Gentherm Initiates $60 Million Accelerated Share Repurchase

November 02 2023 - 8:00AM

Gentherm (NASDAQ:THRM), the global market leader of innovative

thermal management and pneumatic comfort technologies for the

automotive industry and a leader in medical patient temperature

management systems, today announced that it has entered into an

accelerated share repurchase agreement (ASR) with Bank of America,

N.A. to repurchase an aggregate of $60 million of Gentherm’s common

shares. The agreement was entered pursuant to the Company’s

previously announced stock repurchase program. The Board of

Directors authorized an extension of the stock repurchase program

through June 30, 2024, which had approximately $97 million

remaining as of October 31, 2023.

The Company will initially receive approximately 1.22 million

common shares. The final number of shares to be repurchased will be

based on the volume-weighted average price of Gentherm’s common

shares during the term of the transaction, less a discount and

subject to adjustments pursuant to the terms and conditions of the

ASR. The final settlement of the transactions under the ASR is

expected to occur no later than the second quarter of 2024.

“I am pleased to announce our $60 million ASR, which reflects

the strength of our balance sheet, cash flow generation and ample

liquidity, as well as management and our Board’s continued

confidence in our ability over time to grow faster than automotive

production while improving profitability,” said Matteo Anversa,

Executive Vice President of Finance, Chief Financial Officer and

Treasurer. “Returning capital to our shareholders through stock

repurchase programs while simultaneously investing in our strategic

growth drivers, is consistent with our capital allocation strategy

and commitment to increasing shareholder value."

Investor ContactYijing

Brentanoinvestors@gentherm.com 248.308.1702

Media ContactMelissa

Fischermedia@gentherm.com248.289.9702

About GenthermGentherm (NASDAQ: THRM)

is the global market leader of innovative thermal management and

pneumatic comfort technologies for the automotive industry and a

leader in medical patient temperature management systems.

Automotive products include variable temperature Climate Control

Seats, heated automotive interior systems (including heated seats,

steering wheels, armrests and other components), battery

performance solutions, cable systems, lumbar and massage comfort

solutions, valve system technologies, and other electronic devices.

Medical products include patient temperature management systems.

The Company is also developing a number of new technologies and

products that will help enable improvements to existing products

and to create new product applications for existing and new

markets. Gentherm has more than 14,000 employees in

facilities in the United

States, Germany, China, Czech Republic, Hungary,

Japan, Malta, Mexico, North Macedonia, South

Korea, United Kingdom, Ukraine, and Vietnam. For

more information, go to www.gentherm.com.

Forward-Looking Statements Except for

historical information contained herein, statements in this release

are forward-looking statements that are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements represent Gentherm

Incorporated's goals, beliefs, plans and expectations about its

prospects for the future and other future events. The

forward-looking statements included in this release are made as of

the date hereof or as of the date specified herein and are based on

management's reasonable expectations and beliefs. Such statements

are subject to a number of important assumptions, significant risks

and uncertainties (some of which are beyond our control) and other

factors that may cause actual results or performance to differ

materially from that described in or indicated by the

forward-looking statements, including but not limited to:

- macroeconomic, geopolitical and similar global factors on the

cyclical Automotive industry;

- the production levels of our major customers and OEMs in our

key markets and sudden fluctuations in such production levels, in

particular with respect to models for which we supply significant

amounts of product;

- our ability to integrate our recent acquisitions and realize

synergies, as well as to consummate additional strategic

acquisitions, investments and exits;

- our implementation activities to execute our long-term strategy

of Fit-for-Growth 2.0, including profitability improvement and cost

reductions;

- our ability to effectively manage new product launches and

research and development;

- increasing competition, including with non-traditional

entrants;

- the ongoing supply-constrained environment, including raw

material and component shortages, manufacturing disruptions and

delays, logistics challenges, inflationary and other cost

pressures;

- the impact of our global operations, including our global

supply chain, operations within Ukraine, economic and trade

policies by various jurisdictions, and foreign currency risk and

foreign exchange exposure;

- our business in China, which is subject to unique operational,

competitive, regulatory and economic risks;

- a tightening labor market, labor shortages or work stoppages

impacting us, our customers or our suppliers, including the

potential impact of ongoing and future labor strikes among certain

OEMs and suppliers;

- our achievement of product cost reductions to offset

customer-imposed price reductions or other pricing pressures;

- any security breaches and other disruptions to our information

technology networks and systems, as well as privacy, data security

and data protection risks;

- our product quality and safety;

- the evolution of the automotive industry towards electric

vehicles, autonomous vehicles and mobility on demand services, and

related consumer behaviors and preferences;

- the development of and market acceptance of our existing and

future products;

- our borrowing availability under our revolving credit facility,

as well as our ability to access the capital markets, to support

our planned growth;

- our indebtedness and compliance with our debt covenants;

- the effects of climate change and catastrophic events, as well

as regulatory and stakeholder-imposed requirements to address

climate change and other sustainability issues;

- our efforts to optimize our global supply chain and

manufacturing footprint;

- our ability to project future sales volume based on third-party

information, based on which we manage our business;

- our ability to convert new business awards into product

revenues;

- any loss or insolvency of our key customers and OEMs, or key

suppliers;

- risks associated with our manufacturing processes;

- the extensive regulation of our patient temperature management

business;

- the protection of our intellectual property in certain

jurisdictions;

- our compliance with anti-corruption laws and regulations;

and

- legal and regulatory proceedings and claims involving us or one

of our major customers.

The foregoing risks should be read in conjunction with the

Company's reports filed with or furnished to the Securities and

Exchange Commission (the “SEC”), including “Risk Factors,” in its

most recent Annual Report on Form 10-K and subsequent SEC filings,

for a discussion of these and other risks and uncertainties. In

addition, with reasonable frequency, we have entered into business

combinations, acquisitions, divestitures, strategic investments and

other significant transactions. Such forward-looking statements do

not include the potential impact of any such transactions that may

be completed after the date hereof, each of which may present

material risks to the Company’s future business and financial

results.

Except as required by law, the Company expressly disclaims any

obligation or undertaking to update any forward-looking statements

to reflect any change in its expectations with regard thereto or

any change in events, conditions or circumstances on which any such

statement is based.

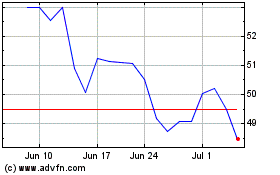

Gentherm (NASDAQ:THRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

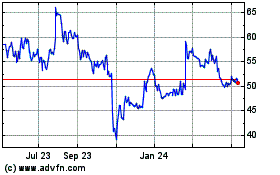

Gentherm (NASDAQ:THRM)

Historical Stock Chart

From Apr 2023 to Apr 2024