,240 |

|

|

|

26,254,502 |

|

|

|

1,422,101 |

|

|

|

27,676,603 |

|

| Depreciation and amortization |

|

|

34,486 |

|

|

|

328,359 |

|

|

|

415,578 |

|

|

|

8,592 |

|

|

|

787,015 |

|

|

|

— |

|

|

|

787,015 |

|

| Capital expenditures |

|

|

26,781 |

|

|

|

233,741 |

|

|

|

1,115,856 |

|

|

|

6,036 |

|

|

|

1,382,414 |

|

|

|

— |

|

|

|

1,382,414 |

|

—9—

For the three months ended September 30, 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Motorcycle

Business |

|

|

Automobile

Business |

|

|

Financial

Services

Business |

|

|

Power Products

and

Other

Businesses |

|

|

Segment

Total |

|

|

Reconciling

Items |

|

|

Consolidated |

|

| Sales revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External customers |

|

|

736,632 |

|

|

|

2,628,707 |

|

|

|

778,531 |

|

|

|

111,884 |

|

|

|

4,255,754 |

|

|

|

— |

|

|

|

4,255,754 |

|

| Intersegment |

|

|

— |

|

|

|

47,056 |

|

|

|

502 |

|

|

|

5,169 |

|

|

|

52,727 |

|

|

|

(52,727 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

736,632 |

|

|

|

2,675,763 |

|

|

|

779,033 |

|

|

|

117,053 |

|

|

|

4,308,481 |

|

|

|

(52,727 |

) |

|

|

4,255,754 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss) |

|

|

126,946 |

|

|

|

25,306 |

|

|

|

74,248 |

|

|

|

4,736 |

|

|

|

231,236 |

|

|

|

— |

|

|

|

231,236 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the three months ended September 30, 2023 |

|

|

|

| |

|

Yen (millions) |

|

| |

|

Motorcycle

Business |

|

|

Automobile

Business |

|

|

Financial

Services

Business |

|

|

Power Products

and

Other

Businesses |

|

|

Segment

Total |

|

|

Reconciling

Items |

|

|

Consolidated |

|

| Sales revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External customers |

|

|

815,603 |

|

|

|

3,269,950 |

|

|

|

803,579 |

|

|

|

95,264 |

|

|

|

4,984,396 |

|

|

|

— |

|

|

|

4,984,396 |

|

| Intersegment |

|

|

— |

|

|

|

45,807 |

|

|

|

627 |

|

|

|

9,865 |

|

|

|

56,299 |

|

|

|

(56,299 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

815,603 |

|

|

|

3,315,757 |

|

|

|

804,206 |

|

|

|

105,129 |

|

|

|

5,040,695 |

|

|

|

(56,299 |

) |

|

|

4,984,396 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss) |

|

|

109,864 |

|

|

|

124,398 |

|

|

|

67,474 |

|

|

|

390 |

|

|

|

302,126 |

|

|

|

— |

|

|

|

302,126 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Explanatory notes:

| 1. |

Intersegment sales revenues are generally made at values that approximate arm’s-length prices.

|

| 2. |

Reconciling items include elimination of intersegment transactions and balances as well as unallocated corporate

assets. Unallocated corporate assets, included in reconciling items as of September 30, 2022 and 2023 amounted to JPY 1,569,670 million and JPY 1,605,913 million, respectively, which consist primarily of the Company’s cash and cash equivalents

and financial assets measured at fair value through other comprehensive income. |

—10—

[B] Subsequent Event

The Board of Directors of the Company, at its meeting held on August 9, 2023, resolved that the Company will implement a stock split, and accordingly, change

in ratio of American Depositary Receipts (ADRs) to underlying shares and modify acquisition of own shares program. Based on the resolution, the Company implemented a stock split and accordingly, change in ratio of American Depositary Receipts (ADRs)

on October 1, 2023.

| |

(1) |

Purpose of the stock split |

The purpose is to expand the investor base by reducing the Company’s stock price per investment unit.

| |

(2) |

Method of the stock split |

Each share of common stock owned by shareholders listed or recorded in the closing register of shareholders on the record date of September 30,

2023 (Due to non-working day of the shareholder registry administrator on the same day, the substantial record date was September 29, 2023) was split into 3 shares per share.

| |

(3) |

Number of shares increased by the stock split |

|

|

|

|

|

|

|

|

|

1. Total number of issued shares before the stock split: |

|

1,811,428,430 shares |

|

|

|

|

2. Number of shares increased by the stock split: |

|

3,622,856,860 shares |

|

|

|

|

3. Total number of issued shares following the stock split: |

|

5,434,285,290 shares |

|

|

|

|

4. Total number of authorized shares following the stock split: |

|

7,086,000,000 shares |

|

|

| |

(4) |

Schedule of the stock split |

|

|

|

|

|

|

|

|

|

Public notice of record date: |

|

September 15, 2023 |

|

|

|

|

Record date: |

|

September 30, 2023 |

|

|

|

|

Effective date: |

|

October 1, 2023 |

|

|

| |

• |

|

There is no change in the amount of stated capital as a result of this stock split. |

| |

• |

|

As the stock split took effect on October 1, 2023, the interim dividend for the fiscal year ending March 31, 2024

which has a dividend record date of September 30, 2023 will be paid based on the shares before the stock split. |

| 2. |

Change in ratio of American Depositary Receipts (ADRs) to underlying shares |

| |

(1) |

Purpose of the ratio change |

The purpose is to continuously offer the current investment environment for ADR holders by maintaining present level of ADRs trading price.

| |

(2) |

Outline of the change of ratio |

|

|

|

|

|

|

|

|

|

Ratio before change: |

|

1 ADR = 1 Share |

|

|

|

|

Ratio after change: |

|

1 ADR = 3 Shares |

|

|

|

|

Effective date of the new ratio: |

|

October 1, 2023 (EST) |

|

|

|

|

First trading date with new ratio: |

|

October 2, 2023 (EST) |

|

|

| 3. |

Modification to acquisition of own shares program |

| |

(1) |

Reason for the modification |

In the details of acquisition of the Company’s own shares resolved at the meeting of the Board of Directors held on May 11, 2023,

“total number of shares to be acquired” shall be modified in connection with the stock split.

—11—

| |

(2) |

Details of the modification |

|

|

|

|

|

|

|

|

|

Current Program: |

|

Total number of shares to be acquired: Up to 64,000,000 shares |

|

|

|

|

Amended Program: |

|

Total number of shares to be acquired: Up to 192,000,000 shares |

|

|

(Reference)

Details of the resolution concerning acquisition of the Company’s own shares at the meeting of the Board of Directors held on May 11, 2023

| |

(1) |

Class of shares to be acquired: |

Shares of common stock

| |

(2) |

Total number of shares to be acquired: |

Up to 64,000,000 shares (3.8 % of the total number of issued shares (excluding treasury stock))

| |

(3) |

Total amount of shares to be acquired: |

Up to 200,000 million yen

| |

(4) |

Period of acquisition: |

Starting on May 12, 2023 and ending on March 31, 2024

| |

(5) |

Method of acquisition: |

Market purchases on the Tokyo Stock Exchange

| |

1. |

Purchases through the Tokyo Stock Exchange Trading Network Off-Auction Own Share Repurchase Trading System

(ToSTNeT-3) |

| |

2. |

Market purchases based on a discretionary trading contract regarding acquisition of own shares

|

| 4. |

Impact on earnings per share |

Basic earnings per share attributable to owners of the parent for the six months ended September 30, 2022 and 2023 assuming the stock split had

been conducted at the beginning of the year ended March 31, 2023 are as follows. There were no significant dilutive potential common shares outstanding for the six months ended September 30, 2022 and 2023.

|

|

|

|

|

|

|

|

|

| |

|

Six months ended

Sep. 30, 2022 |

|

|

Six months ended

Sep. 30, 2023 |

|

| Basic earnings per share attributable to owners of the parent (yen) |

|

|

66.03 |

|

|

|

124.63 |

|

Basic earnings per share attributable to owners of the parent for the three months ended September 30,

2022 and 2023 assuming the stock split had been conducted at the beginning of the year ended March 31, 2023 are as follows. There were no significant dilutive potential common shares outstanding for the three months ended September 30, 2022 and

2023.

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

Sep. 30, 2022 |

|

|

Three months ended

Sep. 30, 2023 |

|

| Basic earnings per share attributable to owners of the parent (yen) |

|

|

36.95 |

|

|

|

51.49 |

|

[C] Other

Loss

related to airbag inflators

Honda has been conducting market-based measures in relation to airbag inflators. Honda recognizes a provision for specific

warranty costs when it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation, and a reliable estimate can be made of the amount of the obligation. There is a possibility that Honda will need

to recognize additional provisions when new evidence related to the product recalls arise, however, it is not possible for Honda to reasonably estimate the amount and timing of potential future losses as of the date of this report.

—12—

[7] Forecast for the Fiscal Year Ending March 31, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Yen (billions) |

|

|

|

|

| |

|

FY 2023 results |

|

|

FY 2024 forecasts |

|

|

Change (%) |

|

| Sales revenue |

|

|

16,907.7 |

|

|

|

20,000.0 |

|

|

|

18.3 |

|

| Operating profit |

|

|

780.7 |

|

|

|

1,200.0 |

|

|

|

53.7 |

|

| Profit before income taxes |

|

|

879.5 |

|

|

|

1,395.0 |

|

|

|

58.6 |

|

| Profit for the year |

|

|

717.3 |

|

|

|

1,000.0 |

|

|

|

39.4 |

|

| Profit for the year attributable to owners of the parent |

|

|

651.4 |

|

|

|

930.0 |

|

|

|

42.8 |

|

|

|

|

| |

|

Yen |

|

|

|

|

| |

|

FY 2023 results |

|

|

FY 2024 forecasts |

|

|

|

|

| Earnings per share attributable to owners of the parent Basic and diluted |

|

|

384.02 |

|

|

|

189.64 |

|

|

|

|

|

Explanatory note:

As of the effective date of October 1, 2023, the Company implemented a three-for-one stock split of its common stock to shareholders as of the

record date of September 30, 2023. Basic earnings per share for the fiscal year ending March 31, 2024 are based on the number of shares after the stock split. Based on the number of shares prior to the stock split, basic earnings per share for the

fiscal year ending March 31, 2024 are expected to be JPY 568.92.

[8] Dividend per Share of Common Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Yen |

|

| |

|

FY 2023 results |

|

|

FY 2024 results |

|

|

FY 2024 forecasts |

|

| Interim dividend |

|

|

60.00 |

|

|

|

87.00 |

|

|

|

|

|

| Year-end dividend |

|

|

60.00 |

|

|

|

|

|

|

|

29.00 |

|

| Total annual dividend |

|

|

120.00 |

|

|

|

|

|

|

|

— |

|

Explanatory note:

As of the effective date of October 1, 2023, the Company implemented a three-for-one stock split of its common stock to shareholders as of the

record date of September 30, 2023. The year-end dividend per share for the fiscal year ending March 31, 2024 is based on the number of shares after the stock split and the total annual dividend is disclosed as “ – ”. Based on the

number of shares prior to the stock split, the year-end dividend and the total annual dividend for the fiscal year ending March 31, 2024 are expected to be JPY 87.00 per share and JPY 174.00 per share, respectively.

This announcement contains “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Such statements are based on management’s assumptions and beliefs taking into account information currently available to it. Therefore, please be advised that the actual results of the Company could

differ materially from those described in these forward-looking statements as a result of numerous factors, including general economic conditions in the principal markets of the Company, its consolidated subsidiaries and its affiliates accounted for

by the equity-method, and fluctuation of foreign exchange rates, as well as other factors detailed from time to time. The various factors for increases and decreases in profit have been classified in accordance with a method that Honda considers

reasonable.

—13—

[Translation]

November 9, 2023

| To: |

Shareholders of Honda Motor Co., Ltd. |

| From: |

Honda Motor Co., Ltd. |

1-1, Minami-Aoyama 2-chome,

Minato-ku, Tokyo, 107-8556

Toshihiro Mibe

Director,

President and Representative Executive Officer

Notice of Resolution by the Board of Directors

Concerning Distribution of Surplus (Interim Dividend)

and Revision of Dividend Forecast for the Fiscal Year Ending March 31, 2024

The Board of Directors of Honda Motor Co., Ltd. (the “Company”), at its meeting held on November 9, 2023, resolved to make a distribution of

surplus (Interim dividend), the record date of which is September 30, 2023, and revised the amount of the projected dividend per share of common stock for the year ending March 31, 2024 as follows:

Particulars

1. Details of Distribution

of Surplus (Interim Dividend)

|

|

|

|

|

|

|

| |

|

Resolution |

|

Previous Dividends

Forecast

(Announced on

August 9, 2023) |

|

Dividends Paid for the

Second Quarter in

Fiscal 2023 |

| Record Date |

|

September 30, 2023 |

|

September 30, 2023 |

|

September 30, 2022 |

| Dividends per Share of Common Stock (yen) |

|

87 |

|

75 |

|

60 |

| Total Amount of Dividends (million yen) |

|

141,949 |

|

— |

|

102,219 |

| Effective Date |

|

December 5, 2023 |

|

— |

|

December 5, 2022 |

| Source of Funds for Dividends |

|

Retained Earnings |

|

— |

|

Retained Earnings |

2. Details of the Revised Dividend Payments

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Annual Dividend per share(yen) |

|

| |

|

Interim

(End of

2nd quarter) |

|

|

Year-end |

|

|

Total |

|

| Previous forecast

(Conversion to the pre-split basis)

<Announced on August 9, 2023> |

|

|

75 |

|

|

|

25

(75 |

) |

|

|

—

(150 |

) |

| Revised forecast

(Conversion to the pre-split basis) |

|

|

— |

|

|

|

29

(87 |

) |

|

|

—

(174 |

) |

| Actual dividend issued |

|

|

87 |

|

|

|

— |

|

|

|

— |

|

| Results in the year ended March 31, 2023 |

|

|

60 |

|

|

|

60 |

|

|

|

120 |

|

(Notes)

| 1. |

The company implemented the stock split into 3 shares per share with the effective date of October 1, 2023. The

interim dividend for the fiscal year ending March 31, 2024, which has a dividend record date of September 30, 2023, is paid based on the shares before the stock split. |

| 2. |

Forecast for the full-year dividend per share is not presented because simple comparisons are not possible due

to the implementation of the stock split. However, the forecast for the full-year dividend per share based on the pre-stock split is ¥24 increase per share. |

3. Basis of the Distribution of Surplus

The Company considers

the redistribution of profits to its shareholders to be one of its most important management issues, and makes distributions after taking into account, among others, its retained earnings for future growth and consolidated earnings performance based

on a long-term perspective. The Company resolved that interim dividend payment of ¥87 per share of common stock is to be paid considering its forecast for consolidated financial results for the fiscal year ending March 31, 2024. The Company

also revised the amount of the projected dividend per share of common stock for the year ending March 31, 2024 that was announced on August 9, 2023.

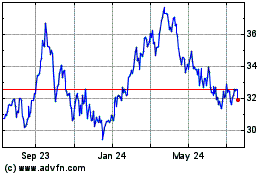

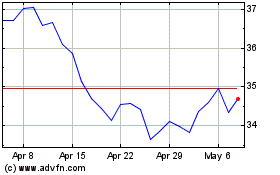

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024