false000132085400013208542023-11-062023-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 6, 2023

_______________________________

FREIGHTCAR AMERICA, INC.

(Exact name of registrant as specified in its charter)

_______________________________

|

|

|

Delaware |

000-51237 |

25-1837219 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

125 S. Wacker Drive, Suite 1500

Chicago, Illinois 60606

(Address of Principal Executive Offices) (Zip Code)

(800) 458-2235

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

RAIL |

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 - Financial Information

Item 2.02. Results of Operations and Financial Condition.

On November 6, 2023, FreightCar America, Inc. issued a press release announcing its financial results for the third quarter of 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in Exhibit 99.1 is being furnished under Item 2.02 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Section 9 - Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

FREIGHTCAR AMERICA, INC. |

|

|

|

|

|

|

Date: November 6, 2023 |

By: |

/s/ Michael A. Riordan |

|

|

Michael A. Riordan |

|

|

Vice President, Finance, Chief Financial Officer and Treasurer |

|

|

|

Exhibit 99.1

Press Release

FreightCar America, Inc. Reports Third Quarter 2023 Results

Company delivers another strong quarterly gross margin with further expansion

Reaffirms EBITDA guidance; adjusts full year revenue and railcar delivery guidance down

CHICAGO, November 6, 2023-- FreightCar America, Inc. (NASDAQ: RAIL) (“FreightCar America” or the “Company”), a diversified manufacturer of railroad freight cars, today reported results for the third quarter ended September 30, 2023.

Third Quarter 2023 Highlights

•Revenues of $61.9 million on 503 railcar deliveries, a decrease of 27.8% compared to revenues of $85.7 million on 783 railcar deliveries in the third quarter of 2022

•Gross margin of 14.9% with gross profit of $9.2 million, compared to gross margin of 5.3% with gross profit of $4.6 million in the third quarter of 2022

•Net income of $3.2 million, or ($0.03) per share and Adjusted Net income of $176 thousand, or ($0.14) per share

•Adjusted EBITDA of $3.5 million, compared to Adjusted EBITDA of $1.6 million in the third quarter of 2022

•Railcar orders of 1,015 in the third quarter and 3,356 year-to-date, with quarter-end backlog totaling 3,800 railcars for an aggregate value of approximately $452 million

•Updated FY23 guidance range of $365 to $380 million for revenue and 3,150 to 3,300 for railcar deliveries; Reaffirmed FY23 Adjusted EBITDA guidance of $18 to $22 million

Jim Meyer, President and Chief Executive Officer of FreightCar America, commented, “Our results this quarter underscore the power of disciplined commercial decision making combined with running the most efficient manufacturing operation in the industry. While the third quarter presented unique challenges for FreightCar America, including the disruptive impacts of the migrant issue and subsequent rail service interruption, we continued to improve the quality of our performance. Although top-line results were pressured, gross margin increased substantially with Adjusted EBITDA increasing to approximately $7,000 per railcar during the quarter, compared to approximately $2,000 in the prior year. This aligns well with our expectations as we progress toward full-scale operations and prepare to make the first deliveries from our fourth production line in the upcoming quarter.”

Fiscal Year 2023 Outlook

The Company has updated its outlook for fiscal year 2023 as follows:

|

|

|

|

Fiscal 2023 Outlook |

Year-over-Year Growth at Midpoint |

|

|

|

Revenue |

$365 - $380 million |

2.3% |

Adjusted EBITDA |

$18 - $22 million |

137.8% |

Railcar Deliveries |

3,150 – 3,300 Railcars |

1.3% |

Mike Riordan, Chief Financial Officer of FreightCar America, added, “While there were macro factors at play during the quarter that muted our top-line results, the true potential of FreightCar America continues to come into focus following our extensive restructuring efforts over the last several years. Given the atypical events during the quarter, and what may continue into the fourth quarter, we are lowering our revenue guidance to between $365 million and $380 million, as well as railcar deliveries to between 3,150 and 3,300, while reaffirming our previously stated full year Adjusted EBITDA guidance range of $18 million to $22 million.”

Riordan continued, “In the quarter, FreightCar America demonstrated the ability to successfully navigate challenges while operating efficiently. We remain extremely confident in the Company’s direction, the strength and quality of the business we continue to build, and our ability to deliver results."

Third Quarter 2023 Conference Call & Webcast Information

The Company will host a conference call and live webcast on Tuesday, November 7, 2023 at 11:00 a.m. (ET) to discuss its third quarter 2023 financial results. FreightCar America invites shareholders and other interested parties to listen to its financial results conference call via the following live and recorded methods:

Live Webcast: https://viavid.webcasts.com/starthere.jsp?ei=1639530&tp_key=2b60b29d6f

Recorded Webcast: A recorded webcast will be available until Tuesday, November 21, 2023 on FreightCar America’s website following the conference call date at: https://investors.freightcaramerica.com/news-events/event-calendar/

Teleconference: Dial-in numbers for the live Conference Call are (877) 407-0789 or (201) 689-8562; Passcode 13742149. Please call in at least 10 minutes prior to the start time of the call. An audio replay may be accessed at (844) 512-2921 or (412) 317-6671; Passcode: 13742149.

About FreightCar America

FreightCar America, headquartered in Chicago, Illinois, is a leading designer, producer and supplier of railroad freight cars, railcar parts and components. We also specialize in railcar repairs, complete railcar rebody services and railcar conversions that repurpose idled rail assets back into revenue service. Since 1901, our customers have trusted us to build quality railcars that are critical to economic growth and instrumental to the North American supply chain. To learn more about FreightCar America, visit www.freightcaramerica.com.

Forward-Looking Statements

This press release may contain statements relating to our expected financial performance and/or future business prospects, events and plans that are “forward-looking statements” as defined under the Private Securities Litigation Reform Act of 1995. Forward-looking statements represent our estimates and assumptions only as of the date of this press release. Our actual results may differ materially from the results described in or anticipated by our

forward-looking statements due to certain risks and uncertainties. These potential risks and uncertainties include, among other things: risks relating to the cyclical nature of our business; adverse economic and market conditions; fluctuating costs of raw materials, including steel and aluminum, and delays in the delivery of raw materials; our ability to maintain relationships with our suppliers of railcar components; our reliance upon a small number of customers that represent a large percentage of our sales; the variable purchase patterns of our customers and the timing of completion, delivery and customer acceptance of orders; potential financial and operational impacts of the COVID-19 pandemic; the highly competitive nature of our industry; the risk of lack of acceptance of our new railcar offerings by our customers; and other competitive factors. We expressly disclaim any duty to provide updates to any forward-looking statements made in this press release, whether as a result of new information, future events or otherwise.

|

|

Investor Contact: |

RAILIR@Riveron.com |

# # #

FreightCar America, Inc.

Condensed Consolidated Balance Sheets

(In thousands, except for share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

September 30,

2023 |

|

|

December 31,

2022 |

|

Assets |

|

|

|

Current assets |

|

|

|

|

|

|

Cash, cash equivalents and restricted cash equivalents |

|

$ |

15,379 |

|

|

$ |

37,912 |

|

Accounts receivable, net of allowance for doubtful accounts of $41 and $126 respectively |

|

|

10,697 |

|

|

|

9,571 |

|

VAT receivable |

|

|

2,141 |

|

|

|

4,682 |

|

Inventories, net |

|

|

122,071 |

|

|

|

64,317 |

|

Assets held for sale |

|

|

— |

|

|

|

3,675 |

|

Related party asset |

|

|

1,172 |

|

|

|

3,261 |

|

Prepaid expenses |

|

|

6,239 |

|

|

|

5,470 |

|

Total current assets |

|

|

157,699 |

|

|

|

128,888 |

|

Property, plant and equipment, net |

|

|

29,344 |

|

|

|

23,248 |

|

Railcars available for lease, net |

|

|

7,002 |

|

|

|

11,324 |

|

Right of use asset operating lease |

|

|

2,926 |

|

|

|

1,596 |

|

Right of use asset finance lease |

|

|

31,694 |

|

|

|

33,093 |

|

Other long-term assets |

|

|

644 |

|

|

|

1,589 |

|

Total assets |

|

$ |

229,309 |

|

|

$ |

199,738 |

|

|

|

|

|

|

|

|

|

|

Liabilities, Mezzanine Equity and Stockholders’ Deficit |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts and contractual payables |

|

$ |

51,611 |

|

|

$ |

48,449 |

|

Related party accounts payable |

|

|

1,569 |

|

|

|

3,393 |

|

Accrued payroll and other employee costs |

|

|

6,360 |

|

|

|

4,081 |

|

Accrued warranty |

|

|

1,638 |

|

|

|

1,940 |

|

Customer deposits |

|

|

19,644 |

|

|

|

— |

|

Current portion of long-term debt |

|

|

— |

|

|

|

40,742 |

|

Other current liabilities |

|

|

4,635 |

|

|

|

7,380 |

|

Total current liabilities |

|

|

85,457 |

|

|

|

105,985 |

|

Long-term debt, net of current portion |

|

|

31,062 |

|

|

|

51,494 |

|

Warrant liability |

|

|

36,441 |

|

|

|

31,028 |

|

Accrued pension costs |

|

|

709 |

|

|

|

1,040 |

|

Lease liability operating lease, long-term |

|

|

3,284 |

|

|

|

1,780 |

|

Lease liability finance lease, long-term |

|

|

32,749 |

|

|

|

33,245 |

|

Other long-term liabilities |

|

|

562 |

|

|

|

3,750 |

|

Total liabilities |

|

|

190,264 |

|

|

|

228,322 |

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

Mezzanine equity |

|

|

|

|

|

|

Series C Preferred stock, $0.01 par value, 85,412 shares authorized, 85,412 and 0 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively. Liquidation value $90,947 and $0 at September 30, 2023 and December 31, 2022, respectively. |

|

|

83,314 |

|

|

|

— |

|

Stockholders’ deficit |

|

|

|

|

|

|

Preferred stock, $0.01 par value, 2,500,000 shares authorized (100,000 shares each

designated as Series A voting and Series B non-voting, 0 shares issued and outstanding

at September 30, 2023 and December 31, 2022) |

|

|

— |

|

|

|

— |

|

Common stock, $0.01 par value, 50,000,000 shares authorized, 17,903,437 and 17,223,306

shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively |

|

|

210 |

|

|

|

203 |

|

Additional paid-in capital |

|

|

93,351 |

|

|

|

89,104 |

|

Accumulated other comprehensive income |

|

|

2,019 |

|

|

|

1,022 |

|

Accumulated deficit |

|

|

(139,849 |

) |

|

|

(118,913 |

) |

Total stockholders' deficit |

|

|

(44,269 |

) |

|

|

(28,584 |

) |

Total liabilities, mezzanine equity and stockholders’ deficit |

|

$ |

229,309 |

|

|

$ |

199,738 |

|

See Notes to Condensed Consolidated Financial Statements (Unaudited).

FreightCar America, Inc.

Condensed Consolidated Statements of Operations

(In thousands, except for share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

Revenues |

|

$ |

61,894 |

|

|

$ |

85,743 |

|

|

$ |

231,489 |

|

|

$ |

235,765 |

|

Cost of sales |

|

|

52,669 |

|

|

|

81,189 |

|

|

|

201,824 |

|

|

|

214,564 |

|

Gross profit |

|

|

9,225 |

|

|

|

4,554 |

|

|

|

29,665 |

|

|

|

21,201 |

|

Selling, general and administrative expenses |

|

|

7,511 |

|

|

|

7,112 |

|

|

|

19,750 |

|

|

|

21,878 |

|

Gain on sale of railcars available for lease |

|

|

— |

|

|

|

— |

|

|

|

622 |

|

|

|

— |

|

Loss on pension settlement |

|

|

313 |

|

|

|

8,105 |

|

|

|

313 |

|

|

|

8,105 |

|

Operating income (loss) |

|

|

1,401 |

|

|

|

(10,663 |

) |

|

|

10,224 |

|

|

|

(8,782 |

) |

Interest expense |

|

|

(2,037 |

) |

|

|

(6,087 |

) |

|

|

(12,988 |

) |

|

|

(17,549 |

) |

Gain (loss) on change in fair market value of Warrant liability |

|

|

4,273 |

|

|

|

(1,274 |

) |

|

|

(1,869 |

) |

|

|

(3,258 |

) |

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

(14,880 |

) |

|

|

— |

|

Other (expense) income |

|

|

(228 |

) |

|

|

190 |

|

|

|

(333 |

) |

|

|

2,347 |

|

Income (loss) before income taxes |

|

|

3,409 |

|

|

|

(17,834 |

) |

|

|

(19,846 |

) |

|

|

(27,242 |

) |

Income tax provision (benefit) |

|

|

216 |

|

|

|

(28 |

) |

|

|

887 |

|

|

|

1,872 |

|

Net income (loss) |

|

$ |

3,193 |

|

|

$ |

(17,806 |

) |

|

$ |

(20,733 |

) |

|

$ |

(29,114 |

) |

Net loss per common share – basic |

|

$ |

(0.03 |

) |

|

$ |

(0.69 |

) |

|

$ |

(0.94 |

) |

|

$ |

(1.19 |

) |

Net loss per common share – diluted |

|

$ |

(0.03 |

) |

|

$ |

(0.69 |

) |

|

$ |

(0.94 |

) |

|

$ |

(1.19 |

) |

Weighted average common shares outstanding – basic |

|

|

29,543,963 |

|

|

|

25,718,414 |

|

|

|

28,064,410 |

|

|

|

24,470,659 |

|

Weighted average common shares outstanding – diluted |

|

|

29,543,963 |

|

|

|

25,718,414 |

|

|

|

28,064,410 |

|

|

|

24,470,659 |

|

See Notes to Condensed Consolidated Financial Statements (Unaudited).

FreightCar America, Inc.

Segment Data

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

|

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

2022 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing |

|

$ |

58,554 |

|

|

$ |

82,817 |

|

|

|

$ |

221,877 |

|

|

$ |

226,548 |

|

Corporate and Other |

|

|

3,340 |

|

|

|

2,926 |

|

|

|

|

9,612 |

|

|

|

9,217 |

|

Consolidated revenues |

|

$ |

61,894 |

|

|

$ |

85,743 |

|

|

|

$ |

231,489 |

|

|

$ |

235,765 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing |

|

$ |

7,378 |

|

|

$ |

3,054 |

|

|

|

$ |

24,775 |

|

|

$ |

16,470 |

|

Corporate and Other |

|

|

(5,977 |

) |

|

|

(13,717 |

) |

|

|

|

(14,551 |

) |

|

|

(25,252 |

) |

Consolidated operating income (loss) |

|

$ |

1,401 |

|

|

$ |

(10,663 |

) |

|

|

$ |

10,224 |

|

|

$ |

(8,782 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FreightCar America, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

Cash flows from operating activities |

|

|

|

Net loss |

|

$ |

(20,733 |

) |

|

$ |

(29,114 |

) |

Adjustments to reconcile net loss to net cash flows used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

3,189 |

|

|

|

3,110 |

|

Non-cash lease expense on right-of-use assets |

|

|

1,873 |

|

|

|

944 |

|

Recognition of deferred income from state and local incentives |

|

|

— |

|

|

|

(2,507 |

) |

Loss on change in fair market value for Warrant liability |

|

|

1,869 |

|

|

|

3,258 |

|

Loss on pension settlement |

|

|

313 |

|

|

|

8,105 |

|

Stock-based compensation recognized |

|

|

524 |

|

|

|

2,307 |

|

Non-cash interest expense |

|

|

8,980 |

|

|

|

11,309 |

|

Loss on extinguishment of debt |

|

|

14,880 |

|

|

|

— |

|

Other non-cash items, net |

|

|

(435 |

) |

|

|

(9 |

) |

Changes in operating assets and liabilities, net of acquisitions: |

|

|

|

|

|

|

Accounts receivable |

|

|

(1,126 |

) |

|

|

(2,603 |

) |

VAT receivable |

|

|

2,320 |

|

|

|

24,634 |

|

Inventories |

|

|

(57,213 |

) |

|

|

(30,110 |

) |

Accounts and contractual payables |

|

|

2,739 |

|

|

|

4,386 |

|

Lease liability |

|

|

(2,779 |

) |

|

|

(1,439 |

) |

Customer deposits |

|

|

19,644 |

|

|

|

(3,300 |

) |

Other assets and liabilities |

|

|

(455 |

) |

|

|

(2,556 |

) |

Net cash flows used in operating activities |

|

|

(26,410 |

) |

|

|

(13,585 |

) |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

(8,971 |

) |

|

|

(3,380 |

) |

Proceeds from sale of railcars available for lease, net of selling costs |

|

|

8,356 |

|

|

|

— |

|

Net cash flows used in investing activities |

|

|

(615 |

) |

|

|

(3,380 |

) |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

Proceeds from issuance of preferred shares, net of issuance costs |

|

|

13,254 |

|

|

|

— |

|

Deferred financing costs |

|

|

(300 |

) |

|

|

— |

|

Borrowings on revolving line of credit |

|

|

115,172 |

|

|

|

84,396 |

|

Repayments on revolving line of credit |

|

|

(123,062 |

) |

|

|

(75,239 |

) |

Employee stock settlement |

|

|

(106 |

) |

|

|

(57 |

) |

Payment for stock appreciation rights exercised |

|

|

(6 |

) |

|

|

(4 |

) |

Financing lease payments |

|

|

(460 |

) |

|

|

— |

|

Net cash flows provided by financing activities |

|

|

4,492 |

|

|

|

9,096 |

|

Net decrease in cash and cash equivalents |

|

|

(22,533 |

) |

|

|

(7,869 |

) |

Cash, cash equivalents and restricted cash equivalents at beginning of period |

|

|

37,912 |

|

|

|

26,240 |

|

Cash, cash equivalents and restricted cash equivalents at end of period |

|

$ |

15,379 |

|

|

$ |

18,371 |

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow information |

|

|

|

|

|

|

Interest paid |

|

$ |

3,961 |

|

|

$ |

6,240 |

|

Income taxes paid |

|

$ |

1,857 |

|

|

$ |

1,110 |

|

|

|

|

|

|

|

|

|

|

Non-cash transactions |

|

|

|

|

|

|

Change in unpaid construction in process |

|

$ |

51 |

|

|

$ |

2,168 |

|

Accrued PIK interest paid through issuance of PIK Note |

|

$ |

3,161 |

|

|

$ |

1,093 |

|

Issuance of preferred shares in exchange of term loan |

|

$ |

72,688 |

|

|

$ |

— |

|

Issuance of warrants |

|

$ |

3,014 |

|

|

$ |

8,560 |

|

Issuance of equity fee |

|

$ |

685 |

|

|

$ |

3,000 |

|

|

|

|

|

|

|

|

See Notes to Condensed Consolidated Financial Statements (Unaudited).

FreightCar America, Inc.

Reconciliation of (loss) income before taxes to EBITDA(1) and Adjusted EBITDA(2)

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) before income taxes |

|

$ |

3,409 |

|

|

$ |

(17,834 |

) |

|

$ |

(19,846 |

) |

|

$ |

(27,242 |

) |

|

Depreciation & Amortization |

|

$ |

1,085 |

|

|

|

1,050 |

|

|

$ |

3,189 |

|

|

|

3,110 |

|

|

Interest Expense, net |

|

$ |

2,037 |

|

|

|

6,087 |

|

|

$ |

12,988 |

|

|

|

17,549 |

|

|

EBITDA |

|

|

6,531 |

|

|

|

(10,697 |

) |

|

|

(3,669 |

) |

|

|

(6,583 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in Fair Value of Warrant (a) |

|

|

(4,273 |

) |

|

|

1,274 |

|

|

|

1,869 |

|

|

|

3,258 |

|

|

Loss on Debt Extinguishment (b) |

|

|

- |

|

|

|

- |

|

|

|

14,880 |

|

|

|

- |

|

|

Alabama Grant Amortization (c) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,857 |

) |

|

Mexican Permanent VAT (d) |

|

|

- |

|

|

|

908 |

|

|

|

- |

|

|

|

908 |

|

|

Loss on Pension Settlement (e) |

|

|

313 |

|

|

|

8,105 |

|

|

|

313 |

|

|

|

8,105 |

|

|

Transaction Costs (f) |

|

|

- |

|

|

|

116 |

|

|

|

- |

|

|

|

116 |

|

|

Startup Costs (g) |

|

|

- |

|

|

|

949 |

|

|

|

- |

|

|

|

949 |

|

|

Consulting Costs (h) |

|

|

- |

|

|

|

226 |

|

|

|

- |

|

|

|

988 |

|

|

Corporate Realignment (i) |

|

|

- |

|

|

|

63 |

|

|

|

- |

|

|

|

1,323 |

|

|

Gain on Sale of Railcars Available for Lease (j) |

|

|

- |

|

|

|

- |

|

|

|

(622 |

) |

|

|

- |

|

|

Stock Based Compensation |

|

|

715 |

|

|

|

817 |

|

|

|

524 |

|

|

|

2,307 |

|

|

Other, net |

|

|

228 |

|

|

|

(190 |

) |

|

|

333 |

|

|

|

(2,347 |

) |

|

Adjusted EBITDA |

|

$ |

3,514 |

|

|

$ |

1,571 |

|

|

$ |

13,628 |

|

|

$ |

7,167 |

|

|

(1) EBITDA represents earnings before interest, taxes, depreciation and amortization. We believe EBITDA is useful to investors in evaluating our operating performance compared to that of other companies in our industry. In addition, our management uses EBITDA to evaluate our operating performance. The calculation of EBITDA eliminates the effects of financing, income taxes and the accounting effects of capital spending. These items may vary for different companies for reasons unrelated to the overall performance of the company’s business. EBITDA is not a financial measure presented in accordance with U.S. GAAP. Accordingly, when analyzing our operating performance, investors should not consider EBITDA in isolation or as a substitute for net income, cash flows from operating activities or other statements of operations or statements of cash flow data prepared in accordance with U.S. GAAP. Our calculation of EBITDA is not necessarily comparable to that of other similar titled measures reported by other companies.

(2) Adjusted EBITDA represents EBITDA before the following charges:

a)This adjustment removes the non-cash (income) expense associated with the change in fair market value of the Company’s warrant liability.

b)During the second quarter of 2023, the Company recorded a non-cash loss on debt extinguishment of its term loan.

c)The Company amortized deferred grant income to cost of goods sold in 2022 that represents a non-cash reduction to its gross margin.

d)The Company transitioned to tolling manufacturing structure in the third quarter of 2022 and as a result incurred permanent VAT costs.

e)The Company recorded a non-cash pre-tax pension settlement loss in the third quarter of 2023 and 2022.

f)The Company incurred certain costs during 2022 for nonrecurring professional services associated with its financing arrangements.

g)The Company incurred certain costs during 2022 related to new production lines.

h)The Company incurred certain non-recurring consulting costs during 2022.

i)The Company incurred certain non-recurring corporate realignment costs in 2022.

j)The Company recorded a non-cash pre-tax gain related to sales of its leased railcar fleet in the second quarter of 2023.

We believe that Adjusted EBITDA is useful to investors evaluating our operating performance compared to that of other companies in our industry because it eliminates the impact of certain non-cash charges and other special items that affect the comparability of results in past quarters. Adjusted EBITDA is not a financial measure presented in accordance with U.S. GAAP. Accordingly, when analyzing our operating performance, investors should not consider Adjusted EBITDA in isolation or as a substitute for net income, cash flows from operating activities or other statements of operations or statements of cash flow data prepared in accordance with U.S. GAAP. Our calculation of Adjusted EBITDA is not necessarily comparable to that of other similarly titled measures reported by other companies.

FreightCar America, Inc.

Reconciliation of Net (loss) income and Adjusted Net (loss) income(1)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

3,193 |

|

|

$ |

(17,806 |

) |

|

$ |

(20,733 |

) |

|

$ |

(29,114 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in Fair Value of Warrant (a) |

|

|

(4,273 |

) |

|

|

1,274 |

|

|

|

1,869 |

|

|

|

3,258 |

|

|

Loss on Debt Extinguishment (b) |

|

|

- |

|

|

|

- |

|

|

|

14,880 |

|

|

|

- |

|

|

Alabama Grant Amortization (c) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,857 |

) |

|

Mexican Permanent VAT (d) |

|

|

- |

|

|

|

908 |

|

|

|

- |

|

|

|

908 |

|

|

Loss on Pension Settlement (e) |

|

|

313 |

|

|

|

8,105 |

|

|

|

313 |

|

|

|

8,105 |

|

|

Transaction Costs (f) |

|

|

- |

|

|

|

116 |

|

|

|

- |

|

|

|

116 |

|

|

Startup Costs (g) |

|

|

- |

|

|

|

949 |

|

|

|

- |

|

|

|

949 |

|

|

Consulting Costs (h) |

|

|

- |

|

|

|

226 |

|

|

|

- |

|

|

|

988 |

|

|

Corporate Realignment (i) |

|

|

- |

|

|

|

63 |

|

|

|

- |

|

|

|

1,323 |

|

|

Gain on Sale of Railcars Available for Lease (j) |

|

|

|

|

|

- |

|

|

|

(622 |

) |

|

|

- |

|

|

Stock Based Compensation |

|

|

715 |

|

|

|

817 |

|

|

|

524 |

|

|

|

2,307 |

|

|

Other, net |

|

|

228 |

|

|

|

(190 |

) |

|

|

333 |

|

|

|

(2,347 |

) |

|

Total non-GAAP adjustments |

|

|

(3,017 |

) |

|

|

12,268 |

|

|

|

17,297 |

|

|

|

13,750 |

|

|

Income tax impact on non-GAAP adjustments (k) |

|

|

- |

|

|

|

104 |

|

|

|

- |

|

|

|

387 |

|

|

Adjusted Net loss |

|

$ |

176 |

|

|

$ |

(5,434 |

) |

|

$ |

(3,436 |

) |

|

$ |

(14,977 |

) |

|

(1) Adjusted net loss represents net loss before the following charges:

a)This adjustment removes the non-cash (income) expense associated with the change in fair market value of the Company’s warrant liability.

b)During the second quarter of 2023, the Company recorded a non-cash loss on debt extinguishment of its term loan.

c)The Company amortized deferred grant income to cost of goods sold in 2022 that represents a non-cash reduction to its gross margin.

d)The Company transitioned to tolling manufacturing structure in the third quarter of 2022 and as a result incurred permanent VAT costs.

e)The Company recorded a non-cash pre-tax pension settlement loss in the third quarter of 2023 and 2022.

f)The Company incurred certain costs during 2022 for nonrecurring professional services associated with its financing arrangements.

g)The Company incurred certain costs during 2022 related to new production lines.

h)The Company incurred certain non-recurring consulting costs during 2022.

i)The Company incurred certain non-recurring corporate realignment costs in 2022.

j)The Company recorded a non-cash pre-tax gain related to sales of its leased railcar fleet in the second quarter of 2023.

k)Income tax impact on non-GAAP adjustments per share represents the tax impact of adjustments specific to Mexico using the effective tax rate. Given the Company’s US based NOLs and Valuation Allowances result in an effective tax rate of about % for the US, all US based adjustments above are not tax affected.

We believe that Adjusted net loss is useful to investors evaluating our operating performance compared to that of other companies in our industry because it eliminates the impact of certain non-cash charges and other special items that affect the comparability of results in past quarters. Adjusted net loss is not a financial measure presented in accordance with U.S. GAAP. Accordingly, when analyzing our operating performance, investors should not consider Adjusted net loss in isolation or as a substitute for net income, cash flows from operating activities or other statements of operations or statements of cash flow data prepared in accordance with U.S. GAAP. Our calculation of Adjusted net loss is not necessarily comparable to that of other similarly titled measures reported by other companies.

FreightCar America, Inc.

Reconciliation of EPS and Adjusted EPS(1)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EPS |

|

$ |

(0.03 |

) |

|

$ |

(0.69 |

) |

|

$ |

(0.94 |

) |

|

$ |

(1.19 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in Fair Value of Warrant (a) |

|

|

(0.15 |

) |

|

|

0.05 |

|

|

|

0.07 |

|

|

|

0.13 |

|

|

Loss on Debt Extinguishment (b) |

|

|

- |

|

|

|

- |

|

|

|

0.53 |

|

|

|

- |

|

|

Alabama Grant Amortization (c) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(0.08 |

) |

|

Mexican Permanent VAT (d) |

|

|

- |

|

|

|

0.04 |

|

|

|

- |

|

|

|

0.04 |

|

|

Loss on Pension Settlement (e) |

|

|

0.01 |

|

|

|

0.32 |

|

|

|

0.01 |

|

|

|

0.33 |

|

|

Startup Costs (f) |

|

|

- |

|

|

|

0.04 |

|

|

|

- |

|

|

|

0.04 |

|

|

Consulting Costs (g) |

|

|

- |

|

|

|

0.01 |

|

|

|

- |

|

|

|

0.04 |

|

|

Corporate Realignment (h) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.05 |

|

|

Gain on Sale of Railcars Available for Lease (i) |

|

|

- |

|

|

|

- |

|

|

|

(0.02 |

) |

|

|

- |

|

|

Stock Based Compensation |

|

|

0.02 |

|

|

|

0.03 |

|

|

|

0.02 |

|

|

|

0.09 |

|

|

Other, net |

|

|

0.01 |

|

|

|

(0.01 |

) |

|

|

0.01 |

|

|

|

(0.10 |

) |

|

Total non-GAAP adjustments pre-tax per-share |

|

|

(0.11 |

) |

|

|

0.48 |

|

|

|

0.62 |

|

|

|

0.54 |

|

|

Income tax impact on non-GAAP adjustments per share (j) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.02 |

|

|

Adjusted EPS |

|

$ |

(0.14 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.32 |

) |

|

$ |

(0.63 |

) |

|

(1) Adjusted EPS represents basic EPS before the following charges:

a)This adjustment removes the non-cash (income) expense associated with the change in fair market value of the Company’s warrant liability.

b)During the second quarter of 2023, the Company recorded a non-cash loss on debt extinguishment of its term loan.

c)The Company amortized deferred grant income to cost of goods sold in 2022 that represents a non-cash reduction to its gross margin.

d)The Company transitioned to tolling manufacturing structure in the third quarter of 2022 and as a result incurred permanent VAT costs.

e)The Company recorded a non-cash pre-tax pension settlement loss in the third quarter of 2023 and 2022.

f)The Company incurred certain costs during 2022 for nonrecurring professional services associated with its financing arrangements.

g)The Company incurred certain costs during 2022 related to new production lines.

h)The Company incurred certain non-recurring consulting costs during 2022.

i)The Company incurred certain non-recurring corporate realignment costs in 2022.

j)The Company recorded a non-cash pre-tax gain related to sales of its leased railcar fleet in the second quarter of 2023.

k)Income tax impact on non-GAAP adjustments per share represents the tax impact of adjustments specific to Mexico using the effective tax rate. Given the Company’s US based NOLs and Valuation Allowances result in an effective tax rate of about % for the US, all US based adjustments above are not tax affected.

We believe that Adjusted EPS is useful to investors evaluating our operating performance compared to that of other companies in our industry because it eliminates the impact of certain non-cash charges and other special items that affect the comparability of results in past quarters. Adjusted EPS is not a financial measure presented in accordance with U.S. GAAP. Accordingly, when analyzing our operating performance, investors should not consider Adjusted EPS in isolation or as a substitute for net income, cash flows from operating activities or other statements of operations or statements of cash flow data prepared in accordance with U.S. GAAP. Our calculation of Adjusted EPS is not necessarily comparable to that of other similarly titled measures reported by other companies.

v3.23.3

Document And Entity Information

|

Nov. 06, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 06, 2023

|

| Entity Registrant Name |

FREIGHTCAR AMERICA, INC.

|

| Entity Central Index Key |

0001320854

|

| Entity File Number |

000-51237

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

25-1837219

|

| Entity Address, Address Line One |

125 S. Wacker Drive

|

| Entity Address, Address Line Two |

Suite 1500

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60606

|

| City Area Code |

800

|

| Local Phone Number |

458-2235

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

RAIL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

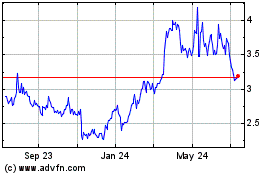

FreightCar America (NASDAQ:RAIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

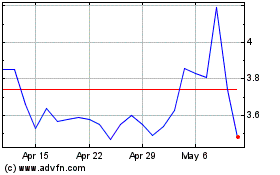

FreightCar America (NASDAQ:RAIL)

Historical Stock Chart

From Apr 2023 to Apr 2024