PetIQ, Inc. (“PetIQ” or the “Company”) (Nasdaq: PETQ), a leading

pet medication and wellness company, today reported financial

results for the third quarter and nine months ended September 30,

2023.

Cord Christensen, PetIQ’s Chairman & CEO commented, “We are

pleased to report the highest third quarter financial results in

the history of the Company. We generated growth significantly above

our guidance resulting in strong third quarter 2023 cash generation

and record low net leverage. We’ve made important strategic

decisions to help us increase operating efficiencies and focus our

spending on the areas of our business where we are seeing the most

favorable returns. PetIQ’s product portfolio continued to

experience increased consumption and gain market share in the

quarter, evidence that our strategic marketing initiatives are

working, and we expect to lean in on these initiatives heading into

next year to support the long-term success of our brands. We have

an incredible team executing at a high-level that have helped to

fuel our record results and ability to raise the Company's full

year 2023 outlook.”

Third Quarter 2023 Highlights Compared to Prior Year

Period

- Record net sales of $277.0 million, an increase of 32.1%, and

above the Company’s guidance for the quarter of $220.0 million to

$240.0 million

- Products segment net sales of $239.7 million compared to $176.2

million, an increase of 36.0%

- Services segment net revenues of $37.4 million compared to

$33.5 million, an increase of 11.5%

- Gross profit was $72.6 million compared to $50.8 million, an

increase of 43.0%

- Gross margin increased 200 basis points to 26.2%

- Net income of $0.5 million, or earnings per diluted share

("EPS") of $0.02, compared to net loss of $49.6 million, or loss

per share of $1.68

- Adjusted net income of $12.6 million, an increase of $11.8

million, or adjusted EPS of $0.42, compared to adjusted net income

of $0.8 million, or adjusted EPS of $0.03

- EBITDA of $24.7 million compared to $12.8 million, an increase

of 93.2%

- Adjusted EBITDA of $29.3 million compared to $16.3 million, an

increase of 80.0% and above the Company's guidance for the quarter

of $18.0 million to $20.0 million

- Adjusted EBITDA margin increased 280 basis points to 10.6%

- Third quarter cash from operations of $50.3 million

- Net leverage as measured under the Company's credit agreement

was 2.8x as of September 30, 2023, compared to 4.3x as of September

30, 2022

- Collaborated with Walmart, an existing partner, on a new, pilot

wellness center to offer a variety of pet services, including

veterinary care, grooming and hygiene care opened in late

September

Nine Month 2023 Highlights Compared to Prior Year

Period

- Net sales of $882.0 million, an increase of 19.6%

- Products segment net sales of $776.8 million compared to $643.0

million, an increase of 20.8%

- Services segment net revenues of $105.2 million compared to

$94.5 million, an increase of 11.4%

- Gross profit was $208.8 million compared to $170.4 million, an

increase of 22.5%

- Gross margin increased 60 basis points to 23.7%

- Net income of $19.8 million, or EPS of $0.67, compared to net

loss of $41.7 million, or loss per share of $1.42

- Adjusted net income of $40.1 million, or adjusted EPS of $1.36,

an increase of 91.5%, compared to adjusted net income of $20.7

million, or adjusted EPS of $0.71

- EBITDA of $80.7 million compared to $50.0 million, an increase

of 61.4%

- Adjusted EBITDA of $92.8 million compared to $64.8 million, an

increase of 43.1%

Services Segment OptimizationLate in the third

quarter of 2023, the Company initiated a Services segment

optimization to improve future profitability which is expected to

generate approximately $6.0 million of net cost savings over the

next 12 months, all of which, the Company expects to reinvest in

its future growth, focusing primarily on areas the Company

continues to experience a favorable return on investment, including

its mobile community clinics and sales and marketing initiatives

for PetIQ's manufactured brands. The optimization included

assessing the operational and financial performance of the

Company's wellness centers since re-opening after the pandemic as

well as the assessment of the veterinary labor market in each

geographic market. The Company also evaluated its ability to

potentially convert these locations to a more hygiene-focused

offering and determined they would be unable to convert these

locations in the future based on the aforementioned assessment and

the available square footage within the respective wellness

centers. As a result of the optimization, the Company identified

149 underperforming wellness centers for closure. The Company

closed 45 wellness centers during the third quarter and expects to

close the remaining 104 wellness centers in the fourth quarter

ending December 31, 2023. The Company ended the third quarter of

2023 with 237 wellness centers and expects to end 2023 with 133

wellness centers.

Christensen continued, “We believe our Services optimization

will be executed swiftly in the fourth quarter of 2023 and result

in a significantly stronger, more profitable segment that is better

positioned for future growth. Over the last 18 months we’ve evolved

our services offering based on changes in the pet health care and

veterinarian labor market, achieved greater operational

efficiencies, and aligned investments in areas of our business

where we are seeing the highest rate of returns. Our mobile

community clinics fueled solid growth driven by our ability to

operate more clinics than the prior year period as our team

successfully matched contract veterinarian labor with pet demand.

In addition, we are pleased with the initial results from the

wellness centers that are testing hygiene, grooming and additional

services. Going forward, we will remain prudent with our wellness

center growth and remain optimistic about our ability to increase

the number of pets served and dollars per pet.”

Third Quarter 2023 Financial ResultsNet sales

were $277.0 million for the third quarter of 2023, an increase of

32.1% compared to net sales of $209.7 million in the prior year

period, driven by an increase in sales from both the Products and

Services segments. Products segment net sales of $239.7 million

increased 36.0% compared to the prior year period reflecting

broad-based growth across product categories and sales channels as

well as from the previously announced acquisition of Rocco &

Roxie LLC ("Rocco & Roxie") completed in January 2023. The

Company experienced continued strength across flea and tick,

prescription medication, and health and wellness product offerings

with favorable consumption trends. Net sales for PetIQ’s

manufactured products outperformed the Company's growth

expectations for the third quarter of 2023 as compared to the prior

year period with an increase of 41.7% including the acquisition of

Rocco & Roxie, or an increase of 27.0%, on an organic basis.

Services revenue for the third quarter of 2023 increased 11.5% to

$37.4 million driven by operational improvements.

Third quarter 2023 gross profit was $72.6 million, an increase

of 43.0%, compared to $50.8 million in the prior year period. Gross

margin increased 200 basis points to 26.2% from 24.2% in the prior

year period as the Company benefited from operating leverage on

higher net sales and increased manufacturing efficiencies as well

as a favorable shift in product mix.

Selling, general and administrative expenses (“SG&A”) were

$55.0 million for the third quarter of 2023 compared to $46.0

million in the prior year period. As a percentage of net sales,

SG&A was 19.9% for the third quarter of 2023, a decrease of 210

basis points compared to the prior year period. Adjusted SG&A

was $51.7 million for the third quarter of 2023 compared to $42.5

million in the prior year period. As a percentage of net sales

adjusted SG&A was 18.6%, a decrease of 160 basis points

compared to the prior year period. The leverage in SG&A and

adjusted SG&A was primarily due to continued leverage of costs

and increased business expense efficiencies relative to the growth

in net sales, partially offset by increased corporate compensation

expense, increased advertising and promotional expense to support

PetIQ's manufactured products, and increased expenses associated

with Rocco & Roxie as compared to the third quarter of

2022.

Restructuring and related charges attributable to the Services

segment optimization were $8.5 million for the third quarter ended

September 30, 2023. The Company expects total restructuring and

related charges of approximately $14.6 million for the year

ending December 31, 2023, including approximately

$11.0 million of depreciation and amortization as well as $0.3

million inventory valuation adjustments. The Company also expects

to settle its lease obligations of approximately $3.0 million

in the fourth quarter of 2023. The lease settlement obligations are

not expected to result in an expense to the Company's consolidated

statements of operations as the liabilities are currently reflected

on its balance sheet as of September 30, 2023. Accordingly, the

total cash expenditures related to the Services segment

optimization are expected to be approximately

$6.3 million.

Third quarter 2023 net income was $0.5 million, and EPS was

$0.02, compared to a net loss of $49.6 million and loss per share

of $1.68 in the prior year period. Adjusted net income for the

third quarter of 2023 was $12.6 million, an increase of $11.8

million, compared to adjusted net income of $0.8 million in the

prior year period. Third quarter 2023 adjusted EPS was $0.42,

compared adjusted EPS of $0.03 in the prior year period.

EBITDA was $24.7 million for the third quarter of 2023 compared

to $12.8 million in the prior year period, an increase of 93.2%.

Third quarter Adjusted EBITDA was a record $29.3 million, an

increase of 80.0%, compared to $16.3 million in the prior year

period and above the Company's guidance of $18.0 million to $20.0

million. Adjusted EBITDA margin increased 280 basis points to 10.6%

compared to 7.8% in the prior year period.

Adjusted SG&A, adjusted net income, adjusted EPS, adjusted

EBITDA, and adjusted EBITDA margin are non-GAAP financial measures.

The Company believes these non-GAAP financial measures provide

investors with additional insight into the way management views

reportable segment operations. See “Non-GAAP Financial Measures”

for a definition of these measures and the financial tables that

accompany this release for a reconciliation to the most comparable

GAAP measure.

Cash Flow and Balance Sheet

The Company ended the third quarter of 2023 with total cash and

cash equivalents of $124.6 million. For the third quarter ended

September 30, 2023, the Company generated $50.3 million of cash

from operations which was driven by increased earnings as well as

$30.2 million from working capital benefits. The Company’s total

debt, which is comprised of its term loan, ABL, convertible notes

and capital leases was $447.9 million as of September 30, 2023. The

Company had total liquidity, which it defines as cash on hand plus

debt availability, of $249.6 million as of September 30, 2023. The

Company's net leverage as measured under the Company's credit

agreement was 2.8x as of September 30, 2023, down from 4.3x in the

prior year period, driven by higher earnings and improved working

capital. Please refer to the financial table within this press

release for a calculation of the Company’s net leverage under the

credit agreement.

Outlook

For the full year 2023 the Company is raising its outlook

previously provided, and now expects the following, inclusive of

its Services segment optimization announced today:

- Net sales of $1,060 million to $1,080 million, an increase of

approximately 16.0% compared to 2022 based on the mid-point of the

guidance

- Adjusted EBITDA of $99 million to $103 million, an increase of

approximately 30.0% compared to 2022 based on the mid-point of the

guidance

The Company does not provide guidance for net income, the most

directly comparable GAAP measure to Adjusted EBITDA, and similarly

cannot provide a reconciliation between its forecasted adjusted

EBITDA and net income without unreasonable effort due to the

unavailability of reliable estimates for certain components of net

income and the respective reconciliations. These forecasted items

are not within the Company’s control, may vary greatly between

periods and could significantly impact future financial results for

the fourth quarter, and full year ending December 31, 2023.

Conference Call and Webcast

The Company will host a conference call with members of the

executive management team to discuss these results. The conference

call is scheduled to begin today at 4:30 p.m. ET. To participate on

the live call listeners in North America may dial 833-816-1410 and

international listeners may dial 412-317-0503.

In addition, the call will be broadcast live over the Internet

hosted at the “Investors” section of the Company's website at

www.PetIQ.com. A telephonic playback will be available through

November 28, 2023. North American listeners may dial 844-512-2921

and international listeners may dial 412-317-6671; the passcode is

10182495.

About PetIQ

PetIQ is a leading pet medication and wellness company

delivering a smarter way for pet parents to help their pets live

their best lives through convenient access to affordable veterinary

products and services. We engage with customers through more than

60,000 points of distribution across retail and e-commerce channels

with our branded and distributed medications as well as health and

wellness items, which are further supported by our world-class

medications manufacturing facility in Omaha, Nebraska and health

and wellness manufacturing facility in Springville, Utah. Our

national service platform operates in over 2,600 retail partner

locations in 41 states, providing cost effective and convenient

veterinary wellness services. PetIQ believes that pets are an

important part of the family and deserve the best products and care

that we can give them.

Investors: katie.turner@petiq.com or

208.513.1513

Media: kara.schafer@petiq.com or

407.929.6727

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

that involve risks and uncertainties, such as statements about our

plans, objectives, expectations, assumptions or future events. In

some cases, you can identify forward-looking statements by

terminology such as “anticipate,” “estimate,” “plan,” “project,”

“continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,”

“will,” “should,” “could” and similar expressions. Forward-looking

statements involve estimates, assumptions, known and unknown risks,

uncertainties and other factors that could cause actual results to

differ materially from any future results, performances, or

achievements expressed or implied by the forward-looking

statements. Forward-looking statements should not be read as a

guarantee of future performance or results and will not necessarily

be accurate indications of the times at, or by, which such

performance or results will be achieved. Forward-looking statements

are based on information available at the time those statements are

made or management's good faith belief as of that time with respect

to future events and are subject to risks and uncertainties that

could cause actual performance or results to differ materially from

those expressed in or suggested by the forward-looking statements.

Important factors that could cause such differences include, but

are not limited to, general economic or market conditions, global

economic slowdown, increased inflation, rising interest rates,

global conflict and recent and potential future bank failures; our

ability to successfully grow our business through acquisitions and

our ability to integrate acquisitions, including Rocco & Roxie;

our ability to achieve the anticipated cost savings and

reinvestment from the Services segment optimization, the

anticipated costs associated with the optimization, and the success

of our remaining wellness centers following the optimization; our

dependency on a limited number of customers; our ability to

implement our growth strategy effectively; our ability to manage

our manufacturing and supply chain effectively; disruptions in our

manufacturing and distribution chains; competition from

veterinarians and others in our industry; reputational damage to

our brands; economic trends and spending on pets; the effectiveness

of our marketing and trade promotion programs; recalls or

withdrawals of our products or product liability claims; our

ability to introduce new products and improve existing products;

our ability to protect our intellectual property; costs associated

with governmental regulation; our ability to keep and retain key

employees; our ability to sustain profitability; and the risks set

forth under the “Risk Factors” section of our Annual Report on Form

10-K for the year ended December 31, 2022 and other reports filed

time to time with the Securities and Exchange Commission.

Additional risks and uncertainties not currently known to us or

that we currently deem to be immaterial may materially adversely

affect our business, financial condition or operating results. The

forward-looking statements speak only as of the date on which they

are made, and, except as required by law, we undertake no

obligation to update any forward-looking statement to reflect

events or circumstances after the date on which the statement is

made or to reflect the occurrence of unanticipated events. In

addition, we cannot assess the impact of each factor on our

business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those

contained in any forward-looking statements. Consequently, you

should not place undue reliance on forward-looking statements.

Non-GAAP Financial Measures

In addition to financial results reported in accordance with

U.S. GAAP, PetIQ uses the following non-GAAP financial measures:

adjusted net income, adjusted earnings per share, adjusted

SG&A, adjusted EBITDA, and adjusted EBITDA margin.

Adjusted net income consists of net income adjusted for tax

expense, acquisition expenses, integration costs, litigation costs,

restructuring costs and stock-based compensation expense. Adjusted

net income is utilized by management to evaluate the effectiveness

of our business strategies. Non-GAAP adjusted earnings per share is

defined as non-GAAP adjusted net income divided by the weighted

average number of shares of common stock outstanding during the

period.

Adjusted SG&A consists of SG&A adjusted for acquisition

expenses, stock-based compensation expense, integration costs, and

litigation expense.

EBITDA represents net income before interest, income taxes, and

depreciation and amortization. Adjusted EBITDA represents EBITDA

plus adjustments for transactions that management does not believe

are representative of our core ongoing business including

acquisition costs, restructuring costs, stock-based compensation

expense, and integration costs. Adjusted EBITDA margin is adjusted

EBITDA stated as a percentage of net sales.

Adjusted EBITDA is utilized by management as a factor in

evaluating the Company's performance and the effectiveness of our

business strategies. The Company presents EBITDA because it is a

necessary component for computing adjusted EBITDA.

We believe that the use of these non-GAAP measures provides

additional tools for investors to use in evaluating ongoing

operating results and trends. In addition, you should be aware when

evaluating these non-GAAP measures that in the future we may incur

expenses similar to those excluded when calculating these measures.

Our presentation of these measures should not be construed as an

inference that our future results will be unaffected by these or

other unusual or non-recurring items. Our computation of non-GAAP

measures may not be comparable to other similarly titled measures

computed by other companies, because all companies do not calculate

these non-GAAP measures in the same manner. Our management does

not, and you should not, consider the non-GAAP financial measures

in isolation or as an alternative to financial measures determined

in accordance with GAAP. The principal limitation of non-GAAP

financial measures is that they exclude significant expenses and

income that are required by GAAP to be recorded in our financial

statements. See a reconciliation of each non-GAAP measure to the

most comparable GAAP measure, in the financial tables that

accompany this release.

|

PetIQ, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(Unaudited, in 000’s except for per share

amounts) |

|

|

| |

|

September 30, 2023 |

|

December 31, 2022 |

| Current assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

124,614 |

|

|

$ |

101,265 |

|

|

Accounts receivable, net |

|

|

151,680 |

|

|

|

118,004 |

|

|

Inventories |

|

|

128,126 |

|

|

|

142,605 |

|

|

Other current assets |

|

|

6,241 |

|

|

|

8,238 |

|

|

Total current assets |

|

|

410,661 |

|

|

|

370,112 |

|

|

Property, plant and equipment, net |

|

|

62,927 |

|

|

|

73,395 |

|

|

Operating lease right of use assets |

|

|

12,289 |

|

|

|

18,231 |

|

|

Other non-current assets |

|

|

2,373 |

|

|

|

1,373 |

|

|

Intangible assets, net |

|

|

164,644 |

|

|

|

172,479 |

|

|

Goodwill |

|

|

204,195 |

|

|

|

183,306 |

|

|

Total assets |

|

$ |

857,089 |

|

|

$ |

818,896 |

|

|

Liabilities and equity |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Accounts payable |

|

$ |

113,449 |

|

|

$ |

112,995 |

|

|

Accrued wages payable |

|

|

19,162 |

|

|

|

11,512 |

|

|

Accrued interest payable |

|

|

7,915 |

|

|

|

1,912 |

|

|

Other accrued expenses |

|

|

9,133 |

|

|

|

7,725 |

|

|

Current portion of operating leases |

|

|

6,877 |

|

|

|

6,595 |

|

|

Current portion of long-term debt and finance leases |

|

|

8,105 |

|

|

|

8,751 |

|

|

Total current liabilities |

|

|

164,641 |

|

|

|

149,490 |

|

|

Operating leases, less current installments |

|

|

8,783 |

|

|

|

12,405 |

|

|

Long-term debt, less current installments |

|

|

439,210 |

|

|

|

443,276 |

|

|

Finance leases, less current installments |

|

|

617 |

|

|

|

907 |

|

|

Other non-current liabilities |

|

|

4,667 |

|

|

|

1,025 |

|

|

Total non-current liabilities |

|

|

453,277 |

|

|

|

457,613 |

|

|

Equity |

|

|

|

|

|

Additional paid-in capital |

|

|

385,839 |

|

|

|

378,709 |

|

|

Class A common stock, par value $0.001 per share, 125,000 shares

authorized; 29,558 and 29,348 shares issued, respectively |

|

|

29 |

|

|

|

29 |

|

|

Class B common stock, par value $0.001 per share, 8,402 shares

authorized; 239 and 252 shares issued and outstanding,

respectively |

|

|

— |

|

|

|

— |

|

|

Class A treasury stock, at cost, 373 shares |

|

|

(3,857 |

) |

|

|

(3,857 |

) |

|

Accumulated deficit |

|

|

(143,115 |

) |

|

|

(162,733 |

) |

|

Accumulated other comprehensive loss |

|

|

(1,715 |

) |

|

|

(2,224 |

) |

|

Total stockholders' equity |

|

|

237,181 |

|

|

|

209,924 |

|

|

Non-controlling interest |

|

|

1,990 |

|

|

|

1,869 |

|

|

Total equity |

|

|

239,171 |

|

|

|

211,793 |

|

|

Total liabilities and equity |

|

$ |

857,089 |

|

|

$ |

818,896 |

|

|

PetIQ, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(Unaudited, in 000’s, except for per share

amounts) |

|

|

| |

|

For the Three Months Ended |

|

For the Nine Months Ended |

| |

|

September 30, 2023 |

September 30, 2022 |

|

September 30, 2023 |

September 30, 2022 |

| |

|

|

|

|

|

|

|

Product sales |

|

$ |

239,665 |

|

$ |

176,217 |

|

|

$ |

776,825 |

|

$ |

642,981 |

|

|

Services revenue |

|

|

37,354 |

|

|

33,508 |

|

|

|

105,212 |

|

|

94,453 |

|

|

Total net sales |

|

|

277,019 |

|

|

209,725 |

|

|

|

882,037 |

|

|

737,434 |

|

| Cost of products sold |

|

|

174,286 |

|

|

131,414 |

|

|

|

585,616 |

|

|

485,833 |

|

| Cost of

services |

|

|

30,122 |

|

|

27,541 |

|

|

|

87,671 |

|

|

81,222 |

|

|

Total cost of sales |

|

|

204,408 |

|

|

158,955 |

|

|

|

673,287 |

|

|

567,055 |

|

|

Gross profit |

|

|

72,611 |

|

|

50,770 |

|

|

|

208,750 |

|

|

170,379 |

|

| Operating expenses |

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

55,021 |

|

|

45,984 |

|

|

|

153,507 |

|

|

144,815 |

|

|

Restructuring(1) |

|

|

8,235 |

|

|

— |

|

|

|

8,235 |

|

|

— |

|

|

Goodwill impairment |

|

|

— |

|

|

47,264 |

|

|

|

|

47,264 |

|

|

Operating income (loss) |

|

|

9,355 |

|

|

(42,478 |

) |

|

|

47,008 |

|

|

(21,700 |

) |

|

Interest expense, net |

|

|

8,581 |

|

|

7,276 |

|

|

|

26,137 |

|

|

19,696 |

|

|

Other expense (income), net |

|

|

35 |

|

|

172 |

|

|

|

158 |

|

|

(31 |

) |

|

Total other expense, net |

|

|

8,616 |

|

|

7,448 |

|

|

|

26,295 |

|

|

19,665 |

|

|

Pretax net income (loss) |

|

|

739 |

|

|

(49,926 |

) |

|

|

20,713 |

|

|

(41,365 |

) |

|

Income tax (expense) benefit |

|

|

(283 |

) |

|

355 |

|

|

|

(923 |

) |

|

(368 |

) |

|

Net income (loss) |

|

|

456 |

|

|

(49,571 |

) |

|

|

19,790 |

|

|

(41,733 |

) |

|

Net income (loss) attributable to non-controlling interest |

|

|

5 |

|

|

(435 |

) |

|

|

172 |

|

|

(360 |

) |

|

Net income (loss) attributable to PetIQ, Inc. |

|

$ |

451 |

|

$ |

(49,136 |

) |

|

$ |

19,618 |

|

$ |

(41,373 |

) |

|

Net income (loss) per share attributable to PetIQ, Inc.

Class A common stock |

|

|

|

|

|

|

|

Basic |

|

$ |

0.02 |

|

$ |

(1.68 |

) |

|

$ |

0.67 |

|

$ |

(1.42 |

) |

|

Diluted |

|

$ |

0.02 |

|

$ |

(1.68 |

) |

|

$ |

0.67 |

|

$ |

(1.42 |

) |

| Weighted Average

shares of Class A common stock outstanding |

|

|

|

|

|

|

|

Basic |

|

|

29,181 |

|

|

29,224 |

|

|

|

29,116 |

|

|

29,224 |

|

|

Diluted |

|

|

29,715 |

|

|

29,224 |

|

|

|

29,386 |

|

|

29,224 |

|

(1) Restructuring charges include accelerated depreciation and

amortization, variable lease expenses, and other miscellaneous

costs. The remaining costs pertain to variable lease expenses,

lease termination costs, severance, and other miscellaneous

costs

|

PetIQ, Inc. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(Unaudited, in 000’s) |

|

|

| |

|

For the Nine Months Ended September 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

| Cash flows from operating

activities |

|

|

|

|

|

Net income (loss) |

|

$ |

19,790 |

|

|

$ |

(41,733 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by

(used in) operating activities |

|

|

|

|

|

Depreciation and amortization of intangible assets and loan

fees |

|

|

35,816 |

|

|

|

26,564 |

|

|

Loss on disposition of property, plant, and equipment |

|

|

7 |

|

|

|

56 |

|

|

Stock based compensation expense |

|

|

8,059 |

|

|

|

8,904 |

|

|

Goodwill impairment |

|

|

— |

|

|

|

47,264 |

|

|

Other non-cash activity |

|

|

672 |

|

|

|

(7 |

) |

|

Changes in assets and liabilities, net of business acquisition |

|

|

|

|

|

Accounts receivable |

|

|

(32,562 |

) |

|

|

(11,219 |

) |

|

Inventories |

|

|

16,451 |

|

|

|

(50,847 |

) |

|

Other assets |

|

|

2,078 |

|

|

|

1,924 |

|

|

Accounts payable |

|

|

(593 |

) |

|

|

18,957 |

|

|

Accrued wages payable |

|

|

7,649 |

|

|

|

1,083 |

|

|

Other accrued expenses |

|

|

7,362 |

|

|

|

(1,818 |

) |

|

Net cash provided by (used in) operating activities |

|

|

64,729 |

|

|

|

(872 |

) |

|

Cash flows from investing activities |

|

|

|

|

|

Business acquisition (net of cash acquired) |

|

|

(27,634 |

) |

|

|

— |

|

|

Purchase of property, plant, and equipment |

|

|

(6,205 |

) |

|

|

(9,797 |

) |

|

Net cash used in investing activities |

|

|

(33,839 |

) |

|

|

(9,797 |

) |

|

Cash flows from financing activities |

|

|

|

|

|

Proceeds from issuance of long-term debt |

|

|

35,000 |

|

|

|

44,000 |

|

|

Principal payments on long-term debt |

|

|

(40,700 |

) |

|

|

(49,700 |

) |

|

Repurchase of Class A common stock |

|

|

— |

|

|

|

(3,857 |

) |

|

Principal payments on finance lease obligations |

|

|

(1,138 |

) |

|

|

(1,097 |

) |

|

Tax withholding payments on Restricted Stock Units |

|

|

(984 |

) |

|

|

(862 |

) |

|

Exercise of options to purchase Class A common stock |

|

|

— |

|

|

|

115 |

|

|

Net cash used in financing activities |

|

|

(7,822 |

) |

|

|

(11,401 |

) |

|

Net change in cash and cash equivalents |

|

|

23,068 |

|

|

|

(22,070 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

|

281 |

|

|

|

(618 |

) |

| Cash

and cash equivalents, beginning of period |

|

|

101,265 |

|

|

|

79,406 |

|

|

Cash and cash equivalents, end of period |

|

$ |

124,614 |

|

|

$ |

56,718 |

|

|

PetIQ, Inc. |

|

Summary Segment Results |

|

(Unaudited, in 000’s) |

| |

| |

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

$'s in 000's |

|

September 30, 2023 |

|

September 30, 2022 |

|

September 30, 2023 |

|

September 30, 2022 |

|

Products segment sales |

|

$ |

239,665 |

|

$ |

176,217 |

|

$ |

776,825 |

|

$ |

642,981 |

| Services segment revenue: |

|

|

|

|

|

|

|

|

|

Same-store sales |

|

|

35,280 |

|

|

29,591 |

|

|

97,441 |

|

|

48,989 |

|

Non same-store sales |

|

|

2,074 |

|

|

3,917 |

|

|

7,771 |

|

|

15,873 |

|

Total services segment revenue |

|

$ |

37,354 |

|

$ |

33,508 |

|

$ |

105,212 |

|

$ |

94,453 |

|

Total net sales |

|

$ |

277,019 |

|

$ |

209,725 |

|

$ |

882,037 |

|

$ |

737,434 |

|

|

|

PetIQ, Inc. |

|

Reconciliation between Selling, General &

Administrative (“SG&A”) and Adjusted SG&A |

|

(Unaudited, in 000’s) |

| |

| |

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

$'s in 000's |

|

September 30, 2023 |

|

September 30, 2022 |

|

September 30, 2023 |

|

September 30, 2022 |

|

SG&A |

|

$ |

55,021 |

|

|

$ |

45,984 |

|

|

$ |

153,507 |

|

|

$ |

144,815 |

|

| % of Sales |

|

|

19.9 |

% |

|

|

21.9 |

% |

|

|

17.4 |

% |

|

|

27.4 |

% |

| Less: |

|

|

|

|

|

|

|

|

|

Acquisition costs(3) |

|

|

— |

|

|

|

1,035 |

|

|

|

713 |

|

|

|

1,191 |

|

|

Stock based compensation expense |

|

|

2,851 |

|

|

|

2,238 |

|

|

|

8,059 |

|

|

|

8,904 |

|

|

Integration costs(4) |

|

|

484 |

|

|

|

200 |

|

|

|

1,508 |

|

|

|

943 |

|

|

Litigation expenses |

|

|

30 |

|

|

|

— |

|

|

|

30 |

|

|

|

3,802 |

|

| Adjusted SG&A(6) |

|

$ |

51,656 |

|

|

$ |

42,511 |

|

|

$ |

143,197 |

|

|

$ |

129,975 |

|

| % of Sales |

|

|

18.6 |

% |

|

|

20.3 |

% |

|

|

16.4 |

% |

|

|

25.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PetIQ, Inc. |

|

Reconciliation between Net Income and Adjusted

EBITDA |

|

(Unaudited, in 000’s) |

| |

| |

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

$'s in 000's |

|

September 30, 2023 |

|

September 30, 2022 |

|

September 30, 2023 |

|

September 30, 2022 |

|

Net income (loss) |

|

$ |

456 |

|

|

$ |

(49,571 |

) |

|

$ |

19,790 |

|

|

$ |

(41,733 |

) |

| Plus: |

|

|

|

|

|

|

|

|

|

Tax expense (benefit) |

|

|

283 |

|

|

|

(355 |

) |

|

|

923 |

|

|

|

368 |

|

|

Depreciation(1) |

|

|

10,851 |

|

|

|

3,576 |

|

|

|

18,536 |

|

|

|

10,773 |

|

|

Amortization |

|

|

4,546 |

|

|

|

4,602 |

|

|

|

15,285 |

|

|

|

13,602 |

|

|

Goodwill impairment(2) |

|

|

— |

|

|

|

47,264 |

|

|

|

— |

|

|

|

47,264 |

|

|

Interest expense, net |

|

|

8,581 |

|

|

|

7,276 |

|

|

|

26,137 |

|

|

|

19,696 |

|

| EBITDA |

|

$ |

24,717 |

|

|

$ |

12,792 |

|

|

$ |

80,671 |

|

|

$ |

49,970 |

|

|

Acquisition costs(3) |

|

|

— |

|

|

|

1,035 |

|

|

|

713 |

|

|

|

1,191 |

|

|

Stock based compensation expense |

|

|

2,851 |

|

|

|

2,238 |

|

|

|

8,059 |

|

|

|

8,904 |

|

|

Integration costs(4) |

|

|

484 |

|

|

|

200 |

|

|

|

2,078 |

|

|

|

943 |

|

|

Restructuring(5) |

|

|

1,200 |

|

|

|

— |

|

|

|

1,200 |

|

|

|

— |

|

|

Litigation expenses |

|

|

30 |

|

|

|

— |

|

|

|

30 |

|

|

|

3,802 |

|

| Adjusted EBITDA(6) |

|

$ |

29,282 |

|

|

$ |

16,265 |

|

|

$ |

92,751 |

|

|

$ |

64,810 |

|

| Adjusted EBITDA Margin |

|

|

10.6 |

% |

|

|

7.8 |

% |

|

|

10.5 |

% |

|

|

12.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PetIQ, Inc. |

|

Reconciliation between Net Income and Adjusted Net

Income |

|

(Unaudited, in 000’s, except for per share

amounts) |

| |

| |

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

$'s in 000's |

|

September 30, 2023 |

|

September 30, 2022 |

|

September 30, 2023 |

|

September 30, 2022 |

|

Net income (loss) |

|

$ |

456 |

|

$ |

(49,571 |

) |

|

$ |

19,790 |

|

$ |

(41,733 |

) |

| Plus: |

|

|

|

|

|

|

|

|

|

Tax expense (benefit) |

|

|

283 |

|

|

(355 |

) |

|

|

923 |

|

|

369 |

|

|

Goodwill impairment(2) |

|

|

— |

|

|

47,264 |

|

|

|

— |

|

|

47,264 |

|

|

Acquisition costs(3) |

|

|

— |

|

|

1,035 |

|

|

|

713 |

|

|

1,191 |

|

|

Stock based compensation expense |

|

|

2,851 |

|

|

2,238 |

|

|

|

8,059 |

|

|

8,904 |

|

|

Integration costs(4) |

|

|

484 |

|

|

200 |

|

|

|

2,078 |

|

|

943 |

|

|

Restructuring(7) |

|

|

8,485 |

|

|

— |

|

|

|

8,485 |

|

|

— |

|

|

Litigation expenses |

|

|

30 |

|

|

— |

|

|

|

30 |

|

|

3,802 |

|

| Adjusted Net income(6) |

|

$ |

12,589 |

|

$ |

811 |

|

|

$ |

40,078 |

|

$ |

20,740 |

|

| |

|

|

|

|

|

|

|

|

| Non-GAAP adjusted EPS |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.43 |

|

$ |

0.03 |

|

|

$ |

1.38 |

|

$ |

0.71 |

|

| Diluted |

|

$ |

0.42 |

|

$ |

0.03 |

|

|

$ |

1.36 |

|

$ |

0.71 |

|

| Weighted Average

shares of Class A common stock outstanding used to compute non-GAAP

adjusted EPS |

| Basic |

|

|

29,181 |

|

|

29,224 |

|

|

|

29,116 |

|

|

29,224 |

|

| Diluted |

|

|

29,715 |

|

|

29,224 |

|

|

|

29,386 |

|

|

29,224 |

|

(1) Depreciation includes $7.3 million of accelerated

depreciation recognized during the three and nine months ended

September 30, 2023, associated with Services segment

optimization.

(2) Non-cash goodwill impairment due to a significant decline in

the Company’s market capitalization, driven primarily by rising

interest rates and macroeconomic conditions.

(3) Acquisition costs include legal, accounting, banking,

consulting, diligence, and other costs related to completed and

contemplated acquisitions.

(4) Integration costs represent costs related to integrating

acquired businesses, including personnel costs such as severance

and retention bonuses, consulting costs, contract termination costs

and IT conversion costs.

(5) Restructuring consists of variable lease expenses, inventory

valuation adjustments and other miscellaneous costs.

(6) Effective December 31, 2022, the Company no longer includes

non-same-store operating results related to the Services segment

wellness centers with less than six full quarters of operating

results, and pre-opening expenses, as an adjustment to its

calculation of its non-GAAP financial measures. As a result, the

following non-GAAP measures have been recast for comparability to

remove non-same-store operating results for the three and nine

months ended September 30, 2022, as follows:

- Adjusted SG&A - $1.2 and

$5.7 million, respectively

- Adjusted net income - $3.5 and

$15.9 million, respectively

- Adjusted EBITDA - $2.9 and

$13.6 million, respectively

(7) Restructuring consists of accelerated depreciation and

amortization, variable lease expenses, and other miscellaneous

costs.

|

PetIQ, Inc. |

|

Calculation of Net Leverage Ratio Under Term Loan

B |

|

(Unaudited, in 000’s, except for multiples) |

| |

| |

September 30, 2023 |

|

Total debt |

$ |

446,546 |

|

| Total Capital Leases |

|

1,386 |

|

| Less Cash |

|

(124,614 |

) |

| Net Debt |

|

323,318 |

|

| LTM Term Loan B Adjusted

EBITDA(1) |

|

115,610 |

|

| Term Loan B net leverage |

|

2.8 |

x |

(1) Our Term Loan B documentation defines Adjusted EBITDA as net

income before interest, income taxes, depreciation and amortization

and a non-cash goodwill impairment charge, as further adjusted for

acquisition costs, loss on debt extinguishment and related costs,

stock based compensation expense, integration costs, litigation

expenses, and non-same-store net income (loss), which we refer to

as “Term Loan B Adjusted EBITDA.” Term Loan B Adjusted EBITDA is

not a non-GAAP measure and is presented solely for purposes of

providing investors an understanding of the Company’s financial

condition and liquidity and should not be relied upon for any

purposes other than an understanding of the Company’s financial

condition and liquidity as it relates to the Company’s Term Loan

B.

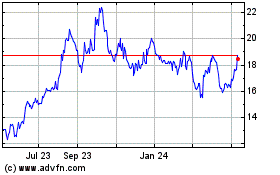

PetIQ (NASDAQ:PETQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

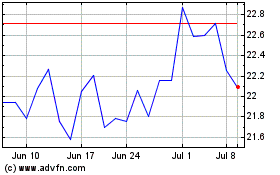

PetIQ (NASDAQ:PETQ)

Historical Stock Chart

From Apr 2023 to Apr 2024