0001553643

false

0001553643

2023-11-08

2023-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): November 8, 2023

RELMADA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-39082 |

|

45-5401931 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

2222 Ponce de Leon Blvd., Floor

3

Coral Gables, FL |

|

33134 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number,

including area code: (786) 629-1376

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of exchange on which registered |

| Common stock, $0.001 par value per share |

|

RLMD |

|

The NASDAQ

Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 8, 2023, Relmada Therapeutics, Inc.

(the “Company”) issued a press release providing a corporate update and reporting its third quarter 2023 financial results.

(These results are preliminary and unaudited.) The Company also announced that it would conduct a conference call and audio webcast on

November 8, 2023, at 4:30 PM EST/1:30 PM PST, to discuss the update and results. The Company’s complete unaudited financial statements

and notes thereto as of, and for the three and nine months ended, September 30, 2023 and 2022, will be contained in its Quarterly Report

on Form 10-Q to be filed with the Securities and Exchange Commission. A copy of this press release is attached as Exhibit 99.1 to this

Current Report on Form 8-K and is incorporated into this Item 2.02 by reference.

In accordance with General Instruction B.2

of Form 8-K, the information in this Item 2.02 of this Current Report on Form 8-K, including the information set forth in Exhibit

99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of

1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: November 8, 2023 |

RELMADA THERAPEUTICS, INC. |

| |

|

|

| |

By: |

/s/ Sergio Traversa |

| |

Name: |

Sergio Traversa |

| |

Title: |

Chief Executive Officer |

2

Exhibit 99.1

Relmada Therapeutics Provides Corporate Update

and Reports Third Quarter 2023 Financial Results

CORAL GABLES, Fla., November 8, 2023 /PRNewswire/

-- Relmada Therapeutics, Inc. (Nasdaq: RLMD), a late-stage biotechnology company addressing diseases of the central nervous system (CNS),

today provided a corporate update and announced preliminary and unaudited financial results for the third quarter ended September 30,

2023. The Company will host a conference call today, Wednesday, November 8, at 4:30 PM

Eastern Time/1:30 PM Pacific Time.

“We continue to advance our Phase 3 clinical

development plan for REL-1017 as an adjunctive treatment for major depressive disorder (MDD),” said Sergio Traversa, Relmada’s Chief

Executive Officer. “Enrollment in the ongoing Reliance II (study 302) is progressing as planned and it remains on track to be completed

in the in the first half of 2024. The initial patients have been enrolled into Relight, the new Phase 3 study (study 304), and we continue

to anticipate the completion of this trial in the second half of next year. Additionally, we are encouraged by the recently announced

efficacy and safety data from the one year, open-label safety study, Reliance-OLS (study 310), which showed rapid and sustained improvement

in MADRS score with REL-1017 in both de novo patients and the full analysis set.”

“We also recently presented new compelling

preclinical data demonstrating the beneficial effect of non-psychedelic/low dose psilocybin on multiple metabolic parameters in a rodent

model of metabolic dysfunction-associated steatotic liver disease (MASLD),” continued Mr. Traversa. “Based on these promising

results, we intend to commence a single-ascending dose Phase 1 trial in obese patients with steatotic liver disease in early 2024 to define

the pharmacokinetic, safety, and tolerability profile of our modified-release psilocybin formulation in this population, followed by a

Phase 2a trial in the same patient population to establish clinical proof-of-concept. Importantly, there are currently no approved drugs

for MASLD, and these initial pre-clinical data support the therapeutic potential of non-psychedelic/low dose psilocybin.”

Recent

Corporate Highlights

| ● | Enrollment

is ongoing in Reliance II (study 302) and Relight (study 304), two sister pivotal Phase 3

trials of REL-1017 for the adjunctive treatment of MDD. |

| ● | Announced

results from recently completed Reliance-OLS (study 310), a long-term, open-label study of

REL-1017 in MDD. |

| ● | Rapid

and sustained improvements in MADRS score were observed with REL-1017 in both de novo patient

and the full analysis sets. |

| ● | Announced

new preclinical data from novel modified-release psilocybin program to be presented at the

American Association for the Study of Liver Diseases (AASLD) The Liver Meeting® 2023. |

| ● | Data

demonstrated the beneficial effect of non-psychedelic/low dose psilocybin on multiple metabolic

parameters in a rodent model of metabolic dysfunction-associated steatotic liver disease

(MASLD). |

| ● | Data

presented from REL-1017 and psilocybin programs at the 36th European College of

Neuropsychopharmacology (ECNP) Congress. |

Upcoming

Anticipated Milestones

| ● | Commence

a Phase 1 trial in obese patients with steatotic liver disease in early 2024 to define the

pharmacokinetic, safety and tolerability profile of the Company’s modified-release

psilocybin formulation, followed by a Phase 2a trial to establish clinical proof-of-concept. |

| ● | Complete

enrollment of Reliance II, which is planned to enroll

approximately 300 patients, in the first half of 2024. |

| ● | Complete

enrollment of Relight (study 304), which is planned

to enroll approximately 300 patients, in the second half of 2024. |

Third

Quarter 2023 Financial Results

| ● | Research

and development expense for the three months ended September 30, 2023, totaled $10.5 million,

compared to $30.5 million for the three months ended September 30, 2022. The decrease was

primarily associated with the completion of the Reliance I and Reliance III clinical studies

in late 2022. |

| ● | General

and administrative expense for the three months ended September 30, 2023, totaled $12.2 million,

compared to $8.2 million for the three months ended September 30, 2022. The increase was

primarily driven by an increase in stock-based compensation. |

| ● | Net

cash used in operating activities for the three months ended September 30, 2023 totaled $11.6

million, compared to $26.9 million for the three months ended September 30, 2022. |

| ● | Net

loss for the three months ended September 30, 2023, was $22.0 million, or $0.73 per basic

and diluted share, compared with a net loss of $39.4 million, or $1.31 per basic and diluted

share, for the three months ended September 30, 2022. |

Nine

Months Ended September 30, 2023 Financial Results

| ● | Research

and development expense for the nine months ended September 30, 2023, totaled $40.1 million,

compared to $86.5 million for the nine months ended September 30, 2022. The

decrease was primarily driven by a decrease in a study costs associated with the completion

of Reliance I and III in late 2022. |

| ● | General

and administrative expense for the nine months ended September 30, 2023, totaled $36.8 million,

compared to $36.1 million for the nine months ended September 30, 2022. The

increase was primarily driven by an increase in stock-based compensation. |

| ● | Net

cash used in operating activities for the nine months ended September 30, 2023 totaled $41.4

million, compared to $67.9 million for the three months ended September 30, 2022. |

| ● | Net

loss for the nine months ended September 30, 2023 and 2022 was $73.6 million and $119.1 million,

respectively. The Company had a net loss of $2.45 and $4.04 per share for the nine months

ended September 30, 2023 and 2022, respectively. |

| ● | As

of September 30, 2023, the Company had cash, cash equivalents, and short-term investments

of approximately $106.3 million, compared to cash, cash equivalents, and short-term investments

of approximately $148.3 million at December 31, 2022. |

Conference Call and Webcast Details

Wednesday, November 8th at

4:30 PM ET

| Toll Free: |

888-886-7786 |

| International: |

416-764-8658 |

| Conference ID: |

54664628 |

| Webcast: |

https://viavid.webcasts.com/starthere.jsp?ei=1636783&tp_key=a6209aa189 |

About REL-1017

REL-1017, a new chemical entity (NCE) and novel

NMDA receptor (NMDAR) channel blocker that preferentially targets hyperactive channels while maintaining physiological glutamatergic neurotransmission,

is currently in late-stage development for the adjunctive treatment of major depressive disorder (MDD). The ongoing clinical research

program is designed to evaluate the potential for REL-1017 as a rapid-acting, oral, once-daily antidepressant treatment.

About Relmada Therapeutics, Inc.

Relmada Therapeutics is a late-stage biotechnology

company addressing diseases of the central nervous system (CNS), with a focus on major depressive disorder (MDD). Relmada’s experienced

and dedicated team is committed to making a difference in the lives of patients and their families. Relmada’s lead program, REL-1017,

is a new chemical entity (NCE) and novel NMDA receptor (NMDAR) channel blocker that preferentially targets hyperactive channels while

maintaining physiological glutamatergic neurotransmission. REL-1017 is in late-stage development as an adjunctive treatment for MDD in

adults. Relmada is also developing a novel non-psychedelic/low dose psilocybin for the treatment of metabolic indications. Learn more

at www.relmada.com.

Forward-Looking Statements

The Private Securities Litigation Reform Act of

1995 provides a safe harbor for forward-looking statements made by us or on our behalf. This press release contains statements which constitute

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Any statement that is not historical in nature is a forward-looking statement and may be identified by the use of

words and phrases such as “expects,” “anticipates,” “believes,” “will,” “will likely result,”

“will continue,” “plans to,” “potential,” “promising,” and similar expressions. These statements

are based on management’s current expectations and beliefs and are subject to a number of risks, uncertainties and assumptions that could

cause actual results to differ materially from those described in the forward-looking statements, including potential failure of clinical

trial results to demonstrate statistically and/or clinically significant evidence of efficacy and/or safety, failure of top-line results

to accurately reflect the complete results of the trial, failure of the 310 open-label study to accurately reflect the results of the

ongoing 302 and 304 blinded, randomized and controlled studies, failure to obtain regulatory approval of REL-1017 for the treatment of

major depressive disorder, failure of the psilocybin program to advance to later stages of development, and the other risk factors described

under the heading “Risk Factors” set forth in the Company’s reports filed with the SEC from time to time. No forward-looking

statement can be guaranteed, and actual results may differ materially from those projected. Relmada undertakes no obligation to publicly

update any forward-looking statement, whether as a result of new information, future events, or otherwise. Readers are cautioned that

it is not possible to predict or identify all the risks, uncertainties and other factors that may affect future results and that the risks

described herein should not be a complete list.

Investor Contact:

Tim McCarthy

LifeSci Advisors

tim@lifesciadvisors.com

Media Inquiries:

Corporate Communications

media@relmada.com

Relmada Therapeutics, Inc.

Condensed Consolidated Balance Sheets

| | |

As of | | |

| |

| | |

September 30, | | |

As of | |

| | |

2023

(Unaudited) | | |

December 31,

2022 | |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 6,698,599 | | |

$ | 5,395,905 | |

| Short-term investments | |

| 99,568,502 | | |

| 142,926,781 | |

| Other receivables | |

| - | | |

| 512,432 | |

| Prepaid expenses | |

| 2,834,037 | | |

| 4,035,186 | |

| Total current assets | |

| 109,101,138 | | |

| 152,870,304 | |

| Other assets | |

| 47,715 | | |

| 34,875 | |

| Total assets | |

$ | 109,148,853 | | |

$ | 152,905,179 | |

| | |

| | | |

| | |

| Commitments and Contingencies (See Note 6) | |

| | | |

| | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 2,856,752 | | |

$ | 5,261,936 | |

| Accrued expenses | |

| 5,565,466 | | |

| 7,206,941 | |

| Total current liabilities | |

| 8,422,218 | | |

| 12,468,877 | |

| | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Class A convertible preferred stock, $0.001 par value, 3,500,000 shares authorized, none issued and outstanding | |

| - | | |

| - | |

| Common stock, $0.001 par value, 150,000,000 shares authorized, 30,099,203 shares issued and outstanding | |

| 30,099 | | |

| 30,099 | |

| Additional paid-in capital | |

| 636,434,059 | | |

| 602,517,138 | |

| Accumulated deficit | |

| (535,737,523 | ) | |

| (462,110,935 | ) |

| Total stockholders’ equity | |

| 100,726,635 | | |

| 140,436,302 | |

| Total liabilities and stockholders’ equity | |

$ | 109,148,853 | | |

$ | 152,905,179 | |

Relmada Therapeutics, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| | |

Three months ended | | |

Nine months ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Operating expenses: | |

| | |

| | |

| | |

| |

| Research and development | |

$ | 10,454,072 | | |

$ | 30,529,108 | | |

$ | 40,055,287 | | |

$ | 86,454,632 | |

| General and administrative | |

| 12,238,566 | | |

| 8,208,053 | | |

| 36,817,686 | | |

| 36,092,024 | |

| Total operating expenses | |

| 22,692,638 | | |

| 38,737,161 | | |

| 76,872,973 | | |

| 122,546,656 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (22,692,638 | ) | |

| (38,737,161 | ) | |

| (76,872,973 | ) | |

| (122,546,656 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other (expenses) income: | |

| | | |

| | | |

| | | |

| | |

| Gain on settlement of fees | |

| - | | |

| - | | |

| - | | |

| 6,351,606 | |

| Interest/investment income, net | |

| 1,321,441 | | |

| 827,614 | | |

| 3,892,478 | | |

| 1,544,898 | |

| Realized loss on short-term investments | |

| (51,714 | ) | |

| (561,648 | ) | |

| (718,422 | ) | |

| (552,171 | ) |

| Unrealized (loss) gain on short-term investments | |

| (579,147 | ) | |

| (947,512 | ) | |

| 72,329 | | |

| (3,897,135 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total other (expense) income – net | |

| 690,580 | | |

| (681,546 | ) | |

| 3,246,385 | | |

| 3,447,198 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (22,002,058 | ) | |

$ | (39,418,707 | ) | |

$ | (73,626,588 | ) | |

$ | (119,099,458 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per common share – basic and diluted | |

$ | (0.73 | ) | |

$ | (1.31 | ) | |

$ | (2.45 | ) | |

$ | (4.04 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding – basic and diluted | |

| 30,099,203 | | |

| 30,063,735 | | |

| 30,099,203 | | |

| 29,470,198 | |

Relmada Therapeutics, Inc.

Condensed Consolidated Statements of Stockholders’

Equity

(Unaudited)

| | |

Nine months ended September 30, 2023 | |

| | |

Common Stock | | |

Additional

Paid-in | | |

Accumulated | | |

| |

| | |

Shares | | |

Par Value | | |

Capital | | |

Deficit | | |

Total | |

| Balance – December 31, 2022 | |

| 30,099,203 | | |

$ | 30,099 | | |

$ | 602,517,138 | | |

$ | (462,110,935 | ) | |

$ | 140,436,302 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 11,354,466 | | |

| - | | |

| 11,354,466 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (26,321,576 | ) | |

| (26,321,576 | ) |

| Balance – March 31, 2023 | |

| 30,099,203 | | |

| 30,099 | | |

| 613,871,604 | | |

| (488,432,511 | ) | |

| 125,469,192 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 11,169,517 | | |

| - | | |

| 11,169,517 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (25,302,954 | ) | |

| (25,302,954 | ) |

| Balance – June 30, 2023 | |

| 30,099,203 | | |

$ | 30,099 | | |

$ | 625,041,121 | | |

$ | (513,735,465 | ) | |

$ | 111,335,755 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 11,392,938 | | |

| - | | |

| 11,392,938 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (22,002,058 | ) | |

| (22,002,058 | ) |

| Balance – September 30, 2023 | |

| 30,099,203 | | |

| 30,099 | | |

| 636,434,059 | | |

| (535,737,523 | ) | |

| 100,726,635 | |

| | |

Nine months ended September 30, 2022 | |

| | |

Common Stock | | |

Additional

Paid-in | | |

Accumulated | | |

| |

| | |

Shares | | |

Par Value | | |

Capital | | |

Deficit | | |

Total | |

| Balance – December 31, 2021 | |

| 27,740,147 | | |

$ | 27,740 | | |

$ | 513,304,258 | | |

$ | (305,067,112 | ) | |

$ | 208,264,886 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 11,930,681 | | |

| - | | |

| 11,930,681 | |

| ATM offering, net | |

| 1,609,343 | | |

| 1,610 | | |

| 29,581,932 | | |

| - | | |

| 29,583,542 | |

| Warrant exercised for cash | |

| 33,334 | | |

| 33 | | |

| 299,973 | | |

| - | | |

| 300,006 | |

| Options exercised for cash | |

| 20,000 | | |

| 20 | | |

| 64,780 | | |

| - | | |

| 64,800 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (39,745,783 | ) | |

| (39,745,783 | ) |

| Balance – March 31, 2022 | |

| 29,402,824 | | |

| 29,403 | | |

| 555,181,624 | | |

| (344,812,895 | ) | |

| 210,398,132 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 12,295,016 | | |

| - | | |

| 12,295,016 | |

| Warrant exercised for cash | |

| 91,058 | | |

| 91 | | |

| 595,259 | | |

| - | | |

| 595,350 | |

| Options exercised for cash | |

| 45,812 | | |

| 46 | | |

| 352,698 | | |

| - | | |

| 352,744 | |

| ATM offering, net of offering costs | |

| 484,900 | | |

| 485 | | |

| 13,144,572 | | |

| - | | |

| 13,145,057 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (39,934,968 | ) | |

| (39,934,968 | ) |

| Balance – June 30, 2022 | |

| 30,024,594 | | |

| 30,025 | | |

| 581,569,169 | | |

| (384,747,863 | ) | |

| 196,851,331 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 8,343,139 | | |

| - | | |

| 8,343,139 | |

| Warrant exercised for cash | |

| 51,527 | | |

| 51 | | |

| 332,865 | | |

| - | | |

| 332,916 | |

| Options exercised for cash | |

| 17,886 | | |

| 18 | | |

| 286,158 | | |

| - | | |

| 286,176 | |

| Share exchange – Pre-funded warrants, net of fees | |

| (1,452,016 | ) | |

| (1,452 | ) | |

| (48,548 | ) | |

| - | | |

| (50,000 | ) |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (39,418,707 | ) | |

| (39,418,707 | ) |

| Balance – September 30, 2022 | |

| 28,641,991 | | |

$ | 28,642 | | |

$ | 590,482,783 | | |

$ | (424,166,570 | ) | |

$ | 166,344,855 | |

Relmada Therapeutics, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | |

Nine months ended | |

| | |

September 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities | |

| | |

| |

| Net loss | |

$ | (73,626,588 | ) | |

$ | (119,099,458 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Stock-based compensation | |

| 33,916,921 | | |

| 32,568,836 | |

| Realized loss on short-term investments | |

| 718,422 | | |

| 552,171 | |

| Unrealized (gain) loss on short-term investments | |

| (72,329 | ) | |

| 3,897,135 | |

| Change in operating assets and liabilities: | |

| | | |

| | |

| Lease payment receivable | |

| - | | |

| 86,377 | |

| Other receivable | |

| 512,432 | | |

| - | |

| Prepaid expenses and other assets | |

| 1,188,309 | | |

| 8,359,994 | |

| Accounts payable | |

| (2,405,184 | ) | |

| (766,661 | ) |

| Accrued expenses | |

| (1,641,475 | ) | |

| 6,482,889 | |

| Net cash used in operating activities | |

| (41,409,492 | ) | |

| (67,918,717 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchase of short-term investments | |

| (57,151,963 | ) | |

| (38,993,173 | ) |

| Sale of short-term investments | |

| 99,864,149 | | |

| 60,382,229 | |

| Net cash provided by investing activities | |

| 42,712,186 | | |

| 21,389,056 | |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Payment of fees for warrants issued for common stock | |

| - | | |

| (50,000 | ) |

| Proceeds from issuance of common stock – net | |

| - | | |

| 42,728,599 | |

| Proceeds from options exercised for common stock | |

| - | | |

| 703,720 | |

| Proceeds from warrants exercised for common stock | |

| - | | |

| 1,228,272 | |

| Net cash provided by financing activities | |

| - | | |

| 44,610,591 | |

| | |

| | | |

| | |

| Net increase /(decrease) in cash and cash equivalents | |

| 1,302,694 | | |

| (1,919,070 | ) |

| Cash and cash equivalents at beginning of the period | |

| 5,395,905 | | |

| 44,443,439 | |

| Cash and cash equivalents at end of the period | |

$ | 6,698,599 | | |

| 42,524,369 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| | |

| | | |

| | |

| Non-cash investing and financing activities: | |

| | | |

| | |

| Share exchange for Pre-funded warrants | |

$ | - | | |

$ | 1,452 | |

8

v3.23.3

Cover

|

Nov. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 08, 2023

|

| Entity File Number |

001-39082

|

| Entity Registrant Name |

RELMADA THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001553643

|

| Entity Tax Identification Number |

45-5401931

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2222 Ponce de Leon Blvd.

|

| Entity Address, Address Line Two |

Floor

3

|

| Entity Address, City or Town |

Coral Gables

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33134

|

| City Area Code |

786

|

| Local Phone Number |

629-1376

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001 par value per share

|

| Trading Symbol |

RLMD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

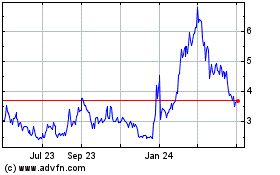

Relmada Therapeutics (NASDAQ:RLMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

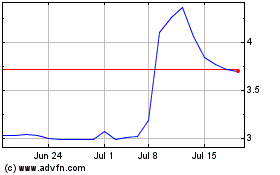

Relmada Therapeutics (NASDAQ:RLMD)

Historical Stock Chart

From Apr 2023 to Apr 2024