0001423902false00014239022023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 1, 2023

WESTERN MIDSTREAM PARTNERS, LP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | 001-35753 | 46-0967367 |

(State or other jurisdiction

of incorporation or organization) | (Commission

File Number) | (IRS Employer

Identification No.) |

9950 Woodloch Forest Drive, Suite 2800

The Woodlands, Texas 77380

(Address of principal executive office) (Zip Code)

(346) 786-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of exchange

on which registered |

| Common units | | WES | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 1, 2023, Western Midstream Partners, LP issued a press release announcing third-quarter 2023 results. The Partnership also simultaneously made the slide presentation for tomorrow’s earnings call available on the Western Midstream website, www.westernmidstream.com. The press release is included in this report as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | WESTERN MIDSTREAM PARTNERS, LP |

| | |

| | By: | Western Midstream Holdings, LLC,

its general partner |

| | |

| | |

| Dated: | November 1, 2023 | By: | /s/ Kristen S. Shults |

| | | Kristen S. Shults

Senior Vice President and Chief Financial Officer |

EXHIBIT 99.1

WESTERN MIDSTREAM ANNOUNCES

THIRD-QUARTER 2023 RESULTS

•Reported third-quarter 2023 Net income attributable to limited partners of $270.8 million, generating third-quarter Adjusted EBITDA(1) of $510.9 million.

•Reported third-quarter 2023 Cash flows provided by operating activities of $394.8 million, generating third-quarter Free cash flow(1) of $200.4 million.

•Announced a third-quarter Base Distribution of $0.5750 per unit, or $2.30 on an annualized basis, which represents a 2.2-percent increase to the prior-quarter’s Base Distribution.

•Repurchased 5.1 million common units from Occidental Petroleum Corporation (“Oxy”) for $127.5 million, reducing Oxy’s total ownership interest in WES to below 50.0% when taking into account both its limited and general partner units.

•Repurchased $159.1 million of near-term senior notes at approximately 94-percent of par during the month of July.

•Subsequent to quarter end, executed an agreement with a large Delaware Basin customer increasing dedicated acreage to approximately 40,000 acres and extending the initial term through 2035, which dedicates existing volumes and supports expected throughput growth.

HOUSTON—(BUSINESS WIRE)—November 1, 2023 – Today Western Midstream Partners, LP (NYSE: WES) (“WES” or the “Partnership”) announced third-quarter 2023 financial and operating results. Net income (loss) attributable to limited partners for the third quarter of 2023 totaled $270.8 million, or $0.70 per common unit (diluted), with third-quarter 2023 Adjusted EBITDA(1) totaling $510.9 million. Third-quarter 2023 Cash flows provided by operating activities totaled $394.8 million, and third-quarter 2023 Free cash flow(1) totaled $200.4 million.

RECENT HIGHLIGHTS

•Achieved record Delaware Basin natural-gas throughput of 1.67 Bcf/d for the third quarter, representing a 5-percent sequential-quarter increase.

•Gathered record Delaware Basin crude-oil and NGLs throughput of 220 MBbls/d for the third

quarter, representing a 6-percent sequential-quarter increase.

•Gathered record Delaware Basin produced-water throughput of 1,101 MBbls/d for the third quarter, representing a 14-percent sequential-quarter increase.

•Averaged over 1.0 Bcf/d of monthly third-party natural-gas volumes in the Delaware Basin during August and September.

•Issued $600 million of 6.35% senior notes due 2029 and used the proceeds to fund a portion of the purchase price for the previously announced acquisition of Meritage Midstream Services II, LLC (“Meritage”) in the Powder River Basin.

•Subsequent to quarter-end, closed the acquisition of Meritage, transforming WES’s Powder River Basin asset base into the largest gatherer and processor in the basin.

On November 13, 2023, WES will pay its third-quarter 2023 per-unit Base Distribution of $0.5750, representing a 2.2-percent sequential-quarter increase to the Partnership’s second-quarter Base Distribution of $0.5625 per unit. This increase is consistent with prior communication regarding a distribution increase upon the close of the Meritage acquisition. Third-quarter 2023 Free cash flow(1) after distributions totaled $(21.0) million. Third-quarter 2023 and year-to-date capital expenditures(2) totaled $194.9 million and $558.5 million, respectively.

Third-quarter 2023 natural-gas throughput(3) averaged 4.5 Bcf/d, representing a 5-percent sequential-quarter increase. Third-quarter 2023 throughput for crude-oil and NGLs assets(3) averaged 667 MBbls/d, representing a 7-percent sequential-quarter increase. Third-quarter 2023 throughput for produced-water assets(3) averaged 1,079 MBbls/d, representing a 14-percent sequential-quarter increase.

“During the third quarter, total throughput for natural-gas, crude-oil and NGLs, and produced-water increased on a sequential-quarter basis primarily driven by new production coming online, and continued high facility operability in the Delaware Basin,” said Michael Ure, President and Chief Executive Officer. “We remain focused on creating substantial value for our unitholders by efficiently allocating capital for future growth organically and through accretive M&A.”

Mr. Ure continued, “Overall, portfolio-wide throughput growth drove a sequential-quarter increase in our Adjusted EBITDA, which was partially offset by decreased distributions from our equity investments and increased operation and maintenance expense that was mostly driven by higher utility costs. Despite the prolonged heat across West Texas, our assets maintained high operability rates with minimal downtime.”

“In early September, we announced the acquisition of Meritage in the Powder River Basin in Wyoming for $885 million in cash consideration. The Meritage acquisition transforms WES into the largest gathering and processing operator in the Powder River Basin. Additionally, the transaction further diversifies our customer base and adds numerous long-term contracts to our portfolio, secured by large acreage dedications or substantial minimum-volume commitments. We have also identified numerous cost synergies that we expect to realize over the coming quarters, which should reduce the acquisition multiple and drive additional unitholder value.”

“Finally, in October, we formally announced our second Base Distribution increase for the year of 2.2% to $0.5750 per unit on a quarterly basis, or $2.30 per unit annualized, in connection with the closing of the Meritage acquisition. Our commitment to improving the strength of our balance sheet over the past three years provided WES the opportunity to undertake this accretive transaction, which we expect will contribute to WES’s profitability and Free cash flow for years to come.”

“When considering the growth we experienced in the third quarter, combined with over two months of expected contribution from the Meritage assets, we now anticipate 2023 Adjusted EBITDA(4) to be towards the high end of our previously announced guidance range of $1.950 billion to $2.050 billion,” concluded Mr. Ure.

CONFERENCE CALL TOMORROW AT 1:00 P.M. CT

WES will host a conference call on Thursday, November 2, 2023, at 1:00 p.m. Central Time (2:00 p.m. Eastern Time) to discuss its third-quarter 2023 results. To participate, individuals should dial 888-770-7129 (Domestic) or 929-203-2109 (International) ten to fifteen minutes before the scheduled conference call time and enter the participant access code 2187921. To access the live audio webcast of the conference call, please visit the investor relations section of the Partnership’s website at www.westernmidstream.com. A replay of the conference call also will be available on the website following the call.

For additional details on WES’s financial and operational performance, please refer to the earnings slides and updated investor presentation available at www.westernmidstream.com.

ABOUT WESTERN MIDSTREAM

Western Midstream Partners, LP (“WES”) is a Delaware master limited partnership formed to acquire, own, develop, and operate midstream assets. With midstream assets located in Texas, New Mexico, Colorado, Utah, Wyoming, and Pennsylvania, WES is engaged in the business of gathering, compressing, treating, processing, and transporting natural gas; gathering, stabilizing, and transporting condensate, natural-gas liquids, and crude oil; and gathering and disposing of produced water for its customers. In its capacity as a natural-gas processor, WES also buys and sells natural gas, natural-gas liquids, and condensate on behalf of itself and its customers under certain contracts.

For more information about Western Midstream Partners, LP, please visit www.westernmidstream.com, and for more information on our sustainability efforts, please visit www.westernmidstream.com/sustainability.

This news release contains forward-looking statements. WES’s management believes that its expectations are based on reasonable assumptions. No assurance, however, can be given that such expectations will prove correct. A number of factors could cause actual results to differ materially from the projections, anticipated results, or other expectations expressed in this news release. These factors include our ability to meet financial guidance or distribution expectations; our ability to safely and efficiently operate WES’s assets; the supply of, demand for, and price of oil, natural gas, NGLs, and related products or services; our ability to meet projected in-service dates for capital-growth projects; construction costs or capital expenditures exceeding estimated or budgeted costs or expenditures; and the other factors described in the “Risk Factors” section of WES’s most-recent Form 10-K filed with the Securities and Exchange Commission and other public filings and press releases. WES undertakes no obligation to publicly update or revise any forward-looking statements.

______________________________________________________________

(1)Please see the definitions of the Partnership’s non-GAAP measures at the end of this release and reconciliation of GAAP to non-GAAP measures.

(2)Accrual-based, includes equity investments, excludes capitalized interest, and excludes capital expenditures associated with the 25% third-party interest in Chipeta.

(3)Represents total throughput attributable to WES, which excludes (i) the 2.0% limited partner interest in WES Operating owned by an Occidental subsidiary and (ii) for natural-gas throughput, the 25% third-party interest in Chipeta, which collectively represent WES’s noncontrolling interests.

(4)A reconciliation of the Adjusted EBITDA range to net cash provided by operating activities and net income (loss) is not provided because the items necessary to estimate such amounts are not reasonably estimable at this time. These items, net of tax, may include, but are not limited to, impairments of assets and other charges, divestiture costs, acquisition costs, or changes in accounting principles. All of these items could significantly impact such financial measures. At this time, WES is not able to estimate the aggregate impact, if any, of these items on future period reported earnings. Accordingly, WES is not able to provide a corresponding GAAP equivalent for the Adjusted EBITDA.

# # #

Source: Western Midstream Partners LP

WESTERN MIDSTREAM CONTACTS

Daniel Jenkins

Director, Investor Relations

Investors@westernmidstream.com

866.512.3523

Rhianna Disch

Manager, Investor Relations

Investors@westernmidstream.com

866.512.3523

Western Midstream Partners, LP

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| thousands except per-unit amounts | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues and other | | | | | | | | |

Service revenues – fee based | | $ | 695,547 | | | $ | 666,555 | | | $ | 2,004,920 | | | $ | 1,954,105 | |

Service revenues – product based | | 48,446 | | | 91,356 | | | 142,212 | | | 202,721 | |

| Product sales | | 31,652 | | | 79,430 | | | 100,336 | | | 314,755 | |

| Other | | 368 | | | 227 | | | 800 | | | 703 | |

| Total revenues and other | | 776,013 | | | 837,568 | | | 2,248,268 | | | 2,472,284 | |

| Equity income, net – related parties | | 35,494 | | | 41,317 | | | 116,839 | | | 139,388 | |

| Operating expenses | | | | | | | | |

| Cost of product | | 27,590 | | | 106,833 | | | 123,795 | | | 328,237 | |

| Operation and maintenance | | 204,434 | | | 190,514 | | | 562,104 | | | 487,643 | |

| General and administrative | | 55,050 | | | 48,185 | | | 159,572 | | | 144,635 | |

| Property and other taxes | | 14,583 | | | 19,390 | | | 39,961 | | | 60,494 | |

| Depreciation and amortization | | 147,363 | | | 156,837 | | | 435,481 | | | 430,455 | |

| Long-lived asset and other impairments | | 245 | | | 4 | | | 52,880 | | | 94 | |

| | | | | | | | |

| Total operating expenses | | 449,265 | | | 521,763 | | | 1,373,793 | | | 1,451,558 | |

| Gain (loss) on divestiture and other, net | | (1,480) | | | (104) | | | (3,668) | | | (884) | |

| Operating income (loss) | | 360,762 | | | 357,018 | | | 987,646 | | | 1,159,230 | |

| | | | | | | | |

| Interest expense | | (82,754) | | | (83,106) | | | (250,606) | | | (249,333) | |

| Gain (loss) on early extinguishment of debt | | 8,565 | | | — | | | 15,378 | | | 91 | |

| Other income (expense), net | | (1,270) | | | 56 | | | 2,817 | | | 117 | |

| Income (loss) before income taxes | | 285,303 | | | 273,968 | | | 755,235 | | | 910,105 | |

| Income tax expense (benefit) | | 905 | | | 387 | | | 2,980 | | | 3,683 | |

| Net income (loss) | | 284,398 | | | 273,581 | | | 752,255 | | | 906,422 | |

| Net income (loss) attributable to noncontrolling interests | | 7,102 | | | 7,836 | | | 18,393 | | | 25,643 | |

Net income (loss) attributable to Western Midstream Partners, LP | | $ | 277,296 | | | $ | 265,745 | | | $ | 733,862 | | | $ | 880,779 | |

| Limited partners’ interest in net income (loss): | | | | | | | | |

Net income (loss) attributable to Western Midstream Partners, LP | | $ | 277,296 | | | $ | 265,745 | | | $ | 733,862 | | | $ | 880,779 | |

| | | | | | | | |

| General partner interest in net (income) loss | | (6,453) | | | (6,244) | | | (16,960) | | | (19,794) | |

| Limited partners’ interest in net income (loss) | | $ | 270,843 | | | $ | 259,501 | | | $ | 716,902 | | | $ | 860,985 | |

| Net income (loss) per common unit – basic | | $ | 0.71 | | | $ | 0.67 | | | $ | 1.87 | | | $ | 2.16 | |

| Net income (loss) per common unit – diluted | | $ | 0.70 | | | $ | 0.66 | | | $ | 1.86 | | | $ | 2.15 | |

| Weighted-average common units outstanding – basic | | 383,561 | | | 388,906 | | | 384,211 | | | 398,343 | |

| Weighted-average common units outstanding – diluted | | 384,772 | | | 390,318 | | | 385,344 | | | 399,545 | |

Western Midstream Partners, LP

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | | | | |

| | |

| | | | |

| thousands except number of units | | September 30,

2023 | | December 31,

2022 |

| Total current assets | | $ | 1,135,806 | | | $ | 900,425 | |

| Net property, plant, and equipment | | 8,664,402 | | | 8,541,600 | |

| Other assets | | 1,826,346 | | | 1,829,603 | |

| Total assets | | $ | 11,626,554 | | | $ | 11,271,628 | |

| Total current liabilities | | $ | 635,900 | | | $ | 903,857 | |

| Long-term debt | | 7,260,051 | | | 6,569,582 | |

| Asset retirement obligations | | 307,945 | | | 290,021 | |

| Other liabilities | | 467,566 | | | 400,053 | |

| Total liabilities | | 8,671,462 | | | 8,163,513 | |

| Equity and partners’ capital | | | | |

| Common units (379,516,369 and 384,070,984 units issued and outstanding at September 30, 2023, and December 31, 2022, respectively) | | 2,821,958 | | | 2,969,604 | |

| General partner units (9,060,641 units issued and outstanding at September 30, 2023, and December 31, 2022) | | 1,678 | | | 2,105 | |

| | | | |

| Noncontrolling interests | | 131,456 | | | 136,406 | |

| Total liabilities, equity, and partners’ capital | | $ | 11,626,554 | | | $ | 11,271,628 | |

Western Midstream Partners, LP

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | |

| | |

| | | Nine Months Ended

September 30, |

| thousands | | 2023 | | 2022 |

| Cash flows from operating activities | | | | |

| Net income (loss) | | $ | 752,255 | | | $ | 906,422 | |

Adjustments to reconcile net income (loss) to net cash provided by operating activities and changes in assets and liabilities: | | | | |

| Depreciation and amortization | | 435,481 | | | 430,455 | |

| Long-lived asset and other impairments | | 52,880 | | | 94 | |

| | | | |

| (Gain) loss on divestiture and other, net | | 3,668 | | | 884 | |

| (Gain) loss on early extinguishment of debt | | (15,378) | | | (91) | |

| Change in other items, net | | (40,872) | | | (125,557) | |

| Net cash provided by operating activities | | $ | 1,188,034 | | | $ | 1,212,207 | |

| Cash flows from investing activities | | | | |

| Capital expenditures | | $ | (536,427) | | | $ | (341,505) | |

| | | | |

| Acquisitions from third parties | | — | | | (41,018) | |

| Contributions to equity investments - related parties | | (1,153) | | | (8,899) | |

| Distributions from equity investments in excess of cumulative earnings – related parties | | 31,715 | | | 41,058 | |

| | | | |

| Proceeds from the sale of assets to third parties | | (60) | | | 1,111 | |

| (Increase) decrease in materials and supplies inventory and other | | (32,659) | | | (6,999) | |

| Net cash used in investing activities | | $ | (538,584) | | | $ | (356,252) | |

| Cash flows from financing activities | | | | |

| Borrowings, net of debt issuance costs | | $ | 1,801,011 | | | $ | 1,389,010 | |

| Repayments of debt | | (1,317,928) | | | (1,268,548) | |

| Increase (decrease) in outstanding checks | | (241) | | | 1,459 | |

| Distributions to Partnership unitholders | | (754,998) | | | (538,690) | |

| Distributions to Chipeta noncontrolling interest owner | | (5,083) | | | (5,020) | |

| Distributions to noncontrolling interest owner of WES Operating | | (18,260) | | | (20,177) | |

| Net contributions from (distributions to) related parties | | — | | | 1,161 | |

| Unit repurchases | | (134,602) | | | (447,075) | |

| Other | | (16,511) | | | (10,981) | |

| Net cash provided by (used in) financing activities | | $ | (446,612) | | | $ | (898,861) | |

| Net increase (decrease) in cash and cash equivalents | | $ | 202,838 | | | $ | (42,906) | |

| Cash and cash equivalents at beginning of period | | 286,656 | | | 201,999 | |

| Cash and cash equivalents at end of period | | $ | 489,494 | | | $ | 159,093 | |

Western Midstream Partners, LP

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

WES defines Adjusted gross margin attributable to Western Midstream Partners, LP (“Adjusted gross margin”) as total revenues and other (less reimbursements for electricity-related expenses recorded as revenue), less cost of product, plus distributions from equity investments, and excluding the noncontrolling interest owners’ proportionate share of revenues and cost of product.

WES defines Adjusted EBITDA as net income (loss), plus (i) distributions from equity investments, (ii) non-cash equity-based compensation expense, (iii) interest expense, (iv) income tax expense, (v) depreciation and amortization, (vi) impairments, and (vii) other expense (including lower of cost or market inventory adjustments recorded in cost of product), less (i) gain (loss) on divestiture and other, net, (ii) gain (loss) on early extinguishment of debt, (iii) income from equity investments, (iv) interest income, (v) income tax benefit, (vi) other income, and (vii) the noncontrolling interest owners’ proportionate share of revenues and expenses.

WES defines Free cash flow as net cash provided by operating activities less total capital expenditures and contributions to equity investments, plus distributions from equity investments in excess of cumulative earnings. Management considers Free cash flow an appropriate metric for assessing capital discipline, cost efficiency, and balance-sheet strength. Although Free cash flow is the metric used to assess WES’s ability to make distributions to unitholders, this measure should not be viewed as indicative of the actual amount of cash that is available for distributions or planned for distributions for a given period. Instead, Free cash flow should be considered indicative of the amount of cash that is available for distributions, debt repayments, and other general partnership purposes.

Below are reconciliations of (i) gross margin (GAAP) to Adjusted gross margin (non-GAAP), (ii) net income (loss) (GAAP) and net cash provided by operating activities (GAAP) to Adjusted EBITDA (non-GAAP), and (iii) net cash provided by operating activities (GAAP) to Free cash flow (non-GAAP), as required under Regulation G of the Securities Exchange Act of 1934. Management believes that Adjusted gross margin, Adjusted EBITDA, and Free cash flow are widely accepted financial indicators of WES’s financial performance compared to other publicly traded partnerships and are useful in assessing WES’s ability to incur and service debt, fund capital expenditures, and make distributions. Adjusted gross margin, Adjusted EBITDA, and Free cash flow as defined by WES, may not be comparable to similarly titled measures used by other companies. Therefore, WES’s Adjusted gross margin, Adjusted EBITDA, and Free cash flow should be considered in conjunction with net income (loss) attributable to Western Midstream Partners, LP and other applicable performance measures, such as gross margin or cash flows provided by operating activities.

Western Midstream Partners, LP

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (CONTINUED)

(Unaudited)

Adjusted Gross Margin

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| thousands | | September 30,

2023 | | June 30,

2023 | | | | |

| Reconciliation of Gross margin to Adjusted gross margin | | | | | | | | |

| Total revenues and other | | $ | 776,013 | | | $ | 738,273 | | | | | |

| Less: | | | | | | | | |

| Cost of product | | 27,590 | | | 44,746 | | | | | |

Depreciation and amortization | | 147,363 | | | 143,492 | | | | | |

| Gross margin | | 601,060 | | | 550,035 | | | | | |

| Add: | | | | | | | | |

| Distributions from equity investments | | 41,562 | | | 54,075 | | | | | |

Depreciation and amortization | | 147,363 | | | 143,492 | | | | | |

| Less: | | | | | | | | |

| Reimbursed electricity-related charges recorded as revenues | | 29,981 | | | 23,286 | | | | | |

Adjusted gross margin attributable to noncontrolling interests (1) | | 18,095 | | | 16,914 | | | | | |

Adjusted gross margin | | $ | 741,909 | | | $ | 707,402 | | | | | |

| | | | | | | | |

| Gross margin | | | | | | | | |

Gross margin for natural-gas assets (2) | | $ | 450,130 | | | $ | 409,634 | | | | | |

Gross margin for crude-oil and NGLs assets (2) | | 87,911 | | | 88,024 | | | | | |

Gross margin for produced-water assets (2) | | 70,353 | | | 59,130 | | | | | |

| Adjusted gross margin | | | | | | | | |

Adjusted gross margin for natural-gas assets | | $ | 518,765 | | | $ | 489,476 | | | | | |

Adjusted gross margin for crude-oil and NGLs assets | | 139,430 | | | 147,036 | | | | | |

| Adjusted gross margin for produced-water assets | | 83,714 | | | 70,890 | | | | | |

(1)For all periods presented, includes (i) the 25% third-party interest in Chipeta and (ii) the 2.0% limited partner interest in WES Operating owned by an Occidental subsidiary, which collectively represent WES’s noncontrolling interests.

(2)Excludes corporate-level depreciation and amortization.

Western Midstream Partners, LP

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (CONTINUED)

(Unaudited)

Adjusted EBITDA

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| thousands | | September 30,

2023 | | June 30,

2023 | | | | |

| Reconciliation of Net income (loss) to Adjusted EBITDA | | | | | | | | |

| Net income (loss) | | $ | 284,398 | | | $ | 259,516 | | | | | |

| Add: | | | | | | | | |

| Distributions from equity investments | | 41,562 | | | 54,075 | | | | | |

| Non-cash equity-based compensation expense | | 7,171 | | | 7,665 | | | | | |

| Interest expense | | 82,754 | | | 86,182 | | | | | |

| Income tax expense | | 905 | | | 659 | | | | | |

| Depreciation and amortization | | 147,363 | | | 143,492 | | | | | |

| Impairments | | 245 | | | 234 | | | | | |

| Other expense | | 1,269 | | | 199 | | | | | |

| Less: | | | | | | | | |

| Gain (loss) on divestiture and other, net | | (1,480) | | | (70) | | | | | |

| Gain (loss) on early extinguishment of debt | | 8,565 | | | 6,813 | | | | | |

| Equity income, net – related parties | | 35,494 | | | 42,324 | | | | | |

| | | | | | | | |

| Other income | | 27 | | | 2,872 | | | | | |

| | | | | | | | |

Adjusted EBITDA attributable to noncontrolling interests (1) | | 12,134 | | | 11,737 | | | | | |

| Adjusted EBITDA | | $ | 510,927 | | | $ | 488,346 | | | | | |

| Reconciliation of Net cash provided by operating activities to Adjusted EBITDA | | | | | | | | |

| Net cash provided by operating activities | | $ | 394,787 | | | $ | 490,823 | | | | | |

| Interest (income) expense, net | | 82,754 | | | 86,182 | | | | | |

| Accretion and amortization of long-term obligations, net | | (1,882) | | | (2,403) | | | | | |

| Current income tax expense (benefit) | | 806 | | | 728 | | | | | |

| Other (income) expense, net | | 1,270 | | | (2,872) | | | | | |

| | | | | | | | |

| Distributions from equity investments in excess of cumulative earnings – related parties | | 8,536 | | | 10,813 | | | | | |

| Changes in assets and liabilities: | | | | | | | | |

| Accounts receivable, net | | 60,614 | | | (4,078) | | | | | |

| Accounts and imbalance payables and accrued liabilities, net | | (12,535) | | | (36,885) | | | | | |

| Other items, net | | (11,289) | | | (42,225) | | | | | |

Adjusted EBITDA attributable to noncontrolling interests (1) | | (12,134) | | | (11,737) | | | | | |

| Adjusted EBITDA | | $ | 510,927 | | | $ | 488,346 | | | | | |

| Cash flow information | | | | | | | | |

| Net cash provided by operating activities | | $ | 394,787 | | | $ | 490,823 | | | | | |

| Net cash used in investing activities | | (207,916) | | | (151,490) | | | | | |

| Net cash provided by (used in) financing activities | | 88,670 | | | (238,025) | | | | | |

(1)For all periods presented, includes (i) the 25% third-party interest in Chipeta and (ii) the 2.0% limited partner interest in WES Operating owned by an Occidental subsidiary, which collectively represent WES’s noncontrolling interests.

Western Midstream Partners, LP

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (CONTINUED)

(Unaudited)

Free Cash Flow

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| thousands | | September 30,

2023 | | June 30,

2023 | | | | |

Reconciliation of Net cash provided by operating activities to Free cash flow | | | | | | | | |

| Net cash provided by operating activities | | $ | 394,787 | | | $ | 490,823 | | | | | |

| Less: | | | | | | | | |

| Capital expenditures | | 201,857 | | | 161,482 | | | | | |

| Contributions to equity investments – related parties | | 1,021 | | | 22 | | | | | |

| Add: | | | | | | | | |

| Distributions from equity investments in excess of cumulative earnings – related parties | | 8,536 | | | 10,813 | | | | | |

| Free cash flow | | $ | 200,445 | | | $ | 340,132 | | | | | |

| Cash flow information | | | | | | | | |

| Net cash provided by operating activities | | $ | 394,787 | | | $ | 490,823 | | | | | |

| Net cash used in investing activities | | (207,916) | | | (151,490) | | | | | |

| Net cash provided by (used in) financing activities | | 88,670 | | | (238,025) | | | | | |

Western Midstream Partners, LP

OPERATING STATISTICS

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | |

| | September 30,

2023 | | June 30,

2023 | | | | |

| Throughput for natural-gas assets (MMcf/d) | | | | | | | | |

| Gathering, treating, and transportation | | 457 | | | 395 | | | | | |

| Processing | | 3,699 | | | 3,567 | | | | | |

Equity investments (1) | | 495 | | | 454 | | | | | |

| Total throughput | | 4,651 | | | 4,416 | | | | | |

Throughput attributable to noncontrolling interests (2) | | 167 | | | 162 | | | | | |

| Total throughput attributable to WES for natural-gas assets | | 4,484 | | | 4,254 | | | | | |

| Throughput for crude-oil and NGLs assets (MBbls/d) | | | | | | | | |

| Gathering, treating, and transportation | | 334 | | | 316 | | | | | |

Equity investments (1) | | 347 | | | 323 | | | | | |

| Total throughput | | 681 | | | 639 | | | | | |

Throughput attributable to noncontrolling interests (2) | | 14 | | | 13 | | | | | |

| Total throughput attributable to WES for crude-oil and NGLs assets | | 667 | | | 626 | | | | | |

| Throughput for produced-water assets (MBbls/d) | | | | | | | | |

| Gathering and disposal | | 1,101 | | | 963 | | | | | |

Throughput attributable to noncontrolling interests (2) | | 22 | | | 20 | | | | | |

| Total throughput attributable to WES for produced-water assets | | 1,079 | | | 943 | | | | | |

Per-Mcf Gross margin for natural-gas assets (3) | | $ | 1.05 | | | $ | 1.02 | | | | | |

Per-Bbl Gross margin for crude-oil and NGLs assets (3) | | 1.40 | | | 1.51 | | | | | |

Per-Bbl Gross margin for produced-water assets (3) | | 0.69 | | | 0.68 | | | | | |

| | | | | | | | |

Per-Mcf Adjusted gross margin for natural-gas assets (4) | | $ | 1.26 | | | $ | 1.26 | | | | | |

Per-Bbl Adjusted gross margin for crude-oil and NGLs assets (4) | | 2.27 | | | 2.58 | | | | | |

Per-Bbl Adjusted gross margin for produced-water assets (4) | | 0.84 | | | 0.83 | | | | | |

(1)Represents our share of average throughput for investments accounted for under the equity method of accounting.

(2)For all periods presented, includes (i) the 2.0% limited partner interest in WES Operating owned by an Occidental subsidiary and (ii) for natural-gas assets, the 25% third-party interest in Chipeta, which collectively represent WES’s noncontrolling interests.

(3)Average for period. Calculated as Gross margin for natural-gas assets, crude-oil and NGLs assets, or produced-water assets, divided by the respective total throughput (MMcf or MBbls) for natural-gas assets, crude-oil and NGLs assets, or produced-water assets.

(4)Average for period. Calculated as Adjusted gross margin for natural-gas assets, crude-oil and NGLs assets, or produced-water assets, divided by the respective total throughput (MMcf or MBbls) attributable to WES for natural-gas assets, crude-oil and NGLs assets, or produced-water assets.

Western Midstream Partners, LP

OPERATING STATISTICS (CONTINUED)

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | September 30,

2023 | | June 30,

2023 | | | | |

| Throughput for natural-gas assets (MMcf/d) | | | | | | | | |

| Delaware Basin | | 1,674 | | | 1,592 | | | | | |

| DJ Basin | | 1,331 | | | 1,309 | | | | | |

| Equity investments | | 495 | | | 454 | | | | | |

| Other | | 1,151 | | | 1,061 | | | | | |

| Total throughput for natural-gas assets | | 4,651 | | | 4,416 | | | | | |

| Throughput for crude-oil and NGLs assets (MBbls/d) | | | | | | | | |

| Delaware Basin | | 220 | | | 208 | | | | | |

| DJ Basin | | 68 | | | 66 | | | | | |

| Equity investments | | 347 | | | 323 | | | | | |

| Other | | 46 | | | 42 | | | | | |

| Total throughput for crude-oil and NGLs assets | | 681 | | | 639 | | | | | |

| Throughput for produced-water assets (MBbls/d) | | | | | | | | |

| Delaware Basin | | 1,101 | | | 963 | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Total throughput for produced-water assets | | 1,101 | | | 963 | | | | | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

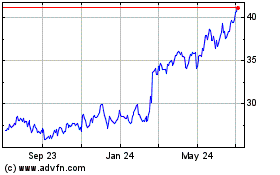

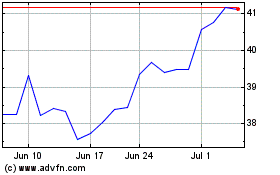

Western Midstream Partners (NYSE:WES)

Historical Stock Chart

From Mar 2024 to Apr 2024

Western Midstream Partners (NYSE:WES)

Historical Stock Chart

From Apr 2023 to Apr 2024