false

0000912061

0000912061

2023-11-01

2023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

|

November 1, 2023

|

|

Date of Report (Date of earliest event reported)

|

| |

NATURAL HEALTH TRENDS CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-36849

|

59-2705336

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

|

Units 1205-07, 12F, Mira Place Tower A, 132 Nathan Road, Tsimshatsui, Kowloon, Hong Kong

(Address of principal executive offices, including zip code)

+852-3107-0800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

☐ |

Emerging growth company

|

| |

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

NHTC

|

The NASDAQ Stock Market LLC

|

Item 2.02 Results of Operations and Financial Condition.

On November 1, 2023, Natural Health Trends Corp. issued an earnings release announcing its results for the quarter ended September 30, 2023. The press release is attached hereto as exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 1, 2023

|

|

NATURAL HEALTH TRENDS CORP.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Timothy S. Davidson

|

|

|

|

|

Timothy S. Davidson

|

|

|

|

|

Senior Vice President and Chief Financial Officer

|

|

Exhibit 99.1

Natural Health Trends Reports Third Quarter 2023 Financial Results

| |

– |

Total orders taken were roughly flat despite continued headwinds of a stronger dollar and trepid consumer sentiment |

| |

– |

Cash flows from operations improved $1.4 million |

| |

– |

Declared a quarterly cash dividend of $0.20 per share |

HONG KONG – November 1, 2023 – Natural Health Trends Corp. (NASDAQ: NHTC), a leading direct-selling and e-commerce company that markets premium quality personal care, wellness and “quality of life” products under the NHT Global brand, today announced its financial results for the quarter ended September 30, 2023.

Third Quarter 2023 Financial Highlights

| |

•

|

Revenue of $10.6 million decreased 9% compared to $11.7 million in the third quarter of 2022. The decrease in revenue was primarily due to the changes in deferred revenue in the two respective quarters. Deferred revenue decreased $603,000 and $1.4 million during the third quarter of 2023 and 2022, respectively, resulting in an $835,000 unfavorable revenue variance.

|

| |

•

|

Net income was $172,000, or $0.02 per diluted share, compared to $47,000, or breakeven per diluted share, in the third quarter of 2022.

|

| |

1

|

Natural Health Trends defines Active Members as those that have placed at least one product order with the Company during the preceding twelve-month period.

|

Year-to-Date 2023 Financial Highlights

| |

•

|

Revenue of $33.0 million decreased 10% compared to $36.6 million in the first nine months of 2022. The revenue decrease was primarily due to the changes in deferred revenue in the two respective nine-month periods. Deferred revenue increased $651,000 during the first nine months of 2023, but decreased $3.3 million during the same period last year, resulting in a $3.9 million unfavorable revenue variance.

|

| |

•

|

Operating loss was $1.4 million compared to $313,000 in the first nine months of 2022.

|

| |

•

|

Net income was $210,000, or $0.02 per diluted share, compared to $125,000, or $0.01 per diluted share, in the first nine months of 2022.

|

Management Commentary

“Adapting to the current environment in which Chinese consumers are reluctant to spend or invest, we managed to generate orders on pace with those of last year. Orders grew 3% at a constant exchange rate compared to the third quarter of 2022, while year-to-date 2023 orders increased 8% compared to prior year. The reported decrease in revenue was largely due to changes in deferred revenue, partly because orders tended to be received later in the quarter this year. Importantly, our members remained responsive to our programs, demonstrating that our promotions, incentives and high-quality product offerings continue to resonate,” commented Chris Sharng, President of Natural Health Trends Corp.

Mr. Sharng continued, “Noteworthy to highlight are the signs of momentum extending to several of our other markets including Taiwan, Peru, North America and Japan, each of which delivered strong performance during the quarter. We’re hopeful that these signs of growth will continue supported by careful planning and execution to our strategies around digital enhancements, new product launches, geographic diversification and superior member support.”

Balance Sheet and Cash Flow

| |

•

|

Net cash used in operating activities was $4.2 million in the first nine months of 2023 compared to $5.8 million in the first nine months of 2022. Before tax installment payments, the liability of which arises from the 2017 U.S. Tax Cuts and Jobs Act (the “Act Act”), cash used in operating activities was $1.2 million in the first nine months 2023, versus $4.2 million in the comparable period a year ago. Of the total Tax Act liability of $20.2 million, $11.2 million has been paid to date.

|

| |

•

|

Total cash and cash equivalents were $58.4 million at September 30, 2023, down from $61.6 million at June 30, 2023.

|

| |

•

|

On October 30, 2023, the Company’s Board of Directors declared a quarterly cash dividend of $0.20 on each share of common stock outstanding. The dividend will be payable on November 24, 2023 to stockholders of record as of November 14, 2023.

|

Third Quarter 2023 Financial Results Conference Call

Management will host a conference call to discuss the third quarter 2023 financial results today, Wednesday, November 1, 2023 at 11:30 a.m. Eastern Time. The conference call details are as follows:

|

Date:

|

Wednesday, November 1, 2023

|

|

Time:

|

11:30 a.m. Eastern Time / 8:30 a.m. Pacific Time

|

|

Dial-in:

|

1-877-407-0789 (Domestic)

1-201-689-8562 (International)

|

|

Conference ID:

|

13740859

|

|

Webcast:

|

https://viavid.webcasts.com/starthere.jsp?ei=1631150&tp_key=ea6cd96ef7 |

For those unable to participate during the live broadcast, a replay of the call will also be available from 2:30 p.m. Eastern Time on November 1, 2023 through 11:59 p.m. Eastern Time on November 8, 2023 by dialing 1-844-512-2921 (domestic) and 1-412-317-6671 (international) and referencing the replay pin number: 13740859.

About Natural Health Trends Corp.

Natural Health Trends Corp. (NASDAQ: NHTC) is an international direct-selling and e-commerce company operating through its subsidiaries throughout Asia, the Americas, and Europe. The Company markets premium quality personal care products under the NHT Global brand. Additional information can be found on the Company’s website at www.naturalhealthtrendscorp.com.

Forward-Looking Statements

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 -- Forward-looking statements in this press release do not constitute guarantees of future performance. Such forward-looking statements are subject to risks and uncertainties that could cause the Company’s actual results to differ materially from those anticipated. Such risks and uncertainties include the risks and uncertainties detailed under the caption “Risk Factors” in Natural Health Trends Corp.’s Annual Report on Form 10-K filed on March 3, 2023 with the Securities and Exchange Commission (SEC), as well as in subsequent reports filed this year with the SEC. The Company assumes no obligation to update any forward-looking information contained in this press release or with respect to the announcements described herein.

CONTACT:

Scott Davidson

Senior Vice President and Chief Financial Officer

Natural Health Trends Corp.

Tel (Hong Kong): +852-3107-0800

Tel (U.S.): 310-541-0888

investor.relations@nhtglobal.com

NATURAL HEALTH TRENDS CORP.

CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

| |

|

September 30, 2023

|

|

|

December 31, 2022

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

58,412 |

|

|

$ |

69,667 |

|

|

Inventories

|

|

|

4,882 |

|

|

|

4,525 |

|

|

Other current assets

|

|

|

3,675 |

|

|

|

3,359 |

|

|

Total current assets

|

|

|

66,969 |

|

|

|

77,551 |

|

|

Property and equipment, net

|

|

|

284 |

|

|

|

394 |

|

|

Operating lease right-of-use assets

|

|

|

3,549 |

|

|

|

3,992 |

|

|

Restricted cash

|

|

|

37 |

|

|

|

79 |

|

|

Deferred tax asset

|

|

|

303 |

|

|

|

195 |

|

|

Other assets

|

|

|

679 |

|

|

|

606 |

|

|

Total assets

|

|

$ |

71,821 |

|

|

$ |

82,817 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

666 |

|

|

$ |

810 |

|

|

Income taxes payable

|

|

|

4,092 |

|

|

|

2,972 |

|

|

Accrued commissions

|

|

|

2,589 |

|

|

|

2,943 |

|

|

Other accrued expenses

|

|

|

1,100 |

|

|

|

1,181 |

|

|

Deferred revenue

|

|

|

6,248 |

|

|

|

5,597 |

|

|

Amounts held in eWallets

|

|

|

4,154 |

|

|

|

4,895 |

|

|

Operating lease liabilities

|

|

|

1,182 |

|

|

|

1,135 |

|

|

Other current liabilities

|

|

|

747 |

|

|

|

905 |

|

|

Total current liabilities

|

|

|

20,778 |

|

|

|

20,438 |

|

|

Income taxes payable

|

|

|

5,054 |

|

|

|

9,098 |

|

|

Deferred tax liability

|

|

|

140 |

|

|

|

141 |

|

|

Operating lease liabilities

|

|

|

2,539 |

|

|

|

2,989 |

|

|

Total liabilities

|

|

|

28,511 |

|

|

|

32,666 |

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock

|

|

|

— |

|

|

|

— |

|

|

Common stock

|

|

|

13 |

|

|

|

13 |

|

|

Additional paid-in capital

|

|

|

84,657 |

|

|

|

86,102 |

|

|

Accumulated deficit

|

|

|

(15,757 |

) |

|

|

(9,056 |

) |

|

Accumulated other comprehensive loss

|

|

|

(1,267 |

) |

|

|

(1,004 |

) |

|

Treasury stock, at cost

|

|

|

(24,336 |

) |

|

|

(25,904 |

) |

|

Total stockholders’ equity

|

|

|

43,310 |

|

|

|

50,151 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

71,821 |

|

|

$ |

82,817 |

|

NATURAL HEALTH TRENDS CORP.

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(In thousands, except per share data)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net sales

|

|

$ |

10,615 |

|

|

$ |

11,716 |

|

|

$ |

32,987 |

|

|

$ |

36,622 |

|

|

Cost of sales

|

|

|

2,689 |

|

|

|

3,098 |

|

|

|

8,386 |

|

|

|

9,398 |

|

|

Gross profit

|

|

|

7,926 |

|

|

|

8,618 |

|

|

|

24,601 |

|

|

|

27,224 |

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commissions expense

|

|

|

4,361 |

|

|

|

4,863 |

|

|

|

13,861 |

|

|

|

15,370 |

|

|

Selling, general and administrative expenses

|

|

|

3,857 |

|

|

|

3,900 |

|

|

|

12,169 |

|

|

|

12,167 |

|

|

Total operating expenses

|

|

|

8,218 |

|

|

|

8,763 |

|

|

|

26,030 |

|

|

|

27,537 |

|

|

Loss from operations

|

|

|

(292 |

) |

|

|

(145 |

) |

|

|

(1,429 |

) |

|

|

(313 |

) |

|

Other income, net

|

|

|

585 |

|

|

|

187 |

|

|

|

1,708 |

|

|

|

472 |

|

|

Income before income taxes

|

|

|

293 |

|

|

|

42 |

|

|

|

279 |

|

|

|

159 |

|

|

Income tax provision (benefit)

|

|

|

121 |

|

|

|

(5 |

) |

|

|

69 |

|

|

|

34 |

|

|

Net income

|

|

$ |

172 |

|

|

$ |

47 |

|

|

$ |

210 |

|

|

$ |

125 |

|

|

Net income per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.02 |

|

|

$ |

0.00 |

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

Diluted

|

|

$ |

0.02 |

|

|

$ |

0.00 |

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

11,440 |

|

|

|

11,423 |

|

|

|

11,432 |

|

|

|

11,341 |

|

|

Diluted

|

|

|

11,454 |

|

|

|

11,423 |

|

|

|

11,449 |

|

|

|

11,423 |

|

NATURAL HEALTH TRENDS CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(In thousands)

| |

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

210 |

|

|

$ |

125 |

|

|

Adjustments to reconcile net income to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

130 |

|

|

|

156 |

|

|

Share-based compensation

|

|

|

123 |

|

|

|

— |

|

|

Noncash lease expense

|

|

|

830 |

|

|

|

889 |

|

|

Deferred income taxes

|

|

|

(117 |

) |

|

|

(2 |

) |

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Inventories

|

|

|

(420 |

) |

|

|

140 |

|

|

Other current assets

|

|

|

(425 |

) |

|

|

1,000 |

|

|

Other assets

|

|

|

(92 |

) |

|

|

(44 |

) |

|

Accounts payable

|

|

|

(141 |

) |

|

|

228 |

|

|

Income taxes payable

|

|

|

(2,923 |

) |

|

|

(1,382 |

) |

|

Accrued commissions

|

|

|

(315 |

) |

|

|

(1,055 |

) |

|

Other accrued expenses

|

|

|

(58 |

) |

|

|

(540 |

) |

|

Deferred revenue

|

|

|

674 |

|

|

|

(3,209 |

) |

|

Amounts held in eWallets

|

|

|

(725 |

) |

|

|

(1,150 |

) |

|

Operating lease liabilities

|

|

|

(812 |

) |

|

|

(950 |

) |

|

Other current liabilities

|

|

|

(148 |

) |

|

|

4 |

|

|

Net cash used in operating activities

|

|

|

(4,209 |

) |

|

|

(5,790 |

) |

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment

|

|

|

(32 |

) |

|

|

(130 |

) |

|

Net cash used in investing activities

|

|

|

(32 |

) |

|

|

(130 |

) |

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Dividends paid

|

|

|

(6,911 |

) |

|

|

(6,855 |

) |

|

Net cash used in financing activities

|

|

|

(6,911 |

) |

|

|

(6,855 |

) |

|

Effect of exchange rates on cash, cash equivalents and restricted cash

|

|

|

(145 |

) |

|

|

(858 |

) |

|

Net decrease in cash, cash equivalents and restricted cash

|

|

|

(11,297 |

) |

|

|

(13,633 |

) |

|

CASH, CASH EQUIVALENTS AND RESTRICTED CASH, beginning of period

|

|

|

69,746 |

|

|

|

84,365 |

|

|

CASH, CASH EQUIVALENTS AND RESTRICTED CASH, end of period

|

|

$ |

58,449 |

|

|

$ |

70,732 |

|

|

SUPPLEMENTAL DISCLOSURE OF NONCASH INVESTING AND FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Right-of-use assets obtained in exchange for operating lease liabilities

|

|

$ |

115 |

|

|

$ |

2,218 |

|

v3.23.3

Document And Entity Information

|

Nov. 01, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NATURAL HEALTH TRENDS CORP.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 01, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-36849

|

| Entity, Tax Identification Number |

59-2705336

|

| Entity, Address, Address Line One |

Units 1205-07, 12F, Mira Place Tower A

|

| Entity, Address, Address Line Two |

132 Nathan Road

|

| Entity, Address, Address Line Three |

Tsimshatsui

|

| Entity, Address, City or Town |

Kowloon

|

| Entity, Address, Country |

HK

|

| City Area Code |

852

|

| Local Phone Number |

3107-0800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NHTC

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000912061

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

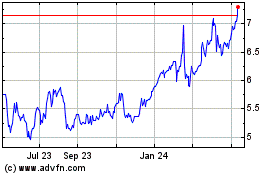

Natural Health Trends (NASDAQ:NHTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natural Health Trends (NASDAQ:NHTC)

Historical Stock Chart

From Apr 2023 to Apr 2024