0000895126false00008951262023-10-312023-10-310000895126us-gaap:CommonClassAMember2023-10-312023-10-310000895126chk:ClassAWarrantsMember2023-10-312023-10-310000895126chk:ClassBWarrantsMember2023-10-312023-10-310000895126chk:ClassCWarrantsMember2023-10-312023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | |

| CHESAPEAKE ENERGY CORPORATION |

| (Exact name of Registrant as specified in its Charter) |

| Oklahoma | | 001-13726 | | 73-1395733 |

(State or other jurisdiction of

incorporation) | | (Commission File No.) | | (IRS Employer Identification No.) |

| 6100 North Western Avenue | Oklahoma City | OK | | 73118 |

| (Address of principal executive offices) | | (Zip Code) |

| | (405) | 848-8000 | | | |

| (Registrant’s telephone number, including area code) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | CHK | | The Nasdaq Stock Market LLC |

| Class A Warrants to purchase Common Stock | | CHKEW | | The Nasdaq Stock Market LLC |

| Class B Warrants to purchase Common Stock | | CHKEZ | | The Nasdaq Stock Market LLC |

| Class C Warrants to purchase Common Stock | | CHKEL | | The Nasdaq Stock Market LLC |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). | | |

| Emerging growth company | | ☐ |

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ☐ |

Item 2.02 Results of Operations and Financial Condition.

On October 31, 2023, Chesapeake Energy Corporation (“Chesapeake”) issued a press release reporting financial and operational results for the third quarter of 2023. A copy of the press release and financial information are attached as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K.

The information in the press release is being furnished, not filed, pursuant to Item 2.02. Accordingly, the information in the press release will not be incorporated by reference into any registration statement filed by Chesapeake under the Securities Act of 1933, as amended, except as set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

On November 1, 2023, Chesapeake will make a presentation about its financial and operating results for the third quarter of 2023, as noted in the press release described in Item 2.02 above. Chesapeake has made the presentation available on its website at http://investors.chk.com.

This information is being furnished, not filed, pursuant to Item 7.01. Accordingly, this information will not be incorporated by reference into any registration statement filed by Chesapeake Energy Corporation under the Securities Act of 1933, as amended, except as set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Document Description |

| | Chesapeake Energy Corporation press release dated October 31, 2023 |

| | Supplemental Financial Information |

| 104.0 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| CHESAPEAKE ENERGY CORPORATION |

| |

| |

| By: | /s/ DOMENIC J. DELL’OSSO, JR. |

| Domenic J. Dell’Osso, Jr. |

| President and Chief Executive Officer |

Date: October 31, 2023

| | | | | |

| Exhibit 99.1 |

| N E W S R E L E A S E |

|

| |

FOR IMMEDIATE RELEASE

OCTOBER 31, 2023

CHESAPEAKE ENERGY CORPORATION REPORTS THIRD QUARTER 2023 RESULTS

OKLAHOMA CITY, October 31, 2023 – Chesapeake Energy Corporation (NASDAQ:CHK) today reported third quarter 2023 financial and operating results.

•Net cash provided by operating activities of $506 million

•Net income of $70 million, or $0.49 per diluted share (all per share amounts stated on a diluted basis); adjusted net income(1) of $155 million, or $1.09 per share

•Delivered total net production of 3,495 mmcfe per day and adjusted EBITDAX(1) of $580 million

•Returned more than $200 million to shareholders through base dividend and share buybacks; announced total quarterly dividend of $0.575 per common share to be paid in December 2023

•Cash on hand of approximately $713 million as of September 30, 2023

•Upgraded to positive watch while maintaining BB at S&P Global Ratings; advancing path toward Investment Grade credit status

•Entered into new heads of agreements (HOA) with Vitol to provide gas sufficient to produce up to 1 mtpa of LNG with net back indexed to the Japan Korea Marker (JKM) for 15 years

•Joined the Oil & Gas Methane Partnership (OGMP) 2.0

(1) A Non-GAAP measure as defined in the supplemental financial tables available on the company's website at www.chk.com.

Nick Dell’Osso, Chesapeake’s President and Chief Executive Officer, said, “Our team is operating at the highest and safest levels, and delivered another strong quarter. We continue to show the resilience of this organization and assets in the midst of lower commodity prices. Our strong balance sheet and deep liquidity underpin the leading rock, returns and runway of our portfolio and have allowed us to maintain our repurchase program in the midst of the trough of the commodity cycle. Our focus is clear — to ‘Be LNG Ready’ and opportunistically capitalize on our strong financial position and leading operating performance. We remain confident in our ability to deliver affordable, reliable, lower carbon energy with peer-leading returns to shareholders.”

Operational Results

Third quarter net production was approximately 3,495 mmcfe per day (97% natural gas and 3% total liquids). This production was delivered despite the elective deferral of 60% of the planned third quarter Marcellus turn in lines and the extension of elective curtailments. The company used an average of nine rigs to drill 35 wells, down from 53 in the second quarter, and placed 34 wells on production which includes 16 wells in the South Texas Rich Eagle Ford asset.

Chesapeake is currently operating nine rigs and three completion crews including four rigs and two crews in the Marcellus and five rigs and one crew in the Haynesville.

| | | | | | | | |

| | |

| INVESTOR CONTACT: | MEDIA CONTACT: | CHESAPEAKE ENERGY CORPORATION |

Chris Ayres (405) 935-8870 ir@chk.com | Brooke Coe (405) 935-8878 media@chk.com | 6100 North Western Avenue P.O. Box 18496 Oklahoma City, OK 73154 |

Operational Results (continued)

Chesapeake continued to build upon its peer leading operational performance, recognizing additional efficiency improvements during the third quarter. In the Marcellus, the company achieved its fastest drilling program performance of all-time, averaging 1,367 feet per day during the quarter. This included four of the top 10 longest laterals in the company’s history. In the Haynesville, Chesapeake continues to benefit from ongoing midstream debottlenecking and gas flow assurance efforts, resulting in lower line pressure and a ~15% quarter-over-quarter reduction in deferred volume due to pipeline / sales disruptions.

In addition to its operational performance records, the combined employee and contractor Total Recordable Incident Rate for the first nine months of 2023 improved ~50% over the same time period last year.

The company expects to drill 35 — 45 wells and place 50 — 60 wells on production in the fourth quarter of 2023. The company’s operating plan remains flexible, as illustrated by the deferral of third quarter turn in lines in the Marcellus, and is prepared for further adjustments based on market conditions.

Year-to-date, the company has acquired 34,000 additional net lease acres in the Marcellus and Haynesville plays at an average cost of $1,500 per acre.

LNG Update

On its continued path to Be LNG Ready, the company entered into a Heads of Agreement (HOA) with Vitol Inc. (Vitol). Under the agreement, Chesapeake will supply natural gas sufficient to produce up to 1.0 mtpa of LNG which, post liquefaction, would be purchased by Vitol at a price indexed to JKM beginning in 2028 for a period of 15 years.

Financial and Shareholder Return Update

During the third quarter of 2023, Chesapeake generated $506 million of operating cash flow, had $713 million of cash on hand, and an undrawn $2.0 billion credit facility at quarter-end.

The company repurchased approximately 1.5 million shares of its common stock for approximately $130 million at an average price of $86.16 per share in the third quarter. Through October 27, 2023, Chesapeake repurchased approximately 3.8 million shares of its common stock for approximately $316 million at an average price of $81.09 per share. Chesapeake has approximately $600 million remaining under its share repurchase program and, in total, has repurchased approximately 16 million shares of its common stock at a cost of approximately $1.4 billion under its current $2 billion authorization.

In the third quarter, the company’s credit rating outlook was moved to positive watch by S&P Global Ratings. Since April 2023, Chesapeake’s issuer default rating has been updated to ‘BB+’ maintaining a positive outlook and ‘Ba1’ with a stable outlook by Fitch Ratings and Moody’s, respectively. The agencies noted increased scale, conservative financial policy, and cash optionality as fundamental to the company’s continued rating improvements.

Sustainability Update

The company continued to advance its commitment to transparency and enhanced disclosures by joining the Oil & Gas Methane Partnership (OGMP) 2.0. OGMP 2.0 is the flagship oil and gas reporting and mitigation program of the United Nations Environment Program (UNEP), the only comprehensive, measurement-based international reporting framework for the sector. The company expects to submit its full implementation plan for OGMP 2.0 in 2024.

The company also announced a unique partnership with Eavor Inc. and the U.S. Air Force to provide Eavor-LoopTM generated geothermal energy to the Joint Base San Antonio Facility in Texas. Chesapeake will aid the project through its expertise in subsurface engineering, surface regulatory and impact mitigation and geologic resource characterization.

Conference Call Information

Chesapeake plans to host a conference call to discuss recent financial and operating results at 9 a.m. ET on Wednesday, November 1, 2023. The telephone number to access the conference call is 888-317-6003 or 412-317-6061 for international callers. The passcode for the call is 1010292.

Financial Statements, Non-GAAP Financial Measures and 2023 Guidance

The company’s 2023 third quarter financial and operational results, along with non-GAAP measures that adjust for items that are typically excluded by securities analysts, are available on the company’s website. Such non-GAAP measures should not be considered as an alternative to GAAP measures. Reconciliations of these non-GAAP measures and other disclosures are provided with the supplemental financial tables and management's updated guidance for 2023 available on the company’s new website at www.chk.com.

Headquartered in Oklahoma City, Chesapeake Energy Corporation (NASDAQ:CHK) is powered by dedicated and innovative employees who are focused on discovering and responsibly developing leading positions in top U.S. oil and gas plays. With a goal to achieve net zero GHG emissions (Scope 1 and 2) by 2035, Chesapeake is committed to safely answering the call for affordable, reliable, lower carbon energy.

Forward-Looking Statements

This release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). Forward-looking statements include our current expectations or forecasts of future events, including matters relating to the continuing effects of the impact of inflation and commodity price volatility resulting from instability in Europe and the Middle East, COVID-19 and related supply chain constraints, and the impact of each on our business, financial condition, results of operations and cash flows, the potential effects of the Plan on our operations, management, and employees, actions by, or disputes among or between, members of OPEC+ and other foreign oil-exporting countries, market factors, market prices, our ability to meet debt service requirements, our ability to continue to pay cash dividends, the amount and timing of any cash dividends, and our ESG initiatives. Forward-looking and other statements in this release regarding our environmental, social and other sustainability plans and goals are not an indication that these statements are necessarily material to investors or required to be disclosed in our filings with the SEC. In addition, historical, current, and forward-looking environmental, social and sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future. Forward-looking statements often address our expected future business, financial performance and financial condition, and often contain words such as "expect," “could,” “may,” "anticipate," "intend," "plan," “ability,” "believe," "seek," "see," "will," "would," “estimate,” “forecast,” "target," “guidance,” “outlook,” “opportunity” or “strategy.”

Although we believe the expectations and forecasts reflected in our forward-looking statements are reasonable, they are inherently subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. No assurance can be given that such forward-looking statements will be correct or achieved or that the assumptions are accurate or will not change over time. Particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include:

•the impact of inflation and commodity price volatility resulting from instability in Europe and the Middle East, COVID-19 and related labor and supply chain constraints, along with the effects of the current global economic environment, including impacts from higher interest rates and recent bank closures and liquidity concerns at certain financial institutions, on our business, financial condition, employees, contractors, vendors and the global demand for natural gas and oil and U.S. and on world financial markets;

•our ability to comply with the covenants under the credit agreement for our New Credit Facility and other indebtedness;

•risks related to acquisitions or dispositions, or potential acquisitions or dispositions;

•our ability to realize anticipated cash cost reductions;

•the volatility of natural gas, oil and NGL prices, which are affected by general economic and business conditions, as well as increased demand for (and availability of) alternative fuels and electric vehicles;

•a deterioration in general economic, business or industry conditions;

•uncertainties inherent in estimating quantities of natural gas, oil and NGL reserves and projecting future rates of production and the amount and timing of development expenditures;

•our ability to replace reserves and sustain production;

•drilling and operating risks and resulting liabilities;

•our ability to generate profits or achieve targeted results in drilling and well operations;

•the limitations our level of indebtedness may have on our financial flexibility;

•our ability to achieve and maintain ESG certifications, goals and commitments;

•our inability to access the capital markets on favorable terms;

•the availability of cash flows from operations and other funds to fund cash dividends and repurchases of equity securities, to finance reserve replacement costs and/or satisfy our debt obligations;

•write-downs of our natural gas and oil asset carrying values due to low commodity prices;

•charges incurred in response to market conditions;

•limited control over properties we do not operate;

•leasehold terms expiring before production can be established;

•commodity derivative activities resulting in lower prices realized on natural gas, oil and NGL sales;

•the need to secure derivative liabilities and the inability of counterparties to satisfy their obligations;

•potential over-the-counter derivatives regulations limiting our ability to hedge against commodity price fluctuations;

•adverse developments or losses from pending or future litigation and regulatory proceedings, including royalty claims;

•our need to secure adequate supplies of water for our drilling operations and to dispose of or recycle the water used;

•pipeline and gathering system capacity constraints and transportation interruptions;

•legislative, regulatory and ESG initiatives, addressing environmental concerns, including initiatives addressing the impact of global climate change or further regulating hydraulic fracturing, methane emissions, flaring or water disposal;

•terrorist activities and/or cyber-attacks adversely impacting our operations;

•an interruption in operations at our headquarters due to a catastrophic event;

•federal and state tax proposals affecting our industry;

•competition in the natural gas and oil exploration and production industry;

•negative public perceptions of our industry;

•effects of purchase price adjustments and indemnity obligations;

•the ability to execute on our business strategy following emergence from bankruptcy; and

•other factors that are described under Risk Factors in Item 1A of our 2022 Form 10-K.

We caution you not to place undue reliance on the forward-looking statements contained in this release which speak only as of the filing date, and we undertake no obligation to update this information. We urge you to carefully review and consider the disclosures in this release and our filings with the SEC that attempt to advise interested parties of the risks and factors that may affect our business.

| | |

CHESAPEAKE ENERGY CORPORATION - SUPPLEMENTAL TABLES |

| | |

CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited) |

| | | | | | | | | | | |

| ($ in millions, except per share data) | September 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 713 | | | $ | 130 | |

| Restricted cash | 73 | | | 62 | |

| Accounts receivable, net | 685 | | | 1,438 | |

| Short-term derivative assets | 361 | | | 34 | |

| Assets held for sale | 520 | | | 819 | |

| Other current assets | 163 | | | 215 | |

| Total current assets | 2,515 | | | 2,698 | |

| Property and equipment: | | | |

| Natural gas and oil properties, successful efforts method | | | |

| Proved natural gas and oil properties | 11,002 | | | 11,096 | |

| Unproved properties | 1,907 | | | 2,022 | |

| Other property and equipment | 496 | | | 500 | |

| Total property and equipment | 13,405 | | | 13,618 | |

| Less: accumulated depreciation, depletion and amortization | (3,299) | | | (2,431) | |

| | | |

| Total property and equipment, net | 10,106 | | | 11,187 | |

| Long-term derivative assets | 30 | | | 47 | |

| Deferred income tax assets | 1,032 | | | 1,351 | |

| Other long-term assets | 565 | | | 185 | |

| Total assets | $ | 14,248 | | | $ | 15,468 | |

| | | |

| Liabilities and stockholders' equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 540 | | | $ | 603 | |

| Accrued interest | 41 | | | 42 | |

| Short-term derivative liabilities | 20 | | | 432 | |

| Other current liabilities | 1,013 | | | 1,627 | |

| Total current liabilities | 1,614 | | | 2,704 | |

| Long-term debt, net | 2,032 | | | 3,093 | |

| Long-term derivative liabilities | 40 | | | 174 | |

| Asset retirement obligations, net of current portion | 273 | | | 323 | |

| Other long-term liabilities | 21 | | | 50 | |

| Total liabilities | 3,980 | | | 6,344 | |

| Contingencies and commitments | | | |

| Stockholders' equity: | | | |

Common stock, $0.01 par value, 450,000,000 shares authorized:

131,182,918 and 134,715,094 shares issued | 1 | | | 1 | |

| Additional paid-in capital | 5,735 | | | 5,724 | |

| Retained earnings | 4,532 | | | 3,399 | |

| Total stockholders' equity | 10,268 | | | 9,124 | |

| Total liabilities and stockholders' equity | $ | 14,248 | | | $ | 15,468 | |

| | |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| ($ in millions, except per share data) | | | | | | | | |

| Revenues and other: | | | | | | | | |

| Natural gas, oil and NGL | | $ | 682 | | | $ | 2,987 | | | $ | 2,784 | | | $ | 7,691 | |

| Marketing | | 724 | | | 1,206 | | | 1,987 | | | 3,296 | |

| Natural gas and oil derivatives | | 106 | | | (1,029) | | | 1,195 | | | (3,668) | |

| Gains (losses) on sales of assets | | — | | | (2) | | | 807 | | | 298 | |

| Total revenues and other | | 1,512 | | | 3,162 | | | 6,773 | | | 7,617 | |

| Operating expenses: | | | | | | | | |

| Production | | 73 | | | 121 | | | 293 | | | 349 | |

| Gathering, processing and transportation | | 192 | | | 286 | | | 663 | | | 802 | |

| Severance and ad valorem taxes | | 27 | | | 67 | | | 136 | | | 187 | |

| Exploration | | 4 | | | 2 | | | 19 | | | 14 | |

| Marketing | | 723 | | | 1,200 | | | 1,985 | | | 3,279 | |

| General and administrative | | 29 | | | 40 | | | 95 | | | 102 | |

| Separation and other termination costs | | — | | | — | | | 3 | | | — | |

| Depreciation, depletion and amortization | | 382 | | | 440 | | | 1,148 | | | 1,300 | |

| | | | | | | | |

| Other operating expense, net | | 3 | | | 1 | | | 15 | | | 32 | |

| Total operating expenses | | 1,433 | | | 2,157 | | | 4,357 | | | 6,065 | |

| Income from operations | | 79 | | | 1,005 | | | 2,416 | | | 1,552 | |

| Other income (expense): | | | | | | | | |

| Interest expense | | (23) | | | (52) | | | (82) | | | (120) | |

| | | | | | | | |

| Other income | | 15 | | | 4 | | | 48 | | | 29 | |

| | | | | | | | |

| Total other expense | | (8) | | | (48) | | | (34) | | | (91) | |

| Income before income taxes | | 71 | | | 957 | | | 2,382 | | | 1,461 | |

| Income tax expense | | 1 | | | 74 | | | 532 | | | 105 | |

| | | | | | | | |

| | | | | | | | |

| Net income | | $ | 70 | | | $ | 883 | | | $ | 1,850 | | | $ | 1,356 | |

| Earnings per common share: | | | | | | | | |

| Basic | | $ | 0.53 | | | $ | 7.29 | | | $ | 13.86 | | | $ | 11.03 | |

| Diluted | | $ | 0.49 | | | $ | 6.12 | | | $ | 12.90 | | | $ | 9.35 | |

| Weighted average common shares outstanding (in thousands): | | | | | | | | |

| Basic | | 132,153 | | | 121,150 | | | 133,460 | | | 122,924 | |

| Diluted | | 142,348 | | | 144,390 | | | 143,463 | | | 145,031 | |

| | |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| ($ in millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | | | | | |

| Net income | | $ | 70 | | | $ | 883 | | | $ | 1,850 | | | $ | 1,356 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

| Depreciation, depletion and amortization | | 382 | | | 440 | | | 1,148 | | | 1,300 | |

| Deferred income tax expense | | (80) | | | 19 | | | 319 | | | 19 | |

| Derivative (gains) losses, net | | (106) | | | 1,029 | | | (1,195) | | | 3,668 | |

| Cash receipts (payments) on derivative settlements, net | | 216 | | | (1,234) | | | 167 | | | (2,845) | |

| Share-based compensation | | 9 | | | 6 | | | 25 | | | 16 | |

| (Gains) losses on sales of assets | | — | | | 2 | | | (807) | | | (298) | |

| | | | | | | | |

| Exploration | | 1 | | | — | | | 9 | | | 10 | |

| | | | | | | | |

| Other | | 5 | | | 14 | | | 26 | | | 19 | |

| Changes in assets and liabilities | | 9 | | | 154 | | | 368 | | | (170) | |

| Net cash provided by operating activities | | 506 | | | 1,313 | | | 1,910 | | | 3,075 | |

| Cash flows from investing activities: | | | | | | | | |

| Capital expenditures | | (423) | | | (540) | | | (1,450) | | | (1,299) | |

| Business combination, net | | — | | | 39 | | | — | | | (1,967) | |

| Contributions to investments | | (61) | | | — | | | (149) | | | — | |

| Proceeds from divestitures of property and equipment | | 4 | | | 6 | | | 1,967 | | | 409 | |

| Net cash provided by (used in) investing activities | | (480) | | | (495) | | | 368 | | | (2,857) | |

| Cash flows from financing activities: | | | | | | | | |

| Proceeds from New Credit Facility | | — | | | — | | | 1,125 | | | — | |

| Payments on New Credit Facility | | — | | | — | | | (2,175) | | | — | |

| Proceeds from Exit Credit Facility | | — | | | 2,705 | | | — | | | 7,255 | |

| Payments on Exit Credit Facility | | — | | | (3,030) | | | — | | | (6,805) | |

| Funds held for transition services | | (6) | | | — | | | 91 | | | — | |

| Proceeds from warrant exercise | | — | | | — | | | — | | | 3 | |

| | | | | | | | |

| Cash paid to repurchase and retire common stock | | (132) | | | (109) | | | (313) | | | (667) | |

| | | | | | | | |

| Cash paid for common stock dividends | | (77) | | | (280) | | | (412) | | | (788) | |

| Net cash used in financing activities | | (215) | | | (714) | | | (1,684) | | | (1,002) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | | (189) | | | 104 | | | 594 | | | (784) | |

| Cash, cash equivalents and restricted cash, beginning of period | | 975 | | | 26 | | | 192 | | | 914 | |

| Cash, cash equivalents and restricted cash, end of period | | $ | 786 | | | $ | 130 | | | $ | 786 | | | $ | 130 | |

| | | | | | | | |

| Cash and cash equivalents | | $ | 713 | | | $ | 74 | | | $ | 713 | | | $ | 74 | |

| Restricted cash | | 73 | | | 56 | | | 73 | | | 56 | |

| Total cash, cash equivalents and restricted cash | | $ | 786 | | | $ | 130 | | | $ | 786 | | | $ | 130 | |

| | |

NATURAL GAS, OIL AND NGL PRODUCTION AND AVERAGE SALES PRICES (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2023 |

| | Natural Gas | | Oil | | NGL | | Total |

| | MMcf per day | | $/Mcf | | MBbl per day | | $/Bbl | | MBbl per day | | $/Bbl | | MMcfe per day | | $/Mcfe |

| Marcellus | | 1,734 | | | 1.63 | | | — | | | — | | | — | | | — | | | 1,734 | | | 1.63 | |

| Haynesville | | 1,568 | | | 2.15 | | | — | | | — | | | — | | | — | | | 1,568 | | | 2.15 | |

| Eagle Ford | | 76 | | | 2.52 | | | 9 | | | 82.33 | | | 10 | | | 25.76 | | | 193 | | | 6.36 | |

| Total | | 3,378 | | | 1.89 | | | 9 | | | 82.33 | | | 10 | | | 25.76 | | | 3,495 | | | 2.12 | |

| | | | | | | | | | | | | | | | |

| Average NYMEX Price | | | | 2.55 | | | | | 82.26 | | | | | | | | | |

Average Realized Price

(including realized derivatives) | | | | 2.58 | | | | | 82.33 | | | | | 25.76 | | | | | 2.79 | |

| | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2022 |

| | Natural Gas | | Oil | | NGL | | Total |

| | MMcf per day | | $/Mcf | | MBbl per day | | $/Bbl | | MBbl per day | | $/Bbl | | MMcfe per day | | $/Mcfe |

| Marcellus | | 1,987 | | | 7.25 | | | — | | | — | | | — | | | — | | | 1,987 | | | 7.25 | |

| Haynesville | | 1,605 | | | 7.40 | | | — | | | — | | | — | | | — | | | 1,605 | | | 7.40 | |

| Eagle Ford | | 121 | | | 7.04 | | | 50 | | | 94.62 | | | 16 | | | 37.53 | | | 516 | | | 11.99 | |

| Total | | 3,713 | | | 7.31 | | | 50 | | | 94.62 | | | 16 | | | 37.53 | | | 4,108 | | | 7.90 | |

| | | | | | | | | | | | | | | | |

| Average NYMEX Price | | | | 8.20 | | | | | 91.56 | | | | | | | | | |

Average Realized Price

(including realized derivatives) | | | | 4.10 | | | | | 65.90 | | | | | 37.53 | | | | | 4.65 | |

| | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2023 |

| | Natural Gas | | Oil | | NGL | | Total |

| | MMcf per day | | $/Mcf | | MBbl per day | | $/Bbl | | MBbl per day | | $/Bbl | | MMcfe per day | | $/Mcfe |

| Marcellus | | 1,845 | | | 2.24 | | | — | | | — | | | — | | | — | | | 1,845 | | | 2.24 | |

| Haynesville | | 1,569 | | | 2.26 | | | — | | | — | | | — | | | — | | | 1,569 | | | 2.26 | |

| Eagle Ford | | 96 | | | 2.22 | | | 26 | | | 77.41 | | | 12 | | | 25.61 | | | 323 | | | 7.82 | |

| Total | | 3,510 | | | 2.25 | | | 26 | | | 77.41 | | | 12 | | | 25.61 | | | 3,737 | | | 2.73 | |

| | | | | | | | | | | | | | | | |

| Average NYMEX Price | | | | 2.69 | | | | | 77.39 | | | | | | | | | |

Average Realized Price

(including realized derivatives) | | | | 2.56 | | | | | 72.10 | | | | | 25.61 | | | | | 2.99 | |

| | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2022 |

| | Natural Gas | | Oil | | NGL | | Total |

| | MMcf per day | | $/Mcf | | MBbl per day | | $/Bbl | | MBbl per day | | $/Bbl | | MMcfe per day | | $/Mcfe |

| Marcellus | | 1,801 | | | 6.27 | | | — | | | — | | | — | | | — | | | 1,801 | | | 6.27 | |

| Haynesville | | 1,624 | | | 6.16 | | | — | | | — | | | — | | | — | | | 1,624 | | | 6.16 | |

| Eagle Ford | | 127 | | | 6.10 | | | 51 | | | 100.11 | | | 16 | | | 40.40 | | | 526 | | | 12.35 | |

| Powder River Basin | | 13 | | | 5.45 | | | 2 | | | 95.18 | | | 1 | | | 53.96 | | | 34 | | | 10.66 | |

| Total | | 3,565 | | | 6.21 | | | 53 | | | 99.87 | | | 17 | | | 41.14 | | | 3,985 | | | 7.07 | |

| | | | | | | | | | | | | | | | |

| Average NYMEX Price | | | | 6.77 | | | | | 98.09 | | | | | | | | | |

Average Realized Price

(including realized derivatives) | | | | 3.77 | | | | | 66.91 | | | | | 41.14 | | | | | 4.44 | |

| | |

| CAPITAL EXPENDITURES ACCRUED (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| ($ in millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Drilling and completion capital expenditures: | | | | | | | | |

| Marcellus | | $ | 91 | | | $ | 151 | | | $ | 324 | | | $ | 338 | |

| Haynesville | | 191 | | | 237 | | | 704 | | | 618 | |

| Eagle Ford | | 9 | | | 172 | | | 222 | | | 350 | |

| Powder River Basin | | — | | | — | | | — | | | 22 | |

| Total drilling and completion capital expenditures | | 291 | | | 560 | | | 1,250 | | | 1,328 | |

| Non-drilling and completion - field | | 48 | | | 33 | | | 100 | | | 74 | |

| Non-drilling and completion - corporate | | 18 | | | 26 | | | 56 | | | 67 | |

| Total capital expenditures | | $ | 357 | | | $ | 619 | | | $ | 1,406 | | | $ | 1,469 | |

| | |

| NON-GAAP FINANCIAL MEASURES |

As a supplement to the financial results prepared in accordance with U.S. GAAP, Chesapeake’s quarterly earnings releases contain certain financial measures that are not prepared or presented in accordance with U.S. GAAP. These non-GAAP financial measures include Adjusted Net Income, Adjusted Diluted Earnings Per Common Share, Adjusted EBITDAX, Free Cash Flow, Adjusted Free Cash Flow and Net Debt. A reconciliation of each financial measure to its most directly comparable GAAP financial measure is included in the tables below. Management believes these adjusted financial measures are a meaningful adjunct to earnings and cash flows calculated in accordance with GAAP because (a) management uses these financial measures to evaluate the company’s trends and performance, (b) these financial measures are comparable to estimates provided by certain securities analysts, and (c) items excluded generally are one-time items or items whose timing or amount cannot be reasonably estimated. Accordingly, any guidance provided by the company generally excludes information regarding these types of items.

Chesapeake's definitions of each non-GAAP measure presented herein are provided below. Because not all companies use identical calculations, Chesapeake’s non-GAAP measures may not be comparable to similarly titled measures of other companies.

Adjusted Net Income: Adjusted Net Income is defined as net income (loss) adjusted to exclude unrealized (gains) losses on natural gas and oil derivatives, (gains) losses on sales of assets, and certain items management believes affect the comparability of operating results, less a tax effect using applicable rates. Chesapeake believes that Adjusted Net Income facilitates comparisons of the company's period-over-period performance, which many investors use in making investment decisions and evaluating operational trends and performance. Adjusted Net Income should not be considered an alternative to, or more meaningful than, net income (loss) as presented in accordance with GAAP.

Adjusted Diluted Earnings Per Common Share: Adjusted Diluted Earnings Per Common Share is defined as diluted earnings (loss) per common share adjusted to exclude the per diluted share amounts attributed to unrealized (gains) losses on natural gas and oil derivatives, (gains) losses on sales of assets, and certain items management believes affect the comparability of operating results, less a tax effect using applicable rates. Chesapeake believes that Adjusted Diluted Earnings Per Common Share facilitates comparisons of the company's period-over-period performance, which many investors use in making investment decisions and evaluating operational trends and performance. Adjusted Diluted Earnings Per Common Share should not be considered an alternative to, or more meaningful than, earnings (loss) per common share as presented in accordance with GAAP.

Adjusted EBITDAX: Adjusted EBITDAX is defined as net income (loss) before interest expense, income tax expense (benefit), depreciation, depletion and amortization expense, exploration expense, unrealized (gains) losses on natural gas and oil derivatives, separation and other termination costs, (gains) losses on sales of assets, and certain items management believes affect the comparability of operating results. Adjusted EBITDAX is presented as it provides investors an indication of the company's ability to internally fund exploration and development activities and service or incur debt. Adjusted EBITDAX should not be considered an alternative to, or more meaningful than, net income (loss) as presented in accordance with GAAP.

Free Cash Flow: Free Cash Flow is defined as net cash provided by (used in) operating activities less cash capital expenditures. Free Cash Flow is a liquidity measure that provides investors additional information regarding the company's ability to service or incur debt and return cash to shareholders. Free Cash Flow should not be considered an alternative to, or more meaningful than, net cash provided by (used in) operating activities, or any other measure of liquidity presented in accordance with GAAP.

Adjusted Free Cash Flow: Adjusted Free Cash Flow is defined as net cash provided by (used in) operating activities less cash capital expenditures and cash contributions to investments, adjusted to exclude certain items management believes affect the comparability of operating results. Adjusted Free Cash Flow is a liquidity measure that provides investors additional information regarding the company's ability to service or incur debt and return cash to shareholders and is used to determine Chesapeake's quarterly variable dividend. Adjusted Free Cash Flow should not be considered an alternative to, or more meaningful than, net cash provided by (used in) operating activities, or any other measure of liquidity presented in accordance with GAAP.

Net Debt: Net Debt is defined as GAAP total debt excluding premiums, discounts, and deferred issuance costs less cash and cash equivalents. Net Debt is useful to investors as a widely understood measure of liquidity and leverage, but this measure should not be considered as an alternative to, or more meaningful than, total debt presented in accordance with GAAP.

| | |

RECONCILIATION OF NET INCOME TO ADJUSTED NET INCOME (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| ($ in millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income (GAAP) | | $ | 70 | | | $ | 883 | | | $ | 1,850 | | | $ | 1,356 | |

| | | | | | | | |

| Adjustments: | | | | | | | | |

| Unrealized (gains) losses on natural gas and oil derivatives | | 110 | | (199) | | | (931) | | 807 | |

| Separation and other termination costs | | — | | — | | | 3 | | — | |

| (Gains) losses on sales of assets | | — | | | 2 | | | (807) | | | (298) | |

| Other operating expense, net | | 3 | | | 6 | | | 18 | | | 53 | |

| Other interest expense | | — | | | 12 | | | — | | | 12 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Other | | (4) | | | (4) | | | (19) | | | (19) | |

Deferred income tax expense(a) | | — | | | 19 | | | — | | | 19 | |

Tax effect of adjustments(b) | | (24) | | | 11 | | | 403 | | | (35) | |

| | | | | | | | |

| | | | | | | | |

| Adjusted net income (Non-GAAP) | | $ | 155 | | | $ | 730 | | | $ | 517 | | | $ | 1,895 | |

| | | | | |

| (a) | In the Prior Period and Prior Quarter, we adjusted the net deferred tax liability associated with our acquisition of Vine. As a result of this adjustment to the deferred tax liability, we increased the valuation allowance that we maintained against our net deferred tax asset position and recorded $19 million of deferred income tax expense. |

| (b) | The Current Quarter and Current Period include a tax effect attributed to the reconciling adjustments using a statutory rate of 23%. The Prior Quarter and Prior Period include a tax effect attributed to the reconciling adjustments using blended rates of 5.7% and 6.3%, respectively. |

| | |

RECONCILIATION OF EARNINGS PER COMMON SHARE TO ADJUSTED DILUTED EARNINGS PER COMMON SHARE (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| ($/share) | | 2023 | | 2022 | | 2023 | | 2022 |

| Earnings per common share (GAAP) | | $ | 0.53 | | | $ | 7.29 | | | $ | 13.86 | | | $ | 11.03 | |

| Effect of dilutive securities | | (0.04) | | | (1.17) | | | (0.96) | | | (1.68) | |

| Diluted earnings per common share (GAAP) | | $ | 0.49 | | | $ | 6.12 | | | $ | 12.90 | | | $ | 9.35 | |

| | | | | | | | |

| Adjustments: | | | | | | | | |

| Unrealized (gains) losses on natural gas and oil derivatives | | 0.78 | | | (1.38) | | | (6.49) | | | 5.56 | |

| Separation and other termination costs | | — | | | — | | | 0.02 | | | — | |

| (Gains) losses on sales of assets | | — | | | 0.02 | | | (5.63) | | | (2.06) | |

| Other operating expense, net | | 0.02 | | | 0.04 | | | 0.13 | | | 0.37 | |

| Other interest expense | | — | | | 0.08 | | | — | | | 0.08 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Other | | (0.03) | | | (0.03) | | | (0.13) | | | (0.13) | |

Deferred income tax expense(a) | | — | | | 0.13 | | | — | | | 0.13 | |

Tax effect of adjustments(b) | | (0.17) | | | 0.08 | | | 2.81 | | | (0.24) | |

| | | | | | | | |

| Adjusted diluted earnings per common share (Non-GAAP) | | $ | 1.09 | | | $ | 5.06 | | | $ | 3.61 | | | $ | 13.06 | |

| | | | | | | | |

| | | | | | | | |

| | | | | |

| (a) | In the Prior Period and Prior Quarter, we adjusted the net deferred tax liability associated with our acquisition of Vine. As a result of this adjustment to the deferred tax liability, we increased the valuation allowance that we maintained against our net deferred tax asset position and recorded $19 million of deferred income tax expense. |

| (b) | The Current Quarter and Current Period include a tax effect attributed to the reconciling adjustments using a statutory rate of 23%. The Prior Quarter and Prior Period include a tax effect attributed to the reconciling adjustments using blended rates of 5.7% and 6.3%, respectively. |

| | |

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDAX (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| ($ in millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income (GAAP) | | $ | 70 | | | $ | 883 | | | $ | 1,850 | | | $ | 1,356 | |

| | | | | | | | |

| Adjustments: | | | | | | | | |

| Interest expense | | 23 | | | 52 | | | 82 | | | 120 | |

| Income tax expense | | 1 | | | 74 | | | 532 | | | 105 | |

| Depreciation, depletion and amortization | | 382 | | | 440 | | | 1,148 | | | 1,300 | |

| Exploration | | 4 | | | 2 | | | 19 | | | 14 | |

| Unrealized (gains) losses on natural gas and oil derivatives | | 110 | | | (199) | | | (931) | | | 807 | |

| Separation and other termination costs | | — | | | — | | | 3 | | | — | |

| (Gains) losses on sales of assets | | — | | | 2 | | | (807) | | | (298) | |

| Other operating expense, net | | 3 | | | 6 | | | 18 | | | 53 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Other | | (13) | | | (4) | | | (36) | | | (19) | |

| Adjusted EBITDAX (Non-GAAP) | | $ | 580 | | | $ | 1,256 | | | $ | 1,878 | | | $ | 3,438 | |

| | |

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO ADJUSTED FREE CASH FLOW (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| ($ in millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net cash provided by operating activities (GAAP) | | $ | 506 | | | $ | 1,313 | | | $ | 1,910 | | | $ | 3,075 | |

| Cash capital expenditures | | (423) | | | (540) | | | (1,450) | | | (1,299) | |

| Free cash flow (Non-GAAP) | | 83 | | | 773 | | | 460 | | | 1,776 | |

| | | | | | | | |

| Cash paid for acquisition costs | | — | | | — | | | — | | | 23 | |

| Cash contributions to investments | | (61) | | | — | | | (149) | | | — | |

Free cash flow associated with assets under contract and divested assets(a) | | (57) | | | — | | | (195) | | | — | |

| Adjusted free cash flow (Non-GAAP) | | $ | (35) | | | $ | 773 | | | $ | 116 | | | $ | 1,799 | |

| | | | | |

| |

| (a) | In March and April of 2023, we closed two divestitures of certain Eagle Ford assets to WildFire Energy I LLC and INEOS Upstream Holdings Limited, respectively. Due to the structure of these transactions, both of which had an effective date of October 1, 2022, the cash generated by these assets was delivered to the respective buyers through a reduction in the proceeds we received at the closing of each transaction. Additionally, in August 2023, we entered into an agreement to sell the final portion of our Eagle Ford assets to SilverBow Resources, Inc., with an economic effective date of February 1, 2023. Included within the adjustment above reflects the cash flows from the three months ended September 30, 2023, associated with these assets to be sold to SilverBow Resources, Inc. This transaction is expected to close in 2023 and the cash generated by these assets are expected to be delivered to the buyer through a reduction in the proceeds we anticipate receiving once the transaction closes. |

| | |

RECONCILIATION OF TOTAL DEBT TO NET DEBT (unaudited) |

| | | | | |

| ($ in millions) | September 30, 2023 |

| Total debt (GAAP) | $ | 2,032 | |

| Premiums and issuance costs on debt | (82) | |

| Principal amount of debt | 1,950 | |

| Cash and cash equivalents | (713) | |

| Net debt (Non-GAAP) | $ | 1,237 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chk_ClassAWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chk_ClassBWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chk_ClassCWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

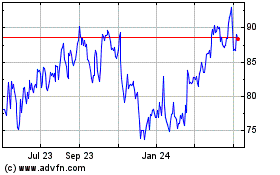

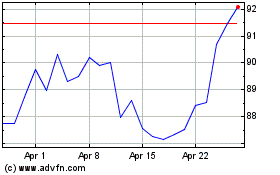

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024