0001746466false00017464662023-11-062023-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): November 6, 2023

EQUILLIUM, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

001-38692 |

82-1554746 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

2223 Avenida de la Playa, Suite 105, La Jolla, CA |

|

92037 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (858) 412-5302

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.0001 per share |

|

EQ |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 8, 2023, Equillium, Inc. (the “Company”) announced its financial results for the third quarter ended September 30, 2023 in the press release attached hereto as Exhibit 99.2 and incorporated herein by reference.

The information in this Item 2.02 of this Current Report on 8-K, including Exhibit 99.2, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information shall not be deemed incorporated by reference into any other filing with the Securities and Exchange Commission made by the Company, whether made before or after today’s date, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific references in such filing.

Item 8.01 Other Events.

On November 6, 2023, the Company issued a press release announcing data from its Phase 1b EQUALISE study. The full text of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirement of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

EQUILLIUM, INC.

|

|

Date: November 8, 2023 |

By: /s/ Bruce D. Steel |

|

Bruce D. Steel |

|

President and Chief Executive Officer |

Exhibit 99.1

Equillium Announces Data from Phase 1b EQUALISE Study Presented at the 2023 Annual Meeting of the American Society of Nephrology

Itolizumab continues to show clinically meaningful response in highly proteinuric subjects

At Week 28, 73% of subjects achieved >50% reduction in urine protein creatinine ratio (UPCR)

Itolizumab demonstrated a favorable safety and tolerability profile

LA JOLLA, California, November 6, 2023 - Equillium, Inc. (Nasdaq: EQ), a clinical-stage biotechnology company focused on developing novel therapeutics to treat severe autoimmune and inflammatory disorders, today announced that data from the Type B portion of the EQUALISE study in lupus nephritis patients was presented at the annual meeting of the American Society of Nephrology (ASN). The data highlights that subjects had high complete and partial response rates with rapid and deep reduction in urine protein creatinine ratio (UPCR) when itolizumab was added to mycophenolate mofetil (MMF) and corticosteroids.

“The presentation at ASN represents current data from the EQUALISE study, which includes all but the last patient in the follow up period,” said Bruce Steel, chief executive officer at Equillium. “We are encouraged that we continue to see clinically meaningful response rates, particularly in these highly proteinuric subjects. While the study is largely complete, we plan to deliver the full data package to Ono Pharmaceutical under the terms of our strategic partnership in early 2024.”

“I’m excited that we saw both early and deep reductions in proteinuria,” said Dr. Maple Fung, chief medical officer at Equillium. “Physicians are looking for a treatment that can safely and rapidly reduce the levels of proteinuria in patients, as this is historically associated with improved long-term outcomes. The data from the EQUALISE study demonstrates that subjects had high complete and partial response rates and tolerated well the subcutaneous injections every two weeks; this is in the setting of tapering their systemic corticosteroids, maintaining stable kidney function, or eGFR, and increasing serum albumin while on study.”

The Type B portion of the EQUALISE study in patients with active proliferative LN (apLN) is evaluating the safety, tolerability and clinical activity of subcutaneous delivery of itolizumab. Patients must present with greater than 1 gram of proteinuria and have a recent kidney biopsy showing ISN/RPS class III or IV apLN to be eligible for the study. During the 24-week treatment period, patients receive a subcutaneous dose of 1.6 mg/kg every two weeks, with follow up out to 36 weeks. Consistent with standard of care, patients on study also receive 2-3 g/day of mycophenolate mofetil/mycophenolic acid (MMF/MPA), and patients may receive pulse systemic corticosteroids that are rapidly tapered.

A total of 17 subjects have been enrolled in the study, with 15 subjects reaching Week 28 (4 weeks following the final dose, or the end of study (EOS)). Based on published guidelines for the management of lupus nephritis from the European League Against Rheumatism (EULAR) and European Renal Association-European Dialysis and Transplant Association (ERA-EDTA), clinical activity assessments in this study are focused on the change in UPCR from baseline; proportion of apLN subjects with a complete response (CR), defined as 50% or greater reduction in UPCR and less than 0.5-0.7 g/g; and proportion of subjects achieving a partial response (PR), defined as 50% or greater reduction in UPCR.

Exhibit 99.1

Key findings from analysis of the Type B portion of the EQUALISE study in lupus nephritis:

•Subjects were highly proteinuric: baseline mean UPCR of 4.9 g/g

•Percent reduction from baseline in median spot UPCR is ~73%

•Clinically meaningful responses were observed:

▪6 of 15 (40%) subjects achieved CR (UPCR < 0.7 g/g)

▪Additional 5 of 15 (33%) subjects achieved PR (UPCR > 50% reduction)

•There was a greater overall response rate (ORR) achieved in patients receiving itolizumab by 12 and 28 weeks than expected compared to the ORR in patients receiving standard of care alone using data generated from the Accelerating Medicines Partnership® (AMP) Lupus Network. Results are comparable to those observed in the Phase 3 AURORA1 study of voclosporin (ORR 70% at 6 and 12 months in active treatment).

•Consistent with the decline in UPCR overtime, subjects were able to taper their systemic corticosteroids over the course of the study.

•Itolizumab induced consistent pharmacodynamic responses in patients reducing the levels of cell surface CD6 on T cells, which is known to reduce T cell activity.

•Itolizumab treatment (over 6 months) was also associated with reductions in absolute lymphocyte counts (ALC), another known pharmacodynamic effect.

•As noted in other studies of drugs whose mechanism leads to reductions in ALC, such as the S1P modulators, the reduction in ALC observed here was not associated with increased rates of infection or other adverse clinical signals.

•77% of TEAEs were assessed as mild (Grade 1) or moderate (Grade 2) by the investigators. Two subjects had at least one serious adverse event.

The poster presentation is available on the Presentations page of Equillium’s website under the Lupus tab.

About Systemic Lupus Erythematosus (SLE) & Lupus Nephritis (LN)

SLE is an autoimmune disease in which the immune system attacks its own tissues, causing widespread inflammation and tissue damage in the affected organs. It can affect the joints, skin, brain, lungs, kidneys, and blood vessels. LN is a serious complication of SLE, occurring in approximately 30% – 60% of individuals with SLE. LN involves the body’s own immune system attacking the kidneys, causing inflammation and significantly reducing kidney function over time. LN is associated with an increase in mortality compared with the general population and may lead to end-stage renal disease.

About the EQUALISE Study

The EQUALISE study is a two-part Phase 1b open-label proof-of-concept study of itolizumab in patients with SLE and LN. The Type A portion of the study was a multiple ascending-dose clinical study evaluating the safety and tolerability of subcutaneous delivery of itolizumab over a two-week treatment period in 35 patients with SLE. The Type B portion of the study, is evaluating the safety, tolerability and clinical activity of subcutaneous delivery of itolizumab dosed at 1.6 mg/kg every two weeks over a 24-week treatment period in patients with active proliferative LN.

Exhibit 99.1

About Itolizumab

Itolizumab is a clinical-stage, first-in-class anti-CD6 monoclonal antibody that selectively targets the CD6-ALCAM signaling pathway to selectively downregulate pathogenic T effector cells while preserving T regulatory cells critical for maintaining a balanced immune response. This pathway plays a central role in modulating the activity and trafficking of T cells that drive a number of immuno-inflammatory diseases.

About Equillium

Equillium is a clinical-stage biotechnology company leveraging a deep understanding of immunobiology to develop novel therapeutics to treat severe autoimmune and inflammatory disorders with high unmet medical need. The company’s pipeline consists of the following novel first-in-class immunomodulatory assets targeting immuno-inflammatory pathways. EQ101: a tri-specific cytokine inhibitor that selectively targets IL-2, IL-9, and IL-15; currently under evaluation in a Phase 2 proof-of-concept clinical study of patients with alopecia areata. EQ102: a bi-specific cytokine inhibitor that selectively targets IL-15 and IL-21; currently under evaluation in a Phase 1 first-in-human clinical study to include healthy volunteers and celiac disease patients. EQ302: an orally-delivered, bi-specific inhibitor of IL-15 and IL-21; currently in preclinical development. Itolizumab: a monoclonal antibody that targets the CD6-ALCAM signaling pathway which plays a central role in the modulation of effector T cells; currently under evaluation in a Phase 3 clinical study of patients with acute graft-versus-host disease (aGVHD) and a Phase 1b clinical study of patients with lupus/lupus nephritis. Equillium acquired rights to itolizumab through an exclusive partnership with Biocon Limited and has entered a strategic partnership with Ono Pharmaceutical Co., Ltd. for the development and commercialization of itolizumab under an option and asset purchase agreement.

For more information, visit www.equilliumbio.com.

Forward Looking Statements

Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate”, “believe”, “could”, “continue”, “expect”, “estimate”, “may”, “plan”, “outlook”, “future” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements include, but are not limited to, statements regarding Equillium’s plan to deliver full data package from its EQUALISE study to Ono Pharmaceuticals in early 2024, the potential benefits of itolizumab as a treatment for SLE and LN; and other statements regarding management’s intentions, plans, beliefs or expectations for the future. Because such statements are subject to risks and uncertainties, many of which are outside of Equillium’s control, actual results may differ materially from those expressed or implied by such forward-looking statements. Risks that contribute to the uncertain nature of the forward-looking statements include: Equillium’s ability to execute its plans and strategies; risks related to performing clinical and pre-clinical studies; whether the results from clinical and pre-clinical studies will validate and support the safety and efficacy of Equillium’s product candidates; the risk that interim results of a clinical study do not necessarily predict final results and that one or more of the clinical outcomes may materially change as patient enrollment continues, following more comprehensive reviews of the data, and as more patient data become available; potential delays in the commencement, enrollment and completion of clinical studies and the reporting of data therefrom; the

Exhibit 99.1

risk that studies will not be completed as planned; Equillium’s plans and product development, including the initiation and completion of clinical studies and the reporting of data therefrom; changes in the competitive landscape; and uncertainties related to Equillium’s capital requirements. These and other risks and uncertainties are described more fully under the caption "Risk Factors" and elsewhere in Equillium's filings and reports, which may be accessed for free by visiting the Securities and Exchange Commission’s website at www.sec.gov and on Equillium’s website under the heading “Investors.” Investors should take such risks into account and should not rely on forward-looking statements when making investment decisions. All forward-looking statements contained in this press release speak only as of the date on which they were made. Equillium undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

Investor Contact

Michael Moore

Vice President, Investor Relations & Corporate Communications

619-302-4431

ir@equilliumbio.com

Exhibit 99.2

Equillium Reports Third Quarter 2023 Financial Results and Provides Corporate and Clinical Updates

$46.3 million in cash at the end of Q3 2023 expected to provide operating runway into 2025

$1.9 million of cash used in operating activities in Q3 2023

LA JOLLA, California, November 8, 2023 – Equillium, Inc. (Nasdaq: EQ), a clinical-stage biotechnology company leveraging a deep understanding of immunobiology to develop novel therapeutics to treat severe autoimmune and inflammatory disorders, today announced financial results for the third quarter 2023 and provided corporate and clinical development updates.

“The third quarter was focused on clinical execution and expanding education on our multi-cytokine platform and clinical programs ahead of initial data expected later this year,” said Bruce Steel, chief executive officer at Equillium. “We have completed enrollment in the Phase 1b EQUALISE study of itolizumab in patients with lupus nephritis and presented current data from that study at the annual meeting of the American Society of Nephrology earlier this month. We plan to provide the topline data to Ono in early 2024, which along with the interim review of the Phase 3 EQUATOR study in acute graft-versus-host disease, expected in 2024, comprise the data deliverables that will trigger Ono’s option decision. If Ono exercises its option, it would result in a payment of approximately $331 million and significantly extend Equillium’s cash runway. We also recently completed enrollment of the Phase 2 study of EQ101 in alopecia areata and expect to announce initial data from that study, as well as data from the SAD/MAD portion of the Phase 1 study of EQ102 before the end of the year. We believe Equillium is well positioned to create shareholder value with near-term milestones and a strong balance sheet that we expect to provide cash runway into 2025.”

Highlights Since Beginning of Third Quarter:

•Hosted an Analyst & Investor Day featuring Arash Mostaghimi, MD, MPA, MPH, associate professor of dermatology at Harvard Medical School, that highlighted Equillium’s pipeline, the multi-cytokine platform and clinical-stage multi-cytokine inhibitors, with a focus on EQ101, currently in a Phase 2 clinical trial for moderate to severe alopecia areata that is now fully-enrolled.

•Announced a presentation at the 18th Annual Peptide Therapeutics Symposium highlighting EQ302, a second generation orally deliverable multi-cytokine inhibitor in development to target IL-15 and IL-21. The presentation outlined the origins of EQ302 from its parent peptide, EQ102, and data illustrating that adding hydrocarbon staples to a peptide can confer increased stability in the gastrointestinal tract while retaining its cytokine inhibitory properties.

•Announced abstracts accepted for poster presentation at the annual meetings of the American Society of Nephrology (ASN) and the American College of Rheumatology (ACR). The abstracts highlight data from 17 Type B subjects in the Phase 1b EQUALISE study in highly proteinuric lupus nephritis patients that demonstrated that subjects had high complete and partial response rates

1 Option exercise payment is denominated in Japanese yen (5 billion) and subject to currency exchange rates at the time of payment.

with rapid and deep reduction in urine protein creatinine ratio (UPCR) when itolizumab was added to mycophenolate mofetil and corticosteroids.

Anticipated Upcoming Milestones:

•EQ101: Phase 2 clinical study in subjects with alopecia areata – initial data anticipated in Q4 2023, topline data anticipated in mid-2024

•EQ102: Phase 1 first-in-human study in healthy volunteers and subjects with celiac disease – single ascending dose (SAD)/multiple ascending dose (MAD) data anticipated in Q4 2023, celiac disease patient data anticipated in 2024

•Itolizumab: EQUALISE lupus nephritis topline data anticipated to be delivered to Ono in early 2024, EQUATOR acute graft-versus-host disease (aGVHD) interim review anticipated in 2024

Third Quarter 2023 Financial Results

Revenue for the third quarter of 2023 was $8.9 million, which was derived from itolizumab development funding from Ono Pharmaceutical Co, Ltd. (Ono) and amortization of the upfront payment from Ono.

Research and development (R&D) expenses for the third quarter of 2023 were $9.0 million, compared with $8.8 million for the same period in 2022. The increase was primarily due to greater clinical development expenses driven by the EQUATOR, EQ101, and EQ102 clinical studies partially offset by lower costs for our other itolizumab (EQ001) studies, and further offset by a greater estimated Australian R&D tax incentive benefit, a decrease in non-clinical research expenses, and a decrease in employee compensation and benefits.

General and administrative (G&A) expenses for the third quarter of 2023 were $3.5 million, compared with $4.5 million for the same period in 2022. The decrease was primarily driven by lower legal fees, overhead and employee compensation and benefits, partially offset by an increase in other professional fees.

Net loss for the third quarter of 2023 was $3.7 million, or $(0.11) per basic and diluted share, compared with a net loss of $13.7 million, or $(0.40) per basic and diluted share for the same period in 2022. The decrease in net loss was primarily attributable to revenue related to the Ono partnership recognized in the third quarter of 2023, whereas no such revenue was recorded in the third quarter of 2022 as it was prior to the Ono partnership. Lower total operating expenses, lower interest expense, and greater interest income in the third quarter of 2023 also contributed to the decrease in net loss compared to the same period last year.

Cash, cash equivalents and short-term investments totaled $46.3 million as of September 30, 2023, compared to $48.4 million as of June 30, 2023. Net cash used in operating activities in the third quarter of 2023 was $1.9 million. Equillium believes that its cash, cash equivalents and short-term investments as of September 30, 2023, including after giving effect to its stock repurchase program, will be sufficient to fund its operations into 2025.

About Multi-Cytokine Platform and EQ101, EQ102 & EQ302

Our proprietary multi-cytokine platform generates rationally designed composite peptides that selectively block key cytokines at the shared receptor level targeting pathogenic cytokine redundancies and synergies while preserving non-pathogenic signaling. This approach is expected to avoid the broad immuno-suppression and off-target safety liabilities that may be associated with other therapeutic classes, such as Janus kinase inhibitors. Many immune-mediated diseases are driven by the same combination of dysregulated cytokines, and we believe identifying the key cytokines for these diseases will allow us to target and develop customized treatment strategies for multiple autoimmune and inflammatory diseases.

Current platform assets include EQ101, a first-in-class, selective, tri-specific inhibitor of IL-2, IL-9, and IL-15 for intravenous and subcutaneous delivery; EQ102, a first-in-class, selective, bi-specific inhibitor of IL-15 and IL-21 for subcutaneous delivery; EQ302, in development as a first-in-class, selective, bi-specific inhibitor of IL-15 and IL-21 for oral delivery.

About Itolizumab

Itolizumab is a clinical-stage, first-in-class anti-CD6 monoclonal antibody that selectively targets the CD6-ALCAM signaling pathway to downregulate pathogenic T effector cells while preserving T regulatory cells critical for maintaining a balanced immune response. This pathway plays a central role in modulating the activity and trafficking of T cells that drive a number of immuno-inflammatory diseases.

About Equillium

Equillium is a clinical-stage biotechnology company leveraging a deep understanding of immunobiology to develop novel therapeutics to treat severe autoimmune and inflammatory disorders with high unmet medical need. The company’s pipeline consists of the following novel first-in-class immunomodulatory assets targeting immuno-inflammatory pathways. EQ101: a tri-specific cytokine inhibitor that selectively targets IL-2, IL-9, and IL-15; currently under evaluation in a Phase 2 proof-of-concept clinical study of patients with alopecia areata. EQ102: a bi-specific cytokine inhibitor that selectively targets IL-15 and IL-21; currently under evaluation in a Phase 1 first-in-human clinical study to include healthy volunteers and celiac disease patients. EQ302: an orally-delivered, bi-specific inhibitor of IL-15 and IL-21; currently in preclinical development. Itolizumab: a monoclonal antibody that targets the CD6-ALCAM signaling pathway which plays a central role in the modulation of effector T cells; currently under evaluation in a Phase 3 clinical study of patients with acute graft-versus-host disease (aGVHD) and a Phase 1b clinical study of patients with lupus/lupus nephritis. Equillium acquired rights to itolizumab through an exclusive partnership with Biocon Limited and has entered a strategic partnership with Ono Pharmaceutical Co., Ltd. for the development and commercialization of itolizumab under an option and asset purchase agreement.

For more information, visit www.equilliumbio.com.

Forward Looking Statements

Statements contained in this press release regarding matters that are not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as "anticipate", "believe", “could”, “continue”, "expect", "estimate", “may”, "plan", "outlook", “future” and "project" and other similar

expressions that predict or indicate future events or trends or that are not statements of historical matters. Because such statements are subject to risks and uncertainties, many of which are outside of Equillium’s control, actual results may differ materially from those expressed or implied by such forward-looking statements. Such statements include, but are not limited to statements regarding Equillium’s plans for developing EQ101, EQ102, EQ302 and itolizumab and the expected timing of results from clinical studies, anticipated upcoming milestones, the potential of Equillium to generate stockholder value, the potential for additional near-term cash income under the asset purchase agreement entered into between Equillium and Ono, the fluctuation of the foreign exchange rate, Equillium’s cash runway, and the potential benefits of Equillium’s product candidates. Risks that contribute to the uncertain nature of the forward-looking statements include: Equillium’s ability to execute its plans and strategies; risks related to performing clinical and pre-clinical studies; the risk that initial and interim results of a clinical study do not necessarily predict final results and that one or more of the clinical outcomes may materially change as patient enrollment continues, following more comprehensive reviews of the data, and as more patient data become available; potential delays in the commencement, enrollment and completion of clinical studies and the reporting of data therefrom; whether Equillium is able to grow its business and increase stockholder value over time; risks related to Ono’s financial condition, willingness to continue to fund the development of itolizumab, and decision to exercise its option, if ever, to purchase itolizumab or terminate the asset purchase agreement; uncertainties related to Equillium’s capital requirements; and having to use cash in ways or on timing other than expected and the impact of market volatility on cash reserves. These and other risks and uncertainties are described more fully under the caption "Risk Factors" and elsewhere in Equillium's filings and reports, which may be accessed for free by visiting the Securities and Exchange Commission’s website and on Equillium’s website under the heading “Investors.” Investors should take such risks into account and should not rely on forward-looking statements when making investment decisions. All forward-looking statements contained in this press release speak only as of the date on which they were made. Equillium undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

Investor & Media Contact

Equillium, Inc.

Michael Moore

Vice President, Investor Relations Officer & Head of Corporate Communications

619-302-4431

ir@equilliumbio.com

Equillium, Inc.

Condensed Consolidated Balance Sheets

(In thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Assets |

|

|

|

|

|

|

Cash, cash equivalents and short-term investments |

|

$ |

46,306 |

|

|

$ |

71,023 |

|

Accounts receivable |

|

|

3,769 |

|

|

|

2,838 |

|

Prepaid expenses and other assets |

|

|

4,228 |

|

|

|

3,369 |

|

Operating lease right-of-use assets |

|

|

922 |

|

|

|

1,191 |

|

Total assets |

|

$ |

55,225 |

|

|

$ |

78,421 |

|

Current liabilities |

|

|

|

|

|

|

Accounts payable and other current liabilities |

|

$ |

12,367 |

|

|

$ |

17,338 |

|

Current portion of deferred revenue |

|

|

15,832 |

|

|

|

14,700 |

|

Total current liabilities |

|

|

28,199 |

|

|

|

32,038 |

|

Long-term deferred revenue |

|

|

2,420 |

|

|

|

10,378 |

|

Other long-term liabilities |

|

|

498 |

|

|

|

4,063 |

|

Total liabilities |

|

|

31,117 |

|

|

|

46,479 |

|

Total stockholders' equity |

|

|

24,108 |

|

|

|

31,942 |

|

Total liabilities and stockholders' equity |

|

$ |

55,225 |

|

|

$ |

78,421 |

|

Equillium, Inc.

Condensed Consolidated Statements of Operations

(In thousands, except share and per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue |

$ |

8,870 |

|

|

$ |

- |

|

|

$ |

26,873 |

|

|

$ |

- |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

8,974 |

|

|

|

8,771 |

|

|

|

27,855 |

|

|

|

29,022 |

|

Acquired in-process research and development |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

23,049 |

|

General and administrative |

|

3,519 |

|

|

|

4,466 |

|

|

|

10,340 |

|

|

|

12,047 |

|

Total operating expenses |

|

12,493 |

|

|

|

13,237 |

|

|

|

38,195 |

|

|

|

64,118 |

|

Loss from operations |

|

(3,623 |

) |

|

|

(13,237 |

) |

|

|

(11,322 |

) |

|

|

(64,118 |

) |

Other income (expense), net |

|

409 |

|

|

|

(418 |

) |

|

|

893 |

|

|

|

(1,083 |

) |

Loss before income taxes |

|

(3,214 |

) |

|

|

(13,655 |

) |

|

|

(10,429 |

) |

|

|

(65,201 |

) |

Income tax expense |

|

496 |

|

|

|

- |

|

|

|

564 |

|

|

|

- |

|

Net loss |

$ |

(3,710 |

) |

|

$ |

(13,655 |

) |

|

$ |

(10,993 |

) |

|

$ |

(65,201 |

) |

Net loss per common share, basic and diluted |

$ |

(0.11 |

) |

|

$ |

(0.40 |

) |

|

$ |

(0.32 |

) |

|

$ |

(1.95 |

) |

Weighted-average number of common shares

outstanding, basic and diluted |

|

34,878,700 |

|

|

|

34,352,084 |

|

|

|

34,582,574 |

|

|

|

33,512,611 |

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

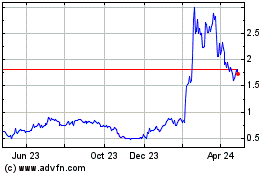

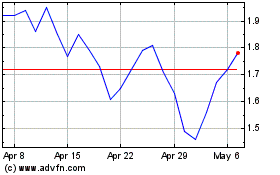

Equillium (NASDAQ:EQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Equillium (NASDAQ:EQ)

Historical Stock Chart

From Apr 2023 to Apr 2024